GOLD DROPPING BADLYXAUUSD is showing a strong impulsive bullish structure on the higher timeframe followed by a sharp rejection candle, signaling a corrective phase after an overextended rally rather than a confirmed trend reversal, with price pulling back into a key Fibonacci retracement and previous breakout demand zone where resistance flipped to support, a classic breakout and retest scenario watched by smart money and trend traders. The broader market context still favors gold strength as safe haven demand, inflation hedge positioning, central bank gold accumulation, and ongoing macro uncertainty continue to underpin the long term bullish narrative, while short term volatility is being driven by US dollar flows, bond yield expectations, and high impact economic releases that temporarily fuel profit taking after parabolic moves. Technically this is a healthy pullback within an overall uptrend, with liquidity being rebalanced and momentum resetting from overbought conditions, and as long as price holds above the major demand block and structural higher low zone, dip buying, trend continuation, bullish order flow, and breakout retest setups remain the dominant strategy for positioning toward higher resistance levels once the correction completes.

Crypto

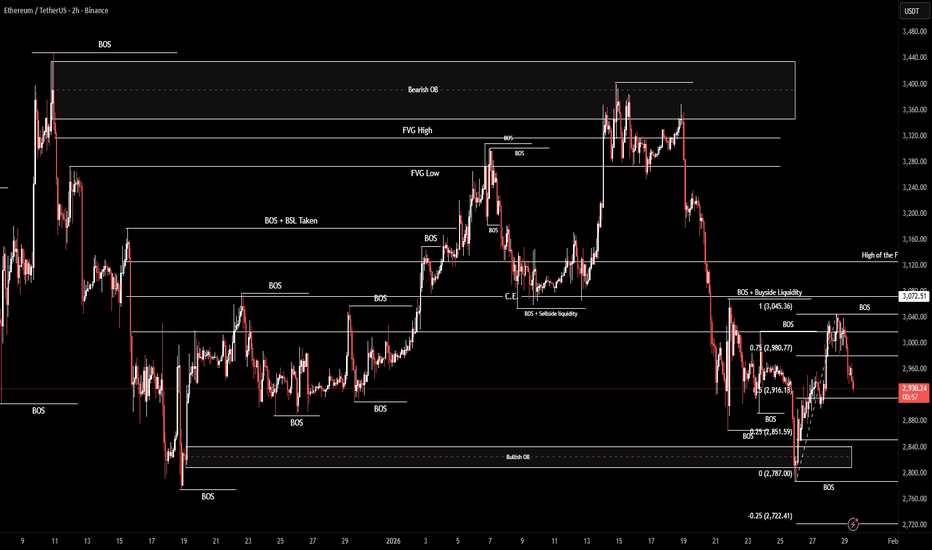

ETHUSD (3H chart pattern ).ETHUSD (3H chart pattern ).

structure-based take.

What the chart shows

Strong impulsive drop → then a bearish descending channel (flag)

Price is below the Ichimoku cloud → bearish bias

Me’ve marked a breakdown attempt near the lower channel

This looks like a bear flag continuation, not a reversal

🎯 Downside Targets

🎯 Target 1 (near-term)

≈ 2,880 – 2,850

Recent reaction lows

First liquidity/support zone

Good partial profit area

🎯 Target 2 (main target)

≈ 2,700 – 2,680

Measured move of the flag (pole → breakdown)

Strong horizontal support

Matches my marked “target point” area

🎯 Target 3 (extension, if momentum is strong)

≈ 2,600

Previous demand zone

Psychological level

❌ Invalidation

If price breaks and holds above ~3,000–3,020

Or cleanly reclaims the channel + cloud → bearish setup fails

Summary

TP1: 2,880–2,850

TP2: 2,700–2,680

TP3: 2,600 (optional extension)

If my want, I can:

Tighten this into a scalp vs swing plan

Help with stop-loss placement

Or flip it and give bullish targets if it breaks up 📈

BTCUSD (3H, chart pattern)...BTCUSD (3H, chart pattern).

clean bearish structure 👍

Here’s the straightforward target map based on what’s on my chart.

🎯 Targets (bearish continuation)

TP1: 87,900 – 88,000

→ Nearest liquidity + minor structure (price already reacting here)

TP2: 85,500 – 85,800

→ Equal lows + demand sweep zone (my marked “target point” area)

TP3 (extended): 83,800 – 84,200

→ Channel projection + higher-timeframe imbalance

🧠 Why these targets

Overall lower highs + lower lows

Price is below the descending trendline

Consolidation under resistance = bearish continuation

Ichimoku cloud above price → bearish bias stays valid

❌ Invalidation

Clean 3H close above 90,200 – 90,500

Break and hold above the descending trendline

🧭 Trade bias

Best plays: sell rallies

Avoid longing until trendline + structure break

If my want, tell me:

Entry price my eyeing

Scalp or swing.

ALGO Approaching Decision Zone Near TrendlineAlgorand has been trading under a long term descending trendline and is now compressing near a critical support zone. Price action shows the formation of a potential inverse head and shoulders structure while still respecting the broader downtrend.

The neckline area aligns closely with the descending trendline, making this zone extremely important. A successful breakout above this trendline would invalidate the bearish structure and open the path for a stronger upside continuation toward higher resistance levels.

However, if price fails to break the neckline and loses the local support, a downside move toward the lower liquidity zone is possible to complete the wick fill. This would keep the broader bearish trend intact.

Momentum is tightening and volatility is likely to expand soon. The next move from this area should define the short to mid term direction.

BTC/USDT | Sweeping the SSL (READ THE CAPTION)After failing to sweep the liquidity, BTCUSDT has been experiencing a dramatic drop in its price, going as low as $81,118 and now being traded at 82,735. I would like to see BTC drop more and sweep the sellside liquidity before make an upwards move.

Targets for BTC: 82,000, 81,500, 81,000 and 80,500.

SOL Holding Major Support Inside Falling WedgeSOL is trading inside a well defined falling wedge structure on the higher timeframe. Price has been compressing within the wedge after a strong prior move and is now reacting near the lower boundary while sitting on a major ascending support trendline.

This ascending support has acted as a strong base multiple times in the past and is currently helping to slow down the downside momentum. As long as SOL holds above this rising support, the falling wedge structure remains valid and constructive.

A short term dip toward the lower wedge support is possible, but if buyers defend this region, price can gradually rotate higher toward the upper wedge boundary. A confirmed breakout above the wedge would open the door for a stronger recovery move toward higher resistance zones.

If price fails to hold the ascending support, the bullish structure weakens and deeper downside levels may come into play. This area is a key decision zone where the next major move is likely to form.

SUI / USDT – Weekly OverviewPrice is currently trading below a key support zone, which previously acted as strong demand.

This level has now turned into resistance (S/R flip).

Key Levels

Resistance: 1.55 – 1.65

Major Resistance: 2.00

Support: 1.20 – 1.25

Downside Target: 0.85 – 0.90

Scenario 1 – Bearish Continuation

As long as price remains below 1.55, the bias stays bearish.

Failure to reclaim this level increases the probability of a move toward 0.85, which aligns with previous demand on the higher timeframe.

Scenario 2 – Bullish Recovery

A clean weekly close above 1.55–1.65 would invalidate the bearish scenario.

In that case, price could rotate back toward 2.00, where heavy resistance is expected.

Conclusion

This is a high-timeframe decision zone.

Patience is key — wait for confirmation instead of anticipating the move.

What do you think: breakdown continuation or reclaim of resistance?

MrC

BTCUSDT Long: Recovery From Demand Zone - $89,800 in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. Bitcoin is trading within a broader corrective-to-recovery phase following a strong bullish impulse that previously developed inside a well-defined ascending channel. Within that channel, price consistently printed higher highs and higher lows, confirming buyer dominance and healthy trend conditions. The rally ultimately reached a key pivot point near the upper boundary of the ascending channel, where bullish momentum began to weaken. From this pivot high, BTC transitioned into a consolidation range, signaling temporary balance and distribution rather than immediate continuation.

Currently, BTC is recovering from the demand zone and moving higher along a rising demand line, while approaching the former supply level near 89,800. Price action suggests a corrective recovery rather than a full trend reversal, with buyers attempting to reclaim key structure. The area around 89,800 now acts as a critical decision zone, where market acceptance or rejection will likely define the next directional move.

