Ethlongsetup

#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1925, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1948

Target 1: 2003

Target 2: 2058

Target 3: 2137

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

ETH/USDT — Long-Term Accumulation ZoneThe bearish triangle and consolidation below the channel midline have played out, and price has reached a key demand zone.

There is buyer reaction, but so far it’s only a bounce.

The only signs hinting at a potential reversal are the long lower wicks on recent candles.

Weekly RSI has entered a zone historically associated with reversals.

However, it is still 5–7 RSI points above the levels seen at prior bear-market bottoms — which could correspond to roughly another $1,000 downside.

The $1,500–2,000 range looks like a reasonable accumulation zone for long-term and investment portfolios.

Yes, a prolonged bear cycle could push price further outside the channel — which is why holding stable reserves is essential.

Buying during declines is psychologically difficult.

But historically, these accumulation phases produce the strongest long-term returns.

Last time ETH bounced from $1,500, the market delivered a 3× move in ~130 days for those who managed risk and emotions.

Downside risk from here may extend $ 1,000 2,000, while upside toward the previous ATH (~$3,000) remains intact.

Risk/reward is asymmetric.

The worst-case scenario is being stuck in a long-term position for an extended period.

Manage risk — but don’t ignore opportunity.

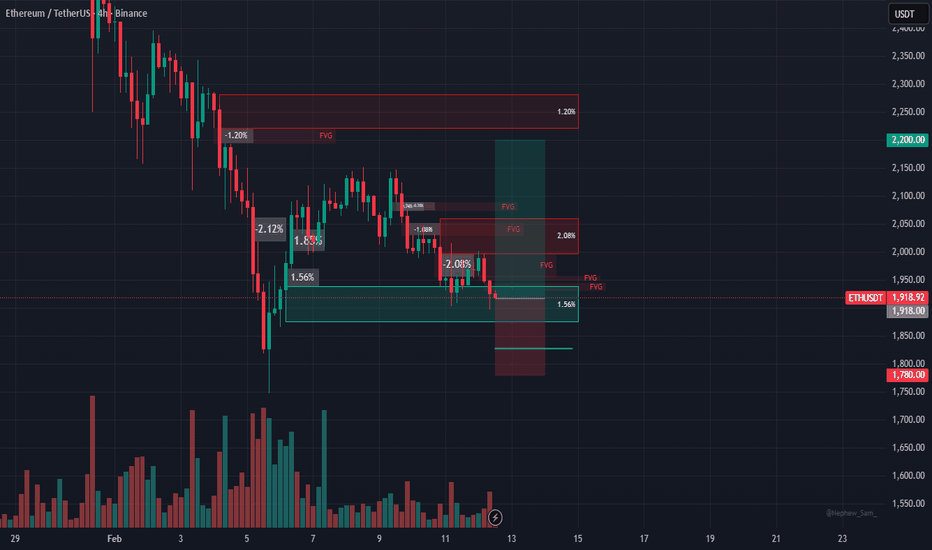

ETHUSDT – Potential Bullish Reversal From Discount Zone 🧠 Market Structure

ETH has been trading in a clear bearish market structure, confirmed by multiple Breaks of Structure (BOS) to the downside.

Recently, price printed a short-term higher low, suggesting potential early accumulation and a shift toward internal bullish momentum.

Currently, price is approaching a key premium resistance / supply zone (~2100-2150) which may act as the next decision point.

📍 Key Zones on Chart

🟥 FVG (Fair Value Gap): ~2000-2030

⬛ POI / Demand Zone: ~1920-1970

🟩 Major Support / Demand: ~1780-1820

🟩 Immediate Resistance: ~2120-2150

These zones represent imbalance areas and liquidity pools where reactions are likely.

🔎 Bullish Scenario (Primary Bias)

Price retraces into FVG / POI zone

Liquidity sweep into demand

Strong bullish reaction with internal BOS

Continuation toward:

🎯 2150 (local resistance)

🎯 2350 – 2450 (mid-range supply)

🎯 2550+ (higher timeframe resistance)

This aligns with the red and black projected paths on the chart.

⚠️ Alternative Scenario

If price fails to hold POI:

Sweep toward major demand ~1800

Possible deeper accumulation phase

Bullish continuation delayed

📈 Confirmation Triggers

Bullish engulfing candle inside POI

LTF BOS / CHoCH

Volume expansion from demand

Strong rejection wicks from imbalance

❌ Invalidation

Strong acceptance below 1780

Continued lower highs without reclaiming 2100

Breakdown of current higher-low structure

📝 Summary

Market is transitioning from bearish momentum into a potential reaccumulation phase.

Best strategy is waiting for discount entries inside FVG / POI rather than chasing price into resistance.

⚠️ Disclaimer

This analysis is for educational purposes only and not financial advice. Always manage risk and trade your own plan.

ETHUSDT | Working the Range Near SupportEthereum is currently moving inside a reaction area where buying interest has started to appear.

However, the structure is not fully defined yet, which means volatility and sudden movements in both directions should be expected before the market commits to a clearer path.

Despite that, price is already positioned in a zone where a recovery can develop, with potential upside projections toward 2,200 and 2,250 if momentum builds.

The critical level for bulls remains the 1,800 – 1,850 region.

Losing that area would weaken the scenario.

At the same time, if price ever trades there, those prices would become very attractive for new long evaluations, as deeper liquidity could provide stronger reactions.

I am already participating in this position while keeping flexibility in case the market delivers more volatility.

Patience and risk management first.

ETH/USD Daily — Support Bounce Setup in a Strong Downtrend

Chart Analysis:

Market Structure:

ETH is clearly in a bearish trend on the daily timeframe. Lower highs and lower lows are intact after a sharp rejection from the major supply zone around 3,300–3,400 (yellow zone).

Impulsive Sell-Off:

The recent move down is strong and aggressive, suggesting capitulation-style selling rather than a slow grind. This often precedes at least a technical relief bounce.

Key Support Zone (Red): ~1,900–2,000

Price has tapped into a well-defined demand/support area, where buyers previously stepped in. The long lower wicks here hint at buying interest and absorption.

Proposed Entry:

The marked entry is based on a support reaction, not a trend reversal. This is a counter-trend long, so it’s tactical, not positional.

Target Zone (Green): ~2,450–2,550

This zone aligns with:

Prior structure support → resistance flip

Likely liquidity resting above

Mean reversion after an extended drop

Bias & Expectations:

Short-term: Bullish relief bounce toward the green zone

Medium-term: Still bearish unless ETH reclaims and holds above ~2,600–2,700

Expect high volatility—clean V-shaped recoveries are rare in this context

Risk Note:

If price loses the 1,900 support decisively, the setup is invalidated and opens the door for continuation toward lower psychological levels.

📌 Summary:

This chart shows a high-risk, counter-trend bounce play off major daily support, targeting a logical resistance zone above. Good for disciplined traders, not for blind bottom-catching.

#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 1794. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 1920

First Target: 1958

Second Target: 2022

Third Target: 2103

Stop Loss: Above the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2164, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2240

Target 1: 2305

Target 2: 2373

Target 3: 2465

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

$ETH bullish update! (LTF)BINANCE:ETHUSDT continues to compress inside the descending trendline + rising support, holding above the key demand zone. No breakdown, no panic — just pressure building.

- Higher low already defended

- Sellers unable to push below demand

- Clear risk definition

- Upside opens up once the descending trendline is fully cleared

Entry: 3,218 – 3,254 (pullbacks into support)

SL: 3,067 (clean loss of structure)

Targets:

TP1: 3,447

TP2: 3,650

Ethereum — Stronger Signal Than BTC

BBG:ETHEREUM has printed a stronger signal than CRYPTOCAP:BTC , sooner than I expected. On top of that, $ETH/BTC is holding its ground, which is exactly what you want to see if ETH is gearing up for relative outperformance.

Will ETH outperform BTC over the next couple of months?

Chart-wise, it looks like it could, but this is something we need to track continuously to avoid losing sats if the setup fails.

For now, the signal is there — and **we act on signals, not opinions**. If you haven’t positioned yet, this is the moment where ETH deserves attention.

If structure continues to hold and momentum follows through, a new ATH is absolutely on the table.

ETH/USDC: A Gentle Unfolding of Harmonious Flow (3H Timeframe)In the serene cadence of the market, ETH/USDC presently dwells within a balanced range of 2685–3065 on the 3-hour chart.

From the perspective of the Harmonious Flow of Energy, this consolidation is not mere hesitation, but a quiet accumulation — a space where forces align in subtle proportion, neither overpowering the other, yet preparing for natural resolution.

The structure speaks of restraint: proportional waves, measured volumes, and a context that favours continuity over disruption. The energy here feels contained, yet directed — pointing toward an upward release when the balance tips with clarity.

A breakout above the range carries a calm probability of extension toward 3800–4000, a zone where past resistance may gently invite reflection. There, the flow could pause, allowing a harmonious correction — not a reversal, but a respectful return to test the conviction of buyers who entered within 2685–3065.

Such a retracement would serve the deeper rhythm: affirming strength without excess, protecting positions with poise rather than force.

This reading requires no urgency. When the elements — flow, harmony, proportion, and context — converge without pressure, the path reveals itself simply. Until then, we observe with lightness.

Wishing you clarity in the flow.