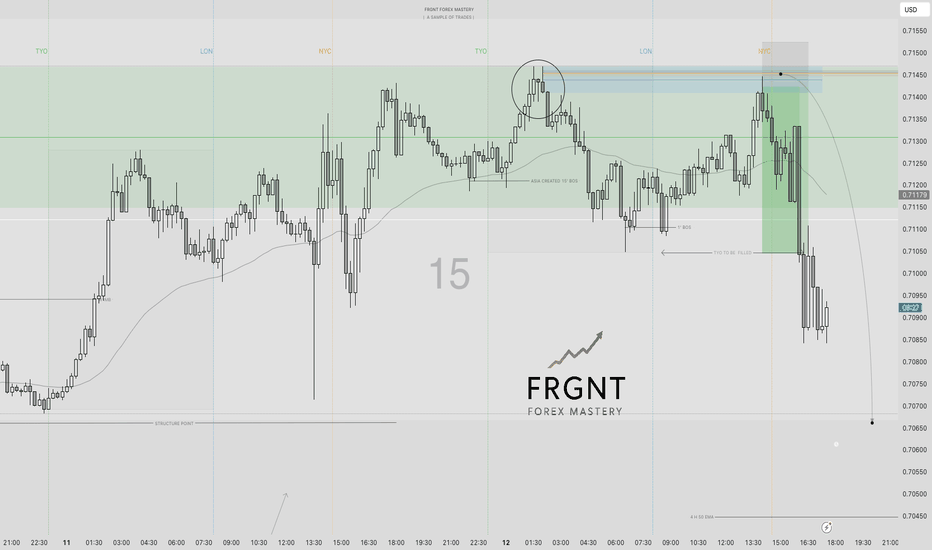

AUDUSD | FRGNT DAILY FORECAST | TEXTBOOK TRADING MADE EASY !📅 Q1 | W6 | D12 | Y26

📊 AUDUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

Freesignals

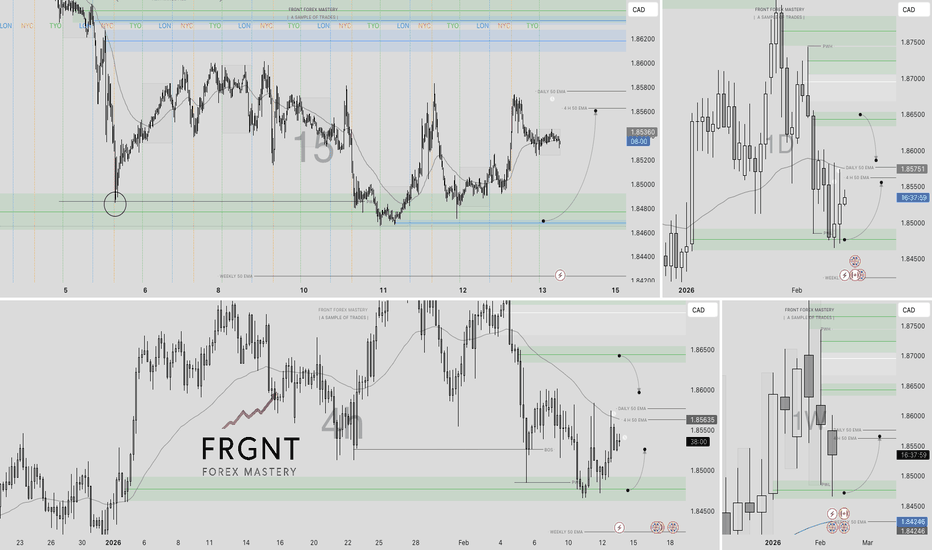

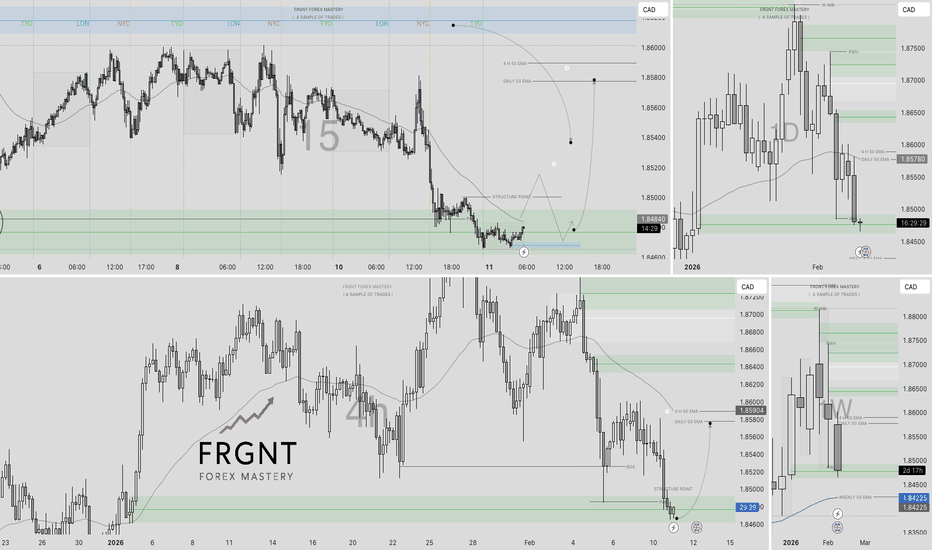

GBPCAD | FRGNT DAILY FORECAST | FRGNT FUN COUPON FRIDAY📅 Q1 | W6 | D13 | Y26

📊 GBPCAD | FRGNT DAILY FORECAST | FRGNT FUN COUPON FRIDAY

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

