EURCAD Coiling at Resistance Breakout Brewing or Quick FakeoutEURCAD is tightening up right under a well-defined resistance band after a messy pullback from the highs. What I like here is the structure: we’ve got compression, higher reaction lows, and repeated tests into the same ceiling. That usually means pressure is building. But with CAD tied closely to oil and EUR tied to rate expectations and growth worries, this pair rarely moves on technicals alone. For me, this is a decision zone — either we get a clean break and continuation higher, or a final sweep into support before the real move.

Current Bias

Neutral to mildly bullish

Price is compressing below resistance with short term higher lows. While still inside a broader range, the structure slightly favors an upside break attempt — provided support holds and CAD doesn’t strengthen sharply through oil.

Key Fundamental Drivers

EUR side:

Eurozone inflation path is cooling but still watched closely by the ECB.

ECB tone remains cautious, not aggressively dovish, which gives EUR some baseline support.

CAD side:

CAD is heavily linked to oil prices and energy exports.

Recent crude inventory draws and stable oil structure lend conditional support to CAD.

Rate spread dynamics:

ECB vs Bank of Canada expectations are relatively close, so marginal data surprises drive this cross more than policy gaps.

Macro Context

Interest rate expectations:

ECB is in a hold-and-watch mode on inflation. Bank of Canada is also cautious, with markets pricing gradual easing later rather than fast cuts. That keeps EURCAD more range-driven than trend-driven unless expectations shift.

Economic growth trends:

Eurozone growth is sluggish but stabilizing in pockets. Canada’s growth is steady but sensitive to external demand and commodities.

Commodity flows:

Oil is the key macro lever here. Firmer oil generally supports CAD and pressures EURCAD. Softer oil tends to lift EURCAD.

Geopolitical themes:

Energy route risk and sanctions policy still matter for both European energy pricing and global crude — indirectly feeding into this cross.

Primary Risk to the Trend

The main risk to the mildly bullish view is a sharp oil rally combined with strong Canadian data. That would strengthen CAD and likely reject EURCAD from resistance back toward range lows.

On the flip side, weak Eurozone inflation or growth data could also undercut EUR quickly.

Most Critical Upcoming News/Event

Canada employment and inflation data

Eurozone CPI and ECB speakers

Weekly oil inventory reports

Any OPEC or energy market headlines

These are the catalysts most likely to break the range.

Leader/Lagger Dynamics

EURCAD is mostly a lagger cross.

It tends to follow:

Oil price direction through CAD legs

Broad EURUSD movement for EUR strength or weakness

It can influence:

Other CAD crosses like GBPCAD and AUDCAD after a move is established.

Oil and EURUSD usually move first — EURCAD reacts second.

Key Levels

Support Levels:

1.6060–1.6080 major range support zone

1.6100–1.6120 near-term structure support

Resistance Levels:

1.6200–1.6220 resistance band

1.6390 area higher breakout target

Stop Loss (SL):

Below 1.6060 for bullish breakout setups

Take Profit (TP):

TP1: 1.6200–1.6220

TP2: 1.6390 zone

Summary: Bias and Watchpoints

EURCAD is compressing under resistance with a neutral to mildly bullish bias as long as price holds above the 1.6060 support base. The pair is being driven by relative ECB vs BoC expectations and, more importantly, oil’s effect on CAD. A break above the 1.62 zone opens room toward 1.6390, while a loss of 1.6060 invalidates the bullish structure. The biggest watchpoints are Canadian data and oil moves — if crude strengthens hard, CAD likely leads and this setup flips from breakout candidate to rejection play.

Eurcadidea

EURCAD Technical Analysis and Trade Idea🔥 Is the EURCAD ready for another massive leg up?

In today's breakdown, we are dissecting the EURCAD pair. The market structure on the 1H and 4H timeframes is undeniably bullish 🐂, but price action is currently screaming "overextended." Amateurs chase the pump, but pros wait for the pullback. Here is the exact game plan to catch the next wave. 🌊

Here is what we are watching:

📈 Technical Setup: The trend is your friend, but we need a discount. We are stalking a precise retracement into key support zones for a high-probability Buy Opportunity.

📅 Fundamental Catalyst: We have high-impact Euro and CAD economic data dropping today! 💣

The Bullish Case: We need to see the data print Positive for the Euro 🇪🇺.

