EUR/USD WEEKLY ANNALISE 03-07 NOV 2025 🕓 5️⃣ ENTRY STRATEGY (LOWER TIMEFRAME CONFIRMATION)

The chart note says:

“Take sells on LTF confirmation — 5M TF would be best.”

Meaning:

Don’t just sell blindly at OB/FVG.

Wait for confirmation on the 5-minute chart, such as:

Liquidity sweep (taking out short-term highs)

CHoCH / BOS (Change of Character)

FVG entry / OB retest in the 5M TF

This ensures precision entries with smaller stop loss and higher R:R.

🎯 6️⃣ TARGET ZONES (TAKE PROFIT AREAS)

There are three major downside zones:

Target Zone Price Area Description

Daily BPR ~1.1460 First key liquidity target; expected strong reaction here

Daily Imbalance (below) ~1.1420–1.1430 Second target; continuation zone

Monthly Next BISI/BPR (Next DOL) ~1.1370–1.1400 Final target zone — likely where a deeper reversal or pullback starts

Essentially, the analyst expects:

Retracement up → Tap into OB / FVG → Strong sell-off → Reach 1.1460 → Possibly extend to 1.1370 zone.

📉 7️⃣ EXPECTED PRICE MOVEMENT SUMMARY

Step-by-step projection:

Retrace Upward

Toward 1.1580–1.1620 (fill FVG + retest H4 OB)

Trigger Institutional Selling

After filling those imbalances, expect bearish rejection.

Drop Toward 1.1460

Hit Daily BPR (liquidity pool target)

Deeper Extension

Potential move to 1.1370–1.1400 range — the monthly rebalancing zone (next DOL).

⚙️ 8️⃣ OVERALL OUTLOOK

🔸 Bias: Bearish

🔸 Short-term: Retracement up to OB/FVG zone (sell zone)

🔸 Medium-term: Drop toward 1.1460

🔸 Long-term: Possibly extend to 1.1370–1.1400

🔸 Best entry confirmation: Wait for 5M liquidity sweep + CHoCH at sell zone

💬 9️⃣ Key Takeaway (Trader’s View)

This chart tells a story of smart money behavior:

Institutions engineered liquidity at the highs (London sweep),

Are now retracing up to rebalance price (fill FVGs / OBs),

Then planning to drive price lower toward unfilled inefficiencies and liquidity below.

So the goal for the trader:

Sell from premium zones (OB/FVG) → Target liquidity below → Manage risk with 5M confirmation.

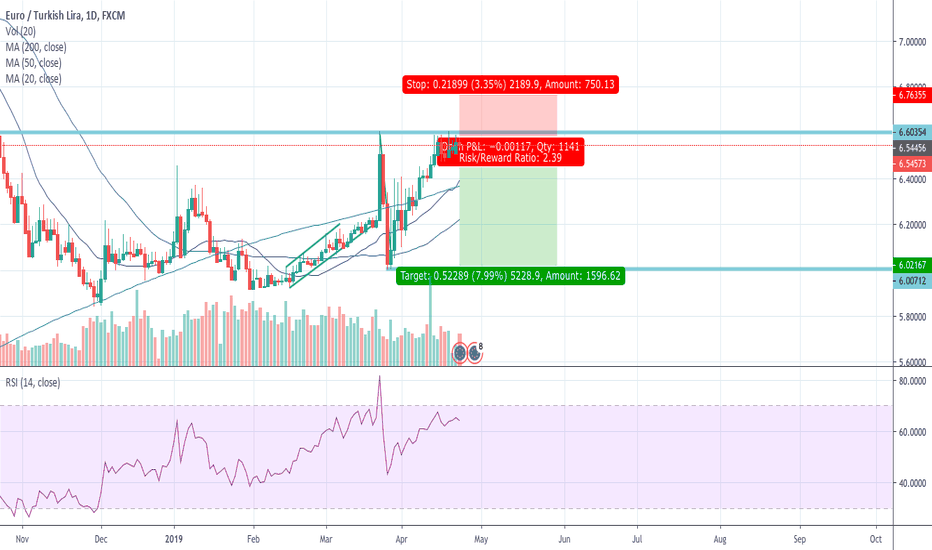

Eurtryshort

EUR/TRY Possible 3,500 pip Short Opportunity - A Watch for NowFor demonstration and educational purposes only. Price testing a key zone. This is a watch for now. Watch for rejection and re-testing of key zone over the next couple of weeks. This could offer a possible 3.500 pip opportunity. Trade at your own risk.

EUR/TRY DOUBLE TOP SHORT SET UP & LONG BREAKOUT SET UP FIRST TIME REVISITING ALL TIME HIGHES

SELL SET UP

SELL EUR/TRY

ORDER TYPE

ENTRY 1 7.7820

ENTRY 2 7.8630

SL 8.987

TAKE PROFIT 1 7.7320

TAKE PROFIT 2 7.2320

TAKE PROFIT 3 6.320

BUY SET UP

BUY EUR/TRY

ORDER TYPE BUY STOP

ENTRY 1 7.8920

ENTRY 2 7.9830

SL 7.865

TAKE PROFIT 1 8.0320

TAKE PROFIT 2 8.4320

TAKE PROFIT 3 8.8220

EUR/TRY Possible Long OpportunityWe enjoyed selling yesterday, and price eventually closed at last month's high, with a re-test to last month's high. Could this be a re-test for a continuation up? Remember overall we are still in a buy trend and can enjoy short opportunities; however until price breaches trendline it may not be wise to open short positions. Trade with caution and do not get caught in a bear trap.

EURTRY - DAILY TECHNICAL ANALYSIS - FOREX - EUR TRY EURTRY has seen a very long and very nice up trend. Not long ago we saw some break down in that up trend. As I see it, price action looks to give a 'failure to continue trend' signal as it attempted a short up trend here recently. Red line was the optimal entry, I doubt we will see that level again but we may and in my opinion its still not too late to find a short position. If I were short I would take profits at lines bellow entry with stop at previous high.

Clearly not financial advice.

Analysis of EURTRY 17.10.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 6.5500

• Take Profit Level: 6.0000 (500 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 6.4800

• Take Profit Level: 6.4600 (200 pips)

USDJPY

A possible long position at the breakout of the level 108.90

GOLD

A possible short position in the breakdown of the level 1476.00

USDCHF

A possible long position at the breakout of the level 0.9910

EURUSD

A possible long position at the breakout of the level 1.1095

EURTRY setup-EURTRY short term RSI (H4 chart) is in oversold zone

-The price is at support level

-Long on short term and close near 6.37

-The best place to entry short position is near 6.37

-The short position is good for short and long term too.

-In long term the price can go completely to February low near 5.9