Freesignal

CAD-CHF Free Signal! Sell!

Hello,Traders!

CAD-CHF has made some

Gains from the recent lows

Just as we expected but now

The pair is entering the

Horizontal resistance area

Around 0.6212 from where

We can enter a short trade

With the Take Profit of 0.6162

And the Stop Loss of 0.6233

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF LongHi Everyone,

Hope you are all well and enjoyed my gold signal that hit all TP's

Here is our EURCHF Signal. wait for the 15 minute candle to close above the entry, and then for price to respect the entry, then we can enter. Here are the numbers.

EURCHF Buy

📊Entry: 0.95727

⚠️Sl: 0.95176

✔️TP1: 0.96349

✔️TP2: 0.97141

✔️TP3: 0.98148

Stick to the rules

Hope you all earn lots of profit.

Best wishes,

Sarah

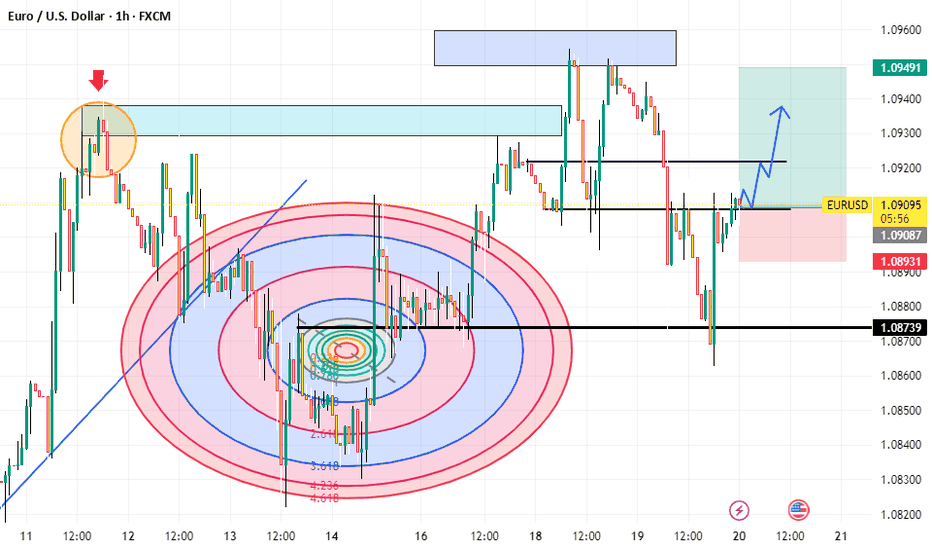

EURUSD TECHNICAL ANALYSIS FOCOUS ON KEY POINTS , EUR POSSIBLEhis chart is a technical analysis of the EUR/USD currency pair on a 1-hour timeframe, featuring several indicators and annotations. Here's a breakdown of what it means:

Key Features of the Chart:

Support & Resistance Levels:

The black horizontal lines indicate important support and resistance levels.

Support: Around 1.08739 (marked with a black line).

Resistance: Around 1.09491 (upper blue zone).

Fibonacci Circles:

The red and blue circular patterns in the middle of the chart suggest Fibonacci time and price levels.

These are used to predict potential reversal points or price movements.

Supply & Demand Zones:

Blue shaded areas indicate resistance (supply zones) where price previously reversed.

The price may react again when reaching these levels.

Candlestick Patterns & Trend Lines:

A previous rejection at the upper blue zone (left side) led to a strong downtrend.

The blue diagonal trendline suggests previous bullish momentum.

Forecasted Price Movement:

The blue arrow suggests an expected bullish move toward the 1.09491 resistance level.

The setup suggests a buy trade with a stop loss around 1.08931 and a target near 1.09491.

Conclusion:

This chart suggests a potential bullish move in EUR/USD, with an expected rise toward 1.09491 if it breaks the resistance near 1.09104. However, if it fails, it could drop back to the 1.08739 support level.

Would you like further analysis or clarification on any aspect? 🚀