ETH - The Last Standing Low!ETH is now sitting right around the lower bound of its range, and this isn’t just any support.

This level marks the last standing low from the weekly timeframe, a zone that has already proven it matters.

As long as this weekly low holds, ETH still has a real chance to rotate higher and work its way back toward the upper bound of the range. This is where strong markets usually make a decision:

either defend structure… or break it.

For now, I’m not guessing bottoms. I’m simply respecting the level.

Hold this zone, and upside scenarios stay valid. Lose it, and the picture changes entirely.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ETH-D

Why You Should Backtest (Before You Trust Any Strategy)Most traders ask the wrong question.

They ask:

“Does this strategy work?”

The better question is:

“When does this strategy stop working?”

Backtesting exists to answer that.

1. A Single Backtest Is Not Proof

One profitable run does not mean a strategy is good.

It means it worked once, under one set of assumptions.

Markets change.

Volatility changes.

Behavior changes.

Backtesting across parameters, symbols, and timeframes shows whether performance is structural or accidental.

2. Drawdown Matters More Than Profit

Profit attracts attention.

Drawdown determines survival.

Two strategies can both make money.

Only one lets you stay disciplined long enough to compound.

Backtesting reveals:

Worst historical drawdown

Length of drawdowns

Recovery behavior

If you don’t know those, you don’t know the strategy.

3. Most Strategies Fail From Fragility

Many strategies look great until you:

Change RSI length by 2

Shift timeframe slightly

Switch from BTC to ETH

If performance collapses from small changes, the edge isn’t robust.

Backtesting exposes fragility before the market does.

4. Backtesting Protects You From Yourself

Most trading mistakes aren’t technical.

They’re emotional.

Backtesting:

Sets realistic expectations

Reduces overconfidence

Prevents panic exits during normal variance

Confidence comes from data, not conviction.

5. Backtesting Is About Risk, Not Prediction

Backtesting doesn’t predict the future.

It defines boundaries.

It tells you:

What’s normal

What’s abnormal

When something is truly broken

That’s the difference between trading and guessing.

Final Thought

Strategies don’t fail because they’re bad.

They fail because traders never tested their limits.

Backtesting isn’t optional.

It’s the cost of taking trading seriously.

Why Default Strategy Settings Break Down Across MarketsThe Assumption: Defaults Are Good Enough

Most traders start with default indicator settings . RSI at 14. MACD at 12, 26, 9. Moving averages set to familiar values.

Defaults feel safe because they are familiar. They feel reasonable because they are widely used.

The problem: defaults are not designed to work across all symbols, timeframes, or market conditions.

The solution: instead of assuming defaults are acceptable, test how those settings behave when parameters are varied. Small changes often reveal whether a strategy is stable or dependent on coincidence.

The Assumption: If It Works on One Chart, It Should Work Elsewhere

A strategy looks clean on a single chart. Entries make sense. Losses feel explainable. Confidence builds.

The problem: one chart is not a market. Performance on a single symbol or timeframe says very little about robustness.

The solution: test the same logic across multiple symbols and timeframes. When behavior changes dramatically, it’s not failure, it’s information. Consistency across variation is what signals durability.

The Assumption: Indicator Logic Is the Edge

Traders often focus heavily on the logic behind indicators. Momentum, trend, mean reversion. The reasoning feels solid.

The problem: good logic does not guarantee good behavior. Two parameter sets can follow the same logic and produce completely different risk profiles.

The solution: explore how performance shifts as parameters move. Testing ranges, not single values, shows whether logic holds up under pressure or collapses when assumptions change.

The Assumption: Profit Tells the Full Story

Many traders judge strategies by net profit alone.

The problem: profit without context hides risk. Large drawdowns, unstable equity curves, or long stagnation periods often go unnoticed until they’re experienced live.

The solution: test for drawdown, consistency, and trade distribution alongside profit. Seeing how risk expands or contracts across parameter combinations changes how strategies are evaluated.

The Assumption: Defaults Fail Because Markets Changed

When defaults stop performing, traders often blame the market.

