IWM - Buy The Rumor Sell The News?Today the IWM saw massive bullish flow, almost piercing the all time high double top.

Many high beta stocks absolutely ripped higher today on huge rate cut expectations.

There a strong chance they may keep small caps strong into the rate cut, which could set up a buy the rumor sell the news.

The rate cut is next week December 10th and it sure has fueled this rally.

we have been trimming some of our long positions into this strength and still have long exposure in key names.

Today we closed

AMEX:UMAC NASDAQ:DPRO FOR 15 - 17% GAINS

NYSE:SLB CALLS 45% GAIN

NYSE:ACN CALLS 102% GAIN

DPRO

Can Regulatory Barriers Create Defense Monopolies?The Geopolitical Catalyst Behind Draganfly's Transformation

Draganfly Inc. (DPRO) is executing a strategic pivot from commercial drone innovation to a defense infrastructure supplier, a transformation driven by geopolitical necessity rather than market competition. The National Defense Authorization Act (NDAA) has created a regulatory moat that mandates the exclusion of foreign-made technology from U.S. critical supply chains, immediately disqualifying dominant players like China's DJI. As one of the few NDAA-compliant North American manufacturers, Draganfly gains exclusive access to billions in government contracts. The company's Commander 3XL platform, featuring a 22-lb payload capacity, patented modular design, and specialized software for GPS-denied environments, is already deployed across Department of Defense branches, validating its technical credibility in high-stakes military applications.

Strategic Positioning and Defense Ecosystem Integration

The company has de-risked its defense market entry through strategic partnerships with Global Ordnance, a Defense Logistics Agency prime contractor that provides crucial logistical expertise and regulatory compliance capabilities. The appointment of former Acting Defense Secretary Christopher Miller to the board further strengthens institutional credibility. Draganfly is rapidly scaling capacity through a new Tampa facility strategically located near major military clients, while maintaining an asset-light model with just 73 employees by leveraging AS9100-certified contract manufacturers. This approach minimizes capital expenditure risk while ensuring responsiveness to large government tenders. The company's intellectual property portfolio, 23 issued patents with a 100% USPTO grant rate, protects foundational innovations in VTOL flight control, modular airframe design, AI-powered tracking systems, and morphing robotics technology.

The Valuation Paradox and Growth Trajectory

Despite Q1 2025 comprehensive losses of $3.43 million on revenue of just $1.55 million, the market assigns Draganfly a premium 16.6x Price-to-Book valuation. This apparent disconnect reflects investor recognition that current losses represent necessary upfront investments in defense readiness facility expansion, manufacturing certification, and partnership development. Analysts forecast explosive growth exceeding 155% in 2026, driven by military contract execution. The military drone market is projected to more than double from $13.42 billion (2023) to $30.5 billion by 2035, with defense ministries worldwide accelerating investments in both offensive and defensive drone technologies. Draganfly's competitive advantage lies not in superior endurance or range AeroVironment's Puma 3 AE offers 2.5 hours flight time versus the Commander 3XL's 55 minutes but in heavy-lift payload capacity essential for deploying specialized equipment like Long Range LiDAR sensors and the M.A.G.I.C. demining system.

The Critical Question of Execution Risk

Draganfly's investment thesis centers on strategic governmental alignment outweighing current operational deficits. The company recently secured a U.S. Army contract for Flex FPV drone systems, including embedded manufacturing capabilities at overseas U.S. Forces facilities, a validation of both technical capability and supply chain flexibility. Integration projects like the M.A.G.I.C. minefield clearance system demonstrate mission-critical utility beyond conventional reconnaissance. However, the path to profitability depends entirely on execution: successfully scaling production capacity, navigating lengthy government procurement cycles, and converting the defense pipeline into realized revenue. The company is positioned to become a major player, specifically in the secure, NDAA-compliant, heavy-lift multirotor segment, not to dominate generalized fixed-wing ISR or mass-market commercial applications. The fundamental question remains whether Draganfly can execute its defense strategy fast enough to justify its premium valuation before competitors develop comparable NDAA-compliant capabilities.

DPRO: in mid-term support NASDAQ:DPRO is pulling back toward the mid-term support zone. As long as price holds above 9–7.85, the trend structure outlined in the October update remains intact.

Chart:

Previously:

On support and trend structure (Oct 7):

DPRO shows good trend linearity, with price structure suggesting further upside potential as long as it holds above the 8.15–7.20 support zone.

See the weekly review:

$DPRO - Dragonfly, Inc - $8.60 Retest - $9.25 PTNASDAQ:DPRO broke out this morning, retesting the $8.60s before consolidating throughout the premarket. Based on current projections, we're targeting a $9.25 Price Target on the trade, look for a re-entry on that lower-level support trend.

This comes after NASDAQ:DPRO announced landing a US Army Deal for Flex FPV Drone Systems. With the increase used of drone's in today's moderinzed warfare, DPRO looks set to win for the time being.

DPRO - DRAGONLY High Risk High RewardDragonfly is a very risky investment that has an amazing amount of upside potential.

A low price equity stock that is gaining market share in Canada as a major ecommerce delivery business.

As a resident of Canada its amazing to see how many of these vehicles have now appeared on our roads and delivering packages.

If you expect continued growth from NASDAQ:AMZN and online ordering this company should drastically benefit.

DPRO could easily steal market share from FDX UPS and other areas of the transport delivery market.

Keep in mind this is very speculative.

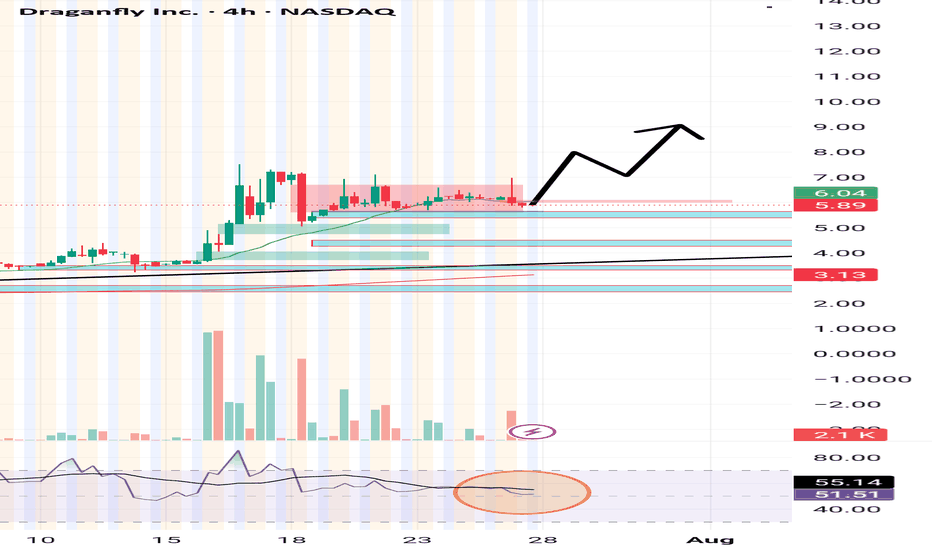

DPRO - Strong BreakoutDPRO has broken out of a down channel very strongly

This is a good sign for the bulls

I expect price to break down to the horizontal green line and then continue upwards, allowing the breakdown of the broadening ascending wedge structure

This breakdown will be short lived and price should continue upwards as the trend has reversed