Ethereum - Possible Zones / How to use them ? Hello everyone, and special greetings to my dear friends who follow me, I hope you're happy that I helped you buy Ethereum at $2200.

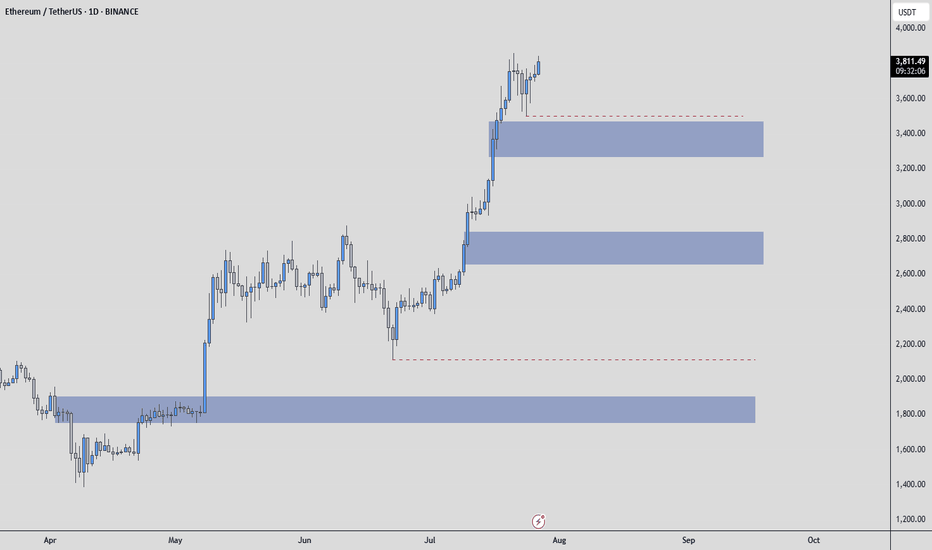

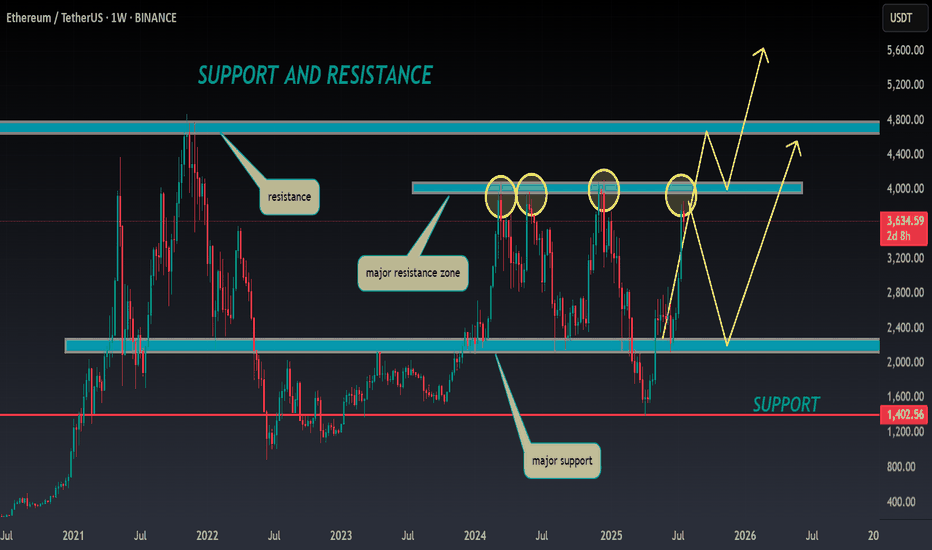

Let's get to today's situation. There are many areas for Ethereum. The first blue box is the one I'd want to be the first buyer in.

I might want to be a buyer in the other blue boxes as well, but there will be increases even before these areas are reached.

I think the bottom blue box could be the one in the event of a Q3 correction.

What is a Q3 correction? All risk-on markets typically experience significant corrections in the third quarter of the year and struggle to recover from this correction until the end of the year.

The first blue box would be the first area I'd want to be in for any increases leading up to this correction.

HOW DO I GET INVOLVED!! THIS IS IMPORTANT BECAUSE SOME OF YOU LOSE MONEY WHEN BLUE BOXES ARE PULLED AWAY. THIS SHOULD NOT HAPPEN!!

When the price reaches the blue box, the transition is made to the 1-hour timeframe. Here, an upward breakout is sought, and during this breakout, the CDV is expected to be positive and rising. If these conditions are met, then RISK is taken. However, the entire amount of money isn't spent; it simply means that the conditions necessary to spend one bullet are met. One bullet is an amount that won't upset you too much; this varies for everyone.

I hope you use this analysis beneficially and profitably, because I want you to make a lot of money. Best wishes to you all, UmutTrades.

ETHUSDT

$ETH Mid-TermLooking at Ethereum from a mid-term perspective, it’s currently sitting near its price ceiling, suggesting a potential need for a correction. Of course, it’s also possible that this level could be broken, depending on overall market conditions. However, the primary scenario is that it fails to break through and pulls back, with the potential reversal zone identified based on Fibonacci levels. On the other hand, the 55 EMA is also providing solid support.

If Ethereum manages to break above this resistance, then we'll wait for either a confirmation or a pullback before entering a long position

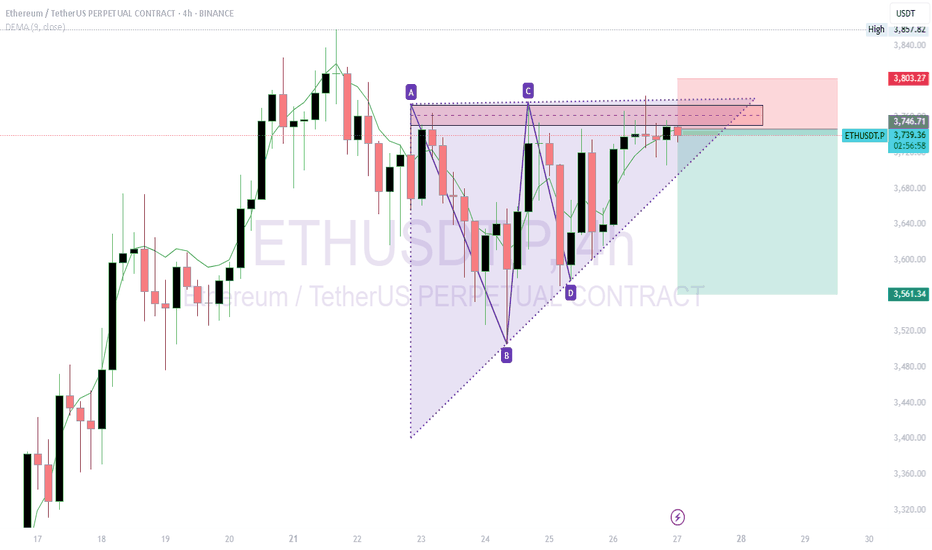

ETHUSDT Short Trade IdeaShort ETHUSDT at $3,745.22 with a target of $3,561.34.

Reason for Short: The 4-hour chart shows a symmetrical triangle pattern with resistance around $3,745-$3,800. The price is testing this upper trendline, and a recent bearish candle suggests potential rejection. The DEMA at $3,747.75 indicates overextension, supporting a pullback.

What I See: Heavy sell pressure is forming near $3,745, with the triangle nearing a breakout/breakdown point. Support lies around $3,561, aligning with prior lows.

Stop Loss: Set at $3,802, above the recent high and triangle resistance, to avoid a bullish breakout.

Trade Rationale: A breakdown from the triangle with volume confirmation could drive the price to $3,561. The tight stop above resistance minimizes risk while targeting a key support level.

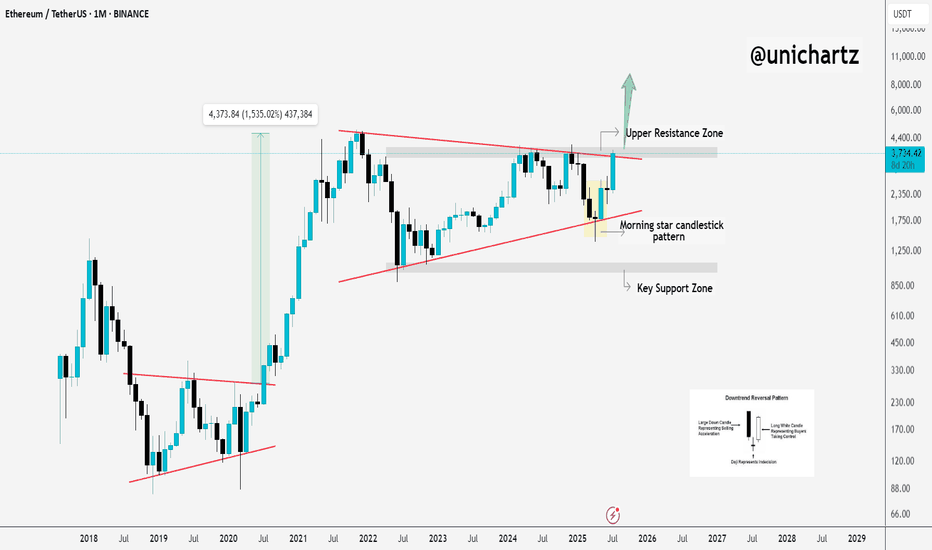

Ethereum Charts Aligning for a Major BreakoutI analyzed Ethereum on both the monthly and 2-week timeframes, and the structure looks strong.

On the right side, we have the monthly chart, where ETH has printed a bullish Morning Star pattern right off the key support trendline.

This is a classic reversal signal, and price is now approaching the upper resistance zone. A breakout from here could trigger a major rally, similar to what we saw in 2020.

On the left side, the 2-week chart shows CRYPTOCAP:ETH pressing into a critical resistance zone after a strong bounce. If price breaks and holds above this zone, it could open the doors to $6K–$8K targets in the coming months.

ETH is showing strength, now we wait for confirmation from the breakout.

Thanks for reading!

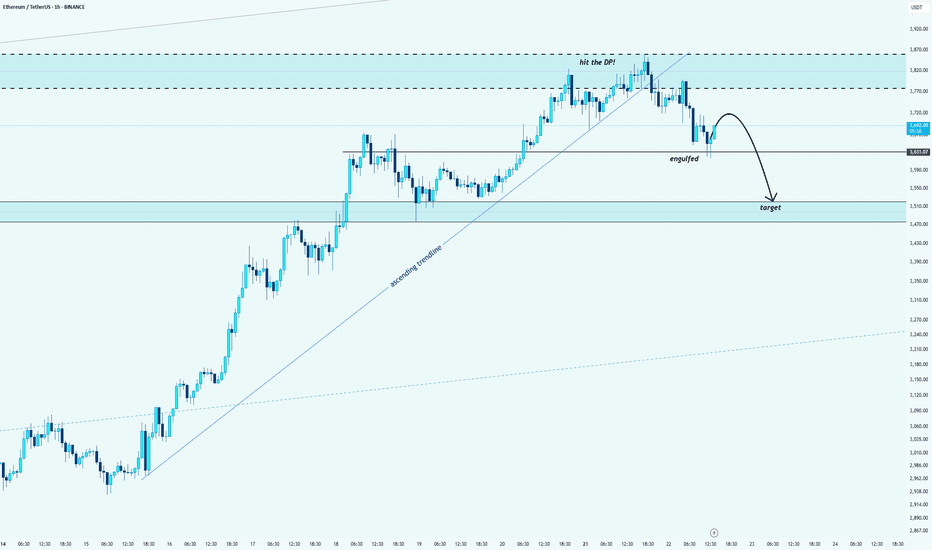

ETH/USDT: Bearish Reversal After Hitting the Decision PointHello guys!

After a strong rally, ETH finally hit the Decision Point (DP) zone marked above. Like what I said:

And we’ve already seen signs of rejection from that level.

🔹 The ascending trendline is broken

🔹 A key support got engulfed

🔹 Price is now forming a bearish structure

The target zone is mapped out around $3,500 – $3,470, where previous demand sits.

We might see a small pullback before continuation, but overall momentum is shifting downward.

Wait for confirmations and protect your capital

ETH ANALYSIS🔮 #ETH Analysis 🚀🚀

💲💲 #ETH is trading between support and resistance area. There is a potential rejection again from its resistance zone and pullback from support zone. If #ETH breaks the major resistance zone then we would see a bullish move

💸Current Price -- $3634

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ETH #Cryptocurrency #DYOR

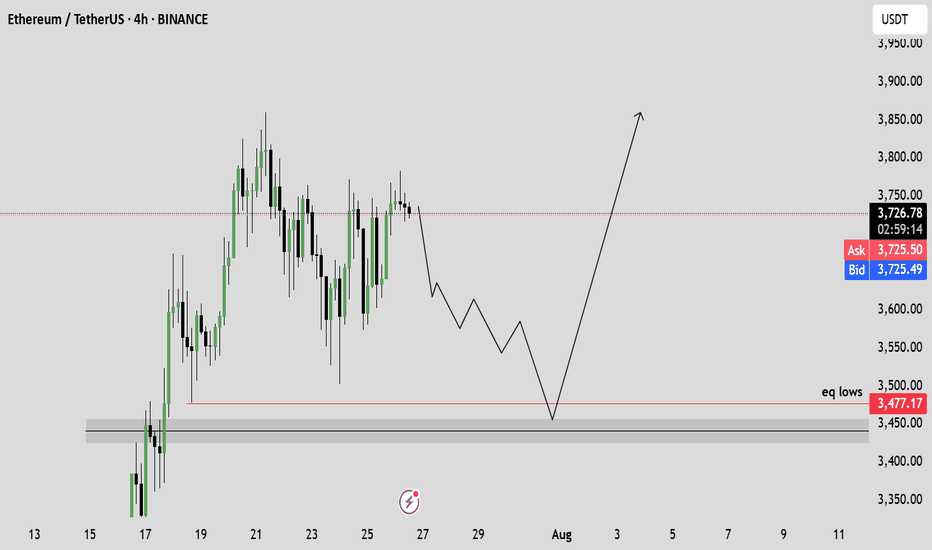

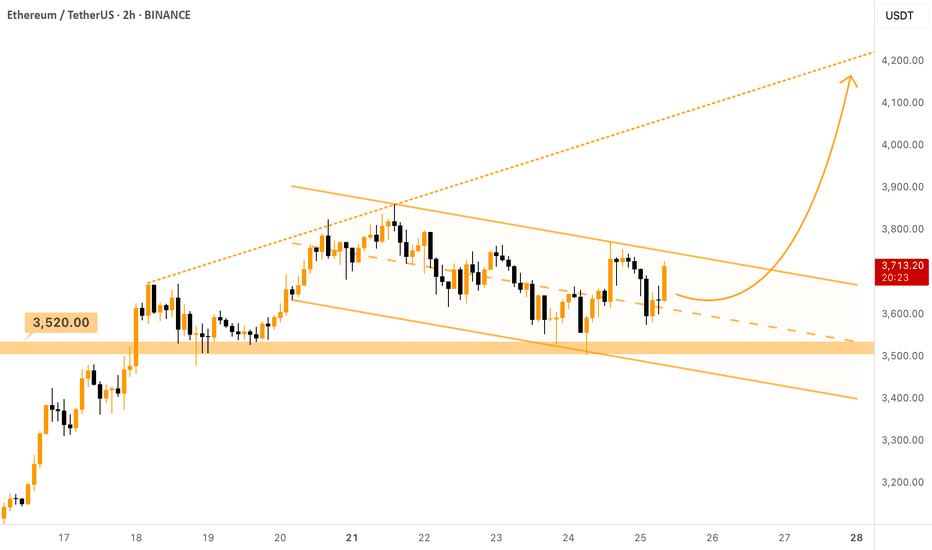

$ETH - Taking Lead Over $BTC (again)Ethereum is strong as ever here. Despite Bitcoin dumped due to the FUD of Galaxy Digital selling CRYPTOCAP:BTC worth of $3.5B, Ethereum managed not stay above the support and even umped!

It is currently forming a Descending Channel (bullish pattern) above the $3520 support level. Local setup. Once this channel is broken upwards, we can expect the price to move towards the ascending resistance that was set a week ago, target is $4100 - $4200 .

You can either enter a trade here or wait for the breakout of the descending channel, the second option is safer.

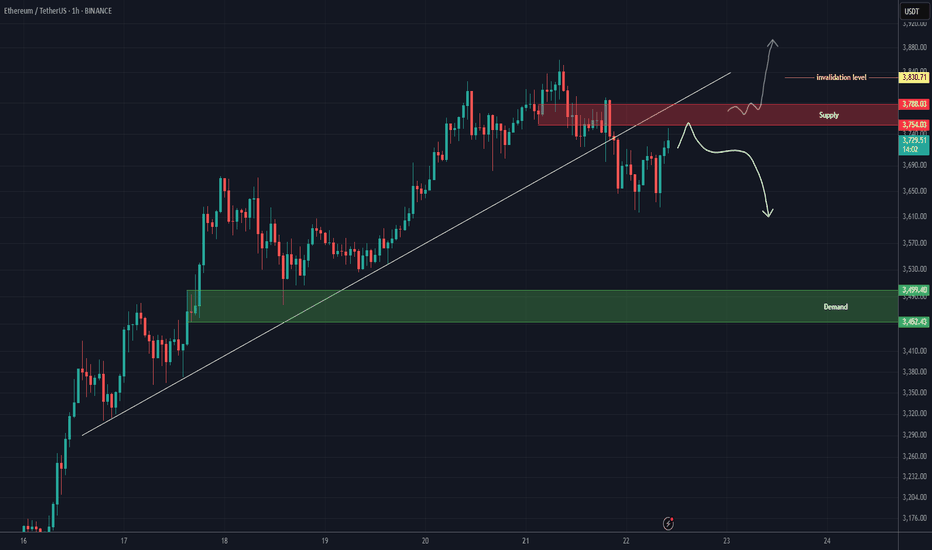

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ETHEREUM: THE NEW BOND OF THE DIGITAL WORLDPrice isn’t the goal. Price is the side effect.

Meanwhile, BlackRock - a black hole with a trust-backed logo - just absorbed 42,000 ETH more.

Yesterday, you may have read this "regular" headline:

BlackRock increases its Ethereum exposure to $4 billion, adding $109.5 million via ETFs.

But here’s what you missed: there are no random numbers on the market.

When a player like this moves - it’s not hype. It’s a blueprint for the future.

Ethereum is no longer an altcoin.

It’s no longer speculation. It’s a financial infrastructure, already recognized by law, exchanges, and institutions.

What does this mean?

💡 Ethereum is now a digital bond - with yield flowing from blocks.

Profit is no longer built on promises, but on the structure of the chain itself.

Trust lies not in faces, but in code.

Growth is not artificial — it’s architectural.

And here’s why this is terrifyingly beautiful:

While you sleep, they are building an era.

Each ETF purchase removes ETH from circulation - permanently. Because:

✅ This ETH is gone from the open market

✅ It won’t be panic-sold

✅ It becomes income-bearing collateral, not a speculative asset

Still waiting for an entry signal?

The big players are already in.

This is no longer crypto - this is cash flow infrastructure, embedded into the digital economy.

And when pension funds, insurers, and sovereign investors move into Ethereum - they will come via ETFs.

Not because it’s trendy, but because it’s regulated, stable, and profitable.

📉 When institutional demand meets vanishing supply - the price won’t simply rise. It will explode, not as growth, but as a structural liquidity shift.

Ethereum is:

💸 Staking = passive yield

🔗 Backbone of DeFi

🖼 Fuel for NFTs

⚙️ Millions of transactions per second

⚖️ A regulated ETF asset

This is the new digital bond system, where the bet isn’t on the dollar - it’s on ETH as an income-producing asset.

💥 While you're reading this, the game is already on.

ETFs are rewriting the rules of time-ownership.

No hype. Just filings. Just intention.

Best regards EXCAVO

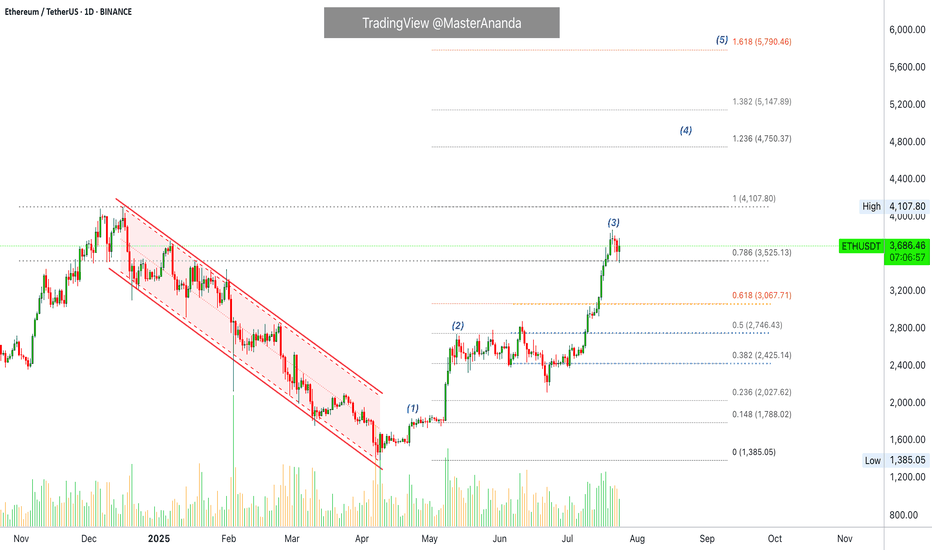

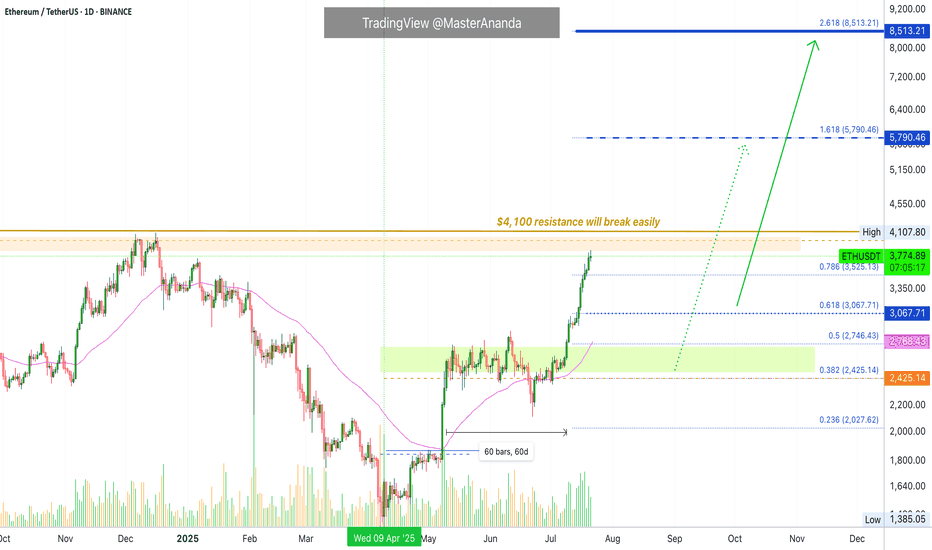

Why Ethereum Will Continue Growing · Trading Above ResistanceEthereum started its latest bullish on the 9th of April. Each advance has been preceded by a period of consolidation.

ETHUSDT (Ether) recovered from its bottom range 23-April, immediately it went sideways for 14 days before moving forward (1). As soon as Ethereum reached $2,700, we have the same pattern but extended, more sideways before moving forward. See this as (2) on the chart. This time the consolidation period lasted 57 days.

The last advance was even stronger (3), Ethereum peaked at $3,860 and we can expect another sideways period, a pause, repeating the same pattern as before. Now, there is an interesting part. The first is a prediction: This consolidation period wont be as long as the second one. The second is related to resistance and support. Notice how ETHUSDT peaked above 0.786 Fib. and this level is being tested as support. The fact that bullish action managed to conquer this level and stop above it, not below, favors the bulls. This means that the market is strong and set to continue growing. There is no significant bearish volume on the red days and the action is neutral so we can expect an advance; the next high will be a new all-time high. We will name it (4) on the chart.

This price pattern should repeat giving us additional growth. After a new all-time high, there will be resistance shy of 6K. And then we expect higher prices with Ethereum peaking around $8,500. Depending on how this level is handled, we can look for $10,000 or even $11,000.

Right now the chart is bullish and points higher.

Continue to hold long-term. It is still too early to fold; it is too early to sell. We are going higher.

Thank you for reading.

Namaste.

Ether is About to Break the FlagETH is making an attept to break flag formation. 3860 top could be the short term target for upward moves. Over the medium term, 4100 could be the main target. Our bull cycle top target is 6830 for the moment. This was a quick update,please check our earlier post for details.

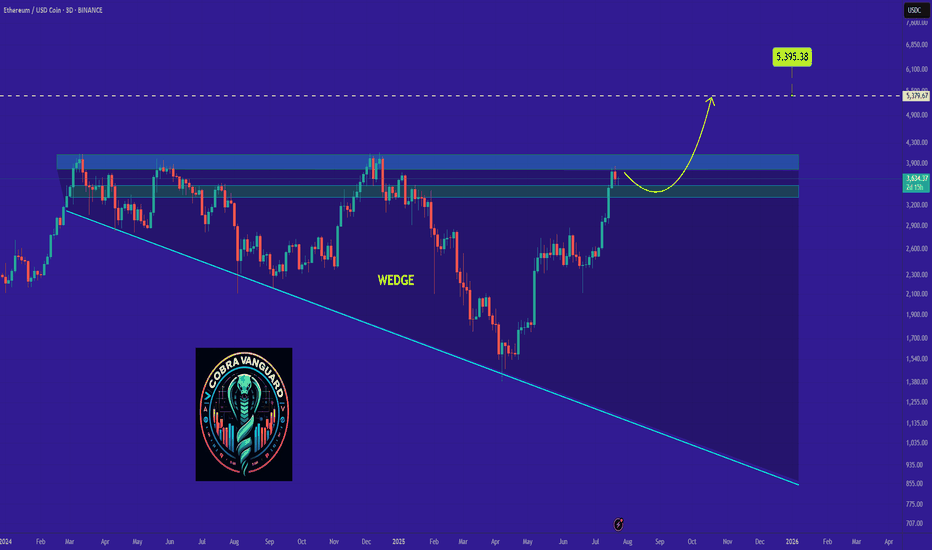

ETH's situation+ Target PredictionThe price has reached the upper boundary of the wedge, which could lead to a slight price drop. We can be hopeful that after breaking out of the wedge, we will see significant price growth.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

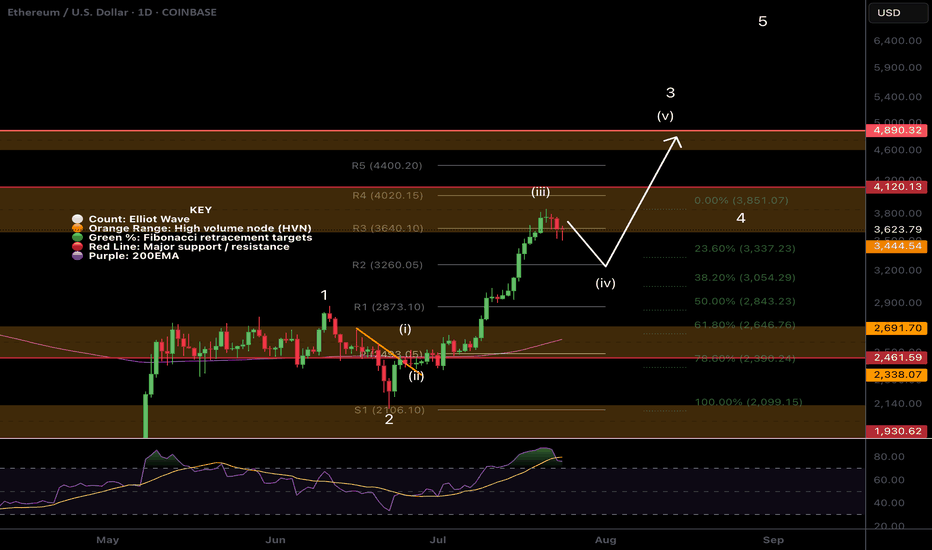

$ETH Hit Our Targets and was rejectedCRYPTOCAP:ETH hit our signal take profit target at $3820 and was rejected at the High Volume Node EQ to the penny.

That appears to have completed wave 3 of this motif wave. Wave 4 has an expected target of the R2 daily pivot and 0.236-0.382 Fibonacci retracement, $3260 before continuing to the upside in wave 5 with a target of the all time high.

This aligns with my views of a significant pullback at the end of August and September which is typical after a summer rally.

No divergences yet in daily RSI.

Safe trading

Ethereum Update · Minor Break Below $4,000, Nothing ChangesOk. Straight up has been confirmed but as you already know, the market never moves straight down neither straight up. It seems Ethereum is about to take a small break. This shouldn't alarm you nor be a concern, we are set for sustained long-term growth. When bullish momentum dies down, the market tends to take a break, a pause, before additional growth.

Please remember that these breaks are very tricky, they can last just a few days, say 3-6 days, just as they can go for weeks. It is very hard to predict. In fact, we don't try to predict the duration of those, we simply focus on the bigger picture and know that a new all-time high will be hit in the coming months. This new all-time high will be followed by additional growth.

The short-term can be tricky though. Ethereum will continue rising, but watch out, it can make a pause and this time can be used wisely to profit beautifully from smaller altcoins. Don't let your capital just sit around when it can grow.

Ethereum is awesome but it is also a giant. The smaller altcoins is where the true opportunities lie. The opportunity to quadruple in a matter of months. And this process can be repeated several times for the duration of the bullish cycle.

Namaste.

ETH - Altseason ??ETH has rallied sharply and is now entering the major resistance zone between $3,725 and $4,081, which has repeatedly acted as a local top during previous cycles.

This red zone represents a high-supply area, and historically ETH has struggled to break and hold above it without a significant catalyst.

Rejection here could lead to a pullback toward the $2,300–$2,000 range.

A clean breakout and weekly close above $4,081 would flip this resistance into support and open the path toward the all-time high (ATH) at $4,868.

If ETH reclaims this red zone and flips it to support, it will act as a major trigger for a broad Altseason.

Historically, such ETH strength is a key confirmation that capital is rotating from BTC into the altcoin market.

Currently, momentum is favoring bulls unless this red supply zone causes a strong rejection.

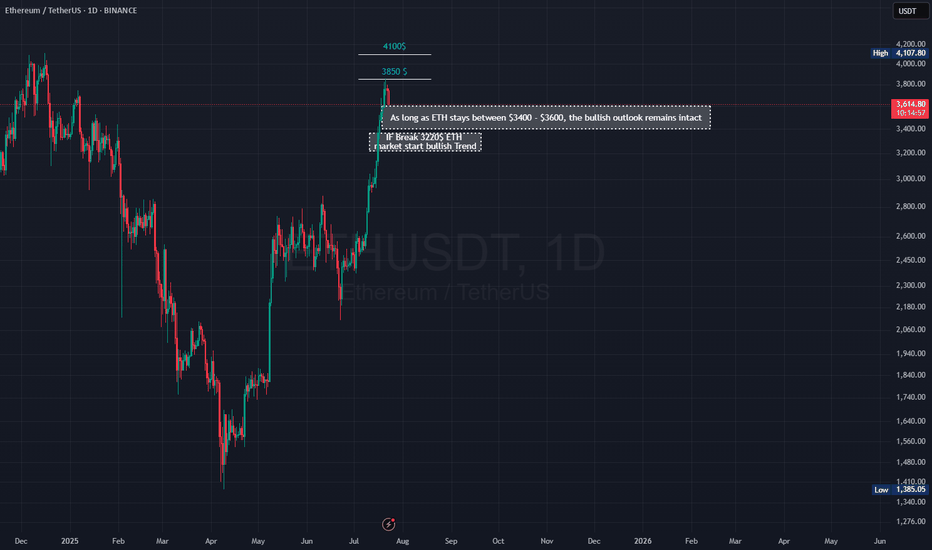

Ethereum Ready for Breakout Above $3850?📊 Ethereum Quick Analysis | Breakout or Breakdown?

✅ As long as ETH stays between $3400 - $3600, the bullish outlook remains intact.

🚨 A confirmed close below $3200 could mark the end of the bull market.

🚀 A clean, shadowless candle close above $3850 may push price toward $4100.

⚠️ However:

📉 Expect retail sell-offs around those highs

💸 But heavy institutional buying could send ETH to $6230 in the short term.

🔥 Altseason is officially here — get ready for explosive moves!

🎯 I'm here to track and update all major targets in real-time 💥

#BullRun#altseason#ETH

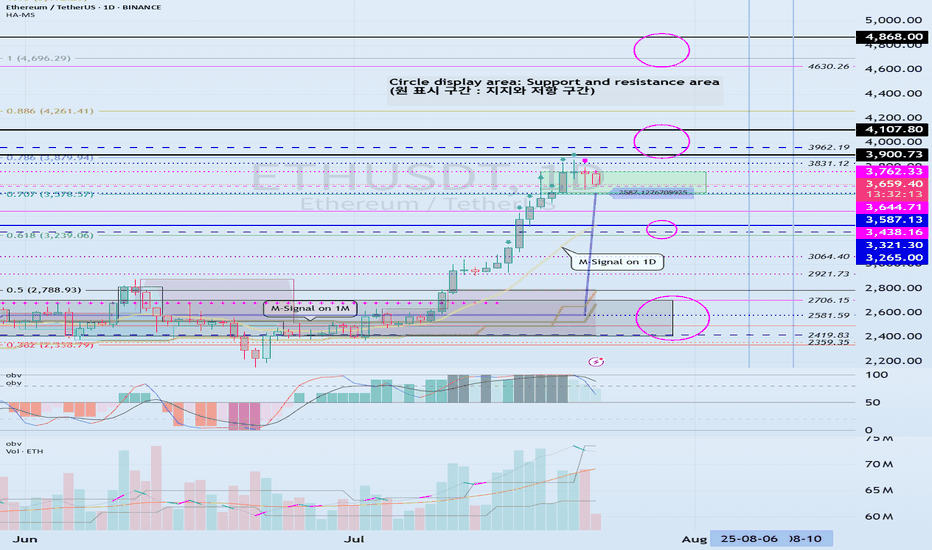

Check if HA-High indicator is forming at 3587.13

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

HA-High indicator is showing that it is about to form at 3587.13.

Accordingly, if the HA-High indicator is newly created, the support in the 3587.13-3762.33 section is an important issue.

If it falls below 3587.13, it is likely to touch the M-Signal indicator on the 1D chart.

Therefore, we should check whether it touches the area around 3265.0-3321.30 and rises.

-

This can be seen as a time to test whether it will continue the first step-up trend while rising in the important section of 2419.83-2706.15.

ETH's volatility period is around August 6-10, but we should check what kind of movement it shows after passing the volatility period of BTC.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Look First, Then LeapIn trading, how you prepare matters more than how you react. The phrase “Look first, then leap” reminds traders to avoid impulsive decisions and instead focus on proper analysis, planning, and risk control. Whether you're trading stocks, forex, crypto, or commodities, this principle can save you from painful losses and build a foundation for long-term success.

Let’s break down what it really means to “look first,” and how applying this mindset can improve your trading discipline.

✅Preparation Beats Emotion

Before entering any trade, a trader should ask: What is this trade based on? Logic or emotion?

🔹 Control Impulsive Decisions

Most losing trades happen when people act on gut feelings, FOMO, or after seeing a sudden price spike. But excitement is not a strategy; analysis is.

🔹 Check the Basics First

-What is the market trend? (uptrend, downtrend, or sideways?)

-Are you trading with or against the trend?

-Are there any upcoming news events that might impact the market?

Taking a moment to “look first” gives clarity and filters out low-probability trades.

✅ Trade Only When There’s a Setup

The best trades often come from waiting for the right moment, not forcing entries.

🔹 Identify Clear Patterns

Before jumping in, confirm your strategy setup:

-Is it a breakout or a fakeout?

-Are key support/resistance levels respected?

-Is volume supporting the move?

🔹 Use Confirmation Tools

Indicators like RSI, MACD, and moving averages can support your decision. Price action and patterns like triangle, channel, and flag also provide valuable clues.

Look first means not reacting to the first move; wait for the follow-through.

✅ Always Define Risk and Reward

Entering a trade without a defined stop-loss or target is like jumping into water without checking its depth.

🔹 Use a Risk-Reward Ratio

Before leaping into a trade, ask yourself:

-What am I risking?

-What can I gain?

Aim for a minimum risk-reward ratio of 1:2 or 1:3 to stay profitable even with a lower win rate.

🔹 Position Sizing Matters

Know how much of your capital to allocate. Using 1-2% of your capital per trade helps manage losses and avoid emotional pressure.

✅ Adjust for Market Conditions

Just because you’ve seen success in one type of market doesn’t mean your strategy will always work.

🔹 Trending vs. Ranging Markets

-Trend-following strategies work well in strong trends.

-Mean-reversion or breakout-fade strategies work better in sideways markets.

🔹 Check for Major News or Events

Earnings reports, central bank meetings, or geopolitical events can change everything in seconds. Before entering a trade, look at the calendar.

Adapting to market conditions is part of looking first.

✅ Use a Trading Plan, Not Just a Feeling

Every trade should follow a plan, not just “I think this will go up.”

🔹 What Should Your Plan Include?

Entry and exit rules

-Stop-loss and take-profit levels

-Criteria for valid setups

-Timeframes and trading hours

A plan brings structure and consistency, reducing emotional decisions.

✅ Journaling and Reviewing Trades

Looking first also means learning from the past.

🔹 Keep a Trading Journal

Log every trade entry, exit, reason, emotion, and outcome. This helps you spot mistakes and patterns in your behavior.

🔹 Review Regularly

After a drawdown or losing streak, review your last 10–20 trades. Was your strategy sound? Were you disciplined? Did you look before you leaped?

Improvement comes from reflection and correction.

✅ Be Mentally Ready Before Every Trade

Looking first also means checking your internal state.

🔹 Ask Yourself Before Trading:

-Am I calm and focused?

-Am I trying to recover a loss?

-Am I trading because I’m bored or emotional?

If your mindset is off, step away. A bad state leads to bad decisions—even with a good strategy.

✅Backtest and Practice Before Going Live

Before risking real money, test your setup thoroughly.

🔹 Why Backtesting Helps

It lets you see how your system performs on historical data. This builds confidence and filters out weak strategies.

🔹 Demo Trading Is Smart, Not Weak

Trading in a demo account before going live helps you learn execution, order management, and emotional control—without financial damage.

✅ Protect Capital First, Trade Second

Your first goal isn’t to make money, it’s to stay in the game.

🔹 Survive First, Then Thrive

Big losses can take weeks or months to recover. That’s why looking first is critical—it prevents careless trades that damage your capital.

✅Final Word: Be the Trader Who Waits

The market rewards those who are patient, disciplined, and prepared. Anyone can open a trade, but only those who look first truly understand what they’re doing.

Before your next trade, ask yourself:

“Do I have a clear reason, a defined risk, and the right mindset? Or am I just reacting?”

Because in trading, it’s not how many trades you take, it’s how many good trades you wait for.

In trading, success doesn't come from speed; it comes from clarity, preparation, and discipline. The principle “Look first, then leap” serves as a constant reminder to slow down, observe, analyze, and plan before taking action. It’s a mindset that separates the disciplined trader from the emotional speculator.

Every trade you take should be backed by logic, not impulse. Whether it’s identifying the right setup, managing your risk, or simply being patient enough to wait for confirmation, looking first gives you control in a world that thrives on chaos.

In the end, trading isn’t about making quick money—it’s about making the right decisions consistently. So before your next trade, take a breath, do your research, and ask yourself:

“Am I truly ready to leap, or do I need to look one more time?”

That one extra moment of reflection could be the difference between a lesson and a profit.

Cheers

Hexa🧘♀️

Chart Image Credit: TradingView

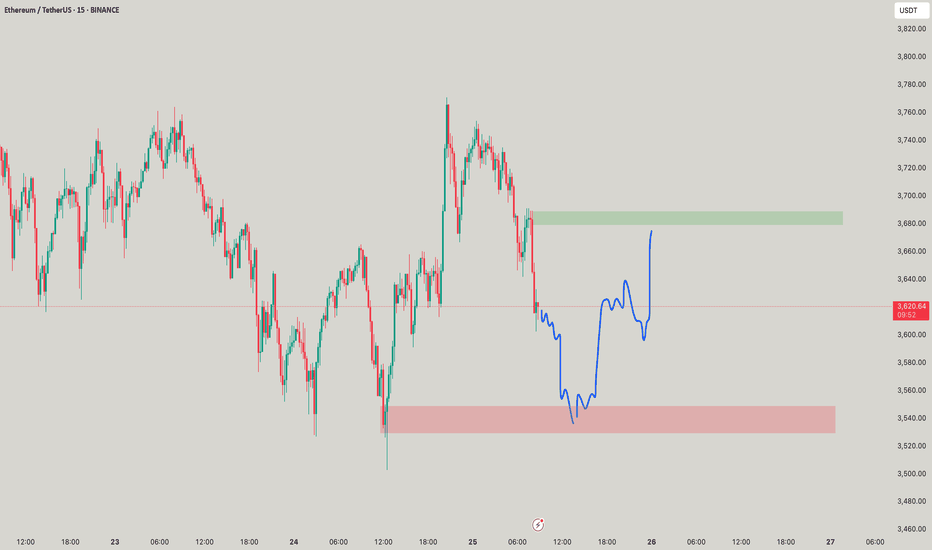

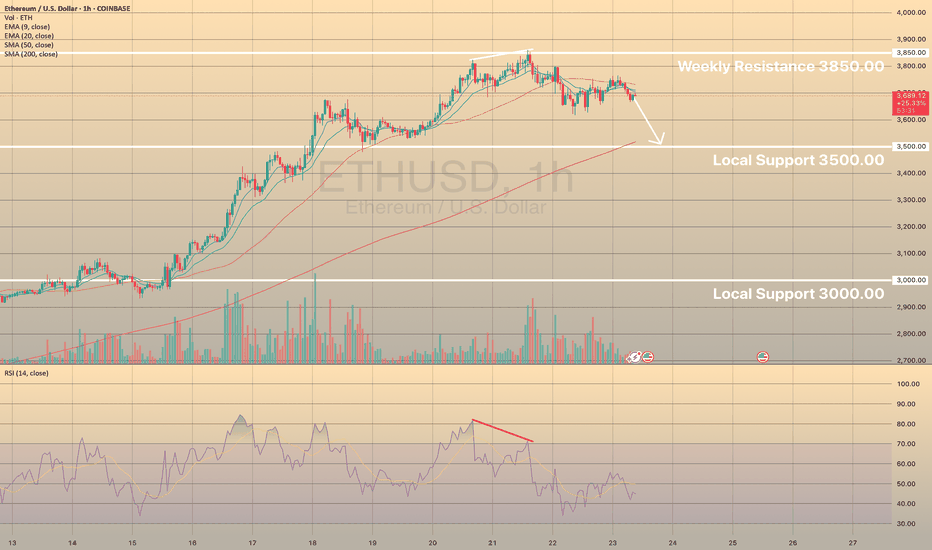

ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00

The ETHUSD has hit some resistance at around 3,850.00 this week. But it's since pulled back from that level, which might be a sign of a cooling trend. That's backed up by the RSI going bearish.

Right now, the price is below the 50 SMA on the 1-hour chart, indicating a mid-term downtrend.

We could see the price find some support at 3500.00 or so. Additionally the SMA 200 lays nearby, providing extra support here.

Ethereum Breakout Could Spark the Next Altseason!A Massive Altseason Is Brewing… 🚀

Ethereum just flashed a major monthly breakout after printing a clean Morning Star reversal right at key support.

Now it's pushing against the upper resistance zone, a structure that held it back for over two years.

If CRYPTOCAP:ETH breaks and closes above this level, it won’t just be bullish for Ethereum — it could ignite the biggest altcoin season since 2021.

Why it matters:

📌 ETH is the heart of the altcoin ecosystem.

📌Historical breakouts like this led to 1500%+ moves.

📌The pattern and price action are lining up perfectly again.

Once Ethereum breaks cleanly above $4,000, expect altcoins to explode across the board — Layer 2s, DeFi, AI tokens, and even the meme coins could all start flying.

Keep your eyes on ETH. Its breakout is the spark… the altseason fire is coming.

DYOR | Not Financial Advice

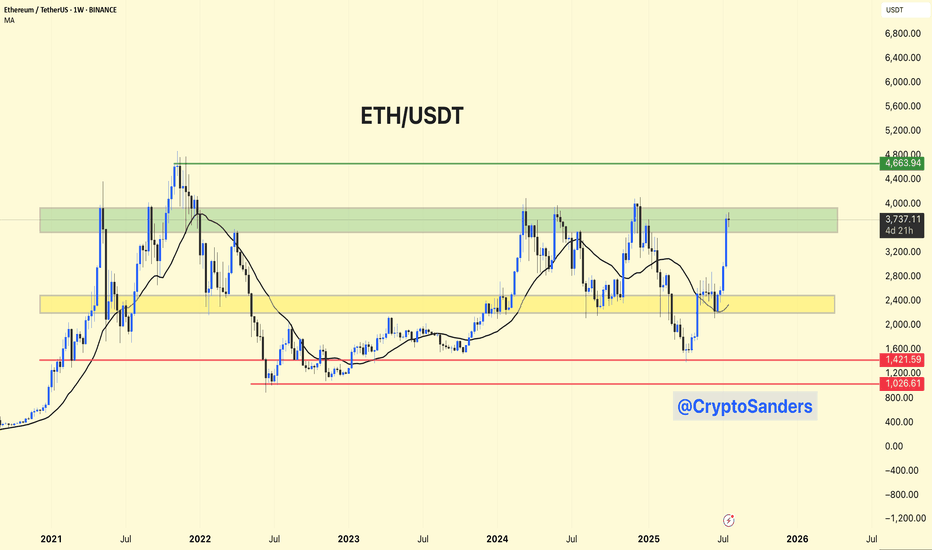

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA