Ethereum (ETH/USDT): Descending Triangle Breakdown ScenarioHI

Ethereum is currently trading within a descending triangle formation, developing after a strong bearish impulse.

Following the sharp sell-off, ETH attempted several recoveries but consistently failed to reclaim higher levels. Price is now compressed between:

A descending internal trendline, acting as dynamic resistance and clearly respected by multiple rejections.

A horizontal support base, forming the lower boundary of the triangle.

This combination reflects a market where sellers remain in control, while buyers are only managing to slow the decline rather than reverse it.

Trade Thesis (Main Idea)

The key setup here is a breakdown of the triangle’s lower boundary:

Trigger: A confirmed break and close below the bottom support of the triangle

Bias: Short position on breakdown confirmation

Target: $2,806, aligned with a high-probability demand zone and prior liquidity

Invalidation: A strong reclaim above the descending trendline would invalidate the bearish continuation scenario

Ethlong

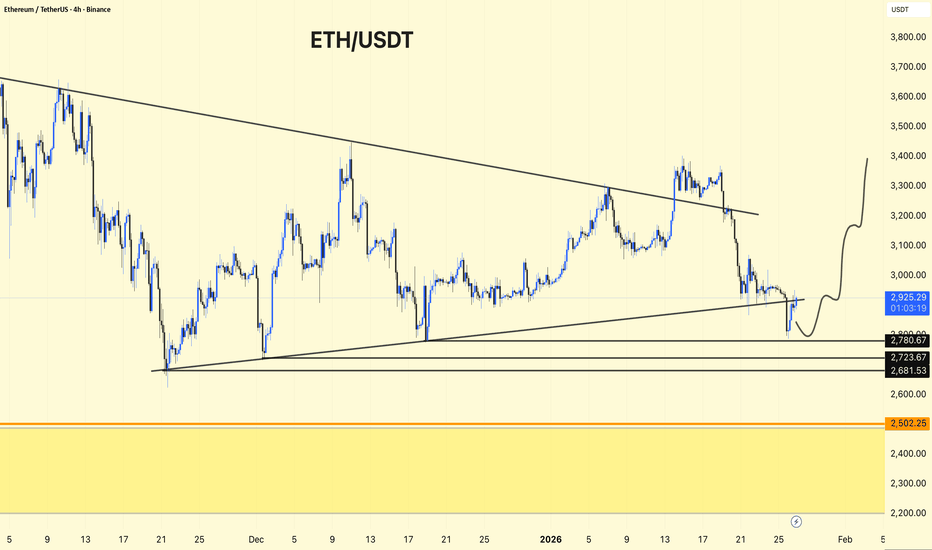

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

ETH is trading inside a descending broad wedge/channel.

Price is currently near the lower trendline support (~2900 zone).

This area can act as a short-term bounce zone.

If support holds, upside targets are 3050 → 3200 → 3350.

A clean breakdown below 2780–2720 may open downside toward 2500.

Short-term bounce possible, trend still range-bound.

⚠️ Wait for confirmation & keep risk tight.

ETH 751% profits potential with 20X leverage —LONG tradeEverybody loves Ethereum. We all love Bitcoin. It is even more lovely when you get to make money trading Bitcoin and Ethereum. The Cryptocurrency market is awesome. Timing is great.

I would like to share with you some trade-numbers, these are for a huge LONG on ETHUSDT with high leverage. Low risk vs a high potential for reward.

What's your take on this chart setup?

_____

LONG ETHUSDT

Leverage: 20X

Potential: 751%

Allocation: 3%

Entry zone: $2850 - $3000

Targets:

1) $3175

2) $3333

3) $3515

4) $3800

5) $4065

Stop: $2825

____

Thanks a lot for your support over the years. It is always a great experience to share with you.

I am wishing you tons of profits. I am wishing you abundance, health, wealth and success.

You are a divine living being and you will always deserve the best.

Namaste.

ETH Local Trade - Bullish Local Trade plan

Local Intraday Long

Ethereum is showing strength as it holds key local support.

Current price action suggests a clear path for upside movement if we maintain this structure.

Are you playing this breakout, or do you think we need one more flush before the real move? 👇

Ethereum... Let me ask you a question!Let me ask you a question and let's be honest: The market flush last year, were you expecting it or did it catch you by surprise?

Right? It is that simple.

The bullish breakout, a major one, super fast; are you expecting it or will it catch you by surprise?

Maybe not you because you are reading this and I've been sharing bullish articles for months, but what about the rest of the market? It is always the same but in reverse.

The market flush was a major surprise for all of us. The same will happen with the advance that is about to develop. If everybody is expecting a bearish continuation because there is nothing bullish on this chart, then the market will go contrary to what the masses think.

The peak happened in late August 2025. Then months of neutral, months of bearish action and now months of consolidation at bottom prices. This bottom consolidation people see as boring, dull and bearish and so they expect a continuation. It will catch them by surprise.

The only reason we are bullish is because we track hundreds of altcoins and not only Bitcoin and Ethereum. If we were tracking Bitcoin and Ether only, then I understand, the market can be mixed at most. But since we track hundreds of charts, we can predict bullish action.

Bitcoin closed three months red and it is closing green this month. This means additional growth. What Bitcoin does, the market follows. Ethereum is going up.

Namaste.

ETHBTC is about to produce a strong bullish continuationBelieve it or not, it's been already five months since ETHBTC produced its last major high, August 2025. Amazing, can you believe it?

Surprising as well, the fact that the correction low happened 77 days ago, that's more than 2.5 months.

The entire bullish move that started in April 2025 lasted 119 days, four months. So the correction plus support consolidation has been going for longer than the duration of the entire bullish period. This is good news, let me explain.

If the market was bearish, just as we see on the left side of the chart, it simple goes down. There cannot be a five months period with no new lows, impossible. That's why it is good news that the peak happened five months ago and yet ETHBTC continues to trade at a strong higher low, above long-term support. We are still within a strong bullish cycle; next we get a resumption, a bullish continuation.

That's the good news and this is as good as it gets. We are aiming for a major high close to the high point in March 2024. It will be awesome. ETHBTC continues bullish and is now set to grow.

Thank you for reading. You are truly appreciated.

Namaste.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a descending broad structure, but the price is now testing a strong demand + trendline support zone.

The current dip looks like a liquidity sweep / stop-hunt into support rather than a trend breakdown.

Price is near the lower rising trendline + horizontal demand high reaction area.

Immediate Support: 2,900 – 2,880

Major Support: 2,780 2,680

Invalidation: Below 2,650 (structure weakness)

Resistance: 3,200 – 3,300

Major Supply: 3,450 – 3,500

Expected Scenario (as marked):

Hold above 2.88K–2.9K base formation → strong bounce

Upside targets: 3.1K 3.3K 3.5K

If support fails deeper pullback toward 2.78K, 2.68K

Neutral-to-bullish as long as demand holds. Patience is key here—reaction at support will decide the next leg.

Not financial advice. Trade with risk management.

#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2912, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2956

First Target: 3021

Second Target: 3092

Third Target: 3160

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

ETH Ascending Triangle: Long SetupEthereum is in an ascending structure, pulling back toward trendline support with clear resistance around 3,400 USD, offering a potential long setup with defined invalidation and targets.

Trade direction

- Long, buying the dip into the rising trendline / lower Bollinger area, aiming for another test of 3,400 resistance.

- Structure: Higher lows since November, forming an ascending triangle against the 3,400 horizontal cap.

Entry and invalidation

- Potential entry zone:

- $2,950–$3,050, near the blue trendline and mid-to-lower Bollinger band.

- Invalidation:

- Below $2,850, which would break the rising trendline and recent swing low structure.

Take‑profit levels

- TP1: $3,180–$3,200 (prior local resistance and Bollinger midline); consider taking partial profits and moving stop to breakeven.

- TP2: $3,400 major resistance; main target of the pattern.

Trade management

- If price closes a daily candle below the trendline and 2,850, treat the idea as invalid and stand aside.

Ethereum Technical Analysis: Bearish Momentum Tests Key Support This 4-hour chart from TradingView displays Ethereum (ETH) against the US Dollar, highlighting a significant shift from a bullish trend to a sharp corrective phase.

• Current Price Action: Ethereum is currently trading at approximately $2,995, reflecting a 6.01% decrease in the current session. The price has broken through several internal support levels and is currently testing the psychological $3,000 barrier.

• Market Structure:

• Previous Uptrend: Earlier in the period (Jan 13–15), ETH showed strong bullish momentum, characterized by a "Break of Structure" (BOS) and an ascending channel that peaked near $3,400.

• The Reversal: After consolidating near the PWH (Previous Week High) around $3,380, the market experienced a "Change of Character" (CHoCH), signaling a shift from bullish to bearish sentiment.

• Descending Channel: Price is currently contained within a steep descending regression channel. The aggressive red candles indicate strong selling pressure as the market seeks a liquidity floor.

• Key Levels to Watch:

• Resistance: Immediate resistance sits at $3,165 and the previous breakdown point near $3,203.

• Support: The chart shows a green "Long Position" projection box, suggesting a potential bounce zone between $2,900 and $2,980. This area aligns with the PWL (Previous Week Low).

• Projected Outlook: The analyst has drawn a projected "zig-zag" path (black arrows), suggesting that while further downside toward $2,900 is possible, a relief rally or trend reversal back toward $3,100 may be expected if the current support zone holds.

Ethereum (ethusdt): two positions Hi!

Eth broke the last level and confirmed a bullish trend!

after the breakout it formed a reversal head and shoulders and broke down the neckline, now the neckline is broken, and the pink area seems a potential area for getting a long position after the short position hit the target.

The short position target: $3200

The long position target: $3320 and then $3450

$ETH bullish update! (LTF)BINANCE:ETHUSDT continues to compress inside the descending trendline + rising support, holding above the key demand zone. No breakdown, no panic — just pressure building.

- Higher low already defended

- Sellers unable to push below demand

- Clear risk definition

- Upside opens up once the descending trendline is fully cleared

Entry: 3,218 – 3,254 (pullbacks into support)

SL: 3,067 (clean loss of structure)

Targets:

TP1: 3,447

TP2: 3,650

ETH/USDT (4H) – Chart Update. ETH/USDT (4H) – Chart Update

Structure: Bullish bias holding

Price Action: ETH has broken above the descending trendline

Ichimoku: Price trading above the cloud → momentum remains positive

Ethereum has reclaimed the trendline resistance, which is now acting as support. The pullback looks controlled and healthy, suggesting continuation rather than rejection.

Holding above 3,200–3,250 keeps the bullish scenario active

A sustained move can push ETH toward 3,450 → 3,650 → 3,800 zones.

A breakdown below 3,150 may trigger a deeper retest toward 3,000 support.

Market structure favors upside continuation. Wait for confirmation and manage risk wisely.

Ethereum (ETHUSD) – 4-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared an Ethereum-ETHUSD analysis for you.

My friends, if ETHUSD manages to close a candle above the levels of ( 3027.3-2964.1 ) on the 4-hour timeframe, I will open a buy position.

My target will be the 3,450 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️

ETH Holds the Line Again… and History Says What Comes Next!Ethereum continues to respect a major higher-timeframe demand zone on the 3-day chart, highlighted in green. This zone has acted as a reliable support area multiple times, producing strong reactions and serving as a clear accumulation region during previous pullbacks.

Price has once again reclaimed and held above this demand zone, while also respecting key Fibonacci retracement levels, suggesting buyers are defending this region aggressively. The recent bounce indicates a higher-timeframe higher low, keeping the broader bullish structure intact.

Key Points:

- HTF demand zone acting as strong support (multiple successful reactions)

- Price reclaiming structure after pullback

- Clear upside path toward previous range highs

- Volume profile shows acceptance above value area

If ETH continues to hold above the demand zone, the structure favors continuation toward upper resistance and prior all-time-high supply zones, as indicated by the projected upside paths. A loss of this area would weaken the bullish thesis and open room for deeper retracement.

Cheers

Hexa

ETHUSD – Weekly Update | Key Level Being TestedThesis

CRYPTOCAP:ETH remains in a long-term bullish structure. Price is rotating higher without a full reset to the 200WMA, suggesting underlying strength and a continuation bias.

Context

- Weekly timeframe

- Long-term ascending wedge intact

- Prior cycle highs still acting as structural reference

What I see

- ETH did not retest the 200WMA around $2450

- Price reclaimed the 50-day MA around $3000

- ETH is now testing the 0.5 Fibonacci level near $3160

- Structure shows higher lows and improving momentum

What matters now

- $3160 needs to flip to support to confirm continuation

- A successful hold here opens a move toward the upper wedge boundary

- Momentum remains constructive while price stays above the 50-day MA

Buy / Accumulation zone

- Current area around $3160 becomes actionable if confirmed as support

- Deeper pullbacks toward moving averages remain secondary opportunities

Targets

- Near-term: $3800 area (200-day MA + upper wedge confluence)

- Long-term cycle target: ~$9000 (Wave 5 extension)

Risk / Invalidation

- Loss of $3000 and failure to hold the 50-day MA would delay the bullish scenario