EURCHF Is in The Selling DirectionHello Traders

In This Chart EURCHF HOURLY Forex Forecast By FOREX PLANET

today EURCHF analysis 👆

🟢This Chart includes_ (EURCHF market update)

🟢What is The Next Opportunity on EURCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Eurchfanalysis

EURCHF | Strategic BUY Opportunity🟢💼 EURCHF | Strategic BUY Opportunity (Structured Upside Setup)

Overview:

EURCHF is showing bullish continuation potential, with price holding strength near a key demand area, favoring further upside movement.

Buy Zone (Focus Area):

🟢 0.9310 – 0.9315

This zone represents a strong accumulation area where buyers are actively supporting price.

Upside Objectives:

🎯 0.9340 – Primary upside reaction

🚀 0.9360 – Possible extension with momentum

🔍 0.9380 – Level to be re-evaluated based on price behavior

Why This Setup Works:

✔ Price holding above a clear demand zone

✔ Bullish structure remains intact

✔ Upside momentum supported by controlled price action

Trade Management Insight:

Partial profit-taking at initial targets helps protect capital while allowing room for extended upside moves.

Execution Guidance:

Enter only after price shows acceptance or bullish confirmation within the buy zone. Patience improves precision.

Final Note:

As long as price respects the demand area, upside continuation remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you value structured levels, calm execution, and professional risk control over emotional trading, feel free to connect. I work with traders who focus on consistency, not noise.

🔒 Professional approach. Disciplined risk. Sustainable growth.

Is 0.92 The Bottom ??0.92 looks like a very strong support level there where multiple attempts to break lower last each attempt quickly failed with the Monthly candles closing back above 0.925.

The setup is very straight forward I will wait for another drop down towards 0.92 then use the daily TF to time my entry on a MACD crossover looking to target the Monthly trendline @ 0.94 which also lines up with a nice resistance.

For further strength above this we want to see a break and close of the trendline resistance and then a quick retest and use the lower TF daily chart to get back in for a move up towards the 0.98 resistance and further towards the key 1 level.

There is a good positive swap on this pair and its common to see CHF cross pairs to strengthen at the beginning of the year if you look at some of my previous ideas on CHF pairs.

Let me know your thoughts wishing you a healthy and prosperous 2026 :)

Is EUR/CHF Ready for the Next Upside Expansion?🔔 EUR/CHF Bullish Breakout | TMA Retest Trade Map Ahead!

📌 Asset

EUR/CHF – “EURO vs SWISSY”

📊 Forex Market | Swing / Day Trade Opportunity

📈 Market Bias

Bullish 🔼

The bullish structure is confirmed after a Triangular Moving Average (TMA) breakout followed by a clean retest, signaling trend continuation and renewed buyer strength.

This setup favors trend-following bulls and pullback buyers looking to position early before momentum expansion.

🧠 Trading Plan Logic

✅ TMA Breakout confirms trend shift

🔁 Retest validates buyer commitment

📊 Structure supports continuation, not exhaustion

🔓 Entry Strategy (Layered Execution 🧩)

Entry: Any price level

➡️ Executed using the Thief Layer Strategy (multi-limit order system)

📥 Buy Limit Layers

0.93200

0.93300

0.93400

0.93500

🧠 You may increase or reduce layers based on volatility, session, and position sizing.

This method improves average entry price, reduces emotional execution, and captures liquidity pullbacks effectively.

🛑 Stop Loss (Risk Control Zone)

SL @ 0.93000 🚨

Dear Ladies & Gentlemen (Thief OG’s),

This stop loss is not mandatory. Adjust SL placement according to:

Your own risk model

Account size

Volatility conditions

⚠️ Capital protection always comes before profits.

🎯 Target Zone (Profit Area)

TP @ 0.94300 💰

Why this zone matters:

⚡ High-Voltage Electric Wall (Strong historical resistance)

📉 Overbought conditions expected

Liquidity trap potential near highs

➡️ Smart traders escape with profits, not hope.

Again, TP is flexible — manage exits based on your system and market reaction.

🔍 Related Pairs to Watch (Correlation Check 👀)

💱 FX:EURUSD

EUR strength here supports bullish pressure in EUR/CHF

Watch for continuation above key intraday supports

💱 OANDA:USDCHF

CHF weakness vs USD often aligns with CHF weakness vs EUR

A falling USD/CHF = supportive for EUR/CHF upside

💱 OANDA:EURJPY

Risk-on confirmation pair

Bullish EUR/JPY adds confidence to EUR strength across the board

💱 OANDA:CHFJPY

If CHF/JPY weakens, it signals safe-haven outflows, favoring EUR/CHF longs

🧠 Correlation is not for entry — it’s for confirmation.

⚠️ Risk Disclaimer

Dear Ladies & Gentlemen (Thief OG’s),

I do not recommend copying my SL or TP blindly.

You control your risk.

You take your profits.

You own your results.

💬 Final Thought

Structure favors bulls, liquidity favors patience, and execution favors discipline.

Trade the plan — not emotions.

📌 If this idea adds value, support it with a 👍, 💬, or ⭐ to help it reach more traders.

Happy trading & trade safe 🚀📊

EUR/CHF Outlook: Is the Euro Losing Strength Against the Swissy?💼 EUR/CHF “Euro vs Swissy” | Forex Market Opportunity Blueprint 🧠

🔻 Bearish Swing Trade Plan – Thief’s Layering Strategy

📊 Market Context:

The EUR/CHF pair is showing a clear bearish structure after a Triangular Moving Average (TMA) pullback trend reversal — confirming strong downside potential. A major support zone has been breached, signaling that bears are firmly in control.

💥 Plan Summary:

This setup aligns with Thief’s signature multi-layer entry strategy, focusing on precision layering and risk scaling for optimal profit capture.

🎯 Thief’s Layered Entry Zones:

💣 Sell Limit 1 → 0.92500

💣 Sell Limit 2 → 0.92400

💣 Sell Limit 3 → 0.92300

💣 Sell Limit 4 → 0.92200 (optional for advanced layering)

🧩 You can increase or reduce layers based on your own comfort & volatility assessment. The goal is smooth entry stacking — not emotional trading.

🛑 Stop Loss (SL):

Thief SL @ 0.92700

Dear Ladies & Gentlemen (Thief OG’s) — remember, this SL is adaptive. Manage according to your own strategy and risk appetite. This isn’t a signal — it’s a structure.

💰 Target Zone (TP):

🎯 Primary TP: 0.91800

As moving averages turn into strong resistance & overbought signals appear, the market forms a bull trap. Be the early one to exit with profits before the herd wakes up.

🔍 Correlation & Related Pairs to Watch

💵 OANDA:USDCHF : Often moves inversely with EUR/CHF — stronger USD tends to pressure EUR/CHF lower.

💶 FX:EURUSD : Watch for bullish exhaustion here; a decline supports the bearish EUR/CHF narrative.

💷 OANDA:GBPCHF : Another CHF cross showing similar CHF strength patterns — confirming broader Swissy momentum.

📈 These pairs help validate directional bias — if CHF is strong across the board, it’s a green light for continuation on EUR/CHF shorts.

⚙️ Thief’s Blueprint Note:

Trading is an art — strategy, patience, and psychology are your real edge. Use your own levels, risk rules, and profit-taking plan. Don’t copy blindly — learn the rhythm, not just the recipe.

🔥 If you value structured swing setups & strategic planning — drop a like, follow, and comment your view below!

Let’s see how the market respects this Thief Blueprint. 💎

EUR/CHF – MACD Momentum Analysis (Sell Bias) Take Profit:0.92902Quantum Pulse Professional Market Outlook

The EUR/CHF pair has generated a strong SELL signal under the MACD Momentum framework. Current price action shows clear signs of weakening bullish pressure, with momentum gradually tilting in favor of sellers. The structure remains highly technical, with no major fundamental catalysts interfering, making this setup clean and actionable.

📌 Signal Summary

Bias: SELL

Model: MACD Momentum

Volatility: Moderate

Risk/Reward: ~1:2.5

Session: Any (broad liquidity)

This signal is supported by momentum divergence across the last 200 bars, indicating exhaustion of the bullish leg and potential continuation of the broader bearish structure.

📊 Technical Outlook

1. Momentum & Structure

MACD shows bearish momentum acceleration, with histogram contracting upward and signal lines positioned for downward expansion.

Price is trading firmly below a micro-resistance cluster and struggling to break higher — a classic sign of trend exhaustion.

Candle bodies are shrinking near resistance, indicating buy-side weakness.

2. Market Conditions

Liquidity remains stable across overlapping sessions.

No high-impact CHF or EUR announcements within the next few hours, keeping the pair technically driven.

EUR remains soft across the board, increasing correlation pressure on EUR/CHF.

📌 Key Technical Levels

Level Type Price

Immediate Resistance 0.93245

Immediate Support 0.93185

Major Resistance 0.93275

Major Support 0.93155

Price is currently reacting beneath 0.93245 resistance, a level that historically triggers intraday reversals.

🎯 Trade Parameters

Entry: 0.93215

Stop Loss: 0.93372

Take Profit: 0.92902

This places the stop above both the immediate and major resistance zones, protecting the trade from intraday noise. The TP aligns with the next liquidity pocket below the 0.93155 support — a high-probability target.

🧠 Trade Rationale

Bearish divergence aligning with MACD momentum shift.

Price pressing against resistance with no bullish follow-through.

Market sentiment favors CHF strength in low-volatility periods.

Clean downside liquidity pool visible toward 0.92900 zone.

📉 Risk Management Guidance

Risk only 1–2% of account capital.

Consider enabling a trailing stop once price breaks below 0.93155.

Monitor volatility spikes around EUR macro sessions.

If price closes above 0.93372, bearish bias becomes invalid.

📌 Analyst Conclusion

EUR/CHF is showing high-quality bearish confluence, with momentum, structure, and liquidity all favoring downside continuation. As long as the pair remains capped under intraday resistance at 0.93245 – 0.93275, selling pressure should dominate toward the 0.92900 region.

EURCHF Forming Bullish WaveEURCHF is currently trading at a key demand zone where price has reacted multiple times in the past. After a steady decline from the September swing high, price is now retesting the horizontal support range around 0.9280–0.9300, which has previously acted as a strong decision point for buyers. If this zone holds again, I expect a corrective bounce back into the 0.9340–0.9360 supply area before the market decides its next leg. However, if price fails to reclaim that resistance, sellers may use it as a fresh distribution point for continuation to the downside.

From a fundamental perspective, the euro remains under pressure as the European Central Bank leans toward prolonged rate cuts amid weak manufacturing data, while the Swiss franc continues to attract safe-haven flows due to lingering geopolitical tensions and persistent risk-off sentiment across global markets. This macro landscape keeps EURCHF naturally tilted to the bearish side unless there is a notable shift in inflation or growth dynamics in the eurozone.

My approach here is straightforward: I am watching for a bullish reaction from this demand zone for a short-term corrective play, but I won’t ignore the possibility of a breakdown. A clean 4H close below 0.9260 would confirm bearish continuation toward 0.9200, while a reclaim of 0.9340 would open the door for a broader recovery swing. Patience and reaction over prediction — price will reveal the direction soon.

EUR/CHF – Bearish Momentum Unfolding! MA Breakout Confirmed🎯 EUR/CHF: The Swiss Heist – Bears Taking Control! 🐻💰

📊 Market Overview

Pair: EUR/CHF (Euro vs Swiss Franc)

Strategy Type: Swing/Day Trade

Bias: 🔴 BEARISH

Setup Confirmation: Moving Average breakout validated ✅

🎭 The "Thief" Strategy Breakdown

Hey traders! 👋 Welcome to another edition of the Thief's playbook where we steal profits from the market like professionals! 😎

Current Setup: EUR/CHF is showing strong bearish momentum after breaking below key moving averages. The technicals are screaming "SHORT" louder than my broker when I hit margin call! 🚨 (Just kidding... or am I? 👀)

🎯 Trade Plan – The Layered Entry Heist

📍 Entry Strategy: "The Thief Layering Method"

Instead of going all-in like a casino gambler, we're using multiple sell limit orders (layering strategy) to build our position like a professional bank robber plans multiple escape routes! 🏦💼

Suggested Layer Entries:

🔸 Layer 1: 0.93200

🔸 Layer 2: 0.93100

🔸 Layer 3: 0.93000

OR you can enter at any current price level based on your risk appetite and market timing! ⏰

(Pro tip: You can add more layers based on your account size and risk tolerance. More layers = More stealth mode activated! 🥷)

🛑 Risk Management (The Escape Plan)

Stop Loss: 0.93400 🚪

⚠️ Important Note: Dear Ladies & Gentlemen (Fellow Thief OG's! 🎩),

I'm NOT recommending you blindly follow my stop loss. This is YOUR money, YOUR risk, YOUR decision! Set your SL based on your own risk management rules. Trade smart, not hard! 🧠💪

🎁 Profit Target (The Treasure Chest)

Target: 0.92500 🏆

Why this target?

✅ Strong support zone

✅ Oversold conditions expected

✅ Potential bull trap area (careful, traders might get trapped here!)

💡 Thief's Wisdom: Take your profits BEFORE the market takes them back! Don't get greedy – escape with your loot while the coast is clear! 🏃♂️💨

⚠️ Important Note: Dear Ladies & Gentlemen (Fellow Thief OG's! 🎩),

I'm NOT recommending you follow only my take profit level. You can secure profits at your own comfort zones! Partial profits? Full exit? It's YOUR call! Remember: Money in your account > Money on the chart! 💰

🔍 Technical Analysis Deep Dive

What's happening technically:

📉 Moving average breakout confirmed (bears in control)

📊 Price action showing lower highs and lower lows

🎯 Momentum favoring the downside

🔮 Key resistance turned support now acting as resistance (classic flip!)

The Swiss franc has been flexing its safe-haven muscles lately, and when SNB (Swiss National Bank) gets involved, the franc tends to show strength! 💪🇨🇭

👀 Related Pairs to Watch (Correlation Game)

Keep your eyes peeled on these bad boys for confirmation:

OANDA:USDCHF 💵🇨🇭 – Watch for franc strength across the board

FX:EURUSD 🇪🇺💵 – Euro weakness would confirm our bias

OANDA:GBPCHF 🇬🇧🇨🇭 – Similar safe-haven dynamics

OANDA:XAUUSD (Gold) 🥇 – Gold & CHF often move together in risk-off scenarios

Correlation Logic: If EUR is weak AND CHF is strong = Perfect storm for our bearish setup! ⛈️📉

🎓 Key Takeaways

✅ Bearish structure intact

✅ Multiple entry opportunities (layering = smart trading!)

✅ Clear risk management zones

✅ Realistic profit targets

✅ Correlation plays to monitor

Remember: The market doesn't care about your bills, your dreams, or your Lambo wishlist! 🏎️ Trade with discipline, manage your risk, and never risk what you can't afford to lose!

📢 Community Love

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ Disclaimer

This is the "Thief Style" trading strategy – just for educational and entertainment purposes! 🎭

This analysis is NOT financial advice. I'm not your financial advisor, your broker, or your fairy godmother! 🧚♀️ Trading forex carries substantial risk of loss and is not suitable for all investors. Always do your own research, trade at your own risk, and never invest more than you can afford to lose. Past performance does not guarantee future results. By using this analysis, you acknowledge that all trading decisions are your own responsibility!

Trade safe, trade smart, stay profitable! 🎯💎

#EURCHF #ForexTrading #TechnicalAnalysis #SwingTrading #DayTrading #BearishSetup #ForexSignals #TradingStrategy #PriceAction #MovingAverage #SwissFranc #Euro #ForexAnalysis #ThiefStrategy #LayeringStrategy #RiskManagement #TradingCommunity #ForexLife #ChartAnalysis #MarketAnalysis

EUR/CHF: Bearish Drop to 0.92920?FX:EURCHF is signaling a bearish move on the 4-hour chart, with an entry zone between 0.93673-0.93773 near a resistance level.

The target at 0.92920 aligns with key support, offering a clear downside play. Set a stop loss on a daily close above 0.93965 t o manage risk effectively. 🌟

📝 Trade Plan:

✅ Entry Zone: 0.93673 – 0.93773 (resistance area)

❌ Stop Loss: Daily close above 0.93965 to manage risk

🎯 Target: 0.92920 (key support zone)

Ready for this move? Drop your take below! 👇

GBPUSD Daily Forecast -Q3 | W37 | D9 | Y25📅 Q3 | W37 | D9 | Y25

📊 GBPUSD Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:GBPUSD

EURCHF Daily Forecast -Q3 | W37 | D9 | Y25📅 Q3 | W37 | D9 | Y25

📊 EURCHF Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURCHF

EURCHF Daily Forecast -Q3 | W37 | Y25📅 Q3 | W37 | Y25

📊 EURCHF Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURCHF

EURCHF – Pullback & New SetupIn my previous analysis (tagged below), I entered a short position. Price reached Reward 2, then pulled back and took me out at breakeven.

This is where you see the power of partial exit — it protects you from losses and keeps your risk low.

With this approach, I rarely see a 5% drawdown, but of course, nothing is guaranteed in trading.

The market broke my level strongly, and that’s okay. We don’t fight the market — we follow it.

Now I’m waiting for a pullback to the broken level, and I’ve also identified another nearby key zone.

If I get a valid signal at either level, I’ll enter a buy trade.

🧠 Remember: Trade with the market, not against it.

Drop the ego, drop the bias — let price lead.

EURCHF - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EUR/CHF Breakout Done , Let`s Sell To Get 100 Pips !Here is my 4H T.F EUR/CHF Chart and we have a very clear breakout and the price confirmed already by amazing bearish candle closed below my Support , So we can sell now and targeting from 50 to 100 pips .

Reasons :

1- Clear Breakout

2- Bearish P.A .

3- Clear Confirmation .

EURCHF – DAILY FORECAST Q3 | W33 | D11 | Y25📊 EURCHF – DAILY FORECAST

Q3 | W33 | D11 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURCHF

EUR/CHF Bullish Vault Raid – The Franc Robbery Begins!💣EUR/CHF Bullish Heist: Thief's Franc Escape Plan 🚨💰

🚨Asset: EUR/CHF "Euro-Franc" Forex Market

📈Plan: Bullish

🎯Entry: Any price level (No breakout entry nonsense – we're stealthy robbers)

🛑Stop Loss: 0.93200

🏆Target: 0.94300

👑Thief's Statement:

Hey Money Muggers & Market Marauders! 🥷💰

Today, we strike the Euro-Franc vault with a clean bullish heist plan. No noise, no breakout bait — just silent limit orders stacked like layers on a cake 🍰.

🎭We ain’t chasing price… we let price chase us! Smart thieves wait. Pullbacks? That’s our entry door 🧨🚪.

🔑Gameplan:

📦 Entry:

🕵️♂️Layer up your Buy Limit orders near recent pullbacks or swing lows.

⏳Wait on the 15M or 30M timeframe for the cleanest setups.

📉No breakout entries – thieves don’t chase, we trap.

🛡️Stop Loss (SL):

🧱Set at 0.93200 — hidden just below the thief's last cover zone.

🎲Risk based on your position size & how many orders you layer.

🎯Keep it tactical. One mistake and the vault closes!

🏁Target (TP):

💎0.94300 is the escape tunnel.

💨Exit fast if heat rises before the target hits. Smart thieves know when to run!

👊Scalpers’ Note:

🪝Only ride long waves — don’t swim against the current.

💣Use trailing SL to secure the loot as price climbs.

👑Big pockets? Dive in. Small pockets? Swing with precision.

🧠Why We Rob Here:

EUR/CHF fundamentals align with the bulls. We're riding sentiment, intermarket flow, and positioning from big money. COT, macro signals, and FX momentum all say: Thieves, it's go time! 🚨

📢News Alert:

❌ Avoid entries during high-impact news – it ain’t worth jail time (or stop hunts).

🎯Use a trailing SL to protect gains if caught mid-heist during volatility.

🔥Like the Plan? Hit that Boost Button 💥

Join the Thief Squad and let’s rob the FX banks together 💵💎

Catch you in the next heist drop 🐱👤🚀

EURCHF – Waiting for the Signal, Not the MiracleWe are currently in a great area for a potential short, and the marked zone looks ideal for an entry—but only if a valid signal confirms it.

We’re not upset if the level gets broken.

We don’t say “this strategy doesn’t work.”

Why? Because we know the market is not under our control.

If price breaks above and gives a clean pullback, we’ll go long.

Simple. No ego. No bias.

Also, the lower level marked on the chart seems to be a great zone for either taking profit from shorts or initiating fresh longs.

🎯 We follow the market, not fight it.

EURCHF - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

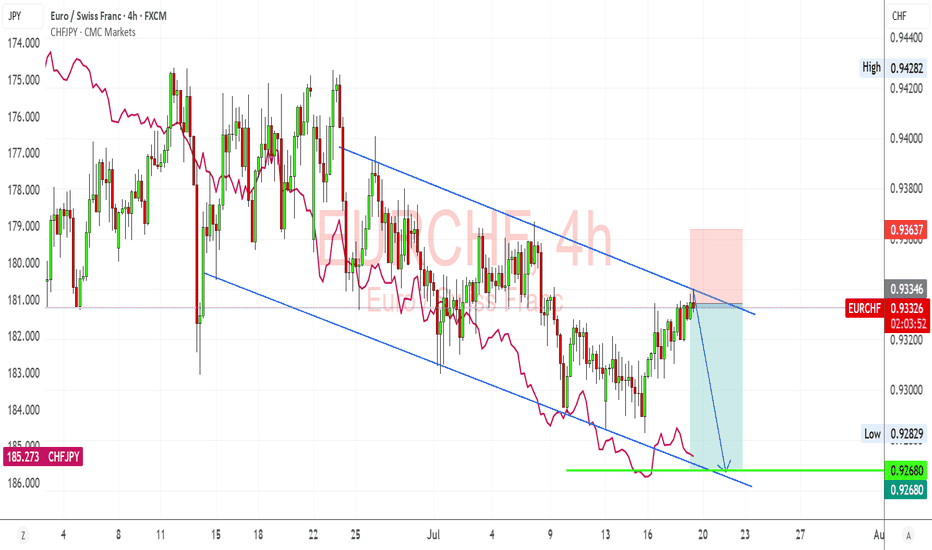

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.