Updated January 14 Volatility Event BreakdownThis video will help you understand how the markets are playing out related to my original prediction of a big volatility event on January 14.

Watching the markets swing up and down over the past two weeks while almost perfectly following my predicted price trends has been incredible.

But, I'm not always this accurate in my predictions - no one is.

I believe this market move is following my longer-term prediction of a moderate breakdown in Q1/Q2 of 2026. If my research is correct, we will continue to see an ABC or ABCDE wave structure where price continues to move downward and attempts to find a base near July 2026.

The one thing I really wanted to point out is the use of Fibonacci Defense Levels and how you can use them to better determine when and how price is breaking from a moderate pullback into an extended or deeper pullback/trend reversal.

I've been using these Defense Levels for quite a while, and I find they work well.

Please take a minute to watch this video.

I also highlight Gold/Silver and Natural Gas in this video.

Hope all of you are GETTING SOME today.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Es!1

#ES_F Daily TF Updated 1.30.26So far we started having topping patterns and strong trend breaks in these areas since October but as we see every break kept getting bought at or under Medium MA preventing actual Trend Change, every bounce/hold back over MAs would bring in more buyers.

We did get a good sell after first tag of new HTF Ranges Edge which right away gave a push away and a sell all the way down tagging lower Edge, when market hits top returns to bottom and pushes away again that signals Balance and Acceptance in New Range which is around 950s - 650 +/-. We can see we tried to change trend then as well after we were able to hold under Small MA and got close/hold under Medium MA which brought more selling to almost hit our 5% marked out target but Large MA was right there to suck in all the selling and gave us another bounce back over Medium/Small MAs to stop the trend from changing.

Since then we have been grinding up/sideways under/over Edge top and so far every push kept getting sold back in, first push was done on low Holiday Volume which came back in right away, second push when January started and everyone started buying again to keep pushing the market higher, after finding new top at new ranges VAL we got a trend break and sell under the Edge flushed VAL where we we did sort of a rubber band over extension move as we moved away too fast leaving Small MA still above Medium and also hitting a HTF Cost Basis which was formed around Dec 18th which gave good support with another bounce back over Medium MA, Month End short covering and of course more buying pushed us again into the Highs. We did get a push above Previous Highs but it was done during ON Session and price came back in and pushed away in RTH giving another Failure Candle for Double top.

Stronger selling came in from there but all of it was met with buying as we are balancing over MAs but Supply has been building up here and weakness keeps coming in. Of course we can say we are holding over MAs and over Edge top so this could mean acceptance in New Range to possibly give more back and forth grind sideways to eventually continue through New Range as it is a possibility since it may seem that this market can never stay down right?

I still believe a better/longer correction is needed for market to cool off as things got a little crazy and all trend breaks and weakness kept getting ignored but at some point it has to catch up, we can clearly see another topping pattern, last one was under the Edge which gave a good sell but market had more juice to go higher, this one right over Key area which to me makes it even stronger than last one. We also have a huge Monthly Wick that we left during November Flush and yes there is even bigger one from April which didn't fill but that was different as it hit Larger Monthly MA and Big Bid Cost basis with immediate strength that followed, Novembers Wick is much smaller and its sort of floating with Supply building up over it last two Months, I feel like we will be able to fill most of it but again this could take time as we still need to transition but IF we continued with trend change up here and be able to get under current Edge to start holding under 6920 - 900s that will continue with weakness under Small MA until we can get/hold under Medium MA to give us a bigger trend change to then target lower Range areas down to VAH / Mean at least and if we get down there and get that pattern break that will give more weakness to visit lower areas. How low we will have to find out but we should see a move lower and consolidation around those areas to fill that wick out not just flush and bounce, I mapped out possible measured move if the middle breaks, will the full thing play out ? or will we find buying and start consolidating above without fully filling it will be for us to find out but I think November half back areas would definitely be something to hit around 6751 - 717 areas with dips under to fill.

This correction if happens probably will change the flow of the market and will change intraday trading unfortunately making it harder.

This week we started getting trend change on 4hr / 2hr / 1hr and are holding at the lower part of Hourly Range which is 6920 - 7040, of course we can continue grinding inside it as for now it is our balance range and correction may not come, to me more and more signs are pointing towards it and I think market is ready for a change that will shake things up intraday. Once we get under 6920s and start getting closes/holds under that will signal more towards this and of course if that doesn't happen we can continue balancing but to think more up trend we would need to see a consolidation over 7000 that can eventually push over 740 - 60s and hold over those areas, unless that happens we have built up supply here and buyers are waiting for it lower.

QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)

Technical Look

QQQ moved exactly as expected on the bearish side, hitting its downside targets with the Tuesday open last week and finding a bounce from those levels.

In the Mid Week Update I shared afterward, I highlighted that the structure had shifted into a bullish phase and that price was now more likely to target higher levels. I’m also linking last week’s outlook on the side for reference.

Scenarios – Prediction

Scenario 1: Bullish Scenario (Likely)

With the current bullish structure established during the week, I expect price to continue higher and potentially target all time highs. Overall bullish sentiment remains strong, which makes this continuation reasonable.

That said, risks remain on the table. Escalation around Iran or a potential 100% tariff on Canada could quickly flip market structure back to bearish, so staying cautious is important.

This bullish scenario can play out in two ways:

1-A direct gap-up open followed by continuation toward bullish targets

2-A pullback toward the 687 area, a brief deviation, then a bounce with a strong close above that level, leading to higher targets

Bullish scenario targets:

626 – 629.5 – 636.5

Scenario 2: Bearish Scenario

Geopolitical tension around Iran or a potential tariff shock could still trigger a bearish shift, keeping this scenario in play.

A strong break and close below 618.5 would activate the bearish scenario for me. On any retest, price should fail to reclaim and close back above 618.5. If that happens, I would look to actively trade this scenario using puts.

Potential bearish targets:

607 and 599.5

Position Management Notes

I manage risk by scaling out of positions at key reaction levels and adjusting exposure as structure confirms. Partial profit taking at major levels is a core part of my approach.

I share deeper SPY-QQQ breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

SPY/QQQ Plan Your Trade For 1-28: Breaking(Up/Down)Today’s pattern is a Breaking(Up/Down) pattern.

This pattern suggests the SPY/QQQ will attempt to break away from yesterday’s price range. Normally, these Breaking patterns resolve as a moderately aggressive move away from the previous candle’s body range. Thus, my expectations are for the SPY/QQQ to attempt to move higher into the “new high” territory as we continue to work through the Flag Apex volatility phase.

Overall, I believe this move higher will stall out in early February and move downward as my Predictive Modeling has suggested. For many weeks, the Predictive Modeling tool has shown the markets will move into a potential breakdown phase in early/min February.

At this time, I believe the markets are pushing higher into a “false high” pattern that could translate into a larger breakdown phase moving through Q1:2026 and into Q2:2026. Time will tell.

As you know, I’ve moved my trades mostly to CASH and am currently sitting on about 70-80% CASH in my account. Yes, I still have some trades active and I have begun to setup 35+ day Shorts/Puts related to my expectation the markets may move downward in early February – but I’m not going to chase this move any further right now.

The one trade I believe I may make by the end of this week is to put on 1-3 longer-term Gold/Silver Calls. I believe this move in metals is unprecedented and I believe a small active position is almost essential. If you don’t play this once in a lifetime move efficiently, you can’t materialize the gains.

Right now, the hardest part of my trading is NOT wanting to get overly excited about these big runs in Metals and the potential for NatGas. I have to keep telling myself to be patient and wait for the right setups. Trust my analysis and trust my instinct.

There will always be another day to trade in the future.

At this point, I think the smartest move is to sit back and watch for a few days. This big move higher in Gold/Silver could be “the rally to the peak of Leg #2” – just like I predicted. One thing I’ve learned is not to chase moves when you believe they are over or nearly done.

Sure, you can leave a small runner position on if you want. Just be prepared for that position to turn into a loss if the markets suddenly turn against your trade.

NatGas rolled to the March contract. That is why we are seeing a big price gap on the NG chart. UNG is holding up well and I believe this storm will continue to increase demand into February – possibly into March. So, I plan on trying to take advantage of any price weakness in UNG.

If today goes as planned, it should be a day of mostly sitting and watching the markets. I don’t plan on being overly aggressive with my trades today.

Get some.

SPY Mid Week Update (Jan 22–23)SPY Mid Week Update

Technical Look:

Price opened the week with a strong breakdown, exactly as outlined in my Sunday Weekly Outlook. After the initial move we saw a retest followed by continuation into the bearish target (please refer to the linked idea).

Then before the market close, Trump’s tariff cancellation comments shifted sentiment and the structure flipped back to a bullish setup.

Bullish Scenario (Active):

With Wednesday’s close, SPY has fully transitioned back into a bullish structure.

A decisive move above 686 would likely trigger a strong upside expansion.

My upside targets are:

696.25 – 700

A strong break below 679.5 would invalidate the bullish scenario.

Bearish Scenario (Unlikely):

If price breaks decisively below 679.5, I would consider the bullish scenario canceled and activate the bearish scenario.

In that case, I would expect price to continue lower and put positions could be considered on a retest near the 679 area.

This scenario would likely require a major narrative shift, such as Trump reintroducing EU tariffs. Without such a catalyst, the bullish scenario remains in play.

The primary bearish target in this scenario would be 671.25.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

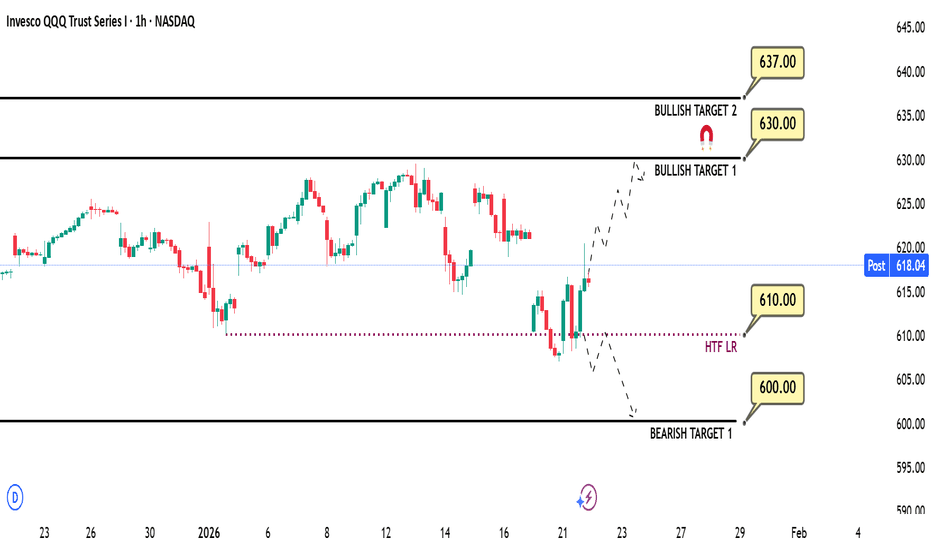

QQQ Mid Week Update (22-23 JAN)QQQ Mid Week Update

Technical Look:

Price opened with a strong breakdown, exactly as I expected in my Weekly Outlook from Sunday. After the initial move, we got a retest, and price continued lower into the bearish target. (Checked the linked idea.)

Then before the market close, Trump’s tariff cancellation comments shifted sentiment, and the structure flipped back to a bullish setup.

With Wednesday’s close, QQQ has fully transitioned into a bullish structure. Price action confirms that the bullish scenario is currently active and in control.

As long as there is no major sentiment shift (such as a cancellation of the Greenland deal), I expect the market to maintain its bullish structure.

Given the current momentum, price may reach upper targets relatively quickly.

Bullish Scenario (Active):

As long as the bullish structure remains intact, I expect price to continue higher.

Upside targets:

Target 1: 630

Target 2: 637

If price breaks the 610 level aggressively due to a sentiment shift, this bullish idea would be considered invalidated.

Bearish Scenario (Unlikely):

A bearish scenario would come into play only if Trump reintroduces EU tariff rhetoric and signals that the Greenland deal has been canceled.

In that case, a decisive break below 610 would open the door for put positions, and a downside continuation could follow.

The first downside target in this scenario would be 600.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

ES Weekly Levels: Reversal Zone 6865–6875 → Target 6950/6955🔱 ES WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Bull reversal setup is the focus — but weakness remains until key sell-side is reclaimed

🧲 Fresh overhead sell-side liquidity / bear FVG: 6950 plus key level 6955

📌 Context: ES gapped down at the open → signals continued weakness into the week

🧲 Bull FVG + preferred reversal zone: 6865–6875 = best area to scale into longs

🛡 Failure zone / risk-off trigger: loss of 6865–6875 opens downside to 6795 → 6790

🎯 Bull target: 6950 fresh liquidity pocket overhead

🏦 Core play: scale buys 6865–6875, manage risk if the zone fails, take profit into 6950–6955

🗳️ ES Weekly Scenarios — What’s Your Play?

Which path do you have for ES next week?

🅰️ Hold 6865–6875 → reversal works → rotation into 6925 → tag 6950

🅱️ Sweep below 6875 → reclaim 6865–6875 → squeeze into 6950–6955

🅲 Drive into 6950–6955 → rejection from sell-side → pullback toward 6925 → 6865

🅳 Break/hold below 6865–6875 → weakness confirms → downside opens to 6795 → 6790

Your key levels: 6955 / 6925 / 6865 / 6795 / 6790

Your FVGs: 6950 (bear sell-side) / 6865–6875 bull reversal

SPY Weekly Outlook – Week 3 of 2026 (Jan 19–23)SPY Weekly Outlook – Week 3 of 2026 (Jan 19–23)

Technical Look:

As expected last week, price found support at the 687.5 level and continued its upside move. We discussed that if SPY failed to push toward 700 on Monday’s open, a post CPI pullback toward 687.5 could occur. That scenario played out precisely on Wednesday, with price retracing into the 687.5 zone and finding support there.

As I mentioned in my Wednesday Mid Week Update, this reaction marked a shift back to a bullish structure, with upside targets at 691.75 – 694 – 695.25. I also stated that I would exit all call positions at 695.25, and price reached that level exactly before getting rejected.

(Please refer to the linked idea for visual reference.)

Scenarios – Prediction:

At this point, I am tracking two possible scenarios for SPY.

Scenario 1: Bearish Scenario (Higher Probability)

This is currently the more likely scenario, mainly due to the macro backdrop, including Trump–EU tensions and potential EU tariffs related to Greenland.

I believe price may open the week with a sharp downside move.

My bearish targets are:

686 – 679.75 – 669.5

If price breaks 686 aggressively and closes a 4H candle below it, I would expect a move toward 679.75.

Similarly, if 679.75 is broken decisively and holds below, price could extend toward 669.5.

Each of these bearish targets also represents a potential bounce or reversal zone, so I prefer taking partial profits (around 1/3) at each level.

If price breaks 686 decisively, I would look to engage on the short side using put options.

Scenario 2: Bullish Scenario

This scenario becomes valid only if Trump EU tensions ease before the market opens (with Monday being a holiday and trading resuming on Tuesday).

The 695 level acts as a call wall in options positioning for SPY. If price breaks above 695 aggressively, I would look to buy calls on a retracement, targeting a move toward the 700 area.

Position Management Notes:

I manage risk by scaling out of positions at key reaction levels and adjusting exposure as structure confirms. Partial profit-taking at major levels is a core part of my approach.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

NQ Weekly Levels: Reversal Zone 24775/24900 → Target 25425/2544🔱 NQ WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Liquidity collection → bounce setup is the focus — patience until sell-side is swept

🧲 Fresh overhead sell-side liquidity magnet / massive FVG target: 25425–25440

📌 Context: Plan is not to chase strength — wait for price to collect liquidity below market first

🧲 Bull FVG: ~25000 but noted as weak — treat as minor support / reaction only

🛡 Preferred reversal / long scale zone: 24775–24900

🛡 Failure zone / risk-off trigger: sustained acceptance below

24770 opens downside continuation / no-bid conditions

🎯 Bull target: rotation into 25425–25440 to tap fresh overhead liquidity pocket

🏦 Core play: let NQ sweep lower liquidity → scale buys 24775–24900

→ manage risk if 24770 fails → take profit into 25425–25440

________________________________________

🗳️ NQ Weekly Scenarios — What’s Your Play?

🅰️ Hold 24775–24900 → reversal works → reclaim 25000 → rotation into 25425–25440

🅱️ Sweep below 24770 → reclaim back into 24775–24900 → squeeze higher → tag 25425–25440

🅲 Drive into 25425–25440 → rejection from fresh sell-side liquidity

→ pullback toward 25000 → 24900

🅳 Break/hold below 24770 → weakness confirms → bounce thesis invalid → downside continuation (stand aside / reassess)

________________________________________

Your key levels: 25440 / 25425–25425 / 25420 / 24900 / 24770

Your FVGs: ~25000 bull / 25425–25440 massive overhead liquidity pocket

Breakdown after Jan 14 Volatility Event - Get some.This video highlights the continued price action I suggested would take place after the Jan 14 volatility event.

Honestly, watching the markets open tonight, moving in the direction of my trades (metals, SPY/QQQ/TECS/XLK/others). I could not be happier.

Additionally, Nat Gas is starting to make a big move higher. I've been positioning into this move for more than 30 days. Now, the dual Polar Vortex may setup driving very cold temps into the US/UK.

Sometimes, you have to trust the ADL predictive modeling and play those bigger moves for profits.

I just wanted to share this success and to ask you if you were able to follow my research and GET SOME as well.

We could see a big breakdown over the next 24 hours on news or social issues in the US/UK.

Get some.

SPY Mid-Week Update (Jan 15–16)SPY Mid-Week Update (Jan 15–16)

Technical Look:

As mentioned in my Sunday SPY Weekly Prediction, price followed the downside move exactly as expected. The market reached 687.50, which I labeled as Bearish Target 1, and once again behaved in line with the outlined plan.

After price printed a daily close back above 687.50, a reversal confirmation was triggered from that level.

Prediction – Outlook:

In my view, once SPY secured a daily close above 687.5, the upside move started to develop. Based on this confirmation, I entered my call contracts approximately one hour before the market close.

I am currently expecting the following upside targets, in sequence:

691.75 – 694 – 695.25

The 688–689 zone now acts as a key support area, where price may find support if a pullback occurs. That said, it is also possible for the market to open strong and continue directly toward the bullish targets without a meaningful retracement.

Bearish Scenario:

If price breaks strongly and closes above the 686 level, I will exit my call positions and look to buy puts from that level. In this scenario, my downside target would be 680.

Options flow shows a concentration of a put wall around the 680 level. Price may first run toward 691.75 and then reverse back to the downside, shifting into a bearish move.

Position Management Notes:

Once price reaches the first target, I plan to close 1/2 of my position and move the stop loss on the remaining size to breakeven. This is how I personally manage my positions.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

SPY Weekly Outlook – Week 2 of 2026 (12-16 JAN 25)SPY Weekly Outlook – Week 2 of 2026

Technical Look:

Price followed the bullish scenario from last week’s SPY outlook, and the expectation played out as planned. I’ve shared the linked idea below so you can clearly review the expectation versus the actual price action.

SPY is currently trading around the area where it has just printed new highs, and attempting to predict price flow ahead of CPI carries elevated risk.

Scenarios – Prediction:

Pre-CPI / Range Expectation:

With CPI data scheduled for Tuesday, market direction is likely to become clearer after the release. For Monday, my base expectation is a range bound session.

If SPY attempts an upside move ahead of CPI, the level I am watching for a potential early expansion is 700. However, I would expect a retracement after a move into the 700 area, rather than immediate continuation. For this reason, 700 remains my primary bullish target ahead of CPI.

Bearish Scenario (CPI-driven):

If CPI data comes in bearish for risk assets, I will be watching the following support zones for a potential reversal or bounce:

687.5 – 679.75 – 669.50

I expect price to react at these levels. For a bullish reversal confirmation, price must tap one of these zones and then close a daily candle above it. This daily close would be my confirmation trigger.

Bullish Scenario (CPI-driven):

If CPI data comes in bullish, I expect price to target the 700 level first.

If 700 is broken decisively, with a daily close above the level, I would expect price to continue higher toward upper levels. Call positions can be considered only after this confirmation.

Position Management Notes:

During high impact macro weeks, I focus strictly on confirmation based entries. Once in a position, I manage risk by scaling at key reaction zones and adjusting exposure based on daily market structure.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

QQQ Weekly Outlook – Week 2 of 2026 (12-16 JAN 25)QQQ Weekly Outlook – Week 2 of 2026

Technical Look:

Price followed last week’s bullish scenario from my previous weekly outlook, and the expectation played out as planned. I’ve shared the linked idea below, where you can clearly review the expectation versus the actual price action.

QQQ is currently trading near a resistance zone and finished Friday’s session in a position that allows for a potential bullish continuation.

Scenarios – Prediction:

Bullish Scenario:

If price continues higher, my bullish targets are:

629.25 – 636.5

However, since the market is likely waiting for the CPI data release on Tuesday, one or both of these targets could be reached through an early expansion on Monday, but I do not expect sustained upside continuation beyond those levels until CPI is released.

Because price is near resistance and close to all time highs, I do not expect Monday to be very active. In my view, a cleaner market structure is more likely to form after Tuesday’s CPI data.

If CPI comes in supportive and price breaks and closes strongly above 636.5, we could see a bullish expansion that continues throughout the rest of the week.

Bearish Scenario:

If CPI data comes in bearish (higher than expected inflation), I expect a short term bearish move.

In that scenario, the key support zones where price may find a bounce or reversal are:

610.25 – 599.50

Trades should only be taken with confirmation at these levels. If price taps one of these zones and closes a daily candle above it, I would look to engage in bullish call options.

Position Management Notes:

I prefer confirmation-based entries around key levels. Once in a position, I manage risk by taking partial profits at reaction zones and adjusting exposure as price structure develops.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

Jan 14 Volatility UpdateThis video highlights what I believe will happen after the Jan 14 volatility event.

I believe the markets are moving through a Flag Apex phase that will result in Apex Volatility over the next 10+ days.

This volatility could present a present a very real potential that price could continue to move downward before finding support.

I believe this move could present a very decent opportunity for traders as price rotates for about 10+ days. Then, price should move into a fairly solid downtrend after Jan 25-28.

Get some

Jan 14 Major Volatility Event Update - Thank youI wanted to give everyone an update related to my thinking.

I'm not expecting this Jan 14 volatility event to be more than a 3-5% pullback event. I know that may seem huge for some of you, but it really is not that big.

What I really do expect is this event changes how the markets develop forward objectives for Q1 and Q2 2026.

I've tried to explain my actions and expectations in this video for all of you to review.

Remember, I'm just a trader like all of you. I use my tools and research to try to make the best decisions.

Overall, as I've learned, it is all about protecting capital and positioning for the best opportunities. If you are wrong, you take your lumps, learn, and try to do better next time. If you are right, you try to replicate that winning process.

As I mentioned before. Last year, I had a great year trading. I'm not going to go into details - but I'm very happy.

I'm looking to do even better this year.

As I continue to share more videos, remember one thing (please), I'm just sharing my thoughts. if you don't like my content - go find someone else you trust.

This is all about trying to make the best decisions.

Get some.

MAJOR VOLATILITY EVENT ON JAN 14 : GET READYI've created this message to alert all of you to a massive volatility event that should take place on January 14, 2026.

My predictive modeling system suggests the SPY/QQQ/DIA will react to some type of massive volatility event on Jan 14. I don't know what will cause the event, but it looks like the SPY/QQQ/DIA may move 3-5% or more and remain in an elevated-volatility period for more than 5-10 days (through the end of January).

I suggest traders take Monday/Tuesday (Jan 12-13) to balance their portfolios/trades and try to position ahead of this massive volatility event.

If you have trades that could be wiped out over the next 5-10 days because of an event like this, make efforts to preserve your capital ASAP.

If you have longer-term trades, expiring after Feb 15 or so, you may be OK holding them if they are LONGS/CALLS. But I believe this volatility event could be something HUGE. So, all of you need to make efforts to protect your account/capital - even if I'm wrong.

I've created this video to explain WHY it is so important for traders to understand what may happen on Jan 14. And the only reason I know this event is likely to happen is because of my predictive modeling tools.

Either way, this is a warning for all of you. The markets will likely move into a massive volatility event on or near Jan 14.. Get ready.

This could be HUGE.

Get some

QQQ Weekly Outlook – Week 1 of 2026QQQ Weekly Outlook – Week 1 of 2026

Technical Look:

Price moved exactly as planned in my December 21 Weekly QQQ outlook (you can check the linked idea). The market bottomed on December 17, as anticipated in my December 14 Weekly QQQ prediction, and then started to move higher. Price reached both of my targets and began retracing from those levels. (Please refer to the linked post for details)

Currently, QQQ is retracing from the highs and appears to be seeking additional liquidity and energy before any continuation higher. This consolidation phase may take longer than initially expected.

Scenarios – Prediction:

Scenario 1: Bullish Scenario

I am looking for price to break and close above the 614.5 level on the 4H timeframe.

A confirmed 4H close above 614.5 would indicate that the bullish scenario is in play, and I would consider engaging on the long side.

Potential upside targets for this scenario:

621.75 – 629.5

Scenario 2: Bearish Scenario

If price fails to break above 614.5, I would consider that QQQ is shifting into a bearish flow and seeking lower prices. In that case, I would look to engage on the short side.

Downside targets for this scenario:

610 – 606.25 – 600 – 588.5

The 588.5 level represents the most extended bearish scenario. If price breaks 600 aggressively , I would then expect a move toward 588.5.

Position Management Notes:

Each target level may trigger significant pullbacks or reversals. Personally, I take partial profits at these levels and keep the remaining position open toward the next targets, while trailing the stop loss to breakeven. This is how I manage my positions.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

SPY Weekly Outlook – Week 1 of 2026SPY Weekly Outlook – Week 1 of 2026

Technical Look:

Price moved exactly as planned in my December 21 Weekly SPY outlook (you can check the linked idea). The market bottomed on December 17, which was also anticipated in my December 14 Weekly SPY prediction. After that, price pushed into all time highs and got rejected from those levels.

Currently, SPY is retracing from the highs and appears to be seeking additional liquidity and energy before any continuation higher. This consolidation phase may take longer than initially expected.

Scenarios – Prediction:

I am tracking two main scenarios for SPY during January 5–9.

Scenario 1: Bullish Scenario

The 684 level is marked as an options put wall. I will be closely watching for a 4H close above this level.

A confirmed 4H close above 684 would indicate that the bullish scenario is in play, and I would look to engage on the long side.

Potential upside targets for this scenario:

686.75 – 689 – 691.75

Scenario 2: Bearish Scenario

If price fails to break above 684 and starts declining, I would consider that SPY is seeking lower prices.

Downside targets in this scenario:

678.75 – 673 – 669.25

If price breaks 678.75 aggressively , I would then consider lower targets to be in play. Otherwise, the 678.75 level could act as a strong bounce zone for a potential upside reaction.

Position Management Notes:

Each target level may cause significant pullbacks or reversals. Personally, I take partial profits at these levels and keep the remaining position open toward the next targets, while trailing the stop loss to breakeven. This is how I manage my positions.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

Disclaimer: This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

Whats in store for 2026?Predicting that, the stock market will move in any direction other than upwards has historically proven to be a fool's errand.

Typically, it's advisable to maintain a long position of America and its robust capital markets until the signs of a recession truly start to emerge.

However, last year's forecast of "7k plus" did indeed come to fruition, albeit by the narrowest of margins (just 11 points on the futures).

Now, let’s consider a potential scenario for 2026, shall we?

Following a stagnant fourth quarter and a lackluster conclusion to the last few trading days of 2025, I suspect that the initial half pf the year may be weaker than the prevailing consensus suggests.

Will we experience a technical bear market with a -20% decline?

Or will policymakers intervene at -19%, as they have done so many times in the past? :)

Regardless of how deep the pullback may be or how quickly the potential softness at the start of the year could occur...

It might actually present another fantastic buying opportunity that paves the way for a strong finish to the roaring twenties, with the SPX trading well above 10,000.

(indeed my SPX chart points towards 17,000 by 2032)

Could the bottom align with a possible four-year cycle low for BTC? That would be quite synchronistic and feasible, especially since crypto has become so intertwined with DJT's policies and serves as a performance metric that this administration is judged on whether praised or criticised for.

Have conviction but remain nimble would be my overriding message.

QQQ (NQ-US100) Weekly Prediction – Outlook (21 DEC)QQQ (NQ-US100) Weekly Prediction – Outlook (21 DEC)

📊 Market Sentiment

Market sentiment turned fully bullish after the CPI data came in significantly lower than expected on Thursday. While the consensus expectation was 3.1%, the actual CPI print came at 2.7%, representing a meaningful downside surprise.

This data does not directly determine the outcome of the January FED meeting, as another CPI report will be released on January 13, 2026, which will be far more critical for the FED’s decision making process. However, the current soft inflation trend increased the probability of another lower CPI reading in January, which positively impacted risk sentiment across markets.

📈 Technical Analysis

Last week’s QQQ analysis played out perfectly. I hope you were able to capitalize on it. Price reversed precisely from the levels we anticipated following the CPI release. I am linking last week’s QQQ weekly analysis below for reference.

After the CPI data, price transitioned back into a clean bullish structure on both the daily and weekly timeframes. On Friday, QQQ rallied impulsively and closed the week with strong bullish momentum.

Overall, I think the market structure supports bullish continuation.

📌 Game Plan

I think QQQ may directly test 618.5 (Target 1) early in the week, followed by a move toward 625.75. These are the two bullish targets I expect to be reached within this week.

Price may also move toward these targets without any meaningful retracement. I plan to close one third of my call options at 618.5 and the remaining portion at 625.75 from the positions I am holding since Thursday.

If price pulls back to 611.75 or 607 before reaching 625.75 and prints strong 1H or 4H bullish candle closes, I will look to add new call option positions targeting 625.75.

In the event of a developing bearish structure, I will provide updates. However, at this stage, I do not see any clear bearish signals.

💬 For deeper sentiment and strategy insights, subscribe to my Substack free access available.

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research before trading or investing.

SPY (ES-US500-SPX) Weekly Prediction – Outlook (21 DEC)SPY (ES-US500-SPX) Weekly Prediction – Outlook (21 DEC)

📊 Market Sentiment

Market sentiment turned fully bullish after the CPI data came in significantly lower than expected on Thursday. While the expectation was 3.1%, the actual CPI print came at 2.7%, which was a meaningful downside surprise.

This data does not directly determine the outcome of the January FED meeting, as another CPI report will be released on January 13, 2026, which will be far more critical for the FED’s decision making process. However, the current soft inflation trend increased the probability of another lower CPI reading in January, which positively impacted risk sentiment across markets.

📈 Technical Analysis

In my previous SPY analysis last week, I clearly outlined the expectation of an early week pullback followed by a precise reversal level. That scenario played out exactly as anticipated.

Following the CPI release, price completed its reversal and closed the week with very strong bullish price action on Friday. In my opinion, this behavior suggests that the corrective phase has likely ended and price is now preparing for continuation to the upside.

📌 Game Plan

I think price may target the 683.5 level early in the week.

For call options and long positions, the key lower timeframe reaction zones I will be monitoring are 678.25 and 675.25.

If price rallies directly toward 683.5, I plan to sell the majority of my existing call positions around that level. However, if price first tests 678.25 or 675.25 before reaching 683.5, I am considering adding additional call exposure from those zones.

That said, my decision to enter will strongly depend on 1H and 4H candle closes. I will not enter positions in a market that simply breaks through these levels. If price tests these zones and prints strong bullish 1H or 4H closes, that is when I will begin executing call option entries.

💬 For deeper sentiment and strategy insights, subscribe to my Substack free access available.

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research before trading or investing.