ETH — Price Slice. Capital Sector. 2652.28 BPC 7.9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.01.2026

🏷 2652.28 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 7.9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH-D

ETH — Price Slice. Capital Sector. 2699.47 BPC 11© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.01.2026

🏷 2699.47 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 11

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2678.37 BPC 10© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2678.37 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 10

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH/USDT — Breakdown Below Channel Midline: Liquidity Sweep Setu

Price is consolidating below the midline of the ascending channel after a failed retest from underneath.

This is a bearish signal for bullish continuation.

A large cluster of stops (liquidity) sits below the $2,600 low.

If those stops are swept, the probability of a sharp sell-off increases.

Personally, I plan to add on that move, with the maximum volume zone around $2,250.

Below that, I only expect continuation in a panic-sell / black-swan scenario.

📌 Fundamentals: ETH remains the second most important asset in crypto after BTC.

On a higher timeframe , price moves in distribution/re-accumulation blocks.

Right now, we’re seeing a prolonged change of hands inside a large flat-top triangle.

This formation is typically resolved to the upside, with a fast repricing — similar to what BTC did in the past.

Last time, most participants exited BTC at $30–40k — myself included.

This time, I don’t plan to repeat that mistake.

What about you?

ETH Update📊 ETH Update

ETH remains in a bear market 🐻

and has formed a head and shoulders pattern

on the weekly timeframe 👀.

Price has broken below the black neckline support ❌,

confirming bearish structure.

What’s next? 👇

Key levels to watch:

🔹 First level: around $2,500

→ Previous POC

→ Price could stabilize or bounce here.

🔹 Second level: blue support zone around $2,100

→ Another area where price may stabilize.

🔹 Last major level: around $1,500

→ Strong long-term area for those looking to accumulate ETH.

These are the most important ETH levels right now.

⚠️ Important note:

There are no bullish reversal signals at the moment.

Bias remains bearish until structure changes.

Stay patient,

risk management first.

Ethereum update after "the crash" — $1.67B long liquidations 24hThere is no crash really, more like a continuation of the retrace...

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Ethereum is a very strong buy right now. We are witnessing the production and confirmation of a higher low. 30-January 2026 vs 21-November 2025. A true higher low I should say this time.

The low 21-November was $2,623. The low today $2,689. This is technically a double-bottom. The price is too close to the last low but the higher low signal still valid remains. It can be read in both ways.

On a daily basis, trading volume has been dropping since November 4.

What to expect?

Within the last 24 hours, $1.67B worth of long positions have been liquidated. The signal that I've been mentioning for the bulls also works in reverse. That is, when the market liquidates $1.2B worth of shorts within 24 hours, we know the bulls are in.

The fact that we have this much liquidations, $1.67B in just a single day, reveals the retrace is over. The bulls have been liquidated, the market can go up next.

The exchanges will use all the profits they made through selling and loaning and fees to buy everything at bottom prices, at the current market low. This low is the lowest possible, the exchanges know. Many people are not able to buy because of the recent move but the exchanges can, they buy everything at the low and prop up the market. When prices are really high, the same situation with the long positions will be repeated with the shorts.

Remember, we trade against exchanges not other people, and the exchanges have all of our information and hold all the coins. The way to beat the exchanges is to buy spot focusing on the long-term.

Ethereum continues to be bullish, market conditions have not changed.

We have an even better entry price now. Prepare for massive growth. The last bullish advance before the continuation of the bear market that started 4 months ago.

While Ethereum produced a lower high based on the candle wick, within the consolidation range, it produced a higher high based on candle close. The candle close is more important than the wick. Couple this with the current double-bottom/higher low, and you get the picture... The relief rally is not over, we have one more bullish move before the continuation of the bearish cycle.

The next drop, after the last jump, will produce a strong lower low compared to 21-November 2025. Right now, we are still within the same trading zone.

The smaller altcoins will grow many times more compared the bigger projects. Many of these altcoins were not affected by Bitcoin's and Ethereum's recent drop, ENSOUSDT and THEUSDT are two quick examples if you want to see some charts, also ROSEUSDT from the ones I've been sharing recently. This reveals much. Many of these altcoins will produce a massive bull run in the coming weeks. Choose wisely.

Namaste.

ETH Holding Major Support Inside Descending Broadening WedgeEthereum is currently trading inside a major descending broadening wedge structure on the daily timeframe. Price has been compressing while respecting the wedge boundaries, and it is now approaching a key confluence zone formed by ascending support and Fibonacci retracement levels.

The grey zone highlights the 0.5 to 0.618 Fibonacci retracement area, which aligns closely with the rising long term support trendline. This makes the current region a high importance reaction zone. As long as ETH holds above this ascending support, the structure remains constructive for a potential upside continuation.