The problem: markets always change. A strategy that only works under narrow conditions was fragile from the start.

The solution: testing across broader conditions reveals whether a strategy is regime-dependent or structurally resilient. This allows expectations to adjust before capital is exposed.

What Testing Actually Replaces

Testing doesn’t replace strategy logic.

It replaces assumptions.

It replaces:

“This should work”

“This looks reasonable”

“Everyone uses this”

With:

“This is how it behaves”

“This is where it struggles”

“This is how sensitive it is”

Final Thought

Default settings are not wrong.

They are incomplete.

They are a starting point, not a conclusion.

The moment defaults are tested across parameters, symbols, and timeframes, they stop being assumptions and start becoming data. That shift is where real understanding begins.

Ethereum (ETH/USDT): Descending Triangle Breakdown ScenarioHI

Ethereum is currently trading within a descending triangle formation, developing after a strong bearish impulse.

Following the sharp sell-off, ETH attempted several recoveries but consistently failed to reclaim higher levels. Price is now compressed between:

A descending internal trendline, acting as dynamic resistance and clearly respected by multiple rejections.

A horizontal support base, forming the lower boundary of the triangle.

This combination reflects a market where sellers remain in control, while buyers are only managing to slow the decline rather than reverse it.

Trade Thesis (Main Idea)

The key setup here is a breakdown of the triangle’s lower boundary:

Trigger: A confirmed break and close below the bottom support of the triangle

Bias: Short position on breakdown confirmation

Target: $2,806, aligned with a high-probability demand zone and prior liquidity

Invalidation: A strong reclaim above the descending trendline would invalidate the bearish continuation scenario

1W ETH Update: Back in the dreaded range ETH update – back inside the range

Ethereum has now reclaimed the range on the weekly, and that’s the key takeaway here.

After the downside reaction, price has rotated back above prior range support, and this week’s candle confirms acceptance rather than a quick rejection. That’s exactly what you want to see after a shakeout.

What stands out:

• ETH is back trading within the established HTF range

• The reclaim around the mid-range held

• Weekly structure remains intact

• This move invalidates immediate breakdown risk

This reinforces the idea that the recent selloff was a liquidity sweep and positioning reset, not a structural failure. As long as ETH holds inside this range, the path of least resistance is continued chop with an upside bias, not trend reversal.

Range rules apply again:

Below support → reassess

Inside range → patience

Acceptance toward range highs → expansion potential

ETH did the hard part by getting back inside. Now it’s about continuation and confirmation.

The key is whether the price can rise above the uptrend line

Hello, fellow traders.

By "Following," you can always get the latest information quickly. Have a great day today.

-------------------------------------

#ETHUSDT

We need to observe the price action from around January 28th to February 4th.

The key is whether it can find support around the 2.828.57 to 2.887.66 range and rise above the uptrend line.

If it fails to rise, we need to check for support around the 2.419.83 to 2.706.15 range.

If the decline continues, the maximum decline is expected to be around the 1597.76 to 1861.57 range.

-

If it falls below the HA-Low indicator on the 1D chart, a stepwise downtrend is likely.

Since the downtrend ends with an uptrend, trading to increase the coins (tokens) corresponding to the profits is possible.

The basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

The time to stop increasing the amount of coins (tokens) representing profits is when the price rises above the M-Signal indicator on the 1M chart and shows support.

This is because increasing the amount of coins (tokens) representing profits when the price is trending upward can actually decrease the number of coins (tokens).

To continue the uptrend by breaking above a key point or range, the StochRSI, TC, and OBV indicators must show upward trends.

If possible,

1. The StochRSI indicator should not have entered the overbought zone.

2. The TC indicator should remain above 0.

3. The OBV indicator should remain above the High Line.

If the above conditions are not met, caution is required when trading, as the price may only pretend to rise and then fall again.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

ETH — Price Slice. Capital Sector. 2798.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2798.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2799.17 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2799.17 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

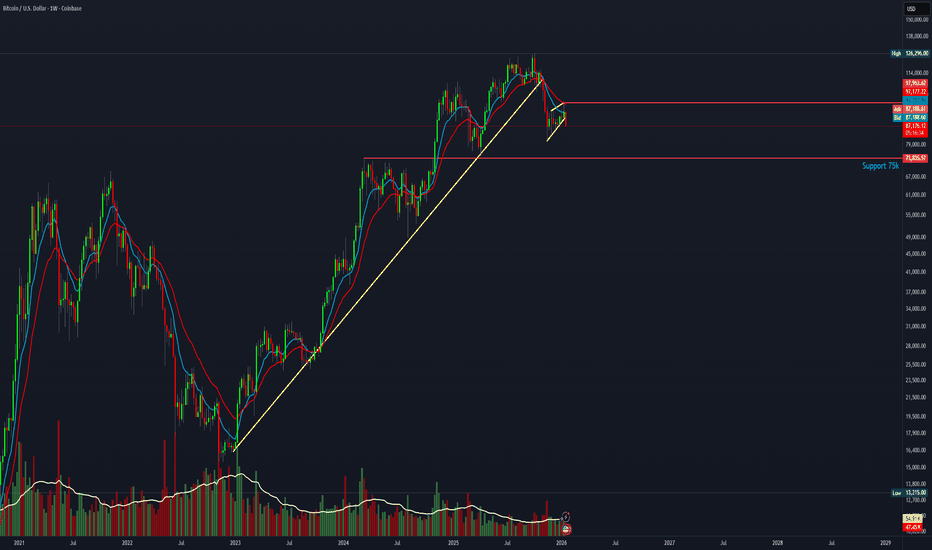

BTC — Price Slice. Capital Sector. 86259.97 BPC 15© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 BTC — Price Slice. Capital Sector.

TradingView Publication Date: 10.01.2026

🏷 86259.97 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 15

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — BTC (numerical equivalent):

🏷 In development — coming soon

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

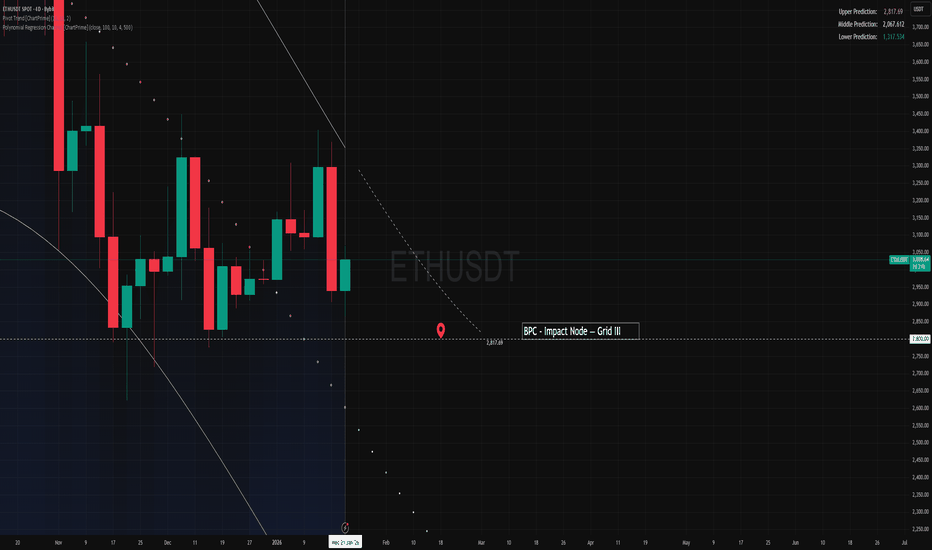

ETH — Price Slice. Capital Sector. 2800 BPC Impact Node© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 2800 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Impact Node — Grid III

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2800.85 BPC 8.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 21.01.2026

🏷 2800.85 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 8.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2807.81 BPC 7.2© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 28.12.2025

🏷 2807.81 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 7.2

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

BRIEFING Week #4 : Look for the Dollar SignalHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

ETH 751% profits potential with 20X leverage —LONG tradeEverybody loves Ethereum. We all love Bitcoin. It is even more lovely when you get to make money trading Bitcoin and Ethereum. The Cryptocurrency market is awesome. Timing is great.

I would like to share with you some trade-numbers, these are for a huge LONG on ETHUSDT with high leverage. Low risk vs a high potential for reward.

What's your take on this chart setup?

_____

LONG ETHUSDT

Leverage: 20X

Potential: 751%

Allocation: 3%

Entry zone: $2850 - $3000

Targets:

1) $3175

2) $3333

3) $3515

4) $3800

5) $4065

Stop: $2825

____

Thanks a lot for your support over the years. It is always a great experience to share with you.

I am wishing you tons of profits. I am wishing you abundance, health, wealth and success.

You are a divine living being and you will always deserve the best.

Namaste.

Stress-Testing Bollinger Bands Across Major Crypto AssetsBollinger Bands are one of the most widely used volatility-based strategies in crypto. Rather than evaluating a single configuration, I ran a large-scale parameter sweep to observe how the same breakout logic behaves across different assumptions.

For this test, I backtested 2,700+ Bollinger Bands Breakout configurations across BTC, ETH, SOL, and AVAX, varying timeframe, band length, standard deviation, and trade direction (long + short) within realistic, non-extreme ranges.

The results showed a wide dispersion of outcomes. Many configurations appeared profitable in isolation, but most exhibited unfavorable drawdown characteristics or were highly sensitive to small parameter changes. Timeframe selection had a larger impact on risk profile than individual band settings, and configurations that performed well on one asset often failed to generalize across others.

A smaller subset of parameter clusters demonstrated comparatively better balance between return and drawdown, but even these were not broadly stable across the full test space.

The takeaway is not about identifying a “best” Bollinger Bands setup. It’s about robustness. Single backtests can be misleading. Examining distributions across symbols, timeframes, and parameters provides a clearer view of where performance is coming from — and where risk is hiding.

What will happen given the tensions?As you know, the accumulation of military equipment in the Middle East has strengthened speculation about a potential conflict with Iran, and this is impossible to ignore. This alone provides a strong justification for the rise in gold, silver, and other key metals. Additionally, the uncertainty surrounding Greenland and ongoing geopolitical tensions further contribute to this trend.

Now, moving to the technical analysis: since the price has broken down from the descending triangle pattern, it could decline toward $2630, or even lower, potentially reaching $2400. This bearish movement is likely to continue as long as geopolitical tensions persist.

Best regards CobraVanguard.💚

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

ETH — Price Slice. Capital Sector. 2841.70 BPC 9.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 2841.70 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 9.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2847.11 BPC 2.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2847.11 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear users!

At the request of all those who support my work and use it for analytics, I’ve decided to start publishing short weekly analytical notes for the upcoming week. Subscribe and read — you already have all the tools to see the market clearly: Prefactum prices, quantum analytics, analytical notes, and the monitoring dashboard.

Every price represents a separate energy block and scenario, down to the smallest changes. I would like to thank the TradingView moderators for the opportunities provided on the international stage.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2857.16 BPC 6.6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 2857.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.6

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

RSI SMA Cross – BTC & ETH Multi-Timeframe TestThe RSI SMA crossover is a simple and widely used TradingView strategy, often assumed to behave consistently once “good” parameters are selected. Rather than evaluating it on a single symbol or timeframe, I tested how the same logic performs across different market environments.

For this test, I ran a parameter sweep across multiple symbols and timeframes, keeping the strategy logic fixed while varying only RSI length and SMA length within reasonable ranges. The test covered BTCUSDT and ETHUSDT across 4H, 1D, 3D, and 1W timeframes, resulting in 160 total combinations.

The goal was not to find a single optimal configuration, but to observe whether performance is driven more by indicator parameters or by the trading environment itself.

Representative Results (Risk-Adjusted)

Below are four configurations that best illustrate the results and support the overall conclusions. These were selected for balance between profitability, drawdown, and trade frequency rather than headline return alone.

1) BTCUSDT — 1D (Most Stable Overall)

RSI Length: 28

SMA Length: 50

Profit Factor: ~1.77

Trades: ~109

This configuration showed the most consistent risk-adjusted behavior across nearby parameter sets and was less sensitive to small changes than others.

2) BTCUSDT — 1D (Lower Drawdown Variant)

RSI Length: 21

SMA Length: 50

Profit Factor: ~1.70

Trades: ~121

Slightly lower profitability than the first configuration, but meaningfully lower drawdown, highlighting a trade-off between responsiveness and stability.

3) ETHUSDT — 1D (Best ETH Environment)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: ~110–120

ETH showed acceptable performance on the daily timeframe, but drawdowns were consistently higher than BTC under similar settings.

4) BTCUSDT — 4H (Higher Activity, Lower Stability)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: 400+

Lower timeframes increased trade frequency substantially but introduced significantly more drawdown and instability.

Takeaway

Across all tests, performance varied far more by symbol and timeframe than by RSI or SMA length. Small parameter changes often mattered less than the environment the strategy was applied to. Some symbol/timeframe combinations remained relatively stable, while others deteriorated quickly despite using identical logic.

The broader takeaway is that strategy performance is often environment-dependent rather than parameter-dependent. Evaluating a strategy on a single symbol or timeframe can give a misleading sense of robustness. Testing across multiple environments provides a clearer view of where a strategy holds up and where it breaks down.

I’m documenting these tests to better understand robustness, sensitivity, and how commonly used TradingView strategies behave under different market conditions.

Weekly analysis 26th-30th January 2026In this video, we present a weekly market outlook for USD, EUR, and Ethereum (ETH) covering the period 26th–30th January 2026.

The analysis focuses on key technical levels, market structure, and momentum across major currency pairs and the crypto market. We break down recent price action, identify critical support and resistance zones, and discuss potential scenarios that may shape market movements during the week ahead.

Ethereum, USD, EUR, SPX500, FTSE100, CAC40, DAX40.

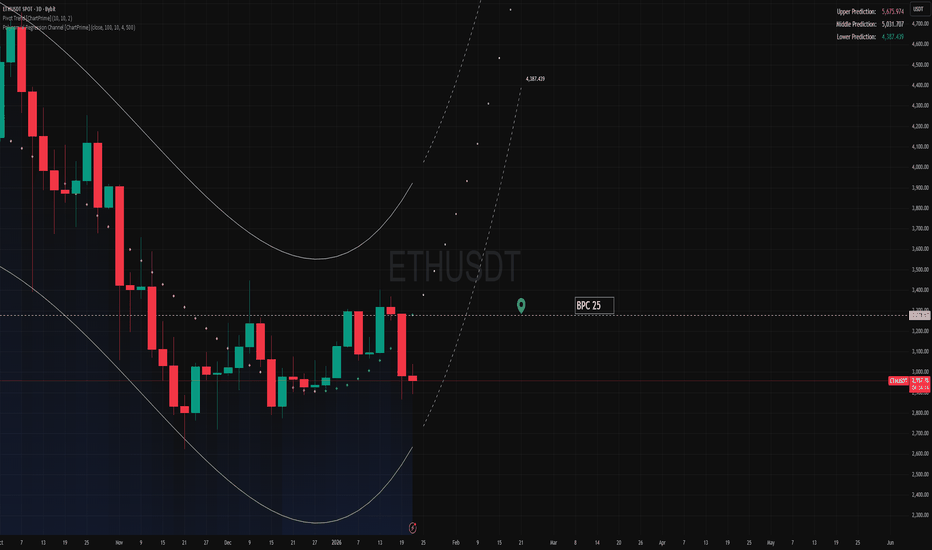

ETH — Price Slice. Capital Sector. 3278.67 BPC 25© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 3278.67 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 25

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant