Two Rules for Crypto Traders in 2026: Less Hype, More DisciplineOver the past years, the crypto market has evolved from a curiosity-driven financial space into a highly competitive environment — where the difference between speculation and disciplined trading has become clearer than ever.

Most traders don’t lose money because they lack technical skills.

They lose because of:

- psychological biases

- unrealistic expectations

- bad information sources

For 2026, I would reduce things to just two essential principles.

🔹 1. Stop following bombastic influencers with a single narrative

If your feed looks like this…

- “Altcoin season is coming”

- “Next 100x coins”

- “How to become a millionaire in 2026”

- “This coin will change your life”

…you are not learning.

You are being emotionally conditioned.

These influencers/content creators are not traders — they are marketers.

Their incentives are:

➡ engagement

➡ clicks

➡ referrals

➡ product sales

Regardless of:

- trend direction

- market cycle

- volume and liquidity

- macro environment

their message remains the same:

“Bullish. Huge upside ahead. Don’t miss the opportunity.”

The real problem?

They never:

- consider alternative scenarios

- discuss risk or downside

- speak in probabilities

- build structured technical arguments

They don’t do analysis.

They sell optimism.

For a trader, exposure to this kind of content:

- increases FOMO

- reduces patience

- destroys discipline

- creates unrealistic expectations

If you see permanent hype — scroll past it .

A sustainable portfolio is not built on motivational narratives.

🔹 2. Use technical analysis and trade major, liquid coins

Most traders don’t blow up accounts because they:

- fail to understand patterns

- misread signals

They blow up because they allocate risk into:

- illiquid tokens

- low-cap projects

- structurally weak charts

- easily manipulated markets

Major, liquid coins:

- respect technical levels better

- have real trading volume

- react more cleanly to structure

- provide clearer probability models

Examples where TA makes sense:

- BTC

- ETH

- SOL

- high-liquidity L1 / L2

Here you can apply:

- trend-following

- support & resistance

- liquidity zones

- volume reactions

- structural break logic

You do NOT need to search for:

❌ “hidden gems”

❌ “next 100x coin”

❌ “unknown early opportunity”

You should be searching for:

👉 discipline

👉 structure

👉 probability

Trading improves when you stop:

- chasing hype

- hunting jackpots

- confusing hope with analysis

Closing Thought

If I had to summarize in one principle:

Less noise. Less spectacle.

More structure. More responsibility.

Success in trading rarely comes from:

❌ catching the miracle coin

❌ believing motivational promises

❌ chasing the next big narrative

It comes from:

✅ disciplined technical analysis

✅ rational risk management

✅ focusing on liquid assets

✅ staying emotionally grounded

Everything else is noise.

Happy New Year!

Mihai Iacob

Cryptoeducation

Radio Yerevan: Is Crypto the Biggest Wealth Transfer in History?Answer: Yes. But not in the direction people hope.

In the last decade, crypto marketing has repeated one grand promise:

“This is the biggest wealth transfer in human history!”

And in classic Radio Yerevan fashion, this statement is both true and misleading.

Yes — a historic wealth transfer took place.

No — it did not empower the average investor.

Instead, it efficiently moved wealth from retail… back to the very entities retail thought it was escaping from.

Let’s break it down: structured, clear, and with just the right amount of irony.

1. The Myth: A Decentralized Financial Uprising

The early crypto narrative was simple and beautiful:

- The people would reclaim financial independence.

- The system would decentralize power.

- Wealth would flow from institutions to individuals.

The idea was inspiring — almost revolutionary.

Reality check: Revolutions are expensive.

And someone has to pay the bill.

In crypto’s case, the average investor volunteered enthusiastically.

2. The Mechanism: How the Transfer Actually Happened

To call crypto a wealth transfer is not an exaggeration.

The numbers speak loudly:

Total market cap peaked above $3+ trillion.

Most of the profit was extracted by:

- VCs who bought early,

- teams with massive token allocations,

- exchanges capturing fees on every trade,

- and whales who mastered liquidity cycles.

Retail investors, meanwhile, contributed:

- capital,

- liquidity,

- hope,

- hype

- and a remarkable tolerance for drawdowns.

It was, in essence, the perfect economic loop:

money flowed from millions → to a concentrated few → exactly like in traditional finance, only faster and with better memes.

3. The Irony: A Centralized Outcome From a Decentralized Dream

Here lies the great contradiction:

Crypto promised decentralization. Tokenomics delivered centralization.

When 5 wallets hold 60% of a token’s supply, you don’t need conspiracy theories — you need a calculator.

The “revolution” looked more like:

- Decentralized marketing

- Centralized ownership

- Retail-funded exits

- And a financial system where “freedom” was defined by unlock schedules and vesting cliffs

But packaged correctly, even a dump can look like innovation.

4. Why Retail Was Doomed From the Start

Not because people are unintelligent, but because:

- No one reads tokenomics.

- Unlock calendars sound boring.

- Supply distribution charts kill the romance.

- Liquidity mechanics are not as exciting as „next 100x gem”.

- And hype travels faster than math.

In a speculative market, psychology beats fundamentals until the moment fundamentals matter again — usually when it's too late.

5. The Real Wealth Transfer: From “Us” to “Them”

The slogan said:

“Crypto will redistribute wealth to the people!”

The chart said:

“Thank you for your liquidity, dear people.”

The actual transfer looked like this:

- Retail bought the story.

- Institutions created the tokens.

- Retail bought the bags.

- Institutions sold the bags.

- Retail called it a correction.

- Institutions called it a cycle.

Everyone had a term for it.

Only one group had consistent profits from it.

6. So, Was It the Biggest Wealth Transfer in History?

Yes.

But not because it made the average investor rich.

It was the biggest because:

- no previous financial system mobilized so many people

- so quickly

- with so little due diligence

- to transfer so much capital

- to so few beneficiaries

- under the banner of liberation.

It wasn’t a scam.

It wasn’t a conspiracy.

It was simply financial physics meeting human psychology.

7. The Lesson: Crypto Isn’t the Problem — Expectations Are

- Blockchain remains a brilliant invention.

- Tokenization has real use cases.

- DeFi is a groundbreaking paradigm.

- And so on

The issue wasn’t the technology.

It was the narrative that convinced people that buying a token was equivalent to buying financial freedom.

Real freedom comes from:

- understanding liquidity,

- reading tokenomics,

- respecting supply dynamics,

- and asking the only question that matters:

“If I’m buying… who is selling?”

In markets — especially crypto — this question is worth more than any airdrop.

8. Final Radio Yerevan Clarification

Question: Will the next crypto cycle finally deliver the wealth transfer to the masses?

Answer: In principle, yes.

In practice… only if the masses stop donating liquidity.

Crypto "Investors" Forget Too Quickly- Part OneI’ve never been much of a gambler.

I don’t chase roulette, I don’t play blackjack regularly, and casinos have never been my second home. But on the rare occasions when I did go—usually dragged by friends who actually like gambling—something strange happened to me.

I ended up losing considerable amounts of money.

- Not because I thought I’d win.

- Not because I had a “system.”

- Not because I felt lucky.

It was the environment:

- the lights

- the noise

- the adrenaline

- the drinks

- the atmosphere that hijacks logic

And the next morning, the internal monologue was always the same:

“See, idiot? Again you drank one too many and managed to lose a Hawaii vacation.”

- The regret is real.

- The pain is real.

- The stupidity is, HOHO, WAY TOO REAL.

But the disturbing part?

Even though I don’t gamble… even though I don’t chase casinos… the environment alone was enough to override my reasoning.

And if that can happen to someone who isn’t a gambler, imagine what happens to someone who willingly walks into a casino every day —because that’s exactly what crypto "investors" do.

Crypto markets are casinos with better screens, countless memes, screaming influencers and worse odds.

And "investors" forget far too quickly.

Crypto "Investors" Forget Too Quickly —

Just Like Casino Gamblers Who Keep Coming Back for More

Crypto "investors" have one of the shortest memories in financial markets.

- Not because they are stupid.

- Not because they don’t care.

- But because the entire crypto environment is engineered to erase pain and preserve hope — exactly like a casino.

Put a gambler in a casino, and he forgets last night’s disaster the moment he sees the lights again.

This comparison is not metaphorical.

It is psychologically identical.

Let’s break it down properly.

1. The Human Brain Is Not Built for Crypto — or Casinos

Both environments share the same psychological architecture:

- bright colors

- fast feedback loops

- uncertainty

- intermittent rewards

- emotional highs

- catastrophic lows

- near-wins that feel like wins

- an illusion of control

Neuroscience calls this:

Intermittent Reinforcement

The most addictive reward structure ever discovered.

Slot machines are built on it.

Most crypto charts mimic it.

Volatility fuels it.

When rewards arrive unpredictably:

- dopamine spikes

- memory of losses fades

- the brain overvalues the next opportunity

- the pain of the past gets overwritten

- the hope of future reward dominates

This is why gamblers return.

And this is why crypto "investors" buy the same s..ts.

2. The Crypto Cycle Erases Memory by Design

After every bull run for an obscure coin:

- big money is made (by insiders)

- screenshots are posted

- what if you have bought with 100usd appear

- influencers multiply

- everyone becomes a “trading wizard”

- Twitter becomes an ego playground

- greed replaces rationality

After every strong bear move:

- portfolios crash 90-95%

- people swear “never again”

- Telegram groups die

- influencers delete posts

- conviction collapses

- despair dominates

But then…

When a new "narrative" appears:

- Everything resets.

- Crypto "investors" forget instantly.

No other financial market resets memory this fast.

- In stocks, a crash leaves scars.

- In forex, blown accounts create caution.

- In real estate, downturns shape behavior for years.

But in crypto?

The new "narative"/ the new hyped coin erases the old one like chalk on a board.

3. The TrumpCoin & MelaniaCoin Episode (Just an Example):

The Best Proof That Crypto Traders Forget Too Quickly

TrumpCoin and MelaniaCoin didn’t have real value.

They weren’t serious projects.

They weren’t even clever memes.

They were psychological traps built on celebrity gravity.

People bought because:

- the names were big

- the media amplified the narrative

- the symbolism felt powerful

- the story was exciting

And the wipeout was brutal.

But the key point is: traders forgot instantly.

Within weeks, they were already hunting for:

- “the next TrumpCoin”

- “the next politician meme”

- “the next celebrity pump”

- “the next token with a ‘name’ behind it”

- "the next 100x"

"the next, the next, the next" and is always the same

- Not the next valuable project.

- Not the next real innovation.

- Not the next sustainable investment.

No.

The next symbol.

This is not market behavior.

This is casino relapse psychology.

4. These Coins Didn’t Fail Because They Were Memes —They Failed Because They Were Nothing

TrumpCoin & MelaniaCoin ( Again, is just an example) pretended to matter because the names mattered.

- Traders didn’t buy utility.

- They bought a fantasy.

The same way gamblers believe a “lucky table” changes their odds.

In crypto, people believe:

- the celebrity matters

- the narrative matters

- the hype matters

Reality doesn’t.

5. Why Crypto "Investors" Don’t Learn: Because They Don’t Remember

Crypto "investors" are not stupid.

They are forgetful.

They forget the months of pain and remember only the few happy moments.

They forget:

- drawdowns

- stress

- panic

- illusions

- scams

- broken promises

- influencers lies

They remember:

- one good run

- one moonshot

- one dream

This is why most altcoins and memes thrive.

Not because they deserve to.

But because forgetting resets demand every time.

6. The Industry Is Designed to Exploit This Amnesia

If traders remembered:

- Luna

- FTX

- SafeMoon

- ICO (2017) crashes

- NFT (2021) collapses

- Meme mania recently

…the most of the altcoin sector would evaporate overnight.

But "investors" forget —so altcoins with a "nice" story resurrect.

Like slot machines resetting after every gambler walks away.

7. The Cure: You Don’t Need Better Tools — You Need a Better Memory

The greatest edge in crypto is not fancy indicators, bots to be the first in, or whatever invention comes next.

It’s remembering.

Remember:

- why you lost

- how you lost

- which narrative fooled you

- how the market humiliated you

- what the casino environment does to your brain

- how celebrity tokens wiped people out

Crypto trading requires memory, not optimism.

Conclusion:

Crypto "Investors" Forget Too Quickly —And That’s Why They Keep Losing

Crypto "investors" don’t think like REAL investors.

They think like gamblers:

- emotional

- hopeful

- impulsive

- forgetful

convinced “this time will be different”

The latest meme mania proved this perfectly.

Crypto is not dangerous because it is volatile.

Crypto is dangerous because it erases your memory.

The "investor" who forgets loses.

The "investor" who remembers wins.

Because in crypto:

The moment you stop forgetting is the moment you finally start winning.

P.S. (A Necessary Clarification, Said Gently — and Honestly)

Throughout this article I used the word “investors” in quotation marks — and it wasn’t an accident.

Most of the people who call themselves investors in crypto are not actually investing.

They are speculating, chasing, hoping, and gambling on meme coins and obscure altcoins purely because “they have 100x potential.”

Let’s be honest:

- buying a token named after a frog

- or a coin launched yesterday by anonymous developers

- or a “next big narrative” pump with zero product

- or a celebrity meme coin

- or something that exists only on Twitter…is not investing.

It’s gambling dressed in nice vocabulary.

And that’s okay — as long as you know what it is.

Also, to be clear:

When I critique “altcoins,” I am not talking about all of them.

There are real infrastructure projects, real protocols, real technology, and real builders out there.

But let’s not pretend:

90% of altcoins exist for hype, for extraction, for speculation, and for the dopamine of “maybe this one will moon.”

I’m talking about those coins — the ones that behave like slot machines and survive only because traders forget too quickly.

If this article made you uncomfortable, good.

Sometimes the truth has to sting before it can help.

You Don’t Need 100 Coins – You Need 1 Plan!b]Hello Traders!

In crypto, most traders believe the key to success is owning every new coin that launches.

They fill their portfolio with 50, 80, even 100 different tokens, hoping one of them will explode and make them rich.

But here’s the truth: you don’t need 100 coins, you just need 1 clear plan.

Because in trading and investing, confusion kills returns, and clarity creates wealth.

1. The Illusion of Diversification

Having too many coins doesn’t make you diversified, it makes you distracted.

True diversification means spreading across uncorrelated assets, not buying every token that trends on Twitter.

Most altcoins move with Bitcoin anyway, so holding 50 of them doesn’t protect you when the market drops.

Owning too much is often a sign of uncertainty, not strategy.

2. The Power of Focus

The most successful investors study deeply, not widely.

They pick a few strong assets, understand their fundamentals, and hold through noise.

You make money by conviction, not collection.

Warren Buffett once said:

“Diversification is protection against ignorance.”

In crypto, it’s often protection against not doing your homework.

3. Why You Need a Plan, Not Picks

A trading plan defines when to buy, when to sell, and how much to risk.

It removes emotion, because you already know what to do when volatility hits.

Without a plan, even 100 coins can’t save you from panic or greed.

With a plan, even one good asset can make you financially free.

The market doesn’t reward how many coins you own, it rewards how you manage them.

4. What a Simple Crypto Plan Looks Like

Step 1: Choose 3–5 coins with real use case, strong community, and consistent development.

Step 2: Define your investment horizon, 1 year, 3 years, or 5 years.

Step 3: Allocate capital based on conviction, not hype.

Step 4: Use SIP or DCA to build positions over time.

Step 5: Rebalance every 6 months to maintain focus and risk control.

That’s it, simple, structured, and powerful.

Rahul’s Tip:

If you ever feel overwhelmed by too many coins, step back and simplify.

The more complicated your portfolio looks, the more uncertain your thinking is.

Remember, wealth doesn’t come from chasing everything. It comes from mastering something.

Conclusion:

The biggest trap in crypto is believing more coins mean more chances.

But true success belongs to those who build systems, not collections.

You don’t need 100 coins, you just need 1 plan that you actually follow.

If this post helped you rethink your strategy, like it, share your thoughts in comments, and follow for more clear and practical crypto insights!

How to Build Consistency in Volatile MarketsVolatile markets test every trader. Prices move fast, spreads widen, and emotion replaces logic. Consistency comes from structure, not prediction. The traders who last stay calm, trade small, and focus on execution. Their process stays the same, no matter how the market moves.

Control Your Risk

When volatility rises, reduce position size. Risk less per trade to protect your capital.

A trader risking 2% per position during calm markets should drop to 1% or lower when volatility spikes.

The goal is survival. Without capital, you cannot stay consistent long enough to let probabilities play out.

Trade Rules, Not Feelings

Rules keep you consistent when emotions take over.

Define entries, exits, and invalidation levels before each session.

Follow them without hesitation.

Avoid impulsive trades driven by fear or excitement. Each disciplined decision builds long-term consistency.

Limit Screen Time

More screen time rarely means better trading.

Constant watching increases stress and leads to reaction-based trades.

Set trading hours. Step away when the market does not match your plan.

Patience is a trading skill. Consistency grows in quiet moments, not in constant activity.

Use Volatility as Data

Volatility is not a signal. It is a condition.

Use tools like ATR to measure it and adjust your position size.

Wait for clean setups after large moves.

Avoid chasing price. Volatile moves without confirmation create poor entries and fast losses.

Track Behavior, Not P&L

You cannot control outcomes, only execution.

Journal each trade. Note whether you followed your plan.

Measure discipline instead of profit.

When you improve your process, the results follow.

Build a Stable Routine

Consistency begins before the first trade.

Start each session by:

• Reviewing key levels.

• Setting daily loss limits.

• Writing down invalidation points.

When preparation becomes habit, decision-making becomes objective.

Final Thoughts

Consistency is built from repetition, not prediction.

Volatile markets punish reaction and reward structure.

Trade your plan. Manage your size. Stay patient.

Each disciplined session adds to your edge. Over time, stability wins.

Why Bitcoin’s 4-Year Cycle Might Be Its Biggest LimitationFor years, traders have treated Bitcoin’s 4-year halving as sacred — a mechanical driver of boom and bust. But what if the real reason these cycles repeat isn’t the code… but the crowd?

Mechanically, Bitcoin’s issuance schedule is a smooth, predictable decline. The halving simply adjusts the slope of supply — it doesn’t dictate price. Yet, like clockwork, markets rise and fall every four years. Why?

Because we expect them to.

This expectation creates a self-fulfilling feedback loop:

- Pre-halving optimism fuels accumulation and speculative positioning.

- Post-halving euphoria drives parabolic rallies as new participants flood in.

- Overvaluation and leverage eventually unwind, triggering brutal corrections.

The halving became the metronome of market psychology — a narrative so powerful that it shaped behavior more than fundamentals ever did.

🧠 The Institutional Shift

Now, that narrative is being rewritten.

Institutions don’t trade on memes or cycles — they trade on models, liquidity, and risk.

Unlike retail investors, institutions hate volatility. They don’t chase euphoria; they manage exposure.

- ETFs and funds accumulate steadily through structured inflows.

- Option and futures desks hedge risk dynamically, suppressing volatility.

- Algorithmic allocators rebalance based on Sharpe ratios, not halving hype.

This structural participation acts as a volatility dampener — flattening the amplitude of Bitcoin’s historic boom-bust waves.

🌍 From “Halving Cycle” to “Liquidity Cycle”

As Bitcoin matures, the real driver of its price action is shifting away from internal events and toward macro liquidity conditions :

- When global liquidity expands (rate cuts, QE, easing credit), Bitcoin thrives.

- When liquidity contracts (rate hikes, QT, risk-off sentiment), Bitcoin cools.

In this new phase, the halving’s scarcity still matters — but it’s no longer the heartbeat.

Instead, Bitcoin is syncing to the rhythm of global capital flows.

📈 The New Market Identity

We’re watching Bitcoin transition from a reflexive narrative asset to a macro-integrated store of value .

If this continues, the implications are profound:

- Shallower drawdowns and fewer liquidation cascades.

- More consistent accumulation across cycles.

- Higher institutional allocation as volatility compresses.

Ironically, the same psychological loop that once fueled Bitcoin’s meteoric rise may now be what caps its potential.

The halving didn’t make Bitcoin cyclical — investor behavior did .

And as smart money takes over, that feedback loop may finally be breaking.

🚀 What This Might Mean for Future Bull Runs

If institutions continue to dominate Bitcoin’s liquidity, the next bull runs may look less like fireworks and more like steady expansion — smoother, slower, but more sustainable.

Instead of 12-month parabolas followed by multi-year winters, we could see:

- Extended accumulation phases where price grinds higher over longer horizons.

- More efficient corrections that reset leverage without catastrophic selloffs.

- Reduced retail blow-off tops as narrative-based speculation loses power.

That doesn’t mean the explosive upside is gone — it means the path to higher valuations might look more like a compound growth curve than a recurring bubble.

The next phase of Bitcoin’s evolution isn’t about chasing the halving — it’s about understanding liquidity, positioning, and psychology on a global scale.

- The crowd traded Bitcoin like a story.

- Institutions are turning it into a system.

Meme Coins: Gambling or Genius? The Untold Psychology!Hello Traders!

From Dogecoin to Shiba Inu to PEPE, meme coins have turned ordinary investors into overnight millionaires… and just as quickly, wiped them out.

But behind all the hype, memes, and moonshots, lies a deeper question:

Are meme coins pure gambling, or is there actually a kind of genius hidden inside this madness?

Let’s explore the real psychology that drives the meme coin phenomenon and what it teaches us about market behavior.

1. The Allure of “Quick Rich” Dreams

Meme coins sell emotion, not utility. They trigger the most powerful desire in human nature, the dream of instant wealth.

Traders jump in not because of fundamentals, but because of FOMO (Fear of Missing Out).

When people see others getting rich on Twitter or Telegram, logic disappears, replaced by hope and greed.

Meme coins don’t just trade on charts; they trade on human emotion.

2. The Hidden Genius of Community Psychology

While most treat meme coins as jokes, their creators understand one truth, markets move on attention .

Every meme coin is a masterclass in viral marketing.

They combine humor, belonging, and financial dreams, creating powerful communities that believe, promote, and act together.

It’s not fundamentals, it’s faith.

And when millions believe at the same time, even a joke becomes valuable, at least for a while.

3. The Bubble Psychology – Why It Repeats

Each meme coin cycle starts the same: early adopters accumulate silently.

Then comes the hype wave, influencers, trends, and social media buzz.

Late buyers rush in, liquidity explodes, and eventually, the supply outpaces the demand.

Finally, prices collapse, but the story repeats with a new name next month.

Humans never learn because our emotions never evolve. The pattern stays the same, only the logos change.

4. Genius or Gambling – The Thin Line

If you treat meme coins as “investments,” you’re gambling.

But if you treat them as short-term speculative plays with strict risk limits, you’re being strategic.

The key difference is not in the coin, it’s in your mindset.

Even BNF-level discipline can’t save someone trading emotionally in meme markets.

The real genius is not in predicting the next PEPE, it’s in managing risk when emotions run wild.

Rahul’s Tip:

Meme coins reveal more about human behavior than any economic theory ever will.

If you can understand why people chase hype, and control the urge within yourself, you’ll already be ahead of 90% of traders.

Conclusion:

Meme coins are not just digital jokes, they are mirrors reflecting our collective greed and hope.

They remind us that markets are not rational, they are emotional.

In the end, whether meme coins make you rich or broke depends less on the coin, and more on your ability to stay grounded while everyone else loses control.

If this post gave you a new perspective on meme coins, like it, share your view in comments, and follow for more deep trading psychology insights!

The Silent War Between Traditional Finance and Crypto!Hello Traders!

Whether you realize it or not, there’s a silent war happening in the financial world, a battle between Traditional Finance and Crypto .

On one side are banks, regulators, and old financial systems built over centuries.

On the other, a decentralized movement that aims to replace them with blockchain and digital assets.

This war isn’t fought with weapons, it’s fought with innovation, control, and trust.

1. The Old Guard, Traditional Finance

Traditional finance relies on intermediaries, banks, brokers, and central banks.

Transactions are slow, heavily regulated, and full of middlemen fees.

The system gives stability but limits freedom. Every transfer, loan, or investment must pass through institutions that hold the power.

2. The New Challenger, Crypto & Decentralization

Crypto removes the middleman by allowing peer-to-peer value exchange through blockchain.

It offers transparency, speed, and global access, anyone with an internet connection can participate.

For the first time, individuals can control their money without asking permission from financial authorities.

3. Why It’s a “Silent War”

Traditional finance sees crypto as a threat to its control.

Regulators tighten policies to limit crypto adoption, while institutions secretly invest behind the scenes.

At the same time, crypto needs traditional finance for liquidity, fiat conversions, and institutional trust.

So both depend on each other, even as they compete.

4. The Future, Integration, Not Elimination

Over time, the war may end in balance, not destruction.

Banks and funds are already entering blockchain through tokenization, ETFs, and digital custody.

The final version of finance may be a hybrid, traditional systems powered by crypto infrastructure.

Rahul’s Tip:

Don’t think of TradFi vs Crypto as enemies, think of them as two forces shaping the next generation of money.

The real winners will be those who understand both worlds and can adapt as they merge.

Conclusion:

The silent war between traditional finance and crypto is not about who wins, it’s about how finance evolves.

Crypto challenges the old system, but also inspires it to improve.

In the end, innovation always wins, and the world moves one step closer to financial freedom.

If this post gave you a new perspective on the battle between TradFi and Crypto, like it, share your view in comments, and follow for more deep market insights!

The best thing you can do as a crypto traderLike many who trade crypto, I’ve got a bitter taste in my mouth after Friday night’s chash.

But with years in the market, I know it’ll pass.

Still, I wanted to give one honest piece of advice to anyone new to this space:

The best thing you can do is stay away from social media.

Everything you see there is fake.

The Lambos.

The “next 100x.”

The guys screaming into the mic about how to become a millionaire, how this coin will make you rich, or how “Trump will print millionaires again.”

You’ll hear about one whale wallet buying — next hour/day, another one selling — and you’ll ask yourself: why?

You’ll see the same people saying for over two years that the mythical altcoin season is just around the corner.

The same people who call for a “100x” no matter what the market does.

The same people who promise that XRP will hit $10,000 on November 21, and when that date passes, it magically becomes “by Christmas, by Summer, by Horses Easter (Romanian expression :) )”

And when one person says something ridiculous and it gets views, a hundred others copy it.

Then a thousand more come and make it even louder, more dramatic, more viral — because attention is currency, not accuracy.

Social media isn’t a place for trading.

It’s a place for noise.

For emotional manipulation.

For dopamine hits disguised as “alpha.”

If you want to survive in this market, learn to think independently.

The moment you stop looking for answers in influencers’ voices (of course, there are exceptions, but...), you’ll start hearing your own.

And that’s when you actually begin to grow as a trader.

P.S. And by the way — instead of scrolling on TikTok or whatever, pick up a real trading book.

At least there, you’ll find something concrete — not another fairytale about how to become a millionaire with the next meme coin.

Being Devil’s Advocate on the “Big Reset” NarrativeI’ll start by saying this clearly: I hold a portfolio of altcoins right now, and honestly, I hope every influencer is right this time.

I want the market to recover. I want the reset story to be real.

But as I scroll through social media, I can’t help noticing how my feed is once again flooded with the same old enthusiasm —“The Big Reset happened!”, “This was the flush we needed!”, “Now it’s time to the moon!”

It’s hard not to feel a sense of déjà vu.

Because every time, the same narrative returns: "now it's time to buy", and the same faces repeat it.

And when everyone suddenly agrees on one explanation — that’s exactly when I prefer to be the devil’s advocate.

________________________________________

Friday’s Crypto Crash: What Actually Happened?

Last Friday, the crypto market went through what many now call “The Big Reset.”

Around $20 billion in leveraged positions were liquidated in hours. Bitcoin dropped more than 10%, and most altcoins went way lower.

The event exposed how fragile the market structure is when leverage, liquidity, and optimism align in the wrong way.

It wasn’t surprising that it happened — it was surprising how easily it happened.

The structure that seemed solid only days before crumbled in a few hours.

Now, the new collective story is that this was the great cleansing — the painful but necessary flush before the next bull run.

But let’s pause: is it really that simple?

________________________________________

The “Big Reset” Narrative

Those who promote the reset idea usually say:

1. Leverage purge: The overleveraged traders are gone, giving the market a clean slate.

2. Healthy structure: Open interest dropped, risk is reduced, and the base is stable again.

3. Cycle logic: Every bull market needs a correction — this was simply the reset before new highs.

It’s an appealing story — it makes the pain feel meaningful.

But just because a story feels good doesn’t mean it’s true; in fact, most of the time it is not

________________________________________

Why am I starting to be skeptical?

1. The same voices, the same narrative

The people calling this “the Big Reset” are often the same ones who have been announcing “altcoin season” for two years straight.

Their optimism is permanent, not analytical; they only have ONE IDEA

2. Reset ≠ recovery

Purging leverage doesn’t automatically bring in new capital.

It doesn’t attract institutions, fix liquidity, or change macro conditions. It just resets the scoreboard.

3. No such thing as free money

The idea that “now it must go up” assumes a law of easy profits. But if markets rewarded wishful thinking, no one would lose.

I don’t believe in free meals — and definitely not in free money.

4. Survivor bias

After every big drop, a few traders claim, “That was the bottom.” The rest remain stuck or silent. History is written by survivors.

5. Liquidity remains fragile

After big volatility, liquidity providers retreat. The market becomes thinner and more unstable.

It takes time — and real inflows — before confidence rebuilds.

________________________________________

The Devil’s Advocate View

What if this wasn’t a reset at all — but a warning?

• Maybe it’s a sign of deeper structural weakness.

• Maybe this is the start of a longer, grinding correction rather than a quick purge.

• Maybe the “reset” narrative is just a way to make pain sound constructive — a psychological shield against pain.

In short, what if the “Big Reset” is just another feel-good illusion for traders who need to stay hopeful?

________________________________________

Between Hope and Reality

The truth is that no one knows.

Markets don’t move on declarations — they move on flows, liquidity, and psychology.

So the best we can do is stay realistic:

• Observe, don’t assume.

• Manage risk and emotions.

• Watch key levels and volume, not influencers.

• Accept uncertainty as part of the job.

If the reset truly happened, we’ll see it in structure, trend, and sustained strength — not in hashtags or memes.

________________________________________

Final Thoughts: No Free Lunch, No Free Money

I’d love to be wrong on this one.

I’d love for the market to stabilize and climb again.

But history tells me to be cautious.

Every time the crowd agrees that “this was it”, the market finds a way to humble everyone.

So until proven otherwise, I’ll stay the devil’s advocate —because in trading, skepticism isn’t negativity; it’s survival.

“Bitcoin Price Action: Liquidity Grab Fuels Next Bullish Impulse“Bitcoin Price Action: Liquidity Grab Fuels Next Bullish Impulse 📈”

Hello Traders & Investors,

Let’s take a closer look at BTCUSD from both a structural and liquidity perspective.

🔹 Market Structure

The chart shows that after a strong bullish leg into mid-August, BTCUSD faced heavy rejection from the 120,000 – 123,000 resistance zone, which remains the most important supply area on the chart. This rejection triggered a clear Break of Structure (BOS), leading to a correction and liquidity grab.

Recently, price created a liquidity sweep in the 108,000 – 110,000 region, trapping late sellers and collecting orders from beneath previous lows. Following that, BTCUSD reclaimed the 111,000 – 112,000 zone, confirming it as new support.

🔹 Liquidity & Smart Money Behavior

The downside sweep indicates accumulation, where smart money entered long positions.

Liquidity resting above current levels (towards 116,000 → 120,000) is now the most likely target for price.

The previous liquidity channel to the downside has been fully absorbed, shifting bias toward bullish continuation.

🔹 Key Levels to Watch

Support: 111,000 – 112,000 (liquidity sweep + reclaimed support).

Resistance: 120,000 – 123,000 (major supply and reaction zone).

🔹 Projection

As long as BTCUSD holds above 111,000, my bias remains bullish. The next objective lies at the 120,000 zone, which aligns with untested supply and prior rejection levels. However, traders should be prepared for a reaction or short-term retracement once this area is tested.

✅ Conclusion:

BTCUSD has shown strength after sweeping liquidity from the downside. The structure now supports a bullish push toward 120,000, provided 111,000 support continues to hold. This remains a critical level for validation of further upside.

Bitcoin Manipulation or Opportunity? Watch This Zone!⚡ Bitcoin Manipulation or Opportunity? Watch This Zone!

The chart highlights significant liquidity zones, BOS (Break of Structure), and liquidity sweeps, pointing to how price action is driven by institutional order flow.

🔎 Key Observations:

Break of Structure (BOS): Multiple BOS points confirm shifts in market direction as price transitioned from bearish → bullish → bearish again.

Liquidity Grab: Notice how price swept liquidity around previous support before reversing—classic manipulation to trigger stop losses before a move higher.

Downtrend Liquidity Channel: Price followed a controlled bearish liquidity channel after rejecting the resistance zone at 120,000 – 123,000, showing distribution.

Liquidity Sweep (Latest Move): The recent sweep near 108,000 suggests that sellers were trapped, providing liquidity for potential buy-side movement.

Projection: Based on the liquidity sweep, a rebound toward 116,000 – 118,000 is anticipated ⭐. However, interim resistance at 112,000 must be broken and retested to confirm bullish continuation.

⚠️ Risk Note: If price fails to hold above the liquidity sweep zone, a deeper correction could occur.

📌 Conclusion:

BTCUSD is showing signs of a bullish reversal after liquidity manipulation. Traders should watch for confirmation above 112,000 to target the 116,000 – 118,000 range, aligning with smart money concepts.

Leverage in Crypto: The Sexy Lie vs. The Boring TruthLet’s be honest: the vast majority of crypto traders don’t come with a trading background. Not in stocks, not in futures, and definitely not in leveraged Forex.

Most enter crypto because of hype, the dream of fast money, and stories of overnight millionaires.

That’s why leverage in crypto is so dangerous. It’s not just a tool — it’s a trap for the unprepared.

________________________________________

What leverage really means

To keep it simple: with 100× leverage, every 1% move in your favor doubles your account, but every 1% move against you wipes it out completely.

👉 No matter the asset — Forex, Gold, Bitcoin, or meme coins — at 100× leverage you only have 1% room to be wrong.

________________________________________

Yesterday’s market moves – a perfect example

Yesterday, markets exploded across all asset classes:

• EURUSD → +1%

• Gold (XAUUSD) → +1.5%

• Bitcoin (BTC) → +4%

• Ethereum (ETH) → +8%

• PEPE, other coins and meme coins → +10%+

Now imagine trading them with 100× leverage, catching the bottom and selling at the top:

• EURUSD → +100% (account doubled)

• Gold → +150%

• BTC → +400%

• ETH → +800%

• PEPE → +1000%

Sounds incredible, right?

But here’s the other side: with 100× leverage, a –1% move against you = instant liquidation.

________________________________________

Effective Leverage – The Hidden Concept

Effective leverage — you rarely see it explained. Why?

Because it’s not sexy, not marketable, and most of all… exchanges and brokers don’t want this to be very clear.

Nominal leverage (the 50×, 100×, 200× banners you see everywhere) sells dreams. Effective leverage, on the other hand, shows the brutal reality: how much exposure you actually control compared to your account size.

Formula:

Effective Leverage=Position Size/Account Equity

• Example 1 (Forex): $1,000 account, $5,000 EURUSD position = 5× effective leverage.

• Example 2 (Crypto): $100,000 account, BTC at $100k, controlling 5 BTC ($500,000 position) = 5× effective leverage.

👉 Nominal leverage is the ad. Effective leverage is the invoice.

And once you understand it, the marketing magic disappears.

________________________________________

A concrete example – Solana trade

Let’s take a real setup I shared recently on Solana:

• Entry: buy at $200

• Stop Loss: $185 → risk on the asset = -7.5%

Case 1 – 100× leverage

From 200 → 198 (–1%), you’re liquidated. You never reach your stop at 185.

Case 2 – 10× effective leverage

Every 1% move = 10% account swing. You could survive down to 180, but you’d be under constant stress.

Case 3 – 2× effective leverage (my choice)

Let’s say you control $2,000 worth of SOL, effectively $4,000 exposure.

• If Solana falls to 185 (–7.5%), that’s a –15% hit to your account. Painful, but survivable.

• If Solana rises to 250 (+25%), with 2× leverage you make +50% on allocated capital.

• Risk–reward ratio: ~1:3.3 — sustainable, worth taking.

________________________________________

The psychological factor

This is where leverage breaks most traders.

• With 100× leverage, every 0.2% fluctuation moves your account by 20% (≈ $400 on a $2,000 account). Every 1% move = liquidation. How do you stay calm? You don’t.

• With 2× effective leverage, a 1% fluctuation only moves your account 2% (≈ $40). Boring? Maybe. Survivable? Absolutely.

Now imagine: you enter SOL at 200 with 100× leverage.

• At 202, you’ve doubled your account.

• At 210, you’ve made 5×.

But will you hold? No. Because:

1. If you’re awake, the stress of watching wild swings (in money, not in price) forces you to close early.

2. If you do hold, it’s usually because you were asleep — or the move happened in a single violent candle.

Markets never move in a straight line. They go 200 → 202 → 201 → 203 → 201 → 205…

At 100× leverage, every retracement feels like life or death. At 2× leverage, it’s just noise.

________________________________________

Conclusion

Leverage isn’t evil. It’s just a tool. But in crypto, with insane volatility and inexperienced traders, it becomes a weapon of mass destruction.

• At 100×, you’re gambling on the next 1% very small move.

• At 10×, you’re constantly stressed and one bad move away from ruin.

• At 2×–5× effective leverage, you can actually follow your plan, respect your stop, and let your targets play out.

Trading isn’t about adrenaline. It’s about survival.

High leverage destroys accounts — and discipline. Small, controlled leverage gives you the one thing you need most in trading: time.

P.S.

Of course, the choice is yours — what leverage you decide to use, whether you take into consideration the concept of effective leverage, or how you handle the psychological impact of high leverage.

But at least now, you know. 🙂

Investing vs. Speculating in Crypto: Stop Mixing the TwoThe crypto market is in a correction, and every time this happens, I see the same pattern repeat: traders and investors talking about the moon — expecting 10x or 100x — but the moment their coin drops by 10%, they panic. They ask “What’s wrong?” or panic that the project is failing.

This is a misunderstanding of what it means to invest versus what it means to speculate. Let’s clear that up.

🚀 The Investor’s Perspective

If you believe Bitcoin is going to 500,000 USD, do you really care if it dips under 100k before reversing?

If you bought Solana with the vision of 1,000 USD, why should a retest of 150 USD make you nervous?

Investors understand:

Markets never move in a straight line.

Patience is essential — big returns require time.

Short-term corrections don’t change a solid long-term thesis.

If you’re aiming for 5x or 10x, you must accept that it takes months or years, not days.

⚡ The Speculator’s Perspective

Speculators play a different game:

They focus on short-term setups.

They use technical analysis and momentum.

They might even short-sell when the conditions align.

Both are fine — but the problem begins when people think they’re “investors” while acting like speculators every time the market moves against them.

🎯 Targets, Plans, and Patience

Here’s what most forget:

The market isn’t a straight line up designed for your convenience or for your dream Lambo

You need to set a clear target and be patient.

Want 5x on BTC? Or 10x on a strong altcoin? Then you’ll have to wait for it.

If you expect daily gains and can’t handle normal corrections, you’re not investing — you’re speculating without realizing it.

🤡 The Quick 10x Illusion

Yes, you can chase 10x in a day or two with meme coins on DEXes. Sometimes it works, most times it ends with rugs or sudden collapses. That’s not investing. That’s just gambling, and you can’t complain when it goes wrong.

✅ Final Thoughts

Decide who you are:

As an investor, set your targets, trust your thesis, and don’t panic on corrections.

As a speculator, play the short-term moves but accept the inherent risks and use discipline.

Crypto can deliver very big returns — but only if you stop mixing long-term conviction with short-term panic.

Patience and discipline will always beat hype. 🚀

P.S.

Let’s take a concrete example: since April, ETH tripled in value in a nearly straight line. What do you expect — for it to keep rising like that to 25k by the end of the year?

Do you look at your portfolio daily expecting more money every single day?

Think also of those who bought ETH with 10 million dollars, not just 3 ETH for 5k.

Maybe they want to mark profits.

Maybe they need a new yacht:)

Their selling affects the market too — and corrections are part of the bull runs.

Bitcoin’s Power Law Curve — Fairly Valued With Room to RunThis chart applies a Power Law Rainbow Model to Bitcoin using a long-term logarithmic regression fitted to BTC's historical price action. Power laws are mathematical relationships often found in nature, science, and network systems — and Bitcoin is no exception.

Rather than relying on arbitrary trendlines, this model fits a curve based on the equation:

Price = a × t^b

Where:

t is the number of days since inception

a and b are constants optimized to Bitcoin's growth

Bands represent log-scaled standard deviation zones from the curve

🌈 Interpreting the Chart

The center white curve reflects Bitcoin's "fair value" according to its adoption-based trajectory.

Colored bands represent ±1σ, ±2σ, ±3σ from the model, creating a "valuation rainbow."

Historically, Bitcoin's cycle bottoms have touched the lower bands (blue/purple), while euphoria tops align with the upper bands (orange/red).

✅ Current Outlook

BTC is trading just under the fair value curve , suggesting it's fairly valued or slightly undervalued from a long-term perspective.

This position has historically preceded major upside moves, especially in post-halving environments.

From a Smart Money Concepts angle, we're in a potential accumulation or markup phase , with institutional and informed capital likely already positioning.

🧠 Why Power Laws Work for BTC

Bitcoin adoption follows network effects — more users = more value — which naturally follows a power law.

Unlike linear trends, power law curves scale with time , making them ideal for modeling exponential assets.

They offer a more objective long-term valuation framework , avoiding emotional cycle chasing.

⚠️ Disclaimer

This is not financial advice . The model reflects historical behavior and is a tool to support long-term perspective — not short-term prediction. Always do your own research and risk management.

“Little Entry Ticket” Scam: Why $50 Can Ruin Your Trading CareerI don’t think there’s a single reader here who hasn’t come across this type of scam.

You know the story: “The next BTC! The next ETH! Entry only $50.”

At first sight, it doesn’t even feel dangerous. So what if you lose $50? That’s a few beers on a terrace.

But here’s the problem: it’s not about the money — it’s about your mindset.

________________________________________

How It Works

1. The promise: “Early entry into the next big coin.”

2. The hook: the price of admission is low — $50 or $100, something anyone can afford to lose

3. The thought trap: “I can’t lose much… but what if it moons?”

4. The harvest: thousands of people fall for it, and the scammer collects a fortune.

5. The ending: the token dies, liquidity vanishes, and your “lottery ticket” is worthless.

________________________________________

Why It’s Dangerous

It’s not dangerous because you’ll lose $50.

It’s dangerous because it sets your brain on the wrong track.

• Instead of thinking in terms of probabilities and risk management, you start thinking in terms of what if .

• Instead of trading or investing, you’re gambling.

• And once your mindset shifts that way, you’ll chase “cheap tickets” over and over, until the small losses pile up — or worse, you start adding bigger amounts hoping for that one lucky hit.

________________________________________

Final Note

Trading or investing isn’t about lottery tickets. It’s about discipline, probabilities, and outcomes.

If you find yourself drawn into a “little entry” scam, remember: the real danger is not losing $50 — it’s losing your focus, your discipline, and eventually your trading career.

From Cold Calling to Whitepapers: Same Game, New ToolsRemember that legendary scene in "The Wolf of Wall Street"?

Jordan Belfort (DiCaprio) picks up the phone to pitch “Aerotyne International” — a company “poised to explode” — operating from… a garage.

The sales pitch is flawless. The story is strong. The potential? Unlimited.

Except it was nothing more than a fantasy designed to move shares from one set of hands to another — at a profit for the seller.

There is a Romanian saying: "Same Mary, different hat"...

________________________________________

Fast forward to crypto

Today, we don’t have cold calls and penny stock brochures.

We have:

• Whitepapers describing revolutionary technology with no working product.

• Influencer threads promising “undervalued gems” to millions of followers.

• Slick promo videos replacing the boiler room pitch.

• Discord AMAs instead of dinner seminars.

The garage is still there — it’s just virtual now, hidden behind a Twitter banner and a Telegram admin.

________________________________________

Human psychology hasn’t changed

The tools evolved, but the emotions stayed the same:

• Greed — “I don’t want to miss the next big thing.”

• Fear — “If I don’t buy now, it’ll be too late.”

• Trust in authority — “He has a big following, he must know.”

Belfort sold the dream of massive returns.

Modern-day devs and influencers sell the dream of “generational wealth” from coins that exist only as code on a blockchain.

________________________________________

The mechanics are identical

1. Create a story.

2. Amplify it through trusted voices.

3. Target an audience hungry for “the next big thing.”

4. Offload the asset onto those late to the party.

Whether it’s “Aerotyne” or “MoonPepeMooning,” the pattern is the same — transfer value from the hopeful to the prepared.

________________________________________

How to not be the exit liquidity

• Verify: A whitepaper is just words. Look for a product, adoption, and revenue.

• Ignore the hype cycle: By the time it reaches you, someone else is unloading.

• Follow the money: Who benefits if you buy right now?

• Remember history: Tools change, human nature doesn’t.

________________________________________

Bottom line:

Cold calling in the ’90s or a viral thread in 2025 — it’s still a sales pitch.

The sooner you recognize it, the less likely you are to fund someone else’s yacht. 🚀

"BTC at Critical Reversal Zone – Watch This Key Liquidity Trap

"BTC at Critical Reversal Zone – Watch This Key Liquidity Trap 🎯"

Market Structure Overview

BOS (Break of Structure): Multiple BOS points indicate shifts in trend phases, first to the downside (end of July to early August) and then back to the upside.

BOL (Break of Low): This marked a key liquidity grab before the reversal rally began.

Liquidity Zones: The chart highlights both sell-side liquidity (below lows) and buy-side liquidity (above highs), showing where institutional traders hunt stops.

2. Key Supply & Demand Zones

Support Zone (112,500 – 114,500): This level acted as a demand base after the liquidity sweep in early August. Price reacted strongly here, triggering the bullish leg.

Previous Resistance (121,500 – 122,500): This zone has capped price multiple times, making it a critical area for sellers to defend.

3. Current Trade Setup

Entry Zone: Around 120,000 – 120,400, where a short setup is triggered upon rejection.

Stop Loss: Above 122,120, just beyond the resistance to avoid premature stop-outs.

Target: 116,500 – aligning with prior liquidity pools and structural support.

4. Educational Takeaways

Liquidity Hunts: Notice how price often spikes into liquidity pools before reversing—this is common in BTC’s volatile environment.

Confluence Trading: The short setup aligns with resistance retest + liquidity grab + BOS, increasing probability.

Risk Management: Using defined zones for stop loss and target helps maintain a favorable risk/reward ratio.

Summary:

BTC is currently respecting the higher-timeframe resistance zone, with a clear short-term bearish setup in play. A rejection from the entry zone could trigger a drop toward the 116,500 target. Traders should monitor price action closely and avoid chasing entries—patience and precision are key.

DOGE Looking Strong as Support HoldsDOGE Looking Strong as Support Holds

🔹 1. Support Zone Validated

The chart shows Dogecoin retested the lower boxed region around $0.221–$0.223, and bounced sharply from that zone. Given the heavy spike in volume during the retest, this suggests aggressive buying and accumulation—a hallmark of bullish conviction.

CryptoRank

The Tradable

🔹 2. Fibonacci 0.618 Support Bounce

On the 4‑hour timeframe, DOGE held firm above the critical Fibonacci 61.8% retracement level, and delivered a strong rebound—indicating technical significance and buyer interest at this level.

Blockchain News

🔹 3. Double-Bottom + Trendline Breakout

Analysts have identified a classic double-bottom formation, with price clearing the neckline (~$0.230–$0.231) and then retesting it successfully. Holding this retest confirms a breakout, suggesting more upside ahead.

Crypto Basic

🔹 4. Whale Activity & Accumulation

On-chain data shows $250 million in Dogecoin accumulation by whales, especially around the support zone—creating a structural demand base and reinforcing the bullish setup.

CoinCentral

🎯 Price Targets & Key Levels

Scenario Levels Rationale

Bullish continuation $0.239–$0.241 union resistance First resistance zone—price must reclaim to continue bullish momentum

$0.260–$0.280 Reclaiming $0.241 could open room toward mid‑channel resistance or prior highs

$0.300+ Potential target if momentum sustains and broader breakout occurs

Bearish invalidation $0.223 support Invalid break below suggests fading momentum—risk of correction to $0.215–$0.218

$0.215–$0.218 Secondary support zone if expansion of sell side continues

⚙️ Trade Setup for a Bullish Bias

Entry Focus: Consider entering long near $0.223 if price retests and holds, with a tight stop just below support.

Stop-Loss Zone: Slightly beneath $0.221 to account for volatility.

Targets: Scale out around $0.241, with larger targets at $0.260–$0.280, and possibly $0.30+ on sustained strength.

Confirmation: Watch for rising volume, break and close above resistance zones, and bullish indicator alignment.

⚡ Market Sentiment & Broader Themes

Momentum Shift: A bearish retrace reversed quickly amid accumulation, suggesting strong buyer commitment.

CryptoRank

The Tradable

AInvest

Double Bottom Status: Analyst commentary supports a reversal setup, with targets toward $0.310–$0.46 if the neckline holds.

Crypto Basic

AInvest

CryptoRank

Macro View: DOGE remains within a bullish channel; some forecasts project

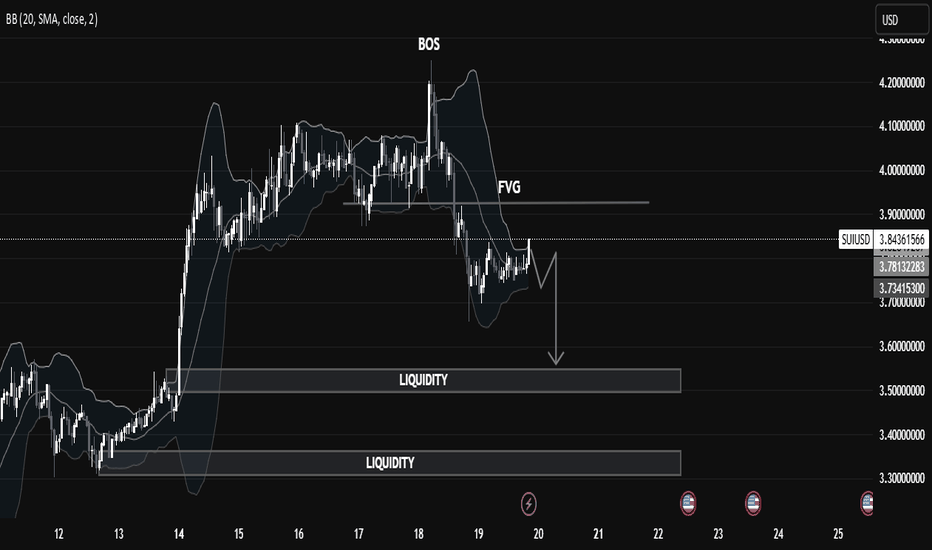

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

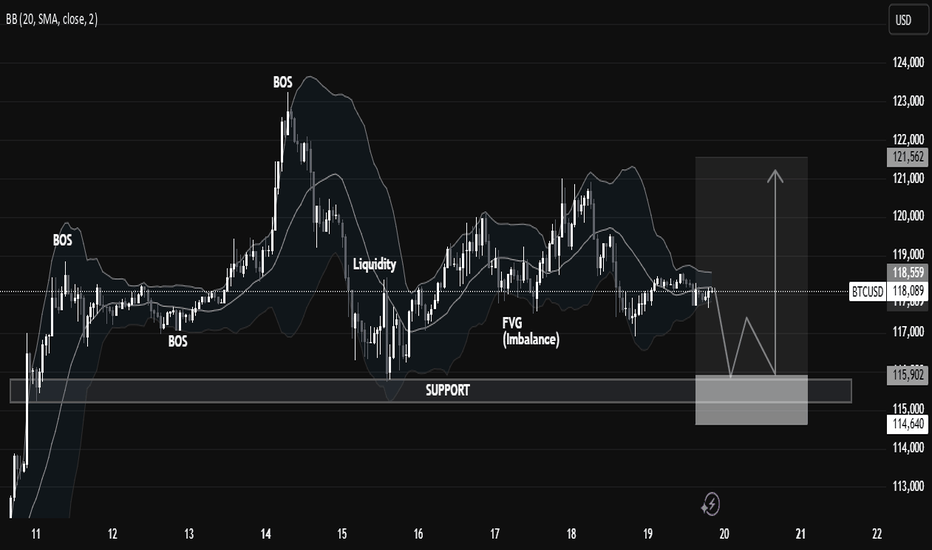

BTCUSD Technical Analysis | Smart Money Concept (SMC) BreakdownBTCUSD Technical Analysis | Smart Money Concept (SMC) Breakdown

🧠 Smart Money Market Structure Insight

📌 Key Elements Identified:

BOS (Break of Structure): Multiple BOS points indicate bullish intent early on. However, the latest BOS on July 14 followed by a significant drop signals a shift in momentum—possibly a distribution phase.

Liquidity Sweep: Price swept prior equal lows/liquidity before reversing, a typical Smart Money trap setup.

FVG (Fair Value Gap) / Imbalance: Identified around the mid-section of the chart—price filled partially but failed to hold, suggesting internal weakness.

Strong Support Zone (Demand Area): Marked between 115,000 - 114,640; this zone is anticipated to act as a springboard for bullish reversal.

📉 Current Price Action Observation:

BTCUSD is hovering around 118,152 - 118,560, moving sideways with lower highs indicating compression.

Price is projected to form a "W" pattern or double bottom in the shaded region.

Expected liquidity grab beneath 115,902 followed by potential bullish reaction targeting 121,562, as indicated by the white arrow.

🧩 Strategic Outlook & Potential Play:

🔻 Bearish Sweep First:

Market likely to sweep the support one more time, tapping into deeper liquidity pools between 115,000–114,640.

This is aligned with the concept of Smart Money hunting for retail stop-losses before reversing.

🔼 Bullish Recovery After Sweep:

Strong probability of bounce due to presence of:

Fair Value Gap (already tested),

Fresh demand zone,

Liquidity grab setup.

Projected Bullish Target: 121,562

Confirmation Needed: A strong bullish engulfing or BOS on lower timeframes near support.

🏷️ Conclusion:

This BTCUSD setup is a textbook Smart Money scenario: BOS ➝ Liquidity Grab ➝ FVG ➝ Reversal from Demand. Traders should wait for confirmation from the support region before entering long positions.

Serios Traders Trade Scenarios, Not Certaintes...If you only post on TradingView, you're lucky — moderation keeps discussions professional.

But on other platforms, especially when you say the crypto market will fall, hate often knows no limits.

Why?

Because most people still confuse trading with cheering for their favorite coins.

The truth is simple:

👉 Serious traders don't operate based on certainties. They work with living, flexible scenarios.

In today's educational post, I'll show you exactly how that mindset works — using a real trade I opened on Solana (SOL).

________________________________________

The Trading Setup:

Here’s the basic setup I’m working with:

• First sell: Solana @ 150

SL (stop-loss): 175

TP (take-profit): 100

• Second sell: Solana @ 160

SL: 175

TP: 100

I won’t detail here why I believe the crypto market hasn’t reversed yet — that was already explained in a previous analysis.

Today, the focus is how I prepare my mind for different outcomes, not sticking to a fixed idea.

________________________________________

The Main Scenarios:

Scenario 1 – The Pessimistic One

The first thing I assume when opening any position is that it could fail.

In the worst case: Solana fills the second sell at 160 and goes straight to my stop-loss at 175.

✅ This is planned for. No drama, no surprise. ( Explained in detail in yesterday's educational post )

________________________________________

Scenario 2 – Pessimistic but Manageable

Solana fills the second sell at 160, then fluctuates between my entries and around 165.

If I judge that it’s accumulation, not distribution, I will close the trade early, taking a small loss or at breakeven.

________________________________________

Scenario 3 – Mini-Optimistic

Solana doesn’t even trigger the second sell.

It starts to drop, but stalls around 120-125, an important support zone as we all saw lately.

✅ In this case, I secure the profit without waiting stubbornly for the 100 target.

Important tactical adjustment:

If Solana drops below 145 (a support level I monitor), I plan to remove the second sell and adjust the stop-loss on the initial position.

________________________________________

Scenario 4 – Moderately Optimistic

Solana doesn’t fill the second order and drops cleanly to the 100 target.

✅ Full win, perfect scenario for the first trade

________________________________________

Scenario 5 – Optimistic but Flexible

Solana fills the second sell at 160, then drops but gets stuck at 120-125(support that we spoken about) instead of reaching 100.

✅ Again, the plan is to close manually at support, taking solid profit instead of being greedy.

________________________________________

Scenario 6 – The Best Scenario

Solana fills both sell orders and cleanly hits the 100 target.

✅ Maximum reward.

________________________________________

Why This Matters:

Scenarios Keep You Rational. Certainties Make You Fragile.

In trading, it's never about being "right" or "wrong."

It's about having a clear plan for multiple outcomes.

By thinking in terms of scenarios:

• You're not emotionally attached to a single result.

• You're prepared for losses and quick to secure wins.

• You're flexible enough to adapt when new information appears.

Meanwhile, traders who operate on certainties?

They get blindsided, frustrated, and emotional every time the market doesn’t do exactly what they expected.

👉 Trading scenarios = trading professionally.

👉 Trading certainties = gambling with emotions.

Plan your scenarios, manage your risk, and stay calm. That's the trader's way. 🚀

Trading Miscalibration: Crypto Aims Too High, FX Aims Too LowI was thinking about something fascinating—the way traders approach different markets and, in my opinion...

One of the biggest mistakes traders make is failing to calibrate their expectations based on the market they’re trading.

📌 In crypto, traders dream of 100x gains, refusing to take profits on a 30-50% move because they believe their coin is going to the moon.

📌 In Forex and gold, the same traders shrink their expectations, chasing 20-30 pip moves instead of riding 200-500 pip trends.

Ironically, both approaches lead to frustration:

🔴 Crypto traders regret not taking profits when the market crashes.

🔴 FX and gold traders regret not holding longer when the market runs without them.

If you want to be a profitable trader, you must align your strategy with the reality of the market you’re trading.

________________________________________

Crypto: Stop Aiming for the Moon—Trade Realistic Outcomes

Crypto markets are highly volatile, and while 10x or 100x gains can happen, they are rare and unpredictable. However, many traders have been conditioned to expect extreme returns, leading them to ignore solid 30-50% gains—which are already fantastic trades in any market.

🔴 The Problem: Holding Too Long & Missing Profits

Many traders refuse to take profits on a 30-50% move, convinced that a 10x ride is around the corner. But when the market reverses, those unrealized gains disappear—sometimes turning into losses.

🚨 Frustration:

"I was up 50%, but I got greedy, and now I’m back to break-even—or worse!"

✅ The Fix: Take Profits at 30-50% Instead of Waiting for 10x

✔️ Take partial profits at key resistance levels.

✔️ Use a trailing stop to lock in gains while allowing for further upside.

✔️ Understand that even professional traders take profits when they’re available—they don’t blindly hold for the next 100x.

📉 Example:

If Bitcoin jumps 30% in a month, that’s already a massive move! Instead of waiting for 200%, a disciplined trader locks in profits along the way. Similarly, if an altcoin is up 50% in two weeks, securing profits makes sense—instead of watching it all disappear in a market dump.

________________________________________

FX and Gold: Stop Thinking Small—Aim for Big Market Trends

On the other hand, when it comes to Forex and gold, many traders shrink their expectations too much. Instead of capturing multi-hundred-pip moves, they settle for 20-30 pip scalps, constantly entering and exiting the market, exposing themselves to unnecessary whipsaws.

🔴 The Problem: Exiting Too Early & Missing Big Trends

Unlike crypto, where traders hold too long, in FX and gold, they don’t hold long enough. Instead of riding a 200-500 pip move, they panic-exit for a small profit, only to watch the market continue without them.

🚨 Frustration:

"I closed at 30 pips, but the market kept running for 300 pips! I left so much money on the table!"

✅ The Fix: Target 200-500 Pip Moves Instead of Scalping

✔️ Focus on higher timeframes (4H, daily) for clearer trends.

✔️ Set realistic yet ambitious targets —200-300 pips in Forex, 300-500 pips in gold.

✔️ Use a strong risk-reward ratio (1:2, 1:3, even 1:5) instead of taking premature profits.

📉 Example:

• If EUR/USD starts a strong downtrend, why settle for 30 pips when the pair could drop 250 pips in a week?

• If gold breaks a major resistance level, a move of 300-500 pips is entirely possible—but you won’t catch it if you exit at 50 pips.

________________________________________

Why Traders Fail to Calibrate Properly

So why do traders fall into this misalignment of expectations?

1️⃣ Social Media & Hype Culture – Crypto traders are bombarded with "to the moon" narratives, making them feel like 30-50% gains are not enough. Meanwhile, in Forex, traders get stuck in a scalping mindset, thinking that small, frequent wins are the only way to trade.

2️⃣ Fear of Missing Out (FOMO) vs. Fear of Losing Profits (FOLP)

• In crypto, FOMO keeps traders holding too long. They don’t want to miss "the big one," so they refuse to take profits.

• In FX and gold, fear of losing small profits makes traders exit too soon. They don’t let trades develop because they fear a pullback.

3️⃣ Misunderstanding Market Structure – Each market moves differently. Crypto is highly volatile but doesn’t always go 10x. Forex and gold move slower but offer consistent multi-hundred-pip trends. Many traders don’t adjust their strategies accordingly.

________________________________________

The Solution: Align Your Strategy with the Market

🔥 In crypto, don’t wait for 10x— start taking profits at 30-50%.

🔥 In FX and gold, don’t settle for 30 pips—hold for 200-500 pip moves.

By making this simple mental shift, you’ll:

✅ Trade smarter, not harder

✅ Increase profitability by targeting realistic moves

✅ Reduce stress and overtrading

________________________________________

Final Thoughts: No More Frustration!

The calibration problem leads to frustration in both cases:

⚠️ Crypto traders regret not taking profits when the market crashes.

⚠️ FX and gold traders regret not holding longer when the market trends.

💡 The solution? Trade according to the market's behavior, not emotions.