#ETH/USDT – Short Setup from Key Supply Zone

#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 3253. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 3218

First target: 3186

Second target: 3164

Third target: 3132

Stop loss: Above the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

Ethlong

ETH M30 Bullish Continuation and Liquidity Expansion Setup📝 Description

ETH on M30 is holding a bullish structure after a controlled pullback into discount. Price respected the 0.618 OTE area and reacted cleanly, suggesting this move is corrective. With downside pressure absorbed, odds favor a bullish continuation toward higher liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish continuation while above 3,200

Long Setup (Preferred):

• Entry (Buy): 3,220 (OTE / reaction zone)

• Stop Loss: Below 3,195

• TP1: 3,242

• TP2: 3,282 (H4/H1 FVG)

• TP3: 3,309 (BSL / range high)

________________________________________

🎯 ICT & SMC Notes

• Clean reaction from OTE 0.618

• Structure still bullish on LTF

• FVG H4/H1 overhead acting as liquidity magnet

________________________________________

🧩 Summary

This looks like a pullback-for-continuation setup. As long as ETH holds above the OTE support, the higher-probability path is upside expansion toward stacked liquidity near 3.28k–3.31k.

________________________________________

🌍 Fundamental Notes / Sentiment

With crypto sentiment stabilizing and no immediate risk-off catalyst, technical structure and liquidity support a bullish continuation. Manage risk and scale out into upside targets.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Happy New Year, Happy New ETH???Happy New Year, Traders! I pray you all are off to a wonderful start to the new year. We've been off for the Holidays, but we're back and ready to tackle the markets again. So, what in the world is going on with ETH and BTC? Things are looking up for the start of the year, so let's dive in and see what's happening. My primary focus is always on the H4 and up for market direction and diving down to the H1 only sparingly for more detailed looks.: Please see my previous posts on ETH in Nov and Dec to see how we got here.

Where are we now?:

Well, over the Holidays, we had an H4 BOS UP. This move is very important, because it is the first Significant Move out of the Daily BOS Source. As I have emphasized, a BOS UP almost always leads to a retracement back to the source, and that is what we saw. We had the initial BOS Up on Dec 22, and came back to the source on the 24th. Then, on Jan 2 we got a confirmation of this move with the retest of the broken H4 supply zone. Once again, as I have emphasized, this confirmed BOS up will almost always lead to a target of the H4 Supply Source Or the Daily Supply. This is ~3360 - 3520. As of today, the market has pushed up 2/3 of the way to this target.

What to expect from here?:

From here, again, we are 2/3 of the way to this target area. There are a few H4 Internal Supply Zones that will likely show some resistance. We need to expect these zones to slow things down and show some pullbacks, but they WILL NOT hold. Possible trade opportunities are:

1. Look for H1 demand zones and buy on the way up. Aggressive traders can simply buy every pullback on the H1 to the previous demand zone. These trades should have small stop losses below the demand zone and targets at the new high. Every significant new high should lead to a pullback to the demand zone. Any BOS down on the H1 will most likely lead to a fall back to the previously broken H4 Supply Zone, so you want to get out if you see this, and wait for the lower re-entry.

2. On the H4, look for any of these previous supply zones that have been broken but not retested. The current H4 supply zone at 3120 - 3175 is a good example. We have pushed above this zone, but there is no retest of it. I'm looking for pullbacks back to this zone for another buy entry.

I hope this helps someone who is trying to make sense out of these seemingly wild rides since the New Year. As I have emphasized before, these type of moves have very little to do with external news events, but are solid structural moves that ANYONE can learn to "READ" on ANY ASSET. If you're struggling to decipher the markets and are seemingly always "late to the game", let us help you learn and grow!

As always, please leave me your comments, suggestions, and questions, and I'll be glad to respond. We have mostly been posting ETH moves as an example of how we read the markets, but we are trading a lot of different assets. If you have one you've been struggling with, or just a favorite that you like to trade, let me know in the comments, and I'll try to help.

Again, Happy New Year and be blessed!!!

ETH is at a critical inflexion point! Bullish Rally ahead!A decisive reclaim of $3,200 (200 EMA) could unlock the next major leg higher.

Ethereum is stabilising after a corrective phase and beginning to show early signs of structural strength on the higher timeframe.

Key observations:

• The 200 EMA (blue) around $3,200 remains the final resistance

• Price compression suggests energy is building

• Momentum is gradually shifting back in favour of the bulls

🔑 Technical Thesis:

A strong reclaim and sustained close above the 200 EMA would confirm bullish intent and signal trend continuation rather than consolidation.

Once this level flips into support, the probability of a measured expansion increases significantly.

🎯 Upside targets:

$3,700 → $4,000

This zone aligns with prior supply and high liquidity, making it a natural target for upside.

📌 Bottom Line:

As long as ETH holds higher-timeframe demand and successfully reclaims the 200 EMA, the broader structure favours continuation.

Patience during consolidation often precedes aggressive directional moves.

Bullish breakout or another fake move? Do share your views in the comments, and please hit the like button if this post adds any value.

Thank you

#PEACE

#ETH #crypto

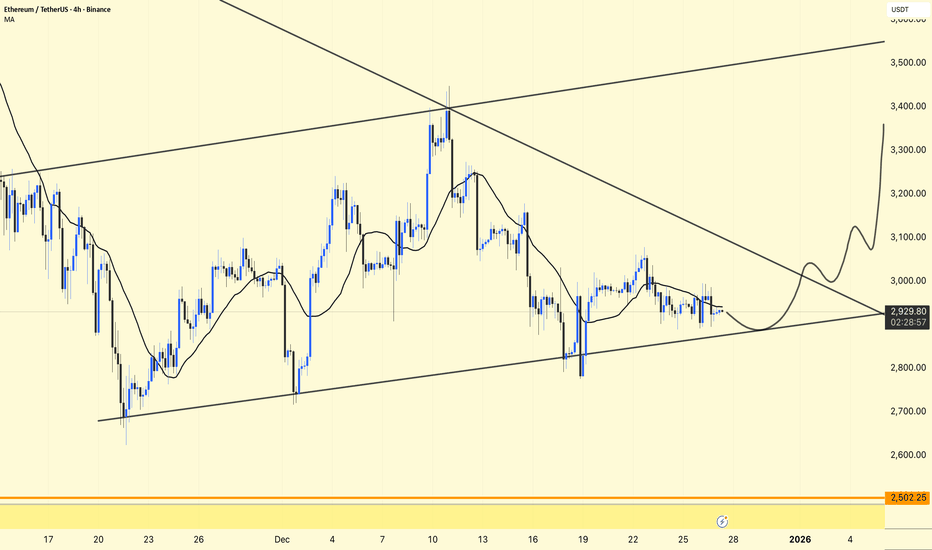

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a rising wedge / ascending structure, holding higher lows.

Price is pushing toward the descending trendline resistance around $3,180–3,220.

Support: $3,000 – $2,950 (trendline + moving averages zone)

Major Support: $2,500 (long-term demand zone)

A clean breakout and hold above the trendline can trigger a strong upside move toward $3,400 → $3,700.

Rejection from resistance may lead to a short-term pullback, but the overall structure remains constructive above support.

⚠️ Trade with confirmation and proper risk management.

Ethereum (ETH) - Bullish LongThe price has formed a bullish double bottom pattern. If price action breaks above the resistance, it can easily reach $4,000.

The double bottom pattern is a classic technical analysis chart formation that signals a potential bullish reversal of a preceding downtrend. It typically resembles the letter "W" on a price chart and indicates that selling pressure is likely exhausted at a strong support level.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is showing strength from the lower trendline and continuing its short-term recovery within the descending structure.

Trend: Still inside a descending channel

Current Move: Higher lows forming → bullish momentum building

Immediate Support: 3,000 – 3,050

Resistance: 3,250 – 3,350 (trendline + supply)

A sustained breakout above 3,300–3,350 can shift momentum toward 3,500+.

Rejection near resistance may cause a pullback toward the 3K support zone.

Bias: Short-term bullish, overall trend neutral until breakout confirmation.

Trade with confirmation and proper risk management.

Quick Bitcoin analyseBitcoin is testing the $90.3k S/R level again, but this time we're seeing 4h candles closing above the EMA200. If this level holds, I expect a clean break toward $95k and $100k after (local high of HTF trading area). Once $90.3k is confirmed as support, everything will pump.

CRYPTOCAP:ETH 4h time frame:

ETH moved into a new trading area between ~$3050 and ~$3250 and is around the mid of the range atm...

No fomo... Wait for confirmations to scalp around the mid... But when it comes back to the lower range around ~$3050 (and bounce on EMA200 on the 4h), Major Highcaps will pump... Keep an eye on that level... ✍️

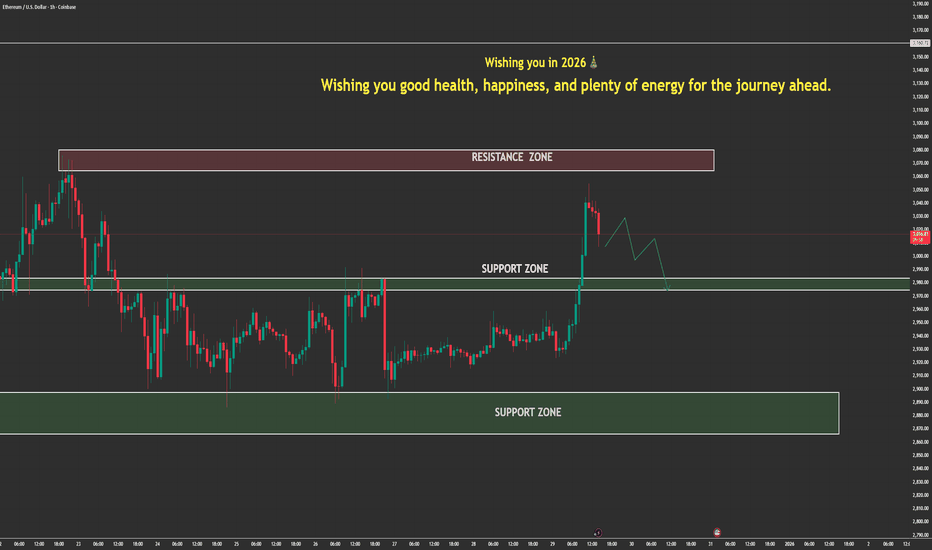

#ETH/USDT : Rebound Setup from ascending channel Support#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 2930. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward move.

Entry price: 2971

First target: 3003

Second target: 3050

Third target: 3106

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Structure: Price is compressing inside a descending wedge, trading near the lower trendline → selling pressure is weakening.

Price reclaimed the short-term 21MA and is testing the 100 MA area — a key decision zone.

Support: 2,900 – 2,880

Resistance: 3,080 – 3,120

Breakout Zone: 3,250 – 3,350+

Sideways grind near support + compression = energy building.

Wait for a clear 4H close above the descending trendline for continuation.

This is a confirmation zone, not a blind entry area.

DYOR | NFA

This Is a Range — Not a Breakout YetCOINBASE:ETHUSD remains in a range-bound structure, respecting a clear support–resistance box. Price continues to rotate between the 2,900 support zone and the 3,050–3,100 resistance area, with repeated swing highs failing to break higher. This behavior signals range trading and liquidity rotation, not a trending expansion yet.

Recent upside attempts into resistance have been rejected, while buyers remain active near support, keeping the structure balanced. Until a decisive breakout occurs, ETH is likely to continue oscillating inside this range.

Resistance: 3,050 – 3,100

Support: 2,900 – 2,880

Range focus: 2,900 – 3,100

➡️ Primary: hold above 2,900 → range continuation → rotation back toward 3,050–3,100.

⚠️ Risk: clean break below 2,900 → downside extension toward the lower demand zone.

ETH/USD – H1 Technical Analysis DetailETH/USD – H1 Technical Analysis

Ethereum has just delivered a strong impulsive breakout from the consolidation structure around 2,950–2,980, pushing price decisively above the prior balance area and reclaiming the psychological $3,000 level. This move is technically significant because it comes after an extended period of compression, where liquidity was building on both sides of the range.

From a structure perspective, ETH has flipped the former resistance zone around 2,980–3,000 into a new support zone. The impulsive bullish candle was accompanied by a clear volume expansion, confirming that this was not a false breakout but rather active participation from buyers. As long as price holds above this reclaimed support, the bullish structure remains intact.

The next key levels are clearly defined:

Immediate support: 2,980–3,000

Resistance 1: ~3,033

Major resistance: ~3,073

A healthy pullback into the 3,000 zone would be structurally bullish, allowing the market to build a higher low before attempting continuation toward 3,030 → 3,070. A clean break and acceptance above 3,073 would open the door for a broader upside expansion on higher timeframes.

On the macro backdrop, ETH is benefiting from a stable risk-on environment, with crypto sentiment supported by expectations of easier monetary conditions in 2026, declining US real yields, and continued institutional positioning in large-cap digital assets. As long as Bitcoin holds its higher range and the USD remains capped, Ethereum retains upside potential.

Conclusion:

This is no longer a range trade. ETH has shifted into a bullish continuation phase, with pullbacks likely to be corrective rather than trend-reversing. The market now favors buying dips above $3,000, not chasing breakouts blindly, while respecting that failure back below 2,980 would invalidate the bullish scenario.

ETH Is at a Make-or-Break ZoneEthereum is currently trading inside a clearly defined range, capped by major resistance around 3,160 and supported by a key demand zone near 2,980, with a deeper structural support around 2,780. The recent impulsive rally was decisively rejected at resistance, confirming that sellers are still defending the upper boundary of this range.

From a technical perspective, price action shows classic range behavior. After the rejection, ETH rotated back toward the mid-range and is now hovering just above support (~2,980). As long as this level holds on a closing basis, the market structure remains neutral-to-bullish within the range. A successful defense here would likely lead to a rebound toward 3,060 and a retest of the 3,160 resistance zone.

However, a clean breakdown below 2,980, especially with strong volume and a 1H/4H close, would invalidate the range floor and open downside continuation toward 2,900, followed by the major liquidity pocket around 2,780.

On the macro side, year-end conditions are playing a critical role. Holiday liquidity is thin, which statistically increases the probability of false breakouts and liquidity sweeps rather than clean trend continuations. At the same time, recent Federal Reserve adjustments to liquidity conditions and easing expectations around monetary policy have kept risk assets supported, but without enough conviction to force a decisive breakout. Crypto markets are therefore reacting more to positioning and short-term flows than to long-term macro repricing.

For Ethereum specifically, the broader narrative around institutional adoption, staking yield, and ETF-related expectations continues to provide medium-term support. That said, these factors are not yet strong enough to override the current technical range in the short term.

Bottom line: ETH remains a range-bound market. As long as 2,980 holds, upside rotations toward 3,060–3,160 remain the higher-probability scenario. A confirmed break below support would shift control back to sellers and expose 2,900 → 2,780. Until a decisive breakout occurs, traders should expect sideways price action with sharp intraday swings, typical of the Christmas trading period.

The Breakout Is LoadingHELLO TRADERS

ETH (Ethereum) – 4H | Key Points

Market Structure: Clear range / accumulation between support and resistance.

Resistance Zone: ~3,040 – 3,080 → supply still active, repeated rejections.

Support Zone: ~2,780 – 2,820 → strong demand, buyers defending lows.

Price Behavior: Sideways oscillation (high liquidity range), no breakout yet.

Bias: Neutral → Slightly bullish while holding above support.

Bullish Trigger: Clean 4H close above resistance → upside expansion.

Bearish Risk: Breakdown below support → deeper retracement.

Bottom line:

ETH is consolidating. Patience > prediction — wait for a confirmed breakout from the range.

ETH / USD >> Scalp Long idea ETH/USD — Bullish Order Flow Scalp (LONG)

# Market Structure Bullish displacement candle

LTF break of structure (CHoCH → BOS)

qual highs / resting buy-side liquidity

sell-side liquidity below recent lows has been taken / swept.

This sweep provided fuel for long

❌ Invalidation

# Clean close below demand zone

# Bearish break of structure after entry

⚠️ Disclaimer

This setup assumes normal market conditions.

Avoid trading during major news releases.

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA

A Christmas Setup: Is the Breakout Gift Coming?ETH/USD – 1H | Key Points:

Market State: Range consolidation after a sharp pullback.

Support Zone: ~2,900–2,920 → buyers defending repeatedly.

Resistance Zone: ~3,030–3,060 → strong supply overhead.

Structure: Higher lows forming from support → recovery attempt.

Bias: Neutral → bullish only if price reclaims 3,000+.

Context (Macro / Holiday):

Low Christmas liquidity → slow, choppy price action.

Real momentum likely comes after a clean breakout.

Plan:

Buy reactions at support.

Confirm longs only on break & hold above resistance.

Christmas Calm Before the Breakout – ETH Is Still WaitingKey Points :

Structure: Range / consolidation between support and resistance.

Bias: Neutral → waiting for expansion.

Support Zone: Holding so far, buyers still defending.

Resistance Zone: Major cap; breakout needed to confirm upside.

Liquidity: Thin Christmas liquidity → false moves possible.

Macro Context:

Holiday period = low volume, reduced institutional flow.

No strong macro catalyst → price driven mainly by technical levels.

Trading Note:

Avoid overtrading during Christmas.

Best opportunity comes after the holidays, not during.