ETH/USDT – Pulling Back to Move Higher, Market Pauses After a StHello, I'm Domic.

Looking at the ETH/USDT H4 chart, what stands out to me right now is not the few recent red candles, but how the market is digesting the prior rally. After moving almost in a straight line from the 2,950 area up toward 3,300, it is completely normal for Ethereum to slow down and correct. A healthy trend never moves in a straight line—it needs pullbacks to test where buying interest is still willing to step in.

From a structural perspective, the medium-term uptrend remains intact. Price is pulling back into the 3,090–3,120 zone, which aligns with the slower EMA and sits just below the faster EMA. Losing the fast EMA and then coming back to test the slow EMA is a scenario I see very often in sustainable uptrends. It points to position rebalancing rather than any sign of major capital exiting the market.

One aspect I find quite constructive is that this pullback is not accompanied by a surge in selling volume. The corrective candles have moderate bodies and show lower wicks, reflecting short-term profit-taking more than aggressive selling. If this were true distribution, both the candle structure and volume profile would look very different.

Wishing you successful trading!

ETHUSDT

#ETHUSDT: Still Waiting For Price To Come Down $2000 LevelETHUSDT OVERVIEW! 🏆🚀

🔺The market is still showing signs of weakness. We’re seeing a lot of traders getting tired of buying at the $3400 level, which is a big deal for many swing traders. Right now, we’re still thinking it’s best to buy ETH when it’s at the lower price of $2000. To do this, we need the price to drop a lot, with lots of strong bearish trading happening each day.

🔺We’re aiming to get in at $2000, but it might take some time for the price to get there. We’re going to wait for a clear sign from the market.Right now, the main reason people are buying is because of what’s happening with the fundamentals, and we think those will settle down soon. Once they do, we expect the price to go down a bit.

🔺When you’re trading cryptocurrency, it’s really important to be careful with your risk. It can be risky and you could lose all your money. This analysis is just to help you learn, so please do your own research and make sure you understand the risks.

Team SetupsFX❤️🧠

ETH/USDT | From this FVG to the other! (READ THE CAPTION)By analysing the 2h chart of ETHUSDT, we can see that 3308, it dropped in price all the way down to the lower FVG's high, showing an initial reaction before dropping in the FVG zone yet again. It is currently being traded at 3109. I expect it to hit the Consequent Encroachment of the FVG and then going back up to test the high of the FVG again.

Current targets: 3113, 3124, 3136, 3148 and 3160.

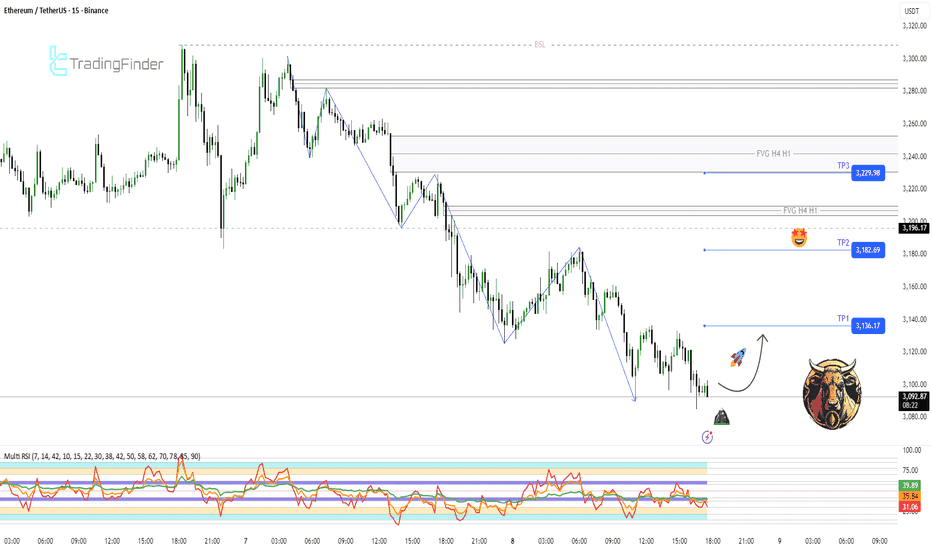

ETH M15 RSI Exhaustion and Mean Reversion Bounce Setup📝 Description

After a clear bearish leg, ETH has swept sell-side liquidity below recent lows and is now consolidating in a discount zone. The downside move looks liquidity-driven and corrective, not continuation. Price reaction at the lows suggests seller exhaustion and a short-term reversal potential.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish (Mean Reversion)

Preferred Setup:

• Entry: 3,090

• Stop Loss: Below 3,070

• TP1: 3,136

• TP2: 3,182

• TP3: 3,230

________________________________________

🎯 ICT & SMC Notes

• Clean SSL sweep of prior lows

• Price trading in HTF discount

• H4/H1 FVGs acting as upside magnets

________________________________________

🧩 Summary

Given the RSI condition and decreasing sell pressure, a short-term bullish reaction is expected. Risk management around the current low is key, and continuation depends on price reaction at higher PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

With no major high-impact news ahead, the market is mainly driven by technical flows. This environment supports a short-term technical bounce based on RSI and liquidity behavior.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

ETHUSDT: Bullish Push to 3435?As the previous analysis worked exactly as predicted, BINANCE:ETHUSDT is eyeing a bullish breakout on the 4-hour chart , with price rebounding from consolidation after a pullback and breakout candle, forming higher lows that could trigger upside momentum if buyers defend amid recent volatility. This setup suggests a continuation opportunity post-correction, targeting higher levels with near 1:5 risk-reward overall.🔥

Entry between 3090–3100 for a long position (entry from current price with proper risk management is recommended)🎯. Targets at 3255 (first) , 3435 (second) . Set a stop loss at a daily close below 3050 , yielding a risk-reward ratio of near 1:5 overall. Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging Ethereum's resilience post-pullback.🌟

📝 Trade Setup

🎯 Entry (Long):

3090 – 3100

(Entry from current price is valid with proper risk & position sizing.)

🎯 Targets:

• 3255 (first target)

• 3435 (second target)

❌ Stop Loss:

• Daily close below 3050

⚖️ Risk-to-Reward:

• ~1:5 overall

💡 Your view?

Does ETHUSDT continue this breakout toward 3255 → 3435, or do you expect another consolidation before the next leg up? 👇

ETHUSD | Corrective Price Action, Before a Relief RallyHi traders,

I can see that price is moving inside a contracting triangle where price is making lower highs and higher lows. This pattern creates a lot of liquidity on both ends because buyers and sellers are equally placing their orders.

From an Elliott perspective, the structure fits a clean ABCDE corrective triangle. Right now, price is approaching the (e) leg.

Afterwards, I'm expecting price to break the triangle shape towards $3300, $3450, $3590

Good Luck!

ETHUSD: Ethereum Wave Structure Awaits ImpulseETHUSD: Ethereum Wave Structure Awaits Impulse

ETHUSD Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that the current picture for Ethereum shows the completion of an extended corrective formation and the potential for a new move.

Chart D1: The global structure indicates that the market is gradually breaking out of its sideways range. The wave formation looks like the end of a correction, which is laying the foundation for the next impulse.

Chart H4: Local dynamics confirm the first signs of an impulse. Key entry points are forming here, which could mark the beginning of a larger wave.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement may be accompanied by increased seller activity and a shift in focus to the downside.

Alternative Scenario

If the price holds above local peaks and forms a stable upward impulse structure, the focus will shift to continued growth. In this case, the correction will be considered incomplete, and Ethereum may experience an additional rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with short stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Results

ETHUSD is at a crossroads between the end of the correction and the beginning of a new impulse. The wave structure on D1 and H4 provides clear guidelines for action: watch for confirmation of the scenario and act with discipline.

