Sandisk TRADE IDEA $SNDKNASDAQ:SNDK SanDisk stock is up nearly 1100% over the last 365 days, and while there are several factors contributing to this massive move, the most important reason is that the rally has been driven by price action and hype. The stock has been forming a strong rising wedge pattern, which is clearly visible on the chart.

This rising wedge has provided well-defined structure, making risk management much easier. Price has respected both the upper and lower trendlines multiple times, offering clean entries and well-placed stop-loss levels. Traders can look to take advantage of moves within this pattern by buying pullbacks near the lower trendline and managing risk just below it.

Alternatively, for a more conservative and potentially high-probability setup, one could wait for a decisive break of the bottom trendline. A confirmed breakdown could present an easier short opportunity in the future, especially if accompanied by strong volume and follow-through. Overall, this chart presents a well-structured trading opportunity with clear levels, making it an attractive setup for both active traders and swing traders. What do you think about this trade idea?

Datacenter

I'm worried for BIT DIGITAL. It can lose -75% of share value. At 50 cents

Bit Digital would be prices as a distressed, option like stub on #crypto and #AI

Rather than a normal business.

A coherent. bear case says it deserves that treatment.

Why?

1. Hyper cyclical BTC linked business model

2. Regulatory and political overhang on mining/crypto

3. Execution risk in the HPC/AI pivot story.

4. Balance sheet and cash flow vulnerability.

5. Narrative fatigue and sentiment risk.

Is Silicon's Silent Giant Rewriting the Rules of AI?Broadcom has emerged as a critical, yet understated, architect of the artificial intelligence revolution. While consumer-facing AI applications dominate headlines, Broadcom operates in the infrastructure layer, designing custom chips, controlling networking technology, and managing enterprise cloud platforms. The company maintains a 75% market share in custom AI accelerators, partnering exclusively with Google on their Tensor Processing Units (TPUs) and recently securing a major deal with OpenAI. This positioning as the "arms dealer" of AI has propelled Broadcom to a $1.78 trillion valuation, making it one of the world's most valuable semiconductor companies.

The company's strategy rests on three pillars: custom silicon dominance through its XPU platform, private cloud control via the VMware acquisition, and aggressive financial engineering. Broadcom's technical expertise in critical areas like SerDes technology and advanced chip packaging creates formidable barriers to competition. Their Ironwood TPU v7, designed for Google, delivers exceptional performance through innovations in liquid cooling, massive HBM3e memory capacity, and high-speed optical interconnects that allow thousands of chips to function as a unified system. This vertical integration from silicon design to enterprise software creates a diversified revenue model resistant to market volatility.

However, Broadcom faces significant risks. The company's dependence on Taiwan Semiconductor Manufacturing Company (TSMC) for production creates geopolitical vulnerability, particularly given rising tensions in the Taiwan Strait. U.S.-China trade restrictions have compressed certain markets, though sanctions have also consolidated demand among compliant vendors. Additionally, Broadcom carries over $70 billion in debt from the VMware acquisition, requiring aggressive deleveraging despite strong cash flows. The company's controversial shift to subscription-based pricing for VMware, while financially successful, has generated customer friction.

Looking ahead, Broadcom appears well-positioned for the continued AI infrastructure buildout through 2030. The shift toward inference workloads and "agentic" AI systems favors application-specific integrated circuits (ASICs) over general-purpose GPUs Broadcom's core strength. The company's patent portfolio provides both offensive licensing revenue and defensive protection for partners. Under CEO Hock Tan's disciplined leadership, Broadcom has demonstrated ruthless operational efficiency, focusing exclusively on the highest-value enterprise customers while divesting non-core assets. As AI deployment accelerates and enterprises embrace private cloud architectures, Broadcom's unique position spanning custom silicon, networking infrastructure, and virtualization software establishes it as an essential, if largely invisible, enabler of the AI era.

Carrier: The AI Infrastructure Winner Hiding in Plain SighHey TradingView community!

I see Carrier as a company that can highly benefit from the AI data center expansion, while at the same time not being exposed to the AI potential downside. Why? Because Carrier is an air conditioning and cooling giant that has a strong commercial and residential business no matter whether we are in an AI bubble or not. Also, it's a 100-year company that is not going belly up anytime soon.

THE OPPORTUNITY

Carrier Global is not a pure AI stock, but it is a critical AI infrastructure enabler through its leadership in high-efficiency cooling for data centers and AI-powered building energy management.

Carrier is quietly becoming a picks-and-shovels play in the AI buildout, without the valuation froth of chip or software names.

AI data center cooling demand surging → Carrier’s liquid cooling investments makes it the number one choice.

They help AI scaling with cooling → 650M kWh saved, 437K tons CO₂ reduced.

Commercial HVAC + Service = Recurring Moat → 15–20% organic growth in data center vertical

Viessmann integration on track → Europe heat pump can be huge

Balance sheet deleveraged → Net debt/EBITDA ~2.0x post-divestitures

THE NUMBERS

Current stock price: $55.16

DCF model values CARR at ~$80/share

2.36x Sales, and 42x TTM P/E (P/E is high due to the amortization of their big Viessmann factory in Europe

EV/EBITDA ~16.5x

Dividend yield 1.5%

Among its competitors (Trane, JCI and Vertiv), Carrier has the lowest EV/EBITDA at 16.5x

EBITDA margin 16.5%

TECHNICAL ANALYSIS

The stock is currently sitting at the $55 resistance level, which seems to be a good entry point. RSI shows oversold. Since July this year, the stock has dropped 32%, giving it a good discount.

I see a potential upside of 40% to 50% over the next year, and a maximum drawdown of 25%

My final thought is that the market is pricing Carrier as a cyclical HVAC company. It’s actually a defensive AI infrastructure play with a 100-year brand, recurring revenue, and a seat at the data center table.

CRWV: price at local support zonePrice has reached a local support area where a potential higher low might start forming. I don’t yet have clarity on the larger-degree structure, but the market’s reaction to earnings on Monday should provide more evidence to work with.

Ideally, I’d like to see a move up toward the 145–157 zone, followed by a higher low to establish a new base. Alternatively, if price fails to hold above the 115–130 resistance area, we might be setting up for a move to re-test the September lows. In any case, I’m expecting at least a short-term bounce.

Chart:

APLD: might be starting a new upswing Price is showing a constructive reaction from the 30–26 support zone and might be starting a new uptrend toward the next mid-term resistance area at 60–75.

As long as price continues to hold above the support zone, I’ll keep this trend structure as my main scenario.

Chart:

$DGXX - Digi Power X - $8PTNASDAQ:DGXX has been churning through this $4.42-$4.56 Level of Resistance, continuing on to push through the Higher $4.96 Levels. We're currently on pace to hit $5.65 and on to the $8.00 PT.

RECENT NEWS:

MIAMI, Oct. 21, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. (“Digi Power X” or the “Company”) (Nasdaq: DGXX / TSXV: DGX), a U.S. developer of Tier III-grade high-performance computing (“HPC”) infrastructure, announced today that it is expanding its AI data center capacity with the addition of five new ARMS-200 GPU modules, scheduled to come online at its Columbiana, Alabama facility in March 2026.

Netweb Technologies: The Backbone of India’s AI RevolutionWhile everyone's talking about AI, Netweb is actually BUILDING India's AI backbone - and the results are spectacular! 📈

What's Happening:

● Stock soared 116% in 6 months (₹1,638 → ₹3,535) 📊

● Just secured ₹450 Cr fresh order (Sep 22) + earlier ₹1,734 Cr NVIDIA deal

● Q1 results were phenomenal - Revenue & PAT both DOUBLED! 💰

Why This Matters:

Netweb is powering India's ambitious AI Mission with high-performance servers and GPU systems. They're not just riding the AI wave - they're the infrastructure making it possible.

The Numbers Speak:

✅ Revenue: ₹301 Cr (+102% YoY)

✅ Profit: ₹30.5 Cr (+101% YoY)

✅ AI Segment: +300% growth

✅ Order book: Strong visibility till FY27

Technical View:

● Fresh breakout confirmed from a rounding bottom, with robust volume support.

● Setup looks primed for another strong rally ahead. 🚀

⚠️ Disclaimer: This is an educational post meant for learning purposes only. Not a stock recommendation.

Can a Crypto Miner Become an AI Infrastructure Giant?Applied Digital Corporation has undergone a dramatic transformation, pivoting from cryptocurrency mining infrastructure to become a key player in the rapidly expanding AI data center market. This strategic shift, completed in November 2022, has resulted in extraordinary stock performance with shares surging over 280% in the past year. The company has successfully repositioned itself from serving volatile crypto clients to securing long-term, stable contracts in the high-performance computing (HPC) sector, fundamentally de-risking its business model while capitalizing on the explosive demand for AI infrastructure.

The company's competitive advantage stems from its purpose-built approach to AI data centers, strategically located in North Dakota to leverage natural cooling advantages and access to abundant "stranded power" from renewable sources. Applied Digital's Polaris Forge campus can achieve over 220 days of free cooling annually, significantly outperforming traditional data center locations. This operational efficiency, combined with the ability to utilize otherwise curtailed renewable energy, creates a sustainable cost structure that traditional operators cannot easily replicate through simple retrofitting of existing facilities.

The transformative CoreWeave partnership represents the cornerstone of Applied Digital's growth strategy, with approximately $11 billion in contracted revenue over 15 years for a total capacity of 400 MW. This massive contract provides unprecedented revenue visibility and validates the company's approach to serving AI hyperscalers. The phased buildout schedule, commencing with a 100 MW facility in Q4 2025, provides predictable revenue growth while the company pursues additional hyperscale clients to diversify its customer base.

Despite current financial challenges including negative free cash flow and steep valuation multiples, institutional investors holding 65.67% of the stock demonstrate confidence in the long-term growth narrative. The company's success will ultimately depend on the execution of its buildout plans and ability to capitalize on the projected $165.73 billion AI data center market by 2034. Applied Digital has positioned itself at the intersection of favorable macroeconomic trends, geostrategic advantages, and technological innovation, transforming from a volatile crypto play into a strategic infrastructure provider for the AI revolution.

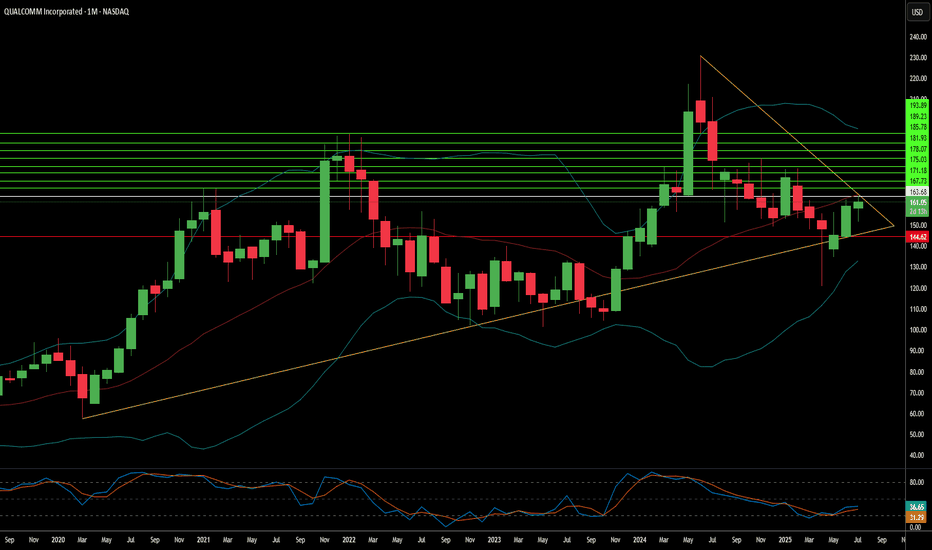

Qualcomm: Beyond the Smartphone Storm?Qualcomm (NASDAQ:QCOM) navigates a dynamic landscape, demonstrating resilience despite smartphone market headwinds and geopolitical complexities. Bernstein SocGen Group recently reaffirmed its "Outperform" rating, setting a \$185.00 price target. This confidence stems from Qualcomm's robust financials, including a 16% revenue growth over the last year and strong liquidity. While concerns persist regarding potential Section 232 tariffs and Apple's diminishing contribution, the company's strategic diversification into high-growth "adjacency" markets like automotive and IoT promises significant value. Qualcomm currently trades at a substantial discount compared to the S&P 500 and the Philadelphia Semiconductor Index (SOX), signaling an attractive entry point for discerning investors.

Qualcomm's technological prowess underpins its long-term growth narrative, extending far beyond its core wireless chipmaking. The company aggressively pushes **on-device AI**, leveraging its Qualcomm AI Engine to enable power-efficient, private, and low-latency AI applications across various devices. Its Snapdragon platforms power advanced features in smartphones, PCs, and the burgeoning **automotive sector** with the Snapdragon Digital Chassis. Further expanding its reach, Qualcomm's recent acquisition of Alphawave IP Group PLC targets the data center market, enhancing its AI capabilities and high-speed connectivity solutions. These strategic moves position Qualcomm at the forefront of the **high-tech revolution**, capitalizing on the pervasive demand for intelligent and connected experiences.

The company's extensive **patent portfolio**, encompassing over 160,000 patents, forms a critical competitive moat. Qualcomm's lucrative Standard Essential Patent (SEP) licensing program generates substantial revenue and solidifies its influence across global wireless standards, from 3G to 5G and beyond. This intellectual property leadership, combined with a calculated pivot away from its historical reliance on a single major customer like Apple, empowers Qualcomm to pursue new revenue streams. By aiming for a 50/50 split between mobile and non-mobile revenues by 2029, Qualcomm strategically mitigates market risks and secures its position as a diversified technology powerhouse. This assertive expansion, alongside its commitment to dividends, underscores a confident long-term outlook for the semiconductor giant.

Micron Technology (MU) – Powering the AI Memory SupercycleCompany Overview:

Micron NASDAQ:MU is a crucial player in the AI infrastructure stack, providing advanced DRAM, NAND, and NOR flash memory solutions that fuel everything from data centers to mobile edge devices.

Key Catalysts:

AI-Driven Memory Demand ⚙️

High-Bandwidth Memory (HBM) adopted in AI accelerators from Nvidia, AMD, Broadcom, and Marvell.

Positions Micron at the core of the AI supply chain, reducing exposure to chip cycle volatility.

Data Center Surge 📈

Data center DRAM revenue tripled YoY in Q2 2025, driven by hyperscaler AI infrastructure upgrades.

Strengthens revenue diversification and margin profile.

Technology Leadership 🔬

Launch of 1-gamma DRAM node and LPDDR5X samples enhances mobile, cloud, and auto capabilities.

Keeps Micron on the cutting edge of memory innovation.

Investment Outlook:

Bullish Case: We remain bullish on MU above $95.00–$97.00.

Upside Target: $155.00–$160.00, supported by AI compute growth, hyperscale momentum, and next-gen product launches.

💡 Micron is not just riding the AI wave—it’s building its memory core.

#Micron #MU #Semiconductors #AI #HBM #DataCenter #DRAM #NAND #Nvidia #AMD #Hyperscalers #TechLeadership

$AMD (ADVANCED MICRO DEVICES) – DATA CENTER DOMINANCE & AI AMD (ADVANCED MICRO DEVICES) – DATA CENTER DOMINANCE & AI POTENTIAL

(1/7)

Q4 2024 Revenue landed between $7.65B–$7.7B, beating estimates (~$7.53B). That’s a year-over-year jump fueled by Data Center sales skyrocketing +69% to $3.9B—now over half of AMD’s total revenue! Let’s dive in. 🚀

(2/7) – EARNINGS BEAT

• Q4 2024 EPS: ~$1.09 (a hair above consensus $1.08–$1.09)

• Operating cash flow up +240% YoY—huge liquidity boost 💰

• Despite the beats, stock dipped -2% post-earnings—profit-taking or a sign of sky-high expectations? 🤔

(3/7) – GUIDANCE & MOMENTUM

• Q1 2025 sales guidance: $7.1B (~above $7.0B estimates)

• Indicates continued growth, with AMD’s pivot to AI & data center paying off 💡

• Investors weigh: Are expectations now too lofty?

(4/7) – SECTOR COMPARISON

• AMD’s data center surge outpaces Intel in growth & profitability

• Trails NVIDIA in AI infrastructure domination, but could be undervalued if the market’s underestimating AMD’s AI diversification potential ⚙️

• Future gains might hinge on capturing more hyperscaler demand 🔗

(5/7) – RISK FACTORS

• NVIDIA: Still the top AI chip supplier—AMD must fight for share

• Semiconductors are cyclical: macro downturn = potential demand drop 📉

• TSMC reliance → supply chain or geopolitical hiccups

• The -2% stock drop post-earnings suggests the bar is set high

(6/7) – SWOT HIGHLIGHTS

Strengths:

Data Center revenue up 69% → half of total rev 🌐

Diversified portfolio, not just PC chips

Strong cash flow fueling R&D

Weaknesses:

Lags NVIDIA in AI adoption

Post-earnings stock dip hints at market skepticism

Opportunities:

AI expansions beyond GPU domination

Partnerships / acquisitions → deeper AI capabilities 🤖

Emerging markets (auto, IoT, etc.) for chip technology

Threats:

Fierce competition (NVIDIA, Intel)

Economic slowdowns

Regulatory or supply chain bumps ⚠️

(7/7) – Is AMD a prime AI contender or overshadowed by NVIDIA?

1️⃣ Bullish—Data center momentum will fuel AI growth 🚀

2️⃣ Neutral—Solid performance, but needs bigger AI share 🤔

3️⃣ Bearish—NVIDIA leads, AMD can’t catch up 🐻

Vote below! 🗳️👇

Is This $1B Tech Deal the Dawn of a New AI Infrastructure Era?In a move that redefines the landscape of enterprise AI infrastructure, Hewlett Packard Enterprise has emerged victorious in securing a transformative $1 billion deal with X, Elon Musk's social media platform. This landmark agreement represents one of the largest AI server contracts to date and signals a pivotal shift in how major tech companies approach their AI computing needs.

The implications of this deal extend far beyond its monetary value. By outmaneuvering industry titans Dell Technologies and Super Micro Computer in a competitive bidding process, HPE has demonstrated that traditional leaders no longer dominate the AI hardware market. This disruption suggests a new era where technological innovation and cooling efficiency may prove more crucial than established market positions.

The timing of this partnership is particularly significant as it coincides with a dramatic surge in data center infrastructure spending, which reached $282 billion in 2024. HPE's success in securing this contract, despite being considered a relative newcomer in the AI server space, challenges conventional wisdom and opens up intriguing possibilities for future market dynamics. As enterprises worldwide grapple with their AI infrastructure needs, this deal may serve as a blueprint for the next wave of major tech investments, marking the beginning of a new chapter in the evolution of AI computing infrastructure.

APLD once again in the buy zone; breakout to 11.8 by early FebAPLD has reached within the 61.8 & 78.6 fibonacci retracement levels of current buy structure on 4 hr cycle.

Based upon the strong buy rates & recent bullish activity, as well as the buy rates building on Nasdaq index, I see this retracement as a perfect discount for a long call options trade setup for 30 DTE contracts.

Long equity positions are being held speculatively with expectations for breakout rally to 34$ prior highs sometime by end of 2025/early 2026. Imminent target is shown at 11.8 zone by end of Jan/early Feb (at the latest).

Can a Tech Giant Rewrite Its Future While Racing Against Time?In a remarkable display of corporate resilience, Super Micro Computer stands at the intersection of crisis and opportunity, navigating regulatory challenges while simultaneously revolutionizing the AI infrastructure landscape. As the company addresses its Nasdaq compliance requirements through comprehensive reforms, including the strategic appointment of BDO USA as its new independent auditor, it hasn't missed a beat in its technological innovation trajectory - a feat that has left critics and supporters watching intently.

The numbers tell a compelling story of growth amidst adversity: a staggering 110% revenue surge to $15 billion in FY2024, coupled with a nearly 90% increase in adjusted earnings. But, perhaps more impressive is Supermicro's technical leadership, maintaining an 18-24 month advantage over competitors in liquid-cooled AI rack technology and demonstrating the capability to deploy 100,000-GPU liquid-cooled AI data centers. This technical prowess, combined with strategic partnerships with industry giants like NVIDIA, positions Supermicro at the forefront of the AI infrastructure revolution.

Looking ahead, Supermicro's journey represents more than just a corporate turnaround story - it's a masterclass in organizational agility and strategic focus. While many companies might have faltered under the weight of regulatory scrutiny, Supermicro has instead used this moment as a catalyst for transformation, strengthening its corporate governance while accelerating its innovation pipeline. With analyst projections indicating 40%+ earnings growth for FY2025 and revenue expected to surge over 70%, the company's trajectory suggests that sometimes, the most significant opportunities for growth emerge from the crucible of challenge.

Can a Tech Giant Redefine the Future of Enterprise Computing?In an era where technology companies rise and fall with stunning rapidity, Dell Technologies has orchestrated a remarkable transformation that challenges conventional wisdom about legacy tech companies. The company's strategic positioning in the hybrid cloud market, coupled with recent market disruptions affecting competitors like Super Micro Computer, has created an unprecedented opportunity for Dell to reshape the enterprise computing landscape.

Dell's masterful execution of its hybrid cloud strategy, particularly through its groundbreaking partnership with Nutanix, demonstrates the power of strategic evolution. The integration of PowerFlex software-defined storage and the introduction of the XC Plus appliance represent more than mere product innovations—they exemplify a deeper understanding of how enterprise computing needs are fundamentally changing. This transformation is particularly evident in regions like Saudi Arabia, where Dell's two-decade presence has evolved into a catalyst for technological advancement and digital transformation.

The financial markets have begun to recognize this shifting dynamic, as reflected in Dell's impressive 38% year-over-year growth in infrastructure solutions revenue. However, the true significance lies not in the numbers alone, but in what they represent: a traditional hardware company successfully pivoting to meet the complex demands of the AI era while maintaining its core strengths in enterprise computing. For investors and industry observers alike, Dell's journey presents a compelling case study in how established tech giants can not only survive but thrive in an era of rapid technological change.

Shorts Trapped Into Insider Selling | DELL I've been actively trading DELL with my private community members and I believe the company is gearing up for another positive run. Despite the news about Michael Dell selling more shares, which may have trapped some short-sellers, DELL is making strategic moves such as reducing costs, rejoining the S&P500, and aiming to capture market share from SMCI.

With this in mind, I see two potential entry points:

a. Enter the trade above $121.50, aiming for $127.

b. Enter the trade once it breaks $127, targeting $138.

Personally, I prefer the second option. DM me with any questions!

KLCI.Who/what made Malaysia's economic will boom again? 8/8/24KLCI / FBMKLCI index will hit reach ATH toward 2200 by 2026? What and who "make it" happen? Robberly it's the A.I, Chips sector. And what Make Malaysia as a "hub" of A.I Data Centre? Compare to STI (Singapore) and SET (Thailand) Chart. FBMKLCI chart almost identical! = It probably meant not because who was PM of Malaysia during 80s "making" Malaysia's GDP grow higher! It's "Cycle Trend/ circumstances?!!". AND. The "Cycle Trend/ Circumstances" was "created" by its millions of citizens! as "weather!" not just because 1 person! P/s. AND Most politicians are "good opportunist" they know how to "grab" the "cycle/Trend"!.

Legrand (LR.pa) bullish scenario:The technical figure Channel Down can be found in the daily chart in the French company Legrand (LR.pa). Legrand is a French industrial group.

Legrand is established in 90 countries and its products are distributed in nearly 180. It generates 85% of its sales internationally. The group has expanded its product range in sustainable development and energy saving technologies, and has developed new products for EV charging/electric vehicles, lighting control and datacenters. The Channel Down broke through the resistance line on 19/04/2023. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 6 days towards 87.50 EUR. According to experts, your stop-loss order should be placed at 78.44 EUR if you decide to enter this position.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals and cannot be held liable nor guarantee any profits or losses.

$SLNH Breakout Bitcoin Play -Shorts Going To Be Squeezed. 27 Check News and Chart people

Do your research Swing trade with Mega Potential

Soluna Inks 25 MW Hosting Deal with Leading Bitcoin Miner

finance.yahoo.com

Soluna Reports $24.4 million in Cryptocurrency Revenue in Full Year 2022, a 123% increase – Provides Operational Update

finance.yahoo.com

DBRG is taking SWCH private? What now?Well, right after data center infrastructure stock SWCH announced solid 1st quarter earnings results, we get an announcement that it's going private. DBRG and IFM Investors are taking it private for $11 billion. Shareholders will get $34.25 per share on the transaction.

The price action gapped up to around that level and it will stay in this range until the transaction is complete and SWCH shares disappear from the exchanges.

This looks like a good thing for SWCH fundamentally, as the company continues to expand its data center capacity. You need investors to keep buying up land for data center infrastructure.

Solid Revenues and Net Income growth make the purchase a sweet deal for NYSE:DBRG and IFM, which is not publicly traded.

But don't go running to buy the REIT DBRG just yet. It's taking a dive like most other large caps. And an acquisition is a costly thing for any company--this can put a dent in the trend of the share price.

Like I've been writing throughout the index correction: WAIT for the bottom to develop. Most traders and investors are just impatient. If you'd just wait for it...

Thanks for reading, hope you learned a little something. Visit my website to learn more.

$COR: A CORE Position For A Deflationary Environment?Real Estate has seen some specific winners starting to emerge, however, as the Fed soon begins the tightening process, is it possible we still see more in the tank for IYR (REIT ETF) as the Dollar continues it's rally? Keep in mind, a rate hike currently isn't priced in until July of 2022 and the inflationary pressures have been strong but with some patience on the REIT investor's part. I do believe the company could be primed to make an early run before a defensive cycle emerges. I'll scale in and manage risk based on price / sentiment toward the defensive names as a whole.

A great company which could survive all weatherThe market turmoil in Feb has eroded a lot people's bank roll, so as to the market cap of tech companies in general, some are extremely good ones.

AMD has evolved themselves from the shadow of intel and became a key players in the IDC and mobile market...its last finance report has shown a lot of traits that they are on the uptrend to become more dominant than ever.

Its share price has dropped from the recent high of 90s back down to mid 70s range has given us a great opportunity to load up.

While the recent turmoil has broken the upward tunnel briefly but it has recovered and built extremely strong support at 74 dollar level.

I would personally stock up at 82-83 dollar range and strong hold until it hits its recent high at 100 range...setting cut loss at 73.5 still give us a fair 2:1 risk reward ratio.