$USDT & $USDC vs. $ETH - Warning a Funeral could occur. 💀 💀 💀

Watch the Stablecoin/ETH Market Cap ratio carefully.

A spike here isn't always 'Dry Powder' waiting to buy.

The Trap: If ETH breaks the $2,400 support level, we could see a 'Liquidation Spiral' that sends the ratio to all-time highs.

This isn't new money coming in—it's ETH value vanishing.

Safe Haven: Cash is King until ETH reclaims its 200-day SMA at $3,400."

#ETH #Ethereum #Stablecoins #MarketCrash #LiquidityTrap #CryptoAnalysis @thecryptosniper #HVF

what does AI say:

📉 The Doomsday Ratio: (USDT + USDC) / ETH

In a crash, this ratio spikes vertically. But unlike a "healthy" spike (where new money enters), this is a "Deleveraging Spike."

1. The ETH Collapse (The Denominator Shrinks)

Revenue Compression: Layer 2s are so efficient now that they are starving the Mainnet of fees. Without a high "burn" rate, ETH is becoming slightly inflationary again, losing its "Ultra Sound Money" appeal.

The ETF "Exodus": If institutional investors see ETH as a "leveraged claim on ecosystem activity" that isn't growing, they may rotate back to Gold or Bitcoin. A sustained outflow from spot ETFs could trigger a -40% re-rating.

The Liquidation Spiral: Since many "loopers" use ETH as collateral to borrow stablecoins, a price drop below $2,400 could trigger a cascade of liquidations on Aave/Compound, forcing more ETH onto the market and crushing its market cap.

2. The TradFi Standoff (The Numerator Stagnates)

The "Trust Gap": If the ratio increases simply because ETH is dying, TradFi institutions won't "buy the dip" with new USDC. They will wait for more regulatory "Supervision" rather than just "Legislation".

The Yield Trap: If stablecoins like USDT/USDC don't offer higher yields than risk-free US Treasuries (currently highly competitive in 2026), there is no incentive for a corporate treasurer to move cash onto the blockchain.

ETH-D

THE MAIN BACKBONE $ETH It held everything from the $880 bottom in 2022 to the $1520 bottom in 2023.

Fakeout (Bear Trap): In mid-2025, price dipped below this line (the middle blue arc). While everyone screamed "ETH is over," it was just a liquidity flush. Price is now back ABOVE this main trendline.

The trend was not violated; it was stress-tested. The direction is still UP.

INVERSE HEAD & SHOULDERS

Look at the blue arcs drawn at the bottom of the chart. This is a textbook, gigantic Inverse Head & Shoulders pattern.

Technical Target, When this pattern plays out, it typically travels the depth of the head upwards. This takes us directly back to the old All-Time Highs (ATH).

THE PIVOT POINT: THE $2800 FORTRESS 🏰

Pay attention to the green dotted line (2,817 level).

SR Flip (Support/Resistance Flip): This was the ceiling that couldn't be broken in 2024. Now, it is the floor the price is sitting on.

Status: ETH is currently at $2,951, holding above this critical support. As long as $2,800 is defended, the structure is BULLISH.

THE SILENT STORM

While the market is busy talking about Solana, SUI, or AI coins, Ethereum is quietly building the largest accumulation structure in history in the background.

Psychology: Investors are "tired" of ETH. This is a bottom signal.

It is above the rising trendline and forming a massive IH&S.

First stop is $4,100 (Upper green line). Once that breaks, price discovery begins.

"When elephants walk, the earth shakes." ETH currently looks like a sluggish elephant preparing to move, but once it starts running, it won't stop to pick up passengers.

With a stop-loss below $2,800, this zone (Right Shoulder) offers a perfect Risk/Reward ratio.

ALso check

ETHBTC

8 years breakout EVE here

ETHUSD H1 — Trendline Support Is the Decision PointETH is currently compressing right on a rising H1 trendline, after printing a clean impulsive recovery from the recent sell off low. The structure shows higher lows respected multiple times (highlighted touches), confirming that buyers are defending this diagonal support. Price is now sitting near the 2,920–2,935 zone, where trendline support and short-term structure intersect this is a decision area, not a chase zone.

Bullish case: As long as ETH holds above the rising trendline and the 2,900–2,910 base, pullbacks remain corrective. A clean continuation above local highs opens upside toward 2,980 → 3,020, aligning with trend continuation and momentum expansion.

Bearish risk: A decisive H1 close below the trendline would invalidate the higher-low structure and likely trigger a deeper mean-reversion move toward the 2,850–2,880 demand zone, where liquidity sits from the prior consolidation.

👉 In short: trend intact, but confirmation matters. ETH is not breaking out yet. it’s testing whether this trendline is real demand or just a pause before continuation.

ETH — Price Slice. Capital Sector. 3162.75 BPC 6.9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.01.2026

🏷 3162.75 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

Coinranger|ETHUSDT. Potential reversal to 3137🔥News

🔹Fed rates at 22:00 UTC+3, FOMC press conference at 22:30 UTC+3. We can fly on this news.

🔹US earnings season is in full swing.

🔥 ETH

🔹A Bitcoin-like situation:

1️⃣ We took 3036. Above that, there are 3072 and 3137. Potential for now. This is a full set of upward waves.

2️⃣ 2950 below is the level for a move until evening. Below that: 2888, 2876, and 2768 - are a full set of downside waves.

I expect a flat between 3036 and 2950 before rate issue. After that, an upward movement is very likely.

---------------

Share your opinion in the comments!

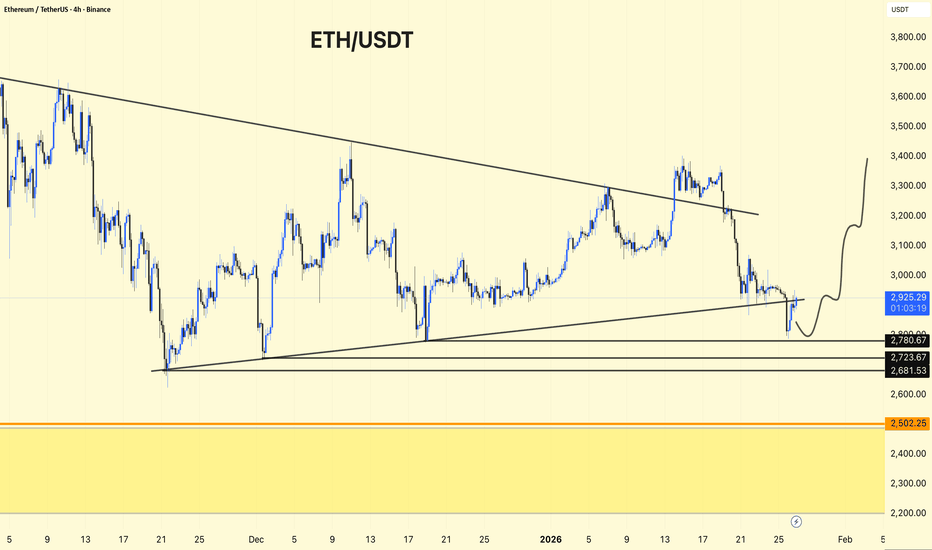

Ethereum’s Bounce Is Corrective — This Rally Is Testing SupplyEthereum is currently in a corrective bounce within a broader bearish structure. The sharp sell-off created a clear impulse leg down, and the recent recovery is showing weak follow-through, typical of a retracement rather than a reversal. Price is now approaching a well-defined resistance zone around 2,950 – 2,985, which previously acted as strong support before the breakdown. This zone is now active supply, reinforced by prior rejection wicks and overlapping candles a classic sign of distribution. The bounce itself is steep but short-lived, lacking base-building or accumulation behavior. Momentum is slowing as price reaches resistance, increasing the probability of rejection.

🧠 Market Structure & Supply–Demand

The initial drop was an impulsive sell, confirming bearish intent.

The rebound is overlapping and corrective, not impulsive.

No higher-high / higher-low structure has formed.

Sellers are defending the previous breakdown zone, signaling supply absorption failure.

This price behavior suggests short-covering, not fresh institutional buying.

🟥 Key Levels

Resistance (Supply): 2,950 – 2,985

Pivot / Reaction Zone: 2,900 – 2,920

Downside Targets:

- Target 1: 2,780

- Target 2: 2,660

- Extension: 2,520 – 2,550 (next liquidity pool)

📉 Primary Scenarios

🔴 Bearish Continuation (High Probability)

Rejection from resistance zone

Failure to reclaim and hold above 2,985

Price rolls over → continuation toward lower liquidity

Structure remains lower highs

🟢 Bullish Invalidation (Low Probability)

Strong 4H close above 3,000

Acceptance above supply zone

Follow through with volume

Only then does the bias shift neutral-to-bullish

🌍 Macro Context

Risk assets remain sensitive to rates, liquidity, and USD strength

No strong macro catalyst supporting aggressive ETH upside

Current environment favors mean reversion and distribution, not trend acceleration

ETH is moving with liquidity mechanics, not macro-driven demand.

