ETH

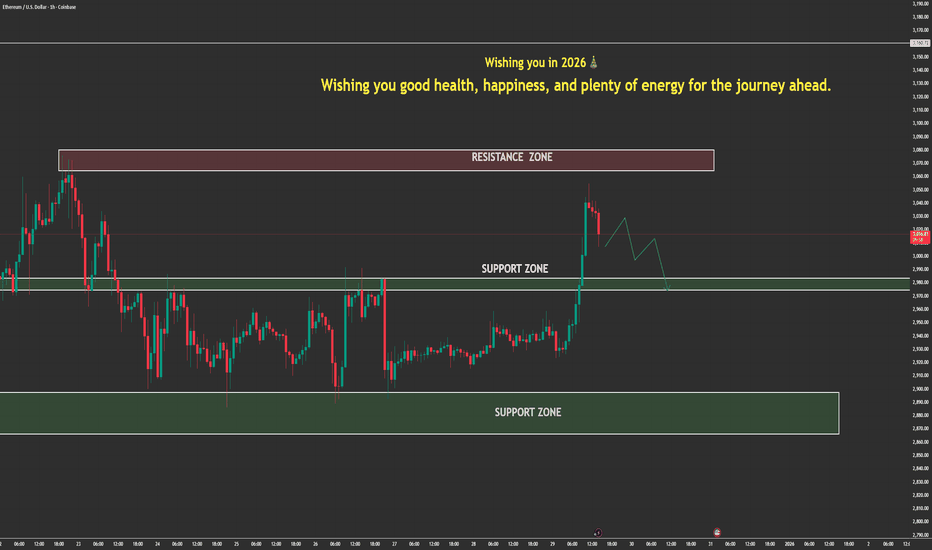

thereum Is Not Trending — It’s Being NegotiatedCOINBASE:ETHUSD is currently trading inside a well-defined sideways range, with price repeatedly oscillating between a strong resistance zone near 3,050–3,080 and a support zone around 2,900–2,920. The chart clearly shows that neither buyers nor sellers have been able to establish sustained control, resulting in rotational price behavior rather than a directional trend.

From a price action standpoint, the recent impulsive rally into the upper resistance zone was met with immediate and aggressive selling pressure. The sharp rejection from this area confirms that supply remains dominant at higher prices, and the market has not yet accepted value above this resistance. Importantly, the rejection was followed by a fast retracement back into the range, a classic sign of failed continuation rather than a healthy breakout.

Structurally, COINBASE:ETHUSD continues to form overlapping highs and lows, which is characteristic of consolidation. There is no clear sequence of higher highs or lower lows on the 1H timeframe. Instead, price is rotating around the mid-range equilibrium near 2,940–2,960, where liquidity is actively exchanged. This reinforces the idea that the market is in a balance phase, not a trend phase.

The moving averages (EMA 34 and EMA 89) further support this neutral bias. Both averages are flattening and converging, with price frequently crossing above and below them. This behavior typically reflects compression and indecision, not momentum. Until price can hold decisively above the EMAs with expansion, or break below them with follow-through, directional conviction remains weak.

On the macro side, COINBASE:ETHUSD is currently lacking a strong catalyst. BITSTAMP:BTCUSD is consolidating, U.S. yields are relatively stable, and there is no immediate Fed driven volatility pushing risk assets decisively in one direction. As a result, COINBASE:ETHUSD is trading more on technical liquidity levels than on macro narrative, which explains the repeated range-bound reactions.

In summary, COINBASE:ETHUSD remains neutral and range-bound, capped by strong resistance overhead and supported by a well-defended demand zone below. The market is waiting for acceptance outside the range, not reacting to anticipation. Until a clean breakout or breakdown occurs with volume and follow-through, COINBASE:ETHUSD should be approached as a mean-reverting market, where patience and level-based execution matter more than directional bias.

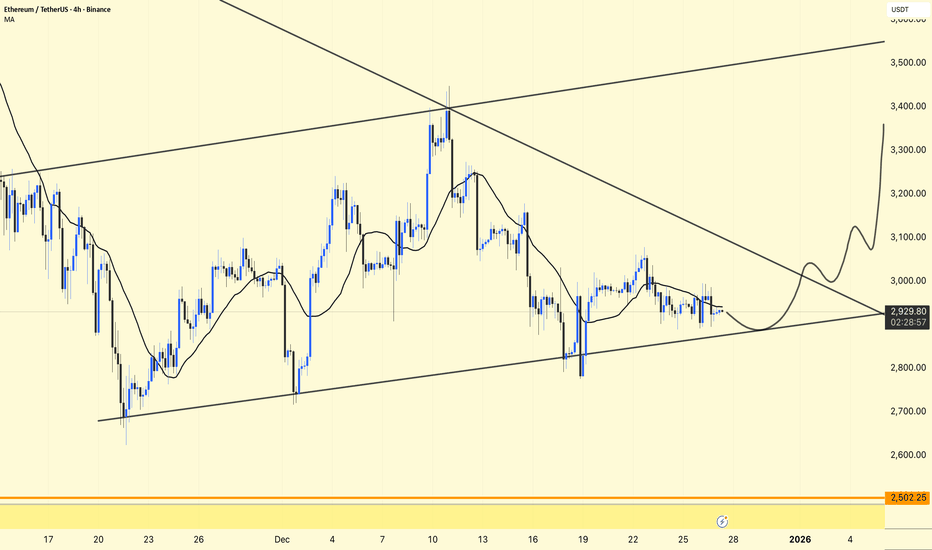

ETH 1W Update: Chopping, but looking good for Q1 2026 ETH Update: Ethereum is continuing to work through a higher timeframe consolidation after the strong move into the upper range earlier this year. The rejection from the ~$4.7k resistance zone was sharp, but importantly, price has since stabilized and is now holding above the key ~$2.7k–$3k support region. That area has acted as a major pivot multiple times in the past, and holding it keeps the broader structure constructive.

From a market structure perspective, this still looks like a reset within a larger range rather than a full trend failure. The selloff from the highs has transitioned into sideways-to-overlapping price action, which is typical during digestion phases on the weekly. ETH is effectively building a base between higher timeframe support and prior resistance, allowing momentum and positioning to cool off.

The ~$3.4k level remains an important inflection zone. Acceptance back above it would be an early signal that ETH is ready to rotate higher again and challenge the upper range. Until then, some chop and volatility should be expected as the market works through this consolidation. The projected path suggests a period of basing followed by a renewed push higher once participation and liquidity return.

Zooming out, the bigger picture remains intact. ETH continues to hold above major cycle support, and as long as that remains the case, the odds favor continuation rather than a deeper corrective phase. This looks less like distribution and more like consolidation ahead of the next leg.

For now, patience is key. As long as ETH holds this support zone and avoids a decisive breakdown, the structure supports higher prices over time, with the upper range near ~$4.7k remaining the key target once momentum rebuilds.

Ethereum Isn’t Breaking Out — It’s Building Pressure Inside Hello everyone,

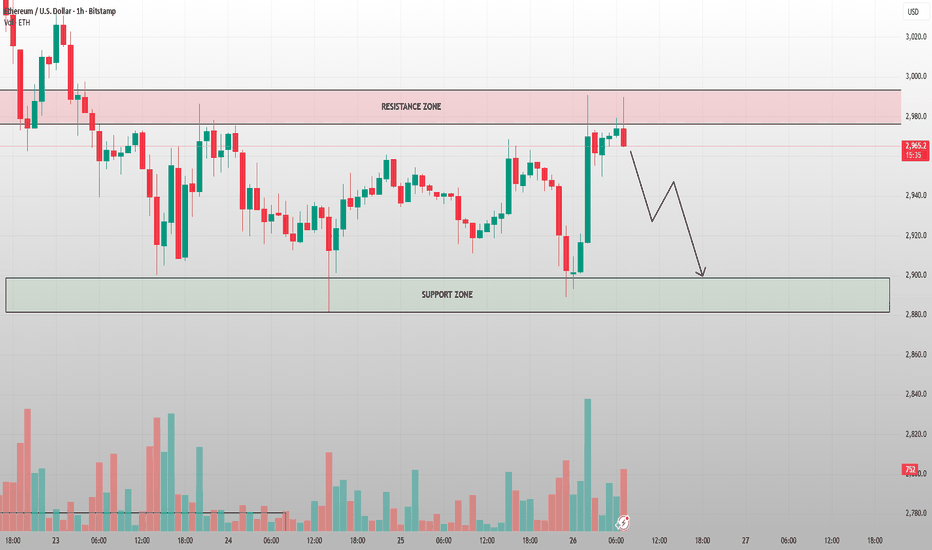

On the H1 timeframe, the key focus right now is not the recent rebound, but the fact that Ethereum remains structurally range-bound after a failed breakout attempt. The market has not transitioned into a new trend yet; instead, it is continuing to rotate between clearly defined supply and demand zones.

After pushing aggressively into the upper resistance zone around 3,040–3,070, ETH was rejected sharply, producing a fast sell-off back into the middle of the range. Importantly, this drop did not trigger a broader breakdown. Price stabilized and began to trade sideways again, which tells us that sellers were able to defend resistance, but buyers are still active at lower levels.

From a structural perspective , COINBASE:ETHUSD is printing overlapping candles and compressed swings, a classic sign of balance rather than trend. There is no sequence of higher highs to confirm bullish continuation, and no lower-low expansion to suggest bearish control. This is a market in rebalancing mode, not directional movement.

Technically , the 2,880–2,910 support zone continues to act as a firm demand base. Each approach into this area has been absorbed quickly, preventing further downside expansion. On the upside, the 2,980–3,000 resistance zone is the first ceiling to clear, followed by the major supply zone near 3,050–3,070, where sellers have previously stepped in aggressively.

The projected price path on the chart reflects this logic well: short-term oscillation inside the range, followed by a potential liquidity sweep before any meaningful expansion. Only clear acceptance above the upper resistance zone would confirm a bullish breakout and open the door for continuation higher. Conversely, a decisive breakdown below the support zone would invalidate the accumulation narrative and shift the bias lower.

Until one of those conditions is met, Ethereum is not trending. It is building pressure inside a range, and patience remains the highest-probability strategy.

Wishing you all effective and disciplined trading.

ETH Is at a Make-or-Break ZoneEthereum is currently trading inside a clearly defined range, capped by major resistance around 3,160 and supported by a key demand zone near 2,980, with a deeper structural support around 2,780. The recent impulsive rally was decisively rejected at resistance, confirming that sellers are still defending the upper boundary of this range.

From a technical perspective, price action shows classic range behavior. After the rejection, ETH rotated back toward the mid-range and is now hovering just above support (~2,980). As long as this level holds on a closing basis, the market structure remains neutral-to-bullish within the range. A successful defense here would likely lead to a rebound toward 3,060 and a retest of the 3,160 resistance zone.

However, a clean breakdown below 2,980, especially with strong volume and a 1H/4H close, would invalidate the range floor and open downside continuation toward 2,900, followed by the major liquidity pocket around 2,780.

On the macro side, year-end conditions are playing a critical role. Holiday liquidity is thin, which statistically increases the probability of false breakouts and liquidity sweeps rather than clean trend continuations. At the same time, recent Federal Reserve adjustments to liquidity conditions and easing expectations around monetary policy have kept risk assets supported, but without enough conviction to force a decisive breakout. Crypto markets are therefore reacting more to positioning and short-term flows than to long-term macro repricing.

For Ethereum specifically, the broader narrative around institutional adoption, staking yield, and ETF-related expectations continues to provide medium-term support. That said, these factors are not yet strong enough to override the current technical range in the short term.

Bottom line: ETH remains a range-bound market. As long as 2,980 holds, upside rotations toward 3,060–3,160 remain the higher-probability scenario. A confirmed break below support would shift control back to sellers and expose 2,900 → 2,780. Until a decisive breakout occurs, traders should expect sideways price action with sharp intraday swings, typical of the Christmas trading period.

This Resistance Test Will Decide the Next 10% MoveETH/USD – 1H Market Analysis

Ethereum is currently locked in a clear range structure, trading between a major support zone around 2,880–2,920 and a well-defined resistance zone near 3,060–3,120. Price has already tested both extremes multiple times, confirming that this is not a trending environment yet, but a controlled consolidation where liquidity is being built.

From a structural perspective, ETH is forming repeated higher lows inside the range, while sellers continue to defend the resistance zone aggressively. This behavior reflects compression, not weakness. The market is balancing orders, shaking out impatience, and preparing for expansion rather than reversing impulsively.

Forward Scenarios to Watch:

Primary scenario (Higher probability): Another pullback toward the mid-range or support zone, followed by a rotation higher and a renewed test of resistance.

Bullish continuation: A clean hourly close above 3,120 with acceptance opens upside toward 3,200–3,280.

Bearish invalidation: A decisive breakdown below 2,880 would shift the structure bearish and target the lower demand zone.

Bottom line:

Ethereum is not breaking out yet it’s compressing. This is the phase where smart money positions quietly, while reactive traders get chopped. The breakout will come, but only after liquidity has been fully harvested. Patience remains the edge.

ETH/USDT 4H Chart Review🧭 Current Market Structure

Medium-term trend: up, but at risk

The price has broken below the uptrend line (black diagonal).

After a strong upward impulse, a sharp downward candlestick (distribution) appeared → no continuation of the uptrend.

This is a classic signal of bullish weakness, not a full trend reversal, but a warning.

🔑 Key Levels

🟢 Resistance

3059–3070 – very strong resistance (multiple reactions)

3126 – higher timeframe resistance (if it reaches this level → euphoria)

🟡 Decision Zone (now)

2938–2960 – current consolidation

This is where the market decides whether to return above the trend or move lower.

🔴 Supports

2911 – local support (very important)

2868 – strong structural support

2755 – critical support (reversal of the uptrend)

📉 RSI Stochastic

A pullback from the upper levels (80+) to ~20

Downward momentum has not yet expired

No bullish divergence → no signal for an aggressive long

📌 Scenarios

🔵 Scenario A – bullish (less likely)

Conditions:

Defense 2911

Return above 2960 + 4-hour candle close

Trend line reclaim

Targets:

3059

3126

👉 This would be a fake breakdown

🔴 Scenario B – bearish (more likely)

Conditions:

4-hour close below 2911

No quick rebound

Targets:

2868

then 2755

👉 Healthy correction in the trend or a change in structure to sideways/bearish

Ethereum Is Compressing — A Volatility Expansion ETHEREUM (ETH/USD) – 4H MARKET ANALYSIS

Market Structure Overview

- Ethereum is currently trading inside a clear range-bound structure on the H4 timeframe.

- Price is being capped by a strong resistance zone around 3,030–3,080, where previous impulsive moves were aggressively sold.

- On the downside, buyers are consistently defending the support zone around 2,880–2,920, forming repeated higher reactions.

- This behavior confirms compression and volatility contraction, often preceding an expansion phase.

Key Observations

Multiple rejections at resistance show supply dominance above, but sellers are failing to push price below support → signs of absorption.

The repeated zig-zag price action inside the range indicates liquidity building, not trend continuation yet.

Volume has decreased compared to the impulsive legs → typical of pre-breakout accumulation.

Scenarios to Watch

Bullish Scenario (Preferred):

A clean break and acceptance above the resistance zone (~3,080) could trigger a strong upside expansion toward the 3,200+ area.

This would confirm that the range was accumulation.

Bearish Risk:

If price decisively loses the support zone (~2,880), ETH could enter a deeper corrective leg toward lower demand.

As long as support holds, this remains a lower-probability scenario.

Trading Bias

Neutral-to-bullish while price holds above support.

Best approach: wait for confirmation either a breakout with volume or a strong reaction from support.

Avoid chasing moves inside the middle of the range.

Conclusion

ETH is in a classic range compression phase. The market is preparing, not moving yet.

Patience is key the next clean breakout will likely define the next multi-session trend.

Ethereum Trapped Between Supply and DemandETH/USD (4H) — Market Analysis

Market Structure

Ethereum is stuck in a broad sideways range after a strong rejection from the upper resistance zone (~3,000–3,050).

The sharp sell-off from the top confirms strong supply pressure at premium prices.

Current price action shows range rotation, not trend continuation.

Key Zones

Strong Resistance: 3,000–3,050

→ Previous rejection zone, heavy sell orders remain.

Mid Resistance: ~2,960–2,980

→ Short-term cap where price repeatedly fails.

Support Zone: 2,880–2,910

→ Buyers defended this area multiple times.

Major Support: 2,760–2,800

→ Last demand before structure turns bearish.

Probable Scenarios

Base Case (Higher Probability):

Price continues sideways consolidation, bouncing between support and resistance to absorb liquidity.

Bullish Scenario:

A clean 4H close above 2,980–3,000 opens upside continuation toward the upper resistance zone again.

Bearish Scenario:

Loss of 2,880 support exposes ETH to a deeper drop toward 2,760–2,800.

Momentum & Trend Context

EMAs are flattening, confirming range conditions.

No impulsive follow-through yet → market is waiting for a catalyst.

Macro Context

Risk assets remain sensitive to USD strength and bond yields.

With no strong bullish macro trigger, ETH is more likely to range than trend aggressively in the near term.

Bottom Line

Ethereum is in balance mode.

Until price clearly accepts above resistance or breaks support, expect choppy, two-sided price action rather than a sustained trend.

DONT SELL BITCOIN TILL 2031 You see those lines on the chart, yeah those lines are when Gold got an ETF and when Bitcoin got a spot ETF. Bitcoin will be in a full on bull market for the rest of this decade with a blow off top in 2031. Bitcoin is such a new asset and everyone calling for a bear market is so short sighted. Bitcoin trading is now run by the big institutional investors. The retail that used to make the market all got liquidated in the flash crash. No more four year cycles based on the halving, none of what youre used to will be the same ever again. Stop looking at imaginary lines that say we need to move this way or that, they are all bullshlt and they dont matter.

Its my belief that Bitcoin will go on a run that no one could ever imagine and were just getting started. So everyone calling for a bear market needs to open their eyes and look at the bigger picture and stop looking at imaginary moving averages. They may have worked before but they dont work in this scenario with Bitcoin. How many who sold thinking it was the top will lose their mind when Bitcoin spikes to 250k no pullback and 100k will never be seen again.

Not financial advice just sharing my opinion

AFTER CYCLE BTC WILL BREAK UP 100k+ - NEW BULLRUN ON WAYBased on the trend analysis around the $92K–$93K level, this zone could mark the beginning of a new bull run. If this target is reached and held, there is a high probability that BTC will enter a new upward cycle, potentially moving beyond $100K. The coming days are crucial for confirming the overall trend direction.

Before this, there could be manipulation trends, with a fake downtrend wick, but the Data shows that we are since the 80k+ still in the uptrend and cycle can get confirmed any time.

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA

$ETH at a Key Decision ZoneEthereum is also sitting at a key decision zone here.

$2950 remains the local resistance, while $2800 is the main support level to watch. Another rejection at $2950 would put the focus squarely on whether $2800 can hold.

If price stabilizes above this support, there’s still a decent chance for a move back into the $3050–3100 area. But if we lose $2800 and start accepting below it, the path opens up toward the $2600–2400 zone.

ETH Is Trapped at Resistance — The Next Move Is Likely Down ETHUSD (1H) — Public Market Commentary

Ethereum is currently retesting a well-defined resistance zone around the 2,980–3,000 area. Price has failed multiple times to hold above this zone, signaling that sellers remain in control at higher levels.

Key Observations

Repeated rejection at resistance shows clear supply absorption failure.

The latest impulsive move up lacked follow-through and was quickly sold.

Market structure remains range-bound, not trending.

Probable Scenario

From a structural perspective, a pullback toward the support zone (≈ 2,880–2,900) is the higher-probability path.

This move would serve to rebalance liquidity before any sustainable upside attempt.

A clean breakdown into support would not be bearish continuation yet — it would be normal corrective behavior inside a range.

Invalidation

Only a strong H1 close above the resistance zone, followed by acceptance, would shift momentum bullish.

Macro Context

Risk sentiment remains fragile:

Strong USD and elevated US yields continue to pressure crypto.

Absence of fresh ETF inflows or bullish macro catalysts limits upside expansion.

Until macro liquidity improves, ETH rallies are likely to be sold at premium zones.

Conclusion:

This is not a breakout market. Until resistance is clearly reclaimed, expect downside probing before any meaningful upside continuation.

BTCUSD trade idea for buysBTC/USD Technical Analysis: Potential to Reach $90K if Current Technicals Hold

Current Market Overview: Bitcoin (BTC) is showing signs of bullish momentum, respecting the current technical indicators. The price is positioned well within key support and resistance zones, with significant upward potential if the prevailing trends continue.

Key Levels to Watch:

Support Level: A strong support around continues to hold, with price bouncing off this level multiple times. A confirmed break below this level could signal a shift in market sentiment.

Resistance Level: The key resistance lies near $90K, a level that could be tested if the current technicals remain intact. Watch for a breakout or rejection at this level.

Indicators to Watch:

RSI: Currently, the Relative Strength Index (RSI) is , indicating . If RSI continues to move higher, it may confirm continued bullish momentum towards $90K.

EMA/MA: The 50-period and 200-period Moving Averages are showing alignment, suggesting the market's trend direction.

Volume: Strong volume support at key levels may suggest a sustainable move upward, with increasing volume acting as confirmation of the rally.

Scenario 1 - Bullish Continuation: If BTC continues respecting these technical levels, we could see a breakout towards $90K, driven by strong bullish sentiment and market momentum. Watch for a clean break above key resistance levels for confirmation.

Scenario 2 - Bearish Reversal: If technicals fail to hold, watch for a potential breakdown below support levels. This could shift the market outlook and present new trading opportunities to reassess.

Maintaining purchases at the turn of the yearThe market has perfectly worked out the scenario outlined in the last review, and buyer activity is growing. We are approaching the end of the year, and we will consider the near-term prospects. On average, the market consolidated in anticipation of determining the opening level of a new annual candle for ETH and BTC. As I expected, ETH opened the second half of the month in the neutral zone, which smooths out sales. There is also a strong bullish signal for a retest of 3500. BTC has reached strong medium-term support around 85k, from which the probability of a rollback to a retest of 100k prevails, which I described in the last review. We have already seen one pullback, but there is still a possibility of an attempt to break through 100k after the opening of a new annual candle. Against the background of preparations for a new wave of purchases at the beginning of the year and the struggle for the closing level of the year, the probability of a new test of the range of 3100-3500 ETH prevails.

A pullback in brent with consolidation above $ 60 also inspires optimism among buyers. If the year opens above this level, a very rapid reaction of the cryptocurrency market with a large wave of purchases is likely. However, most of the market, especially large-cap coins, still retains the potential for a turnaround to a clear bull run, which may linger until the next seasonal bullish period in February. With this picture, it is worth carefully weighing the growth potential before additional purchases today and giving preference to heavily oversold assets with high technical goals for retest and slow issuance.

Today, I still prefer TURTLE NFP HOOK NTRN VIC MITO ENSO BMT SHELL, for which the growth potential is higher than the rest of the altcoin market, which may contribute to growth similar to RESOLV or STO in the near future. Among the coins with the tag monitoring for work, I consider only CHESS, which has high technical signals for retest up to 0.10-15.

Against the background of the annual rollback in CHZ, the probability of a bullying in fan tokens is also increasing. ATM ACM CITY JUV looks especially interesting. However, the dynamics of CHZ in the second half of the year is quite negative, I recommend working with fan tokens in a small volume and not increasing turnover if there are older unclosed positions.

Next Volatility Period: Around December 28th

Hello, traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

#ETHUSDT

With the formation of a new trend line, the next volatility period is expected to occur around December 28th - January 1st.

At this time, the key will be whether the price can find support near the lows of 2828.57-2887.66 and rise above the M-Signal indicator on the 1M chart.

However, the most important support and resistance area is the 2419.83-2706.15 range, so it's crucial to maintain the price above this level.

To turn into an uptrend and establish a bullish trend, it must rise above the 3321.30-3438.16 level.

Therefore, you should develop or adjust your medium- to long-term trading strategy based on the movements of the upcoming volatility period.

If it falls below the 2419.83-2706.15 level, a bear market is likely to begin, so you should consider a response plan.

If it finds support and rises, consider this the final uptrend and focus on finding a time to take profits.

This is because, as mentioned in the explanation of the BTC big picture, 2026 is expected to be a major bear market.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Lower highs, descending trendline still active

ETH rejected from the trendline near 3,350–3,400

Price below cloud → bearish / consolidation phase

Holding around 2,930

Immediate Support: 2,880 – 2,900

Major Support: 2,700 – 2,750

Resistance: 3,050 – 3,120

Major Resistance: 3,350 – 3,400

Above 3,120 → short-term bullish relief toward 3,300+

Below 2,880 → risk of move toward 2,750

Until the breakout, range & patience are best

⚠️ Trend is still weak — trade only with confirmation & strict risk management.

ETH Is Testing DemandCURRENT MARKET ANALYSIS – ETH/USD (H1)

Market Structure

Ethereum is currently correcting within a broader bullish structure. After completing an impulsive move toward the upper resistance (Target 1 area), price has retraced back into a key demand / support zone around 2,91x – 2,93x, where buyers previously stepped in.

This pullback is technical, not a trend reversal.

Technical Breakdown

Trend: Medium-term bullish, short-term corrective

Structure: Higher high → corrective lower high → retest of demand

Support Zone: 2,918 – 2,930 (must hold)

Targets:

Target 1: ~3,059

Target 2: ~3,162

Price is currently compressing near support, indicating potential absorption of selling pressure rather than aggressive distribution.

Probable Scenarios

Primary Scenario (Preferred):

Support zone holds

Short consolidation / base formation

Continuation toward Target 1 → Target 2

Invalidation Scenario:

Strong breakdown below 2,91x with momentum

Would signal a deeper corrective phase before trend continuation

🔔 CRYPTO NEWS UPDATE

ETF Flow Sentiment: Spot ETH ETF inflows remain stable, supporting medium-term bullish bias despite short-term volatility.

Macro Context: Markets are currently pricing in rate-cut expectations, which generally favors risk assets like crypto.

BTC Correlation: Bitcoin holding above key support is helping ETH maintain structural stability.

👉 No bearish fundamental catalyst is currently dominating — price movement remains technically driven.

Conclusion

Main Bias: Bullish continuation

Current Phase: Pullback → Re-accumulation

Strategy: Wait for confirmation at support; avoid chasing price

Ethereum Isn’t Breaking Down — It’s Absorbing SupplyETH/USD – QUICK ANALYSIS (1H)

Market Structure

ETH remains inside a well-defined range

Current pullback = healthy retracement, not trend failure

Structure still favors higher low formation

Key Levels

Support zone: 2,930 – 2,950

Range high / Resistance: 3,040 – 3,080

Major resistance above: ~3,180 – 3,200

Price Behavior

Sellers failed to push price below support → absorption

Buyers stepping in near range low = re-accumulation

Volatility contracting → expansion likely next

Outlook

Base case: Bounce from support → retest range high

Bullish continuation: Acceptance above 3,080

Bearish risk only if: Clean break below 2,930

Bias

Neutral → Bullish

Strategy: Buy support, sell resistance until breakout