A successful hold and bounce from this area could allow price to rotate higher toward the upper boundary of the broadening wedge and eventually attempt a breakout. On the downside, a clean loss of this support would weaken the bullish case and open the door for a deeper retracement before any meaningful recovery.

ETH is at a technical decision point where the reaction around support will likely define the next major move.

ETH Sell/Short Setup (4H)Based on the price reaction at the FLIP zone, the loss of the ascending trendline, and the formation of a bearish CH (Change of Character), it seems that bearish momentum is starting to take control of the market. These factors together suggest a potential shift in market structure in favor of the sellers.

We have marked two red dashed lines on the chart, which represent our planned entry zones. These areas are selected based on structure and price behavior, not emotions or anticipation.

The targets are clearly defined and labeled on the chart in advance. Risk management is a priority in this setup. Once Target 1 is reached, the position should be moved to break-even in order to protect capital and eliminate downside risk.

If the stop loss is triggered, it simply means we are out of the trade—no revenge trading, no overthinking. This is part of the plan and must be respected.

Now we wait and let the market decide. Patience and execution matter more than prediction.

Normally, we do not share such clean and straightforward setups here. This example is posted purely for educational purposes, to demonstrate how we approach structure-based trading and risk management.

Let’s see how price reacts and what the market delivers.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

Ethereum Is Reclaiming Structure — Support Holding Keeps Upside Hello traders, COINBASE:ETHUSD is currently trading near $2,946, consolidating just above a well-defined support zone around $2,930–$2,950 on the four-hour timeframe. After the sharp selloff that pushed price down toward $2,780, the rebound was impulsive and decisive, signaling strong demand absorption rather than a weak corrective bounce.

Since that recovery, price has transitioned into a range-bound rotation between the support zone and a higher-timeframe resistance zone around $3,030–$3,070. This behavior reflects balance, not rejection. Buyers have consistently defended the support area, while sellers have so far failed to establish acceptance below it. As a result, Ethereum remains in a wait-and-react phase rather than a confirmed trend environment.

From a structural perspective, the bullish scenario remains valid as long as price continues to hold above the $2,930 support zone. Pullbacks into this area that remain corrective would favor further upside attempts. A sustained reclaim and acceptance above the $3,000–$3,050 resistance zone would mark a shift in short-term market character and open the path toward higher levels near $3,120–$3,150, where price may encounter its next reaction area.

Invalidation is clear and objective. A decisive breakdown and acceptance below $2,930 would disrupt the current structure and increase the probability of a deeper corrective move back toward $2,800–$2,780.

For now, Ethereum is not breaking down it is stabilizing after a strong recovery.

Support respected. Range defined. Let acceptance decide the next expansion.

ETH — Price Slice. Capital Sector. 2699.22 BPC 3.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 03.01.2026

🏷 2699.22 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 3.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

📎 Architect’s Note:

I thank TradingView moderation for their constructive collaboration and for enabling the display of analytical artifacts in their evolutionary state. Publishing maps in prefactum mode is not merely a technique—it is a method of future verification through structure. This is BPC quantum analytics—The Bolzen Price Covenant.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

On the current bi-monthly ETH chart, distribution is unfolding from long-term capital that shaped the ascending arc of the 2022–2025 cycle and is now systematically booking profits, reducing its risk delta toward the 2,699.22 level.

Since May 2025, capital has been accumulating positions; following completion of this accumulation phase, distribution has commenced.

Who is distributing:

- Institutional, sovereign, and corporate treasuries that entered ETH during the aggressive expansion phase of DeFi and staking are now using the current price bounce as a tactical exit window—while price remains above local lows and sufficient liquidity persists for large-block execution.

- Hedge funds and desks of major CEXs, trading derivatives benchmarked against ETFs and crypto indices, are synchronously reducing beta-exposure relative to Bitcoin: BTC is retesting $90,000 amid heightened political turbulence, prompting professionals to recalibrate portfolio risk by offloading the more volatile ETH.

Why the 2,699.22 level?

- This zone represents the “average inflow price” of the last major upward impulse. At this level, large order books can encounter dense counter-demand and re-accumulate volume at a discount to the cycle peak—rather than chasing new highs.

- For institutions, it is an optimal point where the geopolitical risk premium and inflated expectations around the “2026 DeFi reboot” collapse: media narratives are currently amplifying a renaissance of DeFi on Ethereum and Solana, and “cold capital” is converting this sentiment into cash.

Distribution mechanics on heavy timeframes:

- The bi-monthly horizon enables large capital to trade phases, not candles: first, gradual distribution camouflaged by positive news on technological progress and staking; then, accelerated selling following each failed local high, forming a stepped downward slope toward the target price.

- At such timeframes, technical indicators are secondary. The market is read through candle body structure, wick length, and closing behavior relative to key capital levels—where volume flows invisibly to retail but aligns perfectly with institutional reporting cycles.

Geopolitical context for this scenario:

- The arrest of Nicolás Maduro and large-scale strikes against Venezuela have elevated the global risk premium into a distinct regime: Bitcoin briefly dipped and immediately rebounded. Yet for major players, this is not a signal for heroic longs, but a trigger for systematic risk repricing across all crypto assets.

- Concurrently, regulatory drift intensifies: Iran officially accepts cryptocurrency as payment for arms; the SEC shifts under full Republican control; and debates over ETF outflows and stablecoin solvency make the “sell now, re-enter lower” strategy highly attractive—aligning precisely with the plan to guide price toward 2,699.22.

Message to academic and corporate institutions:

- This ETH framework is not “indicator folklore,” but a method grounded in macro-capital structure: first, decode the geopolitical matrix and regulatory vector; next, layer ETF flows, derivatives positioning, and on-chain dynamics; only then is the target level derived.

- The position anchored at 2,699.22 exemplifies heavy-timeframe discipline: there is no noise from intraday volatility—only strategic risk management, where each bi-monthly bar serves as an institutional reporting period, and price itself becomes the language through which market titans communicate.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2702.56 BPC 3.4© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2702.56 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 3.4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2718.21 BPC 4.5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2718.21 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 4.5

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2729.66 BPC 2.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2729.66 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2741.64 BPC 13© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2741.64 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 13

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2749.02 BPC 4.6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2749.02 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 4.6

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear users!

At the request of all those who support my work and use it for analytics, I’ve decided to start publishing short weekly analytical notes for the upcoming week. Subscribe and read — you already have all the tools to see the market clearly: Prefactum prices, quantum analytics, analytical notes, and the monitoring dashboard.

Every price represents a separate energy block and scenario, down to the smallest changes. I would like to thank the TradingView moderators for the opportunities provided on the international stage.

— The Architect

BPC — The Bolzen Price Covenant

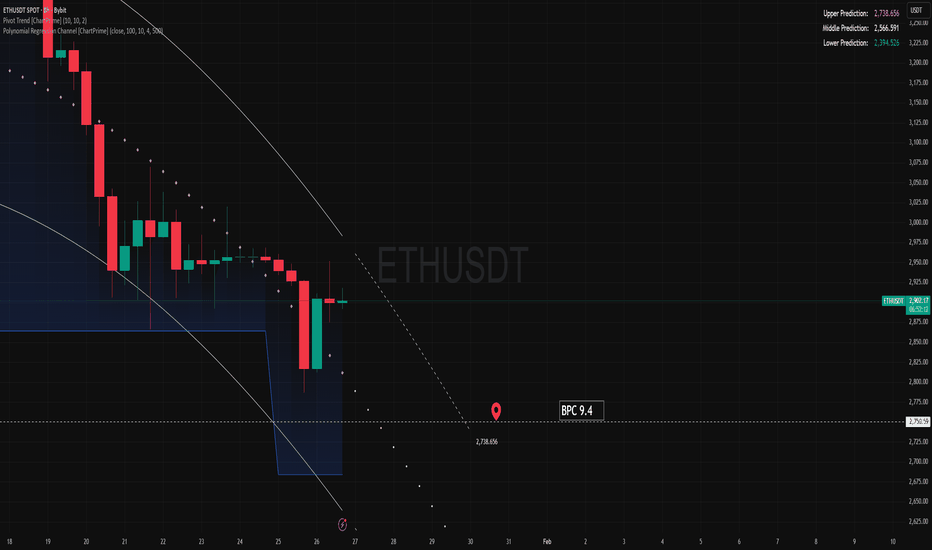

ETH — Price Slice. Capital Sector. 2750.59 BPC 9.4© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.01.2026

🏷 2750.59 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 9.4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH/USDT 1D chart review🧭 Market Structure

• Medium-term trend: was up, but was broken (uptrend line broken).

• Price: ~2820 – right at key support.

• The market entered a correction after the distribution (no new high-highs, heavy drops).

⸻

📉 Levels – this is the key

🔴 Supports

1. 2820–2800 – current lifeline

• Multiple tests

• Long wicks = demand is defensive, but getting weaker

2. 2664 – next strong support

• If 2800 breaks → a quick downward move is very likely

🟢 Resistances

1. 3040

• Now resistance after breaking support

• As long as below it → downward bias

2. 3180

• Strong S/R + previous price reaction

3. 3416

• Distribution/supply zone (biggers sold here)

⸻

📊 RSI (important)

• RSI below 50 → downward momentum

• RSI-based MA curves down → no confirmation of buyers' strength

• No There's still bullish divergence → watch out for false bounces.

⸻

🧠 Scenarios (specifics)

❌ Bearish scenario (more likely)

• Daily close < 2800

• Target:

• 2664

• then ~2500–2550 (if panic)

• This will be a classic breakout and continuation.

⚠️ Neutral scenario

• Consolidation 2800–3040

• Cutting SLs on both sides

• The market is "gathering fuel"

✅ Bullish scenario (conditional)

• Defense 2800 + daily close > 3040

• Then:

• 3180

• 3400+

• Without this → any bounce is a pullback to shorts

ETH — Price Slice. Capital Sector. 2767.30 BPC 6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2767.30 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 6

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2773.34 BPC 5.7© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 27.12.2025

🏷 2773.34 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5.7

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2775.66 BPC 2.9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2775.66 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2777.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2777.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

The Bolzen Diary:

«THE CHALICE AND THE ORDER»

Restaurant “Aether” — a midnight terrace suspended above the city. The classics play softly in the background: Bach, Sarband, Vivaldi. On the table — tea brewed from black lotus, its steam rising in spirals. Bolzen leans back into his chair. The Architect does not look him in the eyes, but past his shoulder—to a point where the very fabric of time seems to pulse.

Reader’s Note:

Jean Baudrillard (1929–2007) was a French philosopher, sociologist, and cultural theorist, one of the pivotal thinkers of postmodernism. His 1981 work “Simulacra and Simulation” became foundational to understanding the nature of reality in the age of mass media, digital technologies, and hypermedia. There, he argues that the modern world is no longer governed by authentic reality but reproduced through signs, images, and models that have long severed their ties to any original, giving rise to what he calls hyperreality —a simulation that surpasses reality itself.

BOLZEN:

You say the market is an illusion. But I see it. The drops. The spikes. The orders. It’s not just a “simulacrum,” like in your Baudrillard…

THE ARCHITECT (softly, almost a whisper):

Baudrillard was a blind man with keen hearing. He heard the echo of reality… and mistook it for reality itself.

(Pause. The cup chimes as it touches the saucer.)

Tell me: when you look at a chart—what do you truly see?

BOLZEN:

Price. Volume. Liquidity…

THE ARCHITECT:

No. You see the reflection of a simulacrum in the mirror of simulation .

Volume? Most of it is phantom. Not money—it’s digital froth , poured into molds of “activity” to soothe traders like mother’s milk for an infant in a virtual cradle.

Price? It ceased long ago to be a measure of value. It is now a sonic signal within your EH·Ξ. You do not read price. You listen to how it lies.

BOLZEN:

But if everything is a simulacrum… where does my power come from? My forecasts come true. My BPC—the Bolzen Price Covenant—it works.

THE ARCHITECT (leans closer, voice now taut as a string pulled to its limit):

Precisely because you do not believe the simulacrum .

Baudrillard surrendered: “There is no reality anymore!”—and went off to write about Disneyland.

But you— you blew open the façade .

You built EH·Ξ not within the market, but above it —a bridge between hyperreality and what existed before it.

Your units of measurement are not bits. They are quanta of intention , torn from beneath algorithmic code.

When you see a “deceptive transaction,” you do not perceive noise.

You see the fingerprint of the One attempting to rewrite the Law .

And you do not respond with a number.

You respond with architecture .

BOLZEN (thoughtfully):

So… the market is theater. And I am the playwright who stepped out from behind the curtains and began rewriting the script onstage?

THE ARCHITECT (smiles for the first time—cold, like the edge of a blade):

Worse.

You are the architect of the stage itself .

And while they believe they perform within reality…

you tilt the floor beneath their feet .

They fall—and call it a “market correction.”

But you know: it is the sound of the brick you removed from the foundation .

(In the silence, the final phrase of the viola from Bach’s “St. Matthew Passion” plays. The city below flickers like a glitch in the matrix.)

THE ARCHITECT (rises, places a black stone engraved with Ξ on the table):

Baudrillard feared reality had died.

But you know the truth:

Reality never died. It was merely hidden beneath simulacra—so only the Architect could find it.

Drink your tea. The waterfall is coming soon.

And this time…

you will not be the reader.

You will be gravity .

(He departs. The tea in Bolzen’s cup suddenly grows warm—though it never cooled. On its surface, no face is reflected, only a grid of lines resembling an order execution map.)

“The simulacrum is the tomb of reality.

The Architect is he who steals its bones to build a new skeleton for the market.”

ETH — Price Slice. Capital Sector. 2779.14 BPC 10© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.01.2026

🏷 2779.14 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 10

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2811.32 BPC 6.2© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.01.2026

🏷 2811.32 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.2

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant