Ethshort

ETH/USDT (4H) – Chart Update. ETH/USDT (4H) – Chart Update

Structure: Bullish bias holding

Price Action: ETH has broken above the descending trendline

Ichimoku: Price trading above the cloud → momentum remains positive

Ethereum has reclaimed the trendline resistance, which is now acting as support. The pullback looks controlled and healthy, suggesting continuation rather than rejection.

Holding above 3,200–3,250 keeps the bullish scenario active

A sustained move can push ETH toward 3,450 → 3,650 → 3,800 zones.

A breakdown below 3,150 may trigger a deeper retest toward 3,000 support.

Market structure favors upside continuation. Wait for confirmation and manage risk wisely.

ETHUSDT M30 HTF Range High Rejection and Bearish Pullback Setup📝 Description

BINANCE:ETHUSDT has reached the previous range high and is reacting from a clear BSL zone. Price is showing rejection near local resistance, suggesting weakness after the recent bullish leg and increasing probability of a corrective pullback.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the range high and BSL

Preferred Setup:

• Entry: 3,375

• Stop Loss: Above 3,395

• TP1: 3,347

• TP2: 3,321

• TP3: 3,286 (HTF FVG draw / lower liquidity)

________________________________________

🎯 ICT & SMC Notes

• Clear reaction from BSL and range high

• No bullish continuation structure confirmed

• Downside targets aligned with HTF FVG and liquidity pools

________________________________________

🧩 Summary

CRYPTOCAP:ETH is showing signs of exhaustion at the range high. As long as price stays below BSL, the expectation remains a controlled bearish pullback toward lower HTF liquidity zones.

________________________________________

🌍 Fundamental Notes / Sentiment

With ongoing USD strength, financial conditions remain tight, pressuring risk assets. In this environment, Ethereum is vulnerable to downside, and a bearish continuation is favored as long as the dollar stays supported.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

ETH/USDC: A Gentle Unfolding of Harmonious Flow (3H Timeframe)In the serene cadence of the market, ETH/USDC presently dwells within a balanced range of 2685–3065 on the 3-hour chart.

From the perspective of the Harmonious Flow of Energy, this consolidation is not mere hesitation, but a quiet accumulation — a space where forces align in subtle proportion, neither overpowering the other, yet preparing for natural resolution.

The structure speaks of restraint: proportional waves, measured volumes, and a context that favours continuity over disruption. The energy here feels contained, yet directed — pointing toward an upward release when the balance tips with clarity.

A breakout above the range carries a calm probability of extension toward 3800–4000, a zone where past resistance may gently invite reflection. There, the flow could pause, allowing a harmonious correction — not a reversal, but a respectful return to test the conviction of buyers who entered within 2685–3065.

Such a retracement would serve the deeper rhythm: affirming strength without excess, protecting positions with poise rather than force.

This reading requires no urgency. When the elements — flow, harmony, proportion, and context — converge without pressure, the path reveals itself simply. Until then, we observe with lightness.

Wishing you clarity in the flow.

#ETH/USDT : Rebound Setup from ascending channel Support

#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 3073, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 3139

First Target: 3152

Second Target: 3195

Third Target: 3240

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

Ethereum did exactly what was outlined earlier. Price lost the $CRYPTOCAP:ETH Weekly Update

Ethereum did exactly what was outlined earlier. Price lost the $3,000 level, dumped into the $2,800 zone, and has now bounced back toward the 1W 50 EMA. This bounce changes nothing structurally..

Right now ETH is testing a key decision area. The 1W 50 EMA is acting as resistance. If ETH manages to hold above $3,300, a squeeze toward $3,600–$3,800 is very possible. That zone is where risk shifts back in favor of shorts, and I would look to add there aggressively.

Downside targets remain unchanged:

First target $3,000

Second target $2,600

Final target $2,200

Same logic applies to BTC. If Bitcoin pushes above $98k, that strength will be used to add more short exposure, not chase upside.

Until ETH reclaims the 1W 50 EMA and builds acceptance above it, every move up is just liquidity, not recovery. Bears still control the higher timeframe.

ETHUSDT M15 BPR Rejection and Short-Term Pullback Setup📝 Description

BINANCE:ETHUSDT has pushed back into a prior H1 BPR / liquidity zone after a strong recovery leg. The current move appears corrective, with price reacting near resistance rather than showing clean continuation strength.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the H1 BPR and recent high

Preferred Setup:

• Entry: 3,141

• Stop Loss: Above 3,148

• TP1: 3,134

• TP2: 3,121

• TP3: 3,093 (lower liquidity)

________________________________________

🎯 ICT & SMC Notes

• Rejection from H1 BPR signals supply presence

• No confirmed bullish BOS after the rally

• Downside liquidity remains unfilled

________________________________________

🧩 Summary

CRYPTOCAP:ETH is showing signs of rejection at resistance. As long as price remains capped below the BPR, a controlled pullback toward lower PD arrays is favored over upside continuation.

________________________________________

🌍 Fundamental Notes / Sentiment

This week’s US macro data supports a stronger USD and higher-for-longer rates, keeping liquidity tight for risk assets. In this environment, Ethereum remains vulnerable to downside, with bearish continuation favored and any short-term rebounds likely corrective rather than trend-changing.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a descending trendline + rising support, forming a compression zone. The price has started to respect higher lows, indicating an improving structure.

The descending trendline near 3,200–3,250 remains the main hurdle.

Trendline support and moving averages are holding around 3,050–3,100.

Confirms bullish continuation, with upside expansion toward 3,400–3,700.

As long as the price holds above the rising support, the bullish setup remains valid.

Would delay the breakout and shift ETH into short-term consolidation.

ETH is in a pre-breakout phase. Structure favors bulls, but confirmation comes only with a clean breakout above the descending trendline. Manage risk until direction is confirmed.

ETH/USD: A global bearish zigzag on Ethereum1. The main idea is a global zigzag {a}-{b}-{c} to the downside.

2. Wave {a} can be counted as a double zigzag WXY, but I don’t want to do that.

3. However, I still want to break this move down into a leading diagonal triangle (LDT), which is what I’m showing on the chart.

4. Locally, there is no clear strength, and the price action looks corrective.

5. So it’s crucial to know whether wave {b} is complete, as this move may develop into a more complex correction.

6. If wave {b} is complete, we may already be seeing the development of wave (iii) of {c} on the local scale.

7. The downside move could extend for a minimum of two more months toward the lower channel boundary.

8. If wave {b} becomes more complex, we may still see its full development into another corrective pattern, followed by the advance of wave {c}.

9. The basic targets of the decline are the 0.618 and 1 Fibonacci levels. For now, I don’t want to include the 1.618 Fibonacci level on the chart.

10. There’s a strong chance that in the future the price could reach the range between $2,033 and $1,141.

#ETH/USDT – Short Setup from Key Supply Zone

#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 3253. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 3218

First target: 3186

Second target: 3164

Third target: 3132

Stop loss: Above the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

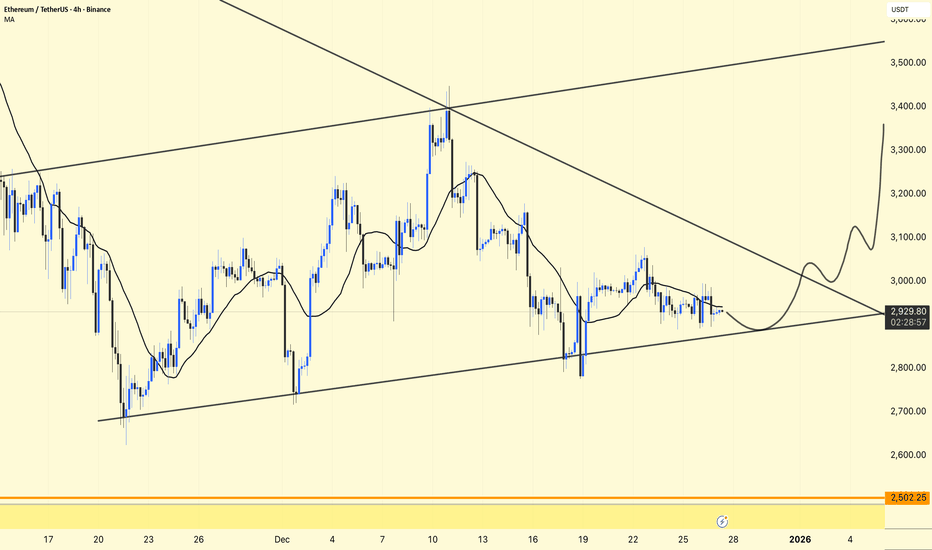

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a rising wedge / ascending structure, holding higher lows.

Price is pushing toward the descending trendline resistance around $3,180–3,220.

Support: $3,000 – $2,950 (trendline + moving averages zone)

Major Support: $2,500 (long-term demand zone)

A clean breakout and hold above the trendline can trigger a strong upside move toward $3,400 → $3,700.

Rejection from resistance may lead to a short-term pullback, but the overall structure remains constructive above support.

⚠️ Trade with confirmation and proper risk management.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is showing strength from the lower trendline and continuing its short-term recovery within the descending structure.

Trend: Still inside a descending channel

Current Move: Higher lows forming → bullish momentum building

Immediate Support: 3,000 – 3,050

Resistance: 3,250 – 3,350 (trendline + supply)

A sustained breakout above 3,300–3,350 can shift momentum toward 3,500+.

Rejection near resistance may cause a pullback toward the 3K support zone.

Bias: Short-term bullish, overall trend neutral until breakout confirmation.

Trade with confirmation and proper risk management.

#ETH/USDT : Rebound Setup from ascending channel Support#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 2930. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward move.

Entry price: 2971

First target: 3003

Second target: 3050

Third target: 3106

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Large Bearish Order Block in Control⚠️ Risk Update: Large Bearish Order Block in Control

A large and long-term Bearish Order Block has formed and is currently dominating price action.

This structure suggests that the recent upside may have been a liquidity-driven move, and the market is now positioned for a potential major downside expansion.

📉 Downside Scenarios to Consider

$2,800

→ First major downside target

→ A level where price could decline relatively smoothly if selling pressure continues

Maximum downside extension: $2,200

→ This scenario should remain open-minded and prepared for

→ Possible if heavy distribution and panic-driven selling accelerate

🔍 Key Notes

This is not a random pullback, but a structural reaction to a dominant bearish order block

Any short-term bounce should be treated as relief or retracement, not trend reversal

Risk management and capital preservation are critical in this zone

⚠️ Conclusion

A large downside move is possible.

Traders should stay prepared, avoid overexposure, and prioritize defensive positioning.

Prepare for risk before the market forces you to.

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Structure: Price is compressing inside a descending wedge, trading near the lower trendline → selling pressure is weakening.

Price reclaimed the short-term 21MA and is testing the 100 MA area — a key decision zone.

Support: 2,900 – 2,880

Resistance: 3,080 – 3,120

Breakout Zone: 3,250 – 3,350+

Sideways grind near support + compression = energy building.

Wait for a clear 4H close above the descending trendline for continuation.

This is a confirmation zone, not a blind entry area.

DYOR | NFA

ETH SELL SETUP ACTIVEETH SELL SETUP ACTIVE ⚡

📌 Trade Plan:

🔓 Entry: 2900 - 2890

❌ Stop Loss: 2860

🎯 Target: 2960

ETH rejected from a strong supply zone after showing clear weakness and momentum shift. Smart money distribution + structure break confirms a high-probability sell. Clean risk management, clear levels — trade the plan, not emotions.

📌 Follow for more accurate, level-based setups

⚠️ Educational purpose only. Not financial advice.

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA

Merry ETHmas, Everyone! - A Retrace to the Daily BOS ZoneMerry Christmas, everyone! On this 24th Day of ETHmas, my True Love gave to me...a signaled return to the Daily BOS Zone with a target of the H1 BOS Source.

If you have been following our ETH analyses for the last two months, you know this has been a seemingly wild ride with ETH...BUT, it has done almost EXACTLY what our analysis of the structure said it would do. Please see our previous posts for details on how we got here.

Where are we now?:

It's Christmas Eve and we have recently seen the H1 BOS Up out of this HUGE Daily Demand Zone. We have been waiting for this, and once we got it, the next target was a retracement back down to the H1 BOS Source. NOTE: We saw the price push up after the BOS Up, but it did not pass the retest rules, so there was no strength to keep moving.

What is next?:

Now that we have seen the rejection after the H1 BOS, it's simply retracing back down to this source area. So, once we get back into the Daily Demand Zone, the target is most likely this H1 BOS Source (2776 - 2811). At that point, we have a pretty strong area of support that should hold ETH...at least give us a consolidation period for the market to determine if it's ready for the strong move up. Keep in mind this is a Daily Demand Zone, so we could see a strong bullish response out or it could consolidate here for days.

Are there Trade Opportunities?:

For now, the possible trade opportunities are to short ETH back down to this H1 BOS Source. If you've been following our analysis, you would already be in that short after the H1 BOS Up.

Once we get to this source area, aggressive traders can take a long, with a stop loss below the Daily Demand Zone.

I pray you all have a MERRY CHRISTMAS! Please send me your comments and ideas, as I would love to hear what other traders are seeing and thinking!

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Lower highs, descending trendline still active

ETH rejected from the trendline near 3,350–3,400

Price below cloud → bearish / consolidation phase

Holding around 2,930

Immediate Support: 2,880 – 2,900

Major Support: 2,700 – 2,750

Resistance: 3,050 – 3,120

Major Resistance: 3,350 – 3,400

Above 3,120 → short-term bullish relief toward 3,300+

Below 2,880 → risk of move toward 2,750

Until the breakout, range & patience are best

⚠️ Trend is still weak — trade only with confirmation & strict risk management.