DOT in accumulation zone!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see DOT once again in beautiful accumulation zone , zone where I personally started accumulating tokens in previous cycle and in this one as well.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 1 00% to 200% depending on our average buy price.

Second TP will bring us anywhere from 300% to 350%.

If we however drop even lower (WHICH WOULD BE AMAZING) there is an ALL-IN zone where I will be looking to put more money on my buys.

My accumulation is buying some DOT every 2-3 days while we are in the zone.

I marked only 2 TP zones for and as we will move UP in the BULL RUN I will post updates on where my next TP zones are.

Hope this helps, play it smart and stay patience!

Crypto

CRV low risk high return? Ou YES!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see CRV is in our FIRST BUY ZONE , zone where I personally started accumulating tokens just now and will continue as long as we are in the zone.

IF we drop lower to the ALL IN zone as I call them :D I will be putting even more money in this coin. Hopefully we can see that happen as we broke the trendline.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 220% to 270% depending on our average buy price which is an amazing return imo.

Second TP will bring us around 760% from the first buy zone!

IF we drop lower second TP will bring us an amazing 1260%!!! And that is not even an ATH for CRV!

Just to add something to make you think.

From where price is right now if we drop to ALL IN zone we are talking about -30% to -55% drawdown. Are you will to hold this small drawdown in order to get from 220% to possibly over 1200% gain?

As always please play it smart, do not over risk and invest only what you are willing to lose. And most importantly be patient!

ALGO to provide us with some GAINS as well?Hi guys,

Again as seen on the chart and historic price action or ALGO we can clearly see the PAIN points of where price is reacting and providing opportunities.

If we manage to break this trendline my first BUYS will begin at $0.16.

Risk here is holding drawdown of around -26% if price drops towards second area, so yes, in my eyes it is worth it!

Second area of accumulation and buying ALGO would be my ALL IN BUY ZONE from $0.10 to $0.14.

Potential gain from first zone towards our first target - HIGH of this cycle in 2024 is 280%!

Potential gain from ALL IN BUY ZONE is around 400%!

Second TP zone would be of course psychological level $1 where our gains from first buying area would be around 500% and from the second area would be around 700%

Please invest only what you are willing to lose, play it smart and be patient as patience is the key.

BTCUSD MORE DROP (READ CAPTION)Hi trader's what do you think about btcusd

BTCUSD is currently showing bearish market structure, where price is struggling to break above key resistance levels. Selling pressure remains dominant, and upward moves are being treated as selling opportunities rather than trend reversals.

🔴 Resistance 1: 84,700

The 84,700 level is acting as an important short-term resistance. Price rejection from this area may strengthen bearish momentum.

🔴 Resistance 2: 89,000

This level represents a major resistance and supply zone. As long as BTCUSD trades below 89,000, the overall bias remains bearish.

🟢 Demand Zone: 67,000

The 67,000 level is a strong long-term demand zone, where buyers may step in and price could slow down or react. This area is a potential target zone for bearish continuation.

📉 Market Bias

Below 84,700 – 89,000 → Bearish trend remains active

Rejection from resistance → Possible sell continuation

Strong reaction at 67,000 → Demand-based bounce possible

Overall, the market favors a sell-on-rallies strategy while price remains below key resistance levels.

please like comment and follow

Perfect Entry LONG for FANTOM (FTM) - BULLISH !Fantom showing tremendously strong buying pressure, with low volumes in its pullbacks.

Now we look for perfect entry from its massive pump by placing buy bids around the 0.618 fib level and 0.5 fib level zone (white box shown above).

TP at the next resistances

Levels are as shown in the charts.

Bitcoin Rebound: Pause Before the Next Move Lower?Hello everyone, looking at Bitcoin on the H4 timeframe, the overall picture hasn’t changed much. The dominant trend remains bearish, and the recent rebound is more likely a technical move rather than a genuine reversal signal.

From a structural perspective, price is still trading below the key EMA levels, and these EMAs continue to slope downward — a clear sign that selling pressure remains in control. The recent bounce came immediately after a sharp sell-off, which is a very typical characteristic of a technical rebound: price retraces to release downside pressure, but without meeting the conditions required to confirm a new uptrend. Volume supports this view as well — selling volume expanded strongly during the decline, while the rebound lacked the kind of volume that would confirm sustained buying interest.

From my experience, when price rallies but fails to reclaim the EMA zone above, it usually signals a pullback within the dominant trend rather than the start of a longer bullish phase.

So what are the key levels to watch next?

On the downside, the 63,000–65,000 USDT area is the nearest support zone I’m closely monitoring. If selling pressure continues, this is a level Bitcoin could realistically revisit to test market reaction. My base case scenario is a move down toward support, potentially followed by short-term consolidation or even a false break, before a rebound toward the resistance zone around 72,000–75,000 USDT.

Only if price can break above and hold above the medium-term EMA zone, while rebuilding a Higher High – Higher Low structure, would I begin to seriously consider a transition into a more sustainable bullish trend.

From a macro and news perspective, current pressures have not fully faded. Based on information flows from Forex Factory and other mainstream financial sources, US interest rate expectations continue to weigh on risk assets. While the market has started to talk more about potential easing in the second half of the year, the Fed has yet to deliver a sufficiently dovish signal to attract large-scale capital back into crypto. At the same time, short-term risk-off sentiment still emerges as investors react to economic data and sharp moves across global financial markets, while larger players appear more patient, waiting for deeper discounted price zones rather than chasing rebounds.

Putting everything together, I’m still leaning toward a decline–rebound–decline scenario. My personal approach is to avoid chasing buys during technical rebounds and instead focus on observing price behavior around the 63k–65k zone. If price rallies into the 72k–75k area but fails to break the broader trend structure, this region is likely to remain a notable selling zone.

What about you? Are you expecting Bitcoin to hold support and form a base, or are you still preparing for a deeper correction ahead?

ETH / EUR – 1H, and the structure is pretty clean.ETH / EUR – 1H, and the structure is pretty clean.

What I’m seeing

Strong bullish ascending channel

Price is reacting from the lower channel + demand box

Ichimoku cloud support holding

Momentum push already started from the demand zone

So bullish continuation is the higher-probability play 📈

🎯 Targets (Bullish)

Target 1 (TP1 – conservative):

➡ 2,000 – 2,020 EUR

(mid / psychological level + first resistance)

Target 2 (TP2 – main):

➡ 2,120 – 2,150 EUR

(previous high + channel resistance — your first marked target)

Target 3 (TP3 – extended):

➡ 2,250 – 2,280 EUR

(upper channel projection — your second marked target)

🛑 Invalidation / Safety

Hourly close below: 1,760 EUR

Below that, bullish structure weakens and targets delay.

Quick Trade Logic

Buy from demand + channel low

Ride trend until upper channel

Scale partial profits at each target 💰

Xauusd 1H chart Pattern.descending triangle / falling wedge squeeze, and price is already breaking upward from the apex with demand support around 4855–4860.

🎯 Targets (Bullish Breakout)

Immediate Target (T1):

➡ 5,100 – 5,120

(previous structure + mid resistance)

Main Target (T2):

➡ 5,200 – 5,230

(matches my marked zone on the chart)

Extended Target (T3 – momentum continuation):

➡ 5,480 – 5,520

(full pattern height projection + higher TF resistance)

🛑 Invalidation / Risk Level

Break & hold below: 4,850

That would weaken the bullish structure and delay targets.

📌 Trade Logic Summary

Structure: Compression → breakout

Cloud support holding

Higher lows forming

Targets you drew are technically valid ✅

Hedera: bounce or trap? key levels and targets for the days aheaHedera Hashgraph. Who else just watched that crazy liquidation wick and thought: "ok, someone big just hit the panic button"? After the broad alt selloff, HBAR flushed into the 0.07s and instantly got bought back, and according to industry sources the project is still on the radar for enterprise and tokenization plays, so the market clearly defended those lows.

On the 4H chart we’ve got a sharp V-reversal from the 0.075 area, huge volume, and RSI has ripped out of oversold to around 60. Price is reclaiming the main volume node near 0.09, aiming straight at the first thick supply zone around 0.098-0.105. With that combo I’m leaning toward a short term long bounce instead of fresh lows.

My base case: while HBAR holds above 0.088-0.089, I’m looking for a move to 0.10 first, with extension toward 0.104-0.107 where I’d start unloading longs. I’m stalking entries on dips into 0.09 with a tight invalidation under 0.088. If that support cracks and we close back under the volume cluster, this turns into a failed bounce and opens the door back to 0.08 - I might be wrong, but the current bounce setup looks too juicy to ignore. ✅

BTCUSD Intraday Long — Contextual ExpectationWithin the daily composite framework and considering the current intensity of market buying, I’m expecting a continuation of the upside move toward the nearest area of friction.

Key zone of interest:

SP 68,700 – 69,150

Current context:

-sustained market buyer pressure

-divergence in the dynamic volume component

-supportive local structure

-liquidity and liquidation-related factors

Taken together, these elements increase the probability of a move toward the outlined zone in the near term.

Idea invalidation:

Acceptance and consolidation below 64,400.

This is a counter-trend perspective, therefore risk remains elevated. Execution, if any, will be strictly conditional and aligned with my system and risk parameters.

Litecoin: potential bounce or deeper drop? key levels to watchLitecoin. Catching the falling knife or loading a discount alt bluechip here? While the whole crypto market just got washed out on fresh regulatory noise and another wave of BTC volatility, LTC dumped into multi‑month lows and finally printed a nasty but promising wick from the 44–45 area. According to market chatter, majors are seeing rotation back in as panic cools off.

On the 4H chart price bounced to 52–53 after a vertical selloff, RSI was buried under 30 and is curling up, and there’s a clear volume gap above current levels. I’m leaning toward a relief rally: first magnet for me is the 57–58 zone, then stronger supply around 60–62 where the big volume shelf starts. Trend is still bearish overall, so I treat this as a counter‑trend squeeze, not a new bull market… yet. I might be wrong, but dead cats usually bounce higher than this.

My base plan: ✅ look for longs only while price holds above 50–51, targeting 57–58 and possibly 60–62 if momentum stays hot. ⚠️ If 50 gives way again, I expect sellers to drag LTC back to 45–46 and maybe sweep that spike low. I’m stalking a small long on dips toward 51 with stops tucked below 49, and I’ll happily flip bias if we lose that support with volume.

XRP/USDT | Where to next? (READ THE CAPTION)After hitting a new ATH mid-2025 at 3.66, Ripple has been just dropping in price since then. It hit the Bullish breaker once on October 10th 2025, and has hit it again, but this time it didn't go back to 2.52. It hit the Bullish Breaker and went as low as 1.117 before going back up and now being traded at 1.374, above the Bullish Breaker zone. If XRP manages to stay above the 1.336 zone, it can go higher a little bit.

If it manages stay above that level, the targets are: 1.3785, 1.3800, 1.3815 and 1.3830.

If it fails: 1.3700, 1.3690 and 1.3680.

BTC/USDT | Dramatic drop! (READ THE CAPTION)BTCUSDT Almost hit the Weekly Bullish OB last night at 59,800, but it stopped at 60,000 in the demand zone and then went back up, currently being traded at 66,300. If it holds above 66,000, we can expect more of it, but if it fails, it may go lower to the bullish OB.

Bitcoin starts to move toward $100,000 —Thanks for your support!This is what I call beautiful, sublime...

Consider this: The main support at $57,772 was not tested, Bitcoin started recovering right after hitting $60,000. This level is marked on the chart with a blue dashed-line. The long-term 0.786 Fib. retracement, the "unbreakable support."

The higher levels, the highs from April and November 2021, just now are being recovered, right now, today and this very same week.

Notice that this is all happening within a weekly candle. Also consider that it is happening early February. We were expecting February to be shaky at first just to turn hyper bullish later on. This is happening now.

While Bitcoin produced a major crash and the lowest price in more than a year, since October 2024, still, the active session has lower volume compared to February 2025. Showing that the bears ran out of force.

The bulls are already in and they are entering the market with power.

The fact that the bearish move was really strong is now a positive development, because we get a strong bullish wave in reverse. A very strong relief rally.

For Bitcoin, this relief rally can last an entire month. It can last more for the altcoins, the smaller altcoins. The bigger altcoins will continue to move together with Bitcoin. The bigger the project, the stronger the positive correlation.

How far up can Bitcoin go?

Minimum based on TA we get to challenge the last high which sits at $98,000. Other factors make it possible for Bitcoin to go beyond 100K. These are not very strong right now and it is still early so we will leave the description for a different day.

Good morning my fellow Cryptocurrency trader, I hope you are ready for an amazing weekend... The best is yet to come.

Thanks a lot for your continued support.

Namaste.

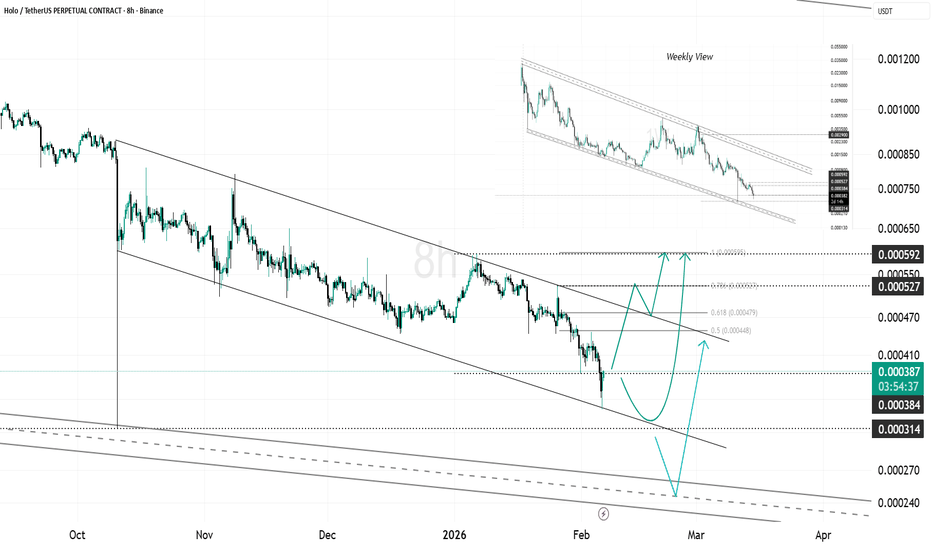

HOT Near Lower Channel Support, Liquidity Zone in FocusHOT continues to trade inside a clear descending channel on the higher time frame and is currently positioned near the lower boundary of the structure.

Price action suggests the market may revisit the previous wick around 0.000314, which sits inside a known liquidity zone. A move into this area could act as a liquidity sweep toward the lower boundary of the larger channel, before any meaningful reaction develops.

As long as HOT remains below channel resistance, the structure stays bearish. A deeper sweep into lower support would still be technically valid within the trend. Only a strong reclaim back above the channel mid-range would start to shift short-term momentum.

This is a high-sensitivity zone where volatility is expected.

Bitcoin - Pullback LevelsOn the larger timeframe, Wave 3 of the decline has been completed.

Locally, within this third wave, the fifth subwave has been completed.

We are currently in an upward corrective move. Let’s define the main targets.

Key targets:

75,000 - local correction

82,000

85,000

The potential move from the current level is 15-30% .

There is also an unfinished sub-division around 55,000 , but it appears unlikely.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

Stellar: bounce ahead or more pain? key levels to watchStellar. Knife catching or discount hunting? Recently the whole alt sector got hit as traders rotated out of risk after fresh macro comments, and according to market news Stellar just rode that same liquidation wave. Price flushed into fresh lows, sentiment is in the gutter... exactly where interesting bounces usually start.

On the 4H chart we have a waterfall drop into the 0.15 area with a volume spike and RSI buried in oversold, starting to curl up. Local HVN sits around 0.17, so any short squeeze has a natural magnet there, with heavier supply stacked higher near 0.185-0.19. Technically I lean to a relief long scenario, not a fresh trend reversal yet. ✅

My base plan: watch 0.15-0.152 as a bounce zone, with intraday targets at 0.17 first, then 0.185 if buyers stay brave. If 0.145 gives way and price can't reclaim 0.16 quickly, I drop the long idea and expect continuation toward 0.14-0.135 instead. I might be wrong, but this looks more like late capitulation than a comfortable place to open new shorts, so I’m only interested in tactical longs here with tight risk.

BTC/USDT | Bitcoin Weekly Update – Key Demand Zone in Play!By analyzing the #Bitcoin chart on the weekly timeframe, we can see that after the rally up to $97,900, price entered a correction. Within just three weeks, Bitcoin dropped around 30% and fell to $66,600, and it is now trading near $67,500.

This current area is a major demand zone. If buyers step in and defend this level, we could see a bullish rebound from Bitcoin. If this scenario plays out, the first upside target will be around $75,500.

This analysis will be updated. We’re back, stronger than ever. Thanks for all your support.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XRP / USDT — Daily Update (Follow-up)Price continued the downtrend after failing to reclaim the prior breakdown level and has now tapped the lower support zone.

The large wick from the previous move has been fully filled, meaning downside liquidity has been taken.

Current situation

Major support: ~1.25 – 1.35

Reclaim level: ~2.00

Higher resistance: ~3.00

Structure: bearish channel still intact

What this means

The market reached a reaction area where bounces normally occur.

However, as long as price trades below 2.00, the overall structure remains weak and any upside is corrective.

Simple plan

Hold 1.25–1.35 → relief bounce possible

Reclaim 2.00 → short-term strength returns

Break below support → continuation lower likely

Right now this looks like a reaction zone, not a confirmed reversal.

Do you expect XRP to stabilize here or sweep the lows first?

MrC

Chainlink: bounce or break? key levels to watch aheadChainlink. Who’s trying to catch this falling knife and actually grab the handle? After the latest risk‑off wave in crypto, LINK got hammered as traders rotated out of DeFi names, and according to market chatter funding flipped heavily negative and sentiment went full doom mode.

On the 4H chart we’re in a clean downtrend, but the last leg looks like a selling climax: long lower wick, big volume, RSI stuck in oversold around 25. Price is sitting below a fat volume node around 8.8–9.0 that used to be support and now looks like the first serious supply zone. So my base case is a relief bounce into that 8.8–9.5 pocket before bears decide what’s next.

✅ Plan: I’m only interested in a counter‑trend long if price holds above 8.0 and starts building a small base, with targets 8.8 then 9.5. ⚠️ If 8.0 gives way on strong volume, I expect a slide toward 7.2–7.0 where the next demand cluster sits. I might be wrong, but shorting straight into an exhausted dump has rarely been a profitable hobby for me.

[BTCUSDT] Bearish Bias · Techincals → ICT ConceptsFundamental Point of View:

We just had neutral data for FOMC.

We might get a strong nfp for usd.

Technical Point of view

We have a strong Resistance of 8100 If it stays strong we can see a little bearish pressure till 71k.

Better Sells are after a retest of POI.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**Key notes to keep in mind:**

1. BTC is already in a bearish trend.

2. we have broken a 4H Low which is the POI now and might get retested times before playing the sell move again.

3. we can look for 57K in this week or next week

**Current Market Overview:**

Technically we have broken our last Low and its now a point of interest for sellers.

Fundamentally we are bearish as we dont

lets take a look at different Time frames

**1Week TF:**

We have a strong POI for sellers at 72k If price touches it and stays strong we can see a little bearish pressure till 57k.

Better Sells are after a retest of POI.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**1D TF:**

We have POI close which will be triggered today for sellls. and sell side liquidity might taken out.

**4H TF:**

keeping eye on the candle breaks we have clean range on the left side.

**1H TF:**

we are currently at no trading zone but will see reaction when it starts moving

**Overall Scenario:**

we are looking for Sells only if we are respecting the 4H POI and breaking Sell side liquidity is another opportunity to trade.

**How will setup fail?**

simple if 4H Poi is broken and a small higher high breaks in 15 min or 1H.