TSLA — [2D] WEEK 49 TREND REPORT | 12/04/2025TSLA — WEEK 49 TREND REPORT | 12/04/2025

Ticker: NASDAQ:TSLA

Timeframe: 2D

This is a reactive structural classification of TSLA based on the weekly chart as of this timestamp. Price conditions are evaluated as they stand — nothing here is predictive or forward-assumptive.

⸻

1) Current Trend Condition [ Numbers to Watch ]

Current Price @ 447.66$

• Trend Duration : +7 Days (Bullish)

• Trend Reversal Level ( Bearish ): 418.70$

• Trend Reversal Level ( Bearish Confirmation ): 428.42$

• Pullback Support : 413.70$

• Correction Support : 354.94$

⸻

2) Structure Health

• Retracement Phase:

Uptrend (operating above 78.6%)

• Position Status:

Healthy (price above both structural layers)

⸻

3) Temperature :

Warming Phase

⸻

4) Momentum :

Bullish

⸻

Author’s Note

UPWARD STRUCTURAL ALIGNMENT

This mark reflects a point where market behavior supported the continuation of the existing upward direction. It does not imply forecasting or targets — it simply notes where strength became observable within the current trend. Its meaning holds only while price continues to respect the broader structural levels that define the trend.

⸻

Methodology Overview

This classification framework evaluates directional conditions using internal trend-interpretation logic that references price behavior relative to its structural layers. These relationships are used to identify when price movement aligns with the framework’s criteria for directional phases, transition points, or regime shifts. Visual elements or structural labels reflect these internal interpretations, rather than explicit trading signals or preset indicator crossovers. This framework is observational only and does not imply future outcomes.

Elonmusk

XRP HOLIDAY SALE!The overall crypto market has been sliding off recent highs since late September. This was after crypto markets created gap structures on the October 10th sell off. The gap left on XRP was priced in near $1.99-$1.98. We have just reached this liquidity zone. I expect fear to boost and bears to be trapped as the crypto season approaches the holidays, this should be an early Black Friday sale to new highs toward $4 and higher.

Happy Thanksgiving and Early Christmas

-This is not financial advice, R2C.

Stop Overcomplicating Trading: The Consistency Blueprint No One Stop Overcomplicating Trading: The Consistency Blueprint Nobody Wants to Talk About

Two decades in the market have taught me a very real truth:

Profit isn’t about being the smartest or catching the breakout. It’s about showing up for yourself every week; especially when motivation disappears and the trades get hard.

I’ve been at this 20 years; through bull runs, ugly drawdowns, burnout, and those quiet Sunday reviews where nothing made sense. The only thing that’s kept me in the game and steadily profitable? Building ultra-simple consistency habits that actually fit my life.

Let me give it to you straight: here’s how to move the needle, no matter where you are:

Forget perfection. Track what REALLY matters.

For most, it’s not a magic strategy—often it’s reviewing trades, keeping promises to yourself, and taking care of your brain and sleep before the next setup.

Pick 2-3 metrics and make them sacred:

For me, it’s weekly trade review, a “focus” score for my setups, and legit sleep tracking. I only look at these, period.

Make review time non-negotiable:

I set aside 20 min a week, never skipped. It’s my reset button after wins and losses.

Write out quick wins & lessons—immediately after they happen.

Let the good trades teach you, but also let the ugly ones humble you and anchor your next week.

Adapt your process to real life:

Swing trading while working? Happens. Family? Kids? You can STILL win long-term—just make the review and tracking match your schedule, not some internet hustle template.

Build the feedback loop

When you slip, note it fast and tweak (don’t obsess). When you nail it, reward yourself—not with risk, but acknowledgment.

How do you know it works? Because it’s kept me in profit while teaching hundreds of traders to turn routines into actual results.

If you’re battling for consistency DM me “Tools” or drop it in the comments. I’ll send my simple routines that changed the game for me and dozens of traders.

Let’s build consistency that lasts and celebrate small wins relentlessly.

If I can help, I will.

TSLA Plunging? The Fake Rebound Before the Real Crash!Tesla (TSLA) is entering a challenging phase as a wave of negative news hits from both fundamental and technical sides. Sales in China — Tesla’s second-largest market — have dropped to their lowest level in three years , sparking fears that real demand for EVs is cooling. At the same time, Elon Musk’s massive $1 trillion compensation package has raised concerns among investors who believe Tesla’s current valuation far exceeds its actual profit potential.

On the daily chart, TSLA is showing clear signs of weakness after an extended uptrend. The price is now testing the medium-term ascending trendline around the $430 zone . If buying pressure fails to hold this level, there’s a strong chance the price will break the trendline and enter a deeper correction phase .

In the short term, Tesla could continue to drop toward the $400 area , where strong support and the Ichimoku cloud base converge. Any rebounds, especially near the $450 resistance zone, should be viewed as opportunities for sellers to re-enter rather than signs of recovery.

Cambium Networks Corporation (CMBM) Spike 300% in Premarket Cambium Networks Corporation (NASDAQ: NASDAQ:CMBM ) saw a noteworthy uptick of 300% gearing for a 500 surge amidst breaking out of a falling wedge .

With the last recorded RSI at 38, NASDAQ:CMBM has more room to capitalize on the dip.

In another event, Cambium Networks (NASDAQ: CMBM), today announced integration of its Cambium ONE Network solution with Starlink satellite Internet services. The integration enables scalable management, visibility, and performance optimization for Starlink Low Earth Orbit (LEO) satellite connections in conjunction with Cambium's Network Service Edge (NSE) security/SD-WAN platform and the cnMaestro™ cloud management system.

The integration brings enterprise-grade services to networks connected to Starlink, delivering enhanced security, traffic intelligence, and multi-WAN scalability to businesses, schools, service providers, and distributed enterprises that depend on satellite broadband for critical connectivity.

About CMBM

Cambium Networks Corporation designs, develops, and manufactures fixed wireless, fiber broadband, and enterprise networking infrastructure solutions in North America, Europe, the Middle East, Africa, the Caribbean and Latin America, and the Asia Pacific. The company offers fixed wireless and PON/XGSPON based broadband, Wi-Fi, and local area networking (LAN) switching infrastructure; and security gateway solutions for a range of applications, such as broadband access, wireless backhaul, Internet of Things (IoT), etc.

TSLA Tesla Options Ahead of EarningsIf you haven`t bought the dip on TSLA:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $40.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Tesla: Will It Blast Off or Fall Fast? The $404 Level Is the KeyTesla is at a big “make or break” point. If the price stays higher than $404, it could blast up to $437 or maybe even $478. But if Tesla drops below $404, watch out! It could fall down to $380 or even as low as $351.

Think about it:

What would you do if Tesla started moving toward those numbers? Do you think it will go up or will it go down?

If you’re not sure or have a question, send me a message! Sometimes asking one good question can help you make a smarter trade. What do you want to know about Tesla right now?

Mindbloome Exchange

Tesla: breakout mode, Elon’s rocket fuel for the chartTechnically , Tesla broke out of a symmetrical triangle while holding above EMA/MA supports, which confirms bullish control. The breakout unlocks targets at 368.46 (Fibo 1), followed by 411.38, 432.03, and the 1.618 extension at 464.30. Volume profile confirms strong accumulation below, leaving the upside path less crowded.

Fundamentally , Tesla keeps investor attention alive. EV sales stabilized, but the focus has shifted to AI and robotaxi — Musk’s latest promises of disruption. With Fed rates peaking and yields easing, growth stocks regain momentum. Risks remain from Chinese competitors, yet Tesla’s margins are still leading the industry.

Tactical plan : entry zone stands at 323–336. As long as price holds above it, buyers target 368.46 → 411.38 → 464.30. A break below 323 would flip the bias back toward 291.

Bottom line: Tesla’s chart looks ready for lift-off. Musk might be dreaming of Mars, but for now, bulls are happy if he just launches the stock a few hundred dollars higher.

Dogecoin: Uptrend Intact, Eyeing $0.90–$1.00 ZoneCRYPTOCAP:DOGE #Crypto #Memecoin #ElonMusk — September 24, 2025.

Price (Sept 24, 2025): $0.24700

Chart (1D):

•

•

💡 Entry & Exit:

Entry: $0.24700

🎯 Take Profit: $0.8900 (+260.32%)

My View:

Dogecoin pulled back nicely, but the overall uptrend is still intact. We’re seeing that rounded base start to tilt toward acceleration. Remember, this is Elon Musk’s meme coin = and it’s also tradable on Robinhood.

Looking at Coinbase order books, there’s a grid of buy orders stacked all the way up to $2.50. If we factor in a light breakout and the 1.618 Fibonacci extension, the $0.90–$1.00 range looks like a logical zone to lock in gains and move on from this coin.

The recent dip across crypto definitely shook a lot of people = myself included.

REDWIRE 13 DOLLARS BY 2026 OR SOON Why Redwire (RDW) Could Blast to $13 by 2026: Bull Case RDW's trading at ~$9 today (Sep 23, 2025), down post-Q2 earnings miss, but with space infrastructure booming, $13 (44% upside) is conservative amid analyst love and catalysts. Here's the setup:Analyst Consensus Screams Upside: 8 firms rate "Buy" with avg PT $16.56–$18.64 (83–107% gain short-term), max $28—easily clearing $13 by EOY 2026 on execution. Even bears like BofA's $10 see room for rebound; H.C. Wainwright holds $22 Buy post-acquisition.

4 sources

Zacks ABR 1.00 (Strong Buy) backs $26 avg.

NASA & Defense Contract Pipeline: $25M NASA IDIQ award (Aug '25) for space tech, plus prime for Skimsat and Honeywell quantum collab—fuels 20%+ YoY revenue to $550M+ in 2026. Artemis funding stability hedges risks, per Roth MKM Buy.

Edge Autonomy UAS integration adds drone revenue, targeting $100M backlog growth.

Acquisition Synergies & Margin Expansion: Q2's Transformative Acquisition (e.g., Hammerhead integration) boosts EPS from -$1.41 to break-even by Q4 '25, with 132M Q3 revenue est. up 15%. Analysts eye 25% margins by 2026 on in-space manufacturing scale.

2 sources

Space Economy Tailwinds: $1T market by 2040; RDW's solar arrays, 3D printing IP position it for 30% sector growth. CoinCodex forecasts $8.41 avg '26 low-end, but bulls like Canaccord ($17.50) see $13 as floor on 11% EPS ramp.

TESLA 500 BY EOY OR 2026 Why Tesla (TSLA) Could Hit $450 Then $500 by EOY 2025 or 2026: Key Catalysts Tesla's hovering around $315 today (as of Sept 23, 2025), down ~20% YTD amid sales dips, but the setup for a rebound to $450 (43% upside) and $500 (59% upside) is primed by execution on autonomy, EVs, and energy. Here's the bull case, blending fundamentals and forecasts:Robotaxi & FSD Rollout Momentum: Tesla's Cybercab unveil in Oct 2025 could catalyze a surge, with unsupervised Full Self-Driving (FSD) v13 hitting highways by year-end. ARK Invest's base case eyes $4,600 by 2026 (driven 60%+ by autonomy), but even conservative models like CoinCodex forecast $453 avg in 2026, with highs to $664 on ride-hailing revenue potentially adding $10T market value.

2 sources

Piper Sandler just hiked their PT, calling TSLA the "top idea" for AV investing.

EV Delivery Rebound & Affordable Models: Post-2025 sales weakness (1.8M deliveries est.), expect 2.3M+ in 2026 with Model 2 launch (~$25K EV) ramping production to 3M+ annually. This counters China/EU headwinds, recaptures 20%+ US market share, and boosts EPS to $0.49 next quarter—fueling a $450 breakout per LongForecast's Q3 2026 path.

2 sources

Morningstar sees a 2026 revival echoing 2016's Model 3 surge.

Energy Storage Boom: Megapack deployments exploding (Q2 2025: 9.4 GWh), with 50%+ YoY growth projected through 2026, diversifying revenue to 15%+ of total. This hedges EV volatility, pushing margins to 20%+ and supporting $500 on 11% revenue growth to $130B.

Optimus Humanoid Robot Sales: External sales kick off late 2025/early 2026, targeting $20K/unit with factory pilots scaling to millions. This could add $1T+ valuation long-term, per ARK, but even modest adoption lifts sentiment to $500 by EOY 2026.

2 sources

Tesla on Track – Golden Zone Respect Leading to $867 TargetAs we discussed in the earlier setup, Tesla retraced beautifully into the golden zone (62–79% retracement area) after sweeping sell-side liquidity. This zone aligned with a higher-timeframe order block, providing strong confluence for a bullish reaction.

The price has since respected that golden zone, confirming buyers stepped in aggressively and validating the bullish bias. From here, the market structure points toward continuation to the upside, with immediate targets at prior buy-side liquidity pools, eventually extending toward the $867 region, a level that aligns with the 100% Fibonacci projection and liquidity resting above previous highs.

This setup illustrates a textbook ICT/SMC play:

Liquidity Sweep ✅

Golden Zone Respect ✅

Strong Bullish Reaction ✅

Clear Buy-side Targets Ahead ✅

If momentum holds, Tesla remains positioned for a multi-month expansion leg toward the $867 target zone.

⚠️ DYOR: Not financial advice. Always confirm setups with your own framework and risk management.

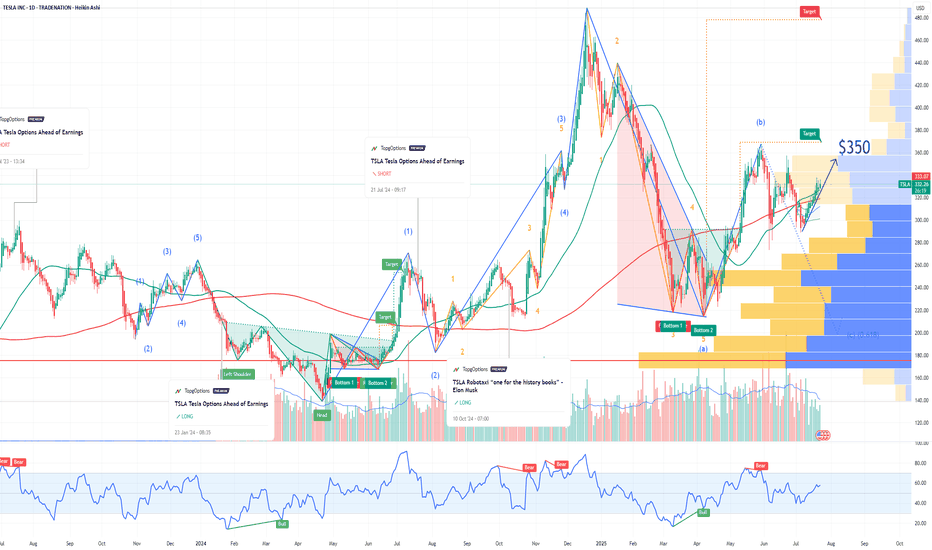

TSLA Tesla Options Ahead of EarningsIf you haven`t bought TSLA before the recent rally:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 350usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $14.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TRUMP!!!Hello friends

Considering the good growth we had, you can see that the price could not continue the growth of the hood and it has fallen. Now it is suspected of a head and shoulders pattern. I repeat, it is suspected of a head and shoulders pattern. The pattern has not yet formed.

If the price breaks the designated resistance, the price can move to the specified targets and if the resistance is broken, I will update it for you.

*Trade safely with us*

Institutional Flow Driving DOGE Upside Liquidity Hunt📊 Report-Based Analysis

Market Structure:

The chart shows multiple “Break of Structure (BOS)” events, indicating that institutional orders are driving the market direction. Frequent upside BOS suggests that the bullish trend is currently dominant.

Liquidity Movements:

Price has repeatedly hunted liquidity around major highs and lows (sharp wicks and sudden moves triggering stop losses) before returning to its intended direction. This behavior reflects strong institutional control over market flow.

Price Action Dynamics:

First, the market expanded upward with strong bullish momentum.

A sharp correction followed, creating volatility.

Afterwards, price entered a consolidation phase, which later broke to the upside.

Despite a recent rejection, the bullish structure remains intact.

Current Situation:

Price is trading around the 0.245 area. A large bullish candle was followed by a quick rejection, but the broader structure continues to lean bullish. Projections on the chart suggest a potential push higher as liquidity targets remain above.

Market Bias:

Short-term bias remains bullish. The consistent BOS and formation of higher lows show that the market is more likely to continue seeking upside liquidity in the near term.

Tesla Pops on Musk’s $1 Trillion Bonus. Here’s How Insane It Is.The mother of all KPIs.

Elon Musk has a new carrot dangling in front of him, and it’s not a Mars colony or a flamethrower.

Tesla’s board is asking investors to approve a bonus so massive, so absurd, so galaxy-brained, that it makes past compensation packages look like pocket change.

Ready? We’re talking about the potential for a $1 trillion payday if Musk manages to drag Tesla to an $8.5 trillion valuation. In ten years.

That’s nearly eight times where it is today. So let’s unpack just how unhinged this deal really is, why Tesla stock popped on the news, and what it would take for Musk to collect.

🚀 The Trillion-Dollar Tease

Tesla stock NASDAQ:TSLA climbed 3.6% Friday on the back of this announcement, not because anything happened then and there, but because something could happen ten years out.

The board dropped the proposal in a securities filing, outlining that Musk could receive up to 423 million shares – worth over $1 trillion – if Tesla smashes through a series of market cap and operational milestones.

In other words, the board is looking to lock Musk in and make sure he doesn’t get distracted by rocket launches, robot brains, or tweeting memes about NPCs at 2 a.m.

💰 What’s the Catch?

The catch is that this isn’t free money. To claim the full $1 trillion, Musk has to lead Tesla into uncharted corporate territory: Boost Tesla’s market cap from $1 trillion to $8.5 trillion by 2035. That’s more than double Nvidia’s NASDAQ:NVDA current valuation ($4.2 trillion) and equal to the GDP of Japan, Germany, and the UK, combined.

Deliver 12 million more EVs (as of this summer, Tesla has managed about 8 million in its entire history).

Land 10 million autonomous driving subscriptions.

Register and operate 1 million robotaxis (Not on the market right now).

Sell 1 million AI robots (Not on the market right now).

Increase adjusted earnings from $13 billion to $400 billion. That’s a 24x jump in profit.

Next stop? Tesla’s earnings report ( Earnings Calendar for reference) in about a month from now.

🪄 The Board’s Spin

Tesla Chair Robyn Denholm called the package “fundamental to Tesla becoming the most valuable company in history.” Translation: Elon, please.

In a letter to shareholders, the board said the award “aligns extraordinary long-term shareholder value with incentives that will drive peak performance from our visionary leader.”

Which is corporate-speak for: We know he’s mercurial, but this should keep him tethered for at least a decade.

⚡ The Stakes for Tesla

Tesla’s stock reaction says investors are cautiously optimistic – emphasis on cautiously. Shares have been down nearly 30% since mid-December, plagued by slowing EV sales , rising competition, and Musk’s very public political feuds (including an ongoing rift with President Trump that’s cost Tesla federal EV incentives).

To make matters trickier, Tesla’s brand halo isn’t as shiny as it used to be. EV rivals like BYD, Rivian, Hyundai, and Mercedes are cutting into Tesla’s dominance, while price cuts have compressed margins.

Analysts expect Tesla to deliver 1.6 million vehicles this year, down from last year’s totals. On top of that, revenue continues to slide, lower by 12% in the last quarter , indicating a shrinking business.

So why the big gamble? Because if this plan works, Tesla wouldn’t just catch up – it would become the undisputed king of EVs, autonomous driving, AI robotics, and energy storage. In other words, a full-blown tech empire.

💰 Musk’s 25% Solution

Part of Musk’s motivation here isn’t just about the money – though a trillion-dollar payday to one person is actually insane. Musk has repeatedly said he wants at least 25% voting control over Tesla to feel “comfortable” keeping his focus there.

Under the proposed plan, if Musk hits every target, his stake in Tesla would rise to 25% from his current holdings of 12%, giving him outsized influence over its future direction. That means if Tesla’s valuation is at $8.5 trillion, he’d be holding shares worth $2.12 trillion. But if he misses? He gets nothing. Zero.

It’s a high-wire act for both Musk and shareholders: reward him with historic wealth if he delivers, but don’t overpay if he falls short.

🤖 Robotaxis, Humanoids, and AI Dreams

A key piece of this plan hinges on Musk’s boldest vision yet: turning Tesla into an autonomous AI platform. Forget just cars – think fleets of robotaxis generating recurring subscription revenue and Optimus humanoid robots replacing repetitive labor in warehouses, factories, and maybe even households.

If this strategy pays off, Tesla won’t just be an automaker – it’ll be an AI-powered infrastructure company. But right now, that future is priced into a present that still depends on selling Model Ys and Cybertrucks.

🔍 The Market’s Split Personality

Wall Street’s reaction has been mixed, and here’s why:

The bulls argue that Tesla has the innovation engine, the brand, and, yes, the Musk factor to make the impossible happen. They point to SpaceX’s reusable rockets and Nvidia’s AI dominance as proof that moonshots sometimes land.

The bears see the trillion-dollar pay package as monopoly money that’ll never be real. Between slowing EV demand, Tesla’s underwhelming Q2 deliveries, and Musk’s penchant for side quests, they’re skeptical Tesla can hit even half of these KPIs.

🏁 The Bottom Line

Tesla’s proposed Musk mega-package is nothing short of audacious. It’s an all-in bet on:

Explosive growth in EVs and autonomous driving

Turning Tesla into an AI + robotics powerhouse

Keeping Musk’s focus locked on Tesla instead of Mars, memes, or political campaigns

Is the plan bold? Absolutely. Is it risky? Without a doubt.

Off to you : Do you believe Musk deserves the “One-Trillion-Dollar Man” (or $2T) title? Or is all that a desperate move to keep him around? Share your thoughts in the comments!