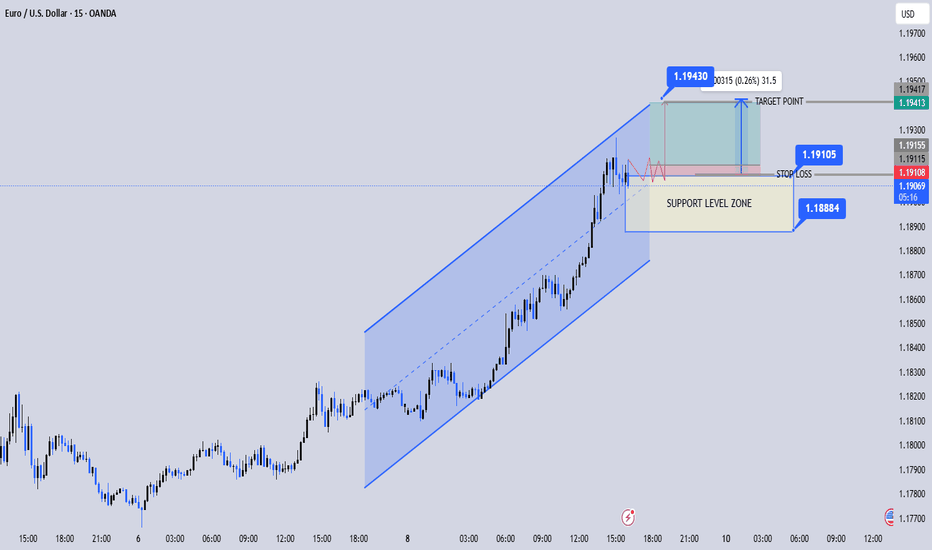

EURUSD Compression Before Breakout | Bullish Bias IntactPrice is clearly moving inside a strong ascending channel, respecting both the lower trendline and the median structure. The overall structure is bullish — higher highs and higher lows are intact.

Right now we’re seeing:

🔹 A consolidation phase just above the support zone (around 1.1899 – 1.1905)

🔹 Multiple rejections from the lower support line

🔹 Price holding above 1.1900 psychological level

🔹 Compression just below minor resistance

That’s typically a bullish continuation setup.

🔎 Trade Idea Breakdown

Entry Zone: Near current structure support (around 1.1905–1.1910)

Stop Loss: 1.19003 (below support & structure low)

Target: 1.19302 (next resistance / channel continuation zone)

Risk-to-reward looks clean, especially if price breaks above the recent consolidation highs with momentum.

🧠 What Confirms the Move?

Strong bullish candle close above current range

Break of minor resistance inside channel

Volume expansion on breakout

🚨 Invalidation

If price breaks and closes below 1.1900 support, that weakens the bullish structure and could open a pullback toward deeper channel support.

Overall Bias:

📈 Bullish continuation within ascending channel.

If you want a premium-style TradingView title, here you go:

“EURUSD Bullish Continuation Setup | Channel Support Holding for 1.1930 Breakout”

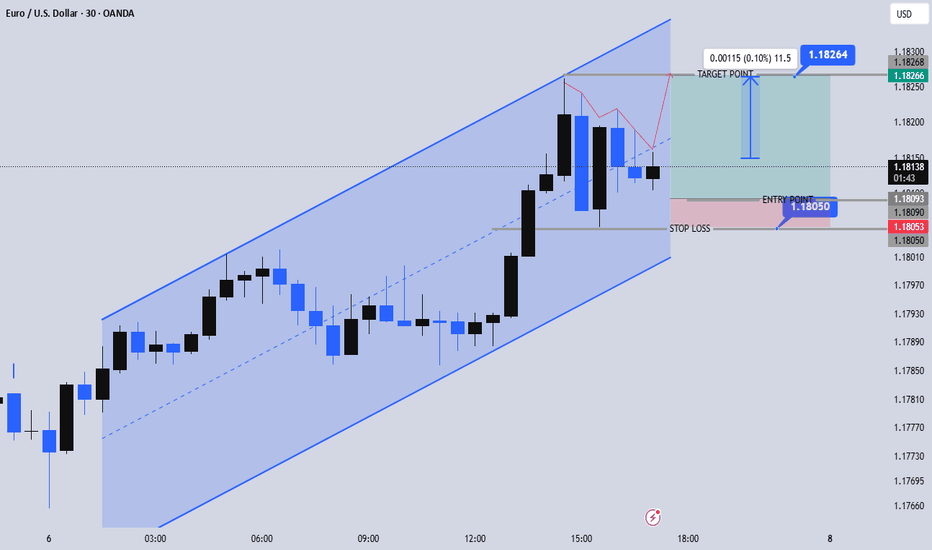

EUR TRY

Ascending Channel Structure Intact – Bulls in ControlPrice is respecting a well-defined rising channel with clear higher highs and higher lows. The recent impulse leg was strong and aggressive — that tells us buyers are in control.

Now price is consolidating near the upper half of the channel inside a support demand zone (1.1888–1.1910 area).

That’s healthy behavior. Strong moves → small pullback → continuation.

🔑 Key Levels

🔹 Support Zone: 1.1888 – 1.1910

🔹 Stop Loss Area: Below 1.1910 (structure protection)

🔹 Target: 1.1943 (channel high / resistance)

The risk-reward here is attractive if price holds the support zone and pushes higher.

🟢 Bullish Scenario (Primary)

If price continues holding above 1.1900 and we get bullish confirmation candles:

🎯 Target = 1.1940 – 1.1945

That aligns with the channel’s upper boundary.

Momentum + structure both favor continuation.

🔴 Bearish Risk

If price breaks and closes below 1.1888 support cleanly, short-term bullish structure weakens and we could see a deeper pullback toward the mid-channel.

🧠 Overall Read

Trend: Strong uptrend

Structure: Clean and respected

Setup Type: Pullback continuation

Probability: Favors upside while inside channel

This is a classic “buy the dip in trend” setup — just wait for confirmation, don’t chase the breakout candle.

EURUSD 30M Market Structure: Higher Highs & Breakout ConfirmatioClear ascending channel with consistent higher highs and higher lows.

Price respected the lower boundary multiple times (strong bullish structure).

We just got a strong impulsive breakout above recent resistance.

Current price is holding near 1.1853–1.1858 zone.

Momentum is strong. No major bearish rejection yet.

📈 Bullish Scenario (Primary Bias)

As long as price holds above 1.1830 – 1.1826 support zone:

Entry Zone: Around 1.1833 (retest area)

Stop Loss: Below 1.1826

Target Point: 1.1858 – 1.1860

Extended Target: 1.1870+

EURUSD Bullish Channel Continuation | Pullback to 1.1805 Before Structure: Strong bullish channel + pullback setup

We’re still respecting that ascending channel beautifully. Price impulsed hard to the upside, tapped the upper boundary, and now we’re seeing a healthy pullback inside structure — not weakness, just profit-taking.

Here’s the real story:

📈 Market Structure

Clear higher highs & higher lows.

Strong bullish impulse leg before consolidation.

Pullback forming above previous structure support.

Price holding mid-channel, not breaking down.

That’s bullish continuation behavior.

🎯 Trade Idea Breakdown

Entry: Around 1.1805 (pullback zone)

Stop Loss: Below 1.1803 / structure low

Target: 1.1826 – 1.1827 (upper channel + liquidity above highs)

Risk-to-reward looks solid. If buyers step in at this pullback zone, we likely retest and sweep above 1.1826.

EURUSD Break & Retest Setup – Bulls Target 1.1800Strong bullish move from the session low.

Clear higher highs + higher lows forming.

Price now consolidating just under minor resistance near 1.1800–1.1801.

Momentum is steady, not impulsive — looks like controlled accumulation before a push.

🟢 Bullish Scenario

As long as price holds above the 1.1786–1.1790 support zone, structure remains bullish.

That zone aligns with:

Previous breakout area

Intraday demand

Higher-low protection

🎯 Target area: 1.1800 – 1.1801

If buyers break and hold above that, extension toward 1.1810+ becomes realistic.

The triangle/pullback you marked suggests continuation if resistance flips to support.

🔴 Bearish Risk

If price closes below 1.1786, we get:

Structure break

Possible move back toward 1.1775–1.1770

That would invalidate the immediate continuation idea.

📌 Key Insight

This is a break-and-retest style setup.

Best entry logic = buy pullback, not breakout chase into resistance.

💡 Bias

Short-term: Bullish above 1.1786

Invalidation: Clean break below support

Target: 1.1800+

EURUSD 15M – Bullish Continuation From Channel SupportMarket Structure

Higher highs and higher lows remain intact

Recent pullback tapped channel support + intraday demand

No strong bearish displacement → bulls still in control

📐 Key Levels

Entry Zone: 1.1808 – 1.1812 (support + channel base)

Stop Loss: Below 1.1788 (structure invalidation)

Target: 1.1837 – 1.1839 (channel high / liquidity zone)

🧠 Trade Expectation

Minor consolidation or liquidity sweep may occur first

Holding above channel support favors bullish continuation

Break and close above recent highs could accelerate momentum

⚠️ Invalidation

Strong 15M close below 1.1788 would break the channel and shift bias to bearish.

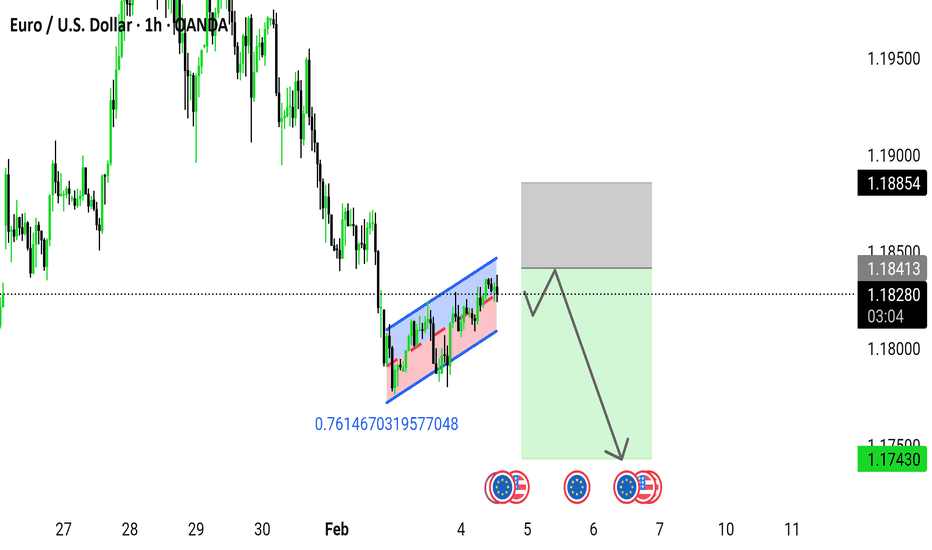

EURUSD – 1H Technical Analysis Price is moving inside a descendEURUSD – 1H Technical Analysis

Price is moving inside a descending channel, showing short-term bearish structure, but it’s currently reacting from a key support zone, hinting at a possible corrective bounce.

Structure & Key Levels

🔽 Trend: Bearish channel (lower highs & lower lows)

🟫 Support zone: 1.1789 (channel lower boundary)

🟢 Entry area: ~1.1867

🔴 Stop loss: 1.1789

🎯 Target: 1.1900 – 1.1906

Scenario

As long as price holds above 1.1789, a pullback to the upside is likely.

The move would be a counter-trend correction, not a full trend reversal unless price breaks and closes above the channel.

Rejection from the upper channel line may resume selling pressure.

Trading Idea

📈 Buy from support → target mid/upper channel

⚠️ Conservative traders should wait for bullish confirmation candle near entry.

Bias

Short-term: Bullish correction

Overall structure: Still bearish

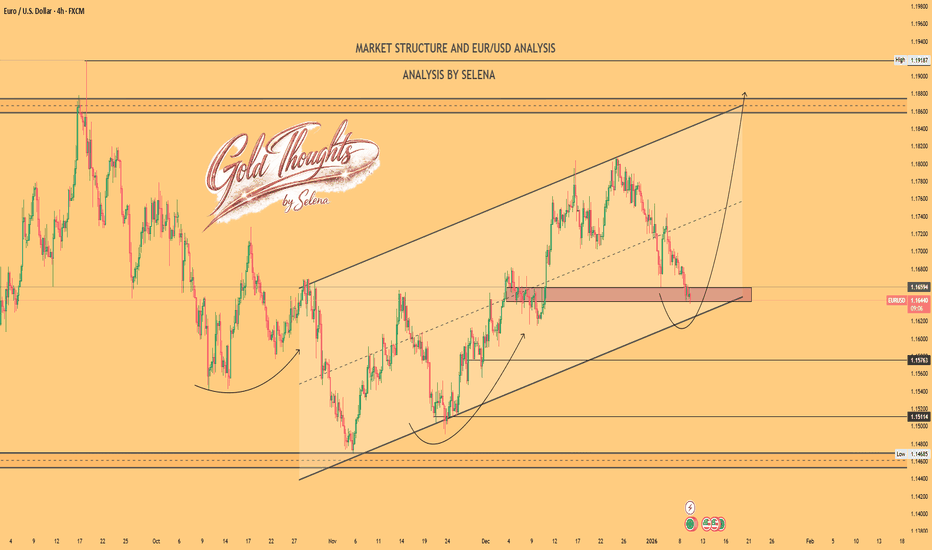

Selena | EURUSD – 4H | Higher-Timeframe Channel Support ReactionFX:EURUSD

After a strong bullish expansion toward the upper range highs, price entered a corrective phase. The current decline has reached a confluence zone consisting of prior support and channel support, where selling momentum has slowed. This suggests potential for a technical bounce as long as structure holds.

Key Scenarios

✅ Bullish Case 🚀

If price holds above the current demand zone and respects the ascending channel:

🎯 Target 1: 1.1720

🎯 Target 2: 1.1800

🎯 Target 3: 1.1880 – 1.1900

❌ Bearish Case 📉

A decisive 4H close below 1.1575 would break the channel structure and open the door toward lower liquidity levels near 1.1510 – 1.1485.

Current Levels to Watch

Resistance 🔴: 1.1720 – 1.1800 – 1.1880

Support 🟢: 1.1640 – 1.1575

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

EURUSDBased on the chart structure, price is moving in line with the prevailing trend, with momentum confirmed by consecutive strong candles and sustained positioning relative to key dynamic levels. Recent swing behavior suggests continuation is favored unless price fails to hold the last valid reaction zone, which would signal a corrective or range phase.

Key Levels (Support & Resistance)

upport: Last major higher low / reaction zone formed at the start of the latest impulse

Support: Mid-range consolidation area inside the current trend

Resistance: Most recent broken swing high acting as the next supply zone

Resistance: Projected target based on the pre

vious impulse leg extension

FX:EURUSD

EURUSD: Strengthening and Steps Towards GrowthIn December, EURUSD shows signs of strengthening after the recent correction. The pair is gradually shifting upward: impulses are becoming more confident, while pullbacks remain limited. This indicates stronger buyer positions.

The current structure is forming a base for continued upward movement. Consolidation at local levels creates conditions for energy accumulation, which often precedes a new impulse.

The fundamental backdrop also supports the euro: expectations of a dovish Federal Reserve policy and stabilization of the eurozone economy increase interest in the asset. As a result, EURUSD has a chance to hold above current levels and develop a new trend.

Thus, the pair is in a strengthening phase, where the market’s next steps will determine the scale of future growth.

EURUSD 2H – Breakout + Retest Continuation PlanFX:EURUSD

Price has broken structure to the upside and is now approaching a key reaction zone. A controlled pullback toward the 1.1550–1.1560 entry zone would confirm demand and provide a cleaner continuation setup toward higher liquidity.

As long as price remains above 1.1505, bullish structure remains valid.

Key Scenarios

✅ Bullish Case (Primary Bias)

Hold above 1.1550–1.1560

→ 🎯 Target 1: 1.1620

→ 🎯 Target 2: 1.1670–1.1680 major liquidity target

❌ Bearish Invalidation:

Break and close below 1.1505 stop loss zone flips structure bearish.

Current Levels to Watch

Support: 1.1550 / 1.1505

Resistance: 1.1620 / 1.1670–1.1680

⚠️ This analysis is for educational purposes only — not financial advice.

EURUSD 15m — Breakout + Retest Setup | Bullish ContinuationFX:EURUSD

Price has formed a clean V-shaped recovery and broke above the previous structure range, confirming a bullish continuation bias. Market is now approaching a minor supply zone, and a controlled pullback toward the entry zone at 1.15511–1.15800 would offer the best risk-to-reward setup.

If price holds above structure and retests cleanly, continuation toward the higher liquidity zone is expected.

Key Scenarios

✅ Bullish Case 🚀

Retest entry zone (1.15511–1.15800)

→ 🎯 Target: 1.16680–1.16850 (major liquidity sweep area)

📌 Best entry style: Retest confirmation / wick trap / bullish engulfing

❌ Invalidation / Stoploss:

Below 1.15050 — if broken, bullish structure is invalid.

Levels to Watch

Type Price

Target 🎯 1.16680–1.16850

Entry Zone 🟩 1.15511–1.15800

Stop Loss ❌ 1.15050

⚠️ This analysis is for educational purposes only — not financial advice.

EUR/USD (2H) Analysis – SMC + Elliott Wave ViewOn the 2H timeframe, price is respecting both SMC supply zones and Elliott Wave corrective structure.

🔹 Elliott Wave Structure:

We are currently unfolding in a Corrective A–B–C pattern.

Wave A completed with strong downside impulse.

Wave B retraced into supply zone but failed to break structure.

Now, wave C is developing, with expectation of further downside toward the 1.1650–1.1620 demand zone.

🔹 SMC Structure:

Price tapped into the sellers’ supply zone (1.1760–1.1780), aligning with previous order block and descending channel trendline.

Market structure remains bearish with lower highs & lower lows.

Liquidity below 1.1700 is the next target for smart money.

📉 Bias:

Looking for a rejection from the seller zone → continuation into the blue demand area marked as Wave C completion.

✅ Confluence:

Elliott Wave C-leg projection

Bearish order flow (SMC)

Supply zone rejection

Channel continuation

⚠️ Invalidation:

Bullish break and close above 1.1800 would invalidate this bearish scenario.

EUR/USD breakout buy alert EUR/USD Buy Opportunity

Current Price: 1.17500

📈 Buy Entry Active — Targeting higher levels

✨ Euro showing bullish momentum against USD.

✨ Buyers are holding strong support at 1.17500.

✨ Upside pressure is building for a breakout.

✨ Trend indicates further gains ahead toward key resistance.

✨ Market sentiment favors the Euro as strength continues.

⚡ Stay with the buyers — momentum is on your side!

---

Do you want me to add specific target levels (like TP1, TP2, SL) to make it look more like a professional signal?

Silver Breakout, Tech Resistance & TRY Rotation 📊🔥 Silver Breakout, Tech Resistance & TRY Rotation – Structure Meets Reality 🌍📉

Hey traders, FXPROFESSOR here 👨🏫

Today’s charts show how technical structure and real-world capital behavior can tell one powerful story. We’re watching Silver surge, Tech stall, and the Turkish Lira react to local capital flows — all aligning with clean market levels.

Let’s break it down:

🔍 Silver (XAG/USD)

Price exploded into $39.30, reaching the top of a well-defined ascending channel.

Now stalling — pullbacks toward $35.38 or even $32.17 would be natural.

🧠 Structurally strong, fundamentally backed by industrial demand, inflation hedging, and tight supply dynamics. Just not a good timing to 'ape it' today.

📉 US Tech 100 (USTEC)

Testing resistance around 23,434.

RSI and OBV show signs of exhaustion, suggesting potential pause or pullback.

In a stretched macro environment, tech is vulnerable to rotation — especially if yields shift or inflation expectations change.

💱 EUR/TRY – Turkish Lira Rotation

We just saw a sharp rejection at 47.78, a key round-number resistance.

On the ground, there’s a notable shift — My Turkish brother says 'FX profits being converted into real estate and hard assets, especially by locals and returning expats'. And I trust a good Turk as much as i trust my Greek family! (yes, we can be friends when there is respect and no hatred! common interests work best in this troubled world)

The chart reflects this move: potential drop toward 46.00 → 45.45 → 43.79 if momentum fades.

🧩 What These Charts Teach Us

This is a perfect storm where technical resistance, macro rotation, and local capital behavior all align:

🔹 Silver rising = hard assets in favor

🔹 Tech pausing = overextension risk

🔹 TRY dropping = profit-taking & capital redeployment

Trade what you see — but understand why it’s happening.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

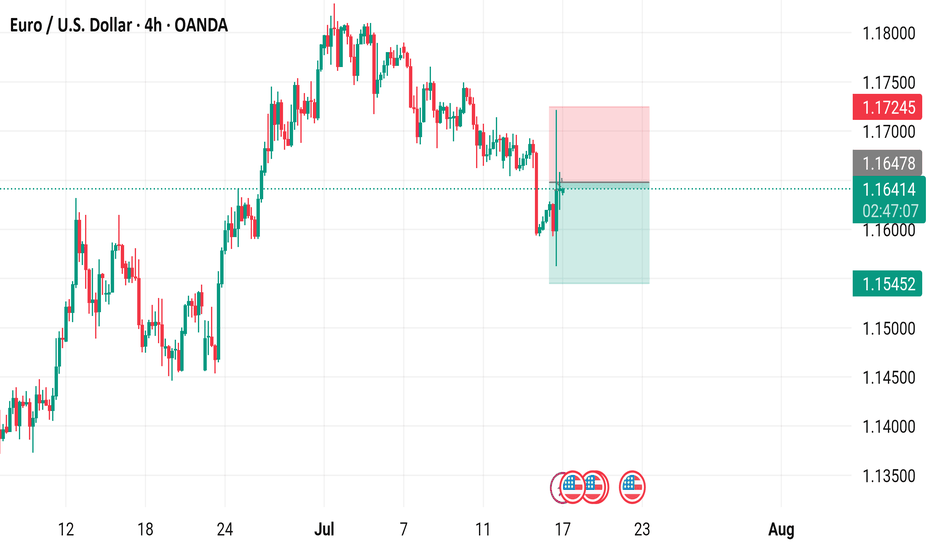

EUR/USD 4-Hour Chart - OANDA4-hour performance of the Euro/US Dollar (EUR/USD) currency pair on the OANDA platform as of July 17, 2025. The current exchange rate is 1.16408, showing a slight decline of 0.01%. Key levels include a buy signal at 1.16417 and a sell signal at 1.16399, with recent price action ranging between 1.1452 and 1.17245. The chart includes candlestick patterns and shaded areas indicating potential resistance and support zones.

EUR/USD 4-Hour Chart Analysis (ONDA)Euro/US Dollar (EUR/USD) exchange rate over a 4-hour interval, sourced from ONDA. The current rate is 1.16177, reflecting a 0.08% increase (+0.00093). The chart highlights a recent upward trend, with a resistance level around 1.16746 and a support zone between 1.15439 and 1.16000, as indicated by the shaded areas. The time frame covers late June to early July 2025.

EUR/USD 2-Hour Chart Analysis2-hour candlestick chart for the Euro/U.S. Dollar (EUR/USD) currency pair, sourced from OANDA, as of June 23, 2025. The current exchange rate is 1.14705, reflecting a 0.45% decrease (-0.00517). The chart highlights recent price movements, with a marked resistance zone around 1.15218 and a support zone near 1.14483. An upward trend is indicated with an arrow, suggesting potential price action toward the resistance level.

EUR/USD Potential Reversal from Resistance Zone –Bearish OutlookThe EUR/USD pair has been trading within a well-defined ascending channel for several weeks. Price recently tested a strong resistance zone near 1.15850 – 1.16000, which aligns with the upper boundary of the channel and a previously marked supply area.

Key observations:

The price action shows signs of rejection from the resistance zone with a potential double-top or fakeout pattern forming.

A projected bearish trajectory is marked, suggesting a possible break below the channel support.

Immediate bearish targets are set at key demand zones around 1.14500, 1.12500, and further down to 1.10500.

A large red arrow indicates the strong downside bias if the price confirms the breakdown.

Conclusion:

If EUR/USD fails to sustain above the 1.15850 resistance zone and breaks below the ascending channel, a strong bearish correction is anticipated. Traders should watch for confirmation of the breakdown before entering short positions.

EUR/USD Bearish Reversal AnalysisEUR/USD Bearish Reversal Analysis 📉🧭

🔍 Technical Breakdown:

Trend Structure:

EUR/USD was trading inside an ascending channel, respecting both support and resistance trendlines.

🔴 Double Rejection at Resistance:

Price action faced strong rejection near the upper boundary of the channel and resistance zone (~1.16500), forming a lower high, suggesting bearish exhaustion.

🟠 Key Breakdown Zone:

A critical horizontal support around 1.13560 has been identified as a short-term target zone. This level previously acted as a demand zone and now may be retested.

🔽 Forecast Path:

A projected bearish wave is anticipated:

A potential pullback or consolidation may occur before resuming the downtrend.

Once 1.13560 is broken, price could drop further toward the major support zone around 1.12000, marked by the previous accumulation area.

🟦 Support Zone:

This final target aligns with a major structural support from late May, strengthening the bearish outlook if the breakdown continues.

📌 Conclusion:

EUR/USD is showing signs of a bearish reversal after failing to sustain above resistance. As long as it remains below the mid-channel region, further downside toward 1.12000 is likely, with 1.13560 as the key short-term level to watch.

Mr. Wave Says... It’s Time for the Last Push!”[ b] EUR/USD is forming a clean Elliott Wave structure — and guess what?

We’re at Wave 4 consolidation, and Wave 5 is about to explode upward!

🔍 Here's what we're seeing:

✅ Wave 1 to 3 already confirmed with solid impulse

✅ Wave 4 found support near previous breakout zone

🎯 Target: Upper supply zone where Wave 5 is likely to terminate

🔔 This isn’t the time to sleep on the charts. Mr. Wave is literally pointing to the target zone — and we’re not ignoring it. 😉

---

🧠 Pro tip:

Use tight risk management, ride the final push of the motive wave, and watch for reversal signals in the supply zone.

---

📌 #GreenFireForex #ElliottWave #Wave5 #ForexTrading #TechnicalAnalysis #EURUSDSetup #ForexReel #WaveTheory #SupplyZone #ForexSignal #SmartTrading