Forex

USDJPY - Price Is "Overbought" At A Historical CeilingHello Trading Fam! 👋

The USD/JPY is currently hitting a major resistance zone at 157.00 - 158.00, coinciding with the top of a long-term ascending channel.

The Trade:

Action: Short (Sell).

Reason: Price is "overbought" at a historical ceiling; a reversal toward the channel's bottom (~150.00) is expected.

Risk: High. If it breaks above 158.00, the "short" thesis fails.

Technical Rebound or Failed Reversal?After a very sharp bounce from the recent short-term low, gold prices weakened again almost immediately, suggesting that the recovery lacked sufficient foundation to sustain itself. On the H4 timeframe, price is now hovering around the medium-term EMA — a familiar post-volatility condition that often reflects a phase of supply–demand rebalancing.

Technical perspective

From a structural standpoint, the latest upswing looks far more like a technical rebound than the beginning of a new trend. Price failed to break decisively above the overhead EMA cluster, and each approach into resistance was followed by a swift loss of upside momentum.

More importantly, volume tapered off during the rebound, highlighting the absence of strong participation from larger players and signaling that buyers were not willing to chase price at higher levels. In this context, short-term profit-taking pressure continues to dominate.

Given the current setup, a broader consolidation or corrective phase carries a higher probability than an immediate, sustainable upside continuation.

Macro perspective

From a medium- to long-term view, gold’s fundamental drivers remain intact. Deutsche Bank continues to emphasize gold’s role as a defensive asset, supported by prolonged geopolitical uncertainty and ongoing currency depreciation pressures across several major economies.

That said, Bloomberg Intelligence has issued a notable caution: the strong rally earlier in the year pushed gold into overbought territory. A deeper correction — potentially even toward the 4,000 USD/oz area — remains a realistic scenario if global financial conditions stabilize and investor risk appetite improves meaningfully.

U.S. data & monetary policy

Recent U.S. economic data suggest that the labor market is gradually cooling, reinforcing expectations that the Federal Reserve could move toward policy easing in the second half of the year. However, at this stage, that supportive backdrop is not yet strong enough to offset the short-term technical correction pressures currently driving price action.

SELL XAUUSDGold is showing short-term bearish signs after being rejected from a key supply zone and failing to break above a descending trendline. Price is forming lower highs, struggling around the moving averages, and the recent bounce from support looks corrective rather than impulsive, suggesting sellers remain in control. With multiple technical factors aligning—trendline resistance, EMA rejection, and weak bullish momentum—the probability favors a short-term continuation lower unless price can reclaim those resistance levels decisively.

iKeyhan | EURUSD 4H EURUSD | H4 – Smart Money Bullish Continuation Setup

EURUSD is maintaining a clear bullish market structure on the H4 timeframe, characterized by higher highs and higher lows. Price has transitioned from accumulation into expansion, confirming a higher-timeframe bullish bias.

After an impulsive rally that expanded liquidity and attracted institutional participation, the market is now undergoing a healthy and controlled pullback. This retracement appears corrective rather than distributive, with no signs of trend exhaustion or reversal at the highs.

Price is currently reacting within a key demand and structure support zone around 1.1760 – 1.1780, which aligns with:

• The 61.8% Fibonacci retracement

• Previous resistance turned support

• Dynamic moving average support

• Demand imbalance

This multi-factor confluence significantly increases the probability of bullish continuation.

Moving averages remain positively sloped, and price is holding above them, confirming trend strength. No bearish crossover or structural breakdown is present.

Bullish Continuation Scenario

• As long as price holds above 1.1760

• Bullish confirmation candles on H4 may offer continuation entries

• Upside targets:

• 1.2080 (previous high / liquidity zone)

• Extension toward 1.2200 upon breakout

Invalidation

• A decisive H4 close below 1.1720

• Clear break of structure with momentum

This setup represents a classic smart-money continuation model: strong structure, healthy pullback into demand, Fibonacci confluence, and intact trend momentum.

Bias: Bullish

Key Support: 1.1760 – 1.1780

Targets: 1.2080 → 1.2200

USDJPY FREE SIGNAL|SHORT|

✅USDJPY taps into a premium supply PD array after a strong rally. Bearish displacement and rejection suggest distribution, with downside continuation toward sell-side liquidity below recent lows.

—————————

Entry: 157.04

Stop Loss: 157.95

Take Profit: 155.76

Time Frame: 5H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

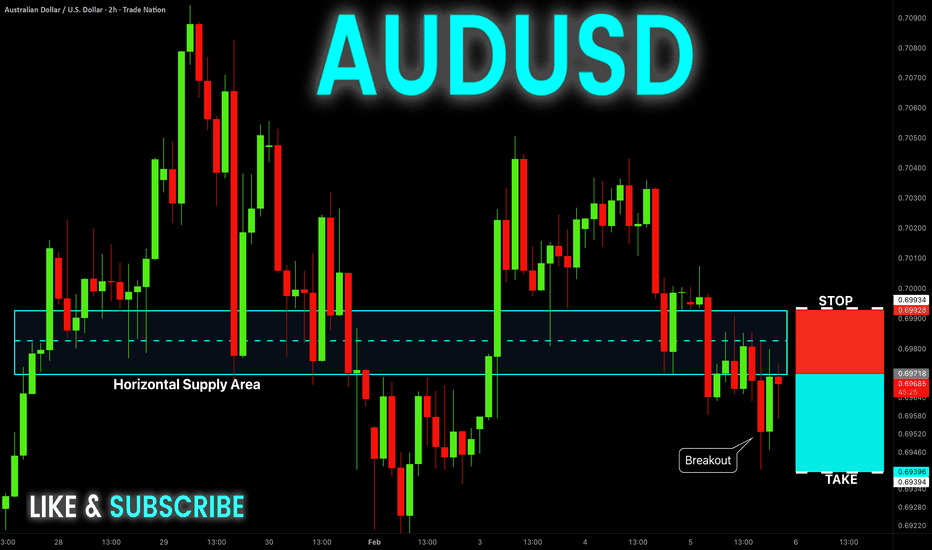

AUD-USD Free Signal! Sell!

Hello,Traders!

AUDUSD breaks decisively below a well-respected horizontal supply zone, confirming bearish structure shift. Acceptance below supply signals smart money distribution and continuation toward lower liquidity.

--------------------

Stop Loss: 0.6993

Take Profit: 0.6939

Entry: 0.6971

Time Frame: 2H

--------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD BEARISH BREAKOUT|SHORT|

✅NZDUSD strong bearish displacement breaks below the prior supply PD array, confirming market structure shift. Expect a shallow retracement into the breakout zone before continuation toward sell-side liquidity. Time Frame 2H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBP-USD Local Short! Sell!

Hello,Traders!

GBPUSD decisively breaks below a well-defined horizontal supply zone, confirming bearish market structure. Acceptance below supply suggests continuation toward lower liquidity pools after the breakout. Time Frame 2H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

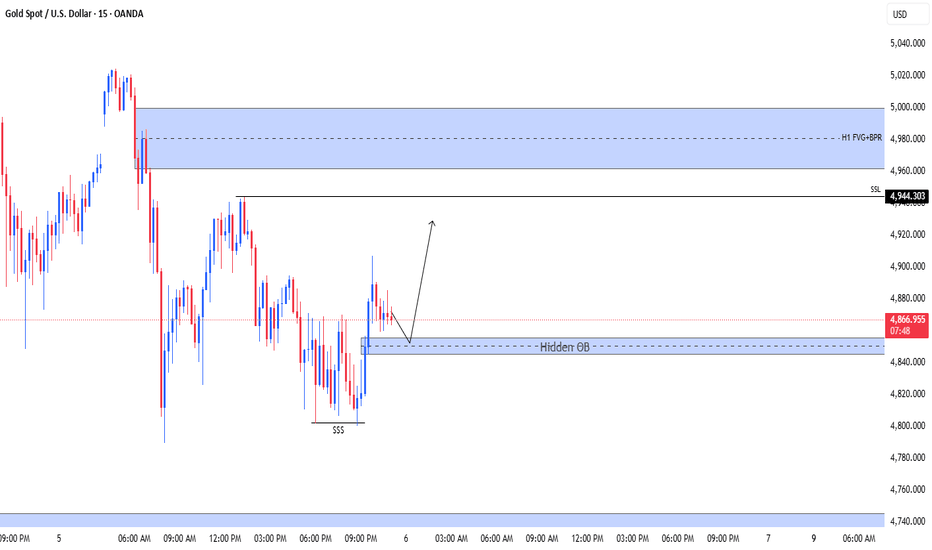

XAUUSD – M15 | Short-Term Bullish Reaction ExpectedPrice has swept liquidity (SSS) and is now reacting from a Hidden Bullish Order Block on M15.

As long as price holds above this OB, a pullback → continuation move is likely.

Upside draw remains toward the H1 FVG / BPR zone near the previous supply area.

Bias: Intraday bullish

Key idea: Liquidity sweep + hidden OB reaction

Note: Wait for confirmation before execution. This is educational, not financial advice.

GBPUSD: Market Sentiment & Price Action

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPUSD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD: Long Trading Opportunity

GBPAUD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPAUD

Entry - 1.9425

Sl - 1.9396

Tp - 1.9483

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bearish reversal off pullback resistance?USD/JPY is rising towards the resistance level, which is a pullback resistance that aligns with the 78.6% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 157.71

Why we like it:

There is a pullback resistance level that aligns with the 78.6% Fibonacci retracement.

Stop loss: 159.39

Why we like it:

There is a swing high resistance level.

Take profit: 155.61

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

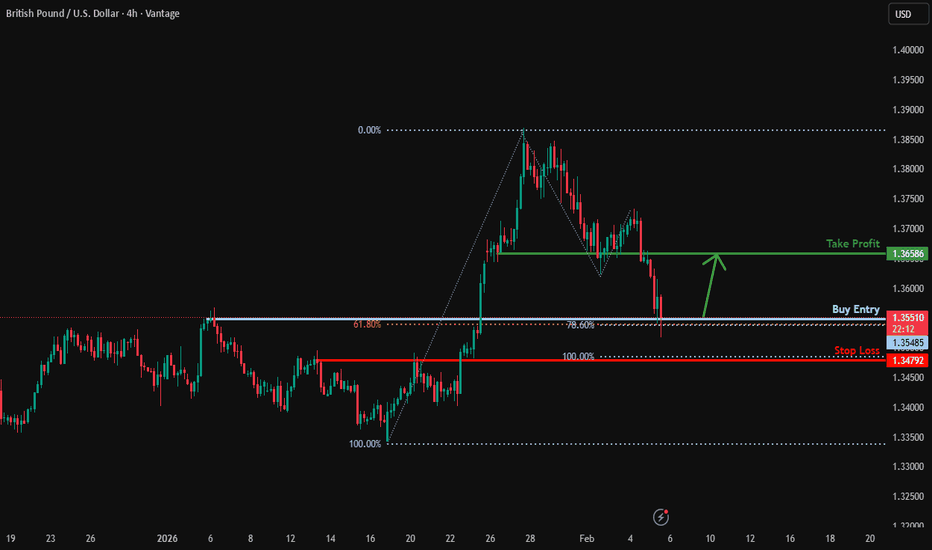

Bullish reversal off Fib levels?GBP/USD is reacting off the support level, which is a pullback support that aligns with the 61.8% Fibonacci retracement and the 78.6% Fibonacci projection, and could bounce from this level to our take profit.

Entry: 1.3548

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonaci retracement and the 78.6% Fibonacci projection.

Stop loss: 1.3479

Why we like it:

There is a pullback support level that aligns with the 100% Fibonacci projection.

Take profit: 1.3658

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY On The Rise! BUY!

My dear followers,

This is my opinion on the GBPJPY next move:

The asset is approaching an important pivot point 212.63

Bias - Bullish

Safe Stop Loss - 212.10

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 213.56

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Heading towards pullback resistance?US Dollar index is rising towards the resistance levle which is a pullback resistance and could reverse from this levle to our take profit.

Entry: 98.17

Why we like it:

There is a pullback resistance level.

Stop loss: 98.90

Why we like it:

There is a pullback resistance level.

Take profit: 97.16

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDJPY - Price Is Moving Within A Rising ChannelThis is an NZD/JPY 4‑hour chart showing an overall bullish uptrend inside an ascending channel, with a plan to buy (go long) on a pullback into a highlighted support area rather than selling the drop.

Trend and Structure 📊

Price is moving within a rising channel marked by two parallel diagonal lines, creating higher highs and higher lows, which defines a bullish market structure.

Labels like “DAILY – BULLISH” and “H4 – BULLISH” indicate that both the daily and 4‑hour timeframes are aligned upward, so the trade idea follows the dominant trend instead of fighting it. ⬆️

Current Price ActionPrice recently pushed up to the upper boundary of the channel and then sharply rejected from it, causing the current pullback you see on the right side of the chart.

This drop is treated as a correction within the uptrend, not yet a reversal, because price still trades above the lower channel line and key support zones.

Trade Idea Logic ✍️

The idea is to buy at a discount in an uptrend: enter near support with the trend, place stops below the recent swing low or below the support zone, and target the midline or upper boundary of the channel as potential take‑profit areas. 📈

If price breaks and closes clearly below the channel support and the green zone, that would invalidate the long setup here and may shift bias from bullish to neutral or bearish until a new support area is found.

GBPCAD — LONG from current levels → 1.8670📈 Price is compressing near support after a corrective pullback. Momentum is rebuilding in favor of the upside.

Technical context: holding above key intraday support, higher lows forming on lower timeframes and bullish continuation structure intact

🎯 Target: 1.8670

Tight entry, asymmetric setup: limited downside, clean upside continuation.

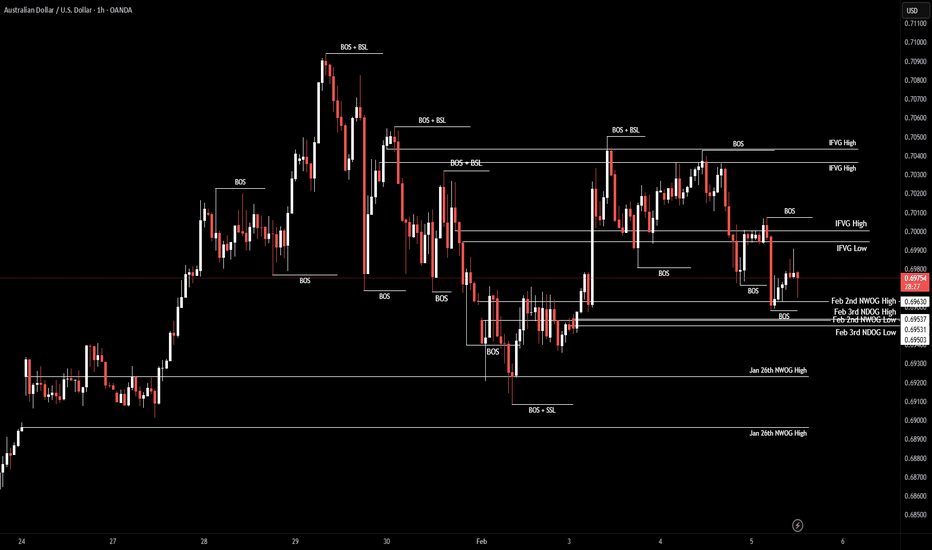

AUD/USD | Where to next? (READ THE CAPTION)As you can see, after hitting the Consequent Encroachment of the Feb 2nd's NWOG, AUDUSD went back up from 0.6958 to 0.6990, and then dropped again just above the high of the NWOG, and is now being at 0.6970.

I expect AUDUSD to retest the IFVG, but before that it may fall back to the Feb 2nd NWOG.

If it holds above the NWOG, the targets are: 0.6978, 0.6988, 0.6998 and 0.7008.

If it fails to hold above the NWOG: 0.6966, 0.6958, 0.6950 and 0.6942.