CRWV - Not too late for a long tradeCRWV setting up good for a long trade.

Formed a inverse H&S and popped to fill the gap above.

Don't jump in with whole size but scale in slowly with small size on dips between 90-100

Target 1 - 120

Target 2 - 140 - So much overhead supply at this level. It can struggle here I guess.

CRWV

CRWV - Risk is clearly defined, making this a structured setup!CRWV - CURRENT PRICE : 79.32

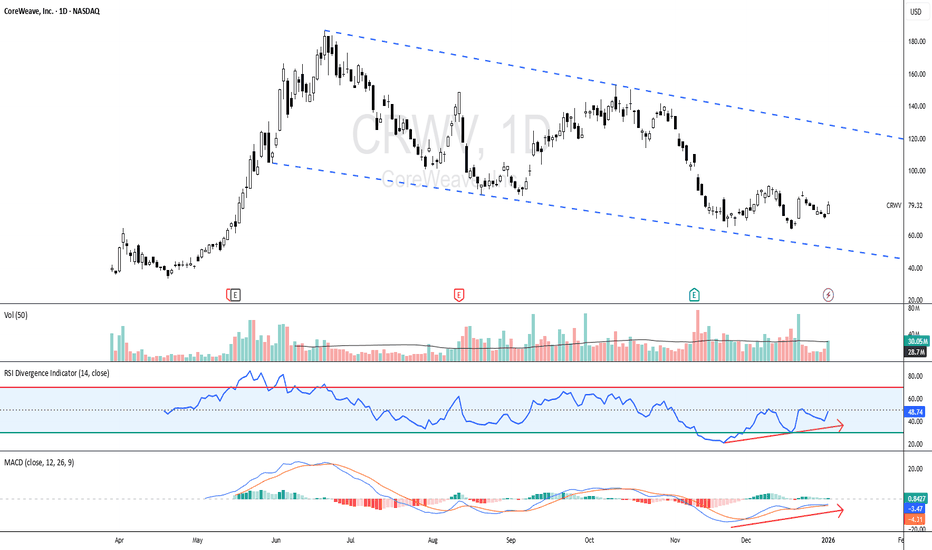

CRWV is currently trading within a descending channel, indicating a medium-term corrective move after a prior uptrend. Importantly, price is now basing near the lower boundary of the channel, a zone where buyers previously showed interest.

Rather than breaking down aggressively, price action is stabilizing, suggesting selling pressure is starting to fade.

📈 Momentum Is Improving (Key Clue)

While price remains subdued, momentum indicators are telling a different story:

~ RSI (14):

RSI is recovering from lower levels and moving higher while price is still near the channel bottom. This signals improving momentum and early bullish divergence characteristics.

~ MACD:

MACD histogram is contracting, and the lines are starting to curl upward. This typically reflects weakening bearish momentum and the potential for a trend shift.

👉 When momentum improves while price holds support, it often precedes a technical rebound.

📌 This is a technical rebound setup — confirmation comes with continued momentum improvement and price holding support.

ENTRY PRICE : 77.00 - 79.32

FIRST TARGET : 96.00

SECOND TARGET : 110.00

SUPPORT : 63.80 (the low of BULLISH HARAMI pattern - 17 and 18 DECEMBER 2025 candle)

CRWV: bullish potential NASDAQ:CRWV continues to act constructively, building a VCP after the recovery attempt from the macro support zone (see prior idea with updates: )

I’m watching for upside follow-through as long as price holds above today’s and the December lows.

Potential swing long trade parameters:

Risk (stop loss): partial below 71.59, full stop at 70.40

First profit targets: 96–103 and 122–131

Chart:

Previously (in CRWV idea):

- On local resistance and downside potential (Dec 7):

- On the support zone (Dec 18):

CRWV📌 CoreWeave shares have fallen by approximately 30% in a month. Despite the AI hype, mounting evidence points to serious structural problems at the company.

🔴 KEY WEAKNESSES FROM THE REPORT (Q3 2024)

1. Losses are growing faster than revenue

Revenue grew 3x (y/y), but operating expenses grew 3.67x. No operating leverage.

Net loss: $110 million for the quarter.

Free cash flow is negative: -$4.75 billion for the first nine months (versus -$2.64 billion a year ago). The company is burning cash at an accelerating rate.

2. Debt trap

$CRWV Riding the AI Infrastructure Wave on a Leveraged TightropeCoreWeave, Inc. (CRWV) has rapidly ascended as a central and controversial figure in the AI infrastructure landscape. Often categorized alongside other "neoclouds" like IREN, which have pivoted aggressively towards AI workloads, CoreWeave exemplifies the explosive potential and inherent fragility of businesses built to capitalize on the generative AI boom. Its stock performance, characterized by dramatic surges and sharp corrections, has become a direct proxy for the market's oscillating hopes and anxieties surrounding AI's near-term profitability.

As of late November, shares traded at approximately $73.12, a level that reflects both the company's staggering reported growth and the significant risks embedded in its financial structure.

The Bull Case: A Critical, Scalable Enabler in a Supply-Constrained Market

The bullish thesis, as articulated by analysts like Bernardo on Level-Headed Investing, centers on CoreWeave’s role as a vital intermediary in a high-demand, supply-constrained ecosystem.

Strategic Positioning and Scalability: CoreWeave has successfully positioned itself as a specialized, high-performance cloud provider exclusively for GPU-intensive workloads, primarily generative AI training and inference. With a reported fleet of over 250,000 NVIDIA GPUs across 33 data centers, it operates at a scale that few competitors can match outside the major hyperscalers (Microsoft Azure, Google Cloud, AWS). This allows it to act as a crucial overflow and specialized partner for those very hyperscalers when their own capacity is limited.

Hyperscaler Partnerships and Validation: The company’s growth is undeniably impressive, with revenue reaching $1.9 billion in 2024 and $1.2 billion in Q2 2025 alone. This trajectory is fundamentally tied to landmark partnerships with technology titans. Most notably, Microsoft accounted for 62-71% of revenue during this period, a double-edged sword that also serves as powerful validation of CoreWeave's technical capability and strategic importance. Similar contracts with Google and Amazon underscore its role as a key enabler in the AI arms race.

Secular Demand Tailwind: Bulls argue that the demand for AI computational power is a secular, long-term trend that is still in its early innings. As AI models grow larger and more pervasive, the need for efficient, scalable infrastructure like CoreWeave’s is expected to compound, providing a multi-year runway for growth.

The Bearish Counterpoint: Structural Vulnerabilities and a Commodity Trap

However, a deep dive into the financials reveals a business model under tremendous strain, painting the growth story in a more cautious light.

The Profitability Mirage: While revenue soars, profitability remains elusive. The company posts substantial GAAP net losses, driven by immense depreciation charges, interest expenses, and relentless capital expenditures. A headline Adjusted EBITDA margin of 62% is misleading; it adds back the massive depreciation on its GPU fleet, a very real economic cost. Crucially, cash flow from operations is deeply negative, revealing a core disconnect: the business is growing on paper but consuming, not generating, cash.

A Leveraged House of Cards: CoreWeave’s expansion is almost entirely debt-financed. With total borrowings of $11.17 billion, its balance sheet is leveraged against its primary asset: GPUs. This financing relies heavily on Delayed-Draw Term Loan (DDTL) facilities, where credit is extended based on the value of future customer contracts. This creates a perilous cycle: growth requires new debt, which is secured by new contracts, which require more GPUs, which depreciate rapidly. The model is acutely vulnerable to any disruption in demand or credit markets.

Customer Concentration and Hardware Obsolescence: The extreme reliance on Microsoft represents an existential risk. Any slowdown, renegotiation, or insourcing of capacity by Microsoft could immediately trigger a liquidity crisis. Furthermore, the business is trapped in a perpetual capital expenditure loop. NVIDIA’s relentless innovation cycle (e.g., Blackwell GPUs replacing Hopper) means CoreWeave’s core assets are constantly depreciating, forcing it to reinvest nearly all its incoming cash into new hardware just to stay competitive, with no residual profit.

Lack of a Moat: Critics argue CoreWeave’s service is fundamentally a commodity—it rents access to another company’s (NVIDIA’s) chips. It lacks a proprietary software ecosystem, a loyal developer community, or unique intellectual property that would create customer stickiness. Its primary advantage, scale, is expensive and replicable by well-capitalized entrants.

Technical Perspective and Price Targets

From a technical analysis standpoint, the $60 - $70 zone is identified as a critical primary support area. This region is expected to be a major battleground between bulls defending the long-term thesis and bears focusing on financial fragility.

On the upside, the bullish trajectory projects three key take-profit targets:

Target 1: $100 – A breakout level representing a significant advance and a test of prior highs.

Target 2: $110 – A further extension signaling sustained momentum.

Target 3: $120 – An ambitious target that would imply a successful navigation of near-term risks and a market re-rating based on proven execution towards profitability.

Conclusion: A High-Stakes Bet on Execution and Endurance

In summary, CoreWeave represents a quintessential high-risk, high-reward investment within the AI megatrend. The bullish thesis rests on its irreplaceable role as a scalable infrastructure provider in a supply-constrained market, validated by elite partnerships. The bearish perspective warns of a structurally flawed business model burdened by extreme leverage, customer concentration, and the relentless financial treadmill of hardware obsolescence.

The investment decision ultimately hinges on a belief in management’s ability to use its current scale and partnerships to bridge towards sustainable cash flow and a more diversified client base before a shift in the credit cycle or AI demand curve exposes its vulnerabilities. For investors, CRWV is not merely a bet on AI demand, but a specific bet on CoreWeave’s financial engineering and operational execution in the face of monumental fixed costs and debt obligations.

Is it time to reload $BITF? We caught the breakout in NASDAQ:BITF when it was below 3 earlier this year. It ripped all the way to $6+. Since then, the stock imploded back to the original crime scene amidst the AI overvaluation selloff. The $2.30 area provides good support and the stock has reacted off that level. If Bitfarms can scale its entrance into AI/HPC capabilities, the stock should be able to see the $3.8-4 area barring any further market selloff on AI names.

Stock is current trading around $2.70. I would put my stop at $2.30 if taking this idea.

Best of luck if tailing.

CoreWave Inc. Technical Analysis and Mid-Term OutlookCoreWave Inc. Technical Analysis and Mid-Term Outlook

CoreWave Inc. has reacted to a key confluence zone formed by horizontal support and an ascending trend line.

A bullish pin bar has also developed at this confluence area, as shown on the chart. This pattern is an important price-action signal and may indicate potential upward momentum.

My Technical Outlook:

I expect buying pressure at the current market price (CMP) to push above the next resistance zone aligned with the 23.6% Fibonacci retracement level. If price successfully breaks and sustains above this level, the asset may advance further toward the descending trend line highlighted on the chart.

This setup aligns with a mid-term to multi-month trade outlook, given the presence of three significant Fibonacci levels within this projected move.

Trade Potential: 16% – 60%

I am ridding of the CMP

As always, caution is advised when navigating market volatility and key reaction zones.

CoreWeave Falling to $68CoreWeave seems to be falling towards $68 support. It's hard to say if $68 will hold, but it's absolutely a good area to close shorts for a potential bounce.

CRWV has yet to form any long term trend lines that I can find. Perhaps this will come from a bounce off $68.

Good luck!

Is This the Last Dip Before CoreWeave’s Next Leg Up? Fundamental View:

CoreWeave (NASDAQ: CRWV) remains one of the most watched AI-infrastructure plays, powering GPU cloud services used by NVIDIA, OpenAI, and multiple large-scale AI firms.

Recent billion-dollar expansions with both partners have reinforced its role as a backbone for AI compute, but after a parabolic rally, valuations look stretched — making any retracement zone highly valuable for accumulation.

Technical View:

Price clearly respected the short-term FVG and swept buyside liquidity at $149.50, closing the weekly candle below it — a classic sign of a liquidity sweep and potential correction.

The drop toward $84.55 tagged the sell-side liquidity and entered a major FVG + OTE golden zone (range $93–$65).

This aligns with the Fibonacci discount area from the previous impulse move, creating a high-probability reaction zone if bullish confirmation appears in the coming weeks.

Outlook:

If we see a strong bullish weekly candle from this level, it could signal the last discounted price range before CoreWeave re-enters its expansion phase.

However, failure to hold above this golden zone could invite deeper retracement.

Patience and confirmation are key before scaling in — this may genuinely be the “last chance to get CoreWeave”, but as always, DYOR and manage risk.

⚠️ Disclaimer: For educational and entertainment purposes only. Not financial advice. Always do your own research.

CRWV 31% upside potentialCRWV has closed the daily candle in the golden pocket of its swing high to swing low fib trace.

