XAU/USD | Can we get much higher? (READ THE CAPTION)Well, what can I say about Gold? With the way it's been moving in the past couple of days and weeks, I believe $6000 gold is not far-fetched. Gold is currently being traded at $5520, and today it has been consolidating so far, as if it is waiting for something to happen! I would like to see Gold drop to the Consequent Encroachment of the NDOG, sweeping the sellside liquidity and then go back up.

For the time being, Gold's targets are: 5525, 5535, 5545, 5555, 5560 and 5570.

Dowjones

DOW JONES bearish short-term as long as this Resistance holds.Dow Jones (DJI) got rejected last week below the 1-month Resistance and that formed a Lower High on the 1H time-frame, establishing a Channel Down.

It appears that we are in the process of repeating a Bearish Leg highly symmetrical to the previous one. So far we have completed a -1.80% Stage 1 decline and after a rebound, the price dropped again below the 1H MA50 (blue trend-line) in a similar way as January 18-19. Observe how even the 1H RSI sequences between the two fractals are identical.

As long as this holds as Resistance, we expect Stage 2 of the Bearish Leg to hit the bottom of the Channel Down on the 1.618 Fibonacci extension (as the previous Bearish Leg) at 48250.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

US30 Long: Corrective Phase Complete and 4H Bullish EngulfingSimple price action setup on the US30 4H chart.

Correction: We saw a clean 5-wave drop into support.

Rejection: Price tapped the 0.618 Fib level and rejected immediately.

Confirmation: A massive 4H Engulfing Candle has formed, signaling a shift in momentum.

I am Long with stops below the swing low. Looking for a run back to the highs.

Disclaimer: This analysis is for educational purposes only and represents my own view of the market. Trading involves significant risk. Please manage your risk according to your own capital rules.

DowJones sideways consolidation capped at 49496Key Support and Resistance Levels

Resistance Level 1: 49496

Resistance Level 2: 49800

Resistance Level 3: 50110

Support Level 1: 48700

Support Level 2: 48480

Support Level 3: 48320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DowJones resistance at 49496 ahead of Fed decisionKey Support and Resistance Levels

Resistance Level 1: 49496

Resistance Level 2: 49800

Resistance Level 3: 50110

Support Level 1: 48700

Support Level 2: 48480

Support Level 3: 48320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

XAU/USD | Going strong! (READ THE CAPTION)By examining the Hourly chart of Gold, we can see that Gold has been on bullish run and still shows no evidence of slowing down or for a reversal. I expect a little bit of correction before going for the next targets.

For the time being, the targets are: 5111, 5141, 5171 and 5200.

DowJones overbought pullback support at 48900Key Support and Resistance Levels

Resistance Level 1: 49540

Resistance Level 2: 49730

Resistance Level 3: 50120

Support Level 1: 48900

Support Level 2: 48700

Support Level 3: 48450

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

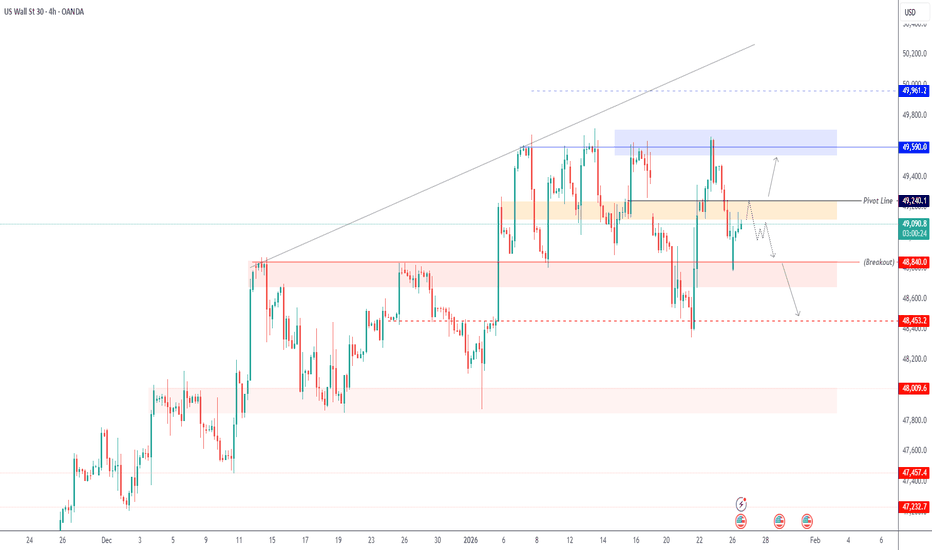

US30 | Price Below Pivot as FOMC Risk BuildsUS30 | Event Risk Builds as Price Holds Below Pivot

Dow Jones futures remain under pressure as markets approach a heavy macro week dominated by the Federal Reserve rate decision, key U.S. earnings, and ongoing shifts in Treasury yields. With industrials and financials sensitive to policy guidance, any change in rate expectations could quickly impact US30 direction.

Recent price action shows consolidation below a key pivot zone, suggesting sellers remain in control unless buyers reclaim higher ground with strong confirmation.

Technical Outlook

The price has stabilized below the 49240 pivot area, maintaining a bearish structure.

As long as the index trades below 49240, downside pressure is expected toward 48840, followed by 48450.

A 4H close with volume stability above 49240 would invalidate the bearish bias and support a bullish recovery toward 49590 and 49960.

Key Levels

• Pivot: 49240

• Support: 48840 – 48450

• Resistance: 49590 – 49960

US30 I Potential upside from support 48,340 - 48,828Welcome back! Let me know your thoughts in the comments!

** US30 Analysis - Listen to video!

We recommend that you keep this on your watch list and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

DowJones resistance retest at 49540Key Support and Resistance Levels

Resistance Level 1: 49540

Resistance Level 2: 49730

Resistance Level 3: 50120

Support Level 1: 48900

Support Level 2: 48700

Support Level 3: 48450

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DowJones Key Support and Resistance LevelsKey Support and Resistance Levels

Resistance Level 1: 49540

Resistance Level 2: 49730

Resistance Level 3: 50120

Support Level 1: 48900

Support Level 2: 48700

Support Level 3: 48450

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow Jones 30The US30 is showing renewed bullish momentum after a strong rebound, with the index recently climbing over 1% and trading near the 49,000+ level following a surge driven by easing geopolitical tensions and improved risk sentiment.

Recent data shows the Dow rising 588+ points, supported by strong buying interest in major components like Nvidia, Amgen, and UnitedHealth, as investors stepped back into equities after tariff concerns cooled.

Overall, buyers are defending higher levels, and the current price action reflects a stabilizing and optimistic tone, suggesting that bullish positions remain justified as long as momentum holds above recent support zones.

DowJones Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 48890

Resistance Level 2: 49280

Resistance Level 3: 49588

Support Level 1: 48060

Support Level 2: 47833

Support Level 3: 47537

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DOW JONES broke below its 4H MA200 after 2 months!Dow Jones (DJI) has been trading within a Channel Up for almost 9 months and 2 weeks ago (January 07, see chart below) we gave a strong Sell Signal on its Top:

Yesterday the price broke below its 4H MA200 (orange trend-line) for the first time in 2 months and this confirms the extension of the current Bearish Leg. We slightly modify our Target on the 47800 Support exactly, which is almost a -4.00% decline from the Top and will also test the 1D MA100 (red trend-line), which is the long-term Support of the pattern.

The 36.50 1D RSI Support is where the last two Channel Up bottoms where priced, so keep an eye on that too.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

US30 | Risk-Off Structure as Geopolitical Tensions PersistUS30 | Technical Outlook

The price dropped approximately 300 points, exactly as anticipated amid elevated geopolitical tensions.

Bearish momentum remains active while price trades below 48840.

A confirmed 4H candle close below 48450 would strengthen the bearish scenario and support further downside toward 48000, followed by 47460.

Corrective Scenario

A corrective rebound may develop toward 48840 only if the next 4H candle closes above 48450.

Any move higher under this condition is considered corrective, not a trend reversal.

Key Levels

Pivot Line: 48450

Resistance: 48660 – 48840 – 49050

Support: 48000 – 47460 – 47240

previous idea:

DJI H4 HTF Pullback and Bearish Continuation Setup📝 Description

CAPITALCOM:US30 on the H4 timeframe is reacting after a strong impulsive bullish leg into premium pricing. Recent price action shows loss of upside momentum and a corrective distribution phase near HTF resistance, suggesting a potential bearish continuation toward lower PD arrays.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the recent H4 lower high and supply reaction zone

Preferred Setup:

• Entry: 48,514

• Stop Loss: Above 48,640

• TP1: 48,422

• TP2: 48,304

• TP3: 48,062 (HTF draw / deeper liquidity)

________________________________________

🎯 ICT & SMC Notes

• Rejection from HTF premium and structural resistance

• Current move classified as a corrective pullback within a bearish leg

• H4 FVG and OB below act as natural draw targets

________________________________________

🧩 Summary

As long as price fails to reclaim the recent H4 supply zone, the expectation remains a continuation to the downside toward stacked HTF liquidity levels and unmitigated PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

Ongoing global policy uncertainty, resurfacing trade-tariff risks, and rising bond yields are tightening financial conditions and weighing on equities. With risk appetite fragile and macro headlines driving volatility, Dow Jones faces downside pressure, and rallies are likely corrective rather than trend-changing.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

DowJones corrective pullback support at 48292Key Support and Resistance Levels

Resistance Level 1: 49107

Resistance Level 2: 49282

Resistance Level 3: 49588

Support Level 1: 48292

Support Level 2: 48060

Support Level 3: 47833

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow Jones | Bearish Pressure Amid Geopolitical RisksUS30 | Technical Outlook

US30 is showing a bearish structure, pressured by ongoing geopolitical tensions, which continue to weigh on market sentiment.

The market is attempting to stabilize below the pivot at 48840.

As long as price holds below this level, bearish momentum is expected to continue toward 48460, followed by 48000.

A recovery scenario would require price to reclaim and stabilize above 49050, along with a reduction in geopolitical tensions, which could allow a pullback toward 49400.

Market Structure

Below 48840: Bearish continuation toward 48460 → 48000

Above 49050: Corrective rebound toward 49400

Key Levels

Pivot Line: 48840

Resistance: 49050 – 49400 – 49590

Support: 48450 – 48000 – 47500

NASDAQ INDEX (US100): Another Gap to Be Filled

I think that there is a high probability that a gap down opening

will be filled on Nasdaq Index soon.

Expect a bullish continuation to 25490.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Dow Jones Free Signal! Buy!

Hello,Traders!

US30 Price trades into a well-defined demand zone after a sharp displacement lower, collecting sell-side liquidity. Strong reaction from this base hints at smart money accumulation and a potential upside continuation.

--------------------

Entry: 48,888

Stop Loss: 48,724

Take Profit: 49,123

Time Frame: 5H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30 is Nearing an Important Support! Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 49,120 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 49,120 support and resistance area.

Trade safe, Joe.