Cryptomarket

Crypto Total Market Cap (Excl. Top 10)Crypto Total Market Cap (Excl. Top 10)

Price still moving inside a long-term descending wedge on the weekly timeframe.

Currently sitting near major lower trendline support (~7.3%) — key reaction zone.

Momentum remains weak, but downside looks limited while support holds.

A solid bounce from this zone → could start a relief rally toward 9–12% dominance (altcoins outside top 10 gain strength).

Breakdown below wedge support → continuation of weak altcoin participation.

Overall: At critical support — bounce zone, not breakout yet.

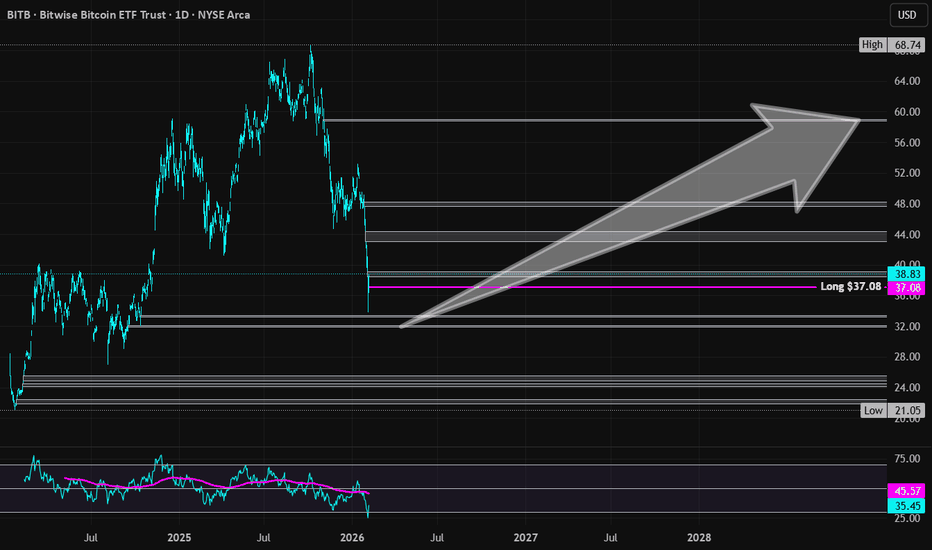

Bitwise Bitcoin ETF | BITB | Long at $37.08Back in AMEX:BITB at $37.08. Crypto is wild beast of speculation, but Bitcoin COINBASE:BTCUSD is the king. I'll leave further analysis to the crypto bros...

More downside may be ahead ("crash" Bitcoin is around $40,000 right now), but even your grandma has heard of Bitcoin / Bitcorn at this point. It's not going anywhere.

Targets into 2029

$44.00 (+18.7%)

$58.00 (+56.4%)

BTCUSD Intraday Long — Contextual ExpectationWithin the daily composite framework and considering the current intensity of market buying, I’m expecting a continuation of the upside move toward the nearest area of friction.

Key zone of interest:

SP 68,700 – 69,150

Current context:

-sustained market buyer pressure

-divergence in the dynamic volume component

-supportive local structure

-liquidity and liquidation-related factors

Taken together, these elements increase the probability of a move toward the outlined zone in the near term.

Idea invalidation:

Acceptance and consolidation below 64,400.

This is a counter-trend perspective, therefore risk remains elevated. Execution, if any, will be strictly conditional and aligned with my system and risk parameters.

ETHUSD Market Analysis: Macro + Structure [MaB]1. The Technical Setup (The "Where") 📉

Timeframe: 15m | Pair: ETHUSD The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge.

Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (74.5%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (9) & Streak Pct (4%): We are at the 9th consecutive impulse. It's a mature trend (we are in the 4th percentile of trend extension), so watch those stop losses, but as long as the music plays, we dance.

🔄 Retest (78.6%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 78.6% of the time.

💥 BOS/Ret Rate (65.2%): This parameter tells us that once price retraces inside the previous zone, it has a high probability of reacting and creating a new BOS.

🎯 Extension Rate (1.8x): The algorithm projects an ambitious target. We expect this move to extend 1.8 times the current pullback leg. That's where we'll take profit.

2. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 15m (Blue Band) and the stop loss a few pips above the zone at the structural high. Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.8x relative to the pullback leg.

Trade Parameters: Entry Price: 1963.2 Stop Loss: 2021.9 Take Profit: 1563.2

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

Bitcoin - Pullback LevelsOn the larger timeframe, Wave 3 of the decline has been completed.

Locally, within this third wave, the fifth subwave has been completed.

We are currently in an upward corrective move. Let’s define the main targets.

Key targets:

75,000 - local correction

82,000

85,000

The potential move from the current level is 15-30% .

There is also an unfinished sub-division around 55,000 , but it appears unlikely.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

Market Structure with Key Support, Resistance & Target Zones”Overall Structure

Market pehle strong fall mein thi (left side).

Phir recovery + consolidation aayi.

Ab range-bound market chal rahi hai.

📦 Current Range (Very Important)

Chart par clearly RANGE mark hai:

Range High / Resistance:

👉 ~ 78,700 – 79,000

Range Low / Support:

👉 ~ 75,000 – 75,200

Jab tak price is range ke andar hai, choppy movement rahegi.

🟢 Support Analysis

Major Support:

74,400 – 74,000 (labelled SUPPORT LEVEL)

Ye strong demand zone hai

Wahan se pehle bhi sharp bounce aaya hai

👉 Agar price 74k ke neeche strong close deta hai:

Next support: 72,600 – 72,900

Bias phir bearish ho jayega

🔴 Resistance / Target Analysis

Immediate Resistance:

78,700 – 79,000 (TARGET POINT)

👉 Agar price:

Range se breakout kare

Aur 79k ke upar close mile

Then targets:

80,500

81,800 – 82,000

📈 Bullish Scenario

Bullish tab hoga jab:

Price 75k ke upar hold kare

Aur 78.7k breakout + retest mile

📌 Strategy idea:

Support ke paas buy

Resistance ke paas partial profit

📉 Bearish Scenario

Bearish tab hoga jab:

74,400 support toot jaye

Strong bearish candle close mile

📌 Then:

72,900

72,600 possible targets

Bitcoin reached Lower trend line of long term Ascending Channel

Going to just say this Clean and simple

Lets remind ourselves of the Bigger picture

Bitcoin has used 4 Cups and a Trendline channel since it started. It entered the channel in 2017 and has been in it ever since.

PA just got down to the lower trendline.

That is where PA is right now. There are multioke lines of supprt here, Not all shown.

Previous occasions were PA can to this line.

2022

2020

The Covid Crash did manage to get PA below that line butnot for Long.

2019

It is Highly unlikely that PA will Drop out of this channel....But It could.... We need to remember this

From the 2013 ATH, PA did Drop out. This was BEFORE PA had fully entered channel BUT there is a chance that we could do this again as we see Bitcoin enter a new Series if cycle patterns. ( this is covered in other posts )

For now though, I will carry on watching Bitcoin and hope we remain in channel and so , see that we may have Hit a Bottom Zone.

This will only be confirmed when we have pushed higher and repassed 100K

Why? Because if we get a Big bounce from here, PA has NEBER gpne to a New ATH directly.....We Rose, Dipped, Rose pr Just Ranged.

A quick look at where we are now.

There we are. But under the 2021 ATH line ( dotted )

That line could be strong resistance. I think PA Will cross it and use it as support..If that happens, I get more Bullish...

I think we are as low as we will go..Could Flash down and recover quick..But..........

We maybe here for a while but not months...We could shoot up and get rejected..

Be cautious.............

TOTAL Market Cap — Weekly UpdateThe market delivered a strong downside displacement and fully mitigated the weekly orderblock that originated after the US election rally.

That means the entire prior expansion move has now been neutralized and liquidity below the range has been taken.

Price is currently reacting from the next higher timeframe demand zone.

Current situation

Upper weekly OB: taken & mitigated

Price swept sellside liquidity

Reaction from lower weekly demand

Large imbalance left above price

What this means

After a vertical move down, markets usually don’t instantly reverse.

They first stabilize.

So this area is a reaction zone — not yet confirmation of a new uptrend.

As long as price stays below the broken range, market structure remains weak.

Only reclaiming higher levels would indicate strength returning.

Simple plan

Hold current demand → stabilization phase

Reclaim prior range → recovery structure

Fail demand → continuation lower

Right now the market is transitioning, not trending.

Do you expect consolidation here or another expansion leg first?

MrC

BITCOIN CYCLE: Reset of the cycle is coming to an end. COINBASE:BTCUSD NASDAQ:IBIT

Bitcoin currently trading at $63,899. The bear market is in full effect, negative news creating fear and bearish sentiment in the market. 200 day and 63 day EMAs crossed, therefore confirmed the bear market. BTC formed a bear flag climbing into a resistance zone, paired with EMAs, this level was respected, we now have continued to dump hard. At this very moment we now are entering a key support level between $49,196 - $59,132. To add context clues, Daily and Weekly RSI are heavily oversold. Monthly RSI is in the discount zone, which will support this idea.

Bitcoin Deep dives into Support zone - Can it Hold position ?

That Deep Dive was a little surprisingand Quick but Given the speed of events right now, I was Stupid to think PA would hang around on the upper lines of support.

The Bears seem to want to show Strength.

It is now time for the Bulls to Show us they are Here.

PA went right down to the 3 Fib Extension at approx 60K usd.

Do we have support here ?

The 4 hour chart

We can seea Very Clear line of support off the Bottom line as PA touched it and bounced right back up to the Middle line.

It is this line that now needs to be Crossed and held as support.

The 1 hour chart is not one I use very often However, when it comes to Situation like this, It is perfect for showing us the initial stages of recovery....or not...

As we look on the 4 hour chart, we see PA appears to have Halted at the Dashed Middle line.

1 hour chart

The ! hour actualy shows us that PA did get over that middle line but then came back down to test it as support.

At the time of writing, this line is holding....................

Let me show you another 1 hour chaart

This shows us a Close up of PA and 3 SMA's

Orange is 9 SMA

Green is 14 and RED is 50

Se how PA is sitting on the 9.......so long as it remains there....we are able to piush higher.

But do remember, the 1 hour charts are "Noisey" , easy to be mislead....Only use to see initial stages.....No more.

The 4 hour shows us another story]

Here you can see how the 9 SMA actually REJECTED PA.

SO, Do we have support Here ?

Potentially, YES but there is yet to be better confirmation of its ability to Keep PA here for a While.

This

area is a Superb Buying Area BUT remeber, this is only a 50% draw down from ATH.

If We are to have a Traditional Bear, we have anoterh 30% to go......

But we simply do not know if that will happen.....................

Caution..........

BTCUSDT Review February 06 2026Long-term price movement opinions

At the moment, price has entered its strongest support zone. This is the manipulation of the previous all-time high, followed by consolidation inside this area before a potential move toward a new high. In fact, the current zone will define the next major direction.

I see two possible scenarios.

The first, and less likely, scenario is an aggressive rebound above the 74,000 level within this month, followed by a strong acceptance and consolidation above it. This would create the conditions for the continuation of the uptrend.

The second, and more likely, scenario is price stalling and entering a prolonged consolidation phase, potentially lasting for months, as we have seen before. This would involve a break of the monthly structure, the formation of new areas of interest to the downside, their subsequent testing or manipulation within them, and a continuation of the broader bearish move.

If you are currently trying to guess whether we are in a bull market or a downtrend, this is not the moment to make rushed decisions. It is better to allow price to develop, at least within the scope of this month, and then evaluate which of the two scenarios has played out.

Personally, I have been on the bearish side for quite some time, and this type of price action only reinforces my narrative. If the second scenario unfolds, I will completely dismiss the possibility of further upside.

XMR – even “strong fundamentals” follow the cycleMonero is often treated as a fundamentals-first asset, but the chart still tells the truth.

Strong vertical expansions were followed by long periods of distribution and deep retracements. Every cycle high attracted sellers, not long-term accumulation.

Historically, even assets with strong use cases don’t escape market cycles. They reset deep — often 70–90% — before meaningful accumulation returns.

This isn’t a failure of the project. It’s the reality of how liquidity-driven markets behave.

ETH – strength illusion at cycle highsEthereum looks strong on the surface, but the structure tells a different story.

Multiple aggressive expansions were followed by sharp rejections, failed follow-through, and long periods of choppy distribution. That’s not sustained demand — that’s liquidity being sold into.

Historically, ETH doesn’t bottom on shallow corrections. In past cycles, it has retraced 80–90% before real accumulation began.

From a cycle perspective, this still looks like unfinished business — not a completed reset.

SOL – leverage, hype, and cycle realitySolana is a perfect example of what late-cycle strength looks like.

Fast expansion, extreme volatility, and repeated failures to hold higher structure. Every push higher was followed by aggressive sell pressure — not accumulation.

Historically, assets that move like this don’t bottom on minor pullbacks. They reset deep. 80–90% drawdowns aren’t anomalies — they’re part of the cycle.

What most people call “the dip” is often just the early stage of a much larger correction.

Until real capitulation happens, I believe the broader crypto market still has downside ahead.

Bitcoin – cycle context, not hypeThis is Bitcoin on the higher timeframe.

What stands out isn’t strength — it’s cycle repetition. A strong expansion, followed by distribution, then a sharp rejection from the highs. This isn’t new behavior; it’s how Bitcoin has moved every major cycle.

Historically, Bitcoin doesn’t form real long-term bottoms on shallow pullbacks. It resets deep — often 70–90% — before true accumulation begins again.

If Bitcoin still has room to unwind, then the rest of the market follows. Alts don’t decouple in bear phases — they amplify the downside.

That’s why I believe the broader crypto market hasn’t seen its final low yet.

XRP – long-term structure perspectiveThis XRP chart tells the real story.

Notice the pattern: a sharp expansion phase, followed by a long period of distribution and compressed price action. Each major pump was met with aggressive selling, and price failed to build a clean, sustained higher structure afterward.

Historically, markets like this don’t bottom on shallow pullbacks. They revisit deep demand — often 80–90% retracements — before real accumulation begins.

The current move doesn’t look like capitulation yet. It looks like the early stages of a broader reset.

I still believe most of crypto hasn’t seen its true bear-market low.

BTC ETH SOLBuy the dip they BTFD , lol

Yes, I'm buying but not aggressively YET.

These next lower levels are looking far more likely than in prior evaluations. selling psi. continues to mount just be patient and give it time.

These levels should provide decent bounces i.e. relief rallies.

BUT I don't think that's the overall bottom either just the near-term local bottom for bounce or reaction.

If you go back and look at my much older ideas for this cycle given while still in the past cycle. I said we could end up coming back to much lower levels.

Just wait until everyone's on that $8k to $12k BTC prediction and we have candles back into the sub $45k range and see what reactions we get.

I wrote a thesis years ago about this going to $123k range and then coming back to $30k range.

That's all healthy cycle if you ask me.

You want REAL fear then to start looking at the cycles as becoming an even larger Head and shoulders, lol

Next cycle we peak in the $60-$75k range as it becomes the right shoulder, lol

Then pull a measured move from that and tell me what you see/get, lol!

SOL (Weekly timeframe): Trend structure Price is approaching a key macro support zone. However, as long as it remains below the $148 level, I cannot rule out the possibility of one more corrective leg toward the $76–$55 range before a medium-term bottom is established and a potential resumption of the broader uptrend begins.

A breakout and sustained close above the $148 level would serve as the first technical signal that either:

- a corrective wave B (preceding a deeper correction toward the macro support zone) is unfolding, or

- a new long-term bullish trend aiming for all-time highs is beginning.

Monthly outlook:

My previous idea from November 2024 has fully realized its structure:

Thanks for reading and wishing you successful trading and investing decision!

BTCUSD (1H) – Bearish Continuation | Trendline Breakdown IdeaMarket Structure

Bitcoin remains in a clear descending channel on the 1H timeframe. Price has consistently respected the downward sloping trendline, confirming a strong bearish structure with lower highs and lower lows.

Technical Confluence

Trendline Resistance (Red): Multiple rejections validate seller dominance.

Auto Pitchfork: Price is trading below the median line, indicating continuation toward the lower parallel.

Dynamic Support (Green): The recent breakdown below channel support signals bearish continuation rather than a reversal.

Balance of Power (BoP): Reading around -0.38 reflects sustained selling pressure with no bullish divergence.

Price Action

A brief consolidation failed to hold, followed by a strong bearish impulse that broke key intraday support. The current move suggests momentum-driven continuation, not exhaustion.

Trade Idea

Bias: Bearish

Sell Zone: Pullback toward broken support / descending trendline

Targets:

First target: Previous minor low

Extended target: Lower pitchfork boundary / demand zone

Invalidation: Sustained close above the descending trendline

Conclusion

As long as BTC remains below the descending trendline and pitchfork median, the path of least resistance is downward. Any retracement into resistance is likely to be a selling opportunity unless market structure shifts.

Always manage risk and wait for confirmation.

ETHUSDT: Bullish Push to 2750?As the previous analysis worked exactly as predicted, BINANCE:ETHUSDT is eyeing a bullish rebound on the 4-hour chart , with price forming higher lows after a pullback to support, converging with a potential entry zone that could ignite upside momentum if buyers defend amid recent consolidation. This setup suggests a recovery opportunity post-correction, targeting higher resistance levels with overall 1:8 risk-reward .🔥

Entry between 2180–2200 for a long position. Targets at 2550 (first), 2750 (second). Set a stop loss at a daily close below 2150 , yielding a risk-reward ratio of 1:8 in total . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging Ethereum's volatility near support.🌟

📝 Trade Setup

🎯 Entry (Long):

2180 – 2200

🎯 Targets:

• TP1: 2550

• TP2: 2750

❌ Stop Loss:

• Daily close below 2150

⚖️ Risk-to-Reward:

• Up to 1:8 overall

⚠️ Risk Level: High

💡 Bias Summary:

As long as ETH holds above 2150, the bias remains bullish for a rebound toward 2550 → 2750. A clean breakdown below support would shift the outlook bearish.

BITCOIN (BTC) — THE FALL HAS ONLY JUST BEGUN⚠️ THE GREAT BITCOIN REVERSAL — THE STORM NO ONE IS READY FOR ⚠️

For years, Bitcoin INDEX:BTCUSD climbed with the arrogance of a king convinced its throne was eternal.

But every empire falls.

And the chart…

The chart has been whispering the truth long before anyone wanted to hear it.

Today, that whisper has become a SCREAM. 📉⚡

🔥 1. The Final Wave Has Broken — and So Has the Illusion

The macro Wave 5 top is in.

Perfect confluence.

Perfect exhaustion.

Perfect euphoria.

The same pattern that ended EVERY Bitcoin mega-cycle… just printed again.

This wasn’t a top.

It was THE top.

The moment the bull cycle let out its final breath. 💀📈

🩸 2. Smart Money Has Already Left the Building

While retail celebrated “new highs,” Smart Money carved out:

• Stop hunts

• Liquidity grabs

• Breaker blocks

• Distribution ranges

• A devastating SOW

• And the cleanest market structure break BTC has shown since 2018

Institutions aren’t buying dips.

They are offloading the mountain .

The crowd doesn’t see it — yet.

⚡ 3. A Market Structure Collapse Echoing 2014, 2018 and 2021

Each cycle’s death began the same way:

A gentle pullback…

A sudden rejection…

Then a violent swing failure ,

followed by the HTF structure snapping in half.

That exact sequence is happening right now .

This is not a correction.

This is a cycle reset .

🎯 4. Fibonacci Retracements Don’t Lie — They Warn

Every true macro Wave 2 in history has returned to:

🔻 0.786

🔻 0.886

🔻 1.0 – 1.618 extensions

Where do they converge this time?

👇

🔮 $6,000 – $1,250

The forgotten land of 2017 mania…

A level BTC has avoided for 8 years.

But the cycle demands balance.

And balance always returns.

🌪️ 5. Price Action Has Flipped From Confidence to Panic

The candles have changed character:

• Weak closes

• Long tall wicks of rejection

• Failed rallies

• Imbalances breaking lower

• Bull traps everywhere

• A violent displacement to the downside

This isn’t cooling off.

This is unwinding.

📉 6. Market Cycle Psychology Has Entered Its Darkest Phase

We just exited Euphoria.

We are in Complacency.

Next comes:

😨 Anxiety

😱 Fear

💀 Capitulation

🔥 Anger

🌑 Depression

Only after that does a new accumulation begin.

And that’s why Wave 2 is infamous.

It destroys what Wave 1 built.

🚨 THE VERDICT: THE DOWNFALL IS IN MOTION — AND WE ARE EARLY

From $126K to $90K was not the crash.

It was merely the first spark in a forest full of dry leaves.

Wave A has barely begun.

Wave B will deceive.

Wave C will devastate.

The endgame target remains:

🎯 $1,250 – $6,000

The cycle reset.

The cleanse.

The opportunity of the decade — but only after the fire burns everything above it.

🔥 This is not fear. This is structure, math, psychology, liquidity, and time itself.

And all of them point in the same direction. Down, Down And Down

🔥 Follow this idea to stay ahead of the next macro move.

📈 We’ll update the chart as the structure unfolds — Wave A, Wave B trap, and the full Wave C capitulation zone.

💬 Drop your thoughts below — agree or disagree, the chart will decide.

🚀 Turn on notifications so you don’t miss the next critical breakdown.

⚠️ DISCLAIMER: This analysis is for educational and informational purposes only.

Not financial advice. Always manage risk and make decisions based on your own research and personal strategy.

#Bitcoin #BTC #Crypto #CryptoAnalysis #TradingView #BTCUSD #BearMarket #ElliottWave #SmartMoney #PriceAction #MarketCycle #Fibonacci #TechnicalAnalysis #CryptoCrash #CryptoWarning