$BCH Rebounds Strongly – Is a Breakout Toward $540 Coming?SET:BCH is showing a strong bullish reversal from a key ascending trendline on the weekly chart. After retesting the support zone near $250, the price bounced with 9% gains, signaling renewed interest. The structure forms a symmetrical triangle, and BCH is now eyeing resistance near $309. A breakout could target the $440–$540 zone.

This move aligns with Bitcoin’s current consolidation at higher levels. If BTC remains strong in Q2 2025, BCH could follow with further upside. Holding the $225–$250 support is crucial to maintain this bullish setup.

DYOR, NFA

Daytrading

BTCUSD Daily View Based on your 15-minute BTC/USD chart, here’s a structured technical analysis for **April 10, 2025**:

---

### 🧠 **Chart Breakdown**

- **Break of Structure (BOS)**: Bullish BOS occurred earlier, indicating short-term upward momentum.

- **Strong High**: Marked at **$83,568** — this is a **liquidity point** that could act as a magnet if bullish momentum resumes.

- **Weak Low Zone**: Around **$81,451** — a key liquidity area that might be swept before any significant move up.

- **Current Price**: **$81,814**, sitting just above the weak low zone and in a minor consolidation phase.

---

### 🔍 **Market Context**

- After a strong impulsive move up, BTC started pulling back with lower highs and lower lows, indicating **retracement** or **distribution**.

- The price is holding slightly above the weak low, meaning:

- Smart money may be trying to **trap shorts or induce longs** before a deeper sweep or reversal.

- There's potential for **liquidity sweep below $81,451** before heading back up to test the strong high ($83,568).

---

### 🔮 **Today's Bias: Neutral-to-Bullish (Scalp or Swing)**

#### 🎯 **Bullish Scenario (Preferred if $81,451 holds)**

- Price holds above or sweeps $81,451 and **reclaims the zone quickly**.

- Expect a bounce toward:

- **$82,500** (intermediate resistance)

- **$83,568** (strong high / liquidity target)

#### 🛑 **Bearish Scenario (Only if clean break below $81,451)**

- Price breaks and holds below **$81,451** → retest failure = bearish.

- Target downside levels:

- **$80,500**

- Potentially **$79,500** if momentum is strong.

---

### 🧭 **Action Plan for Today**

| Type | Strategy |

|-------------|----------------------------------------------------------|

| Intraday Long | Buy near $81,451 zone with tight SL below $81,200 |

| Confirmation Entry | Wait for 15m bullish engulfing / BOS above GETTEX:82K |

| Short Setup | Only valid on clear 15m breakdown + retest below $81,451 |

---

My trade for GOLD (XAUUSD) todayHere's my trade for GOLD today. From daily tf where my bias is bullish targeting the PDH and structure tf which is 1H then entry tf which is 5m. Now for my idea, i am expecting for price to go towards the PDH and that's where i got my bias. For my structure clearly we can see that the recent 1H candle respected the recent bullish FVG so now i can see that the bias is aligned with my structure tf. Once i saw that my entry tf is also aligned with my structure tf, i decided to enter with a target of 1:3R

Learn 3 Best Time Frames for Day Trading Forex & Gold

If you want to day trade Forex & Gold, but you don't know what time frames you should use for chart analysis and trade execution, don't worry.

In this article, I prepared for you the list of best time frames for intraday trading and proven combinations for multiple time frame analysis.

For day trading forex with multiple time frame analysis, I recommend using these 3 time frames: daily, 1 hour, 30 minutes.

Daily Time Frame Analysis

The main time frame for day trading Forex is the daily.

It will be applied for the identification of significant support and resistance levels and the market trend.

You should find at least 2 supports that are below current prices and 2 resistances above.

In a bullish trend, supports will be applied for trend-following trading, the resistances - for trading against the trend.

That's the example of a proper daily time frame analysis on GBPCHF for day trading.

The pair is in an uptrend and 4 significant historic structures are underlined.

In a downtrend, a short from resistance will be a daytrade with the trend while a long from support will be against.

Look at GBPAUD. The market is bearish, and a structure analysis is executed.

Identified supports and resistances will provide the zones to trade from. You should let the price reach one of these areas and start analyzing lower time frames then.

Remember that counter trend trading setups always have lower accuracy and a profit potential. Your ability to properly recognize the market direction and the point that you are planning to open a position from will help you to correctly assess the winning chances and risks.

1H/30M Time Frames Analysis

These 2 time frames will be used for confirmations and entries.

What exactly should you look for?

It strictly depends on the rules of your strategy and trading style.

After a test of a resistance, one should wait for a clear sign of strength of the sellers : it can be based on technical indicators, candlestick, chart pattern, or something else.

For my day trading strategy, I prefer a price action based confirmation.

I wait for a formation of a bearish price action pattern on a resistance.

Look at GBPJPY on a daily. Being in an uptrend, the price is approaching a key resistance. From that, one can look for a day trade .

In that case, a price action signal is a double top pattern on 1H t.f and a violation of its neckline. That provides a nice confirmation to open a counter trend short trade.

Look at this retracement that followed then.

In this situation, there was no need to open 30 minutes chart because a signal was spotted on 1H.

I will show you when one should apply this t.f in another setup.

Once the price is on a key daily support, start looking for a bullish signal.

For me, it will be a bullish price action pattern.

USDCAD is in a strong bullish trend. The price tests a key support.

It can be a nice area for a day trade.

Opening an hourly chart, we can see no bullish pattern.

If so, open even lower time frame, quite often it will reveal hidden confirmations.

A bullish formation appeared on 30 minutes chart - a cup & handle.

Violation of its neckline is a strong day trading long signal.

Look how rapidly the price started to grow then.

In order to profitably day trade Forex, a single time frame analysis is not enough . Incorporation of 3 time frames: one daily and two intraday will help you to identify trading opportunities from safe places with the maximum reward potential.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

OptionsMastery: This is the "h" DayTrading Pattern.This is the "h" pattern. A highly successful daytrading pattern!

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

USDJPY Analysis: Reversal Forecasts Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

151.17 145.09

154.26 142.09

160.53 136.19

166.93 130.42

173.45 124.77

180.10 119.25

186.87 113.85

193.77 108.58

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

XAUUSD Analysis: Reversal Forecasts Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Our Math Analysis as below are Gold Levels:-

3018.720095 - 2991.311155

3032.47144 - 2977.65356

3060.06788 - 2950.43212

3087.78932 - 2923.33568

3115.635761 - 2896.364239

3143.607201 - 2869.517799

3171.703641 - 2842.796359

3199.925081 - 2816.199919

3228.271521 - 2789.728479

3342.907282 - 2685.092718

3459.543042 - 2582.456958

3578.178803 - 2481.821197

3698.814564 - 2383.185436

3821.450324 - 2286.549676

3946.086085 - 2191.913915

4072.721845 - 2099.278155

4201.357606 - 2008.642394

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

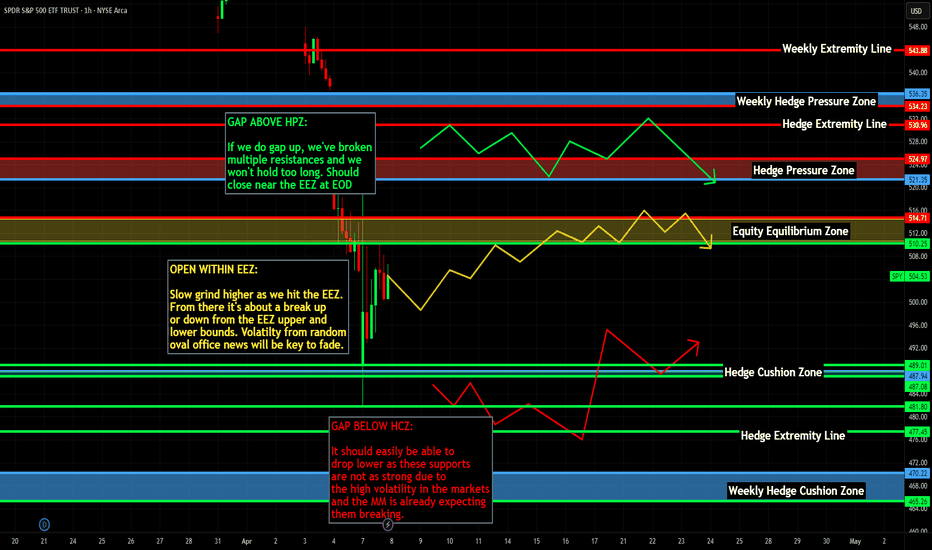

Nightly $SPY / $SPX Scenarios for April 8, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📊 NFIB Small Business Optimism Index Release: The National Federation of Independent Business (NFIB) will release its Small Business Optimism Index for March at 6:00 AM ET. This index provides insights into the health and outlook of small businesses, which are vital to the U.S. economy.

🗣️ Federal Reserve Speeches:

San Francisco Fed President Mary Daly is scheduled to speak at 8:00 AM ET.

Chicago Fed President Austan Goolsbee will deliver remarks at 7:00 PM ET.

📊 Key Data Releases 📊

📅 Tuesday, April 8:

📈 NFIB Small Business Optimism Index (6:00 AM ET):

Forecast: 100.7

Previous: 102.8

Assesses the health and outlook of small businesses, which are vital to the economy.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Assignment for GOLD next weekBase on what happened this week. My idea for GOLD is simple and straight forward next week. After that strong expansion to the downside, i am expecting to see a retracement towards .5 or .62 of fib level before price will continue to go down and mitigate that big weekly imbalance below. Base on the structure of next weeks high impact news, my idea would be a simple consolidation for Monday till Wednesday since we got no high impact news on those given days. Then Thursday and Friday would be the expansion since we got FOMC,CPI and PPI for those 2 remaining days of the week... My entry would still be the same. Top down analysis using my multi timeframe strategy and wait for all timeframes to align and enter in 5m timeframe once it aligns with the overall higher timeframe. Good luck to us all and Happy trading...

SOLUSDT | Elliott Wave Projection – Next big Move Incoming 50%+BINANCE:SOLUSDT

The chart is probably currently developing a five-wave impulsive structure (1)-(2)-(3)-(4)-(5), suggesting a potential bullish movement towards the 174-175 USD resistance zone before a larger correction unfolds.

📈 Bullish Setup:

- A corrective A-B-C structure seems complete, with a potential impulsive wave (1)-(5) forming.

- Price is reacting at a strong demand zone, initiating Wave (1) upwards.

- Possible target for Wave (5) lies near **174-175 USD**.

📉 Bearish Continuation Afterwards

- After reaching the projected high, expect a sharp rejection and reversal.

- The final bearish target lies within the "End of Bear" zone (~108-109 USD).

---

### 🔹 Key Levels to Watch:

✅ First Bullish Target: ~174-175 USD

⚠️ Critical Support Zone: 108-109 USD

---

### 📌 **Trading Plan:**

1️⃣ Long Opportunity: If price respects the current support, target Wave (3)-(5) completion near 174 USD.

2️⃣ Short Confirmation: If price rejects at resistance, a larger bearish wave is expected.

3️⃣ Final Bear Target: 108-109 USD zone for possible long-term support.

🚨 Risk Management:

- Stop-loss below 111 USD for longs.

- Wait for confirmation before shorting after rejection.

💬 What do you think? Will SOL hit 175 USD before the final drop? Comment below!

Day Trade Review – TSLAThis video is a review of TSLA intraday price action based on a request. It examines how the stock could have been traded using a technical approach. The analysis covers the entire session from the open to the close, showing execution, trade management and decision-making without hindsight bias. It also includes additional insights on time and risk management trading intraday.

If you have any requests for future reviews, let me know.

Another great trade for XAUUSD (GOLD) todayAfter seeing the price action of monday to wednesday, it gave a hint as to what to expect for today. Since i was expecting a consolidation reversal week i knew then that thursday will sweep monday to wednesday and do a reversal for today. Combining it with my multi timeframe analysis from daily to 1H with my entry in the 5m timeframe, i was able to capture this 1:7R trade for today...

For tomorrow my expectation would be an expansion friday candle going down targeting the daily +FVG to complete the ERL to IRL scenario...

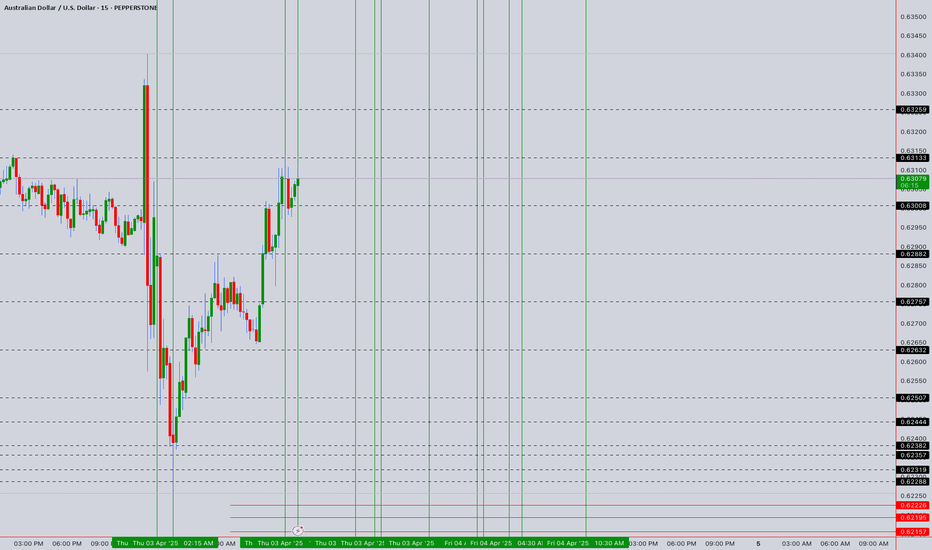

AUDUSD Tap Reading/ Trading Math Analysis Reversal Predictions BDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analysis, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

I welcome your feedback on this analysis, as it will inform and enhance my future research.

3rd Apr12:05 PM

3rd Apr 4:30 PM

3rd APr 6:10 PM

3rd APr 6:30 PM

3rd Apr 10:25PM

4th Apr 2:10 AM to 2:30 AM

4th 4:30 AM to 5:35 AM

4th 10:30 AM

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

NAS100 Analysis: Reversal Predictions Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analysis, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

I welcome your feedback on this analysis, as it will inform and enhance my future research.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Nightly $SPY / $SPX Scenarios for April 2, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 President Trump’s 'Liberation Day' Tariff Announcement: President Donald Trump is set to announce new reciprocal tariffs on April 2, aiming to align U.S. import duties with those imposed by other countries on American goods. This move is expected to impact various sectors, including automotive and manufacturing, and may lead to market volatility as investors react to potential shifts in trade policies.

📊 Key Data Releases 📊

📅 Wednesday, April 2:

🏭 Factory Orders (10:00 AM ET):

Forecast: 0.6%

Previous: 1.7%

Indicates the dollar level of new orders for both durable and non-durable goods, reflecting manufacturing demand.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Another Good Trade for GOLD (XAUUSD) Today

My overall forecast for this week is that Gold will do classic expansion week where monday will go up then tuesday will most likely go up to sweep mondays high then do the reversal so that wednesday and thursday will be expansion going down and target the daily imbalances below. For today i was expecting a bullish push upwards for GOLD before it will reverse so i followed my steps by combining my multi timeframe analysis. From daily for the overall bias to 1H for that confirmation and alignment then 5m for my entry timeframe. Once i saw those 3 timeframes align with combination confirmation that i saw with the price action then i entered the trade. My original target was 1:3R but then i saw the weakness after price came to my 1:2R level so i manually pulled out with a 1:2R gain for today....

FREE $QQQ Day Trade Setup!🚨 FREE NASDAQ:QQQ Day Trade Setup:

Break below $460.71 (Pre-Market Low)

🎯 $458/ $455

Options: April 1st $460 Puts

Ride H5_D on 2Min. chart. (Close above H5 is an Exit)

Retest PDL (Friday Low) = Look for a rejection

🎯Pre-Market Low

Play April 1st $466 Puts

Not Financial Advice