#ETH/USDT — Descending Wedge & High R/R Zone#ETH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1925, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1948

Target 1: 2003

Target 2: 2058

Target 3: 2137

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Ethshortsetup

ETHUSD Short Setup | Strong Supply Zone Rejection🔴 ETHUSD Short Setup | Strong Supply Zone Rejection

Market: ETHUSD (Binance)

Timeframe: 1H

Bias: Short ⬇️

ETHUSD price is approaching a well-tested strong supply zone around 3050–3065, which has previously acted as a major rejection area. Multiple rejections from this zone confirm strong seller presence, increasing the probability of a downside move.

📌 Trade Plan

Entry Zone: 3050 – 3065

Target 1: 3000

Target 2: 2900 – 2920

Invalidation: Strong close and acceptance above supply zone

🧠 Technical Reasoning

Price is trading below a key resistance band

Previous highs rejected sharply from the same zone

Structure shows lower highs + range breakdown potential

Downside liquidity resting below 3000 and 2900

⚠️ Risk Management

Wait for rejection confirmation near the entry zone

Avoid aggressive entries without confirmation

Manage position size according to your risk rules

🔍 Market Outlook

If ETH fails to sustain above 3065, downside momentum can accelerate toward 3000, and further extension toward 2900–2920 is likely.

📊 This is a technical view, not financial advice.

On the 19th Day of ETHmas...A Bullish Bounce from the Daily BOS On the 19th Day of ETHmas, my True Love Gave to me....a Strong Bull Candle out of the Daily BOS Source!

Hey, Traders. Been away a couple of days, but Ol' Faithful ETH is still playing out according to our reading of the market structure. In our last ETH update, we were focusing on the H4 and the last Structure on that time frame. We had some strong bullish responses from H4 Sources that indicated that ETH is at least ready to start pointing north. We pointed out that the Daily Time frame was becoming a stronger influence now, because we also had a bullish Daily BOS UP. This update is focusing on the Daily Chart and also a deep dive down to the H1 to see what we should be watching more closely. Please see our previous posts throughout November and December to see how we walked through ETH's structure up to this point.

So, where are we now?:

After the recent low on ~Nov 21st, ETH, we had a daily BOS UP on Dec 9th. That was a critical structural break, and as we have taught here several times, a key BOS like this almost always leads to a return to the BOS Source. That Daily BOS Source zone is at ~2612 - 2886, and ETH retraced exactly back to that area to regain strength. Once we fell back into this zone, we got the expected daily response that played out today. Today saw a strong bullish candle push up from 2825 to over 3000 again. This is a good sign for the bulls, but there are several things that still need to play out before we can get that White (or Green) ETHmas!

What to look out for:

What we really need out of this Daily BOS Demand Source is an H1 BOS UP and a return to that source. If you dive down to the H1, you will see the last H1 Supply Zone is 2930 - 2995. Today's high did break above that, but we have NOT gotten an H1 candle to close above that level yet. SO...there is no H1 BOS yet. We need to see an H1 Candle close above 2995 to give the BOS, and then we need to look for a retracement again back to the source of that break. This would be the strongest bull case for getting out of this Daily BOS Demand Source. Without a strong enough confirmation out of here, ETH is still not out of the Danger Zone.

What are the Dangers from here?:

If we do not get a strong enough bull structure coming out of this Daily BOS Demand Source, then this signals that even the Daily Structure is not strong enough to propel ETH back to previous highs. We then would have to look at the higher Weekly Structure which has still been playing out. The last Weekly Demand Zone is HUGE (2150 - 2700). So, if we cannot get the push from this Daily Structure, ETH will likely fall back to this level. The most likely target will be the Daily source inside of that Weekly Zone (2150 - 2300).

Are there any good trade opportunities where we are now?:

There are still a few good trade opportunities that should play out very well if you have the discipline and patience. There are both bullish and bearish cases from here. For the short-term, it's pretty much bearish:

1. IF ETH does give the H1 BOS UP we're looking for (Close above 2995), then we can short the retracement back to the source of that. The target would be the low inside of the Daily BOS Demand Source (2800-2830). At that point, we should switch to a LONG with an initial target to come back up to the last H1 Supply Source ~3160.

2. IF ETH rejects from here without giving an H1 BOS (no H1 close above 2995), we can still short it, but can expect it to fall farther down into the Daily Demand Source and make a lower low. Target ~ 2660-2760.

I hope you all have been following along and trading ETH with us. Please leave me any comments or questions, as I would love to hear your thoughts on my analyses. And if you need any help in better understanding how to read the markets, reach out and we'd be glad to help!

$ETH/USDT ANALYSISOn the 15-minute ETH/USDT chart, price is trading inside an ascending channel, showing a gradual bullish structure but currently facing short-term weakness after rejecting near the upper boundary around $3,239. The candles have started pulling back below the 9- and 15-EMA zone, indicating momentum loss. Volume has slightly increased on the recent red candles, confirming mild selling pressure. The key intraday support lies between $3,120 – $3,140, which also aligns with the lower trendline and previous consolidation block visible in green. As long as ETH holds above that zone, overall intraday bias remains bullish, and the price could attempt another push toward $3,200 – $3,240. However, a confirmed candle close below $3,120 would signal potential short-term reversal or deeper correction toward $3,080 levels.

#ETH/USDT Does this scenario cross your mind? What if…#ETH

The price is moving in a descending channel on the 1-hour timeframe and is expected to break out and continue upwards.

We have a trend to stabilize above the 100-period moving average again.

We have a downtrend on the RSI indicator, which supports an upward move if it breaks above it.

We have a key support zone in green that pushed the price higher at 3186.

Entry price: 3230

First target: 3286

Second target: 3350

Third target: 3421

For risk management, don't forget your stop-loss and money management.

The stop-loss should be below the green support zone.

Upon reaching the first target, take some profits and then change your stop-loss order to an entry order.

For any questions, please comment.

Thank you.

Continuation of the previous idea based on the Harmonious EnergyThe consolidation phase is coming to an end. The market structure is gradually moving into the next stage of the energy cycle, where a new flow direction is forming.

At the moment, I am observing a continuation of the energy movement with a noticeable manifestation of buyer strength. The key focus is on price behaviour near the resistance level — this is where it will become clear whether buyers will be able to maintain control and continue the upward momentum, or whether the market will enter a redistribution phase.

According to the GPE concept, this moment reflects the transition from balance to energy release — when the accumulated potential turns into real movement.

📌 Observation: price reaction to resistance and confirmation of the flow's strength.

💬 If you have any questions or would like to discuss the idea in more detail, I am always open to dialogue.

Trading idea based on the Harmonious Energy Flow (HEF) conceptAt the current stage, there is a clear manifestation of buyers’ strength, even though the market environment is changing rapidly without any significant price movement. This forms a state of consolidation, where energy is being accumulated for the next impulse.

According to the HEF concept, consolidation represents a transitional phase — the market is searching for balance before initiating a new wave of directional movement. My current expectation is focused on the moment of breakout from consolidation, when the market will reveal the true side of strength.

📌 Main focus: observing how buyers maintain their advantage within this narrow structure and waiting for a signal confirming the exit from balance.

If you find my charting approach interesting, you are welcome to connect and discuss further. I’m open to communication and collaboration.

Would you like me to refine this version for maximum stylistic alignment with TradingView’s publication tone (slightly shorter, more analytical, and visually structured)?

▒𖢻▒ ETHEREUM FORECAST | 6HR ▒𖢻▒COINBASE:ETHUSD

Here's my Forecast for Ethereum on the 6-hour chart. After an incredible run, ETH is now consolidating in a tight range, and the chart is giving us some very clear levels to watch.

Here's my breakdown of the current situation:

The Bullish Case (Consolidation):

ETH is currently holding strong above the key support level at $4,677. As long as we remain above this line, this sideways action looks like healthy consolidation before the next leg up.

The overall structure is still a clear uptrend, defined by the ascending trendline providing support from below.

The Bearish Case (Potential Pullback):

The price is currently below the recent High near $4,950. A failure to break this level could signal exhaustion and lead to a pullback.

The first major support to watch on any significant dip is the 0.382 Fibonacci retracement level around $4,300. This would be a logical area for buyers to step back in.

Key Levels to Watch:

Resistance: The recent high around $4,950. A clean break and hold above this level signals the next major move higher.

Immediate Support: $4,677. This is the line in the sand for the current consolidation range.

Major Support: The 0.618 Fib level and structural support at $4,000. This is the critical level that bulls absolutely must defend to maintain the larger bullish trend.

My Outlook:

For now, I'm leaning bearish on the 6HR, bullish in the immediate short-term but remaining cautious. I'm watching for a decisive break of $4,950 as confirmation for new highs. If the immediate support at $4,677 fails, I'll be looking for a potential dip-buying opportunity at $4,300.

DISCLAIMER

I AM NOT A FINACIAL ADVISOR, NOR AM I YOURS. THIS IS NOT FINANCIAL ADVICE. MEARLY DOODLINGS ON A MATHMATICALLY DRIVEN GRAPHICAL INTERFACE, TRACKING AN INVISIBLE 256BIT MILITARY-GRADE ENCRYPTED ASSET. . . FOR ENTERTAINMENT/AMUSEMENT PUROSES ONLY. ENJOY!

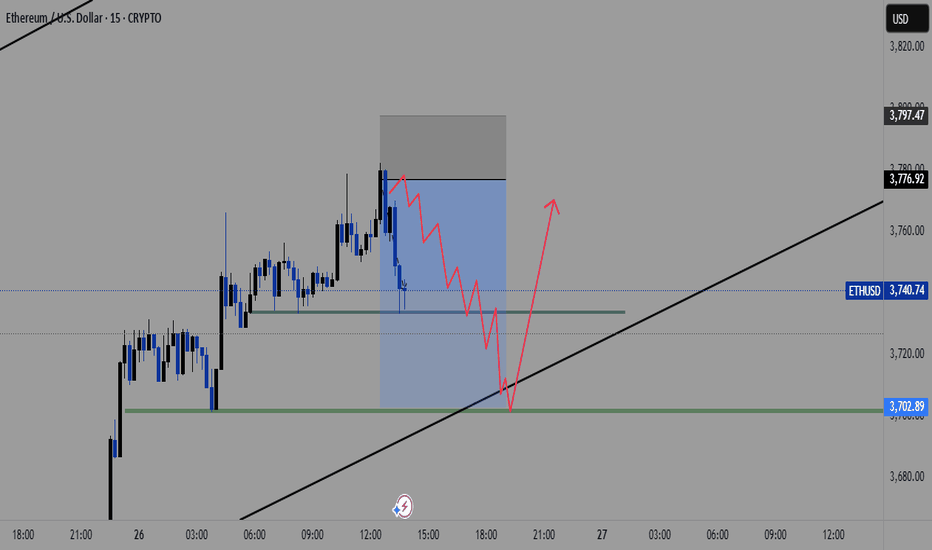

ETH to $3700 Before a Major Bounce?Ethereum has been showing signs of exhaustion after its recent rally. I'm watching the $3700 level closely — it's a key support zone that has acted as both resistance and support in the past.

🟦 If ETH pulls back to this area, I expect it to find strong buying interest, potentially leading to a significant bounce and continuation of the bullish trend.

📌 Scenario I'm Watching:

🔻 Pullback to the $3700 support zone

📉 Shakeout or stop hunt below previous lows

💚 Followed by a strong bullish reversal — possible move toward $4000+

Why $3700?

Confluence of previous highs/lows

Psychological round number

Potential liquidity pocket

Not Financial Advice!

This is a scenario I'm tracking, not a guarantee. As always, wait for confirmation (e.g. bullish engulfing, RSI divergence, volume spike) before jumping in.

📉 If $3700 fails decisively, I'll reassess — next support likely around $3550–3600.

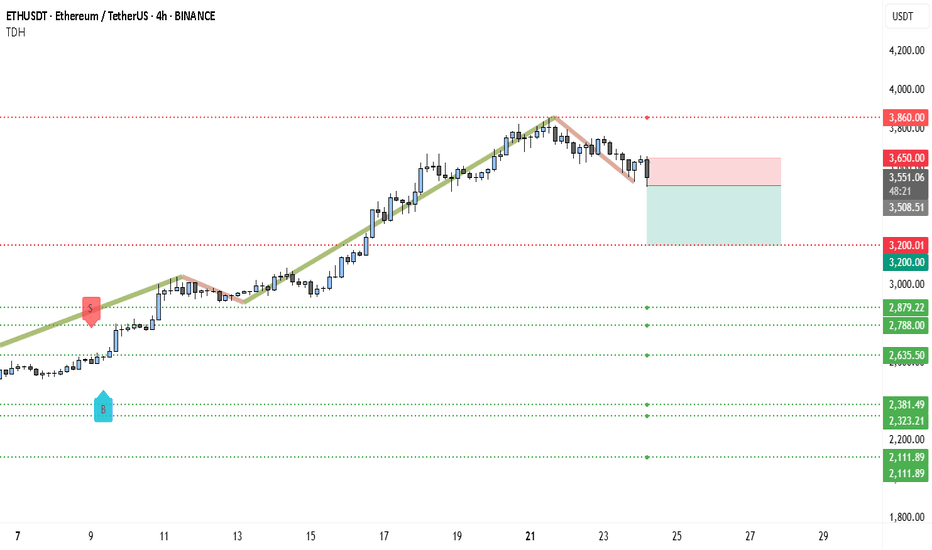

ETH Just Lost Key Support — Next Stop: $2,879?Ethereum (ETH) appears to be losing steam on the 4-hour chart as it fails to sustain above the critical $3,860 resistance level. After a strong rally, the price structure has started showing signs of exhaustion — the previous bullish momentum has clearly stalled, and ETH is now forming lower highs and lower lows. This breakdown marks a potential shift in trend, especially considering the clean rejection from $3,860 with several upper-wick rejections signaling aggressive selling pressure.

The green ascending trendline, which supported ETH throughout its recent rally, has been breached. Price has broken below the trendline and is now moving in a declining structure highlighted by the recent bearish wave. Sellers have stepped in, and the most recent candles indicate a bearish continuation setup forming just below a failed support-turned-resistance near $3,533.

There’s a visible trade setup taking shape:

• Entry: $3,530–$3,550 (post-retest of broken trend support)

• Stop-loss: $3,650 (above recent local highs)

• Target 1: $3,200 (key support level)

• Target 2: $2,879

• Target 3 (extended): $2,635 if downside pressure intensifies

This short setup offers a solid risk-reward ratio, especially if momentum accelerates below $3,500. The sell signal seen earlier aligns with this potential reversal zone, and unless ETH reclaims $3,650 with volume, the bears look likely to stay in control.

In summary, ETH on the 4H timeframe is now trading below major support, with a bearish structure, trendline breakdown, and rejection at resistance — all aligning for a short-biased move in the coming sessions. Any bullish invalidation would require ETH to push and close above $3,650 convincingly. Until then, the path of least resistance appears downward.

ETHEREUM AT A CRUCIAL INFLECTION POINT:CRYPTOCAP:ETH has been grinding just below a major resistance zone (~$2,850) after breaking out of a long-term descending channel.

This is the final barrier before a potential rally towards $4,000.

What to Watch:

Resistance: ~$2,850

Break above = momentum likely to accelerate

Rejection = possible pullback to retest breakout zone (~$2,400–$2,200)

Structure is strong, but confirmation is key. Bulls must clear this ceiling with volume.

Patience. React to a breakout or rejection — don’t front-run.

"ETH Breakout Watch: Holding Support for a Push Toward $1900+"ETH 4H chart par price apne key support (purple box) ke upar consolidate kar raha hai. Jab tak yeh support hold karta hai, $1900 - $1920 ka target active rahega.

Agar support toot jata hai to next major demand zone 1660-1680 ke aas paas hai. Tab tak structure bullish hai.

Trading plan simple hai:

✅ Support hold = Buy dips for $1900+

❌ Support breakdown = Wait for lower entries.

Chart clear path dikhata hai, risk manage karte raho! 🚀

ETHEREUM ( SHORT TERM )Hello crypto community!

In this analysis, I’ve examined the Ethereum (ETH/USDT) 15M chart by inverting it.

It’s 12 March 2025, exactly 5 years since 12 March 2020, when Bitcoin crashed 55% in a single day, marking the “Black Thursday” that shook the market.

Now, the ETH chart shows the purple trendline as resistance (inverted to 1,684 USD) and green zones as support (inverted to 1,500-1,600 USD).

The pattern suggests a potential downturn; a break below the blue line could trigger a sharp pullback. Volume has risen by ~20% in the last hour, supporting this move.

Potential Scenario:

If resistance at 1,684 holds, the price may test support at 1,500-1,600, with a possible drop to 1,400. While not as severe as the 12 March 2020 crash, this week calls for caution. As a spot trader, I’m planning positions around the 1,600-1,500 range.

What do you think? Will ETH drop, or will the bull run continue? Share your thoughts below! 📉📈

ETHUSDT Buy 📢 ETHUSDT Buy Signal 📢

🟢 Buy: After a pullback to the trendline ✅

🔹 Entry Level: 2,663.53 USDT

🔹 Target 1: 2,973.46 USDT 🎯

🔹 Target 2: 3,368.06 USDT 🚀

🔻 Stop Loss: 2,434.30 USDT ⛔

⚠ Risk management is essential! 📊

💡 Analysis is based on the breakout of the downtrend line and a potential bullish move.

#ETH/USDT#ETH

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 3300

Entry price 3340

First target 3387

Second target 3464

Third target 3556

ETH IdeaEth pair has formed a double top pattern and broke the neckline

Retested and got rejected

so we're in a short (sell) position

our take profit will be the 0.76 fib retracement which will be our support zone

once it get reject we can enter a long position with targeting a new high

Follow us for more updates on pairs

eth ethereum"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

#ETH/USDT#ETH

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 2452

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2525

First target 2613

Second target 2686

Third target 2771

ETH (Crypto ETHEREUM) SELL TF H4 TP = 2286.86On the H4 chart the trend started on Sept. 27. (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 2286.86

This level, which I have outlined above, is certainly not a “finish” level. But it is the level that has the “highest percentage of hits on target.”

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading