Hypothetical "StopLoss Hunt" Game Theory.A smart man said " place your buy positions where you would place your Stoplosses ".

Could be interpreted in "If there are (technical) RISKS... then it's almost a guarantee the worst case scenario will materialize ". Because of liquidity.

I thought about this and could differentiate these situations as:

--(Downtrend) crowd influenced. (Say: deathcross.. with risks to break the Higher Low).

--(Uptrend) Euphoric, extended trend. With strong longterm fundamentals and positive future cycle. It would benefit smart money to break this trend and buy everyones shares for cheaper -> when markets are supposed to be slow and they have got all the time in the world.

--(Uptrend) Institutional FOMO. Game theory, 70%+ managers underperform the index, on strong trend every dip is the last price you get.

//Stop Loss Hunt

//Institutional Fomo.

Fomo

THE 3 TRADES THAT KILL FUNDED ACCOUNTSI keep seeing the same 3 trades right before traders blow their funded accounts.

It’s usually not because they don’t know how to trade.

It’s because, in these moments, emotions take over and the plan disappears.

1) FOMO after news: Price moves fast, you feel scared of missing out, and you jump in late. Most of the time, you’re buying near the top and take a big loss.

2) Revenge trade: You take a loss, get angry, and want to “get it back” right away. That next trade usually makes the hole deeper.

3) Oversizing after wins: You have a few good trades, feel unbeatable, and suddenly use way too much size. One normal loser then wipes out days or weeks of progress.

These 3 trades show up in a huge number of blown accounts and resets worked with. They are more about feelings than skill.

If you read this and thought, “That’s me,” you’re not broken. You’re just human.

If FOMO is your main problem, comment “FOMO” and share when it hits you the most.

will DM you one simple thing that has helped other traders handle it better

Trade Smarter Live Better

Kris

THE PSYCHOLOGY OF TRADING: WHY MOST TRADERS LOSE?You have probably heard that most people who attempt trading end up losing money. There’s a

good reason for this, and the reason is primarily that most people think about trading in the

wrong light.

Most people come into the markets with unrealistic expectations, such as thinking they are

going to quit their jobs after a month of trading or thinking they are going to turn $1,000 into

$100,000 in a few months. These unrealistic expectations work to foster an account-destroying

trading mindset because traders feel too much pressure or “need” to make money.

When you begin trading with this pressure, you inevitably end up trading emotionally—which is

the fastest way to lose your money.

To be specific, let’s break down the 4 Main Emotional Factors that destroy portfolios: FOMO,

Fear, Revenge, and Greed.

__________________________________________________________________________________

1. FOMO (Fear of Missing Out)

FOMO is an emotional state experienced by almost everyone. For traders, it is accelerated by

feelings of jealousy, envy, and impatience. The depth of these emotions is intensified by the

fast-acting environment of the Crypto and Forex markets.

How to Avoid FOMO:

● Develop a Routine: Trading is often a singular, lonesome pursuit. Eliminate distractions

and focus on identifying key market spots to tune out external chatter. Avoid social

media outlets and ungrateful attitudes.

● Be Present Minded, Future Thinking: Just because a trade is lost does not mean the

following transactions will follow suit. There are always more trading opportunities. Stay

present-minded yet have your scope set upon the future goals of your trading.

● Employ a Trading Plan: No plan is perfect, but a well-developed plan covers most

eventualities, helping you invest with lower risk exposure and more consistency.

Establish short-term, medium, and long-term trading goals.

● Take Joy from Trading: FOMO stems from insecurity and greed. Once a trader grasps

this truth, they can cast out this reckless state and trade with maximum potential.

__________________________________________________________________________________

2. GREED (The Account Destroyer)

There’s an old saying regarding markets: “Bulls make money, bears make money, and pigs

get slaughtered.”

This means if you are a "greedy pig" in the markets, you are almost certainly going to lose.

Greed acts as a trader’s kryptonite. When the desire for wealth clouds logic, traders make fatal

mistakes such as:

● Not taking profits because they think a trade will go on forever.

● Adding to a position simply because the market moved slightly in their favor (without

logical price action reasons).

● Using excessive leverage to maximize potential gains.

● Doubling down on losing trades (The Martingale Strategy).

Advice for Avoiding Greed:

Think of greed as the counterpart to discipline. Traders who are well-poised and consistent are

less likely to fall victim to greed. It is critical that every trader consistently follow trading plans;

otherwise, the likelihood of slipping into destructive habits is far greater.

__________________________________________________________________________________

3. FEAR

Fear often arises after a trader hits a series of losing trades or suffers a loss larger than what

they are emotionally capable of absorbing.

When fear takes over, you hesitate. You might see a perfect setup that aligns with your strategy, but you freeze because you are afraid of losing again. Or, you might cut a winning trade too early because you are terrified the market will turn against you. Fear paralyzes your ability to execute your edge.

__________________________________________________________________________________

4. REVENGE TRADING

Revenge trading is a natural emotional response when a trader suffers a significant loss. The

idea is to recover the money immediately. The thinking is: "If I put on another trade right now, I can win it back."

Usually, this "expected" winning trade turns into a losing trade—often bigger than the first one.

5 Effective Ways to Fight Revenge Trading:

1. Step Back Temporarily: Take a day or two off. If you must be in the markets, trade

incredibly small, but the best course is to walk away.

2. Make a Self-Assessment: Once you are emotion-free, analyze what led to the loss.

Was it a bad strategy, or bad execution?

3. Assess Market Conditions: Is the market too volatile? Are there no solid trends?

Sometimes the best trade is no trade.

4. Assess Your Strategy: Check your entry and exit criteria. Did you actually see a setup,

or did you force a trade out of anger?

5. Make Necessary Adjustments: Note the feedback, learn the lesson, and mentally

"throw" the bad trade away. Affirm to yourself: "That is how I will do it next time."

__________________________________________________________________________________

SUMMARY

Trading is simple, but it is not easy. The charts are the easy part; managing your own mind is

where the real work begins. Identify these four emotions— FOMO, Fear, Greed, and

Revenge —and suppress them the moment they arise.

Are you controlling your emotions, or are they controlling your portfolio? Let me know in

the comments below.

__________________________________________________________________________________

Disclaimer: This content is for educational purposes only. Trading involves significant risk.

ETHUSDT SELL POSITIONEthereum is currently under strong selling pressure, and with the price hovering around $3,000, it could easily drop back below $2,600. However, for a more reliable entry, the 4-hour timeframe gap around $3,250–$3,350 offers a much better zone to look for a sell position.

If price reaches this area with a strong and impulsive move, there is a high probability (over 70%) that this sell setup will play out successfully. But if Ethereum approaches the $3,300 zone with weak momentum, the trade becomes a bit more risky, and the setup may require further confirmation before entering.

Bitcoin FOMOThe technical levels I am watching in the near term are:

Upside Resistance:

104800

117,500

All Time High

Downside Support

87,700

84,100

Throughout this bull cycle, starting from the low in November 2022, following the January 2023 Ichimoku breakout that truly triggered the bull trend, and after the ETF launch my Bitcoin friends continue to ask if I am buying Bitcoin. My answer now, as it has been all year, is "no." They invariably come back with incredulousness, "but you're going to miss out!" And of course my favorite, "everyone gets Bitcoin at the price they deserve." I suppose that phrase should make me most deserving having bought my first at $20.

The thing I "know" about Bitcoin, based on its history, is that it always pulls back... bigly. That has been "less bigly" each cycle but the double edged sword of volatility is baked in still, only forgotten at the moment. To update that phrase about deserving price I have my own, "you will always be able to buy Bitcoin again at this price." It's the proper counter-FOMO mindset and borne out by history. If Bitcoin were to suddenly rocket to $200,000 and then retrace by 50% it would put it right back here at $96,000.

But I am told "I just dont understand Bitcoin." No, I do, very well I think. I understand Bitcoin itself intimately but more importantly markets broadly.

I understand markets and what makes them work; human emotion and cyclicality. Bitcoin Maximalists believe that Bitcoin is something different; that the rules do not apply. "There is nothing new under the sun." This is especially true of financial markets and Bitcoin is definitely one of those. By expanding my horizon across all the assets and tickers available to traders over the last 16 years I have seen countless tickers go on to make massive gains, capture the attention and frenzy of investors, and then... invariably... come back. Bitcoin is still priced by humans and this is what humans do. I've endured so many missed opportunities. Many that I felt strong pain about. But after so many exposures to negativity one develops a resilience. That's what those who focus exclusively on one thing fail to appreciate and put themselves at risk out of ignorance.

There are events and busted narratives that have happened this year that explain the stall in what many presumed was the guaranteed road to $1M. I find that these changes have gone largely ignored or at least not spoken of again. The taxpayer funded bailout, excuse me, the Strategic Bitcoin Reserve, is not happening. Microstrategy's shareholders finally forced Saylor to stop diluting shares back in August to buy Bitcoin. And an internal political war over the soul and future of Bitcoin's code has broken out. These are not death knells for Bitcoin themselves but they detract from the optimism. And optimism is the emotion that drives price higher.

What is my long term view? It remains the same now as it has all year; "they" must be tested. Every asset that creates a culture of passionate optimism around it invariably reverts at some point to abject despondency. That is the cycle of greed and fear. Though I read the consternations on social media there still remains hope. When all hope has been given up... then one should become interested. It doesn't matter if that comes following an all time high of $126k or $1000k. That point will come. I'll be fine either way.

The Phantom TradeThe Phantom Trade .... In the spirit of Halloween ...

NOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure — so you can trade your own system with calm and confidence.

You missed it.

The setup you’d been watching for days, maybe weeks finally played out.

Clean. Precise. Exactly as planned.

But you weren’t in it.

Maybe you hesitated.

Maybe the trigger didn’t line up perfectly.

Or maybe you just weren’t at your desk.

Either way, it’s done.

But your mind doesn’t let it go.

You replay it.

Frame by frame.

You check where you would have entered, where you would have exited.

You tell yourself it’s “reviewing.”

But it’s not.

It’s rumination.

A mental loop that feels productive but keeps you stuck in what can’t be changed.

You’re not trading the market anymore… you’re trading your memory of it.

And every replay reinforces the belief that you should’ve done better.

The body joins in too.

Tight chest. Restless legs.

An urge to make it back .

That’s the real danger.

Because the next trade isn’t about opportunity, it’s about redemption.

And redemption trades rarely end well.

The skill isn’t in ignoring the regret.

It’s in recognising it for what it is: the echo of unmet expectation.

Ask yourself: what am I actually trying to fix here?

The missed trade… or the feeling of not being enough?

The point here is:

Reflection helps you grow.

Rumination keeps you stuck.

Learn to tell the difference.

That’s where real mastery begins.

Meme Coins: Gambling or Genius? The Untold Psychology!Hello Traders!

From Dogecoin to Shiba Inu to PEPE, meme coins have turned ordinary investors into overnight millionaires… and just as quickly, wiped them out.

But behind all the hype, memes, and moonshots, lies a deeper question:

Are meme coins pure gambling, or is there actually a kind of genius hidden inside this madness?

Let’s explore the real psychology that drives the meme coin phenomenon and what it teaches us about market behavior.

1. The Allure of “Quick Rich” Dreams

Meme coins sell emotion, not utility. They trigger the most powerful desire in human nature, the dream of instant wealth.

Traders jump in not because of fundamentals, but because of FOMO (Fear of Missing Out).

When people see others getting rich on Twitter or Telegram, logic disappears, replaced by hope and greed.

Meme coins don’t just trade on charts; they trade on human emotion.

2. The Hidden Genius of Community Psychology

While most treat meme coins as jokes, their creators understand one truth, markets move on attention .

Every meme coin is a masterclass in viral marketing.

They combine humor, belonging, and financial dreams, creating powerful communities that believe, promote, and act together.

It’s not fundamentals, it’s faith.

And when millions believe at the same time, even a joke becomes valuable, at least for a while.

3. The Bubble Psychology – Why It Repeats

Each meme coin cycle starts the same: early adopters accumulate silently.

Then comes the hype wave, influencers, trends, and social media buzz.

Late buyers rush in, liquidity explodes, and eventually, the supply outpaces the demand.

Finally, prices collapse, but the story repeats with a new name next month.

Humans never learn because our emotions never evolve. The pattern stays the same, only the logos change.

4. Genius or Gambling – The Thin Line

If you treat meme coins as “investments,” you’re gambling.

But if you treat them as short-term speculative plays with strict risk limits, you’re being strategic.

The key difference is not in the coin, it’s in your mindset.

Even BNF-level discipline can’t save someone trading emotionally in meme markets.

The real genius is not in predicting the next PEPE, it’s in managing risk when emotions run wild.

Rahul’s Tip:

Meme coins reveal more about human behavior than any economic theory ever will.

If you can understand why people chase hype, and control the urge within yourself, you’ll already be ahead of 90% of traders.

Conclusion:

Meme coins are not just digital jokes, they are mirrors reflecting our collective greed and hope.

They remind us that markets are not rational, they are emotional.

In the end, whether meme coins make you rich or broke depends less on the coin, and more on your ability to stay grounded while everyone else loses control.

If this post gave you a new perspective on meme coins, like it, share your view in comments, and follow for more deep trading psychology insights!

The Comeback Urge - When a Loss Feels PersonalNOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure so you can trade your own system with clarity and confidence.

We saw some very deep sell offs towards the end of last week.

Imagine this if you will.

You’ve just taken a loss.

This one is not catastrophic, but it stings.

You replay it in your head.

What you could’ve done differently.

Where you should’ve cut.

What you should’ve seen.

And before the dust even settles, there’s an urge .

To get back in.

To “come back strong.”

To show the market and yourself that you’ve still got it.

At first, it feels like determination.

But look closer.

That energy coursing through your body isn’t calm focus.

It’s agitation.

Your jaw tightens.

Your breath shortens.

Your shoulders inch forward toward the screen.

Your system has just taken a hit not just financially, but emotionally.

Your identity as a capable, disciplined trader feels threatened.

And the impulse to trade again isn’t about opportunity.

It’s about redemption.

You’re not trying to win the market back.

You’re trying to win yourself back.

What’s really happening:

After a loss, your mind scrambles to restore equilibrium.

It wants to prove you’re still competent, still in control.

But trading from that place rarely ends well

Because the next trade becomes about repairing ego, not executing process.

It’s subtle, but powerful:

You’re no longer trading the chart.

You’re trading your self-image .

How to shift it:

Pause.

Acknowledge the emotional hit - not with judgment, but awareness.

Let the nervous energy move through your system without acting on it.

Remind yourself: “This is biology, not skill decay.”

You haven’t lost your edge, you’ve just been knocked off-center.

When you can sit in that discomfort without needing to erase it

That’s when emotional maturity starts replacing emotional reactivity.

And that’s not just psychology - it’s edge .

Because trading well doesn’t just depend on your system. It depends on your state .

Ask yourself:

When I rush to make it back,

What part of me am I really trying to fix?

The moment you can see that the need to prove, to redeem, to make it right is coming from ‘make back’

You stop trading from the wound and start trading from awareness.

And that’s where consistent performance begins

If this resonated, please check out my post on FOMO. H'ere's the link:

Universal Trading Psychology: The Patience Paradox PlaybookUniversal Trading Psychology: The Patience Paradox Playbook

A general discipline lesson you can apply to any liquid market and any timeframe

Most trading pain is not caused by a bad system. It is caused by impatience. The edge appears when you plan inactivity, watch with intent, wait for confirmation, and only act when setup quality is high. Cash is a position.

1. Why patience beats impulse in every market

Impatience sneaks in as early entries, overtrading, revenge trading, and random scaling. These habits feel productive because you are clicking and chasing motion. In reality they transfer capital from your future self to the present urge. Patience does the opposite. It gives your method time to read structure, it allows volatility and volume to normalize, and it keeps your energy for the right moment. The effect is universal. It does not matter if you trade indices, commodities, crypto, stocks, or forex. It does not matter if you trade on the one minute, the fifteen minute, or the daily. The core link is simple. Better timing raises the probability of an idea and lowers drawdown. Fewer attempts with higher quality improve expectancy and improve return divided by drawdown. That is the language that every account understands.

2. The Patience Paradox in plain language

The paradox says you can win more by doing less. You plan windows where you watch the market without touching the buy or sell buttons. You promise to yourself that you will let a timer run and you will only act after a confirmation event. Inactive minutes feel like a cost at first. In practice they are an investment. They reduce noise, they teach you the current regime, and they keep you calm enough to apply your edge. The paradox holds across sessions. The first minutes after a session begins often have high noise and emotional bait. The middle of the session can go quiet and trick you into forcing trades. The last minutes can be erratic. A patient trader respects this rhythm and keeps a written plan of when to observe and when to allow action.

3. Observation windows that fit any market

Observation windows are simple. Pick a time block. Start a timer. During the block you do not place orders. You watch the tape, the order of bars, the response to levels, and the size of swings. You collect awareness. You write one or two sentences about regime and structure. Then the timer ends. Only then do you look for a trade.

Observation windows you can adopt today

Pre session scan for fifteen minutes. You prepare levels and watch the first hints of tempo. Inactive only.

Session open observation for fifteen minutes. You let the first box form. No orders until a bar closes beyond this box and the next bar respects that information.

Mid session read for thirty minutes. You classify regime as active or quiet using simple filters and you decide trend, range, or inactivity.

Pre secondary session observation for fifteen minutes. If your market has two major sessions, you repeat the open observation idea.

Post trade cooldown for ten to twenty minutes. You break the dopamine loop, you write a short review, and you reset your attention.

How to make it practical

Place a small physical timer on your desk. A phone timer also works. Print a one page card with your windows and durations. When the window starts, say out loud that you are in observation and you will sit on hands until the timer ends. This small ritual builds identity. It tells your brain that watching is part of trading and not a waste of time.

4. Confirmation that cuts false signals

Impatience usually shows up as early entry without confirmation. The most portable rule is also the simplest. Wait for the close. A signal bar that looks perfect in the middle of its life can close with a wick, a rejection, or a full flip. If you still want earlier entry mechanics, use delay one bar. You let a signal print. You enter on the next bar only if price remains valid. Both rules reduce false positives and reduce the total number of attempts. That is a feature, not a bug. The quality of attempts goes up. The mood in your head calms down. Your journal becomes cleaner to read and your expectancy calculation becomes more stable.

A universal confirmation checklist

The setup is valid by your written plan.

Close confirms beyond structure or a retest holds and closes in your direction.

Regime filters are supportive. You see participation that matches the idea.

Risk and position size are defined. The exit is clear before you click.

5. Regime filters that travel well

Regime is the background condition that decides if your strategy is likely to read the market correctly. You can estimate regime with two simple filters. One measures volatility. One measures participation. These two are available on any platform.

Volatility filter

Use average true range with a long enough length to be stable. A common choice is length fifty. Express ATR as a percent of price so you can compare across timeframes and symbols. Compare the current reading to a baseline such as the daily median over the last few weeks. Above the baseline means active regime. Below means quiet regime.

Participation filter

Use a session volume baseline. A simple moving average of session volume works. When current volume is below the baseline, you demand more patience or you switch to range tactics. When current volume is above the baseline, you keep confirmation strict and you avoid random scalps.

Session filter

Every market has time of day effects. The first minutes can be noisy. Lunchtime or the middle band can be flat. The last minutes can snap. You plan a response. Observe at the open. Reduce attempts in the lull. Keep the end of session simple.

6. Cooldown, loss streak lockout, and daily loss limit

Cooldown is the fastest lever you can pull to stop impulsive streaks. After any loss you start a ten to twenty minute cooldown. You leave the chart zoom alone. You write a short paragraph with what the market did and what you did. This break cuts the urge circuit and lets you reset. A lockout is a stronger version. Two losses in a row at full risk trigger a lockout until the next session. Three small losses also trigger a lockout. A win does not cancel a lockout if you broke plan discipline during the win. A daily loss limit protects the account from a bad day. Pick a fraction of your weekly drawdown budget. When you hit it, you stop for the day. These three guardrails build survivorship and keep your mind from spiraling.

7. Expectancy and return divided by drawdown

Expectancy is the average outcome per trade. Write it as average win multiplied by win probability minus average loss multiplied by loss probability. It is a small number in units of R. That is fine. The power of expectancy is repetition. The second metric to watch is return divided by drawdown. This tells you how efficiently you compound given the cost of the worst pullback. Patience improves both. Cutting early attempts raises win probability and often raises average win because you pick cleaner structure. Removing impulsive losses reduces drawdown. Together they stabilize equity and make your process less emotional.

A quick way to measure

Log ten to twenty trades under the patience protocol. Record average win in R, average loss in R, win rate, and worst drawdown in R. Compute expectancy and return divided by drawdown. Then compare to your prior logs where you did not respect observation or confirmation. The difference shows you why patience pays.

8. A portable pre market checklist

Checklists prevent decision fatigue. Use one page. Keep the language simple.

Trade plan

Plan is visible. Strategy is defined.

Entry, exit, and position size rules are clear and written.

Journal template is open.

Market regime

ATR as percent of price labeled active or quiet.

Session volume labeled below baseline or above baseline.

Prior session open, high, low, close marked.

Observation windows for the first minutes drawn on the chart.

Session timing

Pre session observation timer set.

Open observation window scheduled.

Lunchtime lull noted.

Post session review time booked.

Watchlist and setup quality

Three to five names maximum.

One sentence setup description for each name.

Score the idea from one to five on quality.

Act only on four or five.

Confirmation and patience

Delay one bar or close based confirmation selected.

Inside bar means wait. No exceptions.

If FOMO appears, start a five minute micro timer and breathe.

Say out loud that doing nothing is a valid decision.

Risk and position control

Risk per trade set as a fixed percent of equity.

Stop never widened after entry.

No adds unless the plan explicitly allows scaling.

Daily loss limit and lockout rules visible.

Exit plan

Exit condition defined before entry.

Partial exits use confirmation if the system supports it.

If a volatility spike hits, reduce risk or exit per plan.

Journal the reason for the exit.

9. A simple setup quality score

A score makes permission to trade objective. Use five factors. Each is zero to two.

Factors

Regime. Market aligned with the strategy using the filters.

Structure. Setup is clean with room to target.

Timing. Observation respected and confirmation present.

Risk. Position size correct and stop placed where logic breaks.

Mindset. Patient attention present and FOMO absent.

Eight or more means permission. Seven or less means wait. This one rule saves careers.

10. A day in the life under the Patience Paradox

You begin fifteen minutes before your active session with an observation. You mark levels and write a short line about tempo. No orders. When the session begins you let the first box print. A breakout looks tempting inside the window, but you stay inactive. The next bar fails to close beyond the box. You extend the delay. Later participation rises above the baseline and volatility reaches the active zone. Your strategy calls for a trend pullback entry. You wait for a bar to close back in the direction of trend. Then you take a single position with one percent risk. The trade reaches target. You record the result and start a short cooldown. Near the second session open you repeat the observation idea. A clean setup appears but your score is only six. You pass and write one sentence to honor the decision. You end the day with a review and update your metrics. Equity is stable. Attention is calm. The process feels repeatable.

11. Overtrading prevention that actually works

Limit attempts per session. Use micro breaks whenever fatigue appears. If the journal shows a loss streak, apply the lockout. If volatility is too low, accept inactivity. If noise is heavy near the open, extend the observation. If you break any rule, record the event and reduce size on the next attempt. Prevention is cheaper than recovery. You will never regret a trade you did not take. You will often regret the one you forced.

12. Mindfulness and urge surf for traders

Mindfulness is not about long meditation. It is about a one minute reset. Watch the breath for one minute. Name the urge silently. Start a two minute timer and surf the wave. When it passes, you return to the plan. This tiny protocol moves you from reaction to response. Over time it raises your discipline score and lowers your cost of error.

13. Frequently asked behavior questions

What if the first clean setup appears during the first minutes of the day

You still respect the observation. The first confirmation bar after the window often gives better probability and a calmer entry.

What if volume stays below average all day

Reduce attempts. Focus on one name or stay inactive. Quality beats quantity. You are paid for selectivity, not activity.

What if I miss a win after a long wait

Missing is normal. Write it in the journal and keep the schedule. The market never runs out of opportunities. Your attention does.

How do I measure improvement

Track three numbers. Expectancy. Return divided by drawdown. Discipline score. If the first two rise and the third stays above four, the process is working.

14. Install the Paradox in one week

Day one. Print the checklist and the windows. Place a timer on the desk. Commit to half the usual number of attempts.

Day two. Run all observation windows. Log only confirmed ideas.

Day three. Add the cooldown after any loss. Review your writing at the end of the day.

Day four. Apply the loss streak lockout if needed. Protect the account.

Day five. Score every idea with the five factor grid. Only trade eight or more.

Day six. Compute expectancy and return divided by drawdown from the week.

Day seven. Read your notes. Keep the parts that made you calm and effective. Remove what was noise.

15. Comparator versus a passive baseline

You want to see that patience improves efficiency. Pick a baseline that matches your market. If there is a natural session, use buy at session open and exit at session close. If there is no natural session, use an always in market baseline. Then run the Patience Paradox protocol next to it.

How to compare in three steps

Compute baseline results across your window. Record attempts, average result per session, and worst drawdown in R.

Compute Paradox results with observation windows, confirmation, and guardrails. Record attempts, expectancy, and worst drawdown in R.

Compute return divided by drawdown for both. When the protocol is respected, this ratio usually improves even if total trades drop. Your account and your sleep benefit from that.

16. A journal template you can use today

Before entry

Setup name and one sentence description.

Regime notes on volatility and participation.

Quality score and reason for each point.

Risk in R and exit plan.

After exit

Result in R and whether the logic held.

What you felt and how you responded.

What you would repeat and what you would remove.

One sentence lesson for the board.

17. Advanced patience drills for professionals

The inside bar extension

When a bar prints inside the prior range you extend the observation by one more bar. This drill stops you from guessing breakouts and creates a natural delay.

The half size probation

After a loss you allow the next confirmed idea at half size. You return to full size only after a clean win that followed plan. This keeps you from trying to win it back.

The one pass rule

You allow yourself one pass on a marginal idea each week. You write the reason and the outcome. This rule prevents a cascade of rationalizations.

18. Closing perspective

Patience is not passive. It is active observation guided by rules. A professional monitors regime, respects timers, demands confirmation, and protects the account with cooldowns and lockouts. The paradox is simple. Inactivity at the right time raises probability, keeps drawdown shallow, and makes expectancy stable. Traders who internalize this find that the market stops feeling like a battle and starts feeling like a process. You do less. You see more. You let the best ideas come to you.

Education and analytics only. Not investment advice.

Thank you all for reading this article.

If you have any type of requests, drop a comment below.

FOMO - The Urge That Costs You TwiceNOTE: This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. I’m posting this to help you preserve your capital, energy and will so you can execute your own trading system with calm, patience and confidence.

So here we are, Gold kissing 4000.

It’s been on a tear and hasn’t looked back.

Relentless. Higher, higher, higher.

Now imagine being the trader who stalked this setup… but missed the entry.

The setup was clean. The context made sense.

But you hesitated. You wanted confirmation.

And now it’s gone.

At first, you tell yourself you’re fine.

You’ll wait for the pullback.

But the longer you watch, the more unsettled you become.

Your legs bounce.

Your breath shortens.

Price rips higher without you.

And the thought slips in…

“I can’t miss this.”

Before you know it, your hand hovers over the button

ready to break your own rules just to feel part of the move.

What’s really happening inside you:

Thoughts:

“Argghh… I knew it. Ok, it’s moving. Wait for the pullback.”

“Urgh… another headline, it keeps moving up… everyone else is in.”

“It’s not pulling back. This is the move I’ve been waiting for. Missing out is worse than losing.”

“I’ll never forgive myself if I just watch this go without me.”

Feelings: Restlessness. Envy. Urgency.

Behaviours: Dropping timeframes, chasing moves, flipping charts, forcing setups.

Body cues: Buzzing energy in chest or stomach, jittery hands, shallow breath, can’t sit still.

The Trigger:

Watching a move take off without you, especially after hesitation stopped you last time. Watching price rise without a look back. Everyone's talking about it. It’s on the newsfeed. ‘Record highs’. ‘Biggest day ever’.

Why it feels so powerful:

FOMO isn’t about the market. it’s about survival wiring.

Your brain equates “missing out” with exclusion, being left out.

So urgency feels safer than patience.

Acting now, even without an edge, feels like relief, because at least you’re doing something.

The real cost:

FOMO makes you chase highs and sell lows.

It costs you twice.

Once when you chase the move and lose.

And again when you lose faith in your own process.

Each time you act on urgency, you train your nervous system to link tension with execution.

That’s how confidence quietly drains away.

How to shift it:

Pause & name it: say out loud, “This is FOMO.” Awareness loosens its grip.

Breathe into it: slow your breath until your body settles. Teach your system that calm not chaos precedes execution.

Anchor: remind yourself the market is infinite. “It takes a second to wreck it… it takes time to build.” Beastie Boys

Reset: ask, “If I hadn’t seen that move, would I still take this setup?” If not, stand down.

Missing a move hurts but chasing it turns one mistake into two.

Discipline pays you back; impulse never does.

The market will always offer another opportunity.

Your edge is keeping your nerve, calm and self-control until it does.

By the way, for those that missed the Non Farm post last week. Turns out that Non Farm has been re-scheduled for this Friday... (but they can always reschedule again). Check this link out for anyone lining up for Non Farm this week.

Opportunities Return, Lost Money Doesn’tGold is making all-time highs like there’s no tomorrow. And yet, I haven’t joined the trendin the past days. I made some money selling last week, but I didn’t ride the wave higher. Am I sorry? Not at all.

This brings me to a principle that guides my trading: I would rather miss an opportunity than lose money.

________________________________________

Confidence Over FOMO

The most important thing in trading is not catching every move — it’s trading with confidence. Even when I lose, I want to know why I lost.

That way, the loss has meaning. It’s part of a process I can trust and refine.

At this moment, my internal radar simply won’t allow me to buy Gold. Sure, it might rise more, but I’m not upset about “missing out.” Why? Because I need to believe in what I trade.

If I don’t, then every tick against me becomes torture, and I start questioning myself at every piece of market noise.

________________________________________

Why Missed Opportunities Don’t Hurt

• Opportunities always come back. The market is generous in that way.

• Lost money doesn’t come back by itself. You need another trade, another risk, another exposure — and usually more stress.

• Confidence compounds. When you only take trades you truly believe in , you build trust in your own process. That trust is what keeps you alive in the long run.

________________________________________

The Psychological Edge

Traders often think missing a trade is painful. In reality, it’s a sign of strength. It means you didn’t bend your rules, didn’t give in to FOMO, didn’t chase a market just because “everyone else” is.

Trading without belief in your setup is like walking into a fight without conviction. You’re already halfway defeated.

________________________________________

Final Thoughts

Yes, Gold is printing all-time highs. Yes, I could have bought and made some money. But I’m fine with that. Because keeping my confidence and protecting my capital matters more than chasing every rally.

Opportunities are infinite. My capital and my confidence are not.

That’s why I’ll always prefer missing an opportunity over losing money.

$WLFI: Trump has already pocketed $5B!It’s all over the news: Liberty Financial just made $5B in a single day.

First there was #Melania → rugged.

Then $Trump → rugged.

Now it’s $WLFI. What’s next?

On day one, the coin already dumped –25% overall as insiders cashed out — the usual playbook.

So where did that $5B come from?

👉 From YOU — from millions of retail investors chasing a piece of the cake, only to be rugged and left holding losse.

And the silence is deafening. Crypto isn’t “unregulated” by accident. It’s designed this way so billionaires can keep manipulating markets: buying influencers, manufacturing fake FOMO, and then using retail as exit liquidity.

We’ve seen it before: $GUNS raised $120M with the hype of a “good game, good team” — and still collapsed. Investors ended up deep in the red because, in reality, the game and the team weren’t good at all.

Meanwhile, dozens of genuinely solid projects never get funding or VC support because they don’t have millions to throw around. They just want to build honestly — and that doesn’t attract speculators.

The current model is simple:

Launch = rug retail investors, so VCs and exchanges rake in millions. Sometimes founders get their slice, sometimes they don’t.

Ask around: Daomaker, Polkastarter, CoinTerminal — hundreds of projects, all the same story. Rugged Ponzi schemes enriching launchpads and exchanges.

$WLFI is no different. Welcome to the manipulation dome: FOMO in, FUD out… and in the end, another dead coin dumped into the crypto graveyard.

💡 My advice? Grab some popcorn and watch the masters make billions off the poor and uninformed — because that’s the only entertainment you’re going to get from this circus.

I might be wrong, I whish I am, meanwhile: DYOR, do not gamble with your money.

$TOTAL analysis and the market psychologyOn this chart, I’ve highlighted some reliable patterns showing how the market often moves opposite to public sentiment.

📉 The triple top pattern led to only a small correction, and now we’re entering another one.

It’s the same story every time: when the RSI is overbought, social media explodes with “BUY! BUY! BUY!” — fueling FOMO and pushing late entries. That’s usually the best time to take profits.

Now, with CRYPTOCAP:BTC correcting after touching $124K and eyeing the $111K zone, we’re likely to see fear and negativity on social media, with people calling for the “end of the bull market.” Ironically, that’s exactly when smart money starts buying.

The market is designed to play with your emotions:

When it dumps → that’s your chance to buy at strong entries.

When RSI is overheated and everyone screams ATH → that’s the moment to take profit.

So… are you ready to refill your bags? 🚀

Check my ideas for clear entry zones on coins like CRYPTOCAP:INJ , SEED_DONKEYDAN_MARKET_CAP:BONK , CRYPTOCAP:PEPE , LSE:CFX , SEED_DONKEYDAN_MARKET_CAP:FLOKI , CRYPTOCAP:SUI , and more.

⚠️ DYOR (Do Your Own Research).

The Great Trap: How Billionaires Are Winning, and You're Not!The Great Crypto Trap: How Billionaires Are Winning—And You're Not

The ETFs, Saylor, and all of Trump's billionaire friends are getting richer—thanks to crypto.

Meanwhile, most retail traders are just trying to stay above water. Leverage trades are wiped out, charts feel rigged, and the market makes you feel like you're swimming against a riptide.

Why?

Because these rich guys have a plan: manipulate you and take your money. That’s how they stay rich.

Understanding their strategy is the first step to stop being their exit liquidity.

🧠 The New Battlefield

Crypto is no longer a playground for cypherpunks and tech rebels. It’s fully institutional now. We're not just trading against whales—we're fighting the same entities that own the media, control Wall Street, and write the rules.

So forget the old ways of thinking. The tables have turned.

🗓 The Sunday Rekt Routine

To maximize destruction, they need to avoid friendly fire. So they pump on the weekend when retail is free and optimistic, then dump on Monday to close the CME gap—like clockwork.

The playbook:

Weekend: Pump. Trap your long.

Monday: Dump. “Fill the gap.” Liquidate everyone.

Response:

Don’t fall for weekend FOMO. Exit Sunday afternoon. Wait until Tuesday to re-enter, once Monday’s high and low are set. Trade smart, not emotional.

📈 Top-of-the-Market FOMO

You’ve seen it before. Just before the crash, the media frenzy begins. Influencers say “Don’t miss this pump!” or “99% will miss the next big move!” The ETF gods hint at new inflows. It's a setup.

They're not hyping it for your benefit—they're offloading their bags in your face.

Just look at the charts:

BlackRock bought billions to drive BTC to 121K.

Then, in 72 hours, they dumped billions.

Saylor? Silent. No new buys. That’s not coincidence—it’s coordination.

Response:

Check the MACD, RSI, and Stochastic RSI on daily or weekly timeframes. If they're maxed out and the influencers are screaming green—it’s probably too late.

When they stop buying, the dump is already planned.

🧰 How to Outsmart Them

Watch the MACD for crossovers and divergence.

Monitor RSI zones—don’t long into extreme overbought conditions.

Use Stoch RSI to anticipate momentum shifts.

Rule: When everything is overheated, and FOMO is peaking—step back. Let them dump into each other. You’ll get your entry later, cleaner and cheaper.

⚔️ This Is War

Make no mistake: this is a war for your money.

They want yours. You want theirs.

Only the smart survive.

To be continued.

DYOR.

You've Already Lost: The Bitcoin Delusion of FOMO and False HopeLet’s get one thing straight: if you’re staring at Bitcoin, squinting past the red flags, and convincing yourself it’s not a Ponzi scheme because of that one shiny feature that screams “legit,” you’re not investing—you’re auditioning for the role of “next victim.” And if your motivation is the fear of missing out (FOMO) or the fantasy of getting rich quick, well... congratulations. You’ve already lost.

The 99%: Red Flags Waving Like It’s a Parade

Let’s talk about the indicators—the ones that make Bitcoin look suspiciously like a Ponzi scheme. No, it’s not technically one, but the resemblance is uncanny:

- No intrinsic value: Bitcoin isn’t backed by assets, cash flow, or a government. It’s worth what the next person is willing to pay. That’s not investing. That’s speculative hot potato.

- Early adopters profit from new entrants: The people who got in early? They’re cashing out while newcomers buy in at inflated prices. That’s the classic Ponzi dynamic: old money out, new money in.

- Hype over utility: Bitcoin’s actual use as a currency is minimal. It’s slow, expensive to transact, and volatile. But hey, who needs functionality when you’ve got memes and moon emojis?

- Opaque influencers: From anonymous creators (hello, Satoshi) to crypto bros promising Lambos, the ecosystem thrives on charisma, not accountability.

- Scam magnet: Bitcoin has been the currency of choice for over 1,700 Ponzi schemes and scams, according to a University of New Mexico study cs.unm.edu . That’s not a coincidence. That’s a pattern.

The 1%: The “But It’s Decentralized!” Defense

Ah yes, the one redeeming quality that Bitcoin evangelists cling to like a life raft: decentralization. No central authority! No government control! It’s the financial revolution!

Except… decentralization doesn’t magically make something a good investment. It just means no one’s in charge when things go wrong. And when the market crashes (again), you can’t call customer service. You can tweet into the void, though.

FOMO: The Real Engine Behind the Madness

Let’s be honest. Most people aren’t buying Bitcoin because they believe in the tech. They’re buying because they saw someone on TikTok turn $500 into a Tesla. FOMO is the fuel, and social media is the match.

Bitcoin’s meteoric rises are often driven by hype cycles, not fundamentals. Tesla buys in? Price spikes. El Salvador adopts it? Price spikes. Your cousin’s dog walker says it’s going to $1 million? Price spikes. Then it crashes. Rinse, repeat.

This isn’t investing. It’s gambling with a tech-savvy twist.

The Punchline: You’ve Already Lost

If you’re ignoring the overwhelming signs of speculative mania and clinging to the one feature that makes you feel better about your decision, you’re not ahead of the curve—you’re the mark. And if your motivation is “I don’t want to miss out,” you already have. You’ve missed out on rational thinking, due diligence, and the ability to distinguish between innovation and illusion.

Bitcoin might not be a Ponzi scheme in the legal sense. But if it walks like one, talks like one, and makes early adopters rich at the expense of latecomers… maybe it’s time to stop pretending it’s something else.

INDEX:BTCUSD NYSE:CRCL NASDAQ:HOOD TVC:DXY NASDAQ:MSTR TVC:SILVER TVC:GOLD NASDAQ:TSLA NASDAQ:COIN NASDAQ:MARA

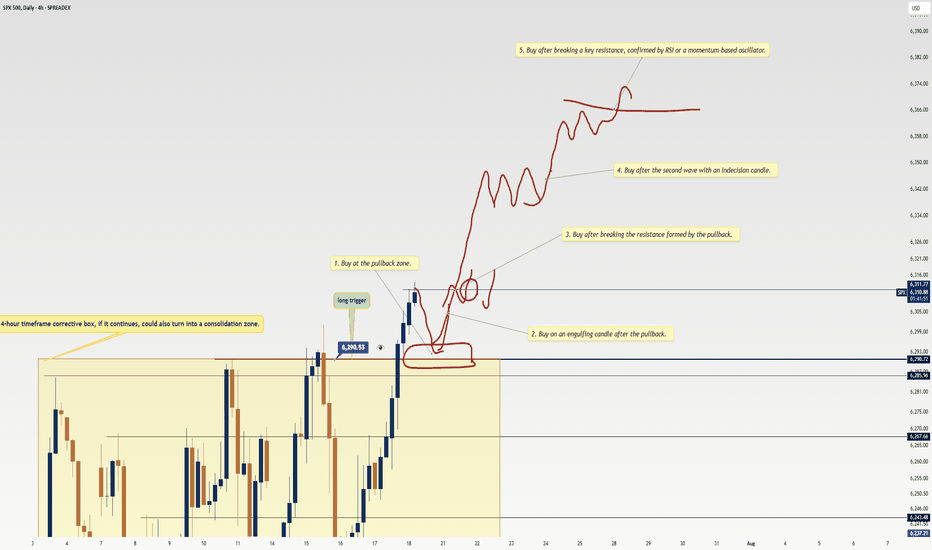

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

Analyzing the Market with Fundamental and Technical AnalysisAnalyzing the Market with Fundamental and Technical Analysis

In addition to technical analysis, it's important to consider fundamental factors that could influence the market. News releases, economic reports, and central bank decisions can significantly impact price movements.

Fundamental Analysis:

Keep an eye on major economic indicators like NFP, CPI, and interest rate decisions. These factors can drive the market and change its trend direction.

Technical Analysis:

Use tools like EMA, Fibonacci, and Price Action to confirm the trend and identify entry points.

For daily updates and comprehensive market analysis, join my MMFLowTrading TradingView channel, where I combine both technical and fundamental analysis to give you the most accurate insights.

Conclusion:

Identifying market trends in one day doesn’t have to be complicated. By using the right tools like EMA, Fibonacci, and Price Action on TradingView, you can make better trading decisions every day. To take your trading to the next level, join my MMFLowTrading TradingView channel for daily updates, real-time trend analysis, and expert trading signals.

Ready to start trading with precision? Join my MMFLowTrading TradingView channel today for daily market insights and trading setups. Stay updated with real-time analysis, get actionable trading signals, and take your trading skills to the next level. Follow me now on TradingView!

Not Every Candle Needs a Reaction — I Know I’ve GrownThere was a time I thought I needed to react to every move.

A clean candle? I’d enter.

A minor imbalance? I’d take the risk.

A zone that “looked okay”? I’d justify it.

Why? Because I was chasing something.

Chasing certainty .

Chasing profit .

Chasing control .

But here’s the thing I didn’t understand back then:

Not every candle needs a reaction. And not every move is my move.

🧠 Overtrading Wasn’t a Strategy. It Was a Symptom.

It was a symptom of fear — fear of missing out (FOMO).

It was a symptom of insecurity — not trusting my own process.

It was a symptom of impatience — not letting the market come to me.

I confused activity with progress. I thought being busy on the charts meant I was becoming better. But most of the time, I was just bleeding my edge.

💡 The Turning Point

Growth didn’t happen because I learned a new indicator. It happened the moment I started asking myself:

Is this my setup? Or am I just bored, hopeful, or triggered?

When you define a clear trading plan, with criteria you believe in, the real test isn’t finding setups...it’s waiting for the right ones. Today, I can watch the market move beautifully without me and feel absolutely nothing.

That’s freedom.

That’s growth.

That’s power.

🧘🏽♂️ From Reactive to Intentional

Now, I focus on:

Waiting for my specific SMC criteria to line up

Sticking to my CRT model (PDL/PWH sweep → BOS → FVG)

Trusting that missing one trade means nothing if I stay consistent

Letting the market come to me

I’m no longer in the game to prove something. I’m here to play my edge , manage my risk , and protect my mind.

📌 Final Words

Growth in trading isn't loud. It doesn’t scream from a winning streak. It shows up quietly:

in the trades you didn’t take.

in the silence between setups.

in the patience to do nothing until it’s time.

So if you’re not constantly in a trade, that’s not weakness that’s wisdom.

Bitcoin's Market Cycles — Are We Nearing the Top?Bitcoin is approaching a critical moment and the signs are everywhere.

After more than 900 days of steady bull market growth, BTC now flirts with all-time highs (ATH) while momentum stalls, liquidity thins, and emotions run hot. You might be asking:

Are we nearing the cycle top?

Is now the time to de-risk or double down?

What comes next?

This isn’t just a question of price. It’s about timing, structure, and psychology.

In this analysis, we’ll break down Bitcoin’s historical cycles, the current macro structure, the hidden signals from Fibonacci time extensions, and how to think like a professional when the crowd is chasing FOMO.

Let’s dive in.

📚 Educational Insight: Understanding Bitcoin Cycles

Bitcoin doesn’t move in straight lines, it moves in cycles.

Bull markets grow slowly, then explode. Bear markets fall fast, then grind sideways. These rhythms are driven by halving events, liquidity expansions, and most importantly: human emotion.

Here’s what history tells us:

Historical Bull Markets:

2009–2011: 540 days (+5,189,598%)

2011–2013: 743 days (+62,086%)

2015–2017: 852 days (+12,125%)

2018–2021: 1061 days (+2,108%)

2022–Present: 917 days so far (+623%)

Bear Market Durations:

2011: 164 days (-93.73%)

2013–2015: 627 days (-86.96%)

2017–2018: 362 days (-84.22%)

2021–2022: 376 days (-77.57%)

💡 What does this tell us?

Bull markets are growing longer, while bear markets have remained consistently brutal. The current cycle has already surpassed the average bull run length of 885 days (cycles #2–#4) and is quickly approaching the 957-day average of the two most recent cycles (#3 and #4). That makes this the second-longest bull market in Bitcoin’s history.

⏳ 1:1 Fibonacci Time Extension — The Hidden Timing Signal

In time-based Fibonacci analysis, the 1.0 (1:1) extension means one simple thing: this cycle has now lasted the same amount of time as previous cycles — a perfect time symmetry.

Here’s how I measured it:

Average bull market length #2–#4(2011–2021): 885 days

Average bull market length #3–#4(2015–2021): 957 days

Today’s date: May 27, 2025 = Day 917

✅ Result: We are well inside the time window where Bitcoin historically tops out.

You don’t need to be a fortune teller to see that this is a zone of caution. Markets peak on euphoria, not logic and this timing confluence is a red flag worth watching.

🗓️ "Sell in May and Go Away" — Not Just a Meme

One of the oldest market adages is showing its teeth again.

Risk assets — including Bitcoin — tend to underperform in the summer months. Why?

Lower liquidity

Institutional rebalancing

Exhaustion from prior run-ups

Vacations and reduced trading volumes

And here we are:

Bitcoin is hovering near ATH

It's been in an uptrend for 917 days

We just entered the time-extension top zone

Liquidity is thinning across the board

You don’t need to panic. But you do need to think like a professional: secure profits, reduce exposure, and wait for structure.

😬 FOMO Is a Portfolio Killer

This is where most traders make their worst decisions.

FOMO (Fear of Missing Out) isn’t just a meme — it’s the reason so many people buy tops and sell bottoms.

Before entering any trade right now, ask yourself:

Where were you at $20K?

Did you have a plan?

Or are you reacting to headlines?

📌 Clear mind > urgent clicks

📌 Patience > chasing green candles

📌 Strategy > emotion

Let the herd FOMO in. You protect your capital.

Will This Bear Market Be Different?

Every past cycle saw BTC retrace between 77%–94%. That was then. But this time feels… different.

Here’s why:

Institutions are here — ETF flows, sovereign wealth funds, and major asset managers

Regulation is clearer — and risk capital feels safer deploying in crypto

Supply is tighter — much of BTC is now held off exchanges and in cold storage

While a massive crash like -80% is less likely, that doesn’t mean a correction isn’t coming. Even a 30%–40% drop from here would wreak havoc on overleveraged traders.

And that brings us to…

🚨 Altseason? Or Alt-bloodbath?

Here’s the hard truth:

If BTC corrects, altcoins will crash — not rally.

Most altcoins have already seen strong rallies from their cycle lows. But if BTC drops 30%, many alts could tumble 50–80%.

Altseason only happens when BTC cools off and ranges — not when it dumps. Don’t get caught holding the bag. Be tactical. Be disciplined.

So Where’s the Next Big Level?

You may be wondering: “If this is the top… where do we fall to?”

Let’s just say there’s a very important Fibonacci confluence aligning with several other key indicators. I’ll reveal it in my next analysis, so stay tuned.

🧭 What Should You Do Right Now? (Not Financial Advice)

✅ Up big? — Take some profits

✅ On the sidelines? — Wait for real setups

✅ Emotional? — Unplug, reassess

✅ Are you new to Trading? — study, learn (how to day trade) and prepare for the next cycle

The best trades come to the calm, not the impulsive.

💡 Final Words of Wisdom

Bitcoin rewards discipline. It punishes emotion.

Right now is not about catching the last 10% of upside — it’s about:

Watching structure for potential trend change

Measuring risk

Avoiding overexposure

Protecting what you’ve earned

📌 The edge isn’t in indicators. It’s in mindset. Stay prepared, stay sharp because in this market…

🔔 Remember: The market will always be there. Your capital won’t — unless you protect it.

The next big opportunity doesn’t go to the loudest.

It goes to the most ready.

_________________________________

Thanks for reading and following along! 🙏

Now the big question remains: Is a bear market just lurking around the corner?

What are your thoughts? Let me know in the comments. I’d love to hear your perspective.

_________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

SOL Hits Major Resistance — Patience Over FOMOOne of the most common mistakes traders make—especially in fast-moving markets—is jumping into trades impulsively at major resistance. It feels exciting when price is surging, but ironically, this is often where risk is highest and reward is most limited.

Why? Because historical resistance zones—like the $175–$183 region on SOL—tend to attract heavy sell pressure. These are levels where many past buyers look to exit, where smart money hunts liquidity, and where false breakouts are most common. Without volume confirmation and a proper retest, breakouts through such zones often fail.

That’s why experienced traders wait. The smarter approach is to let the market come to you, and only act when one of two things happens:

A pullback into a well-defined, confluence-rich support zone

A clean breakout above resistance, followed by a retest and confirmation

SOL has respected structure beautifully, but now is not the time to chase. Either wait for a healthy correction into support, or let price prove its strength through a confirmed breakout. No trade is also a trade — and capital preservation is the foundation of long-term success.

Patience isn’t passive — it’s a strategy. Let the market come to your desired levels. You don't need to catch every move, only the high-probability trades and there aren’t born from impulse — they’re built on patience, structure, and right timing. 💎

Technical Breakdown

SOL has entered a major resistance zone between $175 and $183 — a historically significant level respected for over a year.

Within this zone lie two key highs:

$179.85: Recently swept with a clean Swing Failure Pattern (SFP)

$180.52: Still untested — if broken, it would confirm a strong bullish continuation

Breaking through such a well-established resistance on the first attempt is uncommon — it typically requires momentum and structure. A rejection here would suggest that SOL needs a healthy correction before mustering the strength for a true breakout.

📉 Elliott Wave Count

Looking at the structure, we’ve completed a 5-wave sequence — signaling the potential end of this impulse leg. According to Elliott Wave Theory, a corrective phase is now expected before continuation.

📐 Additional Confluence: Fib Speed Fan

The 0.618 Fib Speed Fan — drawn from the all-time high at $295.83 to the swing low at $95.26 — aligns perfectly with this resistance zone, adding more weight to the idea of a potential rejection or pause.

🟢 Long Setup: The Next High-Probability Entry Zone

We now shift our focus to where the next long opportunity could arise. Here’s the technical confluence:

Anchored VWAP from the recent low at $141.41 sits at $164.70

4H bullish order block around $164.46

0.382 Fib retracement of the full 5-wave impulse: $165.42

0.412 Fib retracement: $164.25

All these levels converge in a tight band, providing a solid long entry zone between:

Long Entry Zone: $165.50 to $164.25

Stop-Loss: Below $160 (to protect against any deep wick)

Targets:

TP1: $171.75 (Point of Control from the range)

TP2: $180.00 (resistance retest)

TP3: $200.00 (psychological level)

Estimated R:R: ~6:1 — High-conviction setup

Bonus: If price returns to this $165 zone within 24 hours, it will also be supported by the 0.618 Speed Fan — adding one more layer of support.

🔴 Short Setup: Reversal Play at $200

For those watching from the sidelines or looking to fade the rally, the psychological level at $200 presents a strong short opportunity — but only on confirmation (e.g., SFP or bearish engulfing).

Short Entry: On rejection at $200

Stop-Loss: $206.10

Target: $187.00

Estimated R:R: ~2:1

🧠 Summary:

Completed 5-wave structure → potential correction phase underway

Strong resistance at $175–$183 with SFP and speed fan alignment

High-probability long setup at $165.5–$164.25 with multi-layered confluence

Potential short at $200 on confirmation

⚠️ Key Takeaway: Don’t Chase the Highs

This is where many traders slip — FOMOing into trades at major resistance. Please, don’t do it. Instead, wait for:

A pullback into well-defined support (like the $165 zone), or

A clean breakout above $180, followed by a confirmed retest

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Mastering Volatile Markets: Why Patience is Your Biggest Edge█ Mastering Volatile Markets Part 3: Why Patience is Your Biggest Edge

If you've read Part 1 about position sizing and Part 2 on liquidity , then you already know how to adapt to the mechanics of volatile markets. The next great tool in your arsenal will be patience.

Your biggest opponent in wild markets is your own mind.

In volatile markets, your emotions can easily get the best of you. Fear of missing out (FOMO) is one of the most dangerous emotions that drives poor decisions.

█ FOMO (Fear of Missing Out) Hits Hardest in Volatile Markets

Wild price swings, like 300-500 point moves in the Nasdaq or Bitcoin jumping $1000 in seconds, can make it feel like easy money is everywhere.

You can quickly get the overwhelming temptation to chase moves , especially when it seems like you're missing every opportunity.

This is where most traders lose.

Let me state some harsh truths that I had to learn the hard way through many losses:

Volatility doesn't equal opportunity.

Fast moves don't mean easy trades.

Most wild price moves are designed to trap liquidity and punish impatience.

The true reality is that the market wants you to overreact in these conditions.

It wants you to buy after a big move.

It wants you to short after a flush.

It thrives on you being emotional, chasing, and reacting.

Because reactive traders = liquidity providers for smart money.

Every single trader has made this mistake — not just once, but over and over again. Jumping into the market after a big move, hoping it will continue… but what usually happens? The market snaps back and stops you out.

Can you relate? Share your story or experience with this in the comments below!

█ What Experienced Traders Do Instead

⚪ They Know the First Move is Often the Trap

Breakout? Expect a fakeout.

Breakdown? Expect a snapback.

New high? Watch for stop hunts.

New low? Watch for a flush.

Effectively speaking, pro traders don't chase the market. We wait for stop hunts to complete, liquidity grabs to finish, price to return into their zone, and for confirmations before entering the market.

⚪ They Train Patience Like a Skill

Professional traders aren't more patient because they're "special." We are patient because we’ve learned the hard way that chasing leads to pain.

⚪ They Know When Not to Trade

It is bad to trade when there’s no clear structure, no clean confirmation, if the spread is too wide or when the liquidity is too thin.

Instead, pro traders let the market come to them , not the other way around.

⚪ They Turn FOMO into Confidence

Instead of saying, "I'm missing the move…" , I recommend you think:

"If it ran without me — it wasn't my trade."

"If it comes back into my setup — now it's my trade."

█ So, what have we learned today?

Volatility triggers FOMO. FOMO triggers bad decisions. Bad decisions trigger losses.

To win long-term, you must stay calm, selective and professional. Let other traders be emotional liquidity. That's how you survive volatile markets.

█ What We Covered Already:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Why Patience is Your Biggest Edge

█ What's Coming Next in the Series:

Part 4: Trend Is Your Best Friend

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

What to do after you missed a big price move (Example: EUR/USD)There was a big fast move in EUR/USD last week.

The ‘European currencies’ did especially well versus the US dollar, including GBP/USD and USD/CHF as well as the ‘Skandies’ SEK/USD and NOK/USD.

If you rode the move, then job done. If you did ride the move up, you might have taken full profits already - or maybe you are leaving a little bit of the position open to ride any continuation of the move.

But, what to do if you missed it completely?

Explosive moves in the market usually mean traders who were on the ‘losing’ side step out for a while, having lost confidence in their view. For example if you were bearish and the market makes a significant move higher - you’re probably going to be a lot less confident in your bearish view - but perhaps also not ready to take an opposite bullish view. The loss of sellers in the market can see the up-move continue with minimal pullback.

This might suggest buying any small dips to ride the next leg higher, and emotionally it would offer some salvation to capture the second leg of the move even if you missed the first leg. However, what you are doing here is ‘chasing the market’.

One trouble is that after a big move in the market, there is no definitive place to put your stop loss, except at the beginning of the move - which is now far away. That's a bad risk: reward.

It is tempting to place a closer (more manageable) stop loss under lower timeframe levels of support - but then you find yourself trading an unknown strategy that requires different rules to follow because it is based on a lower timeframe.

And indeed, after a sharp move in the market - there is still a chance for a sharp pullback to match. Why? Because buyers quickly take profits on their unexpected quick gains, which will create selling pressure into minimal support - because the next support level is far away.

A sharp pullback would mean an opportunity to buy into the uptrend at a lower level, closer to the previous support. But then the flipside of the sharp pullback is that it raises questions over the sustainability of the initial move.

Probably the biggest takeaway here is not to think about this ‘explosive’ move in isolation.

Instead of forcing a trade, consider:

1. Waiting for the right setup in the same market. If your strategy is based on structured breakouts, wait for the next clean consolidation or pattern before re-engaging. A big move often leads to a new setup—but forcing a trade in the middle of a volatile move isn’t a strategy, it’s FOMO.

2. Looking at uncorrelated markets. Just because EUR/USD already made a big move doesn’t mean you have to trade it now. If you want to be in at the start of a move, shift focus to another market that hasn’t yet made its move.

3. Sticking to your edge. If your strategy works over hundreds of trades, don’t abandon it just because one market moved without you. The next opportunity will come—if not in this market, then in another.

Again, the best trades don’t come from reacting to what already happened, but from positioning for what’s about to happen. If you missed the move, accept it, reset, and wait for the next high-quality setup—whether in the same market or somewhere else.