XAU/USD | Can we get much higher? (READ THE CAPTION)Well, what can I say about Gold? With the way it's been moving in the past couple of days and weeks, I believe $6000 gold is not far-fetched. Gold is currently being traded at $5520, and today it has been consolidating so far, as if it is waiting for something to happen! I would like to see Gold drop to the Consequent Encroachment of the NDOG, sweeping the sellside liquidity and then go back up.

For the time being, Gold's targets are: 5525, 5535, 5545, 5555, 5560 and 5570.

Ethereum (Cryptocurrency)

ETHUSD H1 — Trendline Support Is the Decision PointETH is currently compressing right on a rising H1 trendline, after printing a clean impulsive recovery from the recent sell off low. The structure shows higher lows respected multiple times (highlighted touches), confirming that buyers are defending this diagonal support. Price is now sitting near the 2,920–2,935 zone, where trendline support and short-term structure intersect this is a decision area, not a chase zone.

Bullish case: As long as ETH holds above the rising trendline and the 2,900–2,910 base, pullbacks remain corrective. A clean continuation above local highs opens upside toward 2,980 → 3,020, aligning with trend continuation and momentum expansion.

Bearish risk: A decisive H1 close below the trendline would invalidate the higher-low structure and likely trigger a deeper mean-reversion move toward the 2,850–2,880 demand zone, where liquidity sits from the prior consolidation.

👉 In short: trend intact, but confirmation matters. ETH is not breaking out yet. it’s testing whether this trendline is real demand or just a pause before continuation.

ETH Sell/Short Setup (4H)Based on the price reaction at the FLIP zone, the loss of the ascending trendline, and the formation of a bearish CH (Change of Character), it seems that bearish momentum is starting to take control of the market. These factors together suggest a potential shift in market structure in favor of the sellers.

We have marked two red dashed lines on the chart, which represent our planned entry zones. These areas are selected based on structure and price behavior, not emotions or anticipation.

The targets are clearly defined and labeled on the chart in advance. Risk management is a priority in this setup. Once Target 1 is reached, the position should be moved to break-even in order to protect capital and eliminate downside risk.

If the stop loss is triggered, it simply means we are out of the trade—no revenge trading, no overthinking. This is part of the plan and must be respected.

Now we wait and let the market decide. Patience and execution matter more than prediction.

Normally, we do not share such clean and straightforward setups here. This example is posted purely for educational purposes, to demonstrate how we approach structure-based trading and risk management.

Let’s see how price reacts and what the market delivers.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

Trading Weekends Is a Dead-Man ZoneWeekend trading in crypto looks active on the surface, but the structure underneath is fragile. Liquidity thins, participation drops, and price becomes easier to move with relatively small orders. What appears to be opportunity is often noise amplified by absence of depth. This is why weekends quietly drain accounts rather than build them.

Institutional participation is minimal during weekends.

Many large players reduce exposure or remain inactive, which removes the stabilizing force that normally absorbs volatility and validates structure. Without that participation, levels lose reliability. Breakouts occur without follow-through. Reversals happen without warning. The market is not directional; it is reactive.

Spreads widen and order books thin. This increases slippage and distorts risk. Stops that would survive during active sessions are easily tagged. Entries that look precise on the chart fill poorly in reality. Execution quality degrades, even if the setup appears valid in hindsight.

Another issue is narrative vacuum. During the week, price responds to macro flows, funding dynamics, and session-based participation. On weekends, these drivers are largely absent. Price often rotates aimlessly or runs obvious liquidity pools without establishing commitment. Traders mistake movement for intent and become the liquidity that others exit against.

Psychology also shifts. Weekends invite boredom trading.

Without a structured routine, traders lower standards, widen assumptions, and take setups they would normally ignore. Losses feel smaller individually, but they accumulate through frequency and poor sequencing.

There are exceptions. High-impact events or structural carryover from a strong weekly close can create opportunity. These situations are rare and require reduced size and stricter confirmation. For most traders, restraint is the edge.

The market will still be there on Monday with clearer structure, deeper liquidity, and better execution conditions. Survival in trading is not about participation at all times. It is about choosing when conditions justify risk. Weekends rarely do.

THE MAIN BACKBONE $ETH It held everything from the $880 bottom in 2022 to the $1520 bottom in 2023.

Fakeout (Bear Trap): In mid-2025, price dipped below this line (the middle blue arc). While everyone screamed "ETH is over," it was just a liquidity flush. Price is now back ABOVE this main trendline.

The trend was not violated; it was stress-tested. The direction is still UP.

INVERSE HEAD & SHOULDERS

Look at the blue arcs drawn at the bottom of the chart. This is a textbook, gigantic Inverse Head & Shoulders pattern.

Technical Target, When this pattern plays out, it typically travels the depth of the head upwards. This takes us directly back to the old All-Time Highs (ATH).

THE PIVOT POINT: THE $2800 FORTRESS 🏰

Pay attention to the green dotted line (2,817 level).

SR Flip (Support/Resistance Flip): This was the ceiling that couldn't be broken in 2024. Now, it is the floor the price is sitting on.

Status: ETH is currently at $2,951, holding above this critical support. As long as $2,800 is defended, the structure is BULLISH.

THE SILENT STORM

While the market is busy talking about Solana, SUI, or AI coins, Ethereum is quietly building the largest accumulation structure in history in the background.

Psychology: Investors are "tired" of ETH. This is a bottom signal.

It is above the rising trendline and forming a massive IH&S.

First stop is $4,100 (Upper green line). Once that breaks, price discovery begins.

"When elephants walk, the earth shakes." ETH currently looks like a sluggish elephant preparing to move, but once it starts running, it won't stop to pick up passengers.

With a stop-loss below $2,800, this zone (Right Shoulder) offers a perfect Risk/Reward ratio.

ALso check

ETHBTC

8 years breakout EVE here

SOL/USDT | SSL sweep? (READ THE CAPTION)As you can see in the 4h chart of SOLUSDT, it has experienced a massive drop from 148.74 all the way to 117.15, but managed to recover a bit and reached 128.34 before dropping again and now it's being traded at 122.70.

I don't want Solana to go for the Sellside liquidity pinpointed on the chart, but it is not unlikely for it to go there and sweep the liquidity below the 116.88 level, then starting a move upwards, going for the IFVG.

Bullish Targets for Solana: 123.00, 123.50, 124.00, 124.50 and 125.

Bearish targets: 122.50, 122.00, 121.50 and 121.00.

Ethereum update after "the crash" — $1.67B long liquidations 24hThere is no crash really, more like a continuation of the retrace...

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Ethereum is a very strong buy right now. We are witnessing the production and confirmation of a higher low. 30-January 2026 vs 21-November 2025. A true higher low I should say this time.

The low 21-November was $2,623. The low today $2,689. This is technically a double-bottom. The price is too close to the last low but the higher low signal still valid remains. It can be read in both ways.

On a daily basis, trading volume has been dropping since November 4.

What to expect?

Within the last 24 hours, $1.67B worth of long positions have been liquidated. The signal that I've been mentioning for the bulls also works in reverse. That is, when the market liquidates $1.2B worth of shorts within 24 hours, we know the bulls are in.

The fact that we have this much liquidations, $1.67B in just a single day, reveals the retrace is over. The bulls have been liquidated, the market can go up next.

The exchanges will use all the profits they made through selling and loaning and fees to buy everything at bottom prices, at the current market low. This low is the lowest possible, the exchanges know. Many people are not able to buy because of the recent move but the exchanges can, they buy everything at the low and prop up the market. When prices are really high, the same situation with the long positions will be repeated with the shorts.

Remember, we trade against exchanges not other people, and the exchanges have all of our information and hold all the coins. The way to beat the exchanges is to buy spot focusing on the long-term.

Ethereum continues to be bullish, market conditions have not changed.

We have an even better entry price now. Prepare for massive growth. The last bullish advance before the continuation of the bear market that started 4 months ago.

While Ethereum produced a lower high based on the candle wick, within the consolidation range, it produced a higher high based on candle close. The candle close is more important than the wick. Couple this with the current double-bottom/higher low, and you get the picture... The relief rally is not over, we have one more bullish move before the continuation of the bearish cycle.

The next drop, after the last jump, will produce a strong lower low compared to 21-November 2025. Right now, we are still within the same trading zone.

The smaller altcoins will grow many times more compared the bigger projects. Many of these altcoins were not affected by Bitcoin's and Ethereum's recent drop, ENSOUSDT and THEUSDT are two quick examples if you want to see some charts, also ROSEUSDT from the ones I've been sharing recently. This reveals much. Many of these altcoins will produce a massive bull run in the coming weeks. Choose wisely.

Namaste.

BTC/USDT | Sweeping the SSL (READ THE CAPTION)After failing to sweep the liquidity, BTCUSDT has been experiencing a dramatic drop in its price, going as low as $81,118 and now being traded at 82,735. I would like to see BTC drop more and sweep the sellside liquidity before make an upwards move.

Targets for BTC: 82,000, 81,500, 81,000 and 80,500.

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BTC/USDT | Next targets (READ THE CAPTION)After reaching 97,924 around 2 weeks ago, BTCUSDT has been dropping gradually, reaching as low as 86,074 and is now being traded at 88,200 after failing to go through the IFVG. I expect BTCUSDT to retest the IFVG.

Current targets for BTCUSDT: 88,250, 89,000, 89750 and 90,500.

BTC/USDT | What's ahead? (READ THE CAPTION)As you can see in the Hourly chart of BTCUSDT, it reached all 4 targets of the previous analysis, reaching 90,600, going above the high of the IFVG, but then again, it returned to the IFVG zone and then went even lower, being traded now at 87,900.

There are relatively equal lows below with liquidity residing below them.

Ideally, I'd like BTCUSDT to sweep the liquidity below there and then make an upwards move.

For the time being, bullish targets: 88,200, 89,200 and 90,200.

Bearish Targets: 87,500, 86,900 and 86,300.

ETHUSD 2H Demand Reaction & Potential Mean ReversionThis is a 2-hour ETH/USD chart (Coinbase) showing a clear market structure shift from bullish to bearish, followed by consolidation at demand.

Key observations:

Upper Range & Supply Zone (~3,320–3,400):

Price previously traded within a defined range near supply, showing multiple rejections at the highs. This area acted as strong resistance.

Break of Structure (BOS) → Distribution:

After pushing into supply, ETH failed to hold higher highs, indicating distribution before the sell-off.

CHoCH & Breakdown (~3,080):

A Change of Character (CHoCH) occurred as price broke below prior support, confirming bearish control. This level flipped from support to resistance.Strong Impulsive Sell-Off:

Following the breakdown, price dropped aggressively, showing imbalance and momentum to the downside.

Demand Zone (~2,880–2,920):

Price reacted sharply at demand, forming long wicks and halting the decline—suggesting buy-side interest.

Lower Range Consolidation (~2,920–3,040):

ETH is currently ranging at the lows, indicating pause/accumulation after the impulsive move.

Projected Targets:

2nd Target: Return to prior structure near ~3,080

1st Target: Range midpoint / prior resistance near ~3,280

These imply a potential mean reversion or corrective move if demand holds

The chart tells a classic story:

Distribution at supply → structure break → sell-off into demand → consolidation, with upside targets mapped if the demand zone continues to defend.

If you want, I can also:

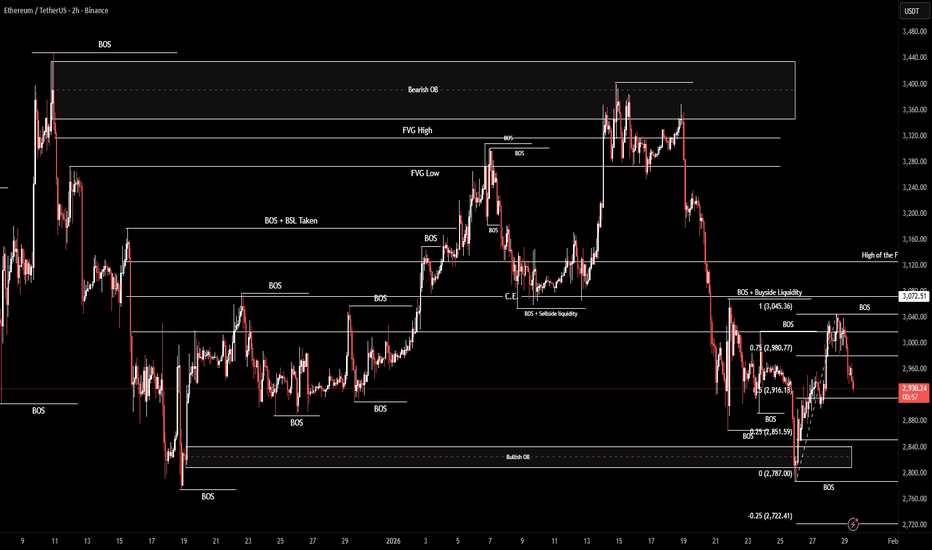

ETH/USDT | Going back up? (READ THE CAPTION)By examining the 2H chart of ETHUSDT, we can see that after reaching 3400 2 weeks ago, it experienced a drop from there all the way to 2787, reaching the Bullish OB and bouncing back up to 2933 and now is being traded at 2908.

I expect ETHUSDT to retest the FVG outlined above, and then going over the Consequent Encroachment of the FVG.

For now, the targets are: 2957, 3000, 3037 and 3074.

ETH/USDT — Breakdown Below Channel Midline: Liquidity Sweep Setu

Price is consolidating below the midline of the ascending channel after a failed retest from underneath.

This is a bearish signal for bullish continuation.

A large cluster of stops (liquidity) sits below the $2,600 low.

If those stops are swept, the probability of a sharp sell-off increases.

Personally, I plan to add on that move, with the maximum volume zone around $2,250.

Below that, I only expect continuation in a panic-sell / black-swan scenario.

📌 Fundamentals: ETH remains the second most important asset in crypto after BTC.

On a higher timeframe , price moves in distribution/re-accumulation blocks.

Right now, we’re seeing a prolonged change of hands inside a large flat-top triangle.

This formation is typically resolved to the upside, with a fast repricing — similar to what BTC did in the past.

Last time, most participants exited BTC at $30–40k — myself included.

This time, I don’t plan to repeat that mistake.

What about you?

Why Market Movements Are About Probability, Not CertaintyWassup traders! 🔥

Ever thought trading was all about making the right calls? Well, let us hit you with a truth bomb — it's not about getting it right every time. It's about managing your edge and playing the odds. Trading is a probability game, and if you're not thinking in terms of probabilities, you're doing it wrong.

⚡Embracing Market Uncertainty

Let’s face it: the market is unpredictable. No matter how much you analyze, you can't fully predict what's coming next. Market uncertainty is real, and that’s exactly what makes trading interesting — and risky. The market isn't going to follow any pre-set rules, and that’s why we call it non-deterministic. It’s random, and if you're not comfortable with that, you're in the wrong game.

🕵️♂️ Understanding the Odds: Randomness in Trading

Simple truth — randomness in trading means you can’t guarantee a win. The good part? You don’t have to. What matters is that you’re stacking the odds in your favor. Probabilistic systems are just a way to describe how markets behave — uncertain, variable, and spread across different outcomes.

📊 Expected Value: A Useful Way to Frame Outcomes

Expected value describes the average result across a series of outcomes rather than the result of a single trade. It’s a statistical concept used to explain how gains and losses distribute over time, not a promise of performance or a guarantee of success. The idea isn’t about constant wins, but about how outcomes balance out across many observations. A helpful analogy is probability theory itself: even when a higher-probability outcome exists, individual results can still vary, and short-term deviations are part of the process.

🪤 Risk and Uncertainty: They’re Always There

In trading, there’s no such thing as no risk. Risk and uncertainty are just part of the game. But that doesn’t mean you can’t take control. The trick is to manage your statistical edge. By analyzing past patterns, using data, and looking at the bigger picture, you can make trades that improve your chances of success. It’s all about getting smarter with your decisions, even when the market feels like chaos.

🧠 Making Smart Decisions Under Uncertainty

The real skill in trading? Decision-making under uncertainty. You can't get rid of the uncertainty — that’s a given. But you can make better choices by using the odds to your advantage. The key is to not freak out over a loss or get too confident after a win. It's about understanding that every trade is a part of a bigger, ongoing strategy.

🧭 Final Thought

So, next time you’re ready to make a trade, remember: it’s not about being right every time. It’s about making your own decisions based on probability in markets and understanding that each trade is part of the bigger picture. Nothing here is a recommendation, signal, or financial advice — you’re on your own with every click you make. The more you manage your edge and stay disciplined with the numbers, the less power uncertainty has over your decisions. Markets thrive on ambiguity, and that’s exactly what creates hesitation. That’s why DYOR isn’t optional — it’s survival. Stay sharp, stay skeptical, and stay safe in this ocean of probabilities.

This material is for informational purposes only and does not constitute trading or investment advice.

ETH Update📊 ETH Update

ETH remains in a bear market 🐻

and has formed a head and shoulders pattern

on the weekly timeframe 👀.

Price has broken below the black neckline support ❌,

confirming bearish structure.

What’s next? 👇

Key levels to watch:

🔹 First level: around $2,500

→ Previous POC

→ Price could stabilize or bounce here.

🔹 Second level: blue support zone around $2,100

→ Another area where price may stabilize.

🔹 Last major level: around $1,500

→ Strong long-term area for those looking to accumulate ETH.

These are the most important ETH levels right now.

⚠️ Important note:

There are no bullish reversal signals at the moment.

Bias remains bearish until structure changes.

Stay patient,

risk management first.

$ETHA head and shoulders top confirmed. Target sub $10As you can see from the chart, we've formed a head and shoulders top and have now broken down under the neckline. If it can't reclaim the neckline, then the most likely path is for it to break the first support and head lower towards the $5-6 range.

Let's see how it plays out.

SOL/USDT | Slowly going back up (READ THE CAPTION)By examining the daily chart of SOLUSDT we can see that after dropping as low as 112.14 and touching the high of the Bullish OB, it bounced back up and its currently being at 116.00.

Considering that Solana has swept the liquidity pool, I expect it to slowly move higher.

Targets for Solana: 116.50, 117.00, 117.50, 118.00, 119.00 and 120.

XAU/USD | Targets ahead (READ THE CAPTION)By examining the hourly chart of Gold, we can see that it has had several 1000+ pips moves in the past couple of days! 3-4 1000+ pips moves in just the past 3 hours!

Since last night, gold has dropped over 4000 pips! Going as low as 4941, going through the NWOG, and sweeping the Sellside Liquidity there before going back up and now it's being traded at 5100. The wicks did their damage, they swept the liquidity and then went back up, and the Body of the candle closed just above the Jan 26 NWOG High.

At the moment, Gold is moving towards the Liquidity pool above the 5241 level, should it make it above the Daily FVG, it'll go for it.

However, if Gold closes below the Jan 26th NWOG low, I can see it going for the Sellside Liquidity below the 4899 level.

Bullish targets for Gold: 5170, 5200, 5230 and 5260.

Bearish Targets: 5060, 5030, 5000 and 4970.

ETH/USDT | Where will it go? (READ THE CAPTION)By examining the 4H chart of the ETHUSDT we can see that Ethereum hit 3045, hitting the low of the FVG, but then today it dropped all the way to 2923, now being traded at 2928.

I'd like to see Ethereum retest the FVG again and then sweep the Buyside Liquidity pool.

Bullish Targets: 2936, 2954, 2972 and 3000.

Bearish targets: 2916, 2900 and 2884.

ETH Holding Major Support Inside Descending Broadening WedgeEthereum is currently trading inside a major descending broadening wedge structure on the daily timeframe. Price has been compressing while respecting the wedge boundaries, and it is now approaching a key confluence zone formed by ascending support and Fibonacci retracement levels.

The grey zone highlights the 0.5 to 0.618 Fibonacci retracement area, which aligns closely with the rising long term support trendline. This makes the current region a high importance reaction zone. As long as ETH holds above this ascending support, the structure remains constructive for a potential upside continuation.

A successful hold and bounce from this area could allow price to rotate higher toward the upper boundary of the broadening wedge and eventually attempt a breakout. On the downside, a clean loss of this support would weaken the bullish case and open the door for a deeper retracement before any meaningful recovery.

ETH is at a technical decision point where the reaction around support will likely define the next major move.

Ethereum Is Reclaiming Structure — Support Holding Keeps Upside Hello traders, COINBASE:ETHUSD is currently trading near $2,946, consolidating just above a well-defined support zone around $2,930–$2,950 on the four-hour timeframe. After the sharp selloff that pushed price down toward $2,780, the rebound was impulsive and decisive, signaling strong demand absorption rather than a weak corrective bounce.

Since that recovery, price has transitioned into a range-bound rotation between the support zone and a higher-timeframe resistance zone around $3,030–$3,070. This behavior reflects balance, not rejection. Buyers have consistently defended the support area, while sellers have so far failed to establish acceptance below it. As a result, Ethereum remains in a wait-and-react phase rather than a confirmed trend environment.

From a structural perspective, the bullish scenario remains valid as long as price continues to hold above the $2,930 support zone. Pullbacks into this area that remain corrective would favor further upside attempts. A sustained reclaim and acceptance above the $3,000–$3,050 resistance zone would mark a shift in short-term market character and open the path toward higher levels near $3,120–$3,150, where price may encounter its next reaction area.

Invalidation is clear and objective. A decisive breakdown and acceptance below $2,930 would disrupt the current structure and increase the probability of a deeper corrective move back toward $2,800–$2,780.

For now, Ethereum is not breaking down it is stabilizing after a strong recovery.

Support respected. Range defined. Let acceptance decide the next expansion.