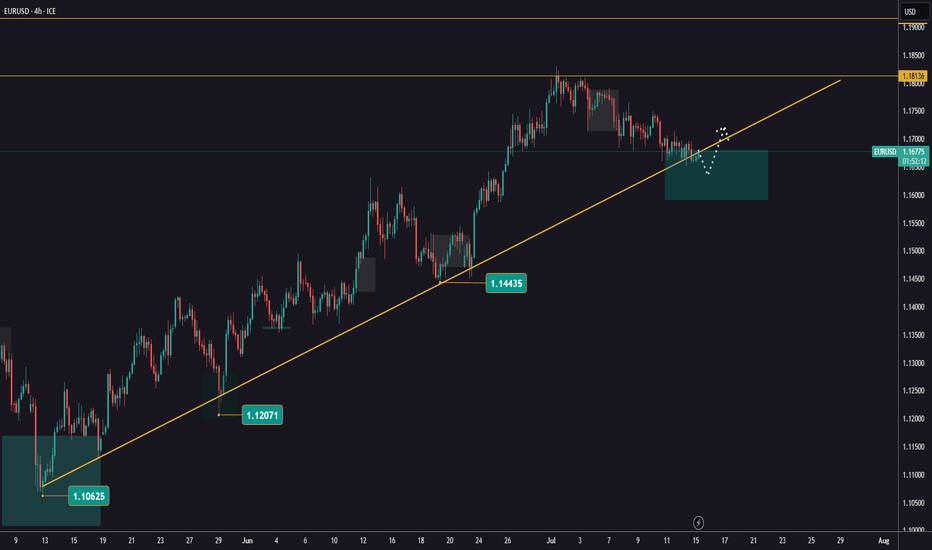

The uptrend continues EURUSD has maintained strong performance this week.

Yesterday it once again attempted to push higher, showing that the bullish momentum is still there.

During a pullback, the key support levels to watch are 1,1608 and 1,1563.

A higher weekly close would provide a clearer signal that the uptrend is likely to continue.

Next week brings the FED decision, and the market is already starting to position itself ahead of it.

Eurusdfundamentals

EURUSD moving higherEURUSD is holding above 1,1580 and is heading toward a retest of the previous high.

We’re watching for the formation of a higher low, which could provide a potential buying opportunity.

The target remains a test and possible break of the prior high.

Monitor the daily close and look for confirmation of a continued move to the upside.

EURUSD after the newsYesterday, the ECB kept interest rates unchanged, while U.S. inflation data was released.

EURUSD bounced off the support zone and is once again moving toward a retest of the previous highs.

The next resistance levels are at 1,1766 and 1,1830.

Next week, the Fed’s interest rate decision will be announced, which will be a key driver for market movement.

Breakout on EURUSDEURUSD continued its bullish move and closed above the previous highs.

This confirms the bullish trend and opens up further buying opportunities.

The next target is a breakout of 1,1830.

Important news is scheduled for Thursday, which could trigger significant volatility.

All positions should remain in line with the trend!

EURUSD correctionYesterday, EURUSD dipped to 1,1610 but managed to hold above that level.

This move is seen as a correction within the broader uptrend.

We expect it to end soon, opening up new buying opportunities.

At the current levels, there’s no reason to enter just yet – it’s best to wait for market confirmation.

EURUSD ahead of NFPEURUSD is still trading within the range established after Wednesday’s news.

We’re watching for a close above 1,1503, which would confirm a potential buying opportunity.

Today at 1:30 PM (London), the NFP data will be released, which could further impact price action - especially if a reversal is underway.

In case of a decline, the next key support level to watch is around 1,1346.

Hold off on EURUSD for nowYesterday, EURUSD dropped over 150 pips following the trade agreement between the US and the European Union.

Tomorrow, the Fed is expected to announce interest rates, which could bring further volatility.

Avoid entering new positions at the moment and don’t overdo it with your lot sizes.

Once the news is out, there will be clearer and more confirmed trade opportunities.

Important News for EURUSDYesterday, EURUSD continued moving sideways as the market waits for upcoming news.

Today at 1:30 PM London time, U.S. inflation data will be released.

This report has a strong impact and is likely to set the next direction for the pair.

It’s advisable to reduce your risk and avoid opening new positions before the news comes out.

The goal is to follow the trend once it resumes!

Be careful with EURUSDEURUSD is holding its bullish trend and hovering around 1,1800.

Tomorrow, U.S. employment data is due.

It will be released on Thursday instead of Friday, as Friday is a holiday.

At the current levels, there’s no favorable risk-reward for new entries.

Watch for a pullback and wait for the right moment.

New rise in EURUSDYesterday, EURUSD continued its bullish movement, reaching 1,1807.

At current levels, all open buy positions should have their risk removed (e.g. stop loss at breakeven).

New buy entries are recommended only after a pullback with a favorable risk-reward setup.

Important news is expected later this week, which may lead to misleading price moves.

Reduce your risk and stay patient!

Profit TakingYesterday, EURUSD continued its bullish move and reached 1,1747.

Currently, we focus more on reducing risk and taking profits rather than entering new positions.

We’re approaching the final days of the quarter, and next week brings key economic events.

New entries will be considered only if a favorable risk-reward setup presents itself.

The next resistance remains at 1,1778!

EURUSD awaits upcoming newsYesterday, EURUSD climbed back above 1,1600, testing the previous high.

Tomorrow, the market is anticipating the FED’s interest rate decision.

For now, the trend remains clear, with expectations of increased volatility.

Keep an eye out for a higher low and a breakout above the previous high.

Trading Through Turbulence: EUR/USD Strategies Amid U.S. Fiscal The current economic indicators, alongside commentary from key Federal Reserve officials, suggest a cautious approach towards the EUR/USD pair. With the U.S. showing no immediate intent to cut interest rates due to a robust labor market and unresolved inflation targets, traders should prepare for potential dollar strength and volatility in the currency markets. The anticipation of a "hard landing" for the U.S. economy further complicates the landscape, warranting a strategic approach to trading the EUR/USD pair.

1. U.S. Interest Rate Outlook:

Federal Reserve Bank of Atlanta President Raphael Bostic's recent statements highlight a significant resistance to cutting interest rates in the near term. The robustness of the U.S. labor market and the economy, coupled with inflation not convincingly on track to meet the 2% target, suggests that the dollar might remain strong. Bostic's remarks underscore the uncertainty surrounding inflation, indicating that the Fed is not yet convinced that inflationary pressures are sufficiently under control to warrant a change in monetary policy. This stance is crucial for EUR/USD traders, as interest rate expectations are a primary driver of currency movements. The Fed's cautious approach may bolster the dollar, creating resistance against EUR gains.

2. Market Reactions and Treasury Movements:

The reaction to Bostic’s comments was immediate, with Treasuries falling and holding their decline, reflecting market adjustments to the expectations of continued strong U.S. monetary policy. Conversely, Jupiter Asset Management's move to increase its Treasury holdings to a record suggests a hedging strategy against a potential economic downturn. For EUR/USD traders, these dynamics indicate a flight to safety and potential volatility, with a strong dollar scenario possibly prevailing in the short term.

3. Equity Market Inflows and Implications for the Dollar:

Significant inflows into global equity funds, especially following substantial sell-offs in U.S. stocks by Japanese and Chinese funds, hint at a complex investment landscape. The S&P 500 and Nasdaq futures' rise indicates investor optimism or speculative positioning, potentially impacting the dollar by influencing risk sentiment. For the EUR/USD, this could mean short-term bullish signals for the dollar, especially if equity market strength translates into confidence in the U.S. economy.

4. Inflation Concerns and Labor Market Strength:

The anticipated high CPI and potential for a similarly high Producer Price Index (PPI) could extinguish hopes for an interest rate cut, further strengthening the dollar. The persistent strength of the U.S. labor market suggests that inflation may not be easily tamed, reinforcing the Fed's cautious stance on rate cuts. For EUR/USD traders, this means monitoring U.S. economic indicators closely, as signs of sustained inflation or labor market overheating could prompt adjustments in trading strategies, favoring the dollar.

The EUR/USD trading environment is marked by uncertainty, with a robust U.S. economy and unresolved inflation concerns suggesting a cautious approach. Traders should remain vigilant, adapting strategies to navigate potential volatility and the implications of U.S. monetary policy on currency movements.

EURUSD Downtrend. The trend retest in 1.06128 at 0.236 Fibonacci Retracement level. A possible downtrend to 1.04824 at 0 Fibonacci Retracement Level.

The Federal Reserve still considering to increase the interest rates due to a still high US inflation rate.

The Fed has implemented a series of interest rate hikes in an effort to tame inflation that had been at its highest level in some 41 years. Markets widely expect a few more hikes before the Fed can pause to assess the impact the tighter policy is having on the economy.

“Simulations of our baseline model suggest that the Fed will need to tighten policy significantly further to achieve its inflation objective by the end of 2025,” the researchers said.

EURUSD - CURRENT SENTIMENT ANALYSE , DXY #EURUSD

- As of last day, the MARKET SENTIMENT for EUR was slightly UP SIDE. The main reason for that is that the dollar is starting to weaken quite a bit. The dollar has strengthened after the December FOMC. All MARKETS including STOCKS and COMMODITIES are going down slightly due to the OFF of MARKET RISK.

But with RETAIL SALES, ISM MANUFACTURING DATA, and FED UPDATES, this situation may change in the future. Therefore, if the FED continues to be HAWKISH, the USD can definitely go UP. So keep an eye on FED UPDATES and US DATA.

- Definitely, according to the market structure, EURUSD can go down to the support level of 1.0418 below. At the moment, there is quite a DOWN SIDE BIAS in the MARKET for EUR. After that, EURUSD can go up to 1.1000 LEVEL. If the MARKET SENTIMENT changes and STOCKS and COMMODITIES start going UP, there will be more EURUSD BUY. So keep an eye on it.

EURUSD - CURRENT SENTIMENT ANALYSE , DXY #EURUSD

- Currently the MARKET SENTIMENT for EUR is on the DOWN SIDE. The main reason for that is that all MARKETS including STOCKS and STOCKS are DOWN due to MARKET RISK OFF. It affects the Euro in a big way. Because today is Monday, there is a DOLLAR WEAKNESS with a somewhat RISK ON nature.

- Definitely, EURUSD can fall to the SUPPORT LEVEL below. The reason for that is because there is a good UP SIDE BIAS in the MARKET for USD. Accordingly, EURUSD can go down to 0.9858 LEVEL. And after that EURUSD can be BUY to the 1.0661 LEVEL if the MARKET SENTIMENT changes and STOCKS and COMMODITIES start going UP. So keep an eye on it.

EURUSD - CURRENT SENTIMENT ANALYSE , DXY - DXY is currently at 105,286 LEVEL. Also the EUR FEATURE stays at 1.0451 LEVEL. The EURUSD PRICE is currently below the DYNAMIC S / R LEVELS. Most likely the PRICE SHORT TERM can be sold a little before BUY.

- Currently the OVERALL MARKET is RISK OFF. STOCKS is currently displaying a DOWNSIDE BIAS. And the VOLATILITY is getting a bit UP. Also COMMODITIES still shows a DOWN SIDE BIAS. Currently there is only one RISK OFF TONE in the market. Therefore, all currencies such as NZD CAD AUD may definitely be somewhat DOWN in the future. Also JPY CHF can be UP.

- The EURUSD PRICE can be slightly up to 1.0652 LEVEL. Maybe a change from the USD HIGH VOLATILE EVENTS coming up in the coming days. So stay tuned. If the MARKET moves to the DOWN SIDE the EURUSD 1.0279 LEVEL can be DOWN.

EURUSD - CURRENT SENTIMENT ANALYSE , DXY - DXY is currently at 101.632 LEVEL. Also the EUR FEATURE stays at 1.07521 LEVEL. The EURUSD PRICE is currently higher than the DYNAMIC S / R LEVELS. Most likely the PRICE SHORT TERM can be sold a little before BUY.

- Currently the OVERALL MARKET is RISK OFF. STOCKS is currently showing a NEUTRAL BIAS. And the VOLATILITY is getting a bit UP. Also COMMODITIES still shows a UP SIDE BIAS. Currently there is only one RISK OFF TONE in the market. Therefore, all currencies such as NZD CAD AUD can definitely be DOWN in the future. Also JPY CHF can be UP.

- The EURUSD PRICE may be slightly up to 1.0921 LEVEL. Maybe a change from the USD HIGH VOLATILE EVENTS coming up in the coming days. So stay tuned.