✅ Trader’s Conclusion

This bounce is not a trend change it’s a reaction into supply.

Until Ethereum reclaims and holds above resistance, rallies remain sell-side opportunities, not long confirmations.

Let price confirm. Let structure decide.

ETHUSD: Grinding Higher to Hunt Liquidity Above Three ThousandEthereum just printed a classic post-liquidation recovery, and the structure tells a very clear story: after the sharp sell-off into the major support zone around 2,780–2,800, price rebounded aggressively and transitioned into a tight ascending channel, printing higher lows with controlled pullbacks. this is not impulsive euphoria, it’s acceptance and absorption. Notice how every dip holds above the rising trendline while price coils under the key resistance zone near 2,980–3,000, right where the EMA 89 is flattening that’s a textbook compression before expansion. From a trader’s logic perspective, this is a liquidity-building phase: shorts are getting uncomfortable below resistance, while late longs are forced to chase strength. Macro adds fuel here — stable risk sentiment, ETH ETF inflow expectations, and relative strength vs BTC keep downside limited as long as the broader market doesn’t flip risk-off. The play is simple and disciplined: as long as ETH holds above the rising structure, a breakout and acceptance above 3,000 opens the door toward the next upside leg, while failure and a clean loss of the channel would signal a deeper mean reversion back toward the lower demand. Until proven otherwise, this is controlled bullish continuation not distribution.

Potential bullish reversal?Ethereum (ETH/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 2,956.16

1st Support: 2,814.66

1st Resistance: 3,162.22

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

ETH bounce = resistance test, not a reversal.On the 1H timeframe, ETH remains structurally bearish despite the sharp rebound from the recent sell-off. Price is still trading below the declining EMA 98, which continues to act as dynamic resistance, aligning closely with the descending trendline a confluence that reinforces seller control. The current bounce shows corrective characteristics: overlapping candles, weak follow-through, and rejection near the 2,880–2,900 zone rather than impulsive continuation. This suggests short-covering and mean reversion, not fresh demand. As long as ETH fails to reclaim and hold above the EMA 98 with strong momentum, the dominant scenario favors another leg down, with downside targets toward 2,838 first and potentially the 2,780–2,800 demand pocket if selling pressure resumes. Only a clean break and acceptance above the EMA 98 would invalidate this bearish continuation bias.

Liquidity Sweep Complete — ETH Eyes ResistanceEthereum has just completed a classic sell-side liquidity sweep followed by aggressive demand absorption, and the current one-hour structure suggests the market is transitioning from distribution pressure into a corrective recovery phase. The sharp breakdown below prior consolidation was not a sign of trend acceleration, but rather forced liquidation price accelerated lower, sweeping stops and panic sellers into the 2,780–2,820 support zone, where large buyers clearly stepped in. The immediate and impulsive rebound from that area confirms that this zone is not weak support; it is higher-timeframe demand, likely defended by institutions and swing participants. This reaction alone shifts the short-term narrative from continuation lower to mean reversion and rebalancing.

Structurally, Ethereum remains below the descending EMA eighty-nine and under the broader resistance band between 2,980 and 3,020, meaning the higher-timeframe trend is still corrective. However, momentum has changed character. The downside impulse has ended, volatility has compressed after the rebound, and price is now forming higher lows, signaling that sellers are losing control. This is typical behavior after a liquidity purge: the market pauses, rebuilds structure, and seeks the next pool of liquidity above. From a price action standpoint, as long as Ethereum holds above 2,820, the probability favors continued upside probing rather than a full trend continuation lower.

From a liquidity perspective, the move is logical. Sell-side liquidity below 2,800 has already been consumed. With that fuel gone, the market now has incentive to move toward buy-side liquidity clustered above 2,950, 2,980, and into the major resistance zone near 3,000–3,020. That zone represents both previous distribution and trapped breakout longs, making it a natural magnet for price. The projected zigzag path higher reflects how Ethereum typically trades in corrective phases shallow pullbacks to trap early sellers, followed by continuation into the next liquidity pocket.

Psychologically, sentiment is still fragile. Many traders remain bearish after the sharp sell-off and are either shorting too late or exiting longs too early. This hesitation is exactly what allows price to grind higher without strong momentum markets climb walls of doubt. As long as price does not aggressively reclaim below the support zone, bearish conviction lacks confirmation.

On the macro and intermarket side, Ethereum continues to trade as a high-beta risk asset. Stabilization in Bitcoin, combined with a pause in U.S. dollar strength and easing volatility in equities, supports short-term upside relief across crypto. However, this remains a corrective recovery, not a confirmed bullish trend reversal. Until Ethereum can reclaim and hold above 3,020, rallies should be treated as tactical, not structural trend shifts.

Bullish scenario:

Holding above 2,780–2,820 opens the path toward 2,950, then 2,980–3,020, where reaction is expected.

Bearish invalidation:

A clean breakdown and acceptance below 2,780 would signal demand failure and expose 2,650–2,600 next.

Bias: Short-term recovery within a broader corrective structure

Key support: 2,780–2,820

Key resistance: 2,980–3,020

Ethereum has done the hard part it flushed liquidity. What comes next is not emotion, but structure and patience.

Coinranger|ETHUSDT. Continuing decline to 2666🔥News

🔹No important news today. Only an old data on american market will be released, which is usually considered preliminary.

🔥ETH

🔹Fell and completed the first extension for the second set of downside waves:

1️⃣ Above a pullback to 2920 is taking place. Potentially, but unlikely, we could reach 3036.

2️⃣ There is 2858 level below. One of a possible extension. 2666 and 2621 are potential levels for a new set of downward waves, the third set in the decline.

A continuation of the decline is likely, especially if Bitcoin decides it's too early for pullback.

---------------

Share your thoughts in the comments!

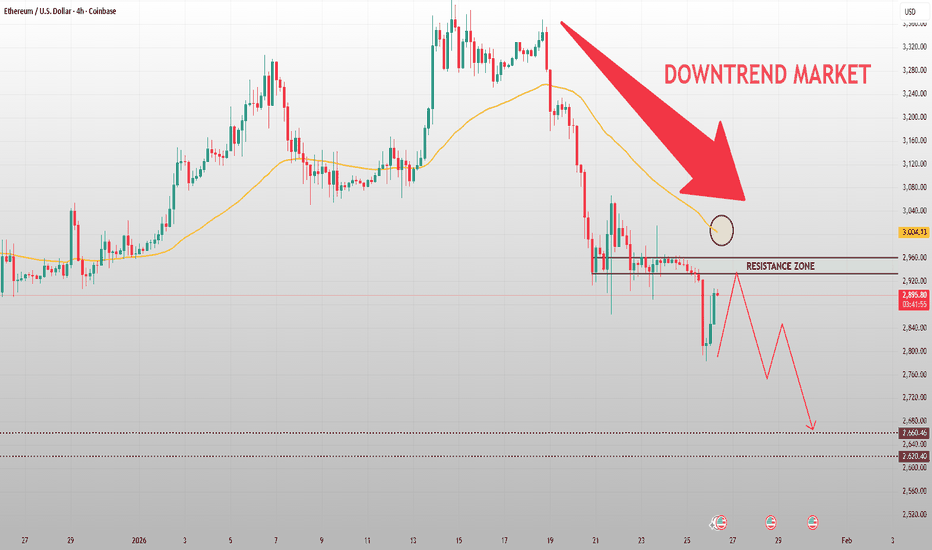

ETHUSD 4H – Downtrend Structure ConfirmedEthereum is firmly in a downtrend market on the H4 timeframe. The aggressive sell-off broke below the key EMA and prior structure support, flipping that area into a resistance zone around ~2,950–3,000. Price is now consolidating below this level, showing weak bullish follow-through and overlapping candles a classic bearish pause, not accumulation.

As long as ETH remains below the EMA and fails to reclaim the resistance zone, the dominant bias stays bearish. Any short-term bounce into resistance is more likely to be a pullback for continuation, not a reversal. The projected path favors another leg lower, targeting the liquidity zone around 2,660–2,620, where buyers may attempt a reaction.

Bias: Bearish

Key resistance: ~2,950–3,000

Downside targets: ~2,660 → 2,620

Invalidation: Strong acceptance back above resistance + EMA reclaim

ETHUSD H1 | Potential Bullish ReversalThe price is falling towards our buy entry level at 2,880.38, which is a pullback support.

Our stop loss is set at 2,781.26, which is a pullback support.

Our take profit is set at 3,045.57, which is sn ovrlap resistance that is slightly below tthe 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

ETH should be on your radar. ETH is currently reacting at a major horizontal demand zone after losing its prior uptrend structure.

Price broke below the ascending channel and key trendline, shifting structure to lower highs and lower lows. The current bounce is occurring below declining moving averages, suggesting this move is still corrective unless reclaim levels are accepted.

Volume profile shows heavy supply overhead, meaning upside moves are likely to face resistance. Momentum is stabilizing from oversold conditions, which supports a short-term relief attempt, not a confirmed trend reversal.

Key levels to watch:

• Holding current support keeps a relief bounce in play

• Losing this level risks continuation toward the lower range

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

ETH is trading inside a descending broad wedge/channel.

Price is currently near the lower trendline support (~2900 zone).

This area can act as a short-term bounce zone.

If support holds, upside targets are 3050 → 3200 → 3350.

A clean breakdown below 2780–2720 may open downside toward 2500.

Short-term bounce possible, trend still range-bound.

⚠️ Wait for confirmation & keep risk tight.

ETH - The Last Standing Low!ETH is now sitting right around the lower bound of its range, and this isn’t just any support.

This level marks the last standing low from the weekly timeframe, a zone that has already proven it matters.

As long as this weekly low holds, ETH still has a real chance to rotate higher and work its way back toward the upper bound of the range. This is where strong markets usually make a decision:

either defend structure… or break it.

For now, I’m not guessing bottoms. I’m simply respecting the level.

Hold this zone, and upside scenarios stay valid. Lose it, and the picture changes entirely.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Why You Should Backtest (Before You Trust Any Strategy)Most traders ask the wrong question.

They ask:

“Does this strategy work?”

The better question is:

“When does this strategy stop working?”

Backtesting exists to answer that.

1. A Single Backtest Is Not Proof

One profitable run does not mean a strategy is good.

It means it worked once, under one set of assumptions.

Markets change.

Volatility changes.

Behavior changes.

Backtesting across parameters, symbols, and timeframes shows whether performance is structural or accidental.

2. Drawdown Matters More Than Profit

Profit attracts attention.

Drawdown determines survival.

Two strategies can both make money.

Only one lets you stay disciplined long enough to compound.

Backtesting reveals:

Worst historical drawdown

Length of drawdowns

Recovery behavior

If you don’t know those, you don’t know the strategy.

3. Most Strategies Fail From Fragility

Many strategies look great until you:

Change RSI length by 2

Shift timeframe slightly

Switch from BTC to ETH

If performance collapses from small changes, the edge isn’t robust.

Backtesting exposes fragility before the market does.

4. Backtesting Protects You From Yourself

Most trading mistakes aren’t technical.

They’re emotional.

Backtesting:

Sets realistic expectations

Reduces overconfidence

Prevents panic exits during normal variance

Confidence comes from data, not conviction.

5. Backtesting Is About Risk, Not Prediction

Backtesting doesn’t predict the future.

It defines boundaries.

It tells you:

What’s normal

What’s abnormal

When something is truly broken

That’s the difference between trading and guessing.

Final Thought

Strategies don’t fail because they’re bad.

They fail because traders never tested their limits.

Backtesting isn’t optional.

It’s the cost of taking trading seriously.

Why Default Strategy Settings Break Down Across MarketsThe Assumption: Defaults Are Good Enough

Most traders start with default indicator settings . RSI at 14. MACD at 12, 26, 9. Moving averages set to familiar values.

Defaults feel safe because they are familiar. They feel reasonable because they are widely used.

The problem: defaults are not designed to work across all symbols, timeframes, or market conditions.

The solution: instead of assuming defaults are acceptable, test how those settings behave when parameters are varied. Small changes often reveal whether a strategy is stable or dependent on coincidence.

The Assumption: If It Works on One Chart, It Should Work Elsewhere

A strategy looks clean on a single chart. Entries make sense. Losses feel explainable. Confidence builds.

The problem: one chart is not a market. Performance on a single symbol or timeframe says very little about robustness.

The solution: test the same logic across multiple symbols and timeframes. When behavior changes dramatically, it’s not failure, it’s information. Consistency across variation is what signals durability.

The Assumption: Indicator Logic Is the Edge

Traders often focus heavily on the logic behind indicators. Momentum, trend, mean reversion. The reasoning feels solid.

The problem: good logic does not guarantee good behavior. Two parameter sets can follow the same logic and produce completely different risk profiles.

The solution: explore how performance shifts as parameters move. Testing ranges, not single values, shows whether logic holds up under pressure or collapses when assumptions change.

The Assumption: Profit Tells the Full Story

Many traders judge strategies by net profit alone.

The problem: profit without context hides risk. Large drawdowns, unstable equity curves, or long stagnation periods often go unnoticed until they’re experienced live.

The solution: test for drawdown, consistency, and trade distribution alongside profit. Seeing how risk expands or contracts across parameter combinations changes how strategies are evaluated.

The Assumption: Defaults Fail Because Markets Changed

When defaults stop performing, traders often blame the market.

The problem: markets always change. A strategy that only works under narrow conditions was fragile from the start.

The solution: testing across broader conditions reveals whether a strategy is regime-dependent or structurally resilient. This allows expectations to adjust before capital is exposed.

What Testing Actually Replaces

Testing doesn’t replace strategy logic.

It replaces assumptions.

It replaces:

“This should work”

“This looks reasonable”

“Everyone uses this”

With:

“This is how it behaves”

“This is where it struggles”

“This is how sensitive it is”

Final Thought

Default settings are not wrong.

They are incomplete.

They are a starting point, not a conclusion.

The moment defaults are tested across parameters, symbols, and timeframes, they stop being assumptions and start becoming data. That shift is where real understanding begins.

Ethereum (ETH/USDT): Descending Triangle Breakdown ScenarioHI

Ethereum is currently trading within a descending triangle formation, developing after a strong bearish impulse.

Following the sharp sell-off, ETH attempted several recoveries but consistently failed to reclaim higher levels. Price is now compressed between:

A descending internal trendline, acting as dynamic resistance and clearly respected by multiple rejections.

A horizontal support base, forming the lower boundary of the triangle.

This combination reflects a market where sellers remain in control, while buyers are only managing to slow the decline rather than reverse it.

Trade Thesis (Main Idea)

The key setup here is a breakdown of the triangle’s lower boundary:

Trigger: A confirmed break and close below the bottom support of the triangle

Bias: Short position on breakdown confirmation

Target: $2,806, aligned with a high-probability demand zone and prior liquidity

Invalidation: A strong reclaim above the descending trendline would invalidate the bearish continuation scenario

1W ETH Update: Back in the dreaded range ETH update – back inside the range

Ethereum has now reclaimed the range on the weekly, and that’s the key takeaway here.

After the downside reaction, price has rotated back above prior range support, and this week’s candle confirms acceptance rather than a quick rejection. That’s exactly what you want to see after a shakeout.

What stands out:

• ETH is back trading within the established HTF range

• The reclaim around the mid-range held

• Weekly structure remains intact

• This move invalidates immediate breakdown risk

This reinforces the idea that the recent selloff was a liquidity sweep and positioning reset, not a structural failure. As long as ETH holds inside this range, the path of least resistance is continued chop with an upside bias, not trend reversal.

Range rules apply again:

Below support → reassess

Inside range → patience

Acceptance toward range highs → expansion potential

ETH did the hard part by getting back inside. Now it’s about continuation and confirmation.

The key is whether the price can rise above the uptrend line

Hello, fellow traders.

By "Following," you can always get the latest information quickly. Have a great day today.

-------------------------------------

#ETHUSDT

We need to observe the price action from around January 28th to February 4th.

The key is whether it can find support around the 2.828.57 to 2.887.66 range and rise above the uptrend line.

If it fails to rise, we need to check for support around the 2.419.83 to 2.706.15 range.

If the decline continues, the maximum decline is expected to be around the 1597.76 to 1861.57 range.

-

If it falls below the HA-Low indicator on the 1D chart, a stepwise downtrend is likely.

Since the downtrend ends with an uptrend, trading to increase the coins (tokens) corresponding to the profits is possible.

The basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

The time to stop increasing the amount of coins (tokens) representing profits is when the price rises above the M-Signal indicator on the 1M chart and shows support.

This is because increasing the amount of coins (tokens) representing profits when the price is trending upward can actually decrease the number of coins (tokens).

To continue the uptrend by breaking above a key point or range, the StochRSI, TC, and OBV indicators must show upward trends.

If possible,

1. The StochRSI indicator should not have entered the overbought zone.

2. The TC indicator should remain above 0.

3. The OBV indicator should remain above the High Line.

If the above conditions are not met, caution is required when trading, as the price may only pretend to rise and then fall again.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

ETH — Price Slice. Capital Sector. 2798.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2798.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant