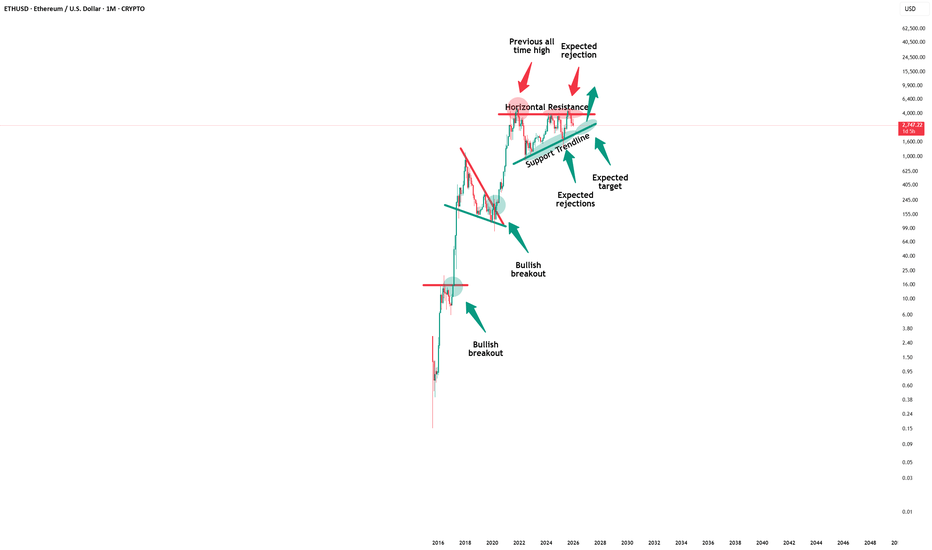

Ethereum - Still a textbook chart!📌Ethereum ( CRYPTO:ETHUSD ) will first drop, then rally more:

🔎Analysis summary:

Over the course of the past couple of weeks, Ethereum has just been consolidating. But actually looking at the higher timeframe, Ethereum remains overall bullish. But first, we have to see another short term drop of about -20% back to the major support trendline.

📝Levels to watch:

$2,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Ethereumusd

ETHUSD 45-Min Chart — Counter-Trend Long From Demand After Major

Chart Analysis:

Market Structure:

Ethereum broke decisively below the 2,855 resistance zone, confirming a bearish structure shift. The move down was impulsive, followed by weak consolidation — classic distribution → continuation behavior.

Support / Demand Zone:

Price is reacting around 2,485–2,520, a highlighted demand area. This zone aligns with the first strong base formed after the sell-off, making it a high-interest reaction level.

Current Price Action:

ETH is printing long lower wicks into support, suggesting seller exhaustion and early dip-buying. However, structure is still bearish until a reclaim occurs.

Entry Logic:

The marked entry near ~2,490–2,510 assumes:

Support holds

A short-term higher low forms

Momentum flips on lower timeframes

Upside Targets:

TP1: ~2,690 (range equilibrium / liquidity grab)

TP2: ~2,740 (previous consolidation + minor resistance)

Final Target: ~2,855 major resistance (breakdown origin)

Invalidation:

A clean breakdown and close below 2,480 invalidates the long bias and opens continuation toward lower liquidity.

Bias Summary:

Trade Type: Counter-trend bounce

Risk Profile: Higher risk, higher R:R

Trend Context: Bearish until 2,855 is reclaimed

Ethereum Breaks Structure as Sellers Regain Control!🎯 ETH/USD: ETHEREUM vs TETHER - Crypto Market Profit Pathway Setup 💰

📊 Day/Swing Trade Opportunity | Bearish Momentum Confirmed ⚡

🔥 REAL-TIME MARKET DATA (January 25, 2026) 📈

Current ETH Price: $2,929 - $2,948 USD 💵

24H Volume: $8.1B - $25.89B (Extremely High Activity! 🚀)

Market Cap: $353.5B - $354.9B (#2 Crypto by Market Cap 👑)

24H Change: -0.06% to -3.07% (Bearish Pressure Building 🐻)

Market Rank: #2 Global Cryptocurrency 🥈

📉 TECHNICAL ANALYSIS & SETUP 🎨

🔴 Trade Plan: BEARISH CONFIRMATION

✅ Triangular Moving Average Breakout Confirmed

✅ Double-Top Pattern Formed at $4,000 Resistance (Major Reversal Signal! ⚠️)

✅ RSI Dropped Below 14-Week MA (Trend Reversal Confirmed 📉)

✅ Price Broke Below 100-Week EMA (5th Time Since 2022 - Historical Bearish Indicator! 🔻)

Chart Pattern: Symmetrical Triangle Breakdown + Structural Support Violation 📐

Momentum Indicators: Bearish divergence across multiple timeframes ⏱️

Bollinger Bands: Tight squeeze pattern (High Volatility Expected! 💥)

🎯 THIEF STRATEGY - LAYERED ENTRY EXECUTION 🏴☠️

💡 What is Thief Strategy?

Multiple Limit Orders (Layering Method) = Dollar-Cost Averaging into position across multiple price zones for optimal risk distribution! 🎲

🚨 RECOMMENDED SELL LIMIT LAYERS (Short Position):

Layer 1: 🔴 $3,150 (25% of Position Size)

Layer 2: 🟠 $3,100 (25% of Position Size)

Layer 3: 🟡 $3,050 (25% of Position Size)

Layer 4: 🟢 $3,000 (25% of Position Size)

Alternative Entry: Any current market price levels ($2,929 - $2,950 range) for aggressive traders 🎯

💎 Pro Tip: You can increase layer count based on your capital allocation and risk management strategy! Scale as you see fit, Thief OG's! 💪

🏆 PROFIT TARGET - "POLICE FORCE ZONE" 🚔

Primary Target: $2,700 🎯

Why This Level?

✅ Strong Historical Support Zone (Multiple bounces recorded 📊)

✅ Oversold Territory Expected (RSI < 30 anticipated 📉)

✅ Liquidity Trap Area (Institutional buyers likely positioned here 💰)

✅ Correlation with BTC Support Levels (Bitcoin dominance analysis confirms 🔗)

Potential Profit: ~8-15% from layered entries 💵

Risk-to-Reward Ratio: Approximately 1:2.5 to 1:3.5 📊

🛡️ RISK MANAGEMENT & STOP LOSS ⛔

Thief Stop Loss: $3,200 🚨

Invalidation Level: Price action above $3,200 negates bearish setup ❌

Risk Per Layer: Approximately 1.5-5% depending on entry point 📊

⚠️ IMPORTANT DISCLAIMER - READ CAREFULLY! 📢

Dear Ladies & Gentlemen (Thief OG's): 👋

I am NOT recommending you set only my TP/SL levels blindly! This is YOUR trade, YOUR capital, YOUR decision. 💯

You can make money, then TAKE MONEY at your own risk and comfort level! 🎰

Partial profits at $2,900? ✅ Your choice!

Exit at $2,850? ✅ Your prerogative!

Hold to $2,700 or beyond? ✅ Your strategy!

Risk Management is KING! 👑 Always trade with stop losses and position sizing! 📏

💱 RELATED PAIRS TO WATCH 👀

Correlated Assets for Multi-Pair Analysis:

BTC/USD (Bitcoin) 💰

Current: ~$89,100 - $93,700

Correlation: HIGH (BTC leads, ETH follows with amplified moves 📈📉)

Strategy: Watch BTC breaks below $88,000 support = ETH acceleration lower! ⚡

ETH/BTC (Ethereum vs Bitcoin Ratio) 🔄

Current: ~0.0346 BTC

Correlation: INVERSE strength indicator

Strategy: Weakening ratio confirms ETH underperformance 📉

SOL/USD (Solana) 🌟

Current: ~$137.45

Correlation: MEDIUM-HIGH (L1 blockchain competitor)

Strategy: Monitor for rotation signals from ETH to SOL 🔄

LINK/USD (Chainlink) 🔗

Correlation: MEDIUM (Ethereum ecosystem dependent)

Strategy: LINK weakness confirms ETH bearish momentum 📊

MATIC/USD (Polygon) 🟣

Correlation: HIGH (L2 scaling solution for Ethereum)

Strategy: Polygon decline = ETH infrastructure stress 🚨

AAVE/USD & UNI/USD (DeFi Leaders) 🏦

Correlation: HIGH (Ethereum DeFi ecosystem health)

Strategy: DeFi token weakness = ETH selling pressure ⚠️

Key Insight: Monitor these pairs for confirmation signals! When multiple correlated assets move together = HIGHER PROBABILITY SETUP! 🎯

🌍 FUNDAMENTAL & ECONOMIC FACTORS 📰

🔴 BEARISH CATALYSTS (Current Market Environment):

1. FEDERAL RESERVE POLICY UNCERTAINTY 🏦

❌ Interest Rates Held at 3.5%-3.75% (No immediate cuts expected! 🚫)

❌ Inflation Remains Above 2% Target (Wholesale prices +3%, Core CPI at 2.6% 📈)

❌ Jerome Powell's Tenure Ends May 2026 (Transition uncertainty ahead! ⚠️)

⚡ Impact: Risk assets under pressure as "higher for longer" narrative persists 📉

2. CRYPTO MARKET SENTIMENT - EXTREME FEAR 😨

📊 Fear & Greed Index: 24 (EXTREME FEAR ZONE!) 🔴

📊 BTC Dominance Rising: 59.8% (Capital fleeing altcoins including ETH! 🏃♂️)

📊 ETF Outflows Accelerating:

BTC ETFs: -$483M outflows (January 20) 💸

ETH ETFs: -$229M outflows (Breaking 2-month green streak!) 😱

3. GEOPOLITICAL TENSIONS & TARIFF CONCERNS 🌐

⚠️ US-Europe Tensions Escalating (Greenland disputes creating risk-off environment 🗺️)

⚠️ Tariff Threats on China (100% tariff increases = market instability! 💥)

⚡ Impact: "Crypto acts like ATM during uncertain times" - Recent 6.6% BTC drop confirms 📉

4. TECHNICAL BREAKDOWN SIGNALS 📉

🔻 Double-Top Pattern at $4,000 (Classic reversal formation! ⚠️)

🔻 $648M ETH Derivatives Liquidated (234,227 trader positions wiped! 💀)

🔻 Price Below $3,200 Key Support (January 19 breakdown confirmed 🚨)

🔻 25-Delta Skew Deterioration (Traders paying premium for downside protection! 🛡️)

🟢 POTENTIAL BULLISH CATALYSTS (Medium-Term, Post $2,700):

1. INSTITUTIONAL ACCUMULATION SIGNALS 💼

✅ Morgan Stanley ETH ETF Filing ($1.8T AUM entering market! 🏦)

✅ BitMine Aggressive Buying: 278,551 ETH purchased (30 days) = $13B+ total holdings 💰

✅ Stablecoin Growth: $300B supply, $1.1T monthly transactions (ETH ecosystem benefit! 📈)

2. ETHEREUM ECOSYSTEM DEVELOPMENTS 🛠️

✅ Pectra Upgrade Success (Improved scalability, lower gas fees ⚡)

✅ Upcoming: Glamsterdam & Hegota Upgrades (2026 implementation planned 🚀)

✅ DeFi Dominance: 68% Market Share ($68B TVL - Aave & Lido leading 👑)

✅ Layer-2 Scaling: Base & Arbitrum efficiency improvements 🔧

3. REGULATORY CLARITY POTENTIAL 📜

✅ CLARITY Act Progress (Could pass Senate in 2026 🏛️)

✅ Trump Administration Crypto-Friendly Stance (Despite current tariff concerns 🤝)

✅ Institutional Framework Development (Traditional finance integration advancing 🏦)

4. FUTURE FED POLICY EASING 📊

✅ 2+ Rate Cuts Expected 2026 (Mark Zandi, Moody's Analytics forecast 📉)

✅ Potential New Fed Chair (Kevin Hassett): "Cheaper car loans, easier mortgages" rhetoric 💰

✅ Historical Pattern: Past cycles peaked during rate hikes; current environment = rate cuts! 📈

🎲 UPCOMING ECONOMIC EVENTS TO MONITOR 📅

Critical Data Releases (Next 30 Days):

January 29, 2026: FOMC Meeting Decision 🏦

Impact: HIGH ⚡⚡⚡

Watch for: Rate guidance, Powell's press conference tone 🎤

February 2026: ISM Manufacturing PMI 📊

Impact: MEDIUM ⚡⚡

Watch for: <50 = economic slowdown = potential risk asset pressure 📉

February 2026: Monthly Jobs Report 💼

Impact: HIGH ⚡⚡⚡

Watch for: Weak job creation = Fed dovish pivot potential 🕊️

Q1 2026: Fed Chair Transition Announcements 🔄

Impact: HIGH ⚡⚡⚡

Watch for: Kevin Hassett confirmation = dovish policy expectations 📈

Ongoing: Trump Tariff Policy Updates 🌐

Impact: VERY HIGH ⚡⚡⚡⚡

Watch for: Escalation = risk-off / De-escalation = risk-on 🎢

📊 VOLUME & LIQUIDITY ANALYSIS 💧

24H Trading Volume: $3.8B - $25.89B (MASSIVE volume spike indicates institutional activity! 🐋)

Open Interest Changes: Declining futures OI = reduced speculative positioning 📉

Exchange Flows: Net outflows from exchanges = potential supply squeeze (bullish for reversal) 🔄

Whale Activity Alert: 🐋

Large liquidations observed ($648M derivatives wiped)

Smart money appears to be accumulating near support zones

Watch for $2,700-$2,750 zone for reversal signals! 👀

🎯 TRADE EXECUTION CHECKLIST ✅

Before Entering This Trade:

✅ Confirm your risk tolerance (Max 2-5% account risk recommended!)

✅ Set ALL limit orders if using layered strategy

✅ Place stop loss at $3,200 (or adjusted to your risk parameters)

✅ Monitor BTC/USD correlation (BTC leads the market!)

✅ Check upcoming FOMC announcements (Calendar marked?)

✅ Review your position size (Never over-leverage, Thief OG's! 🚫)

✅ Have profit-taking plan ready (Partial exits at multiple levels?)

✅ Confirm exchange liquidity for your order sizes

✅ Set price alerts at key levels ($3,000, $2,900, $2,700)

✅ Mentally prepare for volatility (Crypto never sleeps! 🎢)

🔥 FINAL THOUGHTS - THE THIEF OG PHILOSOPHY 🏴☠️

Trading is 90% Risk Management, 10% Entry Timing! 💯

This setup presents a HIGH-PROBABILITY bearish scenario based on:

✅ Technical breakdown patterns

✅ Macro economic headwinds

✅ Market sentiment extremes

✅ Historical correlation data

✅ Real-time volume analysis

BUT REMEMBER: 🧠

Markets can remain irrational longer than you can remain solvent!

Unexpected news can flip the script instantly!

ALWAYS protect your capital with stop losses!

NEVER trade with money you can't afford to lose!

Take profits when you have them - "Pigs get slaughtered" 🐷

💬 COMMUNITY ENGAGEMENT 🤝

Like this idea? Smash that 👍 button!

Disagree? Drop your counter-analysis in comments! 💬

Following this trade? Update us on your results! 📊

Let's make money together, Thief OG's! 💰🎯🔥

🏴☠️ Trade Smart. Trade Safe. Trade Like A Thief OG! 🏴☠️

#ETHUSD #Ethereum #CryptoTrading #TechnicalAnalysis #BearishSetup #DayTrading #SwingTrading #ThiefStrategy #TradingView #CryptoAnalysis #RiskManagement #FOMC #FederalReserve #DeFi #Layer1 #SmartContracts #Blockchain #TradingIdeas #ChartPatterns #PriceAction 🚀📊

ETH - Does THIS FRACTAL Look Familiar ??Hello Fellow Traders

So on this chart, we see some very interesting developments. What we see is Ethereum making a parabolic increase during the bullish cycle, which lasts approximately the same amount of time, which is roughly around 4 - 5 months.

We then see the start of a correction as soon as the parabolic curve is lost and the first three impulse waves down is characterized by the second point, (point B) being almost as high as the all-time high. And then the price further corrects to C, which is minus 40 - 50% of the total price.

After which we then see a period of range trading almost characteristically seeing higher lows again and again. We do not see higher highs. We then see another impulse wave up over 2-3 months, marked by a 30% increase (upside correction):

The price will likely spike, and then fall to lower lows as it did with the previous fractal, Where -60% puts us as $1600:

Ethereum Builds Strength: Day Trading Blueprint🔥 ETH/USD — Ethereum Day-Trade Breakout Blueprint 🚀 | Bullish Momentum Setup 🔍

📌 Asset: ETH/USD — Ethereum vs U.S. Dollar

📈 Market Type: Crypto | DAY TRADE Blueprint

📖 Trade Plan — Bullish Breakout Structure

ETH is building strong upward momentum with clean higher-lows and tightening price compression. Buyers are stepping in across major crypto pairs, signaling strength in the broader market cycle.

🎯 Entry

Any price-level breakout entry depending on your execution style.

🛑 Stop Loss (Risk Management First)

This is Thief SL → @ 2760

Dear Ladies & Gentlemen (Thief OG’s), adjust your SL based on your OWN strategy and risk.

⚠️ I'm NOT recommending to use ONLY my SL — your money, your rules, your risk tolerance.

🏆 Target

Moving Average is acting as strong resistance + market is entering overbought zones + potential trap formation for late buyers.

Our TP Zone → @ 3000

⚠️ Dear Ladies & Gentlemen (Thief OG’s), TP is your personal choice.

You can take profits the way YOU manage risk.

🔗 Related Pairs to Watch (Correlation Radar)

Watching correlated pairs gives confirmation + early signals of ETH strength or weakness.

1️⃣ BTC/USD (Bitcoin) — King Maker

ETH usually follows BTC’s momentum.

If BTC shows bullish continuation + strong volume → ETH breakout becomes HIGHER probability.

If BTC stalls or rejects → ETH breakouts often fail or become fakeouts.

2️⃣ ETH/BTC — Relative Strength Pair

A rising ETH/BTC = Ethereum outperforming Bitcoin.

A falling ETH/BTC = ETH lagging → Breakouts weaken.

Key Significance: Shows where smart money is rotating.

3️⃣ NASDAQ 100 / US Tech Index ( NASDAQ:NDX / NASDAQ:QQQ )

ETH has high correlation with risk-on tech sentiment.

If US tech rallies → Crypto liquidity flows → ETH bullish pressure increases.

If tech sells off → Crypto often follows.

4️⃣ DXY — U.S. Dollar Index ( TVC:DXY )

Weak USD → Crypto strengthens (inverse correlation).

Strong USD → Crypto cooling or correcting.

Watching DXY helps understand global risk appetite.

5️⃣ SOL/USD, AVAX/USD, MATIC/USD — Layer-1 Competitive Coins

High performance in these alt L1s often triggers rotation flows into ETH.

When these pump together → ETH usually follows with momentum.

📊 Why These Correlations Matter

Crypto → Highly interconnected; no asset moves alone.

BTC controls trend direction.

TradFi indices & USD influence liquidity conditions.

ETH/BTC shows smart-money rotation.

Alt-L1s show risk appetite in the broader ecosystem.

Tracking these pairs = fewer fake breakouts + stronger conviction.

ETH/USDT Bullish Continuation Setup With MA Confluence🚀 ETH/USDT BULLISH PROFIT PATHWAY

Ethereum vs Tether | Day / Swing Trade Setup

📌 MARKET OVERVIEW

🔹 Asset: ETH/USDT

🔹 Market Type: Crypto

🔹 Trade Style: Day / Swing

🔹 Bias: BULLISH 📈

Ethereum is showing strong bullish continuation behavior after a healthy pullback, indicating smart money accumulation rather than distribution.

🧠 TRADE PLAN – WHY THIS SETUP WORKS:

✅ Bullish confirmation achieved with:

🔁 786 Hull Moving Average pullback → trend respect by buyers

🚀 386 Triangular Moving Average breakout → momentum shift in favor of bulls

🧲 Price holding above dynamic support → dip buyers active

📊 This structure suggests trend continuation, not exhaustion.

🎯 ENTRY STRATEGY – THIEF LAYERING METHOD

💡 Thief never chases — Thief stacks positions 🥷

🔹 Entry Style: Layered limit entries (cost-averaging with control)

🔹 Execution: Buy ANY price level using layers

📍 Suggested Buy Layers:

• 2950

• 3000

• 3050

• 3100

⚠️ Increase or reduce layers based on:

Risk tolerance

Timeframe

Volatility conditions

🧠 Why layering works:

It reduces emotional entries, improves average price, and lets thieves profit from volatility traps.

🛑 STOP LOSS – CAPITAL PROTECTION

🚨 Thief SL Zone: 2900

⚠️ Important Note for OGs:

This SL is a reference, not an instruction.

Adjust SL based on:

Your position size

Timeframe

Account risk rules

💬 Risk management keeps thieves alive longer than predictions.

🎯 TARGET & EXIT STRATEGY

🎯 Primary Target: 3400

🚓 Why 3400 is critical:

Strong resistance zone

Overbought conditions likely

Profit-booking + trap area

Correlated rejection risk

💰 Smart Exit Idea:

Scale profits instead of waiting for one magic number:

• Partial TP near resistance

• Trail stop after momentum slows

📌 Thieves escape with profits — not with hope.

🔄 RELATED PAIRS TO WATCH (CORRELATION CHECK)

📊 These pairs help confirm or invalidate ETH strength:

🔹 BTC/USDT – Market leader

• BTC strength = ETH momentum confirmation

• BTC weakness = caution on ETH longs

🔹 ETH/BTC – Alt strength meter

• Rising ETH/BTC = alt season behavior

• Falling ETH/BTC = BTC dominance risk

🔹 SOL/USDT & AVAX/USDT

• If these lead → risk-on sentiment

• If they stall → reduce aggression

🧠 Correlation helps thieves filter fake breakouts.

🌍 FUNDAMENTAL & MACRO CONTEXT

📌 Current Market Drivers:

• Ethereum supply dynamics tightening due to staking

• Network upgrades supporting long-term demand

• ETF & institutional attention influencing volatility

• Macro risk sentiment impacting crypto flows

📆 Upcoming Considerations:

• Sudden news = volatility spikes

• Macro data releases can shake leverage

• Always expect fake moves before real expansion

⚠️ News doesn’t create trends — it accelerates them.

🧩 KEY LEVELS SUMMARY

📍 Support Zones: 2950 – 3000

📍 Bull Control Zone: Above 3050

📍 Resistance / Exit Zone: 3280 – 3400

📍 Psychological Levels: 3000 & 3400

FINAL THIEF MESSAGE

💬 Dear Ladies & Gentlemen (Thief OGs),

This plan is a framework, not financial advice.

You control:

Entry size

Stop loss

Profit taking

💰 Make money → protect capital → escape clean.

👇 Drop your bias in comments:

Bullish continuation or trap near 3400?

Let’s see who escapes with loot 🥷🔥

Ethereum - The bearmarket is not over yet!🪚Ethereum ( CRYPTO:ETHUSD ) can still drop about -30%:

🔎Analysis summary:

Over the past four years, Ethereum has been creating a major bullish triangle. With the recent all time high retest, we are now seeing an expected reversal. But considering the bullish nature of this triangle, Ethereum will head higher after a retest of the next support.

📝Levels to watch:

$2,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Ethereum May Have Finished the Sell-Off — Now Comes the TestOn the H4 timeframe, Ethereum’s price action aligns well with a completed 5-wave Elliott impulse to the downside. Wave (1) initiated the breakdown from the prior distribution range, followed by a weak corrective Wave (2) that failed to regain structure. Wave (3) unfolded as the strongest and most extended leg lower, confirming dominant bearish momentum a textbook characteristic of a third wave. This was followed by a shallow, overlapping Wave (4), before ETH printed a final Wave (5) sell-off into the 2,880–2,950 region, where downside momentum visibly slowed, suggesting selling exhaustion.

With Wave (5) likely completed, ETH now appears to be transitioning into a corrective ABC structure to the upside. The initial rebound from the lows can be interpreted as Wave A, followed by a potential pullback to form Wave B, before a broader Wave C advance toward the upper resistance zone around 3,400–3,450. This type of move would represent a technical recovery, not a confirmed trend reversal, consistent with post impulse Elliott behavior.

From a macro perspective, this Elliott setup fits the current environment. Broader crypto markets are stabilizing as risk sentiment improves modestly and no new liquidity shock is present. Expectations around U.S. monetary policy remain relatively steady, with yields no longer accelerating higher a condition that reduces pressure on risk assets like ETH. However, the absence of aggressive liquidity expansion also implies that any upside is more likely corrective and structured, rather than impulsive and trend-defining.

In summary, as long as the Wave (5) low holds, the Elliott framework supports a recovery via an ABC correction. A decisive break below that low would invalidate the count and reopen bearish continuation risk. Until confirmation is clear, patience remains critical the edge lies in letting both structure and macro conditions align before committing.

ETH: Trying to go long.We both took and captured liquidity. The picture looks good.

The RSI for 1, 2, 3, and 4 hours is in the oversold zone. There is a high chance of a rebound.

Our first goal is to correct the short imbalance at approximately $3,100 and move the stop to break even. If we stand on the short imbalance and go down, the price will most likely go down to the lows again.

Good luck, everyone! Use competent risk management.

BINANCE:ETHUSDT.P

ETH/USDT Outlook – Bullish Bias Strengthens Above Key Support💎 ETHEREUM VS TETHER - Crypto Market Opportunity Blueprint (Swing Trade)

📊 CURRENT MARKET STATUS

Current Price: $3,380 - $3,427 USDT

Market Structure: Bullish consolidation at dynamic resistance

Setup Type: Weighted Moving Average Pullback + Breakout Confirmation

🎯 TRADE PLAN

📍 BIAS: BULLISH ✅

The bullish plan is CONFIRMED following:

✅ Weighted MA pullback completion

✅ Breakout at dynamic resistance line

✅ Price holding above key support zones

🔥 ENTRY STRATEGY - "THIEF LAYERING METHOD"

Entry Type: Multiple Limit Orders (Layer Strategy)

💰 THIEF ENTRY LAYERS:

Layer 1: $3,300 USDT

Layer 2: $3,400 USDT

Layer 3: $3,500 USDT

📌 Note: You can enter at ANY PRICE LEVEL or increase limit layers based on your own risk appetite and capital allocation. The layering strategy allows you to average your entry and reduce risk.

💡 Strategy Benefit: Multiple limit orders help capture price fluctuations and build position gradually instead of all-in at one price.

🛡️ STOP LOSS MANAGEMENT

Thief SL: $3,200 USDT

⚠️ IMPORTANT - Dear Ladies & Gentlemen (Thief OG's):

DO NOT blindly follow my SL level

PLACE YOUR SL AFTER BREAKOUT CONFIRMATION ONLY

Adjust your SL based on YOUR OWN strategy and risk tolerance

This is YOUR money, YOUR risk - trade responsibly

🎯 TAKE PROFIT TARGET

Target Zone: $3,800 USDT

⚠️ Exit Strategy Factors:

📉 Moving Average acting as strong resistance

⚠️ Overbought conditions expected

Potential bull trap zone

💰 Escape with profits at target levels

🔔 CRITICAL - Dear Ladies & Gentlemen (Thief OG's):

This is NOT financial advice

I'm NOT recommending you set ONLY my TP

Take profits at YOUR OWN price targets

Make money, THEN take money at your own risk level

No one knows your financial situation better than YOU

📊 CORRELATED PAIRS TO WATCH

Monitor these pairs for confirmation and correlation analysis:

Major Crypto Pairs 💹:

BINANCE:BTCUSDT - Bitcoin dominance and market leader direction

BINANCE:ETHBTC - Ethereum's strength vs Bitcoin (alt season indicator)

BINANCE:SOLUSDT - Layer-1 competitor correlation

BINANCE:BNBUSDT - Exchange token & ecosystem correlation

DeFi Ecosystem 🔗:

BINANCE:LINKUSDT - Oracle network (DeFi infrastructure)

BINANCE:UNIUSDT - DEX token (Ethereum ecosystem strength)

BINANCE:AAVEUSDT - Lending protocol (DeFi sentiment)

Layer-2s ⚡:

BITTREX:MATICUSDT (Polygon) - L2 scaling solution

BINANCE:ARBUSDT (Arbitrum) - L2 rollup correlation

BINANCE:OPUSDT (Optimism) - L2 ecosystem health

🔍 KEY CORRELATION POINTS

1️⃣ BTC Dominance: If BTC pumps independently, ETH might lag initially

2️⃣ ETH/BTC Ratio: Rising = Alt season favorable / Falling = BTC dominance

3️⃣ L2 Tokens: Strong performance = Ethereum ecosystem bullish

4️⃣ DeFi Tokens: Strength indicates institutional rotation into ETH ecosystem

5️⃣ Gas Prices: Rising on-chain activity supports bullish ETH narrative

⚡ TECHNICAL SETUP SUMMARY

✅ Weighted MA pullback completed

✅ Dynamic resistance breakout confirmed

✅ Support holding at lower levels

✅ Volume confirmation on breakout

⚠️ Watch for overbought RSI at target zone

⚠️ Be cautious of bull traps near MA resistance

🎓 RISK MANAGEMENT REMINDER

💼 Never risk more than 1-3% of portfolio per trade

📊 Position size according to YOUR stop loss distance

🎯 Have clear exit strategy BEFORE entering

💰 Take partial profits at psychological levels

🔄 Trail your stop loss as trade moves in profit

🔔 Like this idea? Drop a 👍 and follow for more setups!

💬 Comment your thoughts and TP levels below!

📊 Share with fellow traders who need to see this!

#ETHUSDT #Ethereum #CryptoTrading #SwingTrade #TechnicalAnalysis #TradingView #CryptoAnalysis #AltSeason #DeFi #Layer1

Will Ethereum’s Market Flow Signal a New Bullish Phase?🎯 ETH/USD: The "Thief Strategy" Blueprint | Layer Your Way to Victory! 💰

📊 Market Overview

Asset: ETH/USD (Ethereum vs US Dollar)

Market: Crypto

Trade Type: Swing Trade

Bias: Bullish (Post-Breakout Setup)

🎭 The Thief's Master Plan

Ladies and gentlemen, gather 'round! 🎩 We're not just trading here—we're executing the legendary "Thief Strategy" where we sneak into multiple price levels like a professional heist crew. No single entry point for us, oh no. We layer up, diversify risk, and wait for the vault to open! 💎

🚀 Entry Strategy: The Layering Technique

Primary Entry Zone: Any price level AFTER a confirmed breakout above $4,200 ✅

The Thief's Layering Method (Multiple Limit Orders):

🥇 Layer 1: $3,900

🥈 Layer 2: $4,000

🥉 Layer 3: $4,100

🏆 Layer 4: $4,200

Pro Tip: Feel free to add more layers based on your capital allocation and risk appetite. The more layers, the smoother your average entry price! Think of it as building a ladder to success.

🛑 Stop Loss: Protect Your Treasure

Thief's Stop Loss: $3,700 🚨

⚠️ Important Disclaimer:

Dear Ladies & Gentlemen (Thief OG's), I'm NOT recommending you blindly follow my stop loss. This is MY risk tolerance. You need to assess YOUR own risk management strategy. Set your stop loss according to your capital size, risk appetite, and sleep-at-night comfort level. Remember: Your money, your rules! 💼

🎯 Take Profit Target: Know When to Exit the Heist

Primary Target: $4,600 🎰

Why This Level?

📈 Moving Average acting as a strong resistance zone (think of it as the police barricade!)

🔴 Overbought conditions on technical indicators

⚠️ Bull trap zone — smart money might be waiting to distribute here

Exit Strategy:

When you see the moving average resistance + overbought signals flashing, it's time to take your profits and vanish into the night! 🌙

⚠️ Important Disclaimer:

Dear Ladies & Gentlemen (Thief OG's), I'm NOT recommending you blindly follow my take profit level. This is MY analysis. Scale out profits at levels that make sense for YOUR trading plan. Partial profits, trailing stops, whatever works for YOU. Make money, then TAKE money—at your own discretion! 💵

🔗 Related Pairs to Watch

Keep an eye on these correlated assets to confirm the broader market direction:

BITSTAMP: BITSTAMP:BTCUSD — The king of crypto. When Bitcoin moves, ETH usually follows. Watch for BTC breakouts above resistance.

BINANCE: BINANCE:ETHBTC — Shows ETH's relative strength against Bitcoin. Rising = ETH outperformance.

TVC: TVC:DXY (US Dollar Index) — Inverse correlation. Weaker dollar = stronger crypto typically.

Total Crypto Market Cap — Confirms if capital is flowing INTO or OUT OF the crypto space.

COINBASE: COINBASE:SOLUSD , COINBASE: COINBASE:ADAUSD — Other major altcoins. If they're pumping too, it confirms alt season momentum.

Key Correlation Point: If Bitcoin is breaking resistance zones and the Dollar Index (DXY) is weakening, our ETH setup gets significantly stronger! 📊✨

🧠 Technical Analysis Breakdown

What We're Watching:

✅ Breakout Confirmation: Price must close above $4,200 with volume

✅ Support Levels: $3,900-$4,100 range acts as accumulation zone

✅ Resistance Zone: $4,600 where moving averages + overbought conditions converge

✅ Risk-Reward Ratio: Solid setup with layered entries minimizing average cost basis

The Thief Strategy Philosophy:

Instead of gambling on ONE entry point, we spread our risk across multiple price levels. This way, we're dollar-cost-averaging into the position BEFORE the breakout confirmation, positioning ourselves ahead of the crowd! 🎯

🎬 Final Words from the Thief

Remember, OG's: The best trades are the ones where you're positioned BEFORE the crowd rushes in. Layer your entries, manage your risk like a professional, and know when to take your profits and disappear! 👻

Stay disciplined, stay profitable, and let's make this heist a success! 🏆

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#ETHUSD #Ethereum #CryptoTrading #SwingTrade #ThiefStrategy #LayeringStrategy #CryptoAnalysis #TechnicalAnalysis #TradingView #CryptoSetup #AltcoinSeason #ETHBreakout #RiskManagement #TradingStrategy #CryptoIdeas

ETHUSD Momentum Building! MA Breakout Keeps Bulls in Control📘 **ETHUSD “Ethereum vs U.S. Dollar”

Crypto Market Opportunity Blueprint (DAY Trade)**

🚀 Plan Overview

A bullish continuation scenario is active following a clear Moving Average breakout and clean retest. This structure builds a favorable environment for controlled entries backed by momentum confirmation.

🎯 Entry

👉 You can enter at any price level once your personal confirmation aligns with the ongoing MA structure.

The breakout + retest provides the core framework.

🛡️ Stop Loss Strategy

📍 This is the Thief SL @ 3050 Dear Ladies & Gentleman (Thief OG’s)

Adjust your Stop Loss based on your own strategy, risk tolerance, and trade model.

⚠️ Place the SL only after the MA breakout confirmation, not before.

📝 Note:

Dear Ladies & Gentleman (Thief OG's) I am not recommending that you use only my SL. It’s your own choice; you can make money then take money at your own risk.

🎯 Target

The SuperTrend ATR line is acting as a strong resistance, and current conditions suggest:

📈 Overbought signals building

Trap zones developing

📌 Smart exit required

👉 Our target: 3600

📝 Note:

Dear Ladies & Gentleman (Thief OG’s) I am not recommending that you set only my TP. It’s your own choice; you can make money then take money at your own risk.

🔍 Related Pairs to Watch (Correlation & Key Notes)

1. BITSTAMP:BTCUSD (Bitcoin vs USD)

ETHBTC correlation remains high during MA-driven moves.

BTC’s trend strength often dictates crypto-wide volatility.

Strong BTC breakout boosts ETH’s bullish follow-through potential.

2. BINANCE:ETHBTC (Ethereum vs Bitcoin)

Great pair to measure Ethereum’s relative strength.

Rising ETHBTC = ETH outperforming BTC → supports the bullish ETHUSD narrative.

Useful for detecting early reversals before USD-pairs show it.

3. CRYPTOCAP:TOTAL2 (Altcoin Market Cap)

Represents overall altcoin strength excluding BTC.

If TOTAL2 breaks resistance with volume, ETH usually moves aggressively.

Helps confirm whether the market supports a broad-based ETH rally.

4. COINBASE:SOLUSD (Solana vs USD)

Competes for capital rotation with ETH.

When SOL pumps aggressively, ETH sometimes lags before catching momentum.

Watching SOL gives early hints of altcoin capital flow.

5. TVC:DXY (US Dollar Index)

Inverse correlation with major crypto assets.

Weak DXY = supportive environment for ETHUSD upside.

Strong DXY = caution for crypto longs.

Ethereum crypto strong demand at $2,880 playing outEthereum tapped a major demand zone at $2,880, and the reaction is clear: buyers stepped in, just like they usually do when a clean, fresh imbalance takes control. The last time ETH reacted to a similar structure on the bigger timeframes, we saw extended bullish legs unfolding week after week.

Right now, the question is simple:

Will this demand level hold long enough to push ETH toward $4,120 and beyond?

Based on the current imbalance structure, the answer leans strongly toward yes.

ETH/USDT Bearish Roadmap: Structure + MA Break AligningAsset: ETH/USDT — “Ethereum vs Tether”

Market Context: Crypto Market | Swing Trade | Bearish Profit Pathway Setup

📉 Market Outlook: Bearish Plan Confirmed

Ethereum is displaying a bearish continuation structure, with price breaking below the Triangular Moving Average zone, signaling shifting momentum from buyers to sellers. Market structure is weakening, liquidity is building above the recent highs, and major supports remain untested below.

This creates a clean swing-trade opportunity for disciplined traders.

🎯 Trade Plan: Thief Layered Entry Strategy

The plan uses a layered sell-limit approach to capture premium retracement entries.

🧩 Sell-Limit Layers (Short Entry Zones):

1st Layer: 3200

2nd Layer: 3100

3rd Layer: 3000

(Traders may add additional layers depending on preference, liquidity, and volatility.)

Layering helps reduce emotional entry pressure and allows scaling into premium short zones rather than rushing into the move.

🛑 Stop-Loss: Structural SL @ 3300

This is the Thief SL reference level at 3300, positioned above structural liquidity.

Ladies & Gentlemen (Thief OG’s): adjust SL according to your own risk tolerance, capital, and strategy framework.

Risk is personal — protect your account.

🏆 Target Zone: 2700

The downside objective aligns with:

Strong support retest

Oversold region confluence

Trap-pattern breakdown

Correlation pressures across major crypto pairs

Ladies & Gentlemen (Thief OG’s): this is a community target reference — take profit based on your own comfort and risk appetite. Profit is profit.

🔍 Related Pairs to Watch (Correlation Insights)

1️⃣ BTC/USDT ( CRYPTOCAP:BTC )

Bitcoin leads crypto directional momentum.

ETH generally mirrors BTC swings with slightly slower volatility.

If BTC struggles to reclaim resistance zones, ETH downside probability strengthens.

2️⃣ ETH/BTC ( BINANCE:ETHBTC )

Key ratio indicating Ethereum’s strength vs Bitcoin.

ETHBTC downtrend continues → ETHUSD bearish continuation becomes more reliable.

3️⃣ SOL/USDT ( CRYPTOCAP:SOL )

Strong competitor in Layer-1 ecosystem.

SOL weakness often reflects broader market appetite decreasing → ETH follows.

4️⃣ TOTAL2 (Altcoin Market Cap)

Tracks overall strength of altcoins excluding BTC.

Breakdown in TOTAL2 = bearish environment = supports ETH downside targets.

Monitoring these pairs provides confirmation of:

Trend alignment

Market-wide weakness

Strength of bearish momentum

Liquidity flows across majors

✅ Final Notes

This setup is built for traders who prefer structured entries, disciplined layers, clear SL zones, and realistic targets.

Trade smart, manage risk, and follow your own strategy refinement.

Ethereum Outlook: Divergence + MA Breakout = Bearish Swing Bias🔍 ETH/USD – “Ethereum vs U.S. Dollar” Market-Capital-Flow Blueprint (Swing Trade) 💼💥

🧭 Overview

Hey Thief Tribe 👋, here’s the game plan for Ethereum (ETH/USD) in the crypto arena!

We’ve spotted a confirmed bearish breakout, with momentum fading on the downside.

This setup blends technical precision with layered stealth entries, built the Thief way 🕶️

Let’s stay sharp, swing smart, and rob those pips — professionally, of course! 😎

⚙️ Plan (Bearish Blueprint)

Two strong confirmations back the downside setup:

🔻 Moving Average Breakout – price sliced below key dynamic support (MA line).

🔻 MACD Divergence – momentum fading with lower highs on MACD.

📉 This combo confirms a short bias, preparing us for controlled, layered entries.

💰 Entry (Thief Style – Layering Strategy Explained)

This isn’t a one-shot entry — it’s a strategic ambush plan 😏

We’ll use multiple sell limit orders, spacing them for precision & flexibility:

🧩 Example Layer Setup:

1️⃣ Sell Limit – $3 900.0 → Top layer, catching early weakness near resistance.

2️⃣ Sell Limit – $3 800.0 → Second layer, adding position as momentum confirms.

3️⃣ Sell Limit – $3 700.0 → Sweet zone: aligns with MA retest area.

4️⃣ Sell Limit – $3 600.0 → Deep layer for confirmation or fake-out retrace.

💡 You can expand or tighten your layers based on volatility or personal risk tolerance.

This “scaling-in method” helps manage risk while improving average entry.

🧨 Stop Loss (Defensive Shield)

🛑 Thief’s SL: $4 000.0 — aligned with the previous Higher-High structure.

🔸 This level invalidates the bearish setup if broken with strong volume.

⚠️ Note to all Thief OG’s:

I’m not recommending you use only my SL — trade smart, adapt your protection.

Your capital, your call, your responsibility. 💼

🎯 Target (Profit Escape Zone)

💎 Target: $3 200.0 — key support confluence zone where:

Moving average = police barricade 🧱

RSI likely hits oversold region 📊

Smart money may reverse from here 🔄

So once price nears that trap-reversal area, it’s time to secure profits & vanish gracefully 🏃♂️💨

⚠️ Note to all Thief OG’s:

You’re free to adjust your take profit. When you see green, take your gain! 💰

🔗 Correlated Pairs & Market Flow Watchlist

Stay alert with cross-checks 👇

🔹 BINANCE:ETHBTC → if ETH weakens vs BTC, bearish setup strengthens.

🔹 BITSTAMP:BTCUSD → if BTC falls too, it amplifies crypto market pressure.

🔹 TOTAL / TOTAL2 (Crypto Market Cap Charts) → confirm capital flow rotation.

📊 Correlations help validate or cancel our bias. Always zoom out before striking.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#ETHUSD #Ethereum #CryptoSwing #BearSetup #LayeringStrategy #ThiefTrader #LimitOrders #MACDDivergence #MovingAverageBreakout #CryptoFlow #SwingTrading #CryptoMarket

Can ETHUSDT Sustain Momentum After LSMA Breakout?🔥 ETHUSDT BULLISH BLUEPRINT: LSMA Confirmed, Awaiting WMA Breakout for Range Escape! 🚀

Description:

👑 ATTENTION, LADIES & GENTLEMEN – THE THIEF OGs! 👑

Welcome to a clear, actionable blueprint for $ETHUSDT. This isn't just a signal; it's an educational opportunity to understand confluence and manage your own risk like a pro.

📈 THE BIG PICTURE (Market Context):

Ethereum is showing strength within a defined range. A critical LSMA breakout has already confirmed the underlying bullish bias. We are now waiting for the final confirmation to trigger a potential swing move UP.

⚙️ TRADE PLAN (Bullish Confluence):

Direction: Bullish 🐂

Style: Day Trade / Swing Trade

Phase: Range-Bound, awaiting bullish breakout confirmation.

Key Levels: Range resistance is the key hurdle.

🎯 KEY LEVELS & LOGIC:

🟢 TRIGGER ZONE (Entry): $3,200.00

Wait for a decisive candle close ABOVE the Weighted Moving Average (WMA) at this zone.

This WMA breakout is our awaited confirmation to join the LSMA's bullish bias.

"YOU CAN ENTRY AT ANY PRICE LEVEL AFTER THE WMA BREAKOUT" – but the $3,200 zone is optimal for confirmation.

🔴 RISK DEFINITION (Stop Loss): $2,900.00

This is MY "Thief SL" – a level that invalidates the setup.

CRITICAL NOTE: 📢 I am NOT recommending you use only my SL. ADJUST based on YOUR strategy & risk tolerance. Place your SL AFTER the MA breakout confirmation. Protect your capital first!

🟡 PROFIT TARGET (Take Profit): $3,500.00

This target aligns with a historical resistance zone where moving averages may converge.

WARNING: Be aware of potential overbought traps and resistance. "Escape with profits."

CRITICAL NOTE: 📢 I am NOT recommending you use only my TP. Manage your trade actively. "Take money at your own risk." Scale out partials or trail your stop!

💎 THE THIEF OG's GOLDEN RULES:

This is a BLUEPRINT, not financial advice.

YOU are responsible for your own trades, risk, and money management.

Confirmation > Impulse. Wait for the WMA breakout.

Always use a stop-loss. No excuses.

🔍 RELATED PAIRS TO WATCH (Correlation & Key Insights)

Monitoring correlated assets strengthens confirmation and trend accuracy.

Here are the most relevant ETH-linked market movers:

1️⃣ BINANCE:BTCUSDT – Bitcoin vs Tether

Correlation: High

Why it matters:

Bitcoin leads overall crypto sentiment.

ETH breakouts are stronger when BTC breaks key resistance zones.

If BTC rejects from MA levels, ETH often loses momentum too.

What to track:

BTC Daily MA structure

BTC dominance (BTC.D)

Volatility cycles

2️⃣ BINANCE:ETHBTC – Ethereum vs Bitcoin

Correlation: Medium–High (Relative Strength Pair)

Why it matters:

Shows whether ETH is outperforming or lagging against BTC.

A breakout in ETH/BTC gives early confirmation of strong ETH upside.

If ETH/BTC drops, ETHUSDT upside can slow even if USDT charts look bullish.

Key levels:

ETH/BTC horizontal range

MA crossovers

Relative strength slope

3️⃣ BINANCE:SOLUSDT – Solana vs Tether

Correlation: Moderate

Why it matters:

Competes with Ethereum in Layer-1 dominance.

Solana pumps often trigger temporary liquidity rotation away from ETH.

If SOL rallies aggressively, ETH may consolidate longer.

Watch for:

Layer-1 sentiment shifts

Capital rotation between SOL & ETH

4️⃣ BITTREX:MATICUSDT – Polygon vs Tether

Correlation: Medium

Why it matters:

Ethereum Layer-2 ecosystems influence ETH network usage & fees.

MATIC strong moves can signal increased demand for ETH’s ecosystem indirectly.

5️⃣ COINBASE:XTZUSD (or) BINANCE:AVAXUSDT (or) BINANCE:BNBUSDT

Correlation: Low–Moderate

Why it matters:

Any strong L1 competitor rally can pull temporary liquidity from ETH.

Helps judge broader altcoin sector strength.

🧭 KEY CORRELATION SUMMARY

BTCUSDT → Drives crypto trend direction

ETH/BTC → Determines whether ETH has relative strength

SOL, MATIC, BNB, AVAX → Track liquidity rotation

Stronger confirmations = safer ETH entry after WMA breakout

Ethereum - Another -30% correction!🥊Ethereum ( CRYPTO:ETHUSD ) continues the bearmarket:

🔎Analysis summary:

Just over the past couple of weeks, Ethereum has already been correcting about -40%. This happened due to another failed all time high breakout sending prices lower. And Ethereum can drop another -30% before it will then retest a major confluence of support.

📝Levels to watch:

$2,500 and $ 2,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

3 Altcoins To Watch In The First Week Of December 2025Ethereum is a key altcoin to monitor this week as it approaches the Fusaka upgrade, scheduled to go live on December 3. This marks its second major upgrade of the year following Pectra and aims to strengthen the network’s long-term scalability.

Fusaka is designed to help Ethereum support high transaction throughput from layer-2 chains by implementing 12 Ethereum Improvement Proposals. The upgrade could lift ETH from its $2,814 support level toward $3,000. Reclaiming that level is essential for a push toward $3,131 and a broader recovery.

If bearish momentum continues and Ethereum reacts negatively to the ongoing Death Cross indicated by its EMAs, ETH may lose support. A fall below $2,814 could send the price toward $2,681, invalidating the bullish thesis and signaling deeper downside risk.

Ethereum Faces Death Cross After 9 Months After $4 Billion SellEthereum is currently priced at $2,921, sitting just under the crucial $3,000 resistance level. Losing this psychological threshold triggered the wave of $4 billion in selling and reinforced bearish sentiment.

In the near term, ETH will likely consolidate under $3,000 and attempt to hold above support at $2,814 or $2,681. If market conditions worsen or investors continue to sell, Ethereum could break below $2,681 and slide toward $2,606 or lower.

If broader conditions stabilize, ETH could regain bullish momentum. A decisive reclaim of $3,000 would open the path toward $3,131 and potentially $3,287. This would helping Ethereum invalidate the bearish thesis and rebuild confidence among holders.

Ethereum - A -40% crash comes first!🪄Ethereum ( CRYPTO:ETHUSD ) will soon reverse:

🔎Analysis summary:

Over the course of the past couple of months, Ethereum failed to create a new all time high. So eventually, we will see a bearish reversal and a major move lower in the future. The bullish triangle remains valid though, so it will be a major buying opportunity then.

📝Levels to watch:

$2,000 and $4,500

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Ethereum Roadmap: Will ETH Bounce or Begin a Deeper Correction!?Today, I’d like to dive into an analysis of Ethereum ( BINANCE:ETHUSDT ). Given that over 80% of tokens in the crypto market are built on the Ethereum blockchain, Ethereum’s performance can serve as a roadmap for other tokens on the network.

So, stay tuned!

In recent times, Ethereum hasn’t been able to keep pace with Bitcoin’s growth and struggled to set a new All-Time High(ATH=$4,956). After Bitcoin’s decline, Ethereum also started to drop and is currently moving near the Heavy Support zone($2,160-$1,370), Support lines, Cumulative Long Liquidation Leverage($1,745-$1,629), and Potential Reversal Zone(PRZ) .

From an Elliott Wave perspective, it seems that Ethereum has completed its main five-wave impulsive. This suggests that we might now be entering a corrective phase. The extent of this correction will depend on multiple factors, and technical analysis alone won’t predict the exact magnitude of Ethereum’s decline in the coming days or weeks. Nonetheless, I’ll keep you updated step-by-step.

Looking at the USDT.D%( CRYPTOCAP:USDT.D ), it’s currently on an upward trend. This rising dominance can lead to further declines in Ethereum, reinforcing the bearish outlook.

Another important index is the US 10-Year Government Bond Yield ( TVC:US10 ). If the US 10-Year Government Bond Yield continues its upward movement, it can put additional pressure on risk assets like Bitcoin( BINANCE:BTCUSDT ) and Ethereum, leading to further declines.

Now, the question is: where might we see Ethereum resume its upward trajectory?

It’s likely that Ethereum will continue its downward movement(-30%), potentially filling the CME Gap($2,344-$2,186), CME Gap($1,745-$1,629) near the $2,000(Round Number). Once it stabilizes around that zone, we could look for signs of a recovery.

However, if Ethereum breaks below its Heavy Support zone($2,160-$1,370), we might face even more significant declines, potentially exceeding -60%.

Where do you think Ethereum will start to rise again? Or are more red days ahead?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Ethereum Analyze (ETHUSDT), Weekly time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

This Is How Ethereum Price Can Avoid A Crash Below $3,000Ethereum trades at $3,094, holding above the critical $3,000 support level after its sharp decline. This marks the first time in two months the asset has fallen this low. Maintaining support will be essential in preventing deeper losses and setting the stage for a potential recovery.

ETH is currently positioned below the $3,131 resistance level and is waiting for a catalyst to move higher. The supportive on-chain signals suggest that a push toward $3,287 is likely. If momentum strengthens, Ethereum could extend the rise and target $3,489 in the coming sessions.

If bearish pressure increases, Ethereum could break below $3,000 and invalidate the current bullish outlook. A fall through support may expose ETH to a decline toward $2,814 as selling intensifies. This scenario would reflect broader weakness and delay any major recovery attempt.