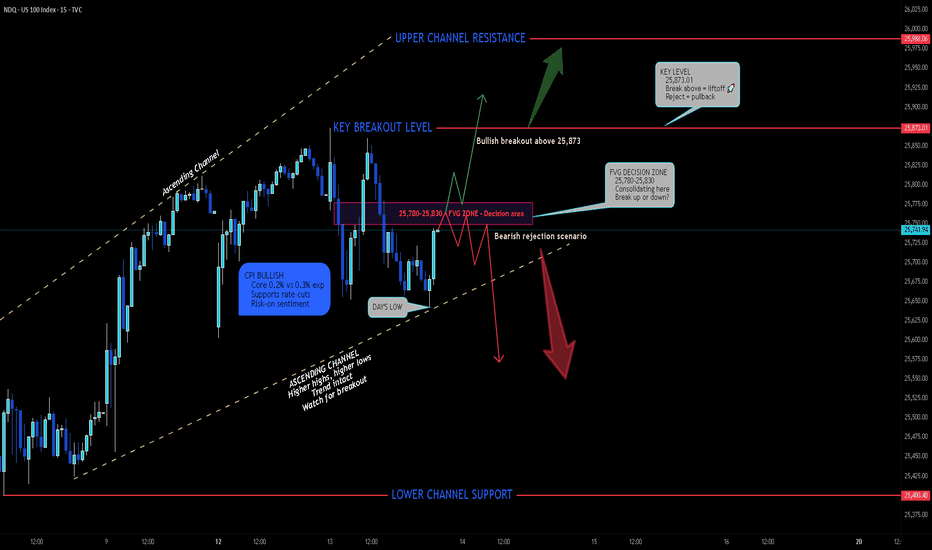

NDQ - Ascending Channel at FVG Decision Zone | Break 25,873?

Hey TradingView!

NASDAQ 100 is at a critical decision point right now. Let me break down what I'm seeing on the 15-minute chart.

The Setup

NDQ is trading at 25,741 inside an ascending channel, currently consolidating in the FVG zone around 25,780-25,830. Price keeps pushing up, pulling back into the FVG, then bouncing - classic accumulation pattern.

The key level is 25,873.01. Break above that = liftoff. Reject = back down to test lower supports.

Why This Level Matters

Ascending channel intact - higher highs, higher lows

FVG zone acting as decision zone - price consolidating here

25,873.01 is the KEY resistance - break above = bullish continuation

CPI came in cooler than expected - supports Fed rate cut narrative

S&P 500 and Dow at record highs - NASDAQ lagging slightly

Intel and AMD upgraded by KeyBanc - chip sector bullish

The News Context

Mixed but leaning bullish:

Core CPI cooler than expected (0.2% vs 0.3%) - bullish for rate cuts

S&P 500 hit record high Monday - broad market strength

JPMorgan beat earnings but stock dropped (credit card cap fears)

Intel +3.4%, AMD +1.9% on KeyBanc upgrades

Alphabet briefly hit $4 trillion market cap - AI momentum

Global central banks releasing coordinated support for Fed independence

Small caps outperforming (Russell 2000 +6.2% YTD vs S&P +1.9%)

Key Levels I'm Watching

Resistance:

25,873.01 - KEY BREAKOUT LEVEL (must break for bulls)

25,930 - Upper channel resistance

26,000+ - Bullish target if breakout confirms

Support:

25,780-25,830 - FVG zone (current consolidation)

25,642 - Day's low / immediate support

25,500 - Channel midline support

25,400 - Lower channel support

My Game Plan

Bullish scenario: If NDQ breaks above 25,873.01 with volume, we fly to 25,930 upper channel, then 26,000+. The ascending channel is intact, CPI was bullish, and chip stocks are getting upgraded. Break the resistance = momentum kicks in.

Bearish scenario: If we reject at 25,873 and lose the FVG zone, next stop is 25,642 (day's low), then 25,500 channel midline. High impact news (Fed drama, earnings misses) could trigger the breakdown.

Range scenario (MOST LIKELY short-term): Price continues to consolidate in the FVG zone, bouncing between 25,780-25,873. Wait for the breakout confirmation before committing.

The Bottom Line

I'm NEUTRAL with a bullish lean. The ascending channel is intact and CPI was supportive, but we need to break 25,873.01 to confirm the next leg up. Until then, we're just consolidating in the FVG zone.

Watch that 25,873 level closely. Break above = bullish. Reject = more consolidation or pullback.

What do you think? Breakout or rejection? Let me know in the comments! 👇

Foryoutrading

ES - Ascending Channel Near ATH | FVG Retest in Play

Hey TradingView community! 👋

S&P 500 futures are consolidating just below all-time highs. Let me break down what I'm seeing on the 45-minute chart.

The Setup

ES1! is trading at 7,001 inside an ascending channel, currently retesting the FVG zone around 6,970-6,990. Price keeps pushing up to resistance, pulling back to the FVG, then bouncing again. Classic consolidation near highs before the next move.

We're literally 0.19% away from the record high. The question is: breakout or rejection?

Why I'm Cautiously Bullish

Ascending channel intact - higher highs, higher lows

FVG zone holding as support - buyers defending this level

Third highest close in HISTORY yesterday

Up 19.39% over the past year - strong momentum

CPI came in line with expectations - Fed cuts still on table

Forward curve pricing 8,000+ by 2031 - long-term bullish

The News Context

Mixed signals but leaning bullish:

S&P 500 hit record high 6,977.27 on Monday - just 0.19% away

CPI in line with expectations - supports Fed rate cut narrative

JPMorgan beat earnings but stock dropped 4% (credit card cap fears)

Trump vs Powell drama continues - "that jerk will be gone soon"

Financials dragging (Visa, Mastercard down 4%+)

Gold hitting record highs - safe-haven demand elevated

Up 22.80% since tariffs announced in April 2025

Key Levels I'm Watching

Resistance:

7,036 - Day's high / immediate resistance

7,040 - Major resistance zone

7,050+ - BREAKOUT TERRITORY (new ATH)

Support:

6,970-6,990 - FVG zone (current retest)

6,955 - Horizontal support

6,900 - Lower channel support

6,858 - 2026 low (major support)

My Game Plan

Bullish scenario (PRIMARY): If ES holds the FVG zone (6,970-6,990) and bounces, we push back to 7,036-7,040 resistance. A break above 7,040 with volume = new all-time highs. Target 7,050+, then 7,100. The ascending channel is intact and we're consolidating near highs - this is typically bullish.

Bearish scenario: If we lose the FVG zone and break below 6,955, next stop is 6,900 lower channel support. Financial sector weakness (JPM, V, MA) could drag the index lower. Watch for Fed drama escalation.

Range scenario: Price continues to oscillate between FVG support (6,970) and resistance (7,040). Trade the range until breakout.

The Bottom Line

I'm CAUTIOUSLY BULLISH. The ascending channel is intact, we're consolidating just below all-time highs, and the FVG zone is holding as support. This is textbook bullish structure - consolidate near highs, then break out.

The risk is the financial sector weakness and Fed drama. But as long as we hold the FVG zone, the path of least resistance is higher.

Watch for the breakout above 7,040. That's the trigger for new ATH.

What do you think? New highs incoming? Let me know in the comments! 👇

MNQ - Ascending Channel Range Play | FVG Zones Holding

Hey TradingView community! 👋

NASDAQ futures are in classic range mode right now. Let me break down what I'm seeing on the 45-minute chart.

The Setup

MNQ1! is trading at 25,941 inside an ascending channel, currently sitting right in the upper FVG zone around 25,880-25,920. Price has been respecting this channel beautifully - bouncing between the upper and lower boundaries like clockwork.

This is a range-bound market. Until we get a decisive breakout, expect more of the same: test resistance, pull back to FVG, bounce, repeat.

Why I'm Neutral Here

Ascending channel intact - but price is RANGING, not trending

Two FVG zones acting as magnets - price keeps retesting them

S&P 500 at record highs but NASDAQ lagging slightly

Fed pressure headlines creating uncertainty (Powell vs Trump drama)

CPI data Tuesday could be the catalyst for breakout

Bank earnings starting this week (JPM Tuesday)

The News Context

Mixed signals keeping the market choppy:

S&P 500 hit record high Friday - but NASDAQ underperforming

Trump vs Powell drama - DOJ threatening Fed Chair over "renovation" testimony

Credit card rate cap proposal hitting bank stocks hard

Soft jobs data (50K vs 60K expected) - but unemployment dropped to 4.4%

Banks pushing back rate cut expectations after jobs report

Walmart joining Nasdaq-100 on Jan 20 - could bring passive fund flows

CPI report Tuesday - this is the big catalyst to watch

Key Levels I'm Watching

Resistance:

26,000 - Psychological level / upper channel

26,280 - Major resistance (near 52-week high)

26,399 - 52-WEEK HIGH

Support:

25,880-25,920 - Upper FVG zone (current)

25,800-25,860 - Lower FVG zone

25,600 - Channel midline support

25,320 - Lower channel support

My Game Plan

Range scenario (MOST LIKELY): Price continues to oscillate within the ascending channel. Expect retests of the FVG zones. Trade the range - buy at lower FVG, sell at upper channel resistance. This is a scalper's market until we get a breakout.

Bullish scenario: If CPI comes in soft and we break above 26,000 with volume, next target is 26,280, then 26,399 (52-week high). Walmart joining Nasdaq-100 on Jan 20 could bring passive buying.

Bearish scenario: If CPI comes in hot or Fed drama escalates, we could break below 25,600 and test 25,320 lower channel support. Watch bank earnings for sentiment.

The Bottom Line

I'm NEUTRAL here. The channel is intact but we're just ranging. No clear trend until we break out. The FVG zones are acting as support/resistance - trade the range or wait for the breakout.

CPI Tuesday is the key. That's likely the catalyst that decides direction.

What do you think? Breakout or more chop? Let me know in the comments! 👇

XRP - Descending Channel | Breakout or Breakdown? | Massive News

Hey TradingView community! 👋

XRP is at a make-or-break level right now. Let me break down what I'm seeing on the 45-minute chart.

The Setup

XRPUSD is trading at $2.09 inside a clear descending channel that's been in play since early January. Price has been making lower highs and lower lows, but we're now sitting right at a critical support zone around $2.10-2.18.

This is the moment of truth - either buyers step in here and we get a breakout, or we lose this level and continue lower.

Why This Level Matters

Descending channel support being tested RIGHT NOW

$2.10-2.18 zone has acted as support multiple times

Whale activity spiking to 3-month highs - smart money accumulating?

CNBC just called XRP the "new crypto darling"

Massive institutional news dropping (Ripple + BNY, FCA approval, Evernorth partnership)

The News is HUGE

Ripple just had a monster week:

BNY (Bank of New York) tapped Ripple Prime for tokenized deposits - this is massive institutional adoption

Ripple secured FCA authorization in the UK - clearing path for expansion

Evernorth + Doppler Finance partnership to boost XRP as yield-generating asset for institutions

South Korea announcing spot Bitcoin ETFs - XRP ETF momentum building

Analysts saying XRP could outperform Bitcoin on percentage gains

Key Levels I'm Watching

Resistance:

$2.18 - Upper channel resistance / breakout level

$2.32 - Major horizontal resistance

$2.50+ - Bullish target if breakout confirms

Support:

$2.10 - Current support zone (CRITICAL)

$1.90 - Lower channel support

$1.61 - 52-week low area

My Game Plan

This is a two-scenario setup:

Bullish scenario: If XRP holds above $2.10 and breaks out of the descending channel with volume, we could see a sharp move toward $2.32 and potentially $2.50+. The institutional news flow is extremely bullish - BNY partnership, FCA approval, whale accumulation. If Bitcoin pumps, XRP could explode.

Bearish scenario: If we lose $2.10 support and break below the channel, next stop is $1.90. The descending channel trend would continue until we see a clear reversal signal.

The Bottom Line

I'm cautiously bullish here. The news catalysts are incredible - Ripple is getting institutional adoption at a rapid pace. Whale activity at 3-month highs suggests smart money is accumulating. BUT the chart structure is still bearish until we break out of this descending channel.

Watch the $2.10 level closely. Hold = bullish. Break = more downside.

What's your take? Breakout or breakdown? Let me know in the comments! 👇

Position Sizing: The Decision That Matters More Than Your Entry

Your Entry Doesn't Matter If Your Size Is Wrong

Here's a truth that will save your trading career:

A mediocre strategy with excellent position sizing will outperform an excellent strategy with poor position sizing.

Every. Single. Time.

Position sizing is the most important decision you make — and most traders barely think about it.

What Is Position Sizing?

Definition:

Position sizing determines how much capital you allocate to each trade.

What It's NOT:

"I'll buy 100 shares"

"I'll use 10% of my account"

"I'll risk what feels right"

What It IS:

A calculated decision based on:

Your account size

Your risk tolerance

The specific trade's risk

Your overall portfolio exposure

Why Position Sizing Matters Most

The Math of Ruin:

If you lose 50% of your account, you need 100% gain to break even.

If you lose 90%, you need 900% to recover.

10% loss → Need 11% to recover

20% loss → Need 25% to recover

30% loss → Need 43% to recover

50% loss → Need 100% to recover

70% loss → Need 233% to recover

90% loss → Need 900% to recover

The Implication:

Avoiding large losses is more important than capturing large gains.

Position sizing is your primary defense.

Position Sizing Methods

Method 1: Fixed Dollar Amount

Risk the same dollar amount on every trade.

Example:

Account: $100,000

Risk per trade: $1,000

Every trade risks exactly $1,000

Pros: Simple, consistent

Cons: Doesn't scale with account growth/decline

Method 2: Fixed Percentage

Risk the same percentage of account on every trade.

Example:

Account: $100,000

Risk per trade: 1%

Risk = $1,000

If account grows to $120,000:

Risk = $1,200

Pros: Scales with account, anti-martingale effect

Cons: Requires recalculation as account changes

Method 3: Volatility-Adjusted

Adjust position size based on the asset's volatility.

Formula:

Position Size = (Account × Risk%) / (ATR × Multiplier)

Example:

Account: $100,000

Risk: 1% = $1,000

Stock ATR: $2

Multiplier: 2 (stop at 2 ATR)

Position Size = $1,000 / ($2 × 2) = 250 shares

Pros: Equalizes risk across different volatility assets

Cons: More complex calculation

Method 4: Kelly Criterion

Mathematically optimal sizing based on edge.

Formula:

Kelly % = W -

Where:

W = Win probability

R = Win/Loss ratio

Example:

Win rate: 55%

Average win: $150

Average loss: $100

R = 1.5

Kelly = 0.55 - (0.45/1.5) = 0.25 = 25%

Reality Check:

Full Kelly is too aggressive. Use fractional Kelly (25-50% of calculated).

Pros: Mathematically optimal for growth

Cons: Requires accurate edge estimation, high variance

The Position Sizing Formula

Universal Formula:

Position Size = Risk Amount / Risk Per Share

Where:

Risk Amount = Account Size × Risk Percentage

Risk Per Share = Entry Price - Stop Loss Price

Step-by-Step Example:

Account Size: $50,000

Risk Percentage: 2%

Risk Amount: $50,000 × 0.02 = $1,000

Entry Price: $100

Stop Loss: $95

Risk Per Share: $100 - $95 = $5

Position Size: $1,000 / $5 = 200 shares

Position Value: 200 × $100 = $20,000

Verification:

If stopped out: 200 shares × $5 loss = $1,000 = 2% of account ✓

Position Sizing Mistakes

Sizing Based on Conviction — "I'm really confident, so I'll size up." Confidence doesn't equal accuracy. Your "best" ideas often fail. Same risk percentage regardless of conviction.

Ignoring Correlation — Taking 5 "different" positions that all move together. You think you're diversified but you're concentrated. Consider correlation when calculating total portfolio risk.

Averaging Down Without Plan — Adding to losers to "lower average cost." Increasing exposure to losing positions. If averaging down, include it in original position sizing plan.

Not Accounting for Gaps — Assuming stop loss will execute at your price. Gaps can blow through stops. Size for worst-case gap, especially around events.

Sizing for Profit, Not Risk — "I want to make $5,000 on this trade." Focuses on reward, ignores risk. Always size based on what you can lose, not what you want to make.

AI-Enhanced Position Sizing

1. Dynamic Risk Adjustment

AI adjusts risk percentage based on:

Recent performance (reduce after losses)

Market volatility (reduce in high vol)

Strategy performance (reduce when underperforming)

2. Correlation-Aware Sizing

AI calculates:

Portfolio correlation matrix

True portfolio risk

Optimal position sizes to maintain target risk

3. Kelly Criterion Optimization

AI continuously updates:

Win rate estimates

Win/loss ratio

Optimal Kelly fraction

4. Scenario Analysis

AI simulates:

Worst-case scenarios

Gap risk

Correlation spikes during stress

Position Sizing Rules

Rule 1: Never Risk More Than 2% Per Trade

For most traders, 1-2% is appropriate.

Aggressive: 2%

Conservative: 0.5-1%

Rule 2: Limit Total Portfolio Risk

Maximum open risk at any time: 6-10%

If you have 5 positions at 2% each = 10% total risk

Rule 3: Reduce Size After Losses

After significant drawdown, reduce position sizes.

This is anti-martingale: bet less when losing.

Rule 4: Account for Correlation

Correlated positions = concentrated risk.

Treat correlated positions as one larger position.

Rule 5: Size for the Stop, Not the Target

Your position size is determined by where you're wrong, not where you want to be right.

Position Sizing Checklist

Before every trade:

What is my account size today?

What percentage am I risking? (1-2%)

What is my dollar risk amount?

Where is my stop loss?

What is my risk per share?

What is my calculated position size?

What is my total portfolio risk with this trade?

Is this position correlated with existing positions?

Quick Reference Table

$10,000 account → 1% = $100, 2% = $200

$25,000 account → 1% = $250, 2% = $500

$50,000 account → 1% = $500, 2% = $1,000

$100,000 account → 1% = $1,000, 2% = $2,000

$250,000 account → 1% = $2,500, 2% = $5,000

Key Takeaways

Position sizing matters more than entry timing or stock selection

Risk a fixed percentage (1-2%) of your account per trade

Calculate position size based on stop loss distance

Account for correlation — correlated positions multiply risk

Reduce size after losses, not increase (anti-martingale)

Your Turn

How do you currently determine position size?

Have you ever been hurt by sizing too large?

Share your position sizing rules below 👇

DJI - Ascending Channel Rejection at 49,000 | Trump Policy

Executive Summary

Dow Jones Industrial Average (DJI) trading at 48,996.08 after a sharp 466-point drop (-0.94%) on January 7, 2026. Price rejected from the upper ascending channel resistance near 49,600 and is now consolidating within a key support zone between 48,500-49,000. Despite the pullback, the Dow just triggered a rare Dow Theory buy signal on January 6 when both the Dow Industrials and Dow Transports hit record highs simultaneously - the first such signal in over a year. Trump policy headlines creating volatility, but the secular bull market remains intact.

BIAS: CAUTIOUSLY BULLISH - Support Zone Test

The trend remains bullish on higher timeframes. Current pullback is a healthy consolidation within the ascending channel. Watch the 48,500-49,000 support zone for bounce or breakdown.

Current Market Data - January 8, 2026

Current Price: 48,996.08 (-466.00 / -0.94%)

Day's Range: 48,951.99 - 49,621.43

52-Week Range: 36,611.78 - 49,621.43

Market Status: Closed (Last update Jan 7, 17:00 GMT-5)

Index Type: CFD

Performance Metrics:

1 Week: +1.29%

1 Month: +2.14%

3 Months: +5.09%

6 Months: +10.15%

YTD: +1.85%

1 Year: +14.45%

All timeframes positive. Best 4-day start to a year since 2018 (+1.9% through first 4 trading days).

THE BIG STORY - Dow Theory Buy Signal + Trump Policy Chaos

Historic Dow Theory Signal

On January 6, 2026, the Dow Theory flashed a bullish signal for the first time in more than a year. Both the Dow Jones Industrial Average and Dow Jones Transportation Average tallied record closing highs on the same day - a classic confirmation that the secular bull market remains alive and well.

Key points:

Dow Industrials hit record high of 49,462.08 on Jan 6

Dow Transports hit first record since Nov 25, 2024

100-year-old indicator confirms bull market intact

Rotation trade benefiting cyclicals and value stocks

Transportation stocks big beneficiaries of rotation

Trump Policy Headlines Creating Volatility

We're only one week into 2026 and the market is already dealing with a flood of geopolitical headlines:

Trump called for 50%+ increase in U.S. defense budget to $1.5 trillion by 2027

Executive order blocking defense contractors from dividends/buybacks until they speed up production

Plans to ban Wall Street firms from buying single-family homes

U.S. intervention in Venezuela - deal to import $2B of Venezuelan crude

"Donroe Doctrine" drama targeting Greenland, Colombia, Cuba

European defense stocks hitting record highs on spending expectations

MACRO DRIVERS - What's Moving the Dow

1. Defense Sector Turmoil

Trump's executive order sent defense stocks tumbling:

Lockheed Martin (LMT): -4.8%

Northrop Grumman: -5.5%

General Dynamics: -3.6%

RTX (Raytheon): -2.5%

European defense stocks at record highs (BAE +5.8%, Leonardo +4.4%)

Stocks bounced in afterhours trading

2. Financial Sector Weakness

JPMorgan Chase (JPM): -2.3% after Wolfe Research downgrade

Blackstone: -5.6% on housing ban news

Invitation Homes: -6% on single-family home ban

Banks expected to report higher Q4 profits next week

Investment banking revenue accelerating

3. Labor Market Data Mixed

JOLTS: Job openings fell to 14-month low in November

ADP: Private payrolls +41,000 in December (weak)

Initial jobless claims: 214,000 (better than expected)

Friday's NFP report is the key data point

Unemployment expected to drop to 4.5% from 4.6%

4. Fed Policy Outlook

83% odds Fed pauses at Jan 27-28 meeting

Hot economy could mean fewer rate cuts

Need unemployment near 5% for significant easing

Few economists expect that in near term

Rate cut expectations fading

5. Venezuela Oil Deal

Trump deal to import up to 50 million barrels of Venezuelan crude

U.S. "selectively rolling back sanctions" on Venezuelan oil

Revenue to stabilize Venezuela economy

Repay Exxon and ConocoPhillips for nationalized assets

Oil prices fell sharply on supply expectations

Brent: $59.96 | WTI: $55.99

Technical Structure Analysis - 45 Minute Timeframe

Ascending Channel Pattern

The chart shows a well-defined ascending channel (blue shaded area):

Lower trendline support connecting higher lows

Upper trendline resistance connecting higher highs

Channel intact since mid-December

Price rejected from upper channel resistance near 49,600

Currently testing mid-channel support zone

Dashed midline providing dynamic support/resistance

Key Price Action

Jan 6: Hit record high 49,462.08 (Dow Theory confirmation)

Jan 7: Rejected from 49,621.43 intraday high

Sharp 466-point drop (-0.94%)

Now consolidating at 48,996.08

Testing critical support zone

Key Levels

Resistance:

49,621.43 - 52-WEEK HIGH / Day's high (red line)

49,462.08 - Jan 6 record close

49,300-49,400 - Upper channel resistance zone (pink box)

50,000 - Psychological round number

Support:

48,951.99 - Day's low / immediate support

48,500-49,000 - Current support zone (pink box on chart)

48,300 - Channel midline support (dashed line)

47,600 - Lower channel support (red line)

47,300 - Major support level

SCENARIO ANALYSIS

BULLISH SCENARIO - Bounce from Support Zone

Trigger Conditions:

Price holds 48,500-49,000 support zone

Bullish rejection candle on 45min/1H

Volume confirmation on bounce

Defense stocks stabilize

Friday NFP comes in strong

Price Targets if Bullish:

Target 1: 49,300-49,400 (upper channel)

Target 2: 49,621 (52-week high retest)

Target 3: 50,000 (psychological)

Extended: 50,500+ (new ATH territory)

BEARISH SCENARIO - Channel Breakdown

Trigger Conditions:

Price breaks below 48,500 support

Volume confirmation on breakdown

Defense sector continues selling

Weak NFP data Friday

Fed hawkish signals

Price Targets if Bearish:

Target 1: 48,300 (channel midline)

Target 2: 47,600 (lower channel support)

Target 3: 47,300 (major support)

Extended: 46,500 (deeper correction)

NEUTRAL SCENARIO - Range Consolidation

Most likely short-term outcome:

Price consolidates between 48,500-49,300

Wait for Friday NFP for direction

Digest Trump policy headlines

Healthy consolidation before next leg

Dow Theory signal provides floor

MY ASSESSMENT - CAUTIOUSLY BULLISH

Bullish Factors (Dominant):

Dow Theory buy signal (first in over a year)

Best 4-day start since 2018

All performance metrics positive

Secular bull market intact since Oct 2022

Ascending channel structure holding

Rotation into cyclicals/value continuing

Strong Q3 GDP (4.3%)

Banks expected to report strong Q4

M&A activity surging

Bearish Factors (Caution):

Sharp rejection from 52-week high

Defense sector turmoil (Dow components)

Trump policy uncertainty

Fed rate cut expectations fading

Friday NFP risk event

Elevated valuations (98th percentile)

My Stance: CAUTIOUSLY BULLISH - Buy Support Zone

The Dow Theory signal is significant - this 100-year-old indicator just confirmed the bull market is alive. The pullback from 49,621 to 48,996 is a healthy 1.3% correction within the ascending channel. The 48,500-49,000 support zone is the key level to watch.

Strategy:

Watch for bounce at 48,500-49,000 support zone

Long on bullish rejection candle with volume

Target 49,300-49,400 (upper channel)

Extended target 49,621 (52-week high)

Stop below 48,300 (channel midline)

Wait for Friday NFP before large positions

Trade Framework

Scenario 1: Support Zone Bounce

Entry Conditions:

Price tests 48,500-48,800 zone

Bullish rejection candle (hammer, engulfing)

Volume spike on bounce

RSI oversold on lower timeframes

Trade Parameters:

Entry: 48,500-48,800 at support

Stop Loss: 48,200 below support zone

Target 1: 49,300 (upper channel)

Target 2: 49,621 (52-week high)

Risk-Reward: ~1:2.5

Scenario 2: Breakout Above 52-Week High

Entry Conditions:

Price breaks above 49,621 with volume

Momentum indicators confirming

Strong NFP data Friday

Trade Parameters:

Entry: 49,650-49,700 on confirmed breakout

Stop Loss: 49,200 below recent support

Target 1: 50,000 (psychological)

Target 2: 50,500 (new ATH territory)

Risk-Reward: ~1:2

Scenario 3: Channel Breakdown

Entry Conditions:

Price breaks below 48,300 channel midline

Volume confirmation

Defense stocks continue selling

Trade Parameters:

Entry: 48,200-48,300 on confirmed breakdown

Stop Loss: 48,700 above breakdown level

Target 1: 47,600 (lower channel)

Target 2: 47,300 (major support)

Risk-Reward: ~1:1.5

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

Friday NFP is major risk event - reduce size before

Trump headlines can move markets suddenly

Defense stocks are Dow components - watch sector

Scale out at targets

Don't fight the trend - it's still bullish

Key Events to Watch

Thursday Jan 8: Initial jobless claims, trade deficit, Q3 productivity

Friday Jan 9: December Non-Farm Payrolls (KEY EVENT)

Next Week: Bank earnings begin (JPM, BAC, WFC, C)

Jan 27-28: FOMC Meeting (83% odds of pause)

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 47,600 (lower channel)

Dow Transports break down significantly

VIX spikes above 20

Major geopolitical escalation

Bearish thesis invalidated if:

Price closes above 49,621 (new ATH)

Strong NFP data Friday

Defense stocks recover

Fed signals more rate cuts

Conclusion

The Dow Jones Industrial Average is at a critical juncture after rejecting from the 52-week high. The Dow Theory buy signal confirms the secular bull market is intact, but Trump policy headlines are creating short-term volatility.

The Numbers:

Current Price: 48,996.08

52-Week High: 49,621.43

YTD Performance: +1.85%

1-Year Performance: +14.45%

Best 4-day start since 2018

Key Levels:

49,621 - 52-WEEK HIGH (bullish target)

49,300-49,400 - Upper channel resistance

48,996 - Current price

48,500-49,000 - Support zone (WATCH THIS)

47,600 - Lower channel support

The Setup:

Dow Theory just flashed a buy signal for the first time in over a year. The ascending channel is intact. The pullback is healthy. Watch the 48,500-49,000 support zone for the next move.

Strategy:

Buy support zone (48,500-49,000)

Target 49,300-49,400 (upper channel)

Extended target 49,621 (52-week high)

Stop below 48,300

Wait for Friday NFP for confirmation

The Dow Theory signal says the bull market is alive. Trade accordingly.

List your thoughts below!

AMD - Descending Wedge at $221 | OpenAI Partnership + MI400 Chip

Executive Summary

AMD trading at $221.08 within a descending wedge on the 4H timeframe. Major catalyst: CES 2026 unveiled MI455, MI440X AI chips with OpenAI partnership expected to generate billions in revenue. MI500 previewed (1,000x faster than MI300, shipping 2027). Descending wedge typically bullish reversal pattern. Earnings in 28 days.

BIAS: BULLISH - Descending Wedge + AI Catalyst

Current Market Data

Current: $221.08 (-1.07%)

Pre-market: $222.77 (+0.76%)

Day's Range: $220.48 - $234.02

52-Week: $76.48 - $267.08

Market Cap: $359.93B

Next Earnings: 28 days

CES 2026 Catalysts

MI455 processors powering OpenAI data centers

MI440X for enterprise on-premise AI deployments

MI500 preview - 1,000x faster than MI300 (shipping 2027)

OpenAI deploying 6 gigawatts of AMD GPUs

Ryzen AI 400 Series for Copilot+ PCs

Ryzen 7 9850X3D - fastest gaming processor

Greg Brockman (OpenAI) on stage with Lisa Su

Technical Structure - 4H

Descending Wedge Pattern:

Falling resistance and support trendlines (yellow dashed)

Wedge narrowing toward apex

Typically bullish reversal (70% break up)

Price broke out of $200-$210 consolidation zone

Key Levels:

Resistance:

$234 - Day's high / immediate resistance

$240 - Secondary resistance

$263 - Upper resistance (red line) / breakout target

$267.08 - 52-WEEK HIGH

Support:

$220 - Immediate support

$200 - $210 - Consolidation zone (red box)

$196 - Major support (red line)

SCENARIO ANALYSIS

BULLISH: Wedge Breakout

Trigger: Break above descending wedge resistance (~$235-$240)

Targets: $250 → $263 → $267 (52-week high)

Catalyst: OpenAI partnership, MI400 deployment, earnings beat

BEARISH: Wedge Breakdown

Trigger: Break below $200 support

Targets: $196 → $180

Invalidates bullish thesis

My Assessment

Descending wedge with major AI catalyst. OpenAI partnership deploying 6GW of AMD GPUs = billions in revenue. CES 2026 unveiled MI455, MI440X, previewed MI500 (1,000x faster). Lisa Su: "AI is the most important technology of the last 50 years." Earnings in 28 days - consistent beats. Bullish structure for breakout.

Strategy:

Long on wedge breakout above $235-$240

Target $250, $263, $267 (52-week high)

Stop below $196 major support

Watch earnings in 28 days

List your thoughts below on the next move!

Zooming Out and In: AI-Powered Multi-Timeframe Mastery

You're Bullish on the 5-Minute Chart. You're Bearish on the Daily. Who's Right?

This conflict destroys more traders than bad entries ever will.

Multi-timeframe analysis isn't optional - it's the difference between trading with the current and swimming against it.

AI doesn't have the human limitation of only seeing one chart at a time. Here's how to think like the machine.

The Timeframe Hierarchy

The Principle:

Higher timeframes carry more weight than lower timeframes.

Why:

More data points = more statistical significance

Larger players operate on higher timeframes

Trends on higher timeframes persist longer

Lower timeframe noise gets filtered out

The Hierarchy:

Monthly → Macro Trend

Weekly → Swing Trend

Daily → Position Trend

4H → Swing Trade

1H → Day Trade

15M → Scalp

5M/1M → Noise

The Three-Timeframe Framework

Timeframe 1: Trend (Higher)

Purpose: Determine overall direction

What is the dominant trend?

Where are major support/resistance levels?

What's the big picture context?

Timeframe 2: Signal (Trading)

Purpose: Find entry opportunities

Where are setups forming?

What patterns are developing?

Where should entries be placed?

Timeframe 3: Execution (Lower)

Purpose: Optimize entry timing

Where is the precise entry?

What's the immediate momentum?

Where should the stop go?

Example Combinations:

Position Trading: Monthly → Weekly → Daily

Swing Trading: Weekly → Daily → 4H

Day Trading: Daily → 1H → 15M

Scalping: 4H → 15M → 5M

How AI Processes Multiple Timeframes

Human Limitation:

You can only look at one chart at a time. Switching between timeframes takes time and mental energy.

AI Advantage:

Processes all timeframes simultaneously, identifying:

Alignment (all timeframes agree)

Conflict (timeframes disagree)

Confluence (multiple signals at same price)

AI Multi-Timeframe Logic:

Calculate trend on TF1 (higher)

Calculate trend on TF2 (trading)

Calculate trend on TF3 (lower)

If all aligned: Signal strength = HIGH

If 2 of 3 aligned: Signal strength = MEDIUM

If conflicting: Signal strength = LOW or NO TRADE

Timeframe Alignment Signals

Full Alignment (Strongest)

Higher TF: Uptrend

Trading TF: Uptrend

Lower TF: Uptrend

Action: High-confidence long entries

Partial Alignment (Moderate)

Higher TF: Uptrend

Trading TF: Pullback in uptrend

Lower TF: Downtrend (temporary)

Action: Wait for lower TF to turn, then enter

Conflict (Weakest/No Trade)

Higher TF: Uptrend

Trading TF: Downtrend

Lower TF: Uptrend

Action: Wait for clarity or reduce size

Practical Multi-Timeframe Workflow

Step 1: Start High

Open your highest timeframe first.

What's the trend?

Where are key levels?

What's the context?

Step 2: Move to Trading Timeframe

Look for setups that align with higher TF.

Is there a pattern forming?

Does it align with higher TF direction?

Where would entry make sense?

Step 3: Drop to Execution Timeframe

Fine-tune your entry.

What's the immediate momentum?

Where's the optimal entry point?

Where should the stop go?

Step 4: Execute and Manage

Enter on lower TF, manage on trading TF.

Don't let lower TF noise shake you out

Use trading TF for trade management

Reference higher TF for overall thesis

Common Multi-Timeframe Mistakes

Fighting the Higher Timeframe — Taking shorts in a strong weekly uptrend because the 15M looks bearish. Higher timeframe wins. Trade with it, not against it.

Analysis Paralysis — Looking at so many timeframes that you never take a trade. Stick to three timeframes maximum.

Timeframe Hopping — Switching timeframes to justify a trade you want to take. Define your timeframes BEFORE looking at charts.

Managing on Wrong Timeframe — Entering on 1H, then panicking at every 5M candle. Manage trades on the timeframe you entered on.

Ignoring Timeframe Transitions — Not recognizing when higher TF trend is changing. Regularly check higher TF for trend health.

AI-Enhanced Multi-Timeframe Indicators

Concept 1: Trend Alignment Score

Single number showing alignment across timeframes.

Score = (TF1_trend × 3) + (TF2_trend × 2) + (TF3_trend × 1)

Where trend = +1 (up), 0 (neutral), -1 (down)

Max bullish = +6

Max bearish = -6

Concept 2: Multi-Timeframe Moving Average

Shows MA from higher timeframe on lower timeframe chart.

Application:

Daily 200 MA plotted on 1H chart

Provides context without switching charts

Concept 3: Timeframe Confluence Zones

Identifies price levels significant on multiple timeframes.

Application:

Support on daily AND weekly = stronger level

Resistance on 4H AND daily = more significant

Building Your Multi-Timeframe System

Define Your Timeframes:

Based on your trading style, select:

Trend timeframe (context)

Signal timeframe (setups)

Execution timeframe (entries)

Create Alignment Rules:

What constitutes "aligned"?

What do you do when conflicted?

How do you handle transitions?

Build Checklists:

Before Any Trade:

What's the higher TF trend?

Does trading TF setup align?

Is lower TF confirming entry?

During Trade:

Is higher TF thesis still valid?

Is trading TF structure intact?

Am I managing on correct TF?

Timeframe-Specific Characteristics

Monthly/Weekly:

Institutional positioning

Macro trends

Major support/resistance

Slow to change

Daily:

Swing trade setups

Clear trend structure

Key for most traders

Balances noise and signal

4H/1H:

Day trade setups

Intraday trends

More noise than daily

Faster signals

15M/5M:

Scalp entries

Execution timing

High noise

Requires quick decisions

1M:

Mostly noise

Only for precise execution

Not for analysis

Easy to overtrade

Key Takeaways

Higher timeframes carry more weight than lower timeframes

Use three timeframes: Trend (context), Signal (setups), Execution (entries)

Full alignment = strongest signals; conflict = wait or skip

AI can process all timeframes simultaneously — humans must be systematic

Manage trades on the timeframe you entered, not lower

Your Turn

What timeframes do you currently use in your trading?

Have you experienced the conflict of different timeframes showing opposite signals?

Share your multi-timeframe strategy below 👇

ATOM - +21% Weekly Rally at $1.16B | Tokenomics Redesign

Executive Summary

Cosmos (ATOM) market cap trading at $1.16B after a massive +21.17% weekly rally on the 4H timeframe. Price surged from $880M support to test $1.18B resistance. Major catalysts ahead: tokenomics redesign (Q1 2026), Solana/Ethereum L2 IBC integrations, and THORChain cross-chain swaps live. Strong momentum but approaching resistance.

BIAS: BULLISH - Strong Momentum, Watch Resistance

Current Market Data

Current: $1.16B (+0.33%)

Day's Range: $1.14B - $1.16B

52-Week: $803.29M - $2.8B

Volume: 63.52M (above 30D avg of 53.47M)

Performance:

1W: +21.17% | 1M: +7.14% | 3M: -39.69%

6M: -31.52% | YTD: +23.37% | 1Y: -59.76%

Key Catalysts

Tokenomics Redesign (Q1 2026) - Lower inflation, fee capture from appchains

IBC Integrations - Solana and Ethereum L2s connectivity coming

THORChain Cross-Chain Swaps - Native ATOM swaps live (no bridges)

CometBFT Upgrades - Targeting 10k+ TPS for enterprise

Enterprise Blockchain Fleet Manager - SWIFT, SMBC adoption potential

Stablecoin Surge - Cosmos Labs predicts new issuers in 2026

Technical Structure - 4H

Strong Uptrend:

Clean rally from $880M to $1.16B

Higher highs and higher lows

Now testing upper resistance at $1.18B

Volume above average - confirms momentum

Key Levels (Market Cap):

Resistance:

$1.16B - $1.18B - Current resistance zone

$1.20B - Psychological resistance

$1.40B+ - Extended bullish target

Support:

$1.10B - Immediate support

$1.00B - Psychological support

$880M - Major support (red line at bottom)

SCENARIO ANALYSIS

BULLISH: Breakout Above $1.18B

Trigger: Close above $1.18B with volume

Targets: $1.20B → $1.40B → $1.60B

Catalyst: Tokenomics redesign approval, IBC integrations

BEARISH: Rejection at Resistance

Rejection at $1.18B resistance

Pullback to $1.00B-$1.10B support

Healthy consolidation before next leg

My Assessment

Strong +21% weekly rally with volume confirmation. Approaching resistance at $1.18B. Major catalysts ahead: tokenomics redesign to lower inflation and capture fees, IBC integrations with Solana/ETH L2s, and enterprise adoption push. Bullish structure intact - watch for breakout or pullback to support.

Strategy:

Long on breakout above $1.18B → Target $1.20B, $1.40B

Or buy pullback to $1.00B-$1.10B support

Stop below $880M major support

Tell me your thoughts below!

AVAX - Rising Wedge at $14.12 | ETF Filings Spark +11% Rally

Executive Summary

Avalanche (AVAX) trading at $14.12 within a rising wedge on the 2H timeframe. Price surged +11% this week as institutional ETF filings sparked a rally. Now testing upper resistance with two scenarios: bullish breakout above $14.75 or pullback to $12.00-$12.75 support zone before continuation.

BIAS: NEUTRAL - Watching for Breakout or Pullback

Current Market Data

Current: $14.123 (-0.82%)

Day's Range: $14.033 - $14.516

52-Week: $9.013 - $44.575

Market Cap: $6.08B

24h Volume: $384.76M

Technical Rating: Neutral

Performance:

1W: +11.80% | 1M: +6.89% | 3M: -53.89%

6M: -23.09% | YTD: +14.80% | 1Y: -66.85%

Key Catalyst

Institutional ETF filings sparked +11% rally

AVAX among altcoins with ETF filing momentum

Fortune 100 companies expected to launch blockchains on Avalanche

Strong ecosystem for enterprise adoption

Technical Structure - 2H

Rising Wedge Pattern:

Rising support and resistance trendlines (yellow dashed)

Wedge narrowing toward apex

Can break either direction

Currently testing upper resistance

Key Levels:

Resistance:

$14.50 - $14.75 - Upper resistance / breakout level

$15.00 - Psychological resistance

$16.00+ - Extended bullish target

Support:

$14.00 - Immediate support

$12.75 - Upper support zone

$12.00 - $12.75 - Major support zone (purple)

$11.75 - Deep support (red line)

SCENARIO ANALYSIS

BULLISH: Breakout Above $14.75

Trigger: 2H close above $14.75 with volume

Targets: $15.00 → $16.00 → $18.00

Catalyst: ETF momentum continues

BEARISH: Pullback to Support Zone

Rejection at upper wedge resistance

Pullback to $12.00-$12.75 support zone

Healthy retest before continuation

Buy opportunity at support

My Assessment

Rising wedge at resistance after +11% ETF-driven rally. Two scenarios: breakout above $14.75 or pullback to $12.00-$12.75 support zone. ETF filings provide fundamental catalyst. Watch for confirmation before entry.

Strategy:

Long above $14.75 breakout → Target $15, $16, $18

Or wait for pullback to $12.00-$12.75 support

Long at support with stop below $11.75

Target $14.50+ on bounce

List your thoughts below!

MNQ - Range-Bound at 25,385 | Support Below, Resistance AboveExecutive Summary

Micro E-mini Nasdaq 100 futures (MNQ1!) trading at 25,385 in a range-bound consolidation on the 4H timeframe. Price rejected from the 25,900-26,000 resistance zone and is now testing lower levels. Multiple support zones below at 25,100-25,200 and 24,850-24,950. Watch for breakout direction from this consolidation range.

BIAS: NEUTRAL - Range-Bound Consolidation

Current Market Data

Current: 25,385.25 (-0.28%)

Day's Range: 25,265.25 - 25,803.50

52-Week: 16,452.50 - 26,399.50

Open Interest: 94.90K

Front Month: MNQH2026

Performance:

1W: -1.87% | 1M: -1.03% | 3M: +1.12%

6M: +10.52% | YTD: -0.29% | 1Y: +10.79%

Key Market Context

Mag 7 outperformed S&P 500 for 3rd straight year

MAG/SPX ratio showing smallest yearly rise in 3 years

Equal-weighted S&P 500 starting to outperform

January Barometer: As January goes, so goes the year (84% hit rate)

Santa Rally sputtering - weak footing into 2026

VIX subdued but could spike in Jan-Feb

Fed expected to pause at Jan 27-28 meeting (83% odds)

Technical Structure - 4H

Range-Bound Consolidation:

Price consolidating between support and resistance

Rejected from 25,900-26,000 resistance zone

Testing lower support zones

Watch for breakout direction

Key Levels:

Resistance:

25,800 - Day's high / immediate resistance

25,900 - 26,000 - Resistance zone (pink box)

26,260 - Upper resistance (red line)

26,399.50 - 52-WEEK HIGH

Support Zones (Purple):

25,100 - 25,200 - Upper support zone

24,850 - 24,950 - Lower support zone

24,850 - Major support (red line at bottom)

SCENARIO ANALYSIS

BULLISH: Break Above Resistance

Trigger: Break above 26,000 with volume

Targets: 26,260 → 26,399 (52-week high) → 26,500+

BEARISH: Test Support Zones

Price tests 25,100-25,200 first support

If fails, drops to 24,850-24,950

Break below 24,850 = bearish continuation

NEUTRAL: Range Continuation

Price oscillates between 24,850 - 26,000

Wait for breakout confirmation

Trade the range until breakout

My Assessment

Range-bound consolidation with clear support and resistance zones. Mag 7 momentum slowing, equal-weighted index gaining ground. Santa Rally weak - cautious into January. Watch support zones for bounce or breakdown.

Strategy:

Watch for bounce at 25,100-25,200 support

Long above 26,000 breakout → Target 26,260, 26,400

Short below 24,850 breakdown → Target 24,500, 24,000

Trade the range until breakout confirms

Comment your thoughts below!

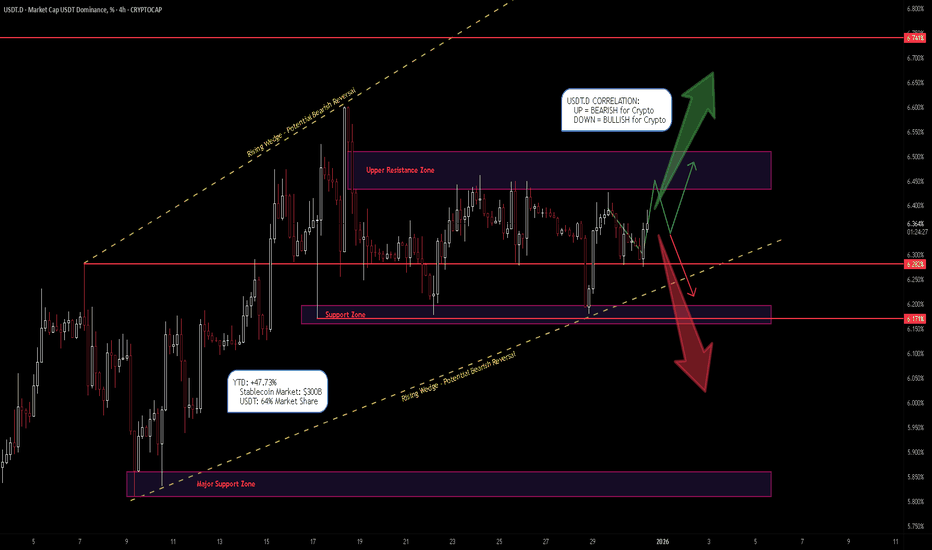

USDT.D - Rising Wedge at 6.36% +47.73% YTD | Critical Crypto

Executive Summary

USDT Dominance is trading at 6.362% within a rising wedge pattern on the 4H timeframe. Up +47.73% YTD as investors rotated into stablecoins during crypto weakness. The rising wedge suggests potential bearish reversal (bullish for crypto), but the uptrend remains intact near the 52-week high of 6.749%.

BIAS: NEUTRAL - Rising Wedge at Resistance

WHY USDT.D MATTERS

USDT.D UP = Risk-off = BEARISH for crypto

USDT.D DOWN = Risk-on = BULLISH for crypto

Leading indicator for BTC, ETH, altcoins

Current Market Data

Current: 6.362% (+0.57%)

Day's Range: 6.270% - 6.399%

52-Week: 3.745% - 6.749%

Technical Rating: NEUTRAL

Performance:

1W: -0.26% | 1M: +4.67% | 3M: +44.84%

6M: +34.12% | YTD: +47.73% | 1Y: +46.90%

Stablecoin Market Context

Total stablecoin market: ~$300B (record high)

USDT: $187B (64% market share)

USDC: $76B (26% market share)

Dragonfly predicts USDT share drops to 55% in 2026

Stablecoin market expected to grow 60% in 2026

Technical Structure - 4H

Rising Wedge Pattern:

Yellow dashed trendlines forming wedge

Typically bearish reversal (70% break down)

Price compressing near apex

Breakdown = BULLISH for crypto

Key Levels:

Resistance:

6.45% - 6.55% - Upper resistance zone

6.749% - 52-WEEK HIGH

Support:

6.15% - 6.25% - Support zone / Breakdown level

5.80% - 5.95% - Major support zone

SCENARIO ANALYSIS

BEARISH USDT.D (Bullish for Crypto)

Trigger: Break below 6.15%

Targets: 6.00% → 5.80% → 5.50%

Implication: LONG crypto - risk-on rotation

BULLISH USDT.D (Bearish for Crypto)

Trigger: Break above 6.55%

Targets: 6.749% → 7.00% → 7.25%

Implication: Reduce crypto exposure - risk-off continues

My Assessment

Rising wedge at resistance suggests potential breakdown (bullish for crypto). However, +47.73% YTD momentum and risk-off sentiment could push higher. Wait for confirmation.

Strategy:

Breakdown below 6.15% = BULLISH for crypto

Breakout above 6.55% = BEARISH for crypto

Use as leading indicator for crypto trades

This is not financial advice.

DXY - Descending Wedge at 98.13 | -9.58% YTD

Executive Summary

The US Dollar Index (DXY) is trading at 98.130 on December 29, 2025, consolidating within a descending wedge pattern on the 2H timeframe. The Dollar is on track for its worst year since 2017 with -9.58% YTD losses, pressured by Fed rate cut expectations, dovish Fed Chair concerns, and Trump's tariff policies. However, a potential bullish reversal pattern is forming at the bottom of the wedge, with an ascending channel developing. FOMC minutes due Tuesday could be the catalyst for the next directional move.

BIAS: NEUTRAL - Watching for Breakout Direction

The Dollar is at a critical inflection point. The descending wedge suggests potential bullish reversal, but fundamental headwinds remain strong. Wait for confirmation before committing to a direction.

Current Market Context - December 29, 2025

DXY is consolidating near yearly lows:

Current Price: 98.130 (+0.08% on the day)

Day's Range: 97.915 - 98.177

52-Week Range: 96.218 - 110.176

52-Week High: 110.176

52-Week Low: 96.218

Technical Rating: SELL

Performance Metrics - MIXED:

1 Week: -0.54%

1 Month: -1.45%

3 Months: +0.22%

6 Months: +1.54%

YTD: -9.58%

1 Year: -9.21%

The Dollar is having its worst year since 2017, down nearly 10% YTD. Short-term metrics are mixed, but the longer-term trend is clearly bearish.

THE BEAR CASE - Dollar Weakness Continues

1. Fed Rate Cut Expectations

The Dollar continues to see underlying weakness as markets price in further rate cuts:

FOMC expected to cut rates by ~50 bp in 2026

Markets pricing 19% chance of -25 bp cut at January 27-28 meeting

Two rate cuts expected in 2026

Fed officials split on path forward - majority forecast single additional cut

Lower rates = weaker Dollar

2. Dovish Fed Chair Concerns

President Trump to announce new Fed Chair in early 2026

Kevin Hassett (National Economic Council Director) most likely choice

Hassett seen as most dovish candidate by markets

Trump wants next Fed chairman to lower rates

Dovish Fed Chair = bearish for Dollar

3. Fed Liquidity Injection

Fed began purchasing $40 billion/month in T-bills mid-December

Announced December 10 - $40 billion/month liquidity injection

Increased liquidity pressures Dollar lower

Quantitative easing-like effects

4. Interest Rate Differentials

FOMC expected to cut rates ~50 bp in 2026

BOJ expected to raise rates +25 bp in 2026

ECB expected to leave rates unchanged in 2026

Narrowing rate differentials = Dollar weakness

Yen strengthening on BOJ rate hike expectations

5. Trump Tariff Policies

Aggressive tariff policies pressuring Dollar

Threats to Fed independence

Trade tensions creating uncertainty

Dollar down nearly 10% YTD partly due to tariff concerns

6. Technical Rating: SELL

TradingView technicals gauge pointing toward "Sell"

Descending wedge pattern (bearish continuation possible)

Below major moving averages

Momentum indicators bearish

THE BULL CASE - Potential Reversal Forming

1. Descending Wedge Pattern (Bullish Reversal)

Descending wedge is typically a bullish reversal pattern

Price compressing at bottom of wedge

Ascending channel forming within wedge

Potential breakout to upside

Pattern suggests exhaustion of selling pressure

2. US Economic Data Still Solid

Q3 GDP came in at +4.3% - stronger than expected

Nov pending home sales rose +3.3% m/m (vs +0.9% expected)

Jobless claims unexpectedly fell

US businesses see employment growth at 4.32%

Revenue growth expectations at 3.83%

Strong data could limit Dollar weakness

3. Safe-Haven Demand

Stock market weakness boosting liquidity demand for Dollar

Geopolitical tensions (Venezuela blockade, ISIS strikes in Nigeria)

Ukraine-Russia peace deal uncertainty

Risk-off events could boost Dollar

4. Oversold Conditions

Dollar down -9.58% YTD - oversold

Mean reversion possible

Near 52-week low (96.218)

Potential for bounce

5. "US Exceptionalism" Positioning

BNY's Bob Savage: Rise above 98.15 could trigger momentum buying

"US exceptionalism positioning" could resurge

Dollar bulls waiting for catalyst

6. FOMC Minutes Catalyst

Fed minutes due Tuesday (December 30)

Could provide signals on rate cut timing

Hawkish surprise could boost Dollar

Key catalyst for next move

Technical Structure Analysis

Price Action Overview - 2 Hour Timeframe

The chart shows a complex structure with potential reversal forming:

Descending Wedge Pattern (Primary):

Clear descending wedge established from highs

Upper trendline: Falling resistance (connecting lower highs)

Lower trendline: Falling support (connecting lower lows)

Wedge narrowing - compression before breakout

Typically bullish reversal pattern

Price near apex of wedge

Ascending Channel (Secondary - Forming at Bottom):

Small ascending channel forming within wedge

Higher lows being established

Potential early reversal signal

Watch for breakout above wedge resistance

Key Zones Identified:

Upper resistance zone: ~99.25 (major resistance)

Secondary resistance: ~98.80

Current consolidation: 97.90-98.20

Support zone: ~97.85-98.00

Major support: ~97.25

52-Week Low: 96.218

Key Support and Resistance Levels

Resistance Levels:

98.177 - Day's high / immediate resistance

98.15 - BNY trigger level for momentum buying

98.80 - Secondary resistance zone

99.00 - Psychological resistance

99.25 - Major resistance zone

100.00 - MAJOR PSYCHOLOGICAL RESISTANCE

110.176 - 52-WEEK HIGH

Support Levels:

97.959 - Recent low

97.915 - Day's low / immediate support

97.85-98.00 - Support zone

97.50 - Secondary support

97.25 - Major support

96.50 - Deep support

96.218 - 52-WEEK LOW (critical)

Pattern Analysis

Descending Wedge Characteristics:

Pattern duration: Several weeks

Wedge narrowing toward apex

Volume typically decreases in wedge

Breakout direction: Usually bullish (70% of cases)

Target: Measured move = wedge height at breakout

Current position: Near bottom of wedge

Ascending Channel (Within Wedge):

Small ascending channel forming

Higher lows: Bullish sign

Could be early reversal signal

Watch for breakout above 98.80

Moving Average Analysis

Price trading below major moving averages

MAs sloping downward - bearish alignment

Short-term MAs below long-term MAs

Death cross patterns on longer timeframes

MAs providing dynamic resistance on rallies

SCENARIO ANALYSIS

BULLISH SCENARIO - Descending Wedge Breakout

Trigger Conditions:

2H close above 98.80 (wedge resistance)

Break above 99.00 psychological level

Volume confirmation on breakout

FOMC minutes hawkish surprise

Risk-off sentiment boosting Dollar

Price Targets if Bullish:

Target 1: 99.25 - Major resistance zone

Target 2: 100.00 - Psychological level

Target 3: 101.00-102.00 - Measured move target

Extended: 103.00+ (trend reversal)

Bullish Catalysts:

Descending wedge = bullish reversal pattern (70% breakout up)

Ascending channel forming at bottom

US economic data still solid (GDP +4.3%)

Oversold conditions (-9.58% YTD)

Safe-haven demand potential

FOMC minutes could be hawkish

"US exceptionalism" positioning could return

Mean reversion from extreme weakness

BEARISH SCENARIO - Wedge Breakdown / Continuation

Trigger Conditions:

Break below 97.25 major support

Close below 97.00

FOMC minutes dovish

Fed signals more aggressive rate cuts

Dovish Fed Chair announcement

Price Targets if Bearish:

Target 1: 97.25 - Major support

Target 2: 96.50 - Deep support

Target 3: 96.218 - 52-week low

Extended: 95.00-96.00 (new lows)

Bearish Catalysts:

-9.58% YTD - Worst year since 2017

Technical rating: SELL

Fed rate cuts expected (~50 bp in 2026)

Dovish Fed Chair concerns (Hassett)

Fed liquidity injection ($40B/month)

Interest rate differentials narrowing

Trump tariff policy uncertainty

Below major moving averages

NEUTRAL SCENARIO - Consolidation in Range

Most likely short-term outcome:

Price consolidates between 97.50-98.80

Thin holiday trading continues

Wait for FOMC minutes Tuesday

Wait for Fed Chair announcement

Wedge pattern continues to compress

Breakout direction unclear until catalyst

MY ASSESSMENT - NEUTRAL with Slight Bullish Bias

The evidence is mixed, but the technical pattern suggests potential reversal:

Bullish Factors:

Descending wedge = typically bullish reversal

Ascending channel forming at bottom

Oversold conditions (-9.58% YTD)

US economic data solid

Safe-haven demand potential

Near 52-week low (mean reversion)

Bearish Factors:

Technical rating: SELL

Fed rate cuts expected

Dovish Fed Chair concerns

Fed liquidity injection

Interest rate differentials narrowing

Below major moving averages

Worst year since 2017

My Stance: NEUTRAL - Wait for Confirmation

The descending wedge pattern suggests potential bullish reversal, but fundamental headwinds are strong. The Dollar could go either way from here. Wait for FOMC minutes and a clear breakout before committing.

Strategy:

Wait for breakout confirmation

Long above 98.80 with targets 99.25, 100.00

Short below 97.25 with targets 96.50, 96.218

Respect the wedge pattern

FOMC minutes Tuesday = key catalyst

Trade Framework

Scenario 1: Bullish Breakout Trade Above 98.80

Entry Conditions:

2H close above 98.80

Volume confirmation

Break above descending wedge resistance

Trade Parameters:

Entry: 98.85-99.00 on confirmed breakout

Stop Loss: 98.00 below recent support

Target 1: 99.25 (Risk-Reward ~1:0.5)

Target 2: 100.00 (Risk-Reward ~1:1.2)

Target 3: 101.00-102.00 (Measured move)

Scenario 2: Bearish Breakdown Trade Below 97.25

Entry Conditions:

2H close below 97.25

Volume confirmation

Break below major support

Trade Parameters:

Entry: 97.20-97.00 on confirmed breakdown

Stop Loss: 97.80 above recent resistance

Target 1: 96.50 (Risk-Reward ~1:1)

Target 2: 96.218 (52-week low)

Target 3: 95.50-96.00 (Extended)

Scenario 3: Range Trade (Neutral)

Entry Conditions:

Price bounces at 97.50-97.85 support

Bullish rejection candle

No breakout yet

Trade Parameters:

Entry: 97.50-97.85 at support

Stop Loss: 97.00 below major support

Target 1: 98.50 (Risk-Reward ~1:1)

Target 2: 98.80 (Wedge resistance)

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

Wait for breakout confirmation

Thin holiday volumes = wider stops

FOMC minutes Tuesday = key catalyst

Don't anticipate breakout direction

Scale out at targets

Move stop to breakeven after first target

Watch for Fed Chair announcement

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 96.218 (52-week low)

Descending wedge breaks down

Fed signals aggressive rate cuts

Dovish Fed Chair confirmed

Bearish thesis invalidated if:

Price closes above 99.25 (major resistance)

Descending wedge breaks up with volume

Fed signals no more rate cuts

Risk-off surge boosts Dollar

Key Events to Watch

FOMC Minutes - Tuesday, December 30

Fed Chair Announcement - Early 2026

Year-End Positioning - Through January 1

BOJ Policy Signals - January 23 meeting

ECB Policy - February 5 meeting

Conclusion

The US Dollar Index is at a critical inflection point, trading at 98.130 within a descending wedge pattern. The Dollar is on track for its worst year since 2017 with -9.58% YTD losses, but a potential bullish reversal pattern is forming.

The Numbers:

Current Price: 98.130

YTD Performance: -9.58%

1-Year Performance: -9.21%

52-Week High: 110.176

52-Week Low: 96.218

Technical Rating: SELL

Key Levels:

99.25 - Major resistance

98.80 - Wedge resistance / breakout level

98.13 - Current price

97.85-98.00 - Support zone

97.25 - Major support

96.218 - 52-WEEK LOW

The Setup:

Descending wedge pattern with ascending channel forming at bottom. Fundamentals are bearish (Fed rate cuts, dovish Fed Chair concerns), but technicals suggest potential reversal. FOMC minutes Tuesday could be the catalyst.

Strategy:

NEUTRAL stance - wait for confirmation

Long above 98.80, target 99.25, 100.00

Short below 97.25, target 96.50, 96.218

FOMC minutes Tuesday = key catalyst

Respect the pattern

The Dollar is at a crossroads. The descending wedge suggests potential bullish reversal, but fundamental headwinds remain strong. Wait for the breakout.

BTC/ISD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of BTCUSD – Daily (1D) chart using SMC + Fibonacci + EMA mean-reversion logic.

⸻

Market Context

• Higher-timeframe bias: Bullish (macro)

• Long-term structure still intact despite the pullback

• Current move down = deep corrective phase, not confirmed trend reversal yet

• Price is trading below EMA 50, but reacting near EMA 200 + HTF support

⸻

What Happened (Why BTC Dropped)

• Liquidity taken at the October high

• Sharp impulsive sell-off → distribution + stop-hunt

• Price retraced into a high-confluence discount zone

⸻

Key Demand / Accumulation Zone (Blue Area)

~85,000 – 92,000

This zone is important because it aligns with:

• Fib OTE zone (0.705 – 0.79)

• Previous daily demand

• Range low support

• Proximity to EMA 50 (93K) → mean reversion magnet

• Multiple long lower wicks → absorption

This suggests smart money accumulation, not panic selling.

⸻

Fibonacci Logic

Measured from major swing low → all-time high

• 0.5 & 0.62 → failed supports

• 0.705 – 0.79 → institutional rebalance zone

Textbook location for trend continuation buys

⸻

Trade Idea (Swing Long)

Buy on confirmation inside demand

• Entry: 86,000 – 90,000

• Stop Loss: Below demand (~82,000)

• Targets:

• TP1: 93,000 (EMA 50)

• TP2: 101,800 (EMA 200 / mid-range)

• Final TP: 121,000+ (marked target point / liquidity above highs)

RR potential: 1:4 to 1:6 (swing setup)

⸻

Confirmation Signals (Very Important on BTC)

Wait for at least one:

• Daily or 4H bullish engulfing

• Strong rejection wick from demand

• 4H CHoCH after sweep of lows

• Compression → expansion behavior

⸻

Invalidation

• Daily close below ~82,000

• Acceptance below demand with strong volume

If that happens → bullish swing idea is invalid, and market likely seeks lower HTF liquidity.

⸻ Mr SMC Trading point

Summary

This is a high-timeframe accumulation & continuation setup:

• Deep discount

• Fib OTE + demand

• EMA mean reversion

BTC rewards patience and HTF discipline — confirmation > prediction.

If you want, I can:

• Break this into a 4H / 1H execution plan

• Help you build a BTC-specific SMC swing model

• Or map bearish alternative scenarios for risk control

Please support boost this analysis

GOLD VIEW 1H READ THE CHAPTIAN Hello 👋 gold Traders

technical analysis of Gold (XAU/USD) on a 1-hour timeframe. Here’s a breakdown of the key elements:

1. Fair Value Gap (FVG Level): The purple zone represents an area of inefficiency where price may return to fill before continuing its trend.

2. Change of Character (CHOCH): Indicates a potential shift in market structure, suggesting bullish momentum.

3. Double Top (Red Arrows): Price was rejected twice at the same level, indicating possible resistance.

4. Moving Averages:

200 EMA (Blue Line at 2,901.507): Long-term trend indicator.

30 EMA (Red Line at 2,911.101): Short-term trend indicator.

5. Price Action Forecast:

Price is expected to retrace into the FVG level before continuing upwards toward the target point at 2,961.779.

This suggests a bullish outlook as long as price respects the FVG level as support. Would you like a more detailed breakdown

Don't forget boost 🚀 and follow don't miss more good idea 💡