Is EJ Going Higher?EURJPY Weekly Chart Analysis — December 9, 2025

The Euro/Japanese Yen (EURJPY) displayed strong movement this week on the 1-week timeframe. The pair opened at 180.775 and closed at 182.010, resulting in a solid weekly gain of +1.164 (+0.64%). During the session, EURJPY hit a high of 182.146 and a low of 180.490. This range points to heightened activity and a clear upward bias during the week.

The Parabolic SAR (0.02) continues to offer guidance for trend-following traders. With the weekly candle closing near its high and above its opening, bullish sentiment persists in the medium-term outlook.

Key Technical Levels:

Weekly Resistance: 182.146 (high)

Weekly Support: 180.490 (low)

Outlook:

Buyers currently appear to have the upper hand, with the price edging toward resistance. A break above 182.146 could signal continued upward momentum. Conversely, a shift below 180.490 would be an early warning for a possible bearish reversal. As always, supporting indicators and broader market trends should be checked for confirmation.

Stay tuned for more weekly insights as EURJPY charts unfold!

EJ

EURJPY ANALYSISEURJPY – Sell to Buy Setup (1D TF)

Sellers are expected to take control early next week before bullish momentum returns. Traders can take advantage of this move by entering on lower timeframes, targeting the buying zone around 172.000. From there, price is anticipated to push upward toward 174.500.

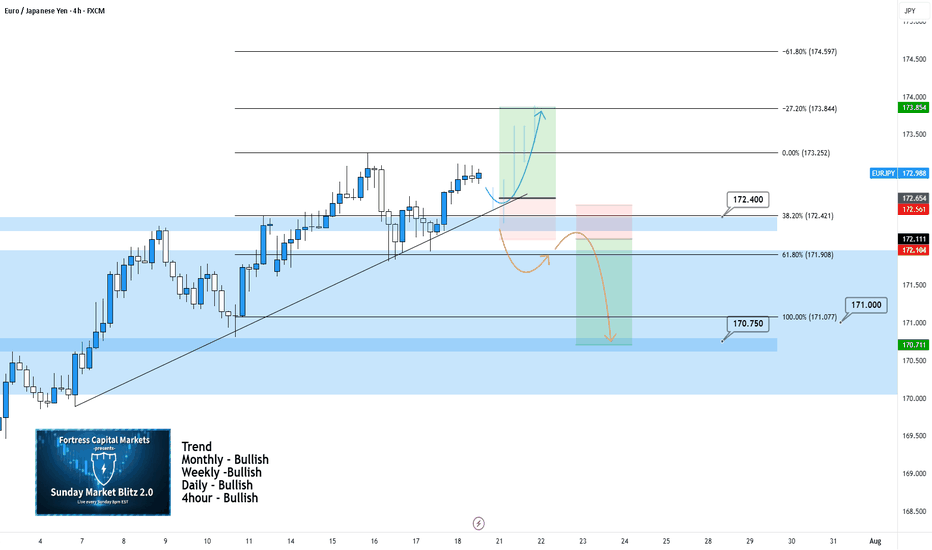

EURJPY 4Hour TF - August 10th, 2025🟦 EURJPY 4H Analysis

📅 August 10, 2025

Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bearish

EURJPY is approaching the 172.25 resistance zone after a strong bullish correction. While higher timeframes remain bullish, the 4H structure is still technically in a retracement phase, making this a critical reaction level.

🔍 Key Zone: 172.50

This area marks prior structure and could serve as either a breakout base for further upside or a strong rejection point for sellers.

✅ Scenario A: Bullish Breakout (Orange Path)

1.If price breaks and closes above 172.50

2.Expect continuation toward 173.75 resistance zone

This would align with the overall bullish HTF bias

⚠️ Scenario B: Bearish Rejection (Blue Path)

1.If price rejects from 172.250

2.Look for bearish confirmation (rejection wicks, engulfing, LTF BOS)

Target 1: 171.00

Target 2: 169.60 support

This would maintain the short term 4H bearish structure while still sitting inside a bullish macro trend.

🧠 Final Notes

• 172.250 is the key decision point, watch for clear confirmation

• HTFs favor upside, but short term traders may find better R:R on a rejection

• Always trade the reaction, not the assumption

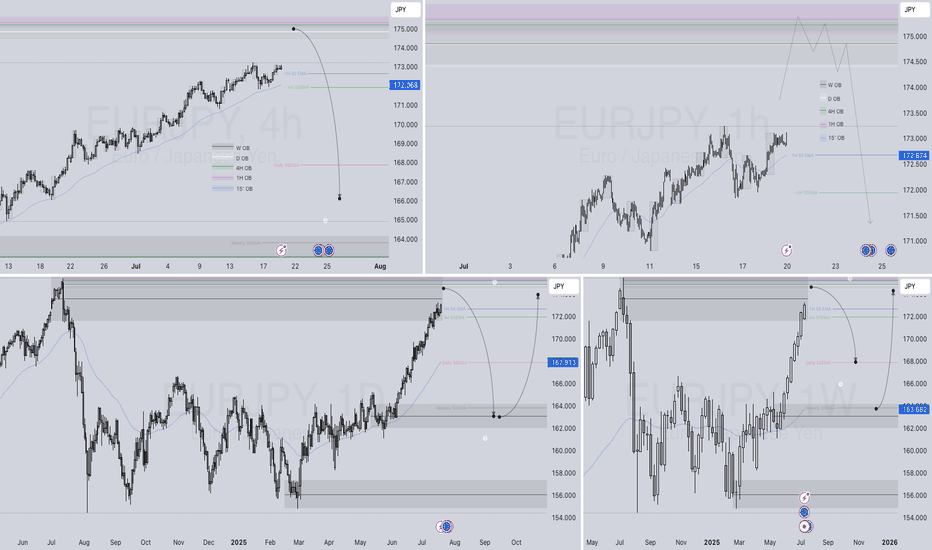

EURJPY 4hour TF - August 3rd,2025🟦 EURJPY 4H Analysis Bearish Idea

📅 August 3, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bearish

EURJPY has pulled back through the previous support zone around 171.000 and is currently consolidating after a sharp bearish move. Short term trend remains bearish, but higher timeframes suggest this may be a corrective phase.

🔍 Key Zone: 171.00 – 171.70

This zone represents the 38.2% fib retracement and prior structure. A rejection from this area could trigger further downside, while a break above may confirm a higher low.

✅ Scenario A: Bearish Continuation (Blue Path)

1.If price taps into 171.00–171.70 and rejects

2.Look for bearish confirmation (rejection wick, bearish engulfing, BOS)

Target: 169.60 (key support)

This setup follows short term momentum and offers clean R:R into prior liquidity.

⚠️ Scenario B: Bullish Break & Hold (Orange Path)

1.If price breaks and closes above 172.250

2.Watch for continuation toward 173.750, our extended fib target

3.Structure shift + bullish PA would align with HTF bullish trend

This would confirm strength returning to the pair, ideal for HTF trend continuation traders.

🧠 Final Notes

• 171.00–171.70 is the reaction zone to watch

• HTFs remain bullish, but 4H momentum must flip to validate upside

• Let price confirm direction

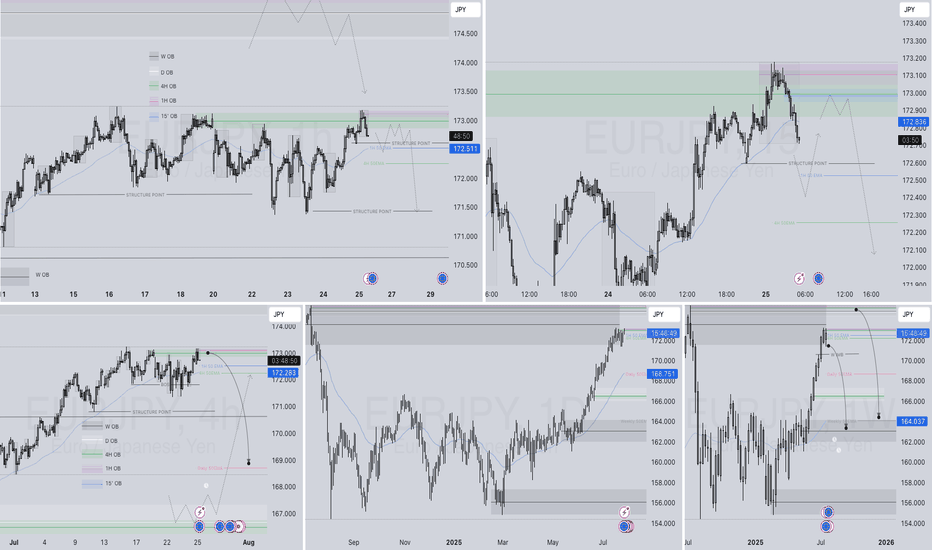

EURJPY 4Hour TF - July 27th, 2025EURJPY 7/27/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

All timeframes suggest we are bullish and after last week that is clear. We’re expecting a bit of a pullback but let’s get into two potential setups for the week ahead:

Bullish Continuation - If we are to continue with the bullish trend we would like to enter a trade at the next point of structure. In this scenario, the next point of structure would be a higher low as close to 172.250 support & our 61.8% fib level as possible.

Look to target higher toward our -27% fib level if this happens.

Bearish Reversal - For us to consider EJ bearish again we would need to see a strong break below our support at 172.250.

If we see bearish structure below this zone we can say price action will most likely fall lower, potentially down to 170.750.

EURJPY Q3 | D25 | W30 | Y25📊 EURJPY Q3 | D25 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

OANDA:EURJPY

EURJPY 4Hour TF - July 20th, 2025EURJPY 7/20/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Bullish Continuation - This is the most likely scenario for EJ this week as nothing suggests anything other than Bullish activity.

EJ could take off right at market open and start pushing up without giving us a retest to enter on. If we do get some sort of retest or pullback, look for rejection as close to 172.400 as possible before looking long.

If this does execute it looks like it will be a very small window of opportunity to enter. Trade cautiously with EJ in this bullish scenario.

Bearish Reversal - This scenario is less likely but is much more favorable in my opinion.

For us to consider EJ bearish we would need to see a clear break below 172.400 with a lower high below. This would give us enough confidence to consider short scenarios and start looking lower toward major support levels like 170.750.

EURJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 EURJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

EURJPY SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURJPY SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURJPY is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Strong reaction and early signs of distribution.

Previous bullish momentum is losing steam; structure is flattening with rejection wicks forming.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

1H structure shift bearish

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY SHORT DAILY FORECAST Q3 D1 W27 Y25EURJPY SHORT DAILY FORECAST Q3 D1 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY LONG FORECAST Q2 W25 D19 Y25EURJPY LONG FORECAST Q2 W25 D19 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅15' Order block identification

✅Daily Order block rejection

✅4H order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY LONG FORECAST Q2 W25 D16 Y25EURJPY LONG FORECAST Q2 W25 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅15' Order block identification

✅Daily Order block rejection

✅4H order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY WEEKLY HTF FORECAST Q2 W25 Y25EURJPY WEEKLY HTF FORECAST Q2 W25 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket tracks the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EJ, bound for a massive upside reversal in the next few seasons!EJ has corrected with so much weight after going parabolic on Q2 of 2024 (June 2024) -- peaking at an ATH of 175.0. There after a massive correction was warranted that has lingered for months ahead.

Now based on recent long term metrics. EJ is now heavily showing some basing behavior from the current range at 157 zone. This is conveying already of a shifting structure on its price.

It has created a triple bottom formation that spans 2 years!

From this scenario alone you can sense the contextual direction it is about to undertake. Reverse to the UPSIDE.

Based on its historical price movements - it has undergone what I called a transitional shift to new ascending channel. You can check the chart above for reference. We are now at that period.

Expect some fresh series of price growth attempts from here on -- aiming to reclaim new high metrics.

Best seeding season is NOW.

Spotted at 157.0

TAYOR.

Trade safely.

EURJPY - buy to sell setup?There is some glitch and previous 2 posts shall be deleted as soon as possible. Okay, onto the EJ - As price finally dropped down to the daily buy zone, while breaking the structures with a big drop and creating it's own ITR, I am bearish on EJ but before that I am looking for buys prior to sells. That would make sense, knowing that liquidity can come into the market from higher buy/sell zones and price is increasing from the daily buy zone. Lets's watch it closely as the setup seems great!