#ETH/USDT – Short Setup from Key Supply Zone

#ETH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 3253. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 3218

First target: 3186

Second target: 3164

Third target: 3132

Stop loss: Above the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

Are Lower Highs Setting Up a Deeper Sell-Off?Hello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Ethereum has transitioned from a previously bullish environment into a clear bearish market structure, defined by a sequence of lower highs (LH) and lower lows (LL). After failing to sustain price above the recent swing highs, sellers stepped in aggressively, forcing a breakdown through multiple structure levels.

The sharp impulsive move lower confirms bearish momentum, while subsequent pullbacks have remained corrective, consistently forming lower highs beneath prior support now acting as resistance. This price behavior reflects a market that has shifted control decisively to sellers.

Key Supply / Structure Resistance:

The 3,130–3,150 region now acts as a critical supply zone, where previous support was broken and sellers have defended retracement attempts. This area is also aligned with the EMA, reinforcing bearish pressure.

Intermediate Resistance:

The 3,090–3,100 level represents a minor structure cap. Any pullback into this zone that fails would likely form another lower high.

Major Downside Demand / Liquidity Target:

The 3,020 area is the next significant demand zone, aligning with projected structure continuation and liquidity resting below recent lows.

Currently, ETH is trading after printing a fresh lower low, placing the market in continuation mode rather than exhaustion. Price is attempting a minor bounce, but as long as retracements remain capped below supply, this move should be treated as bearish corrective price action.

Momentum remains with sellers unless structure is reclaimed.

As long as Ethereum remains below the 3,130–3,150 supply zone, the bearish structure stays valid. Any pullback that stalls below this area is likely to form a lower high, opening the door for continuation toward the 3,020 demand zone and potentially lower if sell-side momentum accelerates.

A structural invalidation would only occur if price reclaims and holds above the broken resistance with strong bullish acceptance. Until then, rallies should be viewed as sell-side corrective moves, not reversals.

For now, the trend is down and controlled by sellers.

ETH/USDT: Holding Above 3,000 as Bulls Eye 3,300 ReboundETHUSDT is stabilizing after a sharp drop, finding support near the key 3,000 psychological level and respecting the rising trendline. Despite the recent sell-off, the structure remains bullish with higher lows intact, signaling accumulation rather than distribution.

As long as ETH holds above the 3,000–3,050 zone, a recovery toward 3,300 remains likely. A breakout above that resistance could open further upside.

➡️ Primary scenario: support holds → recovery toward 3,300

❗️ Risk scenario: breakdown below 3,000 could trigger deeper pullback toward 2,900.

Market makers will soon pump ETHEREUM (8H)Ethereum is continuing to develop a bullish structure.

On the iCH chart, we are observing clear bullish signals. Currently, the price is trading around a key support/resistance level, which has historically acted as a strong decision point for market participants.

The upper order blocks above the current price have already been mitigated and absorbed, meaning that the price now faces less resistance to move upward. This significantly increases the probability of a continued bullish move in the near term.

Given this context, we should be focusing on buy/long opportunities. There are two main entry points, which can be used strategically through a DCA (Dollar-Cost Averaging) approach. Entering gradually allows us to manage risk while taking advantage of potential upward momentum.

Targets are clearly marked on the chart. At the first target, it is recommended to take partial profits to lock in gains, and then move your stop-loss to break-even to protect your capital. This approach allows us to participate in the remaining move toward higher targets without unnecessary risk.

Always remember to manage your risk properly and avoid over-leveraging. The structure suggests that Ethereum has the potential for a strong upward movement, but patience and discipline are key.

In summary:

Trend: Bullish continuation

Chart signal: iCH bullish

Key level: Currently testing a major level

Order blocks: Upper blocks mitigated, price has a clear path

Entry: Two points, DCA recommended

Targets: Marked on chart; take partial profit at first target, move stop to break-even

Strategy: Focus on risk management while participating in the bullish momentum

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

ETH M30 Bullish Continuation and Liquidity Expansion Setup📝 Description

ETH on M30 is holding a bullish structure after a controlled pullback into discount. Price respected the 0.618 OTE area and reacted cleanly, suggesting this move is corrective. With downside pressure absorbed, odds favor a bullish continuation toward higher liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish continuation while above 3,200

Long Setup (Preferred):

• Entry (Buy): 3,220 (OTE / reaction zone)

• Stop Loss: Below 3,195

• TP1: 3,242

• TP2: 3,282 (H4/H1 FVG)

• TP3: 3,309 (BSL / range high)

________________________________________

🎯 ICT & SMC Notes

• Clean reaction from OTE 0.618

• Structure still bullish on LTF

• FVG H4/H1 overhead acting as liquidity magnet

________________________________________

🧩 Summary

This looks like a pullback-for-continuation setup. As long as ETH holds above the OTE support, the higher-probability path is upside expansion toward stacked liquidity near 3.28k–3.31k.

________________________________________

🌍 Fundamental Notes / Sentiment

With crypto sentiment stabilizing and no immediate risk-off catalyst, technical structure and liquidity support a bullish continuation. Manage risk and scale out into upside targets.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

ETHUSD: accumulation at $3,200🛠 Technical Analysis: On the H4 chart, ETHUSD is consolidating under a descending resistance trendline while building an accumulation range around the $3,200 area. The recent impulse higher was rejected at resistance, but price is still holding above the key moving-average cluster (SMA50/100/200), suggesting buyers are defending the structure. A clean breakout and acceptance above the nearby resistance level at $3,281.18 would confirm bullish continuation and open the path toward the next marked supply zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on a confirmed breakout and hold above 3,281.18

🎯 Take Profit: 3,622.98

🔴 Stop Loss: 3,054.07

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Coinranger|ETHUSDT. Potential pullback to 3100 and below.🔹At 16:15 UTC+3 - ADP nonfarm payrolls data.

🔹At 18:00 UTC+3 - PMI in services and the JOLTS employment report. More important.

Volatility is possible on both news

🔥ETH

🔹Almost reached the ideal extension on h1:

1️⃣ 3336 and 3386 are still potentially significant.

2️⃣ 3152, 3100 (potential turning point), 3025, and 2960 is a full set of downward waves with extensions.

We're keeping an eye on Bitcoin. The advantage for price reduction.

ETH/USDT | Testing the FVG! (READ THE CAPTION)By analysing the 2h chart of ETHUSDT we can see that after struggling with the high of the FVG for a while, it finally managed to break free and go up to 3265, $8 lower than the low of the FVG. I'd like to see ETHUSDT test the FVG and then make a decision on which way to go.

For the time being, the bullish targets are: 3223, 3265 and 3297.

Bearish Targets: 3200, 3170, 3140.

Ethereum Will Take Off Soon (1D)📊 Ethereum (ETH) – Updated Bullish Scenario Amid Complex Correction

Before anything else, pay attention to the time frame; the time frame is daily. Based on the latest available market data and the prolonged range-bound price action near the local lows, it is reasonable to restructure Ethereum’s primary scenario. While the overall bias remains bullish, both price targets and timing expectations have been adjusted to better align with the current market structure.

🔍 Market Structure & Neo Wave Perspective

From the point marked by the red arrow on the chart, Ethereum entered a bearish corrective phase. However, this move does not suggest a trend reversal. Instead, it strongly resembles a complex double correction within a larger bullish structure.

First correction: A clear ABC corrective pattern

Second correction: A contracting triangle

These two corrective structures are connected via an X wave, forming a classic W-X-Y corrective formation

This type of structure is commonly observed in higher-timeframe consolidations before strong impulsive continuations.

🔺 Triangle Breakdown (A–B–C–D–E)

Current price behavior suggests that Ethereum is trading inside the D wave of the corrective triangle:

The slow, overlapping, and corrective upward movements strongly indicate that the market is not impulsive, confirming we are still within a correction.

Price action around the red zone is likely to mark the completion of wave D.

Following this, a final pullback for wave E is expected, which typically acts as a bear trap before trend continuation.

🟩 Green Zone & Bullish Continuation Scenario

As price approaches the green box area, conditions may become ideal for:

Completion of wave E

End of the entire corrective triangle

Initiation of the next impulsive bullish leg

Once wave E is completed, Ethereum is expected to resume its primary bullish trend, with upside targets at:

🎯 $3,500

🎯 $3,800

These levels align with previous structural highs and Fibonacci extensions from the corrective base.

⚠️ Invalidation Level & Risk Management

This bullish scenario remains valid as long as price holds above the invalidation level.

A daily candle close below this level would invalidate the wave count and require a full reassessment of the market structure.

🧠 Final Thoughts

Market sentiment may feel weak during wave E, but historically this is where smart money positions itself

Patience is key during complex corrections

The structure favors trend continuation rather than reversal

📌 As always, risk management is essential, and this analysis reflects a probabilistic scenario—not financial advice.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

ETH is at a critical inflexion point! Bullish Rally ahead!A decisive reclaim of $3,200 (200 EMA) could unlock the next major leg higher.

Ethereum is stabilising after a corrective phase and beginning to show early signs of structural strength on the higher timeframe.

Key observations:

• The 200 EMA (blue) around $3,200 remains the final resistance

• Price compression suggests energy is building

• Momentum is gradually shifting back in favour of the bulls

🔑 Technical Thesis:

A strong reclaim and sustained close above the 200 EMA would confirm bullish intent and signal trend continuation rather than consolidation.

Once this level flips into support, the probability of a measured expansion increases significantly.

🎯 Upside targets:

$3,700 → $4,000

This zone aligns with prior supply and high liquidity, making it a natural target for upside.

📌 Bottom Line:

As long as ETH holds higher-timeframe demand and successfully reclaims the 200 EMA, the broader structure favours continuation.

Patience during consolidation often precedes aggressive directional moves.

Bullish breakout or another fake move? Do share your views in the comments, and please hit the like button if this post adds any value.

Thank you

#PEACE

#ETH #crypto

ETH New Analysis (4H)This analysis is an update to the previous one, which you can find in the related analyses section.

Since no significant capital flowed into Ethereum, the pattern changed in a way that shortened the target of the next wave. As we are in the final days of the year, market liquidity is low, which is why we are seeing increased volatility and erratic behavior across market assets.

Analysis is not very effective these days, and as we announced a week ago, you should reduce your trading volume due to the year-end conditions | for exactly these reasons.

Instead of the previous diametric analysis, the price structure appears to have shifted into a wider pattern. This expansion is due to the lack of capital inflow and overall low liquidity in the market during these year-end days.

Price is expected to be supported from the origin of the move, which we have highlighted in green on the chart.

Ethereum is still owed an upward move, but it is likely to make this move with difficulty. The targets are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

can eth hit $888?gm,

this is a contrarian idea.

---

mainstream keeps talking about how crypto is the future,

but the future is in the hands of those who are in control of this market.

the one's in control of this market want 1 thing, and 1 thing only,

your coin.

and they won't stop until they get it.

---

this is one of my oldest ideas on eth, created 4 years ago; played out nicely, just took a bit longer than initially expected.

---

the idea essentially suggests that eth has never exited a bear market since the 2022 peak, which would explain the horrendous price action which we have been seeing.

this particular correction is called a flat, labeled 3,3,5; and it goes into effect when the second 3 sweeps the highs (which it did).

---

🎯 = $888

ETH/USDT | Going higher! (READ THE CAPTION)As you can see in 2h chart of ETHUSDT, it has broken through the FVG, and it is now being traded at 3135. It went down near the high of the FVG, but it went back up before barely hitting the high of the FVG.

Current targets for ETHUSDT: 3144, 3170, 3195, 3120.

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is trading inside a rising wedge / ascending structure, holding higher lows.

Price is pushing toward the descending trendline resistance around $3,180–3,220.

Support: $3,000 – $2,950 (trendline + moving averages zone)

Major Support: $2,500 (long-term demand zone)

A clean breakout and hold above the trendline can trigger a strong upside move toward $3,400 → $3,700.

Rejection from resistance may lead to a short-term pullback, but the overall structure remains constructive above support.

⚠️ Trade with confirmation and proper risk management.