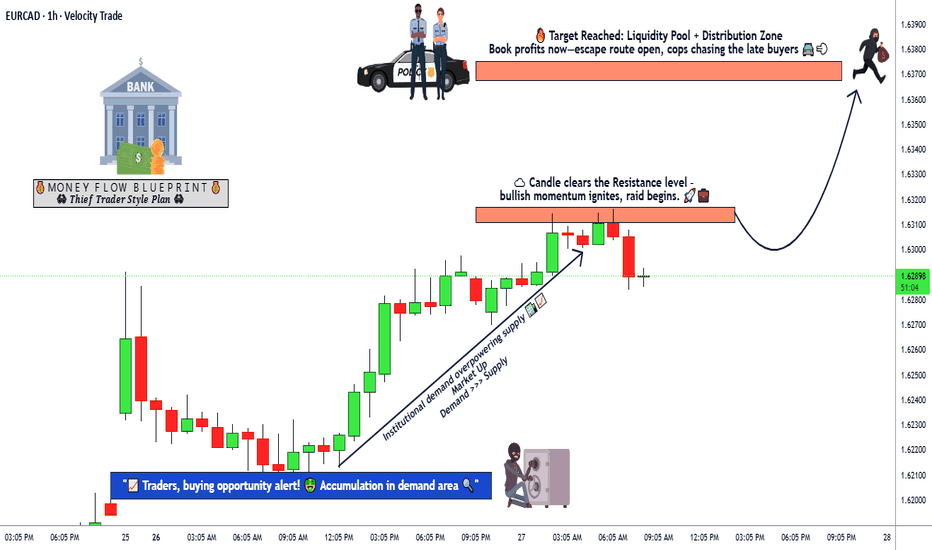

EUR/CAD | Bullish Breakout & Momentum Continuation Setup💶🍁 EUR/CAD "EURO vs CANADIAN DOLLAR" Premium Forex Trading Strategy 🔥

🎯 Day Trading & Swing Trading Opportunity Guide (Jan 2026 - Live Market Data)

📊 CURRENT LIVE MARKET DATA 📈

Current Price: 1.6134 USD/CAD (+0.29%) ⬆️

52-Week High: 1.6466 | 52-Week Low**: 1.4688

Weekly Range: 1.61464 - 1.62974 (As of Jan 26, 2026)

Volatility Rating: 0.23% (Lower volatility = Cleaner moves!) ✅

Market Sentiment: STRONG BUY (Technical Rating) 💪

🚀 BULLISH TRADING PLAN 🚀

📍 ENTRY POINT - Your Green Light to GO! 🟢

Entry Zone: After Resistance Breakout @ 1.63200 CAD

This level acts as a strong psychological barrier

Confirmation = Candle close above 1.6320

Wait for pullback + continuation pattern for safer entry

Risk/Reward Setup = OPTIMAL ✨

🎯 PRIMARY TARGET (Conservative) 🎯

Target Level 1: 1.63700 CAD

Why: Police barricade resistance + overbought conditions detected

Caution: Watch for profit-taking & potential correction trap ⚠️

Action: Consider taking 50% profit here, move SL to breakeven

Reward: +50 pips per lot (Clean & Quick)

🔥 EXTENDED TARGET (Aggressive) 🔥

Target Level 2: 1.64200 - 1.64500 CAD

Requires sustained bullish momentum

Technical resistance weakening

Only chase if daily candle structure confirms

Excellent for swing traders (2-3 day holds)

🛑 STOP LOSS - Protect Your Capital! 🛡️

SL Placement: 1.62700 CAD

Placed below support confirmation level

Provides 50-pips breathing room for volatility

Risk Management = PRIORITY #1

Max Risk: Keep to 1% of your trading capital per trade

📰 FUNDAMENTAL FACTORS TO WATCH 🔔 (Real Data - Jan 2026)

🏦 EUROPEAN CENTRAL BANK (ECB) STANCE 🇪🇺

Current Rate Status:

Main Refinancing Rate: 2.15% ✅ (Unchanged since July 2025)

Deposit Facility Rate: 2.00% ✅

ECB Holding Pattern: Data-Dependent Approach

Key ECB Fundamentals:

Inflation Projection 2026: 1.9% (Below 2% target) 📉

Economic Growth 2026: 1.2% (Slower than 2025's 1.4%)

Services Inflation: Sticky at 3.8-3.9% YoY ⚠️

Wage Growth: Expected to stabilize below 3% by end-2026

ECB Outlook: "Good place" = No hurry for rate changes (Dec 2025)

Impact on EUR:

EUR strength supported by stable rates

No rate cuts expected in 2026 = Euro floor protection 🏛️

Strong euro could dampen inflation further

Market odds of hike by end-2026 = Only ~30%

🍁 BANK OF CANADA (BoC) POSITION 🇨🇦

Current Rate Status:

Overnight Rate Target: 2.25% (Paused cutting cycle)

Rate Decision Upcoming: January 28, 2026 🗓️

Key BoC Fundamentals:

Rate Trajectory 2026: HOLD expected all year (75% economist consensus)

Economic Growth: 1.2-1.8% expected (Gradual pickup from 1.7% in 2025)

Inflation: Hovering at 2.0% target (Well-controlled) ✅

Labour Market: Mixed signals - Job gains in Dec but employment stalling

Unemployment Rate: 6.5% (Lower end, but caution warranted)

Major Risk Factor: USMCA Trade Review (July 2026) ⚡ = BIGGEST HEADWIND

Impact on CAD:

Weaker bias due to trade uncertainty 📍

Rate pause = CAD limited upside potential

Tariff uncertainty = CAD defensive positioning

Cut odds if economy falters = CAD depreciation signal

💰 CORRELATED PAIRS TO MONITOR 📊

Pair 1: OANDA:USDCAD 🔗

Inverse Relationship: When USD/CAD rises = EUR/CAD often falls

Current Level: ~1.38 (CAD weakness = EUR/CAD support)

Watch: If USD/CAD breaks 1.3900 = EUR/CAD bullish acceleration 🚀

Pair 2: FX:EURUSD 🔗

Direct Correlation: Strong positive = EUR/CAD strength linked

Current Level: ~1.1605

Watch: If EUR/USD rallies above 1.165 = EUR/CAD leg higher

Key Level: ECB vs Fed rate differential matters!

Pair 3: OANDA:GBPCAD 🔗

Alternative Long: Currently 1.8643 (+0.90%)

Stronger CAD Weakness Signal: If GBP/CAD rallies hard

Correlation Check: Use as confirmation for EUR/CAD direction

Pair 4: OANDA:CADJPY 🔗

Risk Sentiment Indicator: Japanese Yen strength = Risk-off

Trade Flows: Watch commodity-related USD/JPY moves

Alert Signal: If JPY strengthens = EM currencies weaken including CAD

📌 ECONOMIC CALENDAR - KEY DATES TO WATCH 🗓️

THIS WEEK - CRITICAL! 🔴

Jan 28, 2026 (TOMORROW!): Bank of Canada Rate Decision @ 2:45 PM ET

Expected: Hold at 2.25% ✅ (90% market odds)

Watch: Forward guidance on rate path

Volatility: HIGH - EUR/CAD could swing 30-50 pips

UPCOMING WEEK

Feb 5, 2026: ECB Governing Council (No rate change expected)

Fed Meeting: Monitor US economic data weekly

Canadian Employment Report: Watch hiring trends

MONTHLY RELEASES

Eurozone CPI Inflation: Watch services component (sticky!)

Canadian GDP Data: Q4 2025 results key for growth outlook

Both Central Banks: Wage pressure monitoring = inflation sticky risk

🎓 TRADING NOTES & RISK DISCLAIMERS ⚠️

❌ IMPORTANT RISKS

THIS IS NOT INVESTMENT ADVICE - Trade at your own risk!

Leverage Risk: Forex amplifies gains AND losses

Political Risk: USMCA renegotiation = Major CAD wild card

Central Bank Surprise: Never assume - market moves on unexpected data

Geopolitical: Energy market volatility (Venezuela situation) = Oil/CAD impact

Bank of Canada Jan 28: Rate decision could trigger 50+ pip moves

✅ PRO TRADER RULES

Position Sizing: Risk only 1% of account per trade (non-negotiable!)

Stop Loss: ALWAYS use SL - no exceptions for "Thief OGs"

Take Profits: Bank your gains at targets - Don't be greedy

Confirmation: Wait for candle close above 1.63200 before entry

Journal Everything: Track wins/losses for continuous improvement

🌟 FINAL CHECKLIST BEFORE TRADING ✅

Price above 1.6320? (Breakout confirmed)

Stop loss ready at 1.6270? (Risk defined)

Position size = 1% risk? (Capital protected)

BoC & ECB data checked? (Fundamentals aligned)

EUR/USD & USD/CAD correlated? (Multi-pair confirmation)

Chart pattern supports entry? (Technical + Fundamental match)

Trading plan written down? (Emotions controlled)

📊 SUMMARY SCORECARD

🔵 Technical Setup: 8/10 ✅ Bullish

🔵 Fundamental Support: 7/10 ✅ EUR Stable / CAD Weak

🔵 Risk/Reward Ratio: 9/10 ✅ Excellent (1:1.5)

🔵 Market Volatility: 6/10 ⚠️ Moderate

🔵 Trade Timing: 8/10 ✅ Early Setup Phase

🟢 OVERALL OPPORTUNITY: 8/10 🟢 BUY SETUP READY

🚀 THIS IS YOUR TRADE ZONE - STAY DISCIPLINED & STAY PROFITABLE! 🚀

Remember: Great traders aren't measured by their biggest win. They're measured by consistency, discipline, and how well they manage risk. Build your legacy one disciplined trade at a time.

Let's GET THIS MONEY! 💰💪

-Thief Trader (The Professional Forex Blueprint)

Eurcadanalysis

EURCAD Technical Analysis and Trade Idea🔥 Is the EURCAD ready for another massive leg up?

In today's breakdown, we are dissecting the EURCAD pair. The market structure on the 1H and 4H timeframes is undeniably bullish 🐂, but price action is currently screaming "overextended." Amateurs chase the pump, but pros wait for the pullback. Here is the exact game plan to catch the next wave. 🌊

Here is what we are watching:

📈 Technical Setup: The trend is your friend, but we need a discount. We are stalking a precise retracement into key support zones for a high-probability Buy Opportunity.

📅 Fundamental Catalyst: We have high-impact Euro and CAD economic data dropping today! 💣

The Bullish Case: We need to see the data print Positive for the Euro 🇪🇺.

The Confluence: Simultaneously, we need the release to be Negative for the CAD 🇨🇦.

If these two fundamental events align with our technical support levels, we could see an explosive continuation to the upside. Don't miss this potential sniper entry! 🎯

👇 Drop a comment: Are you Long or Short on the EURCAD today?

⚠️ DISCLAIMER: This video is for educational and entertainment purposes only. This is NOT financial advice. Trading Forex and Crypto involves significant risk. Always do your own research.

EURCAD BUY | Idea Trading AnalysisEURCAD is moving in an UP trend channel.

The chart broke through the dynamic Resistance line, which now acts as support.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity EURCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

Is the Euro Gaining Strength Against the CAD Again?🎯 EUR/CAD SWING TRADE SETUP | FOREX OPPORTUNITY 💱

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 ASSET: EUR/CAD (Euro vs Canadian Dollar)

⏱️ TIMEFRAME: Swing Trade (Multi-Day Hold)

🎬 SETUP: Bullish Reversal - Weighted Moving Average Pullback

📈 BIAS: BULLISH ✅

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 TRADE PLAN BREAKDOWN

📍 ENTRY STRATEGY - "Layering Method" (Multiple Limit Orders)

For optimal entries, use the THIEF layering strategy with staggered limit buy orders:

✅ Layer 1: 1.61800 (Initial Entry)

✅ Layer 2: 1.62000 (Aggressive Entry)

✅ Layer 3: 1.62200 (Dip Entry)

🎯 Tip: Customize layers based on your account risk & trading style

🛑 STOP LOSS

📌 Primary SL Level: 1.61500

⚠️ Note: Adjust your stop loss according to YOUR risk tolerance & strategy. This is a reference level only. Risk management is YOUR responsibility.

🎁 TAKE PROFIT TARGET

🚀 Target Level: 1.64000

📌 Reason: Moving averages acting as dynamic resistance + overbought zone + potential trap breakout

⚠️ Note: Set YOUR own profit targets based on market structure & personal strategy. This is NOT financial advice—always manage risk responsibly.

💡 KEY CONFLUENCE FACTORS

✓ Bullish weighted moving average pullback

✓ Support zone hold at entry levels

✓ Risk/Reward ratio favorable for swing trading

✓ Multiple entry confirmation points

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🌐 CORRELATED PAIRS TO WATCH

1️⃣ OANDA:USDCAD (US Dollar vs Canadian Dollar) 🇺🇸🇨🇦

📊 Inverse Correlation: When USD/CAD rises → EUR/CAD likely falls

💥 Why It Matters: CAD movements drive both pairs; monitor for conflicting signals

🔗 Watch Level: 1.4200+ = CAD strength headwinds for EUR/CAD

2️⃣ FX:EURUSD (Euro vs US Dollar) 🇪🇺🇺🇸

📊 Direct Correlation: Both share EUR component

💥 Why It Matters: EUR strength here = EUR/CAD bullish confirmation

🔗 Watch Level: 1.0800+ = EUR strength = EUR/CAD support

3️⃣ BLACKBULL:WTI Crude Oil 🛢️📈

📊 Positive Correlation: CAD is commodity-driven (oil exporter)

💥 Why It Matters: Oil rally = CAD strength = EUR/CAD pressure

🔗 Watch Level: Oil $75-80/barrel = possible CAD headwind

4️⃣ $S&P500 (SPY/ES) 📊📉

📊 Risk Sentiment: Risk-on = CAD rally, Risk-off = CAD weakness

💥 Why It Matters: Market volatility directly impacts commodity currencies

🔗 Watch Level: SPY weakness = possible CAD weakness = EUR/CAD tailwind

5️⃣ TVC:GOLD (XAU/USD) 🏆💰

📊 Inverse with USD: Gold up = USD weakness = EUR/CAD strength

💥 Why It Matters: Safe-haven flows affect both pairs differently

🔗 Watch Level: Gold $2,100+ = possible EUR strength

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

👍 LIKE | 💬 FOLLOW | 📌 SAVE FOR UPDATES

Your trading success is YOUR responsibility. Trade with conviction & proper risk management. ✨

EURCAD Breakout and Retest , All Eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Is EUR/CAD Ready for Takeoff After the ATR Pullback?💶💰 EUR/CAD: The Pullback Heist Setup | Swing/Day Trade

🎯 THE SETUP

Pair: EUR/CAD (Euro vs Canadian Dollar)

Market: Forex | Timeframe: Flexible (Swing/Day Trade)

Bias: 📈 BULLISH — Confirmed via ATR Pullback Retest

📊 GAME PLAN

The setup identifies a bullish pullback retest structure with ATR (Average True Range) confirmation, creating a high-probability entry zone. This is your "heist opportunity" — multiple entry layers maximize your chances of catching the move.

🎬 ENTRY STRATEGY: LAYERED LIMIT ORDERS

Think of it like stacking chips at the table — multiple small bets beat one big bet:

🔴 Layer 1 at price level 1.61400 — First reconnaissance move to test the waters and gauge initial momentum.

🔴 Layer 2 at price level 1.61600 — Confirm momentum building as price holds and retests the zone.

🔴 Layer 3 at price level 1.61800 — Build your core position as conviction strengthens with each layer filled.

🔴 Layer 4 at price level 1.62000 — Final accumulation layer to complete your position size.

Note: Adjust layers based on your position sizing and risk tolerance. Start with what fits your account!

🛑 STOP LOSS PLACEMENT

Thief SL: 1.61000

⚠️ Risk Disclaimer: Stop loss is your safety net, not a guaranteed protection. Set it based on your personal risk management rules and account capital. Your risk, your rules!

🎁 PROFIT TARGETS

🟢 TARGET 1 (TP1) at 1.63200 — This is where the Hull MA acts as an overbought zone, signaling time to lock in 60% of your position. This is your first checkpoint to secure profits before things get spicy.

🟢 TARGET 2 (TP2) at 1.64500 — This level is the "Police Barricade" — a strong resistance cluster with overbought conditions brewing. This is where the TRAP zone activates. Don't get greedy here! Escape with your remaining 40% of profits and live to trade another day.

⚠️ Profit Target Note: These are suggested levels based on technical structure. Your take-profit strategy is YOUR decision. Trade responsibly!

🔗 CORRELATED PAIRS TO WATCH (Use as Confluence)

📍 USD Strength Indicators

💵 FX:EURUSD — Key Correlation: Inverse relationship. If EUR/USD rallies, EUR/CAD typically strengthens (bullish for setup). When the Euro pumps against the Dollar, CAD strength becomes less relevant, giving EUR/CAD room to fly.

🍁 OANDA:USDCAD — Key Correlation: Direct inverse. USD/CAD weakness = EUR/CAD strength. Monitor USD/CAD for divergence — if it's breaking down while our setup fires, that's GOLDEN confluence.

📍 Commodity Pairs (Loonie Movement)

🛢️ OANDA:USDCAD (Oil Sensitivity) — Canadian Dollar is heavily influenced by crude oil prices. Oil strength = CAD strength = potential headwind for EUR/CAD. Check oil charts before entering! Rising oil can kill your bullish trade.

🍁 OANDA:CADJPY — Reflects broader CAD sentiment across majors. Monitor for divergence signals. If CAD is rallying across the board, EUR/CAD might struggle against the Loonie.

📍 Technical Synergy

🔄 OANDA:EURGBP — Shows Euro strength relative to other majors. If EUR/GBP is bullish, EUR/CAD confluence improves significantly. This is your Euro strength confirmation.

📉 TVC:DXY (Dollar Index) — Broader USD weakness supports Euro strength. Watch for DXY breakdown below key support — when the Dollar bleeds, the Euro typically thrives.

Key Point: Use these pairs as confirmation tools, not entry signals. Multi-pair confluence = higher probability trades.

🔑 KEY TECHNICAL POINTS

✅ ATR Pullback Retest — Price returned to support + ATR shows volatility compression = reversal setup that signals buyers stepping in.

✅ Layered Entry Strategy — Reduces average entry price and eliminates emotional FOMO trading by spreading your risk intelligently.

✅ Multiple Profit Targets — Risk-to-reward ratio calculated at 1.63200 (TP1) and 1.64500 (TP2) with proper scaling strategy.

✅ Overbought Zone Identified — Hull MA and resistance cluster at 1.64500 = natural exit point before the reversal crushes your profits.

⚡ QUICK RULES FOR THIS HEIST

DON'T enter all layers at once — patience is the thief's best friend. Spread them out!

DO move stops to breakeven after first target hit — locks in your win and removes risk.

DO scale out at resistance levels (don't hold to the end) — never let profits become losses.

DON'T average down below the stop loss — that's how traders blow up accounts.

DO respect the "Police Barricade" resistance — it's there for a reason and will stop you out if you ignore it!

📌 TRADE MANAGEMENT CHECKLIST

Set limit orders at all 4 layers (1.61400, 1.61600, 1.61800, 1.62000)

Stop loss placed at 1.61000 with proper position sizing

First target exit ready at 1.63200 (60% of position)

Second target exit ready at 1.64500 (remaining 40%)

Risk-to-reward ratio calculated before entering

Trade size appropriate for account size and risk tolerance

💡 WHY THIS SETUP WORKS

The confluence of pullback retest + ATR confirmation + multi-level resistance creates a high-probability zone where smart money typically enters. By using layered entries, you're not betting the farm on one price level — you're working with market structure, not against it. This is how professionals trade without the emotional baggage. You're stacking the odds in your favor by letting price come to you through multiple layers.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EUR/CAD #ForexTrading #SwingTrading #DayTrading #ThiefOG #TechnicalAnalysis #ATR #BullishSetup #TradingStrategy #ForexSignals #PullbackRetest #LayeredEntry #RiskManagement #TradingCommunity

Happy Trading, Thief OG Crew! 🎭💰

EURCAD is in The Bullish TrendHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD is in The Bullish TrendHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/CAD Retest Complete - Time to Go Long?🎯 EUR/CAD: The "Great Maple Heist" Setup | Swing/Day Trade 🍁💶

📊 Asset Overview

EUR/CAD (Euro vs. Canadian Dollar) - Forex Market

🔍 The Setup: Bullish Retest Play

The EUR/CAD is showing classic bullish confirmation with a pullback retest at the 38.2% Fibonacci retracement level, aligning beautifully with our weighted moving average. This is where the smart money layers in! 🧠💰

🎯 Entry Strategy: The "Thief Method"

Primary Approach: Layered limit orders (The legendary Thief OG style!)

Thief Layer Entry Levels:

Layer 1: 1.63000

Layer 2: 1.63250

Layer 3: 1.63500

Layer 4: 1.63550

Feel free to add more layers based on your risk appetite and position sizing!

Alternative: Market execution at current levels if you prefer immediate entry.

🛡️ Risk Management

Stop Loss: 1.62800 (Thief OG reference level)

⚠️ Note: Ladies & Gentlemen (Thief OG's), this is MY stop loss based on MY analysis. YOU set YOUR own stop loss based on YOUR risk tolerance. Trade at your own risk and protect your capital like it's the Crown Jewels! 👑

🎯 Profit Target

Target: 1.65300

This level represents a confluence of:

🧱 Strong resistance zone ("Electric Shock Wall")

📈 Overbought territory

🪤 Potential trap zone for late longs

⚠️ Note: Ladies & Gentlemen (Thief OG's), this is MY take profit level. YOU decide when to bank YOUR profits. The market gives, and the market takes—don't be greedy, take money when you can! 💸

🔗 Related Pairs to Watch

Keep an eye on these correlated pairs for confirmation:

🇺🇸 USD/CAD - Watch the Loonie's overall strength

Direct inverse correlation to EUR/CAD

Oil prices heavily influence CAD strength

💵 EUR/USD - Euro strength gauge

Shows Euro's overall market sentiment

Risk-on/risk-off indicator

🛢️ Crude Oil (WTI/Brent) - The CAD's best friend

CAD is a commodity currency

Higher oil = Stronger CAD = Pressure on EUR/CAD

Lower oil = Weaker CAD = Support for EUR/CAD

Key Correlation Point: If oil drops while EUR shows strength, this setup becomes even more favorable! 🎰

📝 Technical Summary

✅ Bullish structure intact

✅ 38.2% Fib retest complete

✅ Weighted MA providing support

✅ Multiple confluence factors

✅ Risk/Reward ratio: Favorable (~2.5:1)

⚠️ Disclaimer

This is the "Thief Style" trading strategy — a layered approach to swing/day trading created purely for educational and entertainment purposes. This is NOT financial advice. Trading forex carries substantial risk of loss and is not suitable for all investors. Always do your own research, manage your risk, and never trade with money you can't afford to lose. Past performance does not guarantee future results.

Trade safe, trade smart, and may the pips be ever in your favor! 🎲💎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EURCAD #ForexTrading #SwingTrading #DayTrading #FibonacciRetracement #TechnicalAnalysis #ForexSignals #PriceAction #TradingStrategy #ThiefMethod #ForexSetup #CurrencyTrading #RiskManagement #ForexCommunity #TradingIdeas #CAD #EUR #ForexAnalysis #SupportAndResistance #MovingAverage

EUR/CAD Hits 16-Year HighEUR/CAD Hits 16-Year High

Charts show that the euro strengthened against the Canadian dollar on Thursday, with the pair climbing above 1.6460 for the first time since spring 2009, when the world was still reeling from the global financial crisis.

The current weakness of the Canadian dollar is being influenced by several factors:

→ Trade relations with the United States – according to media reports, some Canadian industries such as steel and automotive manufacturing are facing competitive disadvantages under the current agreement.

→ Oil prices have fallen to a five-month low, partly due to expectations surrounding a potential meeting between the US and Russian presidents. As we noted on 13 October, the XTI/USD exchange rate could drift towards $55 per barrel.

Meanwhile, the euro has benefited from the softening of the US dollar. Notably, the DXY index has turned lower from a key resistance level — the upper boundary of the channel identified in our 9 October analysis.

However, an examination of the EUR/CAD chart suggests that the current upward momentum may be losing steam.

Technical Analysis of the EUR/CAD Chart

Price movements — with key turning points shown in bold — outline a rising channel that has remained relevant since August.

The bearish case rests on the following factors:

→ The pair has reached the upper boundary of the channel, which has repeatedly acted as strong resistance and may do so again.

→ The sharp mid-October rally pushed the RSI indicator into extreme overbought territory.

On the other hand, price action continues to reflect strong demand, as seen in the clean breakout above the previous peak near 1.6400, which occurred on a wide bullish candle with minimal pullback.

In these conditions, it is reasonable to assume that:

→ After a 1.6% rise in seven days, some long holders may start taking profits, leading to consolidation near the upper boundary of the channel;

→ If a correction from the upper channel line develops, it is likely to be shallow, as bullish activity could re-emerge around the median line, reinforced by the former resistance at 1.6400.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Long @ EURCAD, possibility of trend reversalFollowing the 4h chart confirmation the EURCAD, in my honest opinion, is moving from an down trend to an up trend on the 1H chart.

The Accumulation and Distribution indicator confirms by going above 50 WMA.

We can spot a small little flag breakout.

I am going long now @ 1.62698 with my stop at 1.62258 (previous low) and the target is 1.63572 (161.8% projection of the previous spike).

Low leveraged, since the signal is good but not so perfect.

Now which ever touches first I'm out.

Disclaimer: This is NOT a trading advice, I do not offer this services and I'm not responsible for your decisions. If someone ask you money pretending to be me, report immediately to the moderators. I'm not licensed to manage 3rd party capital, so I don't offer this type of service.

EUR/CAD Analysis: Strategic Layer Entries for Swing/Day Trade💹 EUR/CAD Forex Market Profit Blueprint (Swing/Day Trade)

📌 Asset:

EUR/CAD — Euro vs Canadian Dollar

📖 Trading Plan:

I’m looking Bullish on EUR/CAD — waiting for a resistance breakout at 1.62800.

👉 To track it easily, set an alert on TradingView at this breakout level so you don’t miss the move.

🧩 Layered Entry Approach (aka “Thief Layer Strategy”)

This method is basically multiple buy limit orders stacked at key levels to catch the breakout momentum smoothly:

🔑 1.62000

🔑 1.62300

🔑 1.62500

🔑 1.62800

(You can add more layers if you like — the idea is scaling in smartly with the breakout confirmation.)

🛡️ Stop Loss Placement

Suggested SL: 1.61700 (after breakout confirmation).

⚠️ Important: This is just a sample placement. Please adjust your stop loss according to your own strategy, risk management, and comfort.

🎯 Target Zone

Upside target at 1.64000, where:

Moving averages act as resistance

Market looks overbought

Potential liquidity trap signals may appear

So the idea is to secure profits before the market reverses — exit smart, not greedy.

⚖️ Risk Disclaimer

Ladies & Gentlemen (a.k.a. the “Thief OGs” community) 🕶️ — this blueprint is not financial advice.

✅ Use your own TP/SL levels.

✅ Trade at your own risk.

✅ Take profit when it makes sense for you.

This is simply my analysis blueprint for educational purposes.

🔗 Correlated Pairs to Watch

Keep an eye on related crosses to see how momentum aligns:

💵 FX:EURUSD (tracks core EUR strength)

💵 OANDA:USDCAD (mirrors CAD flows & oil link)

💵 OANDA:EURGBP (helps confirm EUR sentiment)

Correlation check helps you filter fake breakouts and confirm real market momentum.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#EURCAD #ForexTrading #SwingTrade #DayTrade #BreakoutStrategy #LayeringStrategy #EURUSD #USDCAD #TradingBlueprint #FXAnalysis

EURCAD Bearish Breakout!

HI,Traders !

#EURCAD made a bearish

Breakout of the rising

Support line and now

I I expect he will return Made a retest of the new

Rising resistance and made

A pullback so we are

Bearish biased and we

Will be expecting a

Further bearish move down !

Comment and subscribe to help us grow !

EURCAD is in The Bullish TrendHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD: Pullback Depth Depends on Euro Data📊 EURCAD has been trending strongly to the upside, and my overall bias remains bullish 📈.

📰 That said, we have a key data release scheduled within the next hour or two that could provide direction for the euro.

🔎 If the data is positive for the euro, I’d expect only a shallow pullback before continuation. If the data comes out negative, we could see a deeper retracement before buyers step back in.

📈 Despite this, the higher timeframe structure is firmly bullish. My plan is to wait for the news release, watch for the pullback, and on the 30-minute chart, look for a bullish break of market structure to time an entry 🚀.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always trade responsibly and manage risk appropriately.

EURCAD is in The Bullish TrendHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD Breakout and Retest , All Eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD LONG

📈 EURCAD 55m Long Setup – Breakout Continuation in Play

Technical Overview:

EURCAD has confirmed a breakout above descending structure on the 55-minute chart, followed by a clean retest. Price action is supported by bullish divergence on RSI and MACD, with volume expansion signaling institutional interest. EMAs are aligned bullishly, and the corrective phase appears complete.

Trade Parameters:

- Entry: 1.46850

- Stop-Loss: 1.46490 (below structure base and EMA cluster)

- Take-Profit 1: 1.47420 (first resistance zone, fib extension)

- Take-Profit 2: 1.47880 (prior swing high, psychological level)

- Risk/Reward: TP1 ≈ 1:1.58 | TP2 ≈ 1:2.86

- ROI:

- TP1: +158%

- TP2: +286%

Strategic Notes:

This setup qualifies as a Breakout Continuation with high tactical confidence. Ideal for journaling under “Legacy Trades” and dashboarding with CrocoBot or ECLIPS overlays. Consider trailing stop recalibration post-TP1 and tagging this as a conviction trade.

Overlay Ideas:

- Annotate breakout zone with “Retest Confirmed” label

- Deploy impulse tracker module with fib-based TP zones

- Use momentum confirmation toggle (RSI > 55, MACD histogram rising)

- Visual theme: Iron Pulse or Momentum Surge

---

#EURCAD #ForexTrading #BreakoutSetup #TechnicalAnalysis #MomentumDivergence #CrocoBot #ECLIPS #TradingView #ForexSignals #TradeJournal #AnnotatedCharts #TradingStrategy #ForexSetup #SmartMoney #PriceAction #TradingDiscipline #VisualTrading #ForexMentor #FXMomentum #TradingDashboard #ForexPrecision #LegacySetup #ConvictionTrade #TPHit #ForexLife #TradeWithConfidence #ForexLegacy #TradingWithAdam

EUR/CAD: Launching Long! Layered Entry Strategy For Gains💸 EUR/CAD "Euro vs Loonie" Bank Plan (Swing / Scalping) 📊

🎯 Trading Plan (Thief Layering Strategy)

Asset: EUR/CAD

Setup: Bullish Hull Moving Average breakout + retest 🟢

Entry (Layering Style): Multiple buy limit orders at

1.60800

1.60900

1.61000

1.61200

(You can expand layers based on your own risk preference)

Stop Loss (SL): Thief SL @ 1.60600 (adjust to your own risk strategy) 🛡️

Target (TP): Resistance "police barricade" around 1.62200 🏁

⚠️ Note: This is not financial advice — manage your own TP and risk as per your trading plan.

🔍 Why This Plan? (Fundamental + Macro + Sentiment + Thief Blend)

📈 Real-Time Snapshot (Sept 5, 2025)

EUR/CAD Spot Rate: 1.6025

Daily Change: +0.12%

52-Week Range: 1.4650 – 1.6350

👥 Trader Sentiment

Retail Traders: 42% Long 🐂 | 58% Short 🐻

Institutions: 55% Long 🐂 | 45% Short 🐻

😱 Investor Mood (Fear & Greed)

Index: 48/100 → Neutral ⚖️ (leaning fear due to global trade + US jobs data)

📋 Fundamentals

Score: 62/100 🟢

Drivers:

Eurozone growth resilient, ECB steady at 2% 🏦

Canada facing weak jobs data, BoC at 2.75% 🛢️

Oil prices steady, modest CAD support ⚡

🌍 Macro Score

Score: 58/100 🟡

Factors:

Global trade tensions weigh on CAD 🛡️

Eurozone recovery boosts EUR 💪

US policy uncertainty adds volatility 🌪️

🧭 Overall Market Outlook

Bias: Neutral → Slightly Bullish Tilt 📈

Why: ECB support + Eurozone recovery outweigh CAD’s oil-linked strength. Range likely 1.60 – 1.63 short-term.

🚦 Related Pairs to Watch

FX:EURUSD , OANDA:USDCAD , OANDA:GBPCAD , OANDA:EURGBP

Keep an eye on BLACKBULL:WTI (Oil) for CAD correlation.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#EURCAD #Forex #TradingPlan #SwingTrading #Scalping #ThiefStrategy #HullMovingAverage #Fundamentals #MacroAnalysis #Sentiment #FXCommunity

Will EURCAD rise from a strong Support Level ?Hello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts