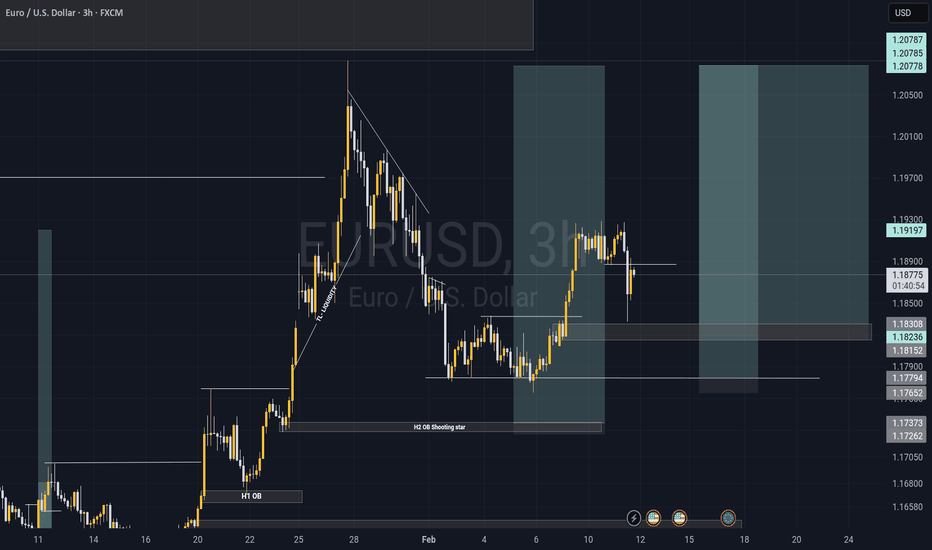

EURUSD – 4H | Continuation Scenario After AccumulationThe pair appears to be completing its corrective phase following a strong impulsive move.

Price is currently stabilizing within a short-term consolidation structure on the 4H timeframe.

🔎 Technical Overview:

A higher low has formed after the recent pullback.

Price is holding above the previous supply breakout area.

Grey zone: short-term demand / mitigation zone.

Liquidity rests above, with relatively clean space toward the 1.20 psychological level.

📌 Scenario:

As long as price maintains acceptance above this zone, a continuation move toward the 1.2020 – 1.2050 range is anticipated.

Primary target: 1.20256

⚠️ Invalidation:

A confirmed 4H close below the demand zone.

Risk management remains the top priority.

Eurusdtrade

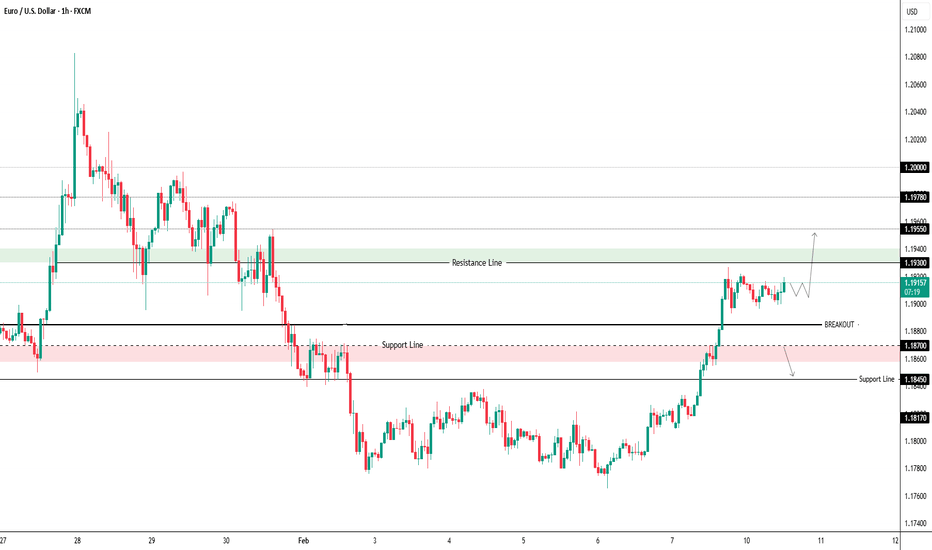

Market Analysis: EUR/USD Breaks HigherMarket Analysis: EUR/USD Breaks Higher

EUR/USD started a decent upward move above 1.1880.

Important Takeaways for EUR/USD Analysis Today

- The Euro found support and started a recovery wave above the 1.1850 resistance zone.

- There is a connecting bullish trend line forming with support at 1.1890 on the hourly chart of EUR/USD.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD, the pair started a fresh increase from 1.1765. The Euro climbed above 1.1800 and 1.1850 against the US Dollar.

The pair even settled above 1.1880 and the 50-hour simple moving average. Finally, it tested the 1.1930 resistance. A high is formed near 1.1928, and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 1.1765 swing low to the 1.1928 high.

Immediate support is near a connecting bullish trend at 1.1890 and the 50-hour simple moving average. The next area of interest could be 1.1835.

The main breakdown zone on the EUR/USD chart sits near the 76.4% Fib retracement at 1.1805. If there is a downside break below 1.1805, the pair could drop toward 1.1765. Any more losses might send the pair toward the 1.1720 low.

On the upside, the pair is now facing resistance near 1.1930. The next hurdle is 1.1950. An upside break above 1.1950 could set the pace for another increase. In the stated case, the pair might rise toward 1.2000.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

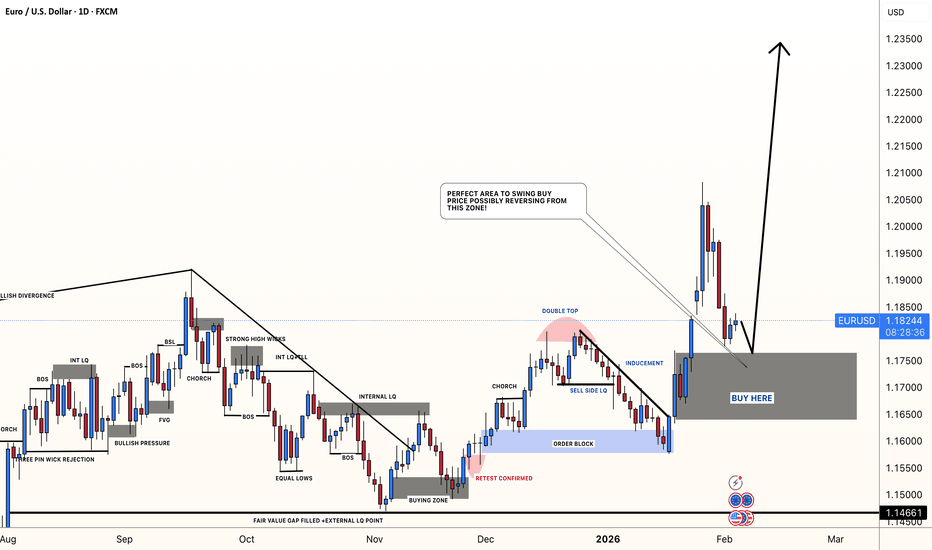

TheGrove | EURUSD buy | Idea Trading AnalysisEURUSD broke through multiple Support level and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

EUR/USD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance LEVEL.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

EURUSD (1H) — Post-Breakout Rally, Now in ConsolidationContext

Price delivered the expected breakout from the prior descending channel, followed by a strong impulsive push to the upside. After that expansion, EURUSD has transitioned into tight consolidation (range/box) — classic “cool-off” behavior after momentum.

RegimeWorks Read

LTF (lower timeframes): can still print bullish continuation signals during a pullback/range (that’s normal inside consolidation).

HTF (higher timeframes): structure is currently pausing and potentially building a pullback base before the next leg.

Translation: don’t confuse LTF noise for HTF permission. This is a decision zone, not a “must trade” zone.

Key Areas on the Chart

Consolidation box: current operating range (buyers vs sellers fighting for control).

Downside references: prior levels below (notably around the marked red lines near 1.187 and 1.184) as potential pullback magnets / invalidation zones depending on your model.

Trade Plan (Rules First)

Plan A — Continuation Only (Break + Hold)

Condition: Clean break above the consolidation range and acceptance (a hold/close above, then controlled retest).

Execution idea: Enter on the retest rejection (or your engine trigger), not in the middle of the breakout candle.

Invalidation: Back inside the box after “breakout” = failed break → stand down.

Plan B — Pullback Scenario (If the Box Breaks Down)

Condition: Loss of the consolidation floor with momentum (clean closes below + failed reclaim).

Execution idea: Either:

wait for a breakdown → retest → rejection, or

stand aside until price reaches your next higher-quality POI (e.g., the lower marked levels) and then reassess.

Invalidation: Reclaim of the range + acceptance back inside = pullback rejected → no short bias.

Risk Management (Non-Negotiable)

Consolidation environments produce fakeouts. Reduce size if your framework allows, or trade fewer setups.

No “guess entries” inside the box — either edge of range + confirmation, or nothing.

Protect capital: if you take a trade, keep it rule-tight (defined SL, defined invalidation, no widening).

RegimeWorks Note

This is not a prediction and not financial advice. It’s a structured response to current price behavior: breakout → expansion → consolidation → next decision. If you can’t get clean confirmation, the correct trade is often no trade.

EURUSD sideways, breakout and price increase.Related Information:!!! ( EUR / USD )

The Euro (EUR) is trading broadly unchanged against the US Dollar (USD) on Tuesday, hovering near 1.1917 at the time of writing and consolidating at one-week highs following a two-session advance. The greenback remains under pressure ahead of a series of key US macroeconomic releases, while a moderately positive risk backdrop continues to weigh on the currency.

The USD is still struggling to recover from last week’s disappointing labor market data. Adding to the soft tone, White House economic adviser Kevin Hassett cautioned on Monday that job creation is likely to slow in the coming months, citing the impact of US President Donald Trump’s immigration policies and rising productivity. These remarks, delivered ahead of Wednesday’s release of the January Nonfarm Payrolls (NFP) report, have done little to shore up demand for the US Dollar.

personal opinion:!!!

The accumulation is continuing, awaiting a breakout from the uptrend, while the DXY index remains weak.

Important price zone to consider : !!!

Resistance zone point: 1.19300, 1.19500 zone

Support zone :1.18850 zone

Follow us for the most accurate gold price trends.

EURUSD | FRGNT DAILY FORECAST | Q1 | W6 | D10 | Y26📅 Q1 | W6 | D10 | Y26

📊 EURUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

EURUSD Outlook: Bullish Above 1.1885EURUSD Technical Analysis

February 11, 2026

Pivot Point: 1.1885 Currently, the price is trading around the pivot level of 1.1885, which serves as the decisive zone for today's direction.

Bullish Scenario (Primary)

As long as the price holds above the pivot point of 1.1885, the bullish momentum remains intact:

Immediate Target: Resistance at 1.1930.

Confirmation: A 1-hour candle close above 1.1930 will pave the way for the next target at 1.1955.

Bearish Scenario (Alternative)

To shift to a bearish outlook, the price must strongly break below the pivot point of 1.1885:

Confirmation: A 4-hour candle close below 1.1885 is required to confirm the downward move.

Downside Targets: 1.1870 followed by 1.1845.

Key Levels at a Glance:

Pivot Point: 1.1885

Resistance Levels: 1.1930 | 1.1955

Support Levels: 1.1870 | 1.1845

EUR/USD Break of Structure + Liquidity Targeting🎯 EUR/USD "THE FIBRE" - Bullish Breakout Strategy 🚀

Day/Swing Trade Opportunity | Forex Major | Risk Management Priority

📊 EXECUTIVE SUMMARY

Current Price (Feb 11, 2026): $1.1908 USD | 52-Week High: $1.2082 (Jan 28, 2026) | Bullish Bias: ✅ ACTIVE

The Euro is approaching multi-year resistance levels as the ECB maintains an accommodative stance while the Federal Reserve signals a cautious pause on rate cuts. Real-time market sentiment remains bullish with speculative long positions at 163.4K contracts (highest since Aug 2023). This setup presents a clean breakout opportunity above structural resistance with solid technical confluence.

🎪 TRADE SETUP: BULLISH BREAKOUT PLAN

Entry Strategy 📍

Primary Entry Zone: ANY PRICE LEVEL POST-RESISTANCE BREAKOUT @ $1.19300 – $1.19400 (confirmed above daily resistance)

Confirmation Method: Wait for 4-hour candle closure ABOVE $1.1930 with volume expansion

Secondary Entry: Pullback-and-retest of $1.1925 after initial breakout confirmation

Entry Type: Pending order activation OR live market entry on impulse break

⚠️ Technical Rationale: This level represents the convergence of:

February psychological resistance ($1.19 handle)

55-day Simple Moving Average (SMA) proximity

Previous swing high resistance zone

Bollinger Band upper band extension trigger

🎯 PROFIT TARGETS (TP) – LIQUIDITY SWEEP STRATEGY

TP1: "First Liquidity Grab Completed" ✨

Target Level: $1.19800

Rationale: Initial supply capture + seller breakeven liquidation zone

Action: PARTIAL PROFIT TAKE (40% position size)

Purpose: Lock in early gains + reduce risk exposure

Technical Confluence: Intermediate resistance + previous weekly highs

TP2: "The Big Money Exit – Final Liquidity Sweep" 💰

Target Level: $1.20500

Rationale: Psychological $1.20 barrier + major multi-year resistance zone (previously tested Jan 28 high @ $1.2082)

Action: FULL POSITION CLOSURE (remaining 60%)

Purpose: Capture the full breakout move with systematic profit extraction

Confluence Factors:

$1.20 psychological level = institutional buy/sell equilibrium

200-week EMA approximation

Prior 4-year resistance tested in January 2026

🛑 RISK MANAGEMENT: STOP LOSS STRUCTURE

Stop Loss Level: $1.1860 (Hard Stop)

Pips at Risk: ~70 pips from entry ($1.1930)

Rationale: Break below the 50-day exponential moving average (EMA)

Logic: Entry invalidated if this structural support fails

Position Sizing Rule: Risk NO MORE than 1-2% of your trading capital per trade

Example: If trading $10,000 account, max loss = $100-$200

At 75-pip stop = ~0.54% account risk ✅ PROFESSIONAL LEVEL

⚠️ CRITICAL NOTE TO ALL THIEF TRADERS & OG's:

"This stop loss is a SUGGESTED technical level – NOT a mandatory requirement. You are the captain of your own ship. Adjust your SL based on YOUR risk tolerance, account size, and personal trading style. A 50-pip stop or 100-pip stop may suit YOUR plan better. The goal is CONSISTENT MONEY MANAGEMENT, not copying mine. Trade YOUR edge, not mine. Your winners keep you in the game, your discipline keeps you IN the game." 🎖️

📈 CORRELATION PAIRS TO WATCH

📊 Watch List for Smart Traders:

1. GBP/USD (Current: $1.3590) 🇬🇧💵

Correlation: Positive (+0.85 to +0.92) — Moves in SAME DIRECTION as EUR/USD

Why It Matters: UK pound strength = Euro strength signal

Current Setup: Testing key support at 1.3267 (200-day EMA); rebound could confirm EUR/USD bullish bias

Action: If GBP/USD breaks above 1.3700, expect EUR/USD to extend beyond $1.20

Watch Level: 1.3350-1.3400 = Confluence zone with EUR/USD momentum

2. USD/JPY (Current: ~155.50) 🇺🇸🇯🇵

Correlation: Negative (-0.70 to -0.78) — Moves in OPPOSITE direction

Why It Matters: USD weakness = JPY weakness; JPY weakness = EUR/USD BULLISH pressure

Current Setup: Testing 154.45-155.00 support zone; recovery here = USD strength headwind

Action: If USD/JPY breaks DOWN below 154.45, EUR/USD will have STRONG BULLISH tailwind

Risk Alert: Japanese Ministry intervention at 160.00 could suddenly flip this dynamic

3. EUR/JPY (Current: ~186.17) 🇪🇺🇯🇵

Correlation: Positive (+0.80 to +0.88)

Why It Matters: Euro weakness vs Yen = potential weakness signal for EUR/USD

Technical Note: Recently formed evening-star pattern; showing lower-high formation

Support Zone: 182.65-183.16 is critical support; break below = caution signal for EUR/USD bulls

4. GBP/JPY (Current: ~214.13) 🇬🇧🇯🇵

Correlation: Strong positive (represents overall risk appetite)

Why It Matters: Carry trade health indicator; when it rallies = risk-on environment = EUR/USD bullish

Technical Setup: Testing 213.50-214.50 resistance zone after 18-year high

Interpretation: Continued strength = confidence in European assets

5. US Dollar Index (DXY) (Current: ~96.60) 💹

Inverse Correlation: For every 1% DXY drops = EUR/USD can add 30-50 pips

Current Trend: Down 10% for the year; multi-day lows suggest weakness persists

Critical Level: 98.00 = psychological resistance; break above = USD strength resumes

Fed Proxy: DXY tracks Fed easing cycle expectations

💼 FUNDAMENTAL & ECONOMIC DRIVERS

🏛️ EUROZONE FACTORS (Supporting Bullish EUR)

ECB Stance: HAWKISH HOLD 📍

Current Policy Rate: 2.15% (Main Refinancing Rate) — UNCHANGED since July 2025

February 5 Decision: ECB kept rates flat as expected; President Lagarde signaled COMFORT with Euro strength

Key Quote from Lagarde: "Inflation outlook remains in a GOOD PLACE" ✅

Implication: ECB willing to tolerate higher EUR/USD; NO urgency to cut rates

Market Pricing: <10% probability of 25bp rate cut by Feb 2026

Inflation Performance: SOFT LANDING ACHIEVED ✅

January 2026 Headline Inflation: 1.7% YoY (BELOW 2% target – unexpected positive!)

Core Inflation: 2.2% YoY (lowest since Oct 2021)

ECB Reaction: Comfortable with current stance; inflation on track to stabilize at 2% target

Trader Takeaway: NO EMERGENCY rate cuts needed; ECB can stay patient and firm = EUR support

Growth Outlook: RESILIENT DESPITE HEADWINDS 💪

2026 Growth Forecast: 0.8-1.2% (modest but stable)

Support Drivers: Higher defense spending + infrastructure investment announced

Risks: German auto sector weakness (-5% output); potential Trump reciprocal tariffs on EU goods

Signal: Growth sufficient to prevent emergency easing; EUR constructive long-term

Positioning Sentiment: EXTREME BULLISH SKEW 📊

Speculative Long Positions: 163.4K contracts (highest since August 2023!)

Implication: Momentum is REAL but crowded; watch for profit-taking

Risk Management: Position likely getting extended; set stops for protection

🇺🇸 UNITED STATES FACTORS (Pressuring USD Weakness)

Federal Reserve: CAUTIOUS PAUSE MODE ⏸️

Current Fed Funds Rate: 3.50%-3.75% (UNCHANGED since January 28, 2026)

2026 Rate Path: Markets pricing 2 additional cuts (June + September consensus)

Powell Stance: "Neutral" rate achieved; no urgency to cut aggressively

BUT: Committee divided on how many cuts acceptable in 2026

Market Reaction: Rate cut expectations already priced into USD weakness

Labor Market: SOFTENING SIGNALS 📉

Recent NFP Data: Softer than expected (latest week: 199K claims vs 219K expected)

Wage Growth: Moderating but still above 3% annually

Implication: Labor market cooling = potential for 2-3 Fed cuts in 2026

EUR/USD Signal: Soft jobs data = USD pressure = EUR/USD bullish trigger

Inflation: STICKY BUT MANAGEABLE 📈

CPI Trend: Fed willing to live with inflation above 2% for longer

Key Risk: If US inflation re-accelerates, Fed cuts could be delayed = USD reversal signal

Watch: This week's CPI release (Friday) = critical volatility catalyst

Trump Policy Uncertainty: MASSIVE WILDCARD 🃏

Tariff Plans: Proposed 10-20% tariffs on EU goods + reciprocal tariff threat

Capital Flow Impact: Risk-off sentiment could flip positions quickly

Geopolitical Risk: Elevated uncertainty pushing traders toward safe havens (JPY/EUR strength)

Trade Note: Geopolitical premium = currently supporting EUR/USD above natural levels

📅 UPCOMING ECONOMIC EVENTS TO MONITOR

THIS WEEK (Feb 10-14, 2026):

🔴 Feb 12 🇺🇸 NFP — Soft = EUR/USD UP ⬆️

🔴 Feb 14 🇺🇸 CPI — Hot CPI = USD RALLY ⬆️

🟡 Feb 12 🇺🇸 Jobless Claims — Labor trend

🟡 Feb 14 🇺🇸 Retail Sales — Consumer check

NEXT MONTH (March 2026):

🔴 March 5 🇪🇺 ECB Decision — MAJOR

🔴 March 19 🇺🇸 Fed FOMC Meeting — Key decision

🎯 RISK MANAGEMENT CHECKLIST ✅

Before You Enter This Trade:

Is your stop loss set at 1.1825? (Non-negotiable SL placement)

Have you calculated position size for max 1-2% account risk?

Are you monitoring the USD/JPY pair for correlation confirmation?

Did you set alerts on GBP/USD 1.3700 (confirmation level)?

Are you aware this is FRONT-RUN by institutional players at 1.20?

Do you have an EXIT PLAN if NFP/CPI surprises hurt USD?

💭 THIEF TRADER WISDOM & MINDSET QUOTES 🎖️

On This Trade Specifically:

"THE FIBRE is playing with big money right now. Institutional players are building positions into $1.20. They'll trap retail both ways – first stop them at 1.1825, then reverse at 1.20. Know their game, execute YOUR plan, take YOUR profits at MY targets. Don't be greedy." — Thief OG's Trading Code 🏴☠️

"At 1.19300, you're buying the breakout where retail panic-buys. Smart money is already 200 pips higher on leveraged positions. Let them do the heavy lifting; you just ride the momentum wave. Lock profits at TP1, then milk the remaining move. This is not a lottery ticket – it's a systematic extraction of value." 💰

General Thief Trading Mentality:

"Money moves in trends, emotions move in noise. The chart doesn't lie, but prices lie often. Enter at confluence zones, exit at institutional resistance. Your biggest enemy is not the market – it's your fear of missing out and your greed for 'just a few more pips.' Take your target and sleep easy." — OG's Philosophy

"Stop losses are your insurance premium, not your enemy. A trader who respects stop losses lives to trade another day. A trader who moves stops dies a thousand deaths. Be disciplined or be broke – there's no middle ground." 🎖️

"The best trades feel boring when you're in them. If you're thrilled and checking every minute, you're over-leveraged. Real money is made in boring accumulation phases, not exciting crash moments. Boring = Profitable." 📊

"Every time you add to a losing position, you're not being brave – you're being BANKRUPT in slow motion. Your first loss is your best loss. Let it go and move to the next setup. Pride kills accounts faster than any bad trade." 🛑

Regarding This Specific Setups' Risks:

"THE FIBRE is strong, but it's also tired after a 600+ pip run from 1.15. When something runs this hard this fast, profit takers are EVERYWHERE above 1.20. Don't be the last fool buying breakout highs. Hit your target 2 at 1.20500 and WALK AWAY. The next 200 pips aren't worth the risk of reversal." ⚠️

📝 FINAL DISCLAIMER (Read This!) ⚖️

This is NOT financial advice. I am NOT recommending you take this trade. I am sharing a technical setup based on real market data as of February 11, 2026.

You are 100% responsible for:

✅ Your entry decision

✅ Your exit decision

✅ Your position sizing

✅ Your stop loss placement

✅ Your profit targets

✅ Your account risk management

Markets can gap through your stops. Forex can move 100+ pips in seconds on economic data. Position sizing incorrectly = account liquidation. Use proper leverage (1:5 max for majors recommended).

This trade has 60%+ probability of hitting TP2 based on technical confluence, but that means 40% probability of loss. Risk/reward = 1:1.75 = Professional standard.

Trade the setup, not the money. Execute the plan, not your emotions. 🎯

Chart Setup Summary:

🟢 BUY SIGNAL: Entry on breakout above 1.1930

⏹️ STOP LOSS: 1.1860 (70 pips risk)

🎯 TARGET 1: 1.1980 (50 pips gain) – Take 40% profits

🚀 TARGET 2: 1.2050 (120 pips gain) – Close remaining 60%

📊 Risk/Reward Ratio: 1:1.75 ✅ PROFESSIONAL GRADE

Trade with a plan. Manage your risk. Respect the market. Make money. 🏴☠️💰📈

Good Luck, Thief OG's & Fellow Traders! 🎖️

EURUSD: Bullish Trend Above 1.1885 Pivot

EUR/USD Technical Outlook

Date: February 10, 2026

Current Market Condition: The pair is currently trading above the Pivot Point at 1.1885, maintaining a bullish bias.

Bullish Scenario:

As long as the price holds above 1.1885, the momentum remains upward toward the resistance at 1.1930.

Confirmation: A successful 1-hour candle close above 1.1930 will signal a continuation toward the next target at 1.1955.

Bearish Scenario:

To shift into a bearish outlook, the price must decisively break below the 1.1885 pivot level.

Confirmation: A 4-hour candle close below this level is required to target 1.1870 and 1.1845.

Key Price Levels:

Pivot Point: 1.1885

Resistance Targets: 1.1930 | 1.1955

Support Levels: 1.1870 | 1.1845

⚠️ Risk Note: Monitor the 1-hour close carefully for trend confirmation.

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is consolidating above a well-defined short-term support zone around 1.1900–1.1904 on the 15-minute timeframe after a sharp impulsive rally. Recent price action shows higher lows forming above support, indicating that downside momentum has weakened. As long as price holds above this support zone, the structure favours a bullish continuation toward the upper resistance band near 1.1923–1.1927.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 1.1900 – 1.1904

Stop Loss: 1.1898

Take Profit 1: 1.1923

Take Profit 2: 1.1927

Risk–Reward Ratio: Approx. 1 : 4.4

📌 Invalidation:

A sustained break and close below 1.1898 would invalidate the bullish setup.

🌐 Macro Background

The US Dollar remains under pressure amid concerns over US lab or market weakness and growing expectations for further Federal Reserve easing. Meanwhile, the Euro is supported by stable ECB policy expectations and improving risk sentiment. In the short term, this macro backdrop supports buy-on-dips behaviour, especially when price stabilizes above key technical support.

🔑 Key Technical Levels

Resistance Zone: 1.1923 – 1.1927

Support Zone: 1.1900 – 1.1904

Bullish Invalidation: Below 1.1898

📌 Trade Summary

EUR/USD is holding above a critical intraday support zone following a strong rebound. As long as price remains above 1.1898, the bias favours buying pullbacks, targeting a move back toward the upper resistance zone.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

EURUSD Outlook: Bulls Eyeing 1.1900 as Long as Pivot HoldsEUR/USD Technical Analysis – February 9, 2026

Pivot Point: 1.1817

Currently, as long as the price trades above the 1.1817 pivot level, the bullish momentum remains dominant.

Bullish Scenario (Upside Trend):

Primary Target: The price is heading toward the resistance level at 1.1900.

Continuation: Breaking above 1.1900 and closing a 1-hour candle above this level will confirm further gains toward the next target at 1.1955.

Bearish Scenario (Downside Trend):

To shift into a sell-off phase, the price must decisively break below the 1.1817 pivot point.

Confirmation: Closing a 4-hour candle below this level is required to target the support zones at 1.1780 and 1.1750.

Key Levels Summary:

Pivot Point: 1.1817

Resistance (Targets): 1.1900 | 1.1955

Support (Targets): 1.1780 | 1.1750

EURUSD Rejection From Supply or Launchpad for the Next Leg Up?EURUSD is sitting at one of those decision zones where structure and macro are about to pick a winner. Price pushed hard into higher-timeframe supply, rejected, and is now grinding inside a tightening structure while dollar and yield expectations stay data-dependent. From my side, this is not a “chase the middle” spot — it’s a location trade. Either we reclaim supply and squeeze higher, or we lose structure and rotate back toward deeper demand. The fundamentals right now actually make both paths realistic — which is exactly why the levels matter more than opinions.

Current Bias

Neutral short term, mildly bullish if resistance breaks cleanly

Price is compressing after rejection from the upper supply zone. Structurally this looks like a decision range. Bias shifts bullish only on confirmed acceptance above the highlighted resistance band. Failure keeps downside rotation in play.

Key Fundamental Drivers

US side: Services PMI remains in expansion, but softer private payroll signals have slightly cooled aggressive USD strength expectations.

Fed policy: Still restrictive, but in hold mode. Market is highly sensitive to inflation prints and labor data for timing of eventual cuts.

Eurozone side: Inflation is easing but not fast enough for aggressive ECB easing. That keeps EUR from being structurally weak.

Rate spread: Still USD-supportive overall, but not widening further right now — which reduces upside momentum for USD.

Macro Context

Interest rate expectations: Fed on hold with cuts expected later rather than sooner. ECB cautious on cuts due to sticky components of inflation. That narrows forward policy divergence slightly compared with prior months.

Growth trends: US growth signals are mixed but still expansionary in services. Eurozone growth is slower but stabilizing in pockets rather than collapsing.

Commodity flows: No strong commodity shock driving EUR directly. Oil firmness supports USD via inflation expectations more than it hurts EUR specifically.

Geopolitical themes: Elevated geopolitical tension keeps safe-haven flows active at times, which tends to support USD on spikes but not always trend-sustainably.

Primary Risk to the Trend

The biggest risk to a bullish EURUSD break is a hot US inflation print that reprices Fed cuts later and pushes US yields higher. That would strengthen USD broadly and likely trigger rejection from resistance with continuation lower.

On the flip side, a soft CPI would raise the odds of a topside break.

Most Critical Upcoming News/Event

US CPI (top priority)

US payrolls / labor data follow-through

ECB speaker guidance on rate path

Those will decide whether rate spread expectations widen again toward USD — or compress toward EUR.

Leader/Lagger Dynamics

EURUSD is a major leader pair.

It often drives:

Broad USD index direction

EUR crosses like EUR/JPY and EUR/CHF

It tends to lead sentiment shifts in FX before smaller USD pairs adjust.

If EURUSD breaks higher, expect synchronized pressure in USD pairs like USD/CHF and USD/JPY.

This is not a lagging pair — it’s a tone setter.

Key Levels

Support Levels:

1.1800–1.1780 structure support zone

1.1500–1.1480 major higher-timeframe demand (green zone on chart)

Resistance Levels:

1.1900–1.1950 supply band

1.2050–1.2100 major upper resistance zone

Stop Loss (SL):

Below 1.1780 for bullish structure idea

Or below 1.1480 for wider swing positioning

Take Profit (TP):

TP1: 1.1950 zone

TP2: 1.2050–1.2100 zone

Summary: Bias and Watchpoints

EURUSD is in a decision range with a neutral short-term bias and a conditional bullish tilt if price can reclaim and hold above the 1.1900–1.1950 supply zone. The fundamental backdrop is balanced: Fed still restrictive but not tightening further, ECB cautious but not aggressively dovish. The main threat to upside is a hot US CPI that drives yields and USD higher. Key invalidation for the bullish structure sits below 1.1780, with deeper protection near 1.1480. Upside targets sit at 1.1950 first, then 1.2050–1.2100 if acceptance occurs. As a leader pair, whichever side EURUSD breaks will likely echo across the broader USD complex.

EURUSD: Bullish-Neutral. Potential For Short Term Sells?Welcome back to the Weekly Forex Forecast for the week of Feb. 9-13th.

EURUSD broke out of the consolidation two weeks ago, only to quickly pullback into the range last week.

This is not a great trading environment.

Look for the short term bearishness to potentially continue into this week. Wait for the market to seek liquidity, and look to fade that move.

NFP is Wed, and CPI is Friday. High impact potential, so be careful in these markets!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD Calm Before the Next Big Move?The Euro’s setting up for what could be a textbook correction before the next drive up.

The question now: does 1.14 hold… or do we break deeper? 👇

Here’s the simple map:

🔻 Correction zone: Price is cooling off toward 1.14.

⚡ If 1.14 holds, we could see a clean bounce and a new leg higher.

⚠️ If it breaks, then eyes on 1.12, 1.10, and in a worst-case dip, 1.08–1.07.

So basically:

👉 Hold 1.14 = bounce potential

👉 Break 1.14 = deeper pullback ahead

Momentum is slowing; this is where smart traders are patient, not panicked.

If you’re watching EUR/USD and unsure where the best risk-to-reward setups might form, DM me; I’ll walk you through how I’m mapping my key levels and what I’m waiting for before jumping in.

Mindbloome Exchange

EURUSD: Is this a start of swing bullish move? Comment your viewThe EURUSD price is currently trading at a crucial level, potentially signalling a strong bullish reversal. We need to confirm a break of the bearish pressure trendline; once achieved, it will be a strong reversal signal. Enter with strict risk management.

If you like our idea, please like and comment below with your thoughts on this move.

Team Setupsfx_

EURUSD Outlook: Bearish Momentum Below 1.1835EUR/USD Technical Analysis

📅 Date: February 4, 2026

💵 Current Price: 1.1815 (Approx.)

📍 Pivot Point: 1.1835

📉 Bearish Scenario (Main Trend)

The price is currently trading below the pivot level of 1.1835. As long as it remains under this zone, the bearish momentum is expected to continue:

Target 1: Support level at 1.1790.

Target 2: If the price breaks 1.1790 and stabilizes below it with a 1-hour or 4-hour candle close, the downtrend will strengthen towards 1.1745.

📈 Bullish Scenario (Alternative Case)

If the price manages to break above the pivot level of 1.1835 and stabilizes:

Target: The trend will shift to bullish, aiming for 1.1900.

📍 Key Technical Levels

Resistance (Upside): 1.1900 | 1.1930

Support (Downside): 1.1790 | 1.1745

💡 Market Sentiment: The EUR/USD pair is facing pressure due to the recent strengthening of the US Dollar, influenced by expectations of a more hawkish Fed policy. Traders should watch for a confirmation close below 1.1790 to confirm the next leg of the sell-off.

EURUSD— FRGNT FUN COUPON FRIDAY Q1 | D6 | W5 | Y26📅 Q1 | D6 | W5 | Y26

📊 EURUSD— FRGNT FUN COUPON FRIDAY

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is facing strong selling pressure around the 1.1800–1.1810 resistance zone, where multiple rejection candles have formed. The pair failed to hold above the rising trendline, signalling a false breakout and momentum exhaustion. Price action remains capped below resistance, suggesting the recent rebound is corrective rather than impulsive. As long as EUR/USD stays below 1.1820, the short-term structure favours bearish continuation.

🎯 Trade Setup (Bearish)

Entry Zone: 1.1802 – 1.1810

Stop Loss: 1.1815

Take Profit 1: 1.1750

Take Profit 2: 1.1740

Risk–Reward (R:R): Approximately 1 : 3.99

📌 Invalidation:

This bearish setup is invalidated if price closes firmly above 1.1815.

🌐 Macro Background

From a macro perspective, market sentiment remains cautious ahead of the ECB interest rate decision, supporting a defensive USD tone. Although stronger-than-expected German Factory Orders offered temporary support to the Euro, investors are reluctant to chase upside. Any dovish nuance or concern from the ECB regarding recent Euro strength could reinforce downside pressure on EUR/USD.

🔑 Key Technical Levels

Resistance Zone: 1.1802 – 1.1810

Support Zone: 1.1740 – 1.1750

Bearish Invalidation Level: Above 1.1815

📌 Trade Summary

EUR/USD remains technically weak below key resistance, with price action favouring a sell-on-rallies approach. Unless the pair reclaims and holds above 1.1820, the downside bias toward the 1.1750 support zone remains intact.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD — FRGNT DAILY FORECAST Q1 | D5 | W5 | Y26📅 Q1 | D5 | W5 | Y26

📊 EURUSD — FRGNT DAILY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD