ETH - is it time for a correction?ETH is starting to look over-bought.

Price is currently hovering around a strong intersection between the orange supply zone and the upper red trendlines. This is not just any resistance, it’s a zone where momentum has historically cooled off.

As long as this area holds, a bearish correction is expected, with price likely rotating back toward the lower blue trendlines, where buyers previously stepped in.

This doesn’t change the bigger picture... it’s simply a reset within structure.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ETH

Bitmine Immersion (BMNR) Invests in Mr Beast’s Beast IndustriesBitmine Immersion Technologies, the Ethereum-focused digital asset treasury firm, announced it will make a $200 million equity investment in Beast Industries, the entertainment and consumer products company founded by YouTube creator Jimmy “MrBeast” Donaldson. The transaction, expected to close around January 19, 2026, marks a significant strategic move as Bitmine leverages its balance sheet to expand beyond pure crypto treasuries and into partnerships with mainstream digital media and consumer brands.

Following the announcement that Bitmine would invest $200 million in Beast Industries, the company’s stock jumped noticeably in today’s session, with shares closing up around 4.6% in early trading after the news broke.

Technically, AMEX:BMNR is consolidating currently down 5.14% eyeing the $25 support point. liquidity will be sweep at that point and shares will eye levels most especially the 61.8% Fib level. that level will be tested to accentuate the bullish thesis.

Analyst Summary

According to one analyst, the rating for BMNR stock is "Strong Buy" and the 12-month stock price target is $47.0.

About BMNR

Bitmine Immersion Technologies, Inc. operates as a blockchain technology company primarily in the United States. The company engages in ETH treasury operations; BTC ecosystem services, including consulting and advisory engagements and equipment leasing; facilitation and optimization of third-party power and hosting arrangements; and disciplined BTC treasury management while winding down proprietary self-mining exposure and deferring new site buildouts.

ETH/USDT (4H) – Chart Update. ETH/USDT (4H) – Chart Update

Structure: Bullish bias holding

Price Action: ETH has broken above the descending trendline

Ichimoku: Price trading above the cloud → momentum remains positive

Ethereum has reclaimed the trendline resistance, which is now acting as support. The pullback looks controlled and healthy, suggesting continuation rather than rejection.

Holding above 3,200–3,250 keeps the bullish scenario active

A sustained move can push ETH toward 3,450 → 3,650 → 3,800 zones.

A breakdown below 3,150 may trigger a deeper retest toward 3,000 support.

Market structure favors upside continuation. Wait for confirmation and manage risk wisely.

$ETH 1W Update: Looking good here, taking off againETH update.

ETH is pumping again on the weekly, and the move is constructive, but it’s important to keep the larger context front and center. Price has pushed back above the mid-range and is reclaiming the $3,300–3,500 area, which has acted as a major pivot throughout this cycle.

What’s encouraging is the character of the move. After the sharp pullback from the highs, ETH didn’t collapse into deeper support. Instead, it held above the $2,700 region, formed a higher low, and is now rotating higher with expanding momentum. That’s a sign buyers are still active on higher timeframes.

That said, ETH is still very much inside a broad range. The upper boundary near $4,700 remains the level that actually matters for trend continuation. Until price can reclaim and hold above that zone, these rallies should still be viewed as range expansion rather than a confirmed breakout.

The $3,500 area is the key short-term test. Acceptance above it would increase the odds of another push toward the range highs. Failure here would likely mean more chop and rotation, potentially back toward the mid-$2,000s before the next attempt higher.

Overall, ETH pumping here is a positive development and confirms the market isn’t rolling over. But structurally, this is still a range market on the weekly. Buying dips and managing expectations matters more than chasing strength, until ETH proves it can break and hold above the top of the range.

Bitcoin at the Late Cycle CrossroadsLooking at the Bitcoin Daily chart, this structure fits extremely cleanly into the historical 4 year cycle framework, and when combined with macro liquidity conditions, it strongly suggests the market is transitioning from a markup → distribution → corrective phase, rather than preparing for an immediate exponential continuation. Across previous cycles (2013–2014, 2017–2018, 2021–2022), Bitcoin consistently topped within a rising channel, formed a series of higher timeframe bull traps, and then broke down toward the lower bound of macro support zones. The current structure is visually and behaviorally consistent with those historical precedents.

From a pure price structure perspective, Bitcoin has already completed a full impulsive expansion from the cycle low, followed by accelerated upside inside a rising channel. The highlighted orange circles on the chart mark exhaustion zones, where price pushed above trend resistance but failed to sustain acceptance. These areas historically represent late-cycle FOMO participation, where retail demand enters aggressively while smart money distributes into strength. The current price action mirrors that behavior: price remains elevated inside a channel, but momentum has clearly slowed, volatility is compressing, and bullish continuation lacks conviction.

The most important technical element on this chart is the bull trap zone marked in blue. This zone represents a scenario where price appears to be holding bullish structure but is, in reality, trading above fair value relative to liquidity distribution. In past cycles, these zones repeatedly resolved lower once macro liquidity tightened or sentiment shifted. The projected downside target toward the $60,000–$54,000 support region aligns with prior range highs, long-term demand imbalance, and historical cycle retracement depth. Importantly, this is not a bearish collapse thesis. it is a mean reversion and re-accumulation thesis, consistent with how Bitcoin resets before its final cycle leg.

From a macro standpoint, conditions are no longer as supportive as they were during the early phase of the rally. Global liquidity growth has slowed, real yields remain elevated, and central banks are transitioning from aggressive easing expectations to a more cautious stance. Historically, Bitcoin performs best when liquidity is expanding rapidly, not merely stabilizing. At the same time, ETF driven inflows have largely been front-loaded, meaning marginal demand is weakening while supply distribution increases. This combination frequently produces sideways to down corrective price action, rather than vertical upside continuation.

When combining cycle theory, macro liquidity, and technical structure, the most logical interpretation is that Bitcoin is likely entering a corrective cycle phase, not the end of the bull market, but a reset within it. A deeper pullback into the highlighted support zone would allow the market to flush weak hands, rebalance leverage, and rebuild a stronger base for the next expansion. Only a sustained acceptance above the upper channel, with expanding volume and renewed macro liquidity acceleration, would invalidate this scenario.

In short, this chart does not argue for panic or blind bearishness. it argues for discipline and patience. Late cycle rallies reward sellers, not chasers. The professional trader reads this structure as a warning: risk is asymmetric at the highs, and opportunity improves significantly closer to structural support, not inside premium distribution zones.

ETHUSD H4 | Bullish Bounce Off Key SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level at 3,201.69, which is an overlap support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 3,069.75, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 3,370.40, which is a multi swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

ETH Pauses at Resistance After Vertical ExpansionHi Guys!! On the H1 chart, Ethereum has just completed a strong vertical bullish expansion, breaking decisively above the EMA structure and leaving behind a clear price imbalance. This type of impulsive move typically signals aggressive buy-side participation, but it also creates unfinished business below, where liquidity and inefficient pricing remain. After the surge, price is now consolidating tightly beneath a well-defined resistance zone around 3,360–3,375, showing hesitation rather than immediate continuation. This behavior suggests that buyers are no longer chasing at premium levels, while sellers are beginning to respond into resistance.

The current consolidation should be read as a distribution-to-correction phase, not an outright trend reversal. Price is holding above the short-term base, but the lack of follow-through above resistance indicates that the market may first seek sell-side liquidity resting below the structure. The highlighted liquidity zone around 3,220–3,200 aligns with prior consolidation and the EMA 89 region, making it a natural draw for price to rebalance before any sustainable continuation. A corrective move into this zone would be technically healthy, allowing the market to mitigate the imbalance created by the impulsive rally.

If ETH rotates lower into the liquidity zone and shows acceptance with slowing bearish momentum, that area becomes a high-probability region for buyers to re-engage, setting the stage for a renewed push back toward resistance and potentially higher levels. Conversely, only a clean acceptance above the resistance zone with strong bullish displacement would invalidate the corrective expectation and open the door for immediate continuation. Until that happens, Ethereum remains in a post-expansion consolidation, with downside liquidity acting as the primary magnet before the next directional move.

ETH — Price Slice. Capital Sector. 3605.61 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3605.61 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 5

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

Range Control After Impulse — ETH Is Being Prepared, Not RejectCOINBASE:ETHUSD has completed a strong impulsive breakout and is now consolidating in a controlled range on the H1 timeframe. Price remains above the EMA cluster, confirming that the recent move was a bullish shift, not a false breakout. Price is currently rotating between 3,380–3,410 resistance and 3,260–3,280 support. Rejections at the top and consistent buyer reactions at support indicate range acceptance and post-impulse consolidation, not distribution. Sellers have failed to produce a lower low, keeping the bullish structure intact. The EMA cluster is rising and aligned with the lower range, reinforcing the view that pullbacks are corrective. As long as price holds above the EMAs, bearish continuation lacks confirmation.

Primary scenario: continued range compression followed by a clean breakout above 3,410, opening the path toward 3,450+.

Alternative scenario: acceptance below 3,260 would signal a deeper correction, though still within a broader bullish context.

Summary: ETH is pausing after strength. This is consolidation, not weakness patience is required while the market prepares for its next expansion.

Bitcoin | Grand Finale Printed – Now Enjoy the Ride DownOn this chart I’ve mapped Bitcoin’s full impulsive structure from 2017–2025 as a completed 5-wave advance. We’ve tagged the (V) top, and what’s forming now looks like the early stages of a larger degree A/B/C – with the local (1)(2) already in and real downside still ahead.

• The prior rallies were clean impulse legs; this last stretch has all the signatures of an exhaustion wave (extended 5th, blow-off structure, and failed follow-through).

• Current bounce fits perfectly as a wave (2) retrace after the first leg down – textbook spot where late bulls feel “saved” while smart money quietly exits.

• Ahead of us I’m expecting a multi-year, 5-wave decline (1–5 on the right side of the chart), unwinding leverage, hype, and all the “number go up forever” narratives.

This isn’t the end of Bitcoin – it’s the end of this cycle. The next few years are, in my view, for skill-building, capital preservation, and accumulation at true value, not chasing tops.

Trade the levels, respect the structure… and enjoy the ride. 🚀⬆️ then 🪂⬇️

Ethereum Reclaims Structure from Support Ethereum on the H1 timeframe is showing clear signs of structural stabilization after completing a prolonged corrective phase. Following a sustained downtrend, price found firm support within a well-defined demand zone, where sell-side momentum was absorbed and downside continuation failed to materialize. This base-building process reflects accumulation rather than further distribution, setting the stage for a potential recovery sequence.

Price action has since transitioned from compression into a gradual bullish rotation, with higher lows forming above the support zone. The recent push higher signals improving buyer control, as ETH begins to reclaim short-term structure and distance itself from the demand area. This behavior suggests that the market is no longer in liquidation mode, but instead shifting toward a corrective-to-bullish phase.

If Ethereum continues to hold above the support zone and maintains higher lows, the first upside objective aligns near the 3,180 region, where prior intraday structure is located. Acceptance above this level would strengthen the recovery narrative and open the path toward the next resistance around 3,220, representing a more meaningful structural hurdle from the previous decline.

Beyond that, sustained bullish momentum could allow ETH to extend toward the upper resistance near 3,300, where higher-timeframe supply is expected to come into play. Reaching this area would confirm a broader mean-reversion move rather than a simple bounce, signaling that buyers have successfully regained control after the corrective phase.

However, failure to hold above the support zone would invalidate the recovery scenario and shift focus back toward range-bound behavior or renewed downside pressure. Until such a breakdown occurs, Ethereum appears technically positioned for a step-by-step recovery, with the current structure favoring continuation as long as demand remains defended.

Ethereum Has Broken Structure — The Pullback Will Decide Hello Traders....

COINBASE:ETHUSD on the H1 timeframe has just completed a clean bullish structure break, marked by a strong impulsive candle that decisively pushed price above the previous consolidation range. This breakout confirms that buyers have taken control after a prolonged accumulation phase, shifting market structure from neutral to bullish expansion. However, following such a sharp move, price is now entering a post-breakout consolidation, hovering just above the broken level a typical behavior where the market pauses to absorb liquidity and rebalance positioning. The highlighted “break” zone around 3,300 now acts as a critical support flip area, and as long as price continues to hold above this level, the bullish thesis remains intact. From a structural perspective, the most constructive scenario is a controlled pullback toward the 3,200–3,180 support zone, where previous resistance and the moving average converge, before buyers step in again to drive continuation. If this pullback is respected, Ethereum has a clear upside roadmap toward the next liquidity targets around 3,400, then 3,475, with potential extension even higher if momentum accelerates. Any short-term retracement should therefore be viewed as healthy price development, not weakness. Only a decisive break and acceptance back below the reclaimed support would invalidate this bullish setup and shift the market back into a deeper corrective phase.

what do you think about ETHUSDT?

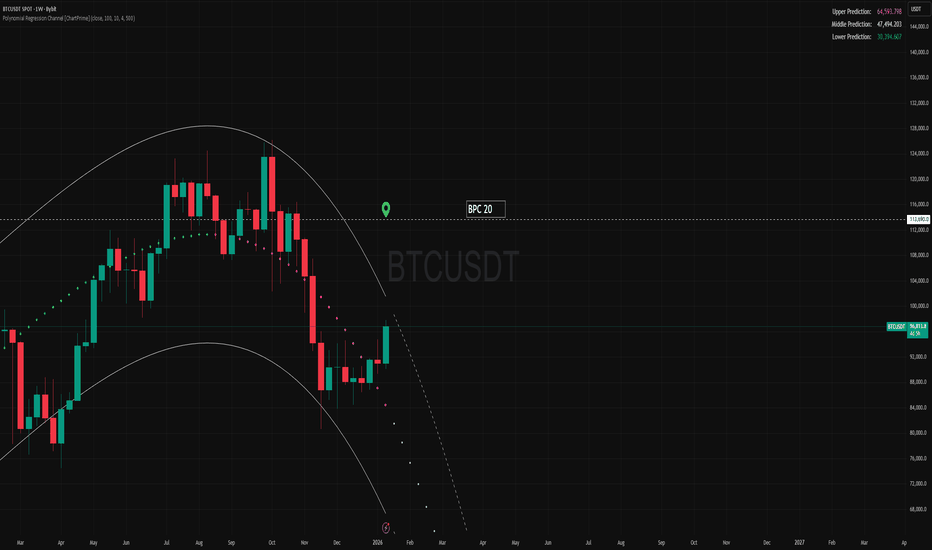

BTC — Price Slice. Capital Sector. 113690 BPC 20© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 BTC — Price Slice. Capital Sector.

TradingView Publication Date: 14.01.2026

🏷 113690 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 20

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — BTC (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3589.46 BPC 7.4© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3589.46 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 7.4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3525.90 BPC 6.3© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3525.90 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.3

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3698.53 BPC 23© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3698.53 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 23

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3602.93© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3602.93 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3500.39 BPC 3.3© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 15.01.2026

🏷 3500.39 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 3.3

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

BTC — Price Slice. Capital Sector. 101940 BPC 1.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 BTC — Price Slice. Capital Sector.

TradingView Publication Date: 14.01.2026

🏷 101940 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 1.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — BTC (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

Coinranger|ETHUSDT. Will it grows yet?🔥News

🔹No important news today. Potentially, Trump could start doing something in Iran. And, as we remember, in such cases, crypto can go down rapidly.

🔥ETH

🔹Stays within yesterday's forecast:

1️⃣ Levels above: 3373 and 3460.

2️⃣ Levels below with the minor changes: 3264, 3230, and 3160.

We'll be following Bitcoin. For now, the priority is to go lower. The minimum target at the bottom is 3264. An upward move is fragile, but not impossible.

Ethereum Holding the Line — Range Compression Before ExpansionEthereum on the H1 timeframe is currently trading inside a clear consolidation range after a strong impulsive rally. Price is oscillating between a key support band around 3,280–3,300 and multiple overhead resistance levels at 3,397 → 3,433 → 3,475. This is classic post-impulse behavior, where the market pauses to rebalance liquidity before choosing direction.

From a price action perspective, buyers have repeatedly defended the same horizontal support zone, with several clean rejections to the downside but no sustained acceptance below it. Each pullback into this zone is met with demand, suggesting that sellers lack strength to extend a deeper correction. The structure inside the range is overlapping and corrective a sign of consolidation, not distribution.

The EMA (yellow) is rising and running directly through the support area, reinforcing this zone as dynamic support. As long as price holds above this EMA and the horizontal base, the broader bullish structure remains intact. The recent downside probe labeled “BREAK” appears more like a liquidity sweep rather than a true breakdown, as price quickly reclaims the range.

Bullish scenario:

If ETH continues to respect the 3,280–3,300 support and builds acceptance, a push toward 3,397, followed by 3,433 and ultimately 3,475, becomes the higher-probability path. A clean breakout and close above the upper resistance would confirm continuation.

Bearish scenario:

A decisive H1 close below 3,280, with acceptance under the EMA, would invalidate the range support and expose the lower liquidity pocket near 3,180–3,200.

➡️ Key support: 3,280–3,300

➡️ Key resistance: 3,397 → 3,433 → 3,475

➡️ Market state: Consolidation after impulse

➡️ Bias: Neutral → Bullish while support holds

Ethereum is not trending yet it’s coiling energy for the next expansion.

Ethereum Is Completing a Classic Head & Shoulders1. Current Market Structure

Ethereum has transitioned from a strong bullish impulse into a clear distribution structure on the H1 timeframe. After the vertical rally from the 3,100 area, price formed a well defined Head & Shoulders pattern, signaling exhaustion rather than continuation. The left shoulder and right shoulder are symmetrical, while the head marks the final aggressive push that failed to attract sustained demand. Since then, price has shifted into lower highs and overlapping candles, confirming loss of bullish control.

This is no longer an impulsive uptrend it is a corrective-to-distributive phase.

2. Key Zones & Market Positioning

Major Supply / Head Zone: 3,390 – 3,420 → Strong rejection, distribution confirmed

Neckline / Key Support: ~3,280 – 3,265 → Structural decision level

Intermediate Demand: ~3,220

Final Downside Liquidity Target: 3,080 – 3,100

Price is currently hovering just above the neckline, which is typical behavior before a decisive breakdown in classical H&S structures.

3. EMA & Momentum Context

The EMA 98 is still rising and located below price, which explains the temporary pauses and bounces. However, price is now trading below prior momentum highs, and EMA support is flattening. This often occurs before deeper pullbacks as late buyers get trapped above the neckline.

Momentum is clearly weakening bullish candles are corrective, not impulsive.

4. Liquidity & Pattern Psychology

The Head & Shoulders structure reflects a distribution of long positions:

- Early buyers took profit near the head

- Late buyers entered near the right shoulder

- Liquidity now rests below the neckline

Once the neckline breaks and acceptance occurs, price typically accelerates quickly as stop-loss liquidity is released.

5. Market Scenarios

🔽 Primary Scenario – Bearish Continuation (High Probability)

Clean break and close below 3,265

Retest of neckline fails

Expansion toward 3,220 → 3,080

This move would be a healthy correction within the broader uptrend, not a macro reversal.

🔼 Invalidation Scenario

Strong reclaim and acceptance above 3,360

Break of right-shoulder structure

This would neutralize the H&S pattern and reopen bullish continuation — currently unlikely without volume.

6. Trading Perspective

Bias: Bearish (short-term)

Avoid longs near the neckline

Shorts favored on rejection or confirmed breakdown

Best long opportunities appear after liquidity is swept lower

Summary

Ethereum is no longer in expansion it is distributing.

The Head & Shoulders pattern is mature, momentum is fading, and liquidity is clearly building below the neckline. As long as price remains capped below the right shoulder, the roadmap remains straightforward:

Distribution → Neckline Break → Liquidity Expansion Downward

Ethereum Stuck Between Supply and DemandHello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure. Ethereum previously delivered a strong impulsive bullish expansion, breaking out aggressively from the lower consolidation range. However, after reaching premium levels, price action has shifted into sideways-to-bearish rotation, with momentum clearly slowing. Recent structure shows failed continuation above the highs, followed by overlapping candles and weaker rebounds. This behavior suggests the market has transitioned from impulsive buying into distribution, rather than healthy consolidation for continuation. The overall structure is now neutral-to-bearish in the short term, as buyers struggle to reclaim control after the impulse.

🟦 SUPPLY & DEMAND – KEY ZONES

Major Supply Zone:

The 3,380–3,400 area is a clearly defined supply zone, where multiple bullish attempts were rejected. This zone represents strong sell-side interest and caps upside momentum.

Immediate Demand Zone:

The 3,270–3,290 region acts as near-term demand, where price has repeatedly bounced. However, reactions from this zone are becoming progressively weaker, indicating demand absorption.

Lower Support Zone:

If the current demand fails, the next major support lies around 3,160–3,180, which aligns with prior consolidation and higher-timeframe structure support.

🎯 CURRENT MARKET POSITION

Currently, ETH is trading just above the immediate demand zone, but the bounce lacks impulsive strength. Price remains trapped between overhead supply and weakening demand, a classic setup that often precedes a breakdown rather than a breakout.

This is a compression phase with bearish risk building, not bullish expansion.

🧠 MY SCENARIO

As long as Ethereum remains below the 3,380–3,400 supply zone, upside is limited and rallies should be treated as corrective moves. A clean break and acceptance below the 3,270–3,290 demand zone would confirm distribution and likely trigger a move toward the 3,160–3,180 support zone.

If buyers manage to defend demand and reclaim supply with strong bullish acceptance, the bearish scenario would be invalidated. Until that happens, the structure favors downside continuation.

For now, Ethereum is compressing under supply, not preparing for continuation.

⚠️ RISK NOTE

Compression zones can resolve aggressively. Wait for confirmation at demand or supply, avoid early bias, and always manage your risk.