#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 1794. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 1920

First Target: 1958

Second Target: 2022

Third Target: 2103

Stop Loss: Above the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

ETHBTC

ETH Rebuy Zone (1D)Honestly, the key support levels have already been lost.

Considering the selling pressure, the bearish momentum, and the current candle structure, it appears that the bearish wave is likely to conclude within the green zone.

This corrective move will require time and proper base formation before any meaningful reversal to the upside can occur. A sustainable recovery is unlikely without consolidation and accumulation in this area.

The optimal approach in the green zone is to enter positions gradually using a DCA (Dollar-Cost Averaging) strategy, while avoiding any form of impatience or emotional decision-making. Rushing entries in such conditions significantly increases risk.

Above all, capital management and risk control remain the most critical factors in navigating this market phase.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2164, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2240

Target 1: 2305

Target 2: 2373

Target 3: 2465

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Ethereum Testing Key Support | Don’t Miss This Setup! (1D)📊 Ethereum Price Analysis | Strong Support Zone & Potential Bullish Reversal | Daily & Weekly Outlook

Ethereum is currently approaching a highly important and well-established support zone, which has historically acted as a strong demand area in the market. This level has proven to be reliable in previous price cycles and is now being tested once again.

Recently, Ethereum has swept major liquidity pools and triggered multiple stop-loss zones. Through consecutive bearish moves and strong downward momentum, the price has been driven toward this critical support region. This liquidity grab often signals a potential market reset and can precede a meaningful trend reversal.

Based on technical structure, price action, and market behavior, Ethereum is expected to react positively from the highlighted zone and potentially move toward the predefined upside targets. These targets are based on previous resistance levels, market structure breaks, and Fibonacci retracement confluences.

⚠️ Important Note on Timeframe:

This analysis is conducted on the daily timeframe, meaning that the projected movement is not expected to happen immediately. The full development of this scenario may take several weeks to play out. Patience and proper risk management are essential.

📈 Bullish Scenario:

If Ethereum holds above the marked support zone and shows strong buying pressure, a gradual bullish move toward the target areas is likely. Confirmation signals such as bullish engulfing candles, higher lows, or volume expansion will strengthen this outlook.

❌ Invalidation Level:

This analysis will be invalidated if a weekly candle closes below the defined invalidation level. Such a move would indicate a breakdown of market structure and could open the door for further downside continuation.

🔍 Key Takeaways:

Strong long-term support zone in focus

Liquidity sweep completed

Potential bullish reversal setup

Daily timeframe analysis (weeks to develop)

Weekly close below invalidation = bearish continuation

📌 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and manage risk appropriately.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

ETH Sell/Short Setup (4H)Based on the price reaction at the FLIP zone, the loss of the ascending trendline, and the formation of a bearish CH (Change of Character), it seems that bearish momentum is starting to take control of the market. These factors together suggest a potential shift in market structure in favor of the sellers.

We have marked two red dashed lines on the chart, which represent our planned entry zones. These areas are selected based on structure and price behavior, not emotions or anticipation.

The targets are clearly defined and labeled on the chart in advance. Risk management is a priority in this setup. Once Target 1 is reached, the position should be moved to break-even in order to protect capital and eliminate downside risk.

If the stop loss is triggered, it simply means we are out of the trade—no revenge trading, no overthinking. This is part of the plan and must be respected.

Now we wait and let the market decide. Patience and execution matter more than prediction.

Normally, we do not share such clean and straightforward setups here. This example is posted purely for educational purposes, to demonstrate how we approach structure-based trading and risk management.

Let’s see how price reacts and what the market delivers.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

THE MAIN BACKBONE $ETH It held everything from the $880 bottom in 2022 to the $1520 bottom in 2023.

Fakeout (Bear Trap): In mid-2025, price dipped below this line (the middle blue arc). While everyone screamed "ETH is over," it was just a liquidity flush. Price is now back ABOVE this main trendline.

The trend was not violated; it was stress-tested. The direction is still UP.

INVERSE HEAD & SHOULDERS

Look at the blue arcs drawn at the bottom of the chart. This is a textbook, gigantic Inverse Head & Shoulders pattern.

Technical Target, When this pattern plays out, it typically travels the depth of the head upwards. This takes us directly back to the old All-Time Highs (ATH).

THE PIVOT POINT: THE $2800 FORTRESS 🏰

Pay attention to the green dotted line (2,817 level).

SR Flip (Support/Resistance Flip): This was the ceiling that couldn't be broken in 2024. Now, it is the floor the price is sitting on.

Status: ETH is currently at $2,951, holding above this critical support. As long as $2,800 is defended, the structure is BULLISH.

THE SILENT STORM

While the market is busy talking about Solana, SUI, or AI coins, Ethereum is quietly building the largest accumulation structure in history in the background.

Psychology: Investors are "tired" of ETH. This is a bottom signal.

It is above the rising trendline and forming a massive IH&S.

First stop is $4,100 (Upper green line). Once that breaks, price discovery begins.

"When elephants walk, the earth shakes." ETH currently looks like a sluggish elephant preparing to move, but once it starts running, it won't stop to pick up passengers.

With a stop-loss below $2,800, this zone (Right Shoulder) offers a perfect Risk/Reward ratio.

ALso check

ETHBTC

8 years breakout EVE here

ETHBTC: A Daily and Monthly Outlook Broken DownDaily Outlook (Primary Focus)

On the daily timeframe, ETHBTC continues to respect a well-defined corrective structure following the prior impulsive advance. Price remains compressed above key support, with multiple reactions confirming the current range as technically relevant rather than transitional noise.

The immediate focus is the highlighted support zone. As long as this region holds, the structure favors continuation rather than breakdown, allowing for the development of the next leg higher. A clean push above the recent swing high would significantly strengthen the case for trend resumption and open the path toward the upper Fibonacci retracement targets highlighted on the chart.

Failure to hold this support, however, would invalidate the near-term constructive outlook and increase the probability of a deeper corrective move, aligning with the alternative scenario already mapped.

Macro Context (Monthly Justification)

Zooming out to the monthly timeframe, ETHBTC remains locked inside a large contracting triangle, a structure that has governed price action for several years. From an Elliott Wave perspective, this formation appears to be missing its wave (d)—suggesting that the broader corrective process is not yet complete.

This macro context is critical:

- The ongoing daily consolidation fits cleanly within a larger triangle environment.

- Volatility compression favors expansion rather than stagnation.

- The next directional move is likely to be decisive, not marginal.

Until wave (d) resolves, expectations should remain tactical rather than aggressively directional, with respect given to both boundaries of the formation.

Bottom Line

ETHBTC is not breaking down, it is coiling.

The daily structure defines the trade, while the monthly triangle defines the risk. A successful defense of current support keeps the upside resolution in play, while failure would simply confirm that the macro corrective process still needs more time to mature.

Patience remains the edge.

ETHBTC is about to produce a strong bullish continuationBelieve it or not, it's been already five months since ETHBTC produced its last major high, August 2025. Amazing, can you believe it?

Surprising as well, the fact that the correction low happened 77 days ago, that's more than 2.5 months.

The entire bullish move that started in April 2025 lasted 119 days, four months. So the correction plus support consolidation has been going for longer than the duration of the entire bullish period. This is good news, let me explain.

If the market was bearish, just as we see on the left side of the chart, it simple goes down. There cannot be a five months period with no new lows, impossible. That's why it is good news that the peak happened five months ago and yet ETHBTC continues to trade at a strong higher low, above long-term support. We are still within a strong bullish cycle; next we get a resumption, a bullish continuation.

That's the good news and this is as good as it gets. We are aiming for a major high close to the high point in March 2024. It will be awesome. ETHBTC continues bullish and is now set to grow.

Thank you for reading. You are truly appreciated.

Namaste.

THIS CHART NOT TESTING YOUR PATIENCE. ITS TESTING YOUR VISIONThe Symmetry is undeniable

First, look at the NASDAQ chart. "The period between 2000 and 2010 was the “Lost Decade” for the Nasdaq. Investors grew weary, grew to hate it, and sold.

But note: between the 2002 bottom (Bottom 1) and the 2009 bottom (Last Bottom), energy was building to break the downtrend.

The structure is frighteningly similar. Ethereum has been losing value against Bitcoin for years (Bleeding).

Just like the Nasdaq's erosion against the Dollar. But the structure between “Bottom 1” and “Last Bottom” is not a collapse, but a Bottom Formation process.

When the Nasdaq broke this line in 2010/2011, the greatest Technology Bull Run in history began.

ETH/BTC is now right on the verge of that breakout. If this black line breaks upwards (which the structure is pushing for),

Historical Repetition

Nasdaq's ‘Dead Period’ between 2000-2010. While everyone hated tech stocks, a massive spring was being wound up for the greatest rally in history.

Below is ETH/BTC today. The same frustration, the same downtrend, the same Final Low

The market currently despises Ethereum. It's ‘slow,’ ‘not going anywhere,’ ‘old.’ When Nasdaq broke that falling trend in 2010, what happened then will happen again when ETH/BTC breaks that trend: The Great Rotation.

This is not a prediction; this is Market Mechanics. The longer the pressure lasts, the more violent the explosion will be. What will happen is not a 20-30% rise; we know what will happen from 2017 and 2021.

ETH USD

Google Trends data since 2016

ETHBTC / Altseason / Fractal / Cycle

ETH to $9,690 by Q1/Q2 2026?ETH is going to outperform BTC

Let me tell you a story about the future.

You might hate it. You might think it’s delusional. And honestly, that’s fine. Markets are not moved by consensus, they are moved by those willing to be early, heretical, and delusional. Only someone with real skin in the game can afford that posture.

One thing people keep missing: BTC/ETH already had its euphoric phase.

ETH/BTC pair bottomed. Both did so in April ’25.

From that point, ETH entered a reflexive loop. Price action validated narrative, narrative attracted capital, capital reinforced price. In roughly 140 days, ETH moved from the ~$1,400 April lows to ~$4,900 ATHs. Not randomly, but alongside the emergence of a new structural buyer.

BitMine, led by Thomas Lee, has positioned itself as the “MicroStrategy of Ethereum.” In plain terms, a corporate entity explicitly focused on maximizing ETH per share via aggressive treasury accumulation and native protocol participation. As of today Bitmine holds approximately 4.17 million ETH, which accounts for roughly 3.45% of the total global Ethereum supply. Their stated ambition is to accumulate up to 5% of total circulating ETH supply. They have staked approximately 1.26 million ETH and plans to launch its own in-house validator network, MAVAN, in Q1 2026 to generate staking rewards.

As ETH rallied aggressively during Q2/Q3 2025, leverage built, profits were taken and then came Q4 and the 10/10 deleveraging event. ETH corrected ~47% off the highs. That correction was not a failure. It was a requirement. Every sustained move needs sellers. Weak hands must exit for strong hands to accumulate.

A drawdown destroys belief just as efficiently as it once created it. Price weakness feeds doubt, doubt feeds selling, selling creates opportunity for entities that are insensitive to short-term volatility. Throughout this process, bitmine kept accumulating quietly. long-term holders absorbed supply and ETH moved from impatient hands to patient ones.

Add to that the steady 9 figures ETH ETF inflows over the past few weeks, and it reinforces it. We’ve seen this movie before. This is where reflexivity flips.

In early 2016, ETH was less than seven months past its ICO launch (July 2015). BTC went sideways with a negative Sharpe profile through much of Q1. ETH did not care. It rallied independently, stretching roughly 1,500% from January to April 2016, massively outperforming BTC despite a sluggish macro backdrop.

Today, when you look at all major pairs (BTC, SOL, XRP, BNB) all tagged or violated April quarterly support. With the only exception of BNB that also held. ETH retraced, yes, but it never took prior quarterly lows. Relative strength is not a myth. It is observable behavior.

This is how leadership changes.

ETH does not need BTC to collapse. It simply needs BTC to stagnate. Go sideways. When the marginal dollar stops chasing safety and starts seeking asymmetry, ETH becomes the obvious vehicle. The market is already telling you this, quietly.

Reflexively, disbelief is now fuel. Underperformance becomes expectation. Expectation suppresses positioning. And suppressed positioning is precisely what enables violent upside.

I believe ETH is entering another window of sustained outperformance versus BTC. Catalysts may emerge. Existing ones may intensify. Or nothing may happen at all, except price violently repricing... this while most crypto investors and most def Solana manlets; cope & seethe on the sidelines.

That’s how it usually works.

There's nothing new under the sun. Time is not linear in markets.

And sometimes, it circles back exactly where it started. Time is a flat circle.

ETH/USDT (4H) – Chart Update. ETH/USDT (4H) – Chart Update

Structure: Bullish bias holding

Price Action: ETH has broken above the descending trendline

Ichimoku: Price trading above the cloud → momentum remains positive

Ethereum has reclaimed the trendline resistance, which is now acting as support. The pullback looks controlled and healthy, suggesting continuation rather than rejection.

Holding above 3,200–3,250 keeps the bullish scenario active

A sustained move can push ETH toward 3,450 → 3,650 → 3,800 zones.

A breakdown below 3,150 may trigger a deeper retest toward 3,000 support.

Market structure favors upside continuation. Wait for confirmation and manage risk wisely.

ETHUSDT Poised for Breakout: Triangle + Golden Fib Support AlignEthereum is currently compressing inside a triangle pattern on the daily timeframe, following a corrective move from recent highs. Price is building higher lows while facing descending resistance, suggesting volatility compression ahead of a potential expansion.

The yellow horizontal level marks the Fibonacci golden retracement zone, which has acted as a strong reaction level and is currently providing structural support. Price is also interacting with the 50, 100, and 200 EMAs, indicating a key decision area where trend direction is likely to be resolved.

Key technical points:

- Triangle pattern signaling imminent breakout

- Golden Fib retracement zone acting as support

- Price reclaiming / challenging the 50, 100 & 200 EMAs

Clear upside objective into the green target zone, a historical resistance area where price has been rejected multiple times over the past years

A confirmed daily breakout from the triangle, especially with strength above the EMAs, could open the path toward the green resistance zone. Failure to hold the Fib support would invalidate the setup and increase downside risk.

Cheers

Hexa

Ethereum — Stronger Signal Than BTC

BBG:ETHEREUM has printed a stronger signal than CRYPTOCAP:BTC , sooner than I expected. On top of that, $ETH/BTC is holding its ground, which is exactly what you want to see if ETH is gearing up for relative outperformance.

Will ETH outperform BTC over the next couple of months?

Chart-wise, it looks like it could, but this is something we need to track continuously to avoid losing sats if the setup fails.

For now, the signal is there — and **we act on signals, not opinions**. If you haven’t positioned yet, this is the moment where ETH deserves attention.

If structure continues to hold and momentum follows through, a new ATH is absolutely on the table.

#ETH/USDT : Rebound Setup from ascending channel Support

#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 3073, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 3139

First Target: 3152

Second Target: 3195

Third Target: 3240

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

Market makers will soon pump ETHEREUM (8H)Ethereum is continuing to develop a bullish structure.

On the iCH chart, we are observing clear bullish signals. Currently, the price is trading around a key support/resistance level, which has historically acted as a strong decision point for market participants.

The upper order blocks above the current price have already been mitigated and absorbed, meaning that the price now faces less resistance to move upward. This significantly increases the probability of a continued bullish move in the near term.

Given this context, we should be focusing on buy/long opportunities. There are two main entry points, which can be used strategically through a DCA (Dollar-Cost Averaging) approach. Entering gradually allows us to manage risk while taking advantage of potential upward momentum.

Targets are clearly marked on the chart. At the first target, it is recommended to take partial profits to lock in gains, and then move your stop-loss to break-even to protect your capital. This approach allows us to participate in the remaining move toward higher targets without unnecessary risk.

Always remember to manage your risk properly and avoid over-leveraging. The structure suggests that Ethereum has the potential for a strong upward movement, but patience and discipline are key.

In summary:

Trend: Bullish continuation

Chart signal: iCH bullish

Key level: Currently testing a major level

Order blocks: Upper blocks mitigated, price has a clear path

Entry: Two points, DCA recommended

Targets: Marked on chart; take partial profit at first target, move stop to break-even

Strategy: Focus on risk management while participating in the bullish momentum

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

#ETH/USDT – Short Setup from Key Supply Zone

#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 3253. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 3218

First target: 3186

Second target: 3164

Third target: 3132

Stop loss: Above the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

eth btc - a macro alt market indicatoreth btc - a macro alt market indicator

not so sure its a great one anymore. eth imo is pretty much a chinese scam. if you look back into its history and vitalik getting funded just as they were going to go under, then of course it became the second big trading pair after btc and took over.

not sure whether that original dynamic is even in play anymore. notice the massive flat top its had for years now.

a ton of eth was sold to US institutions and its become a kind of VC type play. like SOL.

anyway its definately worth watching this ratio for signs of life.

Ethereum Will Take Off Soon (1D)📊 Ethereum (ETH) – Updated Bullish Scenario Amid Complex Correction

Before anything else, pay attention to the time frame; the time frame is daily. Based on the latest available market data and the prolonged range-bound price action near the local lows, it is reasonable to restructure Ethereum’s primary scenario. While the overall bias remains bullish, both price targets and timing expectations have been adjusted to better align with the current market structure.

🔍 Market Structure & Neo Wave Perspective

From the point marked by the red arrow on the chart, Ethereum entered a bearish corrective phase. However, this move does not suggest a trend reversal. Instead, it strongly resembles a complex double correction within a larger bullish structure.

First correction: A clear ABC corrective pattern

Second correction: A contracting triangle

These two corrective structures are connected via an X wave, forming a classic W-X-Y corrective formation

This type of structure is commonly observed in higher-timeframe consolidations before strong impulsive continuations.

🔺 Triangle Breakdown (A–B–C–D–E)

Current price behavior suggests that Ethereum is trading inside the D wave of the corrective triangle:

The slow, overlapping, and corrective upward movements strongly indicate that the market is not impulsive, confirming we are still within a correction.

Price action around the red zone is likely to mark the completion of wave D.

Following this, a final pullback for wave E is expected, which typically acts as a bear trap before trend continuation.

🟩 Green Zone & Bullish Continuation Scenario

As price approaches the green box area, conditions may become ideal for:

Completion of wave E

End of the entire corrective triangle

Initiation of the next impulsive bullish leg

Once wave E is completed, Ethereum is expected to resume its primary bullish trend, with upside targets at:

🎯 $3,500

🎯 $3,800

These levels align with previous structural highs and Fibonacci extensions from the corrective base.

⚠️ Invalidation Level & Risk Management

This bullish scenario remains valid as long as price holds above the invalidation level.

A daily candle close below this level would invalidate the wave count and require a full reassessment of the market structure.

🧠 Final Thoughts

Market sentiment may feel weak during wave E, but historically this is where smart money positions itself

Patience is key during complex corrections

The structure favors trend continuation rather than reversal

📌 As always, risk management is essential, and this analysis reflects a probabilistic scenario—not financial advice.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

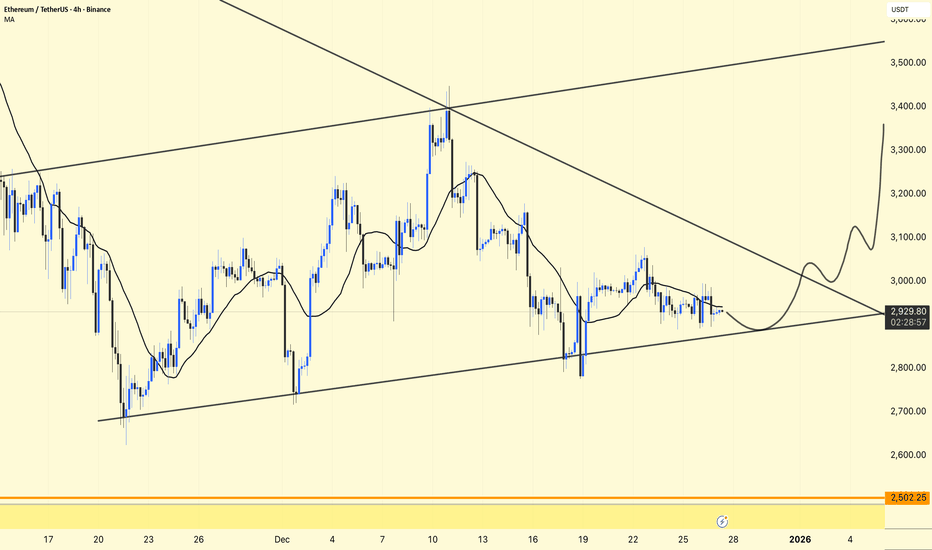

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a rising wedge / ascending structure, holding higher lows.

Price is pushing toward the descending trendline resistance around $3,180–3,220.

Support: $3,000 – $2,950 (trendline + moving averages zone)

Major Support: $2,500 (long-term demand zone)

A clean breakout and hold above the trendline can trigger a strong upside move toward $3,400 → $3,700.

Rejection from resistance may lead to a short-term pullback, but the overall structure remains constructive above support.

⚠️ Trade with confirmation and proper risk management.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is showing strength from the lower trendline and continuing its short-term recovery within the descending structure.

Trend: Still inside a descending channel

Current Move: Higher lows forming → bullish momentum building

Immediate Support: 3,000 – 3,050

Resistance: 3,250 – 3,350 (trendline + supply)

A sustained breakout above 3,300–3,350 can shift momentum toward 3,500+.

Rejection near resistance may cause a pullback toward the 3K support zone.

Bias: Short-term bullish, overall trend neutral until breakout confirmation.

Trade with confirmation and proper risk management.

ETHBTC W Pattern Makes the Case for a Macro Bull MarketIt seems pretty clear to me that ETHBTC is in a multi year W pattern. The higher low on the W, with hidden bullish divergence helps confirm the pattern, as does the recent price action.

From April to May of 2025 price consolidated in a low and then surged to a local high in August when it the orange 0.382 fib level

Since then price has been cooling off to the 200SMA. I kind of feel bad for people that were expecting a death cross, because it very likely that will not be happening any time soon.

Over the next several years ETHBTC is going to chop up. Its going to stall and retrace at fib levels, previous resistance, etc. But the bias is upward.

Total2/Bitcoin

I am also very optimistic on crypto because Total2/Bitcoin is in an ascending triangle formation, also supported by hidden bullish divergence

A daily chart shows a clear break of downward sloping resistance, a breakout and a retest of the trendline as support. We are seeing price going up again after a golden cross a few months ago. Very little chance of bear market in my assessment

Others/Total3

Looks very tempting. Consolidating. About to break out. Impulse up. Probably going to stall at the 0.382 Retrace level. Time will tell. All of the speculative small caps are going to go crazy if Others/Total3 starts to barrel upward to the 1.618. If that happens we are all so pre-rich right now its crazy.

What I am doing

I've stayed biased bull. I bought dips that kept on dipping, and then I bought again. And again when it dipped further. I worked like a dog to get through the holidays so I wouldn't have to cash any out and instead still have money to buy crypto, on top of buying gifts for love ones.

I am going to buy even more.

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Structure: Price is compressing inside a descending wedge, trading near the lower trendline → selling pressure is weakening.

Price reclaimed the short-term 21MA and is testing the 100 MA area — a key decision zone.

Support: 2,900 – 2,880

Resistance: 3,080 – 3,120

Breakout Zone: 3,250 – 3,350+

Sideways grind near support + compression = energy building.

Wait for a clear 4H close above the descending trendline for continuation.

This is a confirmation zone, not a blind entry area.

DYOR | NFA

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA