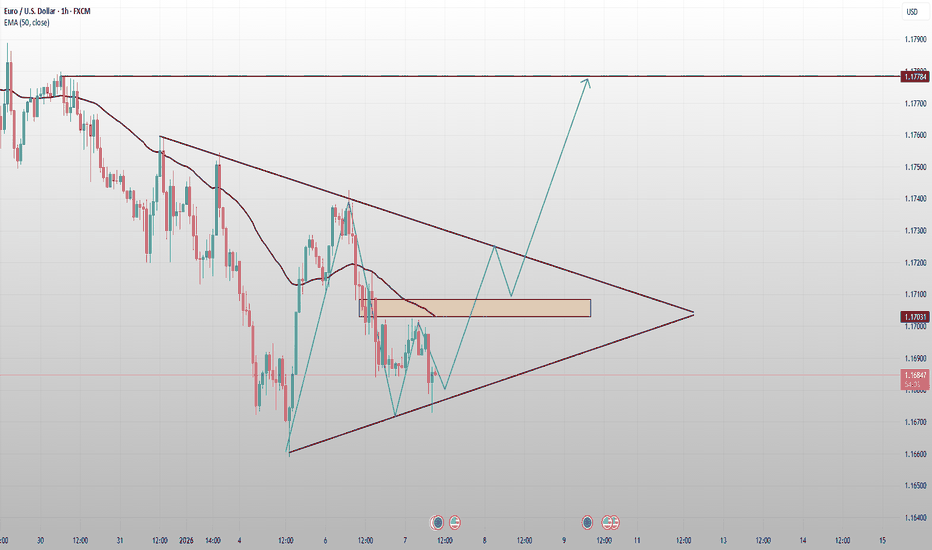

EURUSD Compressing Into a Triangle — Volatility ExpansionEURUSD on H1 is currently trading within a symmetrical triangle, reflecting a clear contraction phase after the prior bearish move. The market is no longer trending impulsively; instead, price is compressing between descending resistance and ascending support, signaling indecision and energy build-up.

Structurally, sellers remain in control below the descending trendline, while buyers are gradually stepping in at higher lows. Price is trading below the EMA 50, which continues to act as dynamic resistance and reinforces the corrective nature of the current price action rather than a confirmed trend reversal.

A key supply / reaction zone around 1.1700–1.1710 has already caused multiple rejections. This area is critical for short-term direction, as acceptance above it would signal a shift in momentum, while rejection keeps the compression bearish-neutral.

At the same time, the rising trendline support is holding, preventing immediate continuation to the downside. This confirms that the market is waiting for a break-and-confirm before committing to the next directional move.

Bullish scenario: A clean breakout above the descending trendline, followed by acceptance above 1.1710, would confirm bullish continuation toward 1.1750 and potentially 1.1780.

Bearish scenario: Failure to break resistance and a confirmed breakdown below the ascending support would expose downside targets toward 1.1680, with extension risk toward 1.1650.

Until a breakout occurs, entries inside the triangle carry elevated risk. Patience is key — the best opportunities will come after confirmation, not while price remains compressed within the structure.

ETH

Ethereum Is Losing Momentum — Distribution Before a PullbackPrice is currently stalling below the key resistance zone around 3,260–3,300, showing clear signs of bullish exhaustion after a strong impulsive rally. Repeated rejections from this area suggest distribution rather than continuation.

A failure to hold above 3,240–3,250 keeps the short-term bias bearish, opening room for a corrective move toward the first support at 3,210–3,190, where price may attempt a temporary bounce.

If selling pressure persists and price breaks below the EMA50 and 3,190 support, the correction could extend deeper toward 3,150 → 3,130, with a worst-case liquidity target near 3,080. Only a strong reclaim and close above 3,300 would invalidate the bearish pullback scenario and revive upside continuation.

Ethereum at a Structural Pivot: Continuation Reload 📊 MARKET STRUCTURE & PRICE ACTION OVERVIEW

Ethereum remains in a broader bullish market structure, characterized by higher highs and higher lows following a strong impulsive advance. After the expansion leg, price transitioned into a range-bound consolidation, reflecting temporary equilibrium between buyers and sellers rather than trend exhaustion.

Multiple attempts to push higher were met with sharp reactions, suggesting active supply near the highs, yet downside momentum has remained limited. This behavior indicates that sellers are reacting, but have not taken control of structure.

The market is now coiling within a defined support–resistance box, preparing for its next expansion phase.

🟦 SUPPLY & DEMAND – KEY ZONES

Key Resistance Zone:

The 3,300–3,310 area acts as a clear supply cap, where prior bullish momentum stalled and aggressive selling emerged. This zone represents institutional selling pressure and remains the level bulls must reclaim for continuation.

Primary Demand / Support:

The 3,240 zone is a critical demand area, aligning with:

Previous breakout structure

Horizontal support

Rising EMA (dynamic demand)

Secondary Demand:

Below that, 3,215–3,220 serves as deeper demand and structure protection. A move into this area would still be considered corrective unless followed by acceptance below.

🎯 CURRENT MARKET POSITION

Currently, ETH is trading near the lower boundary of its consolidation range, sitting directly above demand. This places price at a decision point, where buyers are expected to defend structure if the bullish trend is to remain valid.

The absence of strong bearish follow-through on recent pullbacks suggests selling pressure is corrective, not impulsive.

🧠 MY SCENARIO

As long as Ethereum holds above the 3,240 support zone, the broader bullish structure remains intact, and current price action can be treated as a corrective pullback within an uptrend. A sustained bounce from demand would likely lead to another test of the 3,300–3,310 resistance, and acceptance above this zone could open the door for continuation toward higher highs.

However, a clean breakdown and hourly acceptance below 3,240 would weaken bullish control and signal a deeper retracement toward the 3,215 demand zone. Only a failure to hold that lower demand would suggest a more meaningful structural shift.

For now, Ethereum remains in compression, not reversal.

⚠️ RISK NOTE

Price is sitting at a critical structural level. Wait for confirmation, respect key zones, and always manage your risk.

ETHUSD H4 | Falling Towards 50% Fib SupportThe price is falling towards our buy entry level at 3,053.65, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 2,914.81, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Our take profit is set at 3,252.70, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

ETH/USDT | new ATH ahead in 6 Months! (READ THE CAPTION)Ethereum rallied to $3,300 and is currently attempting to hold above this level. If price stabilizes above $3,300 within the next 24 hours, the next short-term targets are $3,450 and $3,620. A clean break above $3,620 could accelerate momentum toward $3,850 and $4,000. The $2,100–$2,700 demand zone remains a strong institutional support, and as long as Ethereum stays above it, the medium-term outlook remains bullish with a high probability of reaching a new all-time high in the first half of the year.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

$ETH – Early Bottoming Signs + W-Base DevelopingCRYPTOCAP:ETH – Potential Bottoming Process After a 50% Retracement

Ethereum ( CRYPTOCAP:ETH ) is starting to show early signs of a bottom, and the first few weeks of the year often give important clues about where crypto wants to go next.

🔹 Big Picture Context:

CRYPTOCAP:ETH has retraced nearly 50% from the $5,000 highs, a very normal reset after a major cycle move.

We now appear to be entering a rounding phase, with the structure starting to resemble a W-bottom on the daily chart.

This is typically the repair phase before momentum returns.

🔹 Key Levels That Matter:

We’ve now popped back over $3,000, which is an important psychological and technical reclaim.

From here, I want to see a pullback — but it must hold and form higher lows.

If ETH can continue making higher lows on the daily, the next major trigger becomes $3,500.

🔹 My Trade Plan (Patience First):

I am not in this yet.

I want to see:

1️⃣ A pullback that holds above prior support

2️⃣ A higher low on the daily chart

3️⃣ A bit more structure and tightening

If that happens, I’ll look to load up before the $3,500 breakout, not chase it.

🔹 Why This Matters:

Strong trends are built from bases, not from V-shaped bounces.

A clean W-bottom followed by a $3,500 break would signal a trend shift, not just a bounce.

This is how sustainable crypto moves start.

Watching closely — structure first, then size.

ETH CYCLE CHART (LONG-PLAY) ETH/USD: The Macro Fractal – History Rhymes

Ethereum The Great Fractal & Cyclical Symmetry – In-Depth Technical Analysis 🏛️

While markets may appear chaotic, human psychology remains constant, creating price action that moves within a specific mathematical order and symmetry. This analysis explores the fractal similarity between Ethereum's 2016-2017 cycle and the current market structure, alongside the logarithmic growth channel.

"History doesn't repeat itself, but it often rhymes." – Mark Twain

When we zoom out and switch to the Weekly Logarithmic Scale, the noise of daily volatility fades away, and a clear structural symmetry emerges. This chart illustrates the undeniable fractal similarities between the 2016-2017 cycle and our current market structure.

Here is the technical breakdown of the Big Picture:

The Ascending Green Channels (The Trend is Your Friend) 🟢 The price action is respecting a massive, multi-year ascending parallel channel.

2016-2017: We saw a touch of the lower boundary followed by a parabolic run to the upper boundary.

Current Cycle: We have been consolidating in the lower half of this channel. As long as the lower green boundary holds, the macro trend remains strictly BULLISH.

The Fractal Structure (Accumulation vs. Boredom) 📉➡️📈 The chart highlights two distinct correction phases (marked by the orange/black converging lines):

The Past: The post-2017 correction was long and painful, designed to shake out weak hands before the next impulse.

The Present: We are witnessing a larger, time-expanded version of that same pattern. The price is compressing within a wedge/flag structure. This "boredom" phase is usually the precursor to significant expansion.

The Projection 🚀 The Green Arrows represent the path of least resistance once the breakout occurs.

A breakout above the internal resistance (the falling trendlines) confirms the end of the accumulation phase.

The target is the upper boundary of the logarithmic channel. In this macro view, this suggests a potential move toward the $13,000 - $16,000 region in the coming years

1. The Logarithmic Growth Channel (The Macro Channel) 🟢

The backbone of this chart is the Ascending Green Parallel Channel that has supported the price since 2015.

Lower Band (Support): The "Generational Buy Zone." Historically, every touch of this band has offered the highest Risk:Reward (R:R) ratio.

Upper Band (Resistance): The "Euphoria" zone. This is where price goes parabolic and market sentiment peaks.

Current State: Price is currently trading in the equilibrium (mid-lower) area of the channel. This indicates the trend is still bullish, but we have not yet entered the manic (parabolical) phase.

2. Fractal Analysis: Historical Recurrence 🔄

The structural similarity between the left (2017) and right (2021-Present) sides of the chart is no coincidence.

Structure A (2016-2017 Setup): A sharp initial impulse followed by a grueling "Falling Wedge" style correction. During this process, weak hands were shaken out while institutional/smart money accumulated.

Structure B (Current Cycle): We are seeing a similar structure, but on a larger timeframe. As Market Cap grows, the energy and time required to move the asset increases. Therefore, the correction/accumulation process is more "extended" and prolonged.

Black & Orange Lines: These represent the "Dynamic Resistance" pressing price down and the "Dynamic Support" holding it up. Escaping this compression zone (apex) is the trigger that starts the next major wave.

3. "Lengthening Cycles" Theory ⏳

Notice that the compression zone in the first cycle (left) was steeper and shorter. The current cycle (right) is more horizontal and time-consuming.

This supports the "Lengthening Cycles" theory.

While volatility decreases, the potential for sustainable growth increases. This "boring" sideways action is actually the phase where the fuel (liquidity) for an explosive move is being gathered.

4. Targets and Expectations (The Green Arrows) 🚀

The green arrows are not drawn randomly; they target the upper boundary of the logarithmic channel.

Short-Mid Term: Upon breaking the Black/Orange falling trend, the first target is the previous All-Time High (ATH) region.

Long Term (Macro Target): A journey to the upper band of the channel suggests a potential for Ethereum to reach the $10,000 - $16,000 range, depending on the time factor.

Coinranger|ETHUSDT. Potential pullback to 3100 and below.🔹At 16:15 UTC+3 - ADP nonfarm payrolls data.

🔹At 18:00 UTC+3 - PMI in services and the JOLTS employment report. More important.

Volatility is possible on both news

🔥ETH

🔹Almost reached the ideal extension on h1:

1️⃣ 3336 and 3386 are still potentially significant.

2️⃣ 3152, 3100 (potential turning point), 3025, and 2960 is a full set of downward waves with extensions.

We're keeping an eye on Bitcoin. The advantage for price reduction.

XRP Ratios | Relative Strength Confirmation EmergingXRP is now beginning to confirm relative strength versus both BTC and ETH following yesterday’s spot-level early expansion signal.

After an extended period of compression, both XRP/BTC and XRP/ETH have transitioned into early expansion on the Daily timeframe, with structure shifting in favor of continuation rather than mean reversion.

Key observations:

• Both ratios have now closed above key EMAs on the Daily, marking a structural shift rather than a single-candle anomaly.

• Second consecutive expansion candles suggest momentum persistence, not a one-off spike.

• ATR has turned upward, confirming volatility expansion at the ratio level.

• RSI has moved into expansion territory, supporting momentum continuation rather than exhaustion.

• OBV is stabilizing and beginning to slope higher, indicating improving participation beneath price.

At this stage, this move represents relative strength confirmation, not a mature trend. The important signal here is that XRP is no longer lagging — it is beginning to outperform broader crypto benchmarks.

Follow-through and structure maintenance on the Daily timeframe will be key in determining whether this evolves into sustained leadership.

For now, XRP has successfully transitioned from spot-level momentum ignition into early relative strength expansion, placing it firmly on watch.

⭐ Final Clarity Note ⭐

This marks an early relative strength transition. Confirmation will come through sustained structure and follow-through — not immediate price acceleration.

ETH Is Consolidating — Continuation Still Favored.Price remains in a bullish structure after a strong impulsive leg up. Recent candles show range-bound consolidation above support, not a breakdown.

Price Behavior / Momentum

Pullbacks are contained and shallow, with buyers defending the support zone. No aggressive rejection from highs → momentum is cooling, not reversing.

Key Levels

Resistance / Target: 3,260 → 3,310

Support Zone: 3,190 – 3,200

Invalidation: Below 3,180

Scenarios

➡️ Primary: Holding above the support zone opens continuation toward 3,260, then 3,310.

⚠️ Risk: A clean break below 3,180 would signal deeper correction and delay the bullish scenario.

Conclusion

Bias remains bullish, as long as price holds above the support zone.

SHOCKING ETHUSD Update: The 3,200 Level is a Powder KegHello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Market Structure: Ethereum has been in a sustained bullish trend, characterized by aggressive impulse moves followed by shallow consolidations. Price action is consistently making higher highs and higher lows, supported by a steep rising trendline.

Price Action and Support: After the most recent vertical expansion, the market has entered a consolidation phase. Price is currently hovering just above a newly established Support Zone around the 3,200 level. This zone is critical as it aligns with the previous breakout structure and is being reinforced by the blue EMA, which is acting as dynamic support.

Key Levels: The immediate floor is the Support Zone between 3,200 and 3,210. On the upside, the recent local high serves as the first resistance target, with the psychological level of 3,300 being the broader objective if the trend continues.

My Scenario: As long as ETHUSD remains above the 3,200 Support Zone, the bullish bias is firmly intact. I expect a period of sideways accumulation here before another leg higher to test new local highs. However, a decisive break and close below this support would suggest a deeper correction toward the secondary trendline or the red EMA.

Manage your risk!

Ethereum Will Take Off Soon (1D)📊 Ethereum (ETH) – Updated Bullish Scenario Amid Complex Correction

Before anything else, pay attention to the time frame; the time frame is daily. Based on the latest available market data and the prolonged range-bound price action near the local lows, it is reasonable to restructure Ethereum’s primary scenario. While the overall bias remains bullish, both price targets and timing expectations have been adjusted to better align with the current market structure.

🔍 Market Structure & Neo Wave Perspective

From the point marked by the red arrow on the chart, Ethereum entered a bearish corrective phase. However, this move does not suggest a trend reversal. Instead, it strongly resembles a complex double correction within a larger bullish structure.

First correction: A clear ABC corrective pattern

Second correction: A contracting triangle

These two corrective structures are connected via an X wave, forming a classic W-X-Y corrective formation

This type of structure is commonly observed in higher-timeframe consolidations before strong impulsive continuations.

🔺 Triangle Breakdown (A–B–C–D–E)

Current price behavior suggests that Ethereum is trading inside the D wave of the corrective triangle:

The slow, overlapping, and corrective upward movements strongly indicate that the market is not impulsive, confirming we are still within a correction.

Price action around the red zone is likely to mark the completion of wave D.

Following this, a final pullback for wave E is expected, which typically acts as a bear trap before trend continuation.

🟩 Green Zone & Bullish Continuation Scenario

As price approaches the green box area, conditions may become ideal for:

Completion of wave E

End of the entire corrective triangle

Initiation of the next impulsive bullish leg

Once wave E is completed, Ethereum is expected to resume its primary bullish trend, with upside targets at:

🎯 $3,500

🎯 $3,800

These levels align with previous structural highs and Fibonacci extensions from the corrective base.

⚠️ Invalidation Level & Risk Management

This bullish scenario remains valid as long as price holds above the invalidation level.

A daily candle close below this level would invalidate the wave count and require a full reassessment of the market structure.

🧠 Final Thoughts

Market sentiment may feel weak during wave E, but historically this is where smart money positions itself

Patience is key during complex corrections

The structure favors trend continuation rather than reversal

📌 As always, risk management is essential, and this analysis reflects a probabilistic scenario—not financial advice.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

ETH Short-term analysis | Trading and expectationsCRYPTOCAP:ETH

🎯Wave 1 appears to have completed a leading diagonal. Wave 2 appears complete with the recent higher high. Price was rejected at the daily 200EMA but is attempting to break through again. Overcoming this will be very bullish, especially as we are above the daily pivot.

📈 Daily RSI is printing bearish divergence. A move above wave (1) is essential to negate this, or prices could head to new local lows.

👉 Analysis is invalidated below wave (2)

Safe trading

ETHUSD H4 | Could We See A Reversal From Here?Based on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 3,258.01, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our stop loss is set at 3,375.95, which is an overlap resistance.

Our take profit is set at 3,075.27, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

ETHEREUM - Consolidation near 3150 ahead of rallyBINANCE:ETHUSDT.P is rising after breaking through trend resistance and consolidating. The main trend remains bearish, but there are local indications of bullish support. The 3150 trigger is ahead.

Bitcoin is strengthening amid geopolitical nuances, acting as a hedging factor (locally). A rise in the leading cryptocurrency could support Ethereum, which, in turn, could trigger a breakout of 3150 and a subsequent rally.

Ethereum is consolidating near 3150, forming resistance (a trigger). Technically, consolidation continues, and the coin may test local lows at 3120-3100 before retesting 3150 and continuing the rally.

Resistance levels: 3150, 3200, 3270

Support levels: 3120, 3100, 3077

If the pullback is not deep and the price quickly returns to retest 3150, then we can continue to monitor the coin, waiting for a signal to long...

If the bulls hold the price above resistance after breaking through 3150, this move could trigger continued growth toward 3200-3270.

Sincerely, R. Linda!

BTC Update — Rising Risk of a Pullback Toward 85KBTC Update — Rising Risk of a Pullback Toward 85K

Last update with Data proven trend.

Bitcoin is currently trading inside a strong resistance / supply zone around 93–94K, where price is starting to show signs of exhaustion after a sharp impulsive move up.

What the Chart Is Showing

📉 Rejection risk at resistance: Price is pushing into a heavy supply zone with limited follow-through.

🧱 Weak continuation structure: Momentum is slowing, and upside progress is becoming inefficient.

🔄 Distribution signals: The current range suggests potential distribution rather than accumulation.

Bearish Scenario (High Probability)

If BTC fails to hold above the 92–93K zone, a deeper correction becomes likely.

The projected move points toward the 85K area, which aligns with:

Previous demand

Liquidity resting below recent lows

A clean reset level for structure

Key Levels to Watch

93–94K: Major resistance / invalidation zone for shorts

92K: Short-term support — loss of this level increases downside momentum

85K: Primary downside target and potential bounce zone

Summary

At this stage, BTC has a high probability of rolling over from resistance.

Unless price reclaims and holds above 94K with strong volume, the path of least resistance points down toward the 85K zone.

📌 Caution is advised — this looks more like a pullback phase than a breakout continuation.

ETHEREUM: Crucial Formation, Important Levels to Watch!Hello There,

on the short-term perspective Ethereum is forming crucial bearish pressure which could be decisive within the near future. While Ethereum remains the second largest cryptocurrency, it is recently forming crucial formations that should not be underestimated. In the past weeks, trading actions already showed major selling pressure occurred from whales dropping their ETH on the market. Now, there is an important formation forming, which could be the setup of a determined continuation. Especially when the levels confirm this will likely lead to an exaggerated price move.

When looking at the chart, we can see Ethereum is now trading within this major downtrend channel in which it already formed major bearish pressure. Furthermore, it formed a bearish EMA crossover to the downside, confirming the bearish trend. The several lower lows of the bearish trend mark the significance of this condition. Now, within the past few days, Ethereum set up to form a bear flag formation within the downtrend.

Within this bear flag formation, Ethereum already completed the initial waves A and B of the inner bear flag formation. Now with wave C, Ethereum is likely to move into the upper resistance zones. There is a major resistance zone within the upper boundaries of the channels. Several resistances come together, such as the upper boundary of the descending channel, the upper boundary of the bear flag, and the horizontal resistance line.

With a bounce into this area, which should be expected within the next times, Ethereum is entering a really crucial zone from where a pullback is highly likely. Especially when more and more whales enter the market and short sell, a pullback from this area will be an origin for bearish pressure towards the downside. The whole bear flag formation will be confirmed with a breakout below the lower boundary of the flag formation.

Once this formation has been completed, the targets as seen in my chart will be activated. From there on, a bearish continuation could also be likely if Ethereum does not manage to reverse in this area. In any case, this will be a highly important area to watch out for. Currently, it is important to consider the next phases of development and how Ethereum reacts to the resistance zones. The bearish price pressure should not be underestimated in any case.

With this being said, it is great to consider the important trades upcoming.

We will watch out for the main market evolutions.

Thank you very much for watching!

ETH New Analysis (4H)This analysis is an update to the previous one, which you can find in the related analyses section.

Since no significant capital flowed into Ethereum, the pattern changed in a way that shortened the target of the next wave. As we are in the final days of the year, market liquidity is low, which is why we are seeing increased volatility and erratic behavior across market assets.

Analysis is not very effective these days, and as we announced a week ago, you should reduce your trading volume due to the year-end conditions | for exactly these reasons.

Instead of the previous diametric analysis, the price structure appears to have shifted into a wider pattern. This expansion is due to the lack of capital inflow and overall low liquidity in the market during these year-end days.

Price is expected to be supported from the origin of the move, which we have highlighted in green on the chart.

Ethereum is still owed an upward move, but it is likely to make this move with difficulty. The targets are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ETH Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:ETH

🎯 Wave (IV) appears to have completed a multiyear running flat with weekly bullish divergence. A new motif wave is underway, completing its wave 1 of 5 with a poke above all time high on weekly bearish divergence. Wave 2 appears complete at the 0.5 Fibonacci retracement and High Volume Node support. Wave 3 has a target of the R4 weekly pivot at $7348. Wave 5 could extend towards $10,000.

📈 The retracement has been shallow compared to other alts. Weekly RSI is flipping bullish from below the EQ while price is about to challenge the weekly pivot. Price is above the weekly 200EMA, keeping the bullish trend in tact.

👉 Analysis is invalidated only if we get below$2634, keeping wave 2 alive.

Safe trading

Ethereum Is Pressing the Ceiling — Breakout or Final Rejection Hello everyone,

On the H1 timeframe, the key focus right now is not chasing upside, but evaluating how Ethereum is behaving at a critical resistance cluster after a well-structured recovery. Price has already done the hard work on the downside; the market is now at a decision point.

After the sharp sell-off into the 2,900–2,920 support zone, ETH formed a clean base and transitioned into a step-by-step recovery, printing higher lows and reclaiming multiple intraday levels. The advance has been orderly and controlled, not impulsive — a sign that buyers are rebuilding positions rather than FOMO buying.

Structurally, price has now pushed into the 3,020–3,035 resistance zone, which has historically capped upside. The current candles are reacting directly at this level, confirming it as active supply, not a level the market can ignore. This is exactly where we expect hesitation, consolidation, or a rejection attempt.

From a price action perspective, two valid scenarios are visible directly on the chart:

- Primary scenario: a shallow pullback toward the 3,000–3,010 area to retest demand, followed by another push higher. Acceptance above 3,035–3,050 would confirm a breakout and open the door toward 3,070–3,100.

- Alternative scenario: failure to hold above reclaimed levels, leading to a deeper pullback toward 2,970–2,990, where buyers would need to step in again to keep the bullish structure intact.

Importantly, there is no distribution pattern yet. Pullbacks remain corrective, candles overlap constructively, and price continues to hold above prior breakout levels. That keeps the bias constructive, but not confirmed.

In short, Ethereum is not late, and it is not guaranteed. It is compressing at resistance, and the next few H1 closes will determine whether this move resolves into acceptance and expansion, or a final rejection and reset.

Wishing you all effective and disciplined trading.

Ethereum Near Major Resistance: Structure StrengtheningEthereum is currently trading just below a strong resistance zone around 3,050–3,070, where multiple prior rejections have occurred. Price is advancing within a clearly defined ascending price channel, indicating controlled bullish pressure rather than impulsive expansion. The recent sequence of higher lows suggests buyers are active, but the lack of strong follow-through near resistance highlights hesitation.

From a technical structure perspective, ETH is transitioning from a recovery phase into a potential range environment. The upper boundary of the rising channel aligns closely with horizontal resistance near 3,030–3,050, creating a confluence zone where profit-taking is likely. Momentum candles are slowing, and price is beginning to overlap, which typically precedes either consolidation or a corrective pullback rather than an immediate breakout.

If ETH fails to reclaim and hold above 3,050 on a clean H1/H4 close, the higher-probability scenario is a rotation back toward the mid-range, with downside targets around 3,000 → 2,970, and potentially deeper into the 2,950–2,930 support cluster. This would keep Ethereum locked in a sideways range, rather than confirming a trend continuation.

From a macro perspective, the environment remains mixed. While expectations of future rate cuts in 2026 provide medium-term support for risk assets, near-term USD stability and restrictive financial conditions continue to cap aggressive upside moves. Additionally, flows into crypto remain selective, favoring short-term rotations rather than sustained breakouts. Without a clear macro catalyst (such as dovish Fed signaling or a strong risk-on impulse), upside attempts near resistance are vulnerable to rejection.

Summary:

Ethereum is technically constructive but not in breakout conditions yet. As long as price remains below the strong resistance zone, the market should be treated as range-bound, with upside capped and pullbacks toward support remaining a valid and healthy scenario. Patience is required until either structure breaks decisively higher—or the range resolves with confirmation.

We LOVE this indicator!Our Power Band Oscillator Pro has been a real game changer for picking tops and bottoms and determining exhaustion levels, whether you’re already in a trade or looking to enter one. This is a great example of a recent short position we took on Bitcoin. Hopefully, this explanation shows why we see so much value in the Power Band Oscillator, which has taken us over six months to build and perfect.

Happy Trading!