GOLD at Key Decision Zone — Will Price Reject or Expand Higher?Description

Gold has returned to a critical imbalance area following a strong bearish impulse, placing price at an important reaction zone. The current structure shows price consolidating within a supply region where previous selling pressure entered the market.

Traders often monitor these zones to observe whether price shows rejection and continuation toward lower liquidity, or acceptance that may support short-term upside expansion. The highlighted levels represent areas where market participants typically wait for confirmation and structure development rather than predicting direction.

This chart focuses on market structure, liquidity behavior, and reaction zones commonly observed in volatile sessions. Watching how price behaves within this region can offer insight into potential short-term momentum shifts and overall market positioning.

This analysis is shared for educational and chart-study purposes to help traders better understand price action and liquidity movement.

Posted on TradingView for market structure observation and learning.

Forex-gold

Gold Post NFP?Hi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Yesterday’s daily close after NFP was still bullish.

Today we need to monitor jobless claims.

The NFP that will really matter for us, and give clearer direction on the Fed’s next moves, will be the one coming out in March.

Gold dropped right after the strong data, because a solid labor market reduces expectations of Fed rate cuts. That puts pressure on a non-yielding asset like gold.

For now, the 5000 level is a key psychological safe-haven support.

We can continue to monitor it today.

Also pay attention to all the dynamic liquidity built in the previous days.

The marked levels are the ones I’m watching today.

See you live at 14:00. Have a good Thursday.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

XAUUSD Range Accumulation → Potential Upside BreakGold (XAUUSD) is currently trading inside a structured accumulation range on the 1H timeframe. Price has been respecting a strong support base around the 4,980–5,020 zone while forming higher lows, indicating steady buying interest and controlled consolidation.

The chart highlights repeated bounce patterns from support, suggesting institutional demand and liquidity collection before a potential continuation move. Price is now testing the upper range near 5,100–5,150, where resistance has previously rejected bullish attempts.

A sustained hold above the range support keeps the bullish structure intact, while a clean break and hold above the upper resistance area could open room toward higher target zones near 5,145 and 5,188. As long as price remains inside this structure, expect consolidation with breakout potential.

This analysis is for educational and informational purposes only and reflects technical structure, not financial advice. Always manage risk and confirm with your own strategy before making trading decisions.

XAUUSD 15M Key Support & Resistance Zones with Buy/Sell ScenarioGold (XAUUSD) is currently trading inside a well-defined range on the 15-minute timeframe.

This analysis highlights major support, resistance, and decision zones to identify high-probability trading opportunities.

📌 Buy Scenario:

Price holding above support with bullish confirmation → target previous resistance.

📌 Sell Scenario:

Price rejecting resistance or breaking below support → target lower demand zones.

⚠️ Avoid trades inside the decision zone without confirmation.

Always manage risk and wait for price reaction at key levels.

XAUUSD (Gold) – H1 Market Structure AnalysisContext: Liquidity → Structure Shift → Reaction Zones

Price previously respected a descending trendline. A clean breakout has occurred, followed by a pullback, indicating a potential change in market character.

🔍 Key Technical Observations

Trendline Breakout Confirmed

Price has broken above the descending trendline, suggesting bearish momentum is weakening.

Market Structure Shift (MSS)

A bullish displacement from the lows signals a possible short-term structural shift.

Liquidity Sweep Completed

Sell-side liquidity was taken below prior lows before the impulsive move upward, often seen before reversals.

Fair Value Gaps (H1 FVGs)

Upper FVG (Premium zone): Acts as resistance; reaction or rejection possible.

Lower FVG (Discount zone): Potential reaction area if price retraces.

Order Block Zone (H1 OB)

Below price, this zone represents a strong demand area where buyers previously stepped in.

🧠 Scenarios to Watch (No Predictions)

If price reacts from the upper FVG, short-term pullbacks toward imbalance zones are possible.

If price retests the lower FVG / OB and holds, continuation toward recent highs may develop.

Acceptance above the upper imbalance would indicate strength, while rejection signals range behavior.

⚠️ Notes

This idea is for educational and technical discussion purposes only.

Always wait for confirmation and manage risk according to your own plan.

No buy/sell instructions are provided.

SELL XAUUSDGold is now trading back into a clear supply zone after a sharp impulsive bounce from the lows, and price is stalling right below a descending trendline and prior structure resistance. This area also aligns with previous rejection points, suggesting sellers may step back in to defend the zone. The bullish move into resistance looks corrective rather than impulsive. From here, a short-term sell makes sense targeting the nearest demand zone below and the recent swing low, where price previously reacted strongly before the rally.

XAUUSD (2H) chart:..XAUUSD (2H) chart:

What I see

Clear breakout above the descending trendline

Price is holding above the demand / yellow zone

Ichimoku cloud ahead is thin → easier upside continuation

Momentum looks corrective → turning bullish

Targets (step-by-step)

TP1: 5,120 – 5,150 (nearest resistance / reaction high)

TP2: 5,280 – 5,320 (previous structure resistance)

Final target: 5,480 – 5,550 🎯

(Matches my drawn target point + measured move)

Invalidation / Safety

If price closes back below 4,980 – 5,000 on 2H → bullish setup weak

Conservative SL: below 4,950

Bias

📈 Bullish continuation as long as price stays above the breakout zone

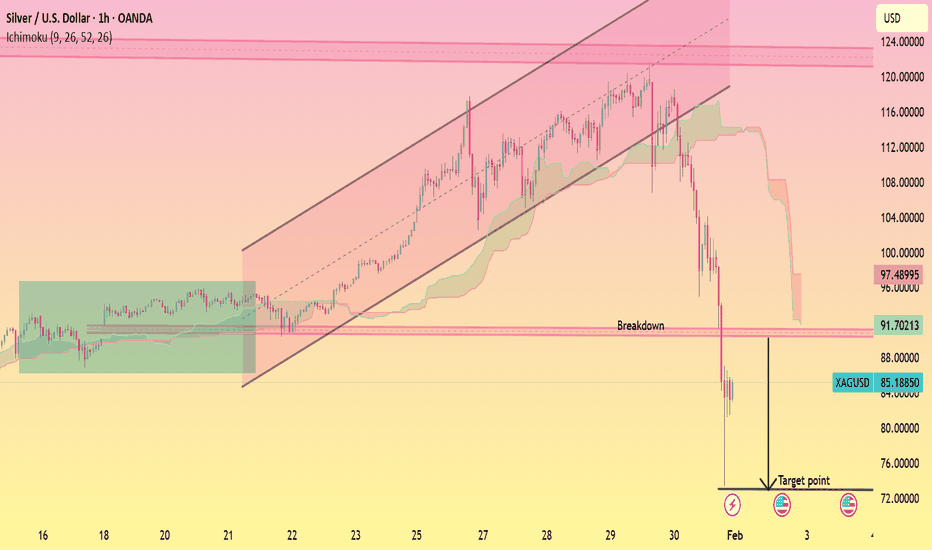

XAGUSD Channel Breakdown

This is a 1-hour XAGUSD (Silver/USD) chart. Price was moving in a clear ascending channel with Ichimoku support, then broke down below the channel and key support zone. After the breakdown, strong bearish momentum appeared, indicating a trend reversal from bullish to bearish, with downside continuation toward the marked lower target area.

One Candle = One Decision – Simple & Powerful Price ActionOne Candle = One Decision is a pure price action concept where a single candle defines market intent.

This candle shows rejection, liquidity grab, and direction bias without using indicators.

The wick represents failed price acceptance, while the candle close shows who is in control — buyers or sellers.

Entry, stop loss, and trade direction are all derived from one single candle, making this setup clean, fast, and objective.

This method works best on ETH, BTC, GOLD, and Forex pairs across intraday and swing timeframes.

🕯️ How the Concept Works (Step-by-Step)

🔹 Step 1: Location Matters

The candle must form at:

Support / Resistance

Liquidity high or low

Previous high / low

Range extreme

Location gives the candle meaning.

🔹 Step 2: Candle Structure

The decision candle usually has:

Long wick (liquidity sweep)

Clear rejection

Strong close (body)

📌 Wick = rejection

📌 Close = decision

🔹 Step 3: Trade Execution Rules

✅ Bullish Setup

Long lower wick

Candle closes bullish or strong rejection

Entry on high break

Stop loss below wick low

Bias → Bullish continuation or reversal

❌ Bearish Setup

Long upper wick

Candle closes bearish or strong rejection

Entry on low break

Stop loss above wick high

Bias → Bearish continuation or reversal

🧠 Why This Strategy Works

Smart Money hunts liquidity first

Retail traders enter late

This candle shows real intent after liquidity grab

That’s why:

👉 One Candle = One Decision

⏱️ Best Timeframes

5m / 15m → Intraday

1H / 4H → Swing

Daily → High probability setups

📈 Markets Where It Works Best

ETH / BTC

XAUUSD (Gold)

EURUSD, GBPUSD

Indices & Crypto pairs

⚠️ Risk Management Tip

Risk max 1–2% per trade

Avoid news candles

One candle = one idea (no overtrading)

XAUUSD: at Key Resistance - Pullback Scenario in Focus To $5,400Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish structure that previously developed inside a well-defined upward channel. After a prolonged consolidation phase marked by a clear range, price broke to the upside, confirming buyer control and initiating a strong impulsive rally. This breakout from the range acted as a key structural shift, pushing gold into an accelerated bullish phase supported by higher highs and higher lows within the ascending channel. As price continued higher, XAUUSD approached a major higher-timeframe Resistance Zone around the 5,580–5,600 area. This zone has historically acted as a strong supply region, and current price action suggests that bullish momentum is starting to weaken near this level. The market is now showing signs of overextension after a near-vertical move, increasing the probability of a corrective pullback. Importantly, price is currently trading at the upper boundary of the ascending channel, where buyers often begin to take profits and sellers look for short-term opportunities.

Currently, a clearly defined Support Zone around the 5,380–5,420 area aligns with the prior breakout level and the upper boundary of the former consolidation. This zone represents a key area of interest, as it previously acted as resistance before being broken and now serves as potential support. The structure suggests that a pullback into this zone would be a healthy correction rather than a trend reversal.

My Scenario & Strategy

My primary scenario is a short-term corrective pullback from the Resistance Zone toward the Support Zone. As long as price remains capped below the 5,600 resistance and shows rejection from the upper channel boundary, I expect a move lower toward the 5,400 support area (TP1). This short idea is counter-trend and should be treated strictly as a corrective trade within a broader bullish market structure. A clean reaction into the Support Zone could attract fresh buyers and potentially lead to trend continuation afterward.

However, if price fails to find support and breaks decisively below the 5,380 level with strong bearish acceptance, a deeper correction toward the lower channel boundary would become more likely. On the other hand, a strong breakout and acceptance above the 5,600 Resistance Zone would invalidate the short scenario and signal bullish continuation. For now, price is at a critical reaction area where a pullback is technically justified.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSDToday, gold prices rose to a new all-time high of $5111. From a technical perspective, the price is currently in an "overbought" condition, which may lead to a short-term correction. Consider selling in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

XAUUSD 1H – Bullish Continuation with Mapped TargetsGold (XAUUSD) is trading in a strong bullish structure on the 1H timeframe, characterized by consistent higher highs and higher lows. Price is currently consolidating near recent highs, indicating healthy price action and potential continuation rather than reversal.

This chart highlights:

A clear buy-on-dip zone aligned with previous demand

A well-defined invalidation level to manage risk

Multiple upside targets based on market expansion and liquidity zones

As long as price holds above the key structure support, the bullish bias remains valid. Breakout or pullback confirmations from the marked zone may offer continuation opportunities in the direction of the trend.

⚠️ A strong close below the invalidation level would signal a possible shift into correction or consolidation.

🔑 Key Concepts Used

Market Structure (HH / HL)

Demand & Resistance Zones

Trend Continuation Logic

Risk-to-Reward Target Mapping

3 Best Forex Scalping Strategies For 15-Minutes Minutes Trading

If you are looking for a profitable gold forex scalping strategy, but you are struggling to choose one among hundreds that are available,

I prepared for you 3 must-try profitable scalping strategies.

These strategies are very different and unique:

one is based on a p rice action analysis , one is smart money concepts based and one is a technical indicator strategy.

So you will definitely find the one that suits your trading style.

One important note before we start.

There is one crucial element that unites all these strategies:

we will strictly look for trading entries from 4H key levels: key horizontal supports and resistances.

Only when the price tests such structures, we will start searching for a trading signal on 15 minutes time frames.

For that reason, make sure that you execute structure analysis on a 4h time frame.

Here is how a 4h time frame structure analysis should look like.

You should underline recent, historically significant horizontal support and resistance areas.

Strategy 1

Price action

Scalping with a price action on 15 minutes time frames, you should look for:

- a bullish price action pattern after a test of a 4H support

- a bearish price action pattern after a test of a 4H resistance

Here is the list of bullish patterns:

Double bottom, horizontal range, inverted head & shoulders pattern,

cup & handle pattern, ascending triangle.

Your bullish signal will be a breakout - a candle close above a neckline of the pattern.

After a test of a 4H horizontal support, EURUSD formed an ascending triangle formation on 15 minutes time frame.

Its neckline violation is a strong bullish confirmation.

A perfect entry point should be a retest of a broken neckline.

The safest stop loss will be below the low of the pattern.

Target - the closest 15 minutes key resistance.

Formation of a bullish price action pattern and its neckline breakout signifies the strength of the buyers and confirms the validity of a structure that was identified on a 4H time frame.

Here is the list of bearish patterns:

Double top, horizontal range, head & shoulders pattern, inverted cup & handle pattern, descending triangle.

Your bearish signal will be a breakout - a candle close below a neckline of the pattern.

Take a look at the example:

after a test of a key horizontal 4H resistance, the price formed a double top formation on a 15 minutes time frame.

The violation of a neckline of the pattern is a strong bearish confirmation.

Set a sell-limit order on a retest of a broken neckline,

place stop loss above the highs of the pattern,

target will be the closest 15 minutes key support.

Formation of a bearish price action pattern and its neckline breakout signifies the strength of the sellers and confirm the validity of a structure that was identified on a 4H time frame.

Strategy 2

Smart Money Concepts

Scalping with SMC, key horizontal 4H supports and resistances will be perceived as liquidity zones.

Your bullish confirmation after a test of a bullish liquidity zone will be an inducement (a false violation of a lower boundary of the zone) with a consequent formation of an imbalance bullish candle that completely engulfs the range of a previous bearish candle with its body.

Here are the examples of bearish inducements - a false structure violation.

Here is the example of a bullish imbalance after the inducement.

An imbalance bullish candle should have a relatively big body and should completely engulf the entire range of a previous bearish candle.

You should open a long position immediately after the close of a bullish imbalance candle.

Stop loss should lie below its low.

Take profit - the closest 15 minutes resistance.

With bearish inducement, smart money are attempting to force buyers close their position in losses and force sellers to open short positions, grabbing their liquidity.

Formation of a bullish imbalance indicates a real intention of big players.

Your bearish confirmation after a test of a bearish liquidity zone will be an inducement (a false violation of an upper boundary of the zone) with a consequent formation of an imbalance bearish candle that completely engulfs the range of a previous bullish candle with its body.

Above is the example of a bullish inducement followed by a bearish imbalance that completely engulfed the range of a previous bullish candle.

Short position should be opened immediately after a close of an imbalance bearish candle.

Take profit - the closest 15 minutes support.

Stop loss above the high of the candle.

With bullish inducement, smart money are attempting to force sellers close their position in losses and force buyers to open long positions, grabbing their liquidity.

Formation of a bearish imbalance indicates a real intention of big players.

Scalping Strategy 3

Technical Indicators

Technical indicators can provide a strong confirmation after a test of key 4H horizontal structure.

One of the most accurate technical indicators is the combination of 2 Moving Averages with different ranges.

Their crossover will provide an accurate bullish and bearish signal.

For our strategy, we will take Simple Moving Average with 5 range and Exponential Moving Average with 9 range.

The crossover of Exponential Moving Average by Simple Moving Average from downside will be a strong bullish signal and a long position should be opened immediately then.

Stop loss should lie below the entire 4H horizontal support, and the target will be THE CLOSEST 4H resistance.

In comparison to 2 previous strategies, the Moving Average confirmation gives much bigger profit potential.

The crossover of Exponential Moving Average by Simple Moving Average from the upside will be a strong bearish signal and a short position should be opened immediately then.

Stop loss should lie above the entire 4H horizontal resistance, and the target will be THE CLOSEST 4H support.

Being applied properly, the strategy will provide very high accuracy and reward to risk ratio.

Try these 3 scalping strategies, backtest them and choose the one that suites your trading style.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD 15M Breakout or Rejection at Key Supply Zone📊 XAUUSD (Gold) – 15-Minute Chart Overview

This chart illustrates a range-to-breakout market structure with dual scenarios (bullish & bearish) based on key supply and demand zones.

🔹 Key Zones & Structure

🟢 Upper Resistance / Supply Zone

Highlighted by the green band with a wave-like overlay.

Price has tested this area multiple times → strong resistance.

Market reaction here decides continuation or rejection.

🟣 Lower Demand / Buy Zone

The purple rectangle below shows a strong demand area.

Previous accumulation and impulsive bullish move started from here.

Acts as a decision zone for buyers.

🔹 Bullish Scenario (Top Side)

Breakout: Price consolidates under resistance, then breaks above the green zone.

Entry: On a successful break & retest of the resistance turned support.

Target: Marked above → continuation toward higher highs (liquidity sweep / expansion).

👉 This represents trend continuation after consolidation.

🔹 Bearish Scenario (Rejection Setup)

Rejection: Price fails to hold above resistance.

Entry: Short entry from the rejection zone or lower consolidation.

Sell Zone: Price ranges inside the purple zone before breakdown.

Target: Lower purple line → previous liquidity / support sweep.

👉 This represents a fake breakout → reversal play.

🔹 Market Logic Behind the Chart

Multiple equal highs near resistance → liquidity build-up.

Compression + breakout attempt → either:

True breakout (buy continuation)

or false breakout (sell reversal)

This is a classic smart money + liquidity-based setup.

✅ Summary

📈 Above resistance → Buy continuation

📉 Rejection from resistance → Sell toward demand

⚠️ Wait for confirmation (break & retest or rejection candle)

XAUUSD: Holds $4,770 Support With Upside Potential Toward $4,890Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a well-defined bullish structure, supported by a clear ascending channel that reflects sustained buyer control. Earlier in the move, price respected the lower boundary of the channel and formed a sequence of higher highs and higher lows, confirming strong bullish momentum. During the advance, XAUUSD entered a consolidation range, signaling a temporary pause and accumulation before continuation. This range eventually resolved to the upside, reinforcing the prevailing bullish trend. After the breakout, price experienced a brief corrective move, including a fake breakout to the downside, which was quickly absorbed by buyers. This false break further validated underlying demand and led to a strong impulsive move higher back into the channel. Most recently, Gold broke above a key intraday resistance and successfully retested the former resistance as support near the 4,770 Support Zone, confirming acceptance above this level.

Currently, XAUUSD is trading above support and pushing toward the upper boundary of the ascending channel. Price is approaching a major Resistance Zone around 4,880–4,890, which aligns with the channel high and represents a critical reaction area where profit-taking or short-term selling pressure may appear.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,770 support zone and continues to respect the ascending channel structure. A sustained move and acceptance above the 4,890 resistance would confirm continuation toward higher levels within the channel.

However, rejection from the resistance zone could lead to a short-term consolidation or a corrective pullback toward the 4,770 support area before the next attempt higher. A clear breakdown and acceptance below support would weaken the bullish bias and signal a deeper correction. For now, market structure and momentum favor buyers while price remains supported above key levels.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD: Holds Key Support - Buyers Aim for $4,720 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish market structure, supported by a rising trend line that has guided price action from the recent swing lows. Earlier in the move, gold advanced inside a well-defined upward channel, confirming strong buyer control with consistent higher highs and higher lows. This bullish leg eventually led to a breakout attempt near the upper boundary of the channel, after which price experienced a sharp corrective move and transitioned into a consolidation phase. Following the correction, XAUUSD formed a range, where price moved sideways as buyers and sellers reached temporary equilibrium. This range acted as an accumulation zone before the next directional move. Price eventually broke out of the range to the upside, signaling renewed bullish momentum. However, shortly after the breakout, a fake breakout occurred on the downside, where price briefly dipped below support but was quickly reclaimed by buyers, reinforcing demand strength.

Currently, price is holding above a clearly defined Support Zone around 4,650, which aligns with the former range high and a key structural level. This area is now acting as demand after the successful breakout and retest. On the upside, XAUUSD is approaching a major Resistance Zone near 4,720, where selling pressure has previously emerged. The recent price action shows controlled consolidation above support, suggesting continuation rather than distribution.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,650 Support Zone and continues to respect the rising trend line. In this case, I expect buyers to remain in control and attempt another push toward the 4,720 Resistance Zone (TP1). A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside expansion.

However, a strong rejection from resistance followed by a decisive breakdown below the 4,650 support would weaken the bullish bias and signal a deeper corrective move. Until that happens, the overall structure favors buyers, and pullbacks into support are viewed as potential continuation opportunities.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

EURUSD – Bearish Outlook (Daily Time Frame)As shown on the chart, price reacted bearishly from the bearish FVG and printed a lower low, confirming a bearish order flow on the daily time frame.

As long as price continues to respect the bearish FVG, we can expect further downside and the formation of another lower low. The equal lows below price are acting as a clear draw on sell-side liquidity, which aligns with this bearish bias.

XAUUSDXAUUSD is still in an uptrend. If the price can remain above $4420, further price growth is expected.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

XAUUSD Short: Rejection from Supply – 4,340 Demand as TargetHello traders! Here’s a clear technical breakdown of XAUUSD (1H) based on the current chart structure. After an extended bullish phase, Gold was trading inside a well-defined ascending channel, confirming strong buyer control and a sequence of higher highs and higher lows. During this phase, price respected the channel structure multiple times, using the lower boundary as dynamic support. Before the impulsive move higher, XAUUSD also formed two visible consolidation ranges, indicating accumulation prior to expansion. A clean breakout from the upper range triggered strong upside momentum and accelerated price toward the upper channel boundary.

Currently, XAUUSD is trading near the Demand Zone around 4,340, which aligns with a rising trend line and a previous reaction area. A recent dip below this level resulted in a fake breakout, followed by a quick recovery back above demand, suggesting buyers are still active in this zone. Price is now reacting upward from demand, but remains capped below the 4,400 supply area, keeping the structure corrective rather than fully bullish.

My scenario: as long as XAUUSD remains below the 4,400 Supply Zone, the bias favors sellers. I expect price to show rejection signals in this area—such as long upper wicks, bearish engulfing candles, or failed breakouts—followed by renewed downside pressure. The first downside target is a move back toward the 4,340 Demand Zone. A clean breakdown and acceptance below this level would confirm bearish continuation and open the door for a deeper move toward lower support levels. Manage your risk!

XAUUSD Fake Breakout at 4,520 - Price Tests Buyer Zone at 4,260Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold is trading within a broader ascending channel, confirming a dominant bullish structure despite the recent sharp pullback. After a strong impulsive rally, price respected the channel support and continued forming higher highs and higher lows, highlighting sustained buyer control throughout the trend. Currently, XAUUSD is trading below the broken channel support and has entered the Buyer Zone around 4,260, which aligns with a key Support Level and a prior breakout area. This zone represents an important reaction area where buyers may attempt to regain control. The projected path suggests a possible corrective bounce from this level, but overall price action remains vulnerable as long as it stays below the former resistance and channel structure. My scenario: as long as XAUUSD remains below the 4,520 Seller Zone and fails to reclaim the broken channel support, the bias favors further downside or consolidation. A clean hold above the Buyer Zone could trigger a short-term rebound toward the mid-channel area, while a decisive breakdown below 4,260 would open the door for a deeper corrective move. Please share this idea with your friends and click Boost 🚀