My scenario: as long as BTCUSDT holds above the 87,200 Demand Zone and continues to respect the rising demand line, I expect a continuation of the recovery toward the 89,800 Supply Level (TP1). A clean breakout and acceptance above this resistance would strengthen the bullish recovery scenario and open the door for a move back toward higher resistance levels. However, a strong rejection from supply followed by a breakdown below demand would invalidate the recovery and suggest continuation of the broader corrective move. For now, price action shows buyers regaining short-term control, but confirmation at resistance is key. Manage your risk!

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BTCUSDT: Recovery From Support Within a Uptrend Toward $92,300Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader bullish market structure, previously supported by a well-defined upward channel. Inside this channel, price consistently printed higher highs and higher lows, confirming strong buyer dominance. During the advance, BTC reached the upper boundary of the channel, where a fake breakout occurred. This failure to hold above the channel top signaled temporary exhaustion and triggered a sharp corrective move to the downside. Following the rejection, price broke below the mid-channel structure and dropped aggressively into a clearly defined Support Zone around 88,500–89,000. This zone acted as a key reaction area, where selling pressure weakened and buyers began to absorb liquidity. The initial breakdown below support resulted in a fake breakout to the downside, after which BTC quickly reclaimed the level, indicating seller trap behavior.

Currently, after the fake breakdown, price entered a consolidation range, showing balance and compression rather than continuation selling. This range reflects a corrective phase after the impulsive drop, not a trend reversal. Recently, BTC broke out of this range to the upside and is now respecting a rising triangle support line, which suggests growing buyer strength and improving short-term structure.

My Scenario & Strategy

My primary scenario is bullish continuation as long as BTCUSDT holds above the 88,500–89,000 Support Zone and respects the ascending triangle support line. The recent breakout from the consolidation range strengthens the probability of a corrective recovery turning into a continuation move. I expect buyers to push price higher toward the 92,300 Resistance Zone (TP1), which represents previous resistance and a key reaction level. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for a move back toward the upper boundary of the larger bullish structure.

However, if price fails to hold above support and shows strong bearish acceptance below the 88,500 zone, this long scenario would be invalidated and increase the probability of deeper downside continuation. For now, structure favors buyers, and the current move appears to be a healthy recovery after a corrective shakeout.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

SOL/USDT | SSL sweep? (READ THE CAPTION)As you can see in the 4h chart of SOLUSDT, it has experienced a massive drop from 148.74 all the way to 117.15, but managed to recover a bit and reached 128.34 before dropping again and now it's being traded at 122.70.

I don't want Solana to go for the Sellside liquidity pinpointed on the chart, but it is not unlikely for it to go there and sweep the liquidity below the 116.88 level, then starting a move upwards, going for the IFVG.

Bullish Targets for Solana: 123.00, 123.50, 124.00, 124.50 and 125.

Bearish targets: 122.50, 122.00, 121.50 and 121.00.

ETH/USDT | Where will it go? (READ THE CAPTION)By examining the 4H chart of the ETHUSDT we can see that Ethereum hit 3045, hitting the low of the FVG, but then today it dropped all the way to 2923, now being traded at 2928.

I'd like to see Ethereum retest the FVG again and then sweep the Buyside Liquidity pool.

Bullish Targets: 2936, 2954, 2972 and 3000.

Bearish targets: 2916, 2900 and 2884.

BTC/USDT | What's ahead? (READ THE CAPTION)As you can see in the Hourly chart of BTCUSDT, it reached all 4 targets of the previous analysis, reaching 90,600, going above the high of the IFVG, but then again, it returned to the IFVG zone and then went even lower, being traded now at 87,900.

There are relatively equal lows below with liquidity residing below them.

Ideally, I'd like BTCUSDT to sweep the liquidity below there and then make an upwards move.

For the time being, bullish targets: 88,200, 89,200 and 90,200.

Bearish Targets: 87,500, 86,900 and 86,300.

ETH Holding Major Support Inside Descending Broadening WedgeEthereum is currently trading inside a major descending broadening wedge structure on the daily timeframe. Price has been compressing while respecting the wedge boundaries, and it is now approaching a key confluence zone formed by ascending support and Fibonacci retracement levels.

The grey zone highlights the 0.5 to 0.618 Fibonacci retracement area, which aligns closely with the rising long term support trendline. This makes the current region a high importance reaction zone. As long as ETH holds above this ascending support, the structure remains constructive for a potential upside continuation.

A successful hold and bounce from this area could allow price to rotate higher toward the upper boundary of the broadening wedge and eventually attempt a breakout. On the downside, a clean loss of this support would weaken the bullish case and open the door for a deeper retracement before any meaningful recovery.

ETH is at a technical decision point where the reaction around support will likely define the next major move.

UNI Holding Support Inside Falling StructureUNI is currently trading inside a long term falling structure and is reacting near an important support zone. Price has recently tested the lower boundary of the descending move and is attempting to stabilize, while still remaining below the key descending resistance line.

The blue trendlines highlight a falling wedge style compression within the broader downtrend. This area is critical, as holding above the current support could allow UNI to move back toward the upper trendline and challenge nearby resistance levels. A breakout above this descending resistance would be the first sign of a trend shift.

On the downside, failure to hold this support may lead to a deeper continuation move toward the lower demand zone shown on the chart. RSI remains weak but close to oversold territory, suggesting downside momentum may be slowing.

UNI is at a decision point where the next reaction will likely define whether this move develops into a recovery or continues as a bearish extension.

BTCUSD: Bearish Structure Still in ControlHello, this is Domic.

On the D1 timeframe, Bitcoin remains in a medium-term downtrend. Price is currently trading around 87.6K but is still capped below the EMA levels, indicating that the recent upside move was only a technical rebound and not strong enough to signal a trend reversal.

The key level to watch is 85K. Price structure continues to form lower highs, while the 90.5K zone above has clearly turned into a structural resistance. To shift the bias back to bullish, BTC must post a daily close above 90.5K. Until that happens, all rebounds should still be viewed as corrective moves within a broader downtrend.

Wishing you successful trading!

Bitcoin at Key Support as Trendline Reclaim Comes Into FocusBTC is currently reacting from a major support zone after a sharp corrective move from the previous highs. Price has moved back into a historically important demand area, where buyers have stepped in before. This zone aligns with higher time frame structure support and acts as a key level for market stability.

The most important factor to watch now is the long term ascending trendline. A successful reclaim and hold above this trendline would signal that bullish structure is being restored and could open the path for a continuation toward the upper resistance range shown on the chart.

If price fails to hold above the current support and loses momentum, a deeper retracement toward the lower demand zone remains possible. This area still sits within the maximum corrective range without breaking the broader market structure.

Bitcoin is approaching a critical decision point where volatility is expected to increase. The next move will likely define the medium term trend direction.

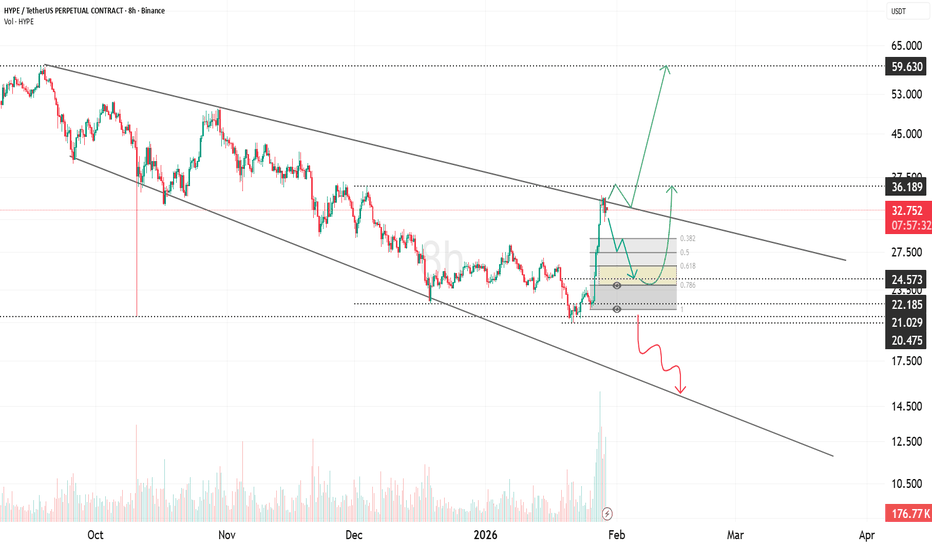

HYPE Testing Broadening Wedge ResistanceHYPE is forming a broadening wedge pattern, where price action is expanding with higher volatility over time. After reacting from the lower boundary of the structure, price has moved back toward the upper trendline, which is acting as a key resistance zone.

This area is important because broadening wedges often signal increasing market participation and volatility before a larger directional move. A sustained breakout above the upper wedge resistance could confirm bullish continuation and open the path toward higher supply zones marked on the chart.

If price fails to break this resistance and gets rejected, a pullback toward the lower boundary of the broadening wedge remains possible. The market is approaching a decision point, and a strong move is likely once this range resolves.

Prop Firms vs Real Accounts: The Structural Trade-Off Most TradeMost comparisons between prop firms and real accounts focus on capital size, profit splits, or challenge difficulty. What is discussed far less is how each environment reshapes the way traders think, decide, and execute. The difference is structural, and it has a direct impact on performance.

Prop firm accounts are rule-bound by design. Daily drawdown limits, maximum loss thresholds, and evaluation deadlines create a narrow operating window. These constraints reward control and consistency, but they also introduce pressure. Every trade is filtered through the question of survival. Traders become highly sensitive to short-term equity fluctuations because a single mistake can end the account.

This changes behavior in subtle ways. Traders hesitate to hold through normal drawdowns, cut winners early to protect equity, or avoid valid setups late in the day to reduce risk exposure. None of these actions are irrational. They are logical responses to the environment. The issue arises when traders confuse rule compliance with optimal execution.

Real accounts remove these external constraints. There is no forced stop at a daily loss and no expiration date. Drawdowns are uncomfortable but recoverable. This freedom allows for longer holding periods, broader trade selection, and more flexibility in execution. At the same time, it demands a higher level of internal discipline. Without rules enforced externally, risk management becomes entirely self-regulated.

Many traders perform well in one environment and struggle in the other because the skill sets are different. Prop firms reward precision, restraint, and consistency under pressure. Real accounts reward patience, emotional regulation, and long-term thinking. Success in one does not automatically translate to success in the other.

The mistake is treating prop accounts as practice for real trading without acknowledging the incentives involved. The rules shape behavior, expectations, and even strategy selection. Traders who understand this stop blaming themselves for feeling constrained or overly cautious.

Neither model is superior. Each serves a different purpose. Clarity comes from aligning your approach with the structure you are trading under, rather than forcing one mindset into the wrong environment.

$USDT & $USDC vs. $ETH - Warning a Funeral could occur. 💀 💀 💀

Watch the Stablecoin/ETH Market Cap ratio carefully.

A spike here isn't always 'Dry Powder' waiting to buy.

The Trap: If ETH breaks the $2,400 support level, we could see a 'Liquidation Spiral' that sends the ratio to all-time highs.

This isn't new money coming in—it's ETH value vanishing.

Safe Haven: Cash is King until ETH reclaims its 200-day SMA at $3,400."

#ETH #Ethereum #Stablecoins #MarketCrash #LiquidityTrap #CryptoAnalysis @thecryptosniper #HVF

what does AI say:

📉 The Doomsday Ratio: (USDT + USDC) / ETH

In a crash, this ratio spikes vertically. But unlike a "healthy" spike (where new money enters), this is a "Deleveraging Spike."

1. The ETH Collapse (The Denominator Shrinks)

Revenue Compression: Layer 2s are so efficient now that they are starving the Mainnet of fees. Without a high "burn" rate, ETH is becoming slightly inflationary again, losing its "Ultra Sound Money" appeal.

The ETF "Exodus": If institutional investors see ETH as a "leveraged claim on ecosystem activity" that isn't growing, they may rotate back to Gold or Bitcoin. A sustained outflow from spot ETFs could trigger a -40% re-rating.

The Liquidation Spiral: Since many "loopers" use ETH as collateral to borrow stablecoins, a price drop below $2,400 could trigger a cascade of liquidations on Aave/Compound, forcing more ETH onto the market and crushing its market cap.

2. The TradFi Standoff (The Numerator Stagnates)

The "Trust Gap": If the ratio increases simply because ETH is dying, TradFi institutions won't "buy the dip" with new USDC. They will wait for more regulatory "Supervision" rather than just "Legislation".

The Yield Trap: If stablecoins like USDT/USDC don't offer higher yields than risk-free US Treasuries (currently highly competitive in 2026), there is no incentive for a corporate treasurer to move cash onto the blockchain.