The Confluence: Simultaneously, we need the release to be Negative for the CAD 🇨🇦.

If these two fundamental events align with our technical support levels, we could see an explosive continuation to the upside. Don't miss this potential sniper entry! 🎯

👇 Drop a comment: Are you Long or Short on the EURCAD today?

⚠️ DISCLAIMER: This video is for educational and entertainment purposes only. This is NOT financial advice. Trading Forex and Crypto involves significant risk. Always do your own research.

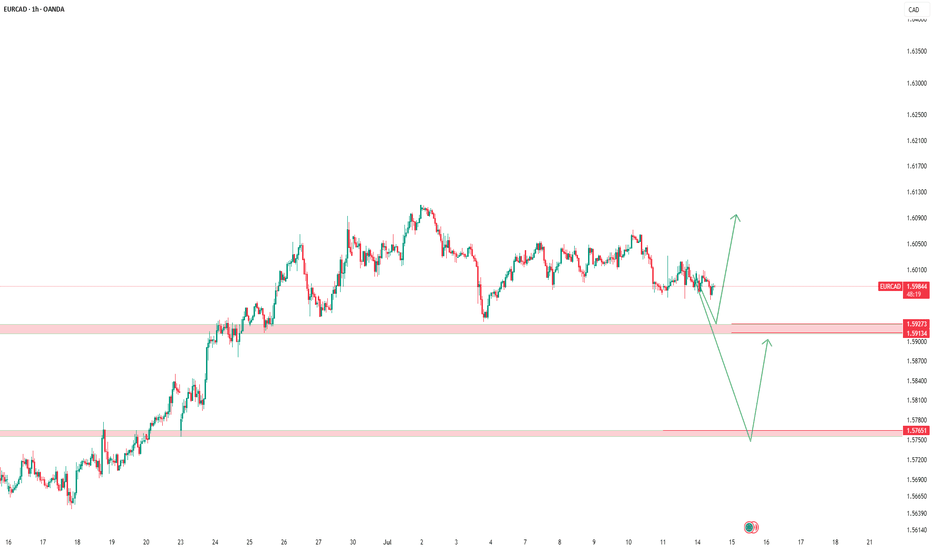

EURCAD BUY | Idea Trading AnalysisEURCAD is moving in an UP trend channel.

The chart broke through the dynamic Resistance line, which now acts as support.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity EURCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

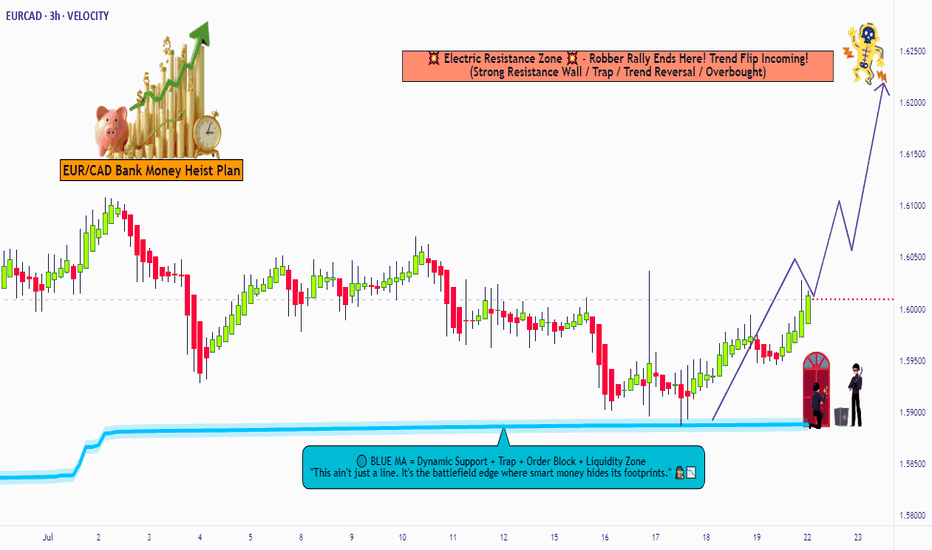

Is the Euro Gaining Strength Against the CAD Again?🎯 EUR/CAD SWING TRADE SETUP | FOREX OPPORTUNITY 💱

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 ASSET: EUR/CAD (Euro vs Canadian Dollar)

⏱️ TIMEFRAME: Swing Trade (Multi-Day Hold)

🎬 SETUP: Bullish Reversal - Weighted Moving Average Pullback

📈 BIAS: BULLISH ✅

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 TRADE PLAN BREAKDOWN

📍 ENTRY STRATEGY - "Layering Method" (Multiple Limit Orders)

For optimal entries, use the THIEF layering strategy with staggered limit buy orders:

✅ Layer 1: 1.61800 (Initial Entry)

✅ Layer 2: 1.62000 (Aggressive Entry)

✅ Layer 3: 1.62200 (Dip Entry)

🎯 Tip: Customize layers based on your account risk & trading style

🛑 STOP LOSS

📌 Primary SL Level: 1.61500

⚠️ Note: Adjust your stop loss according to YOUR risk tolerance & strategy. This is a reference level only. Risk management is YOUR responsibility.

🎁 TAKE PROFIT TARGET

🚀 Target Level: 1.64000

📌 Reason: Moving averages acting as dynamic resistance + overbought zone + potential trap breakout

⚠️ Note: Set YOUR own profit targets based on market structure & personal strategy. This is NOT financial advice—always manage risk responsibly.

💡 KEY CONFLUENCE FACTORS

✓ Bullish weighted moving average pullback

✓ Support zone hold at entry levels

✓ Risk/Reward ratio favorable for swing trading

✓ Multiple entry confirmation points

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🌐 CORRELATED PAIRS TO WATCH

1️⃣ OANDA:USDCAD (US Dollar vs Canadian Dollar) 🇺🇸🇨🇦

📊 Inverse Correlation: When USD/CAD rises → EUR/CAD likely falls

💥 Why It Matters: CAD movements drive both pairs; monitor for conflicting signals

🔗 Watch Level: 1.4200+ = CAD strength headwinds for EUR/CAD

2️⃣ FX:EURUSD (Euro vs US Dollar) 🇪🇺🇺🇸

📊 Direct Correlation: Both share EUR component

💥 Why It Matters: EUR strength here = EUR/CAD bullish confirmation

🔗 Watch Level: 1.0800+ = EUR strength = EUR/CAD support

3️⃣ BLACKBULL:WTI Crude Oil 🛢️📈

📊 Positive Correlation: CAD is commodity-driven (oil exporter)

💥 Why It Matters: Oil rally = CAD strength = EUR/CAD pressure

🔗 Watch Level: Oil $75-80/barrel = possible CAD headwind

4️⃣ $S&P500 (SPY/ES) 📊📉

📊 Risk Sentiment: Risk-on = CAD rally, Risk-off = CAD weakness

💥 Why It Matters: Market volatility directly impacts commodity currencies

🔗 Watch Level: SPY weakness = possible CAD weakness = EUR/CAD tailwind

5️⃣ TVC:GOLD (XAU/USD) 🏆💰

📊 Inverse with USD: Gold up = USD weakness = EUR/CAD strength

💥 Why It Matters: Safe-haven flows affect both pairs differently

🔗 Watch Level: Gold $2,100+ = possible EUR strength

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

👍 LIKE | 💬 FOLLOW | 📌 SAVE FOR UPDATES

Your trading success is YOUR responsibility. Trade with conviction & proper risk management. ✨

Is EUR/CAD Ready for Takeoff After the ATR Pullback?💶💰 EUR/CAD: The Pullback Heist Setup | Swing/Day Trade

🎯 THE SETUP

Pair: EUR/CAD (Euro vs Canadian Dollar)

Market: Forex | Timeframe: Flexible (Swing/Day Trade)

Bias: 📈 BULLISH — Confirmed via ATR Pullback Retest

📊 GAME PLAN

The setup identifies a bullish pullback retest structure with ATR (Average True Range) confirmation, creating a high-probability entry zone. This is your "heist opportunity" — multiple entry layers maximize your chances of catching the move.

🎬 ENTRY STRATEGY: LAYERED LIMIT ORDERS

Think of it like stacking chips at the table — multiple small bets beat one big bet:

🔴 Layer 1 at price level 1.61400 — First reconnaissance move to test the waters and gauge initial momentum.

🔴 Layer 2 at price level 1.61600 — Confirm momentum building as price holds and retests the zone.

🔴 Layer 3 at price level 1.61800 — Build your core position as conviction strengthens with each layer filled.

🔴 Layer 4 at price level 1.62000 — Final accumulation layer to complete your position size.

Note: Adjust layers based on your position sizing and risk tolerance. Start with what fits your account!

🛑 STOP LOSS PLACEMENT

Thief SL: 1.61000

⚠️ Risk Disclaimer: Stop loss is your safety net, not a guaranteed protection. Set it based on your personal risk management rules and account capital. Your risk, your rules!

🎁 PROFIT TARGETS

🟢 TARGET 1 (TP1) at 1.63200 — This is where the Hull MA acts as an overbought zone, signaling time to lock in 60% of your position. This is your first checkpoint to secure profits before things get spicy.

🟢 TARGET 2 (TP2) at 1.64500 — This level is the "Police Barricade" — a strong resistance cluster with overbought conditions brewing. This is where the TRAP zone activates. Don't get greedy here! Escape with your remaining 40% of profits and live to trade another day.

⚠️ Profit Target Note: These are suggested levels based on technical structure. Your take-profit strategy is YOUR decision. Trade responsibly!

🔗 CORRELATED PAIRS TO WATCH (Use as Confluence)

📍 USD Strength Indicators

💵 FX:EURUSD — Key Correlation: Inverse relationship. If EUR/USD rallies, EUR/CAD typically strengthens (bullish for setup). When the Euro pumps against the Dollar, CAD strength becomes less relevant, giving EUR/CAD room to fly.

🍁 OANDA:USDCAD — Key Correlation: Direct inverse. USD/CAD weakness = EUR/CAD strength. Monitor USD/CAD for divergence — if it's breaking down while our setup fires, that's GOLDEN confluence.

📍 Commodity Pairs (Loonie Movement)

🛢️ OANDA:USDCAD (Oil Sensitivity) — Canadian Dollar is heavily influenced by crude oil prices. Oil strength = CAD strength = potential headwind for EUR/CAD. Check oil charts before entering! Rising oil can kill your bullish trade.

🍁 OANDA:CADJPY — Reflects broader CAD sentiment across majors. Monitor for divergence signals. If CAD is rallying across the board, EUR/CAD might struggle against the Loonie.

📍 Technical Synergy

🔄 OANDA:EURGBP — Shows Euro strength relative to other majors. If EUR/GBP is bullish, EUR/CAD confluence improves significantly. This is your Euro strength confirmation.

📉 TVC:DXY (Dollar Index) — Broader USD weakness supports Euro strength. Watch for DXY breakdown below key support — when the Dollar bleeds, the Euro typically thrives.

Key Point: Use these pairs as confirmation tools, not entry signals. Multi-pair confluence = higher probability trades.

🔑 KEY TECHNICAL POINTS

✅ ATR Pullback Retest — Price returned to support + ATR shows volatility compression = reversal setup that signals buyers stepping in.

✅ Layered Entry Strategy — Reduces average entry price and eliminates emotional FOMO trading by spreading your risk intelligently.

✅ Multiple Profit Targets — Risk-to-reward ratio calculated at 1.63200 (TP1) and 1.64500 (TP2) with proper scaling strategy.

✅ Overbought Zone Identified — Hull MA and resistance cluster at 1.64500 = natural exit point before the reversal crushes your profits.

⚡ QUICK RULES FOR THIS HEIST

DON'T enter all layers at once — patience is the thief's best friend. Spread them out!

DO move stops to breakeven after first target hit — locks in your win and removes risk.

DO scale out at resistance levels (don't hold to the end) — never let profits become losses.

DON'T average down below the stop loss — that's how traders blow up accounts.

DO respect the "Police Barricade" resistance — it's there for a reason and will stop you out if you ignore it!

📌 TRADE MANAGEMENT CHECKLIST

Set limit orders at all 4 layers (1.61400, 1.61600, 1.61800, 1.62000)

Stop loss placed at 1.61000 with proper position sizing

First target exit ready at 1.63200 (60% of position)

Second target exit ready at 1.64500 (remaining 40%)

Risk-to-reward ratio calculated before entering

Trade size appropriate for account size and risk tolerance

💡 WHY THIS SETUP WORKS

The confluence of pullback retest + ATR confirmation + multi-level resistance creates a high-probability zone where smart money typically enters. By using layered entries, you're not betting the farm on one price level — you're working with market structure, not against it. This is how professionals trade without the emotional baggage. You're stacking the odds in your favor by letting price come to you through multiple layers.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EUR/CAD #ForexTrading #SwingTrading #DayTrading #ThiefOG #TechnicalAnalysis #ATR #BullishSetup #TradingStrategy #ForexSignals #PullbackRetest #LayeredEntry #RiskManagement #TradingCommunity

Happy Trading, Thief OG Crew! 🎭💰

EUR/CAD Retest Complete - Time to Go Long?🎯 EUR/CAD: The "Great Maple Heist" Setup | Swing/Day Trade 🍁💶

📊 Asset Overview

EUR/CAD (Euro vs. Canadian Dollar) - Forex Market

🔍 The Setup: Bullish Retest Play

The EUR/CAD is showing classic bullish confirmation with a pullback retest at the 38.2% Fibonacci retracement level, aligning beautifully with our weighted moving average. This is where the smart money layers in! 🧠💰

🎯 Entry Strategy: The "Thief Method"

Primary Approach: Layered limit orders (The legendary Thief OG style!)

Thief Layer Entry Levels:

Layer 1: 1.63000

Layer 2: 1.63250

Layer 3: 1.63500

Layer 4: 1.63550

Feel free to add more layers based on your risk appetite and position sizing!

Alternative: Market execution at current levels if you prefer immediate entry.

🛡️ Risk Management

Stop Loss: 1.62800 (Thief OG reference level)

⚠️ Note: Ladies & Gentlemen (Thief OG's), this is MY stop loss based on MY analysis. YOU set YOUR own stop loss based on YOUR risk tolerance. Trade at your own risk and protect your capital like it's the Crown Jewels! 👑

🎯 Profit Target

Target: 1.65300

This level represents a confluence of:

🧱 Strong resistance zone ("Electric Shock Wall")

📈 Overbought territory

🪤 Potential trap zone for late longs

⚠️ Note: Ladies & Gentlemen (Thief OG's), this is MY take profit level. YOU decide when to bank YOUR profits. The market gives, and the market takes—don't be greedy, take money when you can! 💸

🔗 Related Pairs to Watch

Keep an eye on these correlated pairs for confirmation:

🇺🇸 USD/CAD - Watch the Loonie's overall strength

Direct inverse correlation to EUR/CAD

Oil prices heavily influence CAD strength

💵 EUR/USD - Euro strength gauge

Shows Euro's overall market sentiment

Risk-on/risk-off indicator

🛢️ Crude Oil (WTI/Brent) - The CAD's best friend

CAD is a commodity currency

Higher oil = Stronger CAD = Pressure on EUR/CAD

Lower oil = Weaker CAD = Support for EUR/CAD

Key Correlation Point: If oil drops while EUR shows strength, this setup becomes even more favorable! 🎰

📝 Technical Summary

✅ Bullish structure intact

✅ 38.2% Fib retest complete

✅ Weighted MA providing support

✅ Multiple confluence factors

✅ Risk/Reward ratio: Favorable (~2.5:1)

⚠️ Disclaimer

This is the "Thief Style" trading strategy — a layered approach to swing/day trading created purely for educational and entertainment purposes. This is NOT financial advice. Trading forex carries substantial risk of loss and is not suitable for all investors. Always do your own research, manage your risk, and never trade with money you can't afford to lose. Past performance does not guarantee future results.

Trade safe, trade smart, and may the pips be ever in your favor! 🎲💎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EURCAD #ForexTrading #SwingTrading #DayTrading #FibonacciRetracement #TechnicalAnalysis #ForexSignals #PriceAction #TradingStrategy #ThiefMethod #ForexSetup #CurrencyTrading #RiskManagement #ForexCommunity #TradingIdeas #CAD #EUR #ForexAnalysis #SupportAndResistance #MovingAverage

EUR/CAD Analysis: Strategic Layer Entries for Swing/Day Trade💹 EUR/CAD Forex Market Profit Blueprint (Swing/Day Trade)

📌 Asset:

EUR/CAD — Euro vs Canadian Dollar

📖 Trading Plan:

I’m looking Bullish on EUR/CAD — waiting for a resistance breakout at 1.62800.

👉 To track it easily, set an alert on TradingView at this breakout level so you don’t miss the move.

🧩 Layered Entry Approach (aka “Thief Layer Strategy”)

This method is basically multiple buy limit orders stacked at key levels to catch the breakout momentum smoothly:

🔑 1.62000

🔑 1.62300

🔑 1.62500

🔑 1.62800

(You can add more layers if you like — the idea is scaling in smartly with the breakout confirmation.)

🛡️ Stop Loss Placement

Suggested SL: 1.61700 (after breakout confirmation).

⚠️ Important: This is just a sample placement. Please adjust your stop loss according to your own strategy, risk management, and comfort.

🎯 Target Zone

Upside target at 1.64000, where:

Moving averages act as resistance

Market looks overbought

Potential liquidity trap signals may appear

So the idea is to secure profits before the market reverses — exit smart, not greedy.

⚖️ Risk Disclaimer

Ladies & Gentlemen (a.k.a. the “Thief OGs” community) 🕶️ — this blueprint is not financial advice.

✅ Use your own TP/SL levels.

✅ Trade at your own risk.

✅ Take profit when it makes sense for you.

This is simply my analysis blueprint for educational purposes.

🔗 Correlated Pairs to Watch

Keep an eye on related crosses to see how momentum aligns:

💵 FX:EURUSD (tracks core EUR strength)

💵 OANDA:USDCAD (mirrors CAD flows & oil link)

💵 OANDA:EURGBP (helps confirm EUR sentiment)

Correlation check helps you filter fake breakouts and confirm real market momentum.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#EURCAD #ForexTrading #SwingTrade #DayTrade #BreakoutStrategy #LayeringStrategy #EURUSD #USDCAD #TradingBlueprint #FXAnalysis

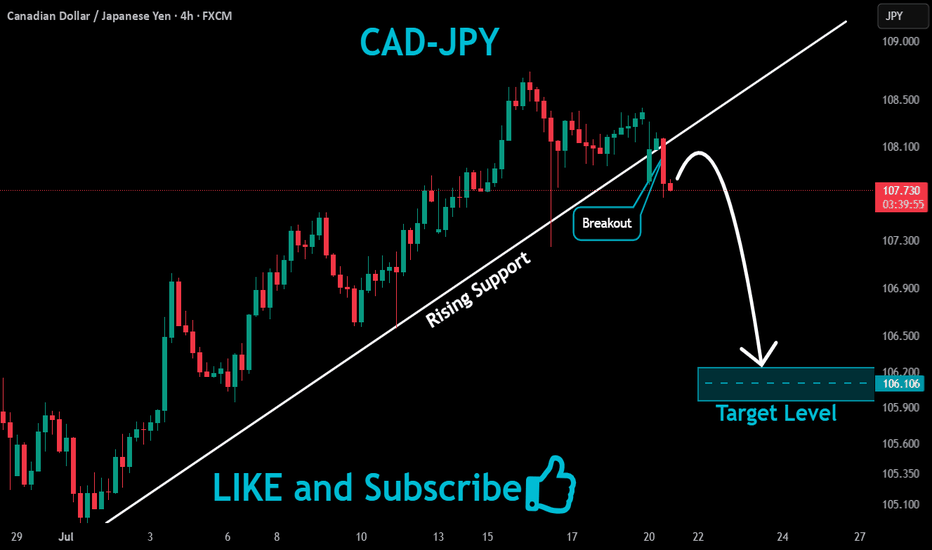

EURCAD Bearish Breakout!

HI,Traders !

#EURCAD made a bearish

Breakout of the rising

Support line and now

I I expect he will return Made a retest of the new

Rising resistance and made

A pullback so we are

Bearish biased and we

Will be expecting a

Further bearish move down !

Comment and subscribe to help us grow !

EURCAD: Pullback Depth Depends on Euro Data📊 EURCAD has been trending strongly to the upside, and my overall bias remains bullish 📈.

📰 That said, we have a key data release scheduled within the next hour or two that could provide direction for the euro.

🔎 If the data is positive for the euro, I’d expect only a shallow pullback before continuation. If the data comes out negative, we could see a deeper retracement before buyers step back in.

📈 Despite this, the higher timeframe structure is firmly bullish. My plan is to wait for the news release, watch for the pullback, and on the 30-minute chart, look for a bullish break of market structure to time an entry 🚀.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always trade responsibly and manage risk appropriately.

EURCAD LONG

📈 EURCAD 55m Long Setup – Breakout Continuation in Play

Technical Overview:

EURCAD has confirmed a breakout above descending structure on the 55-minute chart, followed by a clean retest. Price action is supported by bullish divergence on RSI and MACD, with volume expansion signaling institutional interest. EMAs are aligned bullishly, and the corrective phase appears complete.

Trade Parameters:

- Entry: 1.46850

- Stop-Loss: 1.46490 (below structure base and EMA cluster)

- Take-Profit 1: 1.47420 (first resistance zone, fib extension)

- Take-Profit 2: 1.47880 (prior swing high, psychological level)

- Risk/Reward: TP1 ≈ 1:1.58 | TP2 ≈ 1:2.86

- ROI:

- TP1: +158%

- TP2: +286%

Strategic Notes:

This setup qualifies as a Breakout Continuation with high tactical confidence. Ideal for journaling under “Legacy Trades” and dashboarding with CrocoBot or ECLIPS overlays. Consider trailing stop recalibration post-TP1 and tagging this as a conviction trade.

Overlay Ideas:

- Annotate breakout zone with “Retest Confirmed” label

- Deploy impulse tracker module with fib-based TP zones

- Use momentum confirmation toggle (RSI > 55, MACD histogram rising)

- Visual theme: Iron Pulse or Momentum Surge

---

#EURCAD #ForexTrading #BreakoutSetup #TechnicalAnalysis #MomentumDivergence #CrocoBot #ECLIPS #TradingView #ForexSignals #TradeJournal #AnnotatedCharts #TradingStrategy #ForexSetup #SmartMoney #PriceAction #TradingDiscipline #VisualTrading #ForexMentor #FXMomentum #TradingDashboard #ForexPrecision #LegacySetup #ConvictionTrade #TPHit #ForexLife #TradeWithConfidence #ForexLegacy #TradingWithAdam

EURCAD – Potential Short OpportunityEURCAD is currently at a very good level for a short position.

If you spot a valid sell signal, you can consider entering.

In case the level breaks, a long position could also be possible — but you need to be very experienced to distinguish between a fake breakout and a real one.

EURCAD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

EUR/CAD Bullish Layered Heist Plan – Will You Join the Loot?💎⚡ "EUR/CAD Bullish Layered Loot Grab – Thief Master Plan!" ⚡💎

👋 Hey Profit Bandits & Forex Loot Raiders! 🏴☠️💰

The Euro vs Loonie vault is swinging wide open, and the Thief Crew is moving in! 🏦🔥

We’re running a BULLISH layering raid—stacking our entries like gold bars in the getaway van! 🚐💨

🎯 TRADE BLUEPRINT (Layered Bullish Heist)

📌 Entry Zones – Anywhere in the vault! But pro thieves layer buy limits for maximum loot efficiency:

💎 1️⃣ 1.61200

💎 2️⃣ 1.61100

💎 3️⃣ 1.61000

💎 4️⃣ 1.60800

💎 5️⃣ 1.60700

💡 Add more layers if the market tries to shake you off the loot trail!

🛡 Stop Loss (The Getaway Trigger)

🚨 Thief SL: 1.60000 – If the vault doors slam, bail out fast!

📢 Adjust your SL based on your personal thief strategy & risk appetite.

🏁 Targets (Escape Before Police Barricade)

💰 Primary Escape Target: 1.62500 – grab loot & vanish before sirens blare! 🚓💨

💰 Grand Loot Target: 1.62800 – but beware, heavy police barricade up ahead!

💡 WHY THIS RAID LOOKS SWEET

✅ Bullish price structure with room to run

✅ CAD weakness = Loonie limping 🦵💥

✅ Layered entries let thieves get more loot with less risk

📢 CREW ORDERS

🔥 Hit 👍 LIKE if you’re joining the crew

💬 Drop your entry & TP below – let’s count the loot together!

🔔 FOLLOW for more Daily Thief Heist Plans

⚠️ DISCLAIMER – This isn’t financial advice, just a treasure map for fellow market pirates. Manage your loot wisely—don’t get caught in the bear trap! 🐻🚫

🚀 Ready to stack the loot & vanish? Let’s raid EUR/CAD! 💎🏴☠️💸

"EUR/CAD Price Pirate Mode: Long Entries Loading!"🔥🚨 "EUR/CAD BANK HEIST: The Ultimate Bullish Loot Grab! (Thief Trading Style) 🚨🔥

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

The EUR/CAD "Euro vs Loonie" vault is WIDE OPEN—time to execute the Thief Trading Heist Plan! 🏦💰 Based on 🔥 high-probability technicals & stealthy fundamental analysis 🔥, here’s how we SWIPE THE LOOT before the bears catch on!

🎯 TRADE SETUP (Scalping/Day Heist)

📈 Entry (Bullish Raid):

"The vault door is cracked—enter anywhere!"

Pro Thief Move: Use buy limit orders near swing lows (15M/30M) for sneaky pullback entries.

Advanced Raid Tactics: Layer entries (DCA-style) for maximum loot efficiency.

🛑 Stop Loss (Escape Route):

Swing Low (4H) = 1.58800 (Adjust based on your risk tolerance & lot size!)

Thieves’ Golden Rule: "No heist is worth a jail sentence!" 🚔💨

🎯 Take Profit (Escape Before the Cops Arrive!):

Primary Target: 1.62300 (or exit early if resistance gets too hot!)

⚠️ Danger Zone: High-voltage resistance = Bear Trap Territory! ⚡🐻

💡 WHY THIS HEIST WILL WORK:

✅ Bullish Momentum Intact (Price structure favors buyers)

✅ Weak CAD Fundamentals (Loonie under pressure)

✅ Smart Money Algos Likely Pushing Higher (COT data hints at institutional bias)

📰 NEWS ALERT (Avoid the Market Police!)

🚨 Upcoming High-Impact Events?

Avoid new trades during news spikes!

Trailing stops = Your getaway car! 🚗💨

💥 BOOST THIS HEIST! (Let’s Get RICH Together!)

🔥 Hit the 👍 LIKE & 🚀 BOOST button to strengthen our robbery squad!

💬 Comment your entry & TP—let’s track the loot!

🔔 Follow for DAILY HEIST PLANS!

⚠️ DISCLAIMER (Stay Out of Jail!):

This is NOT financial advice—just a pirate’s treasure map! 🗺️

Manage risk like a pro thief—don’t blow your capital!

🚀 Ready to RAID? Let’s STEAL those pips! 🏴☠️💸

EURCAD – Two Key Levels, One Solid PlanOn this pair, we have two important levels:

🟡 The first level might act as a trap (stop hunting).

So don’t rush to buy — wait for confirmation.

🟢 The second level offers a safer buy opportunity.

As always, our plan stays firm —

we don’t tell the market what to do, we follow it.

🔻 If a clean break and valid pullback occurs on the first level,

a short trade toward the lower level is possible.

⚠️ This pullback short scenario is only valid until price reaches the lower level.

If price hits the lower level and starts moving up,

any short position becomes much riskier.

Discipline > Prediction.

EURCAD Analysis & The Blueprint for a Winning Trading Strategy📍 You’ve got to have a roadmap — a solid trading plan is absolutely essential 🧭.

In this video, I break down my personal trading plan and walk you through exactly how I approach the markets 🎯. I’m currently looking at EURCAD and there’s a lot happening on this chart 📉📊.

First things first: price action is clearly overextended 📈. The question is — do you really want to be buying at a premium? That’s where risk increases significantly ⚠️.

My approach is simple yet effective: I look for signs of reversal or a pullback into equilibrium 🌀 — then I wait for price to break structure before I act 📐.

Having a system in place that alerts you when key conditions are met is critical 🔔. That’s how you build consistency and gain a real edge in the market 🧠⚔️.

In this video, I’ll show you my strategy, how I plan a trade, what I’m looking for, and why patience is key 🧘♂️.

🛑 Don’t chase price. Let the setup come to you. Let the chart reveal its hand 🃏.

Not financial advice — always do your own research. 📚