From this point , with the current momentum and market trend favouring the stock , this could easily go to 180 which is a 30% upside potential. With your own risk/reward ratio based stop loss I think this trade setup is looking good

CRWV: The Beautiful Path ForwardCoreWeave (CRWV) has reached a pivotal moment in its market journey. After months of decline within a defined descending channel, the stock is showing signs of a complete structural reversal. The higher-timeframe breakout, the mid-timeframe shift into higher lows, and the execution-level formation of an inverse head and shoulders all point toward a unified, bullish story.

The following stages will outline the necessary phases for this development to fully mature—from breaking free of the broader downtrend, to establishing a foundation of strength, and finally to executing the reversal that unlocks higher price targets. Together, they form the roadmap of why CRWV has, indeed, a beautiful path forward.

Phase 1: The Big Picture – Breaking Free from the Downtrend

On the higher-timeframe 4H chart, CRWV has spent months trapped within a descending channel, carving out lower lows (LL) and reinforcing bearish sentiment. This long consolidation served to reset valuations and shake out weak hands, but now the structure has shifted.

The decisive break above the descending channel represents more than just a technical move—it’s a structural transition. Price has climbed from a deep demand base near $85 and pushed into a breakout zone around $138–$148, marking the first higher high after a prolonged series of lower lows. This moment defines the end of the downtrend and the birth of a new market cycle.

Phase 2: The Reversal Zone – Building a Foundation

Zooming into the mid-timeframe, we see how the market began transitioning out of weakness. After establishing a double bottom (DB) near the lows, CRWV started printing higher lows (HLs), gradually chipping away at resistance. Each break of structure (BoS) confirmed strength, and the final move toward $148 created the key break that unlocked bullish continuation potential.

This reversal is critical—it shows that buyers are not just stepping in at demand but are defending higher levels. Market sentiment is shifting as supply diminishes and accumulation takes place. The $148 zone now becomes a key pivot, where a breakout and retest would transform resistance into support and set the stage for acceleration.

Phase 3: The Execution – The Inverse Head and Shoulders

On the execution timeframe, the structure is clear: CRWV has formed an inverse head and shoulders pattern, a powerful reversal signal. The left shoulder, head, and right shoulder align perfectly with the neckline at $148. A breakout above this neckline, followed by a successful retest, provides the precise technical entry for traders.

From there, the projection points higher, with potential upside first into $160, and then a measured move back toward the all-time highs around $187. Beyond that, continuation could even extend toward the $220 zone as momentum builds, fueled by both technical breakout dynamics and strengthening fundamentals, such as CRWV’s recent $14.2 billion AI partnership deal with Meta.

Conclusion: The Beautiful Path Forward

CRWV’s chart tells a story of patience, accumulation, and now rebirth. From the wide-angle view of a descending channel break, through the detail of higher lows and structural shifts, down to the execution of a textbook inverse head and shoulders—the setup is harmonious and compelling.

With momentum aligning across all timeframes, and key catalysts supporting growth, CRWV indeed has a beautiful path forward. The market has spoken: the downtrend is behind us, the foundation is built, and the future points higher.

$NVDA - $280 PT WEEKLY BULL FLAGStay Positioned with Nvidia's Weekly Bullish Chart. A Bull Flag is setting up with an imminent breakout. Long/Short Ratio is also very bullish at almost 60%. Price Target is $280. Remember Pole length of the flag = extended measured move at the breakout point of the flag.

CoreWeave – Golden Zone Setup with FVG ConfluencePrice action on CoreWeave (CRVW) has delivered exactly what high-probability ICT setups are built on. After the strong bullish expansion post-IPO, price retraced cleanly into the golden Fibonacci zone (62%–79%), aligning perfectly with a higher-timeframe Fair Value Gap (FVG).

This retracement holds confluence from multiple PD arrays:

- Golden Zone Respect → Buyers stepped in right at equilibrium levels, where institutional order flow often reloads.

- Weekly FVG → The retracement filled imbalance left on the weekly expansion leg, strengthening the bullish narrative.

- Volume Profile → The drop into this zone occurred on decreasing sell volume, suggesting sellers are exhausted while buyers accumulate.

If price continues to hold above this golden zone/FVG region, the bias remains to the upside with immediate targets at:

- $147 (Weekly Buyside Liquidity)

- $185 (Above Prior Weekly Highs)

- $198–200 (FVG Fill & Structural Target)

Ultimately, a full bullish expansion could send CoreWeave towards $360 (778% projection) in the long term if liquidity pools above are targeted. DYOR.

CRWV Breakdown Setup — $80 PUT in Play!

# 🐻 CRWV Weekly Trade Setup (Sep 6, 2025) 🐻

### 🔎 Market Consensus

* **Momentum:** Daily RSI 35.2 ↓, Weekly RSI 45.4 ↓ → bearish trend.

* **Performance:** -13.3% last week → downside pressure.

* **Volume:** 0.7x → weak institutional support.

* **Options Flow:** C/P = **1.61** → contrarian bearish (likely retail call chasing).

* **Consensus:** 📉 Moderate → Strong Bearish Bias

---

### 🎯 Trade Plan

* **Instrument:** CRWV

* **Direction:** PUT (SHORT)

* **Strike:** 80.00

* **Expiry:** 2025-09-12 (6 DTE)

* **Entry Price:** 0.73

* **Profit Target:** 1.46 (+100%)

* **Stop Loss:** 0.37 (-50%)

* **Size:** 1 contract (scale risk 2–4% max)

* **Entry Timing:** Market Open

* **Exit Rule:** Take profits early if hit; hard exit **by Thu Sep 11** (avoid Friday decay).

* **Confidence:** 🔥 65%

---

### ⚖️ Key Risks

* Call flow heavy (C/P 1.61) → possible squeeze/hedge pops.

* Weak volume could limit follow-through.

* News/gap risk can reverse quickly.

* Theta decay accelerates mid-week — OTM puts decay fast if price stalls.

---

📊 **TRADE DETAILS (JSON)**

```json

{

"instrument": "CRWV",

"direction": "put",

"strike": 80.0,

"expiry": "2025-09-12",

"confidence": 0.65,

"profit_target": 1.46,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-09-06 10:25:45 EDT"

}

```

---

🔥 \ NASDAQ:CRWV | \ AMEX:SPY | \ NASDAQ:QQQ | #OptionsTrading #BearishSetup #TradingView #PutOptions #GammaSqueeze #StocksToWatch#MarketMoves#EarningsSeason#MomentumTrading#RiskReward

CRWV Ready to Breakout? Institutions Loading $107C

# 🚀 CRWV WEEKLY CALLS ALERT (2025-09-01) 🐂💎

### 📊 Consensus Bias → **BULLISH**

* ✅ RSI >50 📈 → Momentum holding strong

* ✅ Options Flow: Call/Put = 2.06 💥 → Institutions loading calls

* ✅ Heavy OI @ \$107 → Gamma magnet 🎯

* ✅ VIX \~15.3 → Great for long calls

⚠️ Volume soft (0.8x last week) → Size conservatively

---

### 🎯 TRADE SETUP

👉 **CRWV 107C (2025-09-05)**

💵 Entry: \~\$1.91 (ask)

🛑 Stop: \$1.15 (-40%)

🎯 Target: \$2.50 (+30%)

📏 Size: 1 contract (risk ≤2–3% acct)

⏰ Entry: Market open

🔥 Confidence: 70%

🗓 Exit: By **Thursday EOD**

---

📌 **Trade JSON (for algos 🤖)**

```json

{

"instrument": "CRWV",

"direction": "call",

"strike": 107.0,

"expiry": "2025-09-05",

"confidence": 0.70,

"profit_target": 2.50,

"stop_loss": 1.15,

"size": 1,

"entry_price": 1.91,

"entry_timing": "open",

"signal_publish_time": "2025-09-01 21:27:34 EDT"

}

```

---

\#️⃣ **Tags / Hashtags**

\#CRWV #OptionsTrading #WeeklyOptions #FlowTrading #BreakoutStocks

\#TradingSignals #CallOptions #SmartMoneyFlow #StockMarket 🚀📈🔥

CRWV - Bearish zigzag sequence in play against 8.12.2025 highIt favors daily zigzag correction since June peak. Below 155.05 high if (B) wave, it should continue downside towards 67.6 or lower. Short term bounce in 2 should expect to fail in simple, double or triple correction to continue downside. SPY is showing impulse sequence from April-2025 low and expect pullback soon, which may fuel more weakness in CRWV.

CRWV Long-Term Big Bet--$100C Early Entry for the Big Move!

# 🌐 CRWV LEAP Options Setup (08/24/2025)

**Consensus:** ⚖️ Moderate Bullish (Monthly RSI ↑ 55, but Weekly Neutral)

**Volatility:** VIX \~14.2 ✅ Favorable for buying premium

**Institutional Flow:** Neutral (Call/Put OI ≈ 1.0)

---

## 🔎 Model Signals

* **Gemini/Google:** Bullish, \$85c (2026-09-18) | Target \$22.5 | Conf 65%

* **DeepSeek:** No trade — multi-timeframe misaligned | Conf 45%

* **Grok/xAI:** Bullish, \$95c (2026-09-18) | Notes low OI | Conf 75%

* **Claude/Anthropic:** No trade yet (wait for weekly align) | Conf 60%

* **Llama/Meta:** Bullish, prefers 0.6–0.8 delta, \$100c candidate | Conf 75%

---

## ✅ Agreement

* **Monthly RSI:** Rising → Bullish bias

* **Volatility:** Low VIX = Good time to buy long-dated options

* **Direction:** None are bearish

## ⚠️ Disagreement

* **Timing:** 3 models bullish now vs. 2 advising wait

* **Strike:** \$85 / \$95 / \$100 debated (liquidity favors \$100)

* **Conviction:** Mixed (45–75%)

---

## 📌 Recommended Trade (LEAP Call)

**Rationale:** Favorable vol, monthly bullish, liquidity at \$100 strike. Best balance of execution + upside.

🎯 **Instrument:** CRWV

🔀 **Direction:** CALL (LONG LEAP)

📅 **Expiry:** 2026-09-18 (\~390 days)

🎯 **Strike:** \$100.00 (largest OI — 564)

💵 **Entry Price (Mid):** \$28.80

🛑 **Stop Loss:** \$18.72 (-35%)

🎯 **Profit Target:** \$43.20 (+50%/+100% partial, +200% stretch)

📏 **Size:** 1 contract (starter; scale w/ risk budget)

📈 **Confidence:** 65%

⏰ **Entry Timing:** Market open w/ limit at mid

---

## ⚡ Risks & Notes

* Multi-timeframe mismatch (monthly bullish vs weekly neutral)

* Wide spreads — use **limit orders at mid**

* High premium (\$28.80) — size small

* Monitor insider activity / sector news

* Exit partial @ +100% to de-risk

---

## 🧾 JSON (Trade Details)

```json

{

"instrument": "CRWV",

"direction": "call",

"strike": 100.0,

"expiry": "2026-09-18",

"confidence": 0.65,

"profit_target": 43.20,

"stop_loss": 18.72,

"size": 1,

"entry_price": 28.80,

"entry_timing": "open",

"signal_publish_time": "2025-08-24 03:56:31 UTC-04:00"

}

```

---

🔥 This is LEAP positioning (long runway, lower gamma risk, higher convexity). Perfect for **chart annotation** with 📈 arrows → buy zone at \$28.8, stop at \$18.7, PT at \$43.2.

CRWV Breakdown Alert: Short Setup Ready!

## **⚠️ CRWV Bearish Swing Setup – Puts in Play!**

**Moderate Bearish Bias | Aug 15, 2025**

**📊 Key Highlights:**

* **RSI:** 37.9 – Clear bearish momentum 📉

* **5D Perf:** -17.98% 🚨

* **10D Perf:** Similar heavy downside pressure

* **Volume:** Average (1.0x) – no panic selling, but no bullish rescue either

* **Options Flow:** Neutral Call/Put (1.00)

* **VIX:** 14.84 – Low volatility, clean downside setups

---

**💡 Trade Plan:**

* **Type:** Aug 29 ’25 \$95 PUT

* **Entry:** \$6.50 (on confirmed break < \$98)

* **Stop Loss:** \$2.52 (-40%)

* **Target 1:** \$9.45 (+50%)

* **Target 2:** \$15.75 (+150%)

* **Confidence:** 75%

---

**⚠️ Risks:**

* Reversal above \$100 = high risk of stop hit

* Premiums elevated vs historical norms

* Weak volume = could slow downside momentum

---

📆 **Signal Time:** 2025-08-15 11:46 EDT

💎 **Execution:** Enter at open ONLY if \$98 breaks with momentum

---

\#CRWV #OptionsAlert #SwingTrade #PutOptions #NASDAQ #BearishTrade #MomentumStocks #StockMarket