Salesforce Wins $5.6B Army Deal: AI & Strategic AnalysisAn in-depth analysis of Salesforce’s $5.6B U.S. Army contract and its multi-domain impact on CRM stock.

Geostrategy and Geopolitics: The Defense Pivot

Salesforce effectively entered the hard-power arena with its $5.6 billion U.S. Army contract. This move transcends typical software procurement. It signals a strategic alignment between Silicon Valley innovation and national security imperatives. The Pentagon, now emphasizing an "AI-first" warfighting stance, requires robust commercial partners. Salesforce’s "Missionforce" initiative directly addresses this geopolitical need. By securing this foothold, Salesforce mitigates risks associated with purely commercial market fluctuations. The deal positions the company as a critical infrastructure provider for the Department of Defense. This geopolitical integration offers a long-term hedge against global economic instability.

Business Models and Economics: The IDIQ Structure

Investors must scrutinize the "indefinite-delivery, indefinite-quantity" (IDIQ) nature of this agreement. While the $5.6 billion headline figure grabs attention, it represents a ceiling, not guaranteed revenue. The actual economic value depends entirely on the velocity of task orders. This business model shifts the focus from immediate bookings to long-term consumption utility. Analysts note a transition from buying software to "orchestrating outcomes at scale." Consequently, revenue recognition will likely trickle in rather than surge. This structure demands patience from shareholders expecting immediate quarterly spikes.

Technology and High-Tech Innovation: Agentic AI

The core value proposition lies in "Agentic AI." Salesforce aims to deploy autonomous agents that streamline logistics and decision-making. This technology leapfrogs traditional static dashboards. The Army contract specifically targets the unification of disparate data sources. By creating a "trusted data fabric," Salesforce lays the groundwork for advanced AI deployment. This focus aligns with the Pentagon’s broader GenAI.mil initiative. Success here proves that Salesforce’s AI tools work in high-stakes, chaotic environments.

Industry Trends and Competition

The government IT sector remains a crowded battlefield. Microsoft and Oracle traditionally dominate this space, while Palantir commands the data analytics niche. Salesforce’s entry disrupts this oligopoly. The contract validates Salesforce’s ability to compete for massive federal allocations. It challenges the assumption that CRM tools lack the robustness for defense applications. This trend suggests a blurring line between enterprise customer service tools and military-grade logistics. Salesforce is aggressively carving out market share from established defense contractors.

Management and Leadership: Strategic Alignment

Salesforce leadership executed a precise pivot toward the public sector. Kendall Collins, CEO of Missionforce, effectively operationalized this strategy. This leadership success highlights an adaptive corporate culture capable of navigating complex federal procurement. Furthermore, alignment with Defense Secretary Pete Hegseth’s "AI-first" vision demonstrates high-level strategic synergy. Peter Lington, VP for the Department of War business, emphasizes data as a "strategic asset." This coherent messaging between corporate executives and Pentagon leadership instills market confidence.

Cyber Security and Data Sovereignty

Security remains the linchpin of this deal. The Army requires absolute trust in its data before unleashing autonomous agents. Salesforce’s "Computable Insights" subsidiary addresses these specific security mandates. The emphasis on a "Modular Open-Source Approach" (MOSA) reduces vendor lock-in risks. It also forces Salesforce to prove its cybersecurity resilience constantly. Any breach would jeopardize not just the contract, but the company's entire federal reputation. Therefore, cybersecurity excellence acts as the primary gatekeeper for realizing the contract’s full value.

Macroeconomics and Market Sentiment

Salesforce shares ticked up 0.6% to $229.40 following the news. This muted reaction reflects investor caution regarding the macroeconomic environment. High interest rates continue to pressure tech valuations. Traders currently weigh the "hype" of AI against tangible book orders. The upcoming February 25 earnings report becomes the critical litmus test. The market demands proof that federal wins effectively counter broader economic slowdowns. Until then, the stock likely remains range-bound, waiting for concrete revenue data.

Patent Analysis and Science

The underlying science of this deal rests on data unification and API orchestration. Salesforce must leverage its intellectual property to connect legacy military systems. This requires advanced patent-protected methods for data ingestion and normalization. The "Golden Record" concept, a single source of truth, relies on sophisticated algorithmic reconciliation. Future patent filings will likely focus on "Agentic" behaviors and secure government cloud architectures. This intellectual property moat protects Salesforce from competitors seeking to clone its government-specific solutions.

Digitaltransformation

Eli Lilly & NVIDIA: A $1B AI Pharma RevolutionEli Lilly’s $1 billion partnership with NVIDIA signals a seismic shift in pharmaceutical valuation and strategy.

The convergence of biology and silicon is no longer theoretical; it is the new standard for industry leadership. By integrating NVIDIA’s AI supercomputing into its core operations, Eli Lilly (NYSE: LLY) is transitioning from a traditional drug maker to a bio-computation giant. This move secures its dominance not just in medicine, but in the high-growth data economy.

Technology & Science: The "Loop" Advantage

The core of this growth thesis is the new "loop-style" discovery system. Traditional drug discovery is linear, slow, and prone to failure. Lilly’s new model utilizes an AI supercomputer to generate molecular candidates, which physicians then test. Crucially, the biological data from these tests immediately feeds back into the AI, refining the model in real-time. This recursive learning cycle drastically reduces the time-to-market for new therapies. Science is now software-defined, and Lilly controls the source code.

Industry Trends & Economics: Capturing the $105B Market

The financial implications are staggering. The drug discovery market hit $105 billion in 2025, growing at a steady 10% annually. However, the real explosion lies in AI-enabled discovery, currently under 20% of the sector but projected to expand sixfold by 2034. Lilly is not just participating in this growth; they are engineering it. By dominating AI-driven discovery, they unlock inroads to the $550 million U.S. production market, effectively vertically integrating intelligence with manufacturing.

Geopolitics & Geostrategy: Health Security

Pharmaceutical dominance is a pillar of modern national security. Nations that control the fastest drug discovery platforms possess a distinct geostrategic advantage. By onshoring this supercomputing capacity, Eli Lilly aligns itself with U.S. interests in biological resilience. This reduces reliance on foreign research supply chains and positions the company as a strategic asset. Investors should view this as a government-aligned moat that insulates the stock from standard market volatility.

Cyber & High-Tech: The Data Fortress

Integrating NVIDIA’s Thor IGX platform transforms Lilly’s cyber profile. The company is no longer just protecting formulas; it is guarding proprietary training data. This shift demands a "Zero Trust" cyber architecture. As Lilly digitizes biological experimentation, its database becomes one of the most valuable intellectual properties on earth. Management’s foresight to secure industrial-grade AI infrastructure proactively mitigates the risks of IP theft in an era of digital espionage.

Management & Leadership: A Culture of Disruption

Corporate leadership is abandoning the "siloed" R&D model. Lilly’s executives are aggressively fostering a culture where data scientists sit equal to biologists. This cross-pollination drives innovation speed. While competitors hesitate to disrupt legacy workflows, Lilly’s management is betting the balance sheet on generative AI. This decisiveness commands a valuation premium. It signals to shareholders that leadership prioritizes long-term structural dominance over short-term quarterly safety.

Conclusion

Eli Lilly is redefining the pharmaceutical business model. Through its partnership with NVIDIA, it has effectively operationalized the future of medicine. For investors, LLY is no longer just a healthcare play; it is a high-tech growth stock backed by biological assets.

UiPath (PATH) — From RPA to Agentic AI at Enterprise ScaleCompany Overview

UiPath NYSE:PATH delivers enterprise automation across RPA + AI-driven agentic workflows, boosting efficiency for global organizations.

Momentum & Metrics (Q3 FY26)

First GAAP-profitable quarter; revenue $411M (+16% YoY)

ARR $1.78B (+11% YoY) with 107% net retention, signaling expansion into AI-powered agents

Go-to-Market Catalysts

Microsoft & Veeva partnerships accelerating adoption and measurable productivity/cost savings

Clear shift from task automation to end-to-end agentic orchestration

Investment Outlook

Bullish above: $13.50–$14.00

Target: $26–$27 — supported by profitability inflection, durable ARR growth, and partner-led distribution.

#UiPath #PATH #RPA #AgenticAI #Automation #EnterpriseAI #DigitalTransformation

Outfront Media (OUT) — Digital OOH MomentumCompany Overview

Outfront Media NYSE:OUT is a leading U.S. out-of-home (OOH) platform spanning billboards, transit, and digital screens. A cyclical rebound in advertising and rising mobility are lifting demand across national and local advertisers.

Key Catalysts

Beat & Rebound: Q3’25 revenue $467.5M, ahead of expectations, reflecting healthy OOH bookings and mix improvement.

Digital Shift = Higher Margins: Nearly 1,900 digital displays drive premium pricing, dynamic campaigns, and stronger utilization.

Diversification & Scale: Broad geographic and vertical exposure smooths cycles as brand spend re-accelerates.

Investment Outlook

Bullish above: $19.50–$20.00

Target: $31.00–$32.00 — supported by OOH recovery, digital conversion tailwinds, and operating leverage.

📌 OUT — modern OOH with expanding digital yield and resilient advertiser demand.

Can Software Win Wars and Transform Commerce?Palantir Technologies has emerged as a dominant force in artificial intelligence, achieving explosive growth through its unique positioning at the intersection of national security and enterprise transformation. The company reported its first billion-dollar quarter with 48% year-over-year sales growth, driven by an unprecedented 93% surge in U.S. commercial revenue. This performance stems from Palantir's proprietary Ontology architecture, which solves the critical challenge of unifying disparate data sources across organizations, and its Artificial Intelligence Platform (AIP) that accelerates deployment through intensive bootcamp sessions. The company's technological moat is reinforced by strategic patent protections and a remarkable 94% Rule of 40 score, signaling exceptional operational efficiency.

Palantir's defense entrenchment provides a formidable competitive advantage and guaranteed revenue streams. The company secured a $618.9 million Army Vantage contract and deployed the Maven Smart System for the Marine Corps, positioning itself as essential infrastructure for the Pentagon's Combined Joint All-Domain Command and Control strategy. These systems enhance battlefield decision-making, with targeting officers processing 80 targets per hour versus 30 without the platform. Beyond U.S. forces, Palantir supports NATO operations, assists Ukraine, and partners with the UK Ministry of Defence, creating a global network of high-margin, long-term government contracts across democratic allies.

Despite achieving profitability with 26.8% operating margins and maintaining $6 billion in cash with virtually no debt, Palantir trades at extreme valuations of 100 times revenue and 224 times forward earnings. With 84% of analysts recommending Hold or Sell ratings, the market remains divided on whether the premium is justified. Bulls argue the valuation reflects Palantir's transformation from niche government contractor to critical AI infrastructure provider, with analysts projecting potential revenue growth from $4.2 billion to $21 billion. The company's success across nine strategic domains—from military modernization to healthcare analytics—suggests it has built an "institutionally required platform" that could justify sustained premium pricing.

The investment thesis ultimately hinges on whether Palantir's structural advantages—its proprietary data integration technology, defense entrenchment, and accelerating commercial adoption—can sustain the growth trajectory demanded by its valuation. While the platform's complexity requires heavy customization and limits immediate scalability compared to simpler competitors, the 93% commercial growth rate validates enterprise demand. Investors must balance the company's undeniable technological and strategic positioning against valuation risk, with any growth deceleration likely triggering significant multiple compression. For long-term investors willing to weather volatility, Palantir represents a bet on AI infrastructure dominance across both military and commercial domains.

Pegasystems (PEGA) — Growth via AI & Cloud PartnershipsCompany Overview:

Pegasystems Inc. NASDAQ:PEGA is a leader in enterprise software, specializing in business process management and customer engagement solutions. Its offerings enable organizations to enhance efficiency, scalability, and customer experience, positioning it well within the fast-growing digital transformation market.

Key Catalysts:

AI acceleration: The Pega GenAI Blueprint platform reduces development time, delivering stronger ROI for clients such as Vodafone.

Cloud expansion: Partnerships with AWS and Microsoft boost integration, sales reach, and co-selling opportunities—supporting revenue scale.

Industry recognition: Named a Leader in Forrester’s Q3 2025 Digital Process Automation Platforms report, reinforcing brand credibility and competitive edge.

Investment Outlook:

Bullish above: $49–$50

Upside target: $85–$90, driven by AI adoption, cloud partnerships, and industry validation.

#PEGA #AI #CloudComputing #DigitalTransformation #EnterpriseSoftware #TechGrowth #Investing

Baidu (BIDU) –AI Upgrades + Open-Source Strategy Powering GrowthCompany Snapshot:

Baidu NASDAQ:BIDU is cementing its position as a top AI platform leader in China, combining core search dominance with cutting-edge AI innovations and strategic open-source moves.

Key Catalysts:

Next-Gen AI Infrastructure ⚙️

Major Qianfan platform upgrades and PaddlePaddle 3.0 launch streamline model training & deployment for China’s AI developer ecosystem.

Reduces barriers to AI adoption, expanding the company’s developer base and ecosystem stickiness.

Open-Source Breakthrough 📂

ERNIE language models released under Apache 2.0 license—mirroring successful U.S. big-tech strategies.

Aims to accelerate adoption, attract global partnerships, and enhance monetization over the long term.

Rising User Engagement 📱

724M MAUs (+7% YoY) on Baidu’s mobile app.

AI-generated content now on 35% of search pages (up from 22% in January), increasing ad monetization potential.

Investment Outlook:

Bullish Entry Zone: Above $76.00–$78.00

Upside Target: $160.00–$165.00, fueled by AI leadership, developer adoption, and rising engagement metrics.

📈 Baidu’s combination of AI innovation, open-source strategy, and a massive user base creates a strong runway for both near-term revenue growth and long-term platform dominance.

#BIDU #AI #PaddlePaddle #ERNIE #OpenSource #ChinaTech #Search #CloudComputing #ArtificialIntelligence #BigData #DigitalTransformation #TechStocks

Can Global Chaos Fuel Pharmaceutical Giants?Merck's remarkable growth trajectory demonstrates how a pharmaceutical leader can transform global uncertainties into strategic advantages. The company has masterfully navigated geopolitical tensions, including US-China trade disputes, by diversifying supply chains and establishing regionalized manufacturing networks. Simultaneously, Merck has capitalized on macroeconomic trends such as aging populations and rising chronic disease prevalence, which create sustained demand for pharmaceutical products regardless of economic fluctuations. This strategic positioning allows the company to thrive amid global instability while securing revenue streams through demographic tailwinds.

The foundation of Merck's success lies in its innovation engine, powered by cutting-edge scientific breakthroughs and comprehensive digital transformation. The company's partnership with Moderna for mRNA technology and its continued expansion of Keytruda's indications exemplify its ability to leverage both external collaborations and internal R&D prowess. Merck has strategically integrated artificial intelligence, big data analytics, and advanced manufacturing techniques across its operations, creating a holistic competitive advantage that accelerates drug development, reduces costs, and improves time-to-market efficiency.

Protecting future growth requires fortress-like defenses of intellectual property and cybersecurity assets. Merck employs sophisticated patent lifecycle management strategies, including aggressive biosimilar defense and continuous indication expansions, to extend the commercial life of blockbuster drugs beyond their primary patent expiry. The company's substantial cybersecurity investments safeguard its valuable R&D data and intellectual property from increasingly sophisticated threats, including state-sponsored espionage, thereby ensuring operational continuity and a competitive advantage.

Looking forward, Merck's sustained momentum depends on its ability to maintain this multifaceted approach while adapting to evolving market dynamics. The company's commitment to ESG principles and corporate social responsibility not only attracts socially conscious investors but also helps retain top talent in a competitive landscape. By combining organic innovation with strategic acquisitions, robust IP protection, and proactive risk management, Merck has positioned itself as a resilient leader capable of converting global complexity into sustained pharmaceutical dominance.

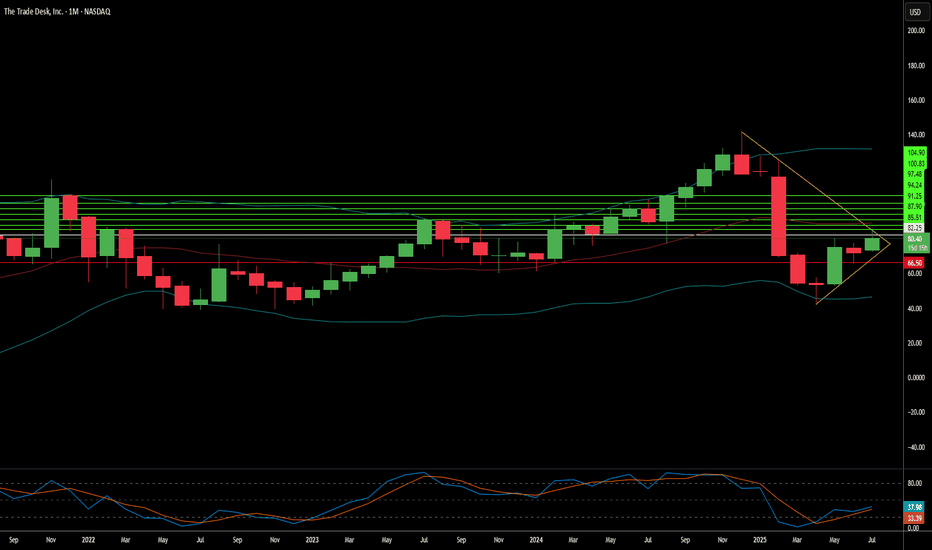

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion validates TTD's market importance and enhances its visibility and liquidity. This artificial demand floor, coupled with TTD's $37 billion market capitalization, underscores its growing influence within the financial landscape.

Beyond index inclusion, TTD benefits from a significant structural shift in advertising. Programmatic advertising is rapidly replacing traditional media buying, expected to account for nearly 90% of digital display ad spending by 2025. This growth is driven by advertisers' need for transparent ROI, publishers avoiding "walled gardens" through platforms like TTD's OpenPath, and AI-driven innovation. TTD's AI platform, Kokai, greatly lowers acquisition costs and enhances reach, resulting in over 95% client retention. Strategic partnerships in high-growth areas like Connected TV (CTV) further reinforce TTD's leadership.

Financially, The Trade Desk demonstrates remarkable resilience and growth. Its Q2 2025 revenue growth of 17% outpaces the broader programmatic market. Adjusted EBITDA margins hit 38%, reflecting strong operational efficiency. While TTD trades at a premium valuation - over 13x 2025 sales targets-its high profitability, substantial cash flow, and historical investor returns support this. Despite intense competition and regulatory scrutiny, TTD's consistent market share gains and strategic positioning in an expanding digital ad market make it a compelling long-term investment.

Lemonade, Inc. (LMND) – AI-Driven Disruption in InsuranceCompany Snapshot:

Lemonade NYSE:LMND is a tech-forward insurer reinventing traditional insurance through AI, data science, and a mobile-first experience across renters, homeowners, auto, pet, and life products.

Key Catalysts:

AI + OpenAI Integration 🚀

Collaborations with OpenAI are powering Lemonade’s RealTime API and AI voice agents, improving claims automation and customer support.

Enhances scalability and reduces overhead, key to long-term margin expansion.

Operational Resilience 🔥

Despite a $22M wildfire loss in California, Lemonade met Q1 guidance—thanks to robust reinsurance and effective risk management, underscoring operational maturity.

Auto Insurance Momentum 🚗

Car insurance was the top growth driver in Q1 2025, tapping into a multi-billion-dollar market where Lemonade still holds early-stage penetration.

AI-powered underwriting gives it an edge over legacy incumbents.

Investment Outlook:

Bullish Entry Zone: Above $38.00–$39.00

Upside Target: $65.00–$70.00, supported by AI innovation, product diversification, and scalable infrastructure.

🧠 Lemonade is not just selling insurance—it’s rewriting the rulebook on how it’s delivered, priced, and experienced.

#Lemonade #LMND #Insurtech #AIInsurance #OpenAI #DigitalTransformation #AutoInsurance #TechStocks #GrowthStocks #ClaimsAutomation #Reinsurance #Fintech #CustomerExperience

Datadog's S&P 500 Entry: A New Tech Paradigm?Datadog (DDOG), a leading cloud observability platform, recently marked a significant milestone with its inclusion in the S&P 500 index. This pivotal announcement, made on July 2, 2025, confirmed Datadog's replacement of Juniper Networks (JNPR), effective before the opening of trading on Wednesday, July 9. The unscheduled change followed Hewlett-Packard Enterprise Co.'s (HPE) completion of its acquisition of Juniper Networks on the same day. The market reacted robustly, with Datadog shares surging by approximately 9.40% in extended trading following the news, reaching a five-month high and underscoring the anticipated "index effect" from passive fund inflows. Datadog's market capitalization, approximately $46.63 billion as of July 2, 2025, significantly exceeded the updated S&P 500 minimum threshold of $22.7 billion, effective July 1, 2025.

Datadog's financial performance further solidifies its position. The company reported $762 million in revenue and $24.6 million in GAAP net income for the first quarter of 2025. For the full year 2024, Datadog generated $2.68 billion in revenue. While the document suggested a cloud observability market valued at "over $10 billion," independent verification from sources like Mordor Intelligence indicates the "observability platform market" was valued at approximately $2.9 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 15.9% to reach $6.1 billion by 2030. Other analyses, like Market Research Future, project the "Full-Stack Observability Services Market" to be $8.56 billion in 2025 with a higher CAGR of 22.37% through 2034, highlighting varying market definitions. Datadog operates within a competitive landscape, facing rivals such as Elastic and cloud giants like Amazon and Microsoft, alongside Cisco, which completed its acquisition of Splunk on March 18, 2024.

The S&P committee's decision to include Datadog, despite other companies like AppLovin boasting a higher market capitalization of $114.65 billion (as of July 2, 2025), underscores a strategic preference for foundational enterprise technology addressing critical infrastructure needs. This move signals an evolving S&P 500 that increasingly reflects software-defined infrastructure management and analytics as a core economic driver, moving beyond traditional hardware or consumer-facing software. While Workday's inclusion was cited as occurring in 2012 in the original document, it was added to the S&P 500 effective December 23, 2024, preceding its significant growth in the enterprise SaaS sector. Datadog's ascension thus serves as a powerful signal of the technological segments achieving critical mass and institutional validation, guiding future investment and strategic planning in the enterprise technology landscape.

Why Is CrowdStrike's Stock Soaring Amidst Cyber Chaos?The digital landscape is increasingly fraught with sophisticated cyber threats, transforming cybersecurity from a mere IT expense into an indispensable business imperative. With global cybercrime costs projected to reach $10.5 trillion annually by 2025, organizations face severe financial penalties, operational disruptions, and reputational damage from data breaches and ransomware attacks. This escalating threat environment has created an urgent and inelastic demand for robust digital defenses, positioning leading cybersecurity firms like CrowdStrike as critical enablers of economic stability and growth.

CrowdStrike's remarkable ascent is directly tied to this surging demand, fueled by pervasive trends such as widespread digital transformation, extensive cloud adoption, and the proliferation of hybrid work models. These shifts have vastly expanded attack surfaces, necessitating comprehensive, cloud-native security solutions that can protect diverse endpoints and cloud workloads. Organizations are increasingly prioritizing cyber resilience, seeking integrated platforms that offer proactive detection and rapid response capabilities. CrowdStrike's Falcon platform, with its AI-native, single-agent architecture, effectively addresses these needs, providing real-time threat intelligence and enabling seamless expansion across various security modules, which drives high customer retention and significant upsell opportunities.

The company's strong financial performance underscores its market leadership and operational efficiency. CrowdStrike consistently reports impressive Annual Recurring Revenue (ARR) growth, healthy non-GAAP operating margins, and robust free cash flow generation, demonstrating a sustainable and profitable business model. This financial strength, combined with its continuous innovation and strategic partnerships, positions CrowdStrike for sustained long-term growth. As enterprises seek to consolidate security vendors and simplify complex operations, CrowdStrike's comprehensive platform is ideally situated to capture a larger share of global cybersecurity spending, solidifying its role as a cornerstone of the digital economy and a compelling investment in a high-stakes environment.

What Fuels Cisco's Quiet AI Domination?Cisco Systems, a long-standing titan in networking infrastructure, is experiencing a significant resurgence, largely driven by a pragmatic and highly effective approach to artificial intelligence. Unlike many enterprises chasing broad AI initiatives, Cisco focuses on solving "boring" yet critical customer experience problems. This strategy yields tangible benefits, including substantial reductions in support cases and significant time savings for customer success teams, ultimately freeing resources to address more complex challenges and enhance sales processes. This practical application of AI, coupled with a focus on resiliency, simplicity through unified interfaces, and personalized customer journeys, underpins Cisco's strengthening market position.

The company's strategic evolution also involves a nuanced embrace of Agentic AI, viewing it not as a replacement for human intellect but as a powerful augmentation. This shift from AI as a mere "tool" to a "teammate" enables proactive problem detection and resolution, often before customers even recognize an issue. Beyond internal efficiencies, Cisco's growth is further fueled by shrewd strategic investments and acquisitions, such as the integration of Isovalent's eBPF technology. This acquisition has rapidly enhanced Cisco's offerings in cloud-native networking, security, and load balancing, demonstrating its agility and commitment to staying at the forefront of technological innovation.

Cisco's robust financial performance and strategic partnerships, particularly with AI leaders like Nvidia and Microsoft, underscore its market momentum. The company reports impressive growth in product revenues, especially in its Security and Observability segments, signaling a successful transition toward a more predictable, software-driven revenue model. This strong performance, combined with a clear vision for AI-driven customer experience and strategic collaborations, positions Cisco as a formidable force in the evolving technology landscape. The company's disciplined approach offers valuable lessons for any organization seeking to harness the transformative power of AI effectively.

Core Scientific (CORZ) – Mining Bitcoin to Powering AICompany Snapshot:

Core Scientific NASDAQ:CORZ is evolving from a crypto miner into a high-density colocation provider, strategically pivoting into the explosive AI infrastructure space.

Key Catalysts:

Strategic Shift to AI Infrastructure 🧠📡

$1.2B agreement with CoreWeave expands AI compute colocation footprint

Signals institutional validation of CORZ’s infrastructure capabilities

Massive Power Footprint ⚡

1,300 MW capacity across North America

Ideal for power-hungry AI training and inference workloads

AI & HPC Market Tailwinds 🚀

AI infrastructure demand is surging; CORZ is positioned as a first-mover

Colocation demand outpacing supply = pricing power & revenue upside

Transformation Narrative 📈

Transitioning from volatile crypto dependence to stable, high-margin AI hosting

Increased diversification and enterprise appeal

Investment Outlook:

✅ Bullish Above: $8.75–$9.00

🚀 Upside Target: $15.00–$16.00

📈 Growth Drivers: Strategic AI pivot, large-scale power assets, and long-term demand for compute

💡 Core Scientific – No longer just mining blocks, now powering breakthroughs. #CORZ #AIInfrastructure #DigitalTransformation