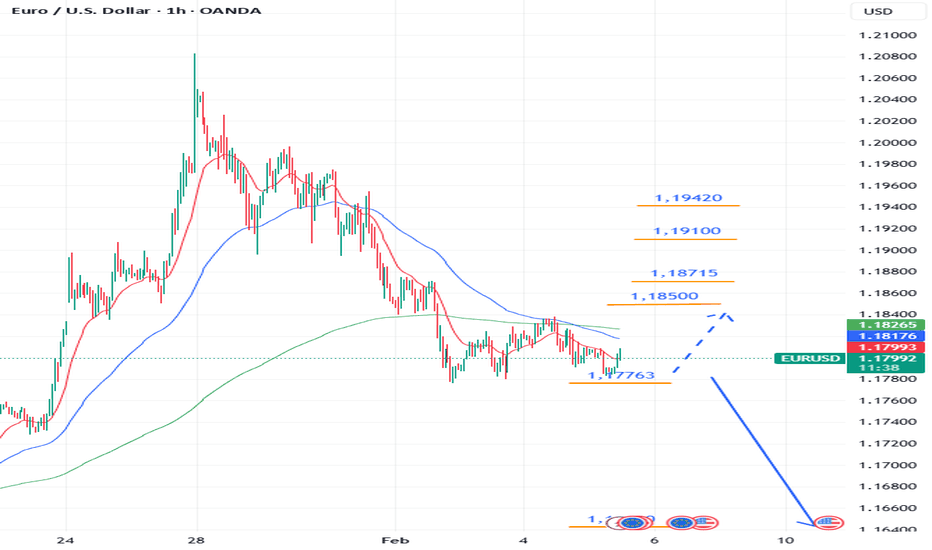

Coinranger|EURUSD. Continued decline🔹DXY continues to move higher. Potential to reach 98.353 - the first extension of the upward move

🔹This evening at 18:00 UTC+3, the JOLTS employment report

🔹The earnings season continues in the US.

By level:

Above

1.18500 - first upward move

1.18715 - or here

1.19100 - full upward move

1.19420 - first extension

Below

1.17763 - full downward move

1.16500 - first downward extension

There's a chance of a slight pullback and then a further decline, or a significant drop from the current level. There are a potential early stops possible at M15 levels.

---------------

Share your thoughts in the comments!

Eurusdforecast

Coinranger|EURUSD. Potential return to growth🔹DXY has made its first wave up. The potential of a move is still up to 97.43, but we could already be starting to reverse.

🔹Manufacturing PMI (18:00 UTC+3) and budget funding vote today

🔹The earnings season continues in the US

Levels:

Above

1.21657 - first extension up

1.20657 - full set up

1.20000 - first wave up

Below

1.18470 - first wave down

1.17763 - full set down

1.16500 - first extension down

The situation is unclear for now. While the PMI will influence the trend, it's difficult to say how the pice will react on the vote. Let's watch the US session.

---------------

Share your thoughts in the comments!

EUR/USD - Buy Entry (H1 - Flag Pattern)The EUR/USD Pair, Price has been trading within a Flag Pattern on the H1 chart, forming consistent higher highs and higher lows. Price action is now testing the upper boundary of the Pattern, signalling a possible breakout. FX:EURUSD

✅Market Context:

1️⃣Strong Upward Structure Inside the Pattern.

2️⃣Buyers are showing strength near Resistance.

3️⃣Breakout above the Trendline indicates Momentum continuation toward higher zones.

✅Trade Plan:

Entry: Buy after Confirmed Breakout above the Resistance (H1 candle close above trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – a Major Resistance area identified ahead.

🛑Stop Loss (SL): Below the Pattern Structure.

✅Psychological Discipline :

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as Part of the Strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

Coinranger|EURUSD. Uncertainty at 1.19906🔹DXY has completed a full set of downward extensions on h1. Ideally, it should pullback, but its size is still uncertain. We could continue to fall.

🔹Today at 22 UTC+3 is the Fed rate. At 22:30 UTC+3 is the FOMC press conference. The rate is expected to remain at the same level as before - 3.75%.

🔹It's earnings season in the US.

Levels:

Above

1.12319 - the first extension on the h4

1.21042 - the first extension on the h1

1.20600 - a full set on the h4

Below

1.19100 - potential pullback if we don't hold at current levels soon or don't move higher.

It's difficult to say anything specific yet; minor movements are occurring on the euro on the m5/m15, which will likely determine our next move by this evening.

---------------

Share your thoughts in the comments!

Coinranger|EURUSD. Potential for a decline to 1.17619🔹DXY fell even more overnight than on Friday. It could go even lower, but it's unlikely to do so without a reversal.

🔹No interesting news on the euro today.

🔹Earnings season is starting in the US, but there's nothing particularly interesting there today.

According to current levels on EUR:

Below:

Preliminary wave set for M15

1.17924

1.17619

1.17060

Above:

1.18448 - the end of the first upward extension

1.18752 - the end of the second upward extension (we may return here)

1.19135 - the first wave in a new set

After a significant rise, we're likely to correct today, most likely to 1.17619

-------------------

Share your thoughts in the comments!

EURUSD entry candle has formed?EURUSD 1h just bouncing off the orderblock after a short pullback market is just resuming the uptrend towards the longer term trend.

The pullback is has few strong liquidity sweep, tested the both 10ema and 20ema, grabbed liquidity from support level showing a higher confluence for the price potenatilly close above 1.1807 before weekend close ?

Coinranger|EURUSD. Uncertainty at 1.17375. Continued🔹Yesterday, the DXY failed to achieve a reversal, and today there's nothing left to do one.

🔹Davos continues.

🔹All the interesting news on the euro has already been released at the time of this post issue.

The levels are the same:

Below:

Will be recalculated on Monday.

1.16827 - the first wave down on m15

1.16470 and 1.16200 - a potential first wave down on h1

Above:

1.17658 - 1.17788 - the first potential wave in a new uptrend. This is a full set on m15

1.17917 - additional level above on m15 (not marked on the chart)

So far, the story looks more like growth, but there's simply nothing to support a serious one. Therefore, we're moving within the old markings.

------------------

Share your opinion in the comments

Coinranger|EURUSD. Uncertainty at 1.17375🔹DXY has finally decided to fall and has already reached the potential pullback area of 98.3. A non-pullback down to 98.1 is still possible. We'll have to watch what happens next.

🔹Davos continues.

🔹During the DXY decline, the euro made a wave set and its first extension. The second is at 1.17375 - potential pullback point.

Levels:

Below:

Levels are tentatively calculated; it's difficult to say more precisely until the uptrend is complete.

1.16510 - first potential wave down

1.16267 - complete set down

Above:

1.17375 - second extension of the upward waves set, we'll likely take it.

1.17658 - 1.17788 - first potential wave in a new uptrend. This is a new, complete set for M15.

We're waiting for the DXY to behave from 98.1. For now, it's time to wait.

-------------------

Share your thoughts in the comments.

Coinranger | EURUSD. Continued decline to 1.15539🔹The DXY has faded a bit in its rise, but there's no clear indication of a significant reversal on the elder timeframes yet. So, it's very likely that after the pullback is realized, we'll continue to rise to the 99.23 area and higher, to 99.44.

🔹No news today, except for the International Economic Forum in Davos. There's no significant news for the euro this week, except for Friday.

🔹So, we're continuing to decline.

Levels

Below:

1.15700 - second downward extension from the old set

1.15539 - first downward extension from the new set

1.15310 - second downward extension from the new set

Above:

Potential pullback level, but not guaranteed to materialize.

1.16570 - first potential upside wave.

While the DXY is rising, the euro is falling.

-------------------

Share your thoughts in the comments.

Coinranger | EURUSD. Continued decline to 1.16254🔹The DXY continues to rise and will likely continue without significant pullbacks for some time. Prospects: at least 99.1. Then the movement will need to be recalculated.

🔹Today at 16:30 (UTC+3) will issue data on PPI for December and October. Retail sales data will also be released at the same time.

🔹And the euro continues to decline.

Levels

Below:

1.16254 - a full set of downward waves.

1.15953 - the first downward extension.

1.15723 - the second downward extension.

Above:

Potential pullback levels until we break the January 9th peak.

1.16732 - first potential upward wave.

1.16846 - a full set of upward waves.

While DXY rises, the euro will fall.

EURUSD Trade Still Valid AFTER Invalidation Break - Here's WhyEURUSD: Trade Valid After Invalidation - Lower Risk Entry

Price broke the invalidation point once, but this presents us with an even better low-risk entry opportunity. Here's why the trade remains valid.

📊 What Happened:

Original Invalidation: 1.1763

Price Action: Broke above invalidation point briefly, then rejected back down.

Current Status: Trade remains VALID with improved risk profile

💡 Why This WORKS:

Key Principle:

When price tests your invalidation level and fails to hold above it, it confirms weakness rather than invalidating the trade. This is called a failed breakout or liquidity grab.

What the Break Told Us:

✅ Buyers tried to push higher (tested invalidation)

✅ Failed to sustain above the level (rejection)

✅ Confirms exhaustion and bearish bias

✅ Creates lower risk entry on the rejection

🎯 Updated Trade Setup:

Entry: 1.1763 (or current price on rejection)

New Stop Loss: 1.1775

Target: Break below 1.0703 (Momentum Low 3)

Risk: Reward: Now IMPROVED (lower risk due to tighter stop)

📚 Trading Lesson:

Invalidation ≠ Automatic Exit

When your invalidation gets tested:

If it holds above → Exit the trade (truly invalidated)

If it rejects back → Opportunity to re-enter with lower risk

This is advanced price behaviour reading.

The failed break above invalidation actually strengthens the bearish case:

Shows buyer exhaustion, Creates trapped longs above, Confirms sellers in control.

🌊 Wave Structure Remains Intact:

Wave 4 Pullback: Extended slightly higher

Wave 5 Expected: Still anticipates break below 1.1703

Structure: Bearish sequence intact

The higher test doesn't change the wave count—it just gave us better confirmation and a tighter entry.

⚠️ Risk Management:

If price closes ABOVE the rejection high:

Then true invalidation occurs. Exit immediately.

Current Plan:

Tighter stop = lower risk

Same target = same reward

Better R:R ratio

Summary:

Original invalidation tested and rejected ✓

Failed breakout confirms bearish bias ✓

Lower risk entry opportunity created ✓

Wave structure remains valid ✓

Improved risk: reward ratio ✓

This is why understanding price behaviour > rigid rules.

👍 Boost if this lesson on invalidation helps

💬 Have you experienced this? Share below

EURUSD ANALYSIS & FORECAST | Wave Structure That WORKSEURUSD MARKET ANALYSIS & FOREX FORECAST: Wave Structure Breakdown

Complete market analysis using wave structure methodology. High-probability sell entry executed with 2:1+ risk: reward targeting break below momentum low.

📊 TOP-DOWN MARKET ANALYSIS:

Recent High: 1.18042 (Tuesday, 17th December 2025)

Since making this momentum high, EURUSD has been attempting to complete its bearish secondary trend (pullback/correction phase).

🌊 1HR CHART WAVE STRUCTURE:

Wave Count Analysis:

Price has printed two momentum lows:

Wave 1 Momentum Low ✓

Wave 3 Momentum Low @ 1.17024 ✓

Current Position: Wave 4 (Bullish Pullback)

The current bullish run is Wave 4, a pullback from Momentum Low 3 to a structural point. This wave should terminate below Wave 2 (trend invalidation point).

🎯 FOREX FORECAST - What's Next:

Expected Move:

Once Wave 4 completes, we expect a break below Momentum Low 3 (1.17024) to form Wave 5 and complete the larger bearish structure.

💡 Why This WORKS - Objectivity Through Structure:

This market understanding and price behaviour analysis allows us to be:

✅ Objective - No emotion

✅ Clear - No guessing

✅ Strict - Follow the rules

We know exactly what we're looking for and when to act.

🔬 ADVANCED EXECUTION - Internal Wave Analysis:

Method: Isolating the minor wave within the major swing

Focus Area: Wave 4 → Wave 5 (final leg of this Wave 4 structure)

Fractal Nature Applied:

Counted the internal bars based on fractal, what WORKS on big timeframes WORKS on small timeframes. This is the beauty of understanding the wave structure.

💼 TRADE EXECUTION:

Entry: Internal Wave 5 completion @ 1.07454

Why This WORKS:

This timing is a key component of the WavesOfSuccess methodology because it provides:

✅ High-probability entries

✅ Low-risk execution

✅ Optimal entry at reversal point

Stop Loss: 1.1763 (17.6 pips risk)

Target: Break below 1.1703 (72.4 pips potential)

Risk:Reward: >2:1 (2.05:1 minimum, potential for more)

Key Principle:

Wave structure provides the roadmap. Fractals ensure consistency across timeframes. Precision timing creates asymmetric risk: reward opportunities.

This is market analysis that WORK, it is mechanical, objective and repeatable.

👍 Boost if this market analysis helps

👤 Follow for continued EURUSD FOREX FORECAST updates

EURUSD Short Term Buy Trading Opportunity SpottedH4 - Price has made a turn around

Expecting short term bullish moves to happen until the two strong support zones hold

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.

EUR/USD – H1 Wedge Breakout |Bullish Momentum Targeting 1.1600📌 Setup Overview FX:EURUSD

EUR/USD has broken out of a falling wedge on H1, signalling a potential bullish trend reversal.

Price has reclaimed the Ichimoku cloud — now acting as support, showing fresh buyer strength.

• Pattern: Wedge Breakout Pattern

• Timeframe: H1 Chart

• Bias: Bullish

• Reason for setup: Breakout & Retested

🎯 Trading Plan

• Entry idea: Retest of breakout zone for confirmation before continuation

• TP1: 1.15886 (1st Resistance)

• TP2: 1.16148 (2nd Resistance / liquidity sweep zone)

🧠 Fundamental Drivers

1️⃣ 80% probability the Federal Reserve cuts rates in December → weaker USD supports bullish EUR/USD

2️⃣ Upcoming high-impact data to watch:

• EUR – German GDP

• USD – Core PPI

• USD – Retail Sales

Fundamentals currently favour bullish EUR side, with USD losing momentum.

#EURUSD #forex #forexanalysis #priceaction #chartanalysis #technicalanalysis #fundamentalanalysis #tradingview #supportandresistance #smartmoney #breakout #wedgebreakout #ichimokucloud #marketstructure

📌 What to expect

Break/retest continuation structure suggests 1.1588 is the first magnet.

If momentum remains strong, price could extend to 1.1614 liquidity zone.

🔖 SAVE this post so you don’t miss the update when levels hit.

👍 LIKE if you want more Wedge & Breakout setups.

⚠ Disclaimer:

Trade for education/study only. Manage risk according to your own system.

EURUSD Bullish for 1.1560#eurusd daily chart bearish forming lower low and lower high. broke down strong trendline strong support level 1.1528 which is low of 5th August. suspect price may drop further to test previous demand 1.1420-1393. which is the level of interest for buying short term. stop loss below 1.1375, target: 1.1560

Euro Eyes Breakout Ahead of Rate DecisionFenzoFx—EUR/USD is trading lower today, below the descending trendline. The price has been reacting to the ascending trendline multiple times as shown on the chart. There is a double bottom formed at $1.1584, which could limit the upside momentum as liquidity rests below them. As we approach the US interest rate decision, we expect Euro to trade higher against the U.S. dollar and break above the descending trendline.

In this scenario, Euro could rally to 1.1766, followed by 1.1830. On the flip side, if Euro remains below the descending trendline, the price could target the double bottom at 1.1584, as sell-side liquidity is resting below this level.

EUR/USD Forecast: How I Plan to Trade the Euro Next WeekOn the daily chart, we can see the formation of a new trading range as a result of interaction with the weekly key level. We can mark D FVG as a zone of interest from which I would like to work on continuing the trend in long. Entry into the position will be executed upon confirmation of the volume on the 4-hour chart.

If you found this useful, please write about it in the comments. Feedback is very motivating to publish more useful material.

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Wait Zones for Euro After Accelerated DowntrendFenzoFx—Euro's downtrend escalated after Germany's exports data fell by 0.50%. Currently, the equal lows at $1.1574 are in focus. This level will likely be targeted by bears.

From a technical perspective, we expect EUR/USD to consolidate after tapping into the liquidity below $1.1574. In this scenario, the market will likely rise toward $1.1704 or a higher resistance level. In the longer term, we expect the downtrend to resume toward the bullish fair value gap with support at $1.1438.

Please be aware not to grab a falling knife, because the current price does not offer a premium entry to join the bear market. We advise waiting for the Euro to consolidate after profit-taking at or below the equal lows.

Euro May Drop Toward $1.1656FenzoFx—Euro traded higher today, up by 0.33%; however, the uptrend eased after the price reached the equal highs at $1.1807. However, the volume profile formed lower lows, meaning the current uptick in momentum could be fake.

The immediate support rests at $1.1761. From a technical perspective, a close below this level can trigger the downtrend. If this scenario unfolds, Euro could target the lows at $1.1656.