ICHIMOKU-DMI-RSI-setupWhen DMI is above 20

and top of Histogram sticks on DMI = Green --- go Long

and top of Histogram sticks on DMI = RED --- Short

NOTE: If candles are far away from cloud, try to wait for a better entry, as candles move toward the cloud and thru moving averages for support/resistance entries.

If DMI is below 20 , no entry

Above the cloud is long, Below the cloud is Short

As candles move thru the cloud, long or short, enter as it exits the cloud, then use the cloud edge as stop loss.

Use the RSI as it nears top or bottom for possible long/short exits.

BUY and SELL triangles to help with possible entry / exit points.

120 day MA added for reference point to

I mostly use this on 1 min, 3 min and 5 min for daytrading futures, stocks. Can be used on anything. Higher time frames are more for swing trading.

DMI

Long FBEntry price: 369-375$

Target price: 408$

Stop loss: 365-369$

Keltner Channel: the price is inside of the channel, approaching the upper boundary.

Chart pattern: symmetrical triangle

DMI: +DI line crossed -DI line from the below. Moreover, the intersection moment appeared above the ADX line what might suggest the bullish momentum of the price.

Conclusions: The price broke the upper boundary of the triangle pattern, however there is no volume increase at the moment. Thus, long position is recommended after the price correction above the pattern with the entry price on the new support level.

An oppertunistic shake-outSince I've posted the previous chart (on 1th of may) we can see the TTM squeeze hasn't completed yet (marked in upper chart with yellow circles).

But in my previous post, I've also explained how I use this DMI indicator to

signal the start of a new trend.

measure the fading trendline untill its end.

track the intermediate bearish pushes up till strength 40

The focus on strength 40 wasn't the right way to look at it. All the pumping happening at the time got to me, making me grow impatience. Because since I've posted that chart, these pushes became more dominant. And now we have had two consecutive bearish pushes. This can be described in two ways.

The first explanation (oppertunistic shakeout, my prospect. Previous analysis still applies):

When the trend is stale in both directions, it doesn't take a lot of force to move the price significantly. What this means is (I try to explain in layman's terms) less bears are necessary when the bulls are absent and vice-versa. The price shift is caused by opportunistic trades and do not have a fundamental catalyst. This does not cause a change in prospects but is psychologically torturing traders with long positions.

The second explanation, the reversal engages and a trend down is set. This is a premature conclusion and the chart is misinterpreted. I like to point out, misinterpreted. Not a false signal . It is extremely hard to predict a reversal (means charting before a reliable confirmation signal has happened). The DMI can be used for these things if used accordingly. We have 3 points in our chart that tell us we can't predict a reversal 'reliable'.

1. If we were to chart a new trend, this can only happen after the current trend halts.

- An example of a flaky trend stop signal would be on 23rd-24th april.

- An example of a clear trend stop signal would be on the 20th of march

No trend halts abrupt, nor is the halt always very clear. But we can see pretty obvious that the combined trend hasn't dropped below 20 since the 1th of may.

It has come close to 20, but didn't drop below it. And even if it did, it would take an additional bar (longer silence = more reliable) for an acceptable trend stop according to my own methods.

2. Both bearish pushes had less strength than past bullish push

3. The second bearish push was weaker than the first one, while the last bullish push was stronger than the bullish push before that.

If you enjoyed reading this please leave a comment. If you have any questions, please DM me. I can imagine you have questions, i am happy to answer them personally.

As I am a small analyst with few followers, comments actually give me huge dopamine rushes.

SXP wait Momentum to moon, this ranges midtrend low by price actmany long-time SXP bullish trend by action following flow indicators like ADX DMI.

but we wait for this range for retail accumulation & distribution within ranges below and below by DMI action.

you know can setup Fibonacci support. if the SXP downtrend follows pricing Bitcoin so the resistance 2.5 cent.

Fib green : main midlong

Fib orange : main long setup

thx

DOGE - It's Happening Again - I can't not buy it...

Well. Doge is at it again. Obviously yesterday's big push has me excited. I exited a swing trade after a few days +12%... but now I'm looking at getting back in (see linked idea below) but this time for a play that could take a bit longer to finish.

Here's why I'm looking at getting back in:

Clear establishment of a double bottom

1, 2, and 3 day RSI and DMI are bullish

Previous test of neck line was rejected - but second pass could break it

I'll have a stop limit sell order to limit my risk, but the more I'm looking at this the more I'm liking the possibility of a longer play to see the W pattern play out. If that does happen, I could see doge in the $0.078 to $0.088 range.

Correction, Dip, or Bearish Market is coming?ATR volatility is increasing, last candle show bearish engulfing, picturing from yesterday "so-called-dip" is showing bearish movement, and I think that last pattern looks like bear flag.

Also, as some of us know crypto market are kinda tidally-locked with BTC market movement, we should take a close look at what BTC market is doing.

So, are we really still on a bullish market? Let me know.

Anyway, just be careful.

Notes:

- All indicator uses 24 length period to measure 24 hours statistics

- ATR is modified to use EMA instead of RMA

- ATR is modified to use HMA as a predicting oscillator

- I modify the DMI to look like MACD (don't know why, I just like it that way) and added RSI on top of it (not sure why)

how to... CareBear 👾4h on left showing hma and dmi setting up to bear cross. However, current di- structure presents potential bull div with LL price on Jan 31 not reflected in HH on Di- within DMI.

Sell pressure still present but projected targets downside (post mercy pomp on 30m to 3841, give or take) would be mid level, 3796, 3786, 3768 , and 3754. From current HOD @ 3843, all targets to 3754 are feasible based on 1d atr @ roughly 89 pts.

Weekly atr @ 146 pts; from the current low @ 3656 to the High @ 3843, we've done roughly 128% of the weekly atr all to the upside. Current price @3829 is roughly 167 pts or 112% of the weekly atr from the weekly low.

Possible to push higher? Always, but probabilities would favor a dip.

Across the board: 4h bearish , 1d bullish , 1W bearish

Appreciate the risk.

BTC Monthly, uncharted waters Trying to time corn again out of indicators, and historic patterns, sounds a bit silly at this tie, but as the title says, uncharted waters.

On a Connors RSI every period spent on the overbought zones ended with a touch back at the 7 SMA. I noticed a pattern of 3 periods with different lengths where this happened. If the pattern is to repeat it self this should drag on for through Feb, due to the DMIADX indicator has just signalized the uptrend movement, and in march we get that touch back on SMA, really difficult to set a price target but those touches are around 30~50% retraces. We could still see a touch there by late this month or Jan. In any case, just a thought for longer term, trying to time the next big moves.

Not financial advice.

NZD/USD skyrockets towards the targetsIt's a daily chart of NZD/USD. From the 19th of March 2020, it started to rise and still moving upward. For an easy understanding of the trend, I have applied the DMI and SuperTrend.

Let's take a look at indicators,

DI+ is above DI- that means the trend will continue to move upside. ADX is greater than 25, which also indicates the upside movement.

Now talking about the trend,

At present, the trend is moving upward, and it's marching towards the targets, which are 0.7160 - 0.7260 . But if the trend crosses the control price and successfully makes consecutive candles, then targets for the fall will be 0.6900 - 0.6800 .

Heikin-Ashi + DMI + Pitchfork = A super easy trend system!I have been trading this system recently and have been surprised at how easy it is to trade with a predominant trend. Using a unique 3-indicator system composed of Heikin-Ashi + the DMI + Pitchforks allow a trader to reduce chart noise and stay in a trade until the trend has exhausted itself. The basic rules of the system include waiting for buy signals on both the Heikin-Ashi and the DMI and then exiting a trade when both the DMI and Heikin-Ashi have given sell signals. The Pitchforks serve as hidden support and resistance and help the trader with placing stop losses based on swing points of the candles and the next nearest pitchfork support lines to minimize chances of stops being triggered. The Pitchforks are also useful for identifying potential reversal zones to enter and exit trades if a trader notices particular pitchfork lines support price more significantly than others. Extra layers of support/resistance confluence can be added with Fibonacci Retracements and Extensions/Projections at these potential price reversal zones. I personally do this myself but the chart does get a bit cluttered and was hard to show clear entrance/exits with them included on here in this photo.

I personally use this on shorter time frames (3min) and it is just as accurate, however, TradingView requires a minimum 15-min resolution to post an idea. I imagine, as with all trades, the longer the time frame the stronger the signals, and the shorter the choppier the trades could get with being stopped out. While I have not tested this extensively, reversing this system for a short does work as well (data not shown on this chart). I have not tested longs or shorts on futures or Forex, so YRMV, and I would suggest testing extensively before implementing on those markets.

Illustration of this system can be seen on $FUV on the 15min chart. It shows two trades, first with a trade of 51% profit and a second of 24%. Average return over two days was 37.5% profit.

Pros of this system:

Very easy to use to identify and trade in the direction of the predominant market trends

Makes it easy to identify Elliot Waves, XABCD, or ABCD market geometry setups due to the nature of the Heikin-Ashi Candles

Ample noise reduction for "nervous" or new traders to make sure they catch the most of a trade trend with easily identifiable entrances and exits

PDT traders may find this system on longer periods/for swings more agreeable than day trading since it minimizes number of trades and maximizes potential return

Traders with full time jobs may find this more agreeable as it is a "set-it and forget it" type of system where they can schedule alerts/exits on the DMI cross over threshold to focus on other important things

Cons of this system:

Trading during ranged markets can lead to being stopped out or quickly lost profits (additional period length or higher level can minimize this risk, see below)

Missing out on "perfect" entry and exits due to combining two lagging indicators

Heikin-Ashi does not represent "true" chart price and it is recommended to add the real stock price on the chart somehow or have broker open with true price to not miss a potential entrance/exit if price reverses quickly/strongly

System Settings:

Heikin-Ashi = Standard

DMI length = 5 period, 20 level (can adjust both period and level higher or lower depending on needs of the trader. Longer = less profit but stronger signals; shorter = max potential profit but more frequent trading/more chop).

Pitchfork = Schiff (change angle more vertical to Modified Schiff or Original as trend goes outside of Schiff Fork if needed. I prefer to just clone the Schiff and move it higher or lower above the main fork since I trade corrections).

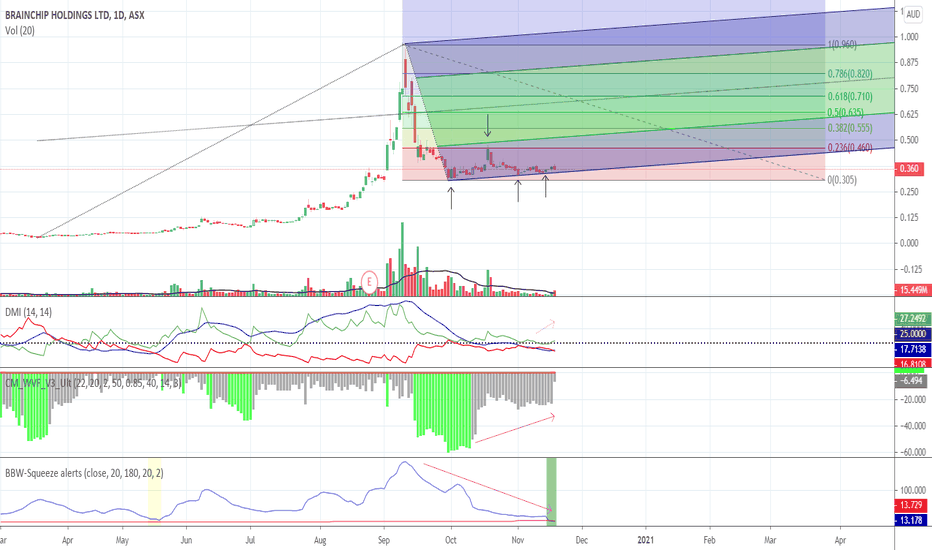

BRN consolidation over?Quick technical analysis of ASX:BRN following its rapid rise and subsequent consolidation over the past two months.

In summary:

Indicators are showing that support has been found at ~$0.31 and the .236 fib retracement level / -0.5 schiff resistance level has been tested.

As per BBW, volatility is decreasing which indicates that a breakout may be on the horizon. The BBW-squeeze also shows a potential alert for an entry point. This is supported by the Vix which hints that we have moved away from market bottoms.

Finally, DMI+ remains above ADX and has been toying with the 25 level. Movement above this level would further strengthen technical indicators for ASX:BRN .

The above indicate that BRN is in a favourable position for opting in. This would be further strengthened by positive news and / or increase in trading volume.

DYOR.

BTCUSD | Two important questions about further price actionAfter trading below $11 000 for weeks, Bitcoin finally broke above that psychological level with a 5% increase in the past 24 hours. The alt coins have come along for the ride, and the market cap has jumped by nearly $20 billion since yesterday.

The price rally finished 5 impulse Elliott waves pattern and formed an ascending supportive trend. The consolidation area is located around $11 300 zone which is represented by Ichimoku green cloud.

Q1: What should happen next?

We can see decreasing trade volume based on oscillator relative value which is below 0. Directional Movement Indicator (DMI) is still bullish but +DI line decreases and soon will cross key level. Such conditions reveals decreasing buying power and upcoming trend shift. Based on these findings we can forecast a small local increase but it soon should change to a downtrend which can bring the price to consolidation area near with $11 300 area.

Q2: Will this level hold the retracement?

It is possible due to bullish mood of the market and DeFI market capitalization outflow back to spot market. However 5 Elliott waves pattern is usually followed by Elliott ABC corrective waves which work perfectly with Ichimoku clouds indicator which shows where downward pressure should meet a strong resistance. In such cases price action tends to decrease until lower red edge which acts as a support.

Summary

Elliott ABC correction wave pattern has not been finished yet. It still can be rejected if price bounces from support near (B) point. In this case we can see a new growth waves begin. However there is a higher probability of retracement pattern to be finished and in this case we will see Bitcoin's price action in lateral trend around $11 030 level

Hedge your positions with strict risk management settings

Best regards,

SkyRock Signals team

ETFMJ- Cannabis ETF- Capture the gain (Industry)Cannabis industry, after a wild run-up and capitulation in 2018, has been trading under its intrinsic value for a while.

For investors who want the exposure to the industry without taking on the excessive amount of risk associated with individual cannabis stocks, ETFMG Alternative Harvest ETF is the way to go.

Go long now in the trading range or go long in the demand zone if the consolidation break-down happens.

Crypto Trading 101: Trading Bitcoin With The DMIThe Directional Movement Index (DMI) is one of the few indicators that can be used on its own in trading, especially when it comes to swing trading. The DMI can work as a standalone indicator because it is made up of multiple indicators, specifically: the +DI, -DI, and the ADX indicator. Let’s now dive into how these components fit together!

+DI & -DI

The +DI and -DI are two lines that measure the strength of positive and negative trends. +DI indicates a positive trend, and in our case, it is marked by the color blue on the chart. -DI represents a negative trend, and it is orange in our graph. When the +DI is above the -DI, the bullish pressure is larger than the bearish one. And if the negative line is above, the bears are dominating the market. Therefore, a bullish signal is given when the +DI crosses the -DI upwards, and a bearish signal is given when the +DI crosses the -DI downwards.

ADX

You may have noticed the positive (+DI) and negative (-DI) lines have crossed many times on the chart, but we have identified only a few signals (indicated by the green circles on the graph). This is because the signals from the +DI & -DI lines are filtered out by the ADX. The ADX identifies the strength of a trend and the volatility in the market. The white line on the bottom graph represents the ADX, while the horizontal black line has an ADX value of 25. Therefore each time the ADX is above the black line, it indicates a strong market trend and volatility.

Following June 3, 2020, the ADX filtered out all of the +DI and -DI signals until the 20th of July. Not trading was preferable as the market has been ranging and was not the best time to trade due to the low volatility.

We have used the following settings when creating this analysis.

Stop Loss: 5%

Trailing Stop loss percentage 2% and arming at 7%

—CRYPTOHOPPER—

Gold is going down ...I'm predicting a 50% move down until 151, or possibly a little lower to 148 with a target of around July 6th.

The DMI is looking like it will cross. The ADX, which represents strength of move is a little low for me. But that could go higher by the target date.

The MacD is starting to decline. (not included)

The CCI is in the overbought position.

The Stoch RSI which is leading indicator has crossed signifying a down move.

I have the EM, MA, and WMA because I am trying to learn more about them right now.

US500 bull divergence 15 min was a good idea :-Ptoday 19,45-22,00 / finished /CFD open 2.846 close 2,881 / used indicators: DMI, MACD, Stohastic, RSI, PIV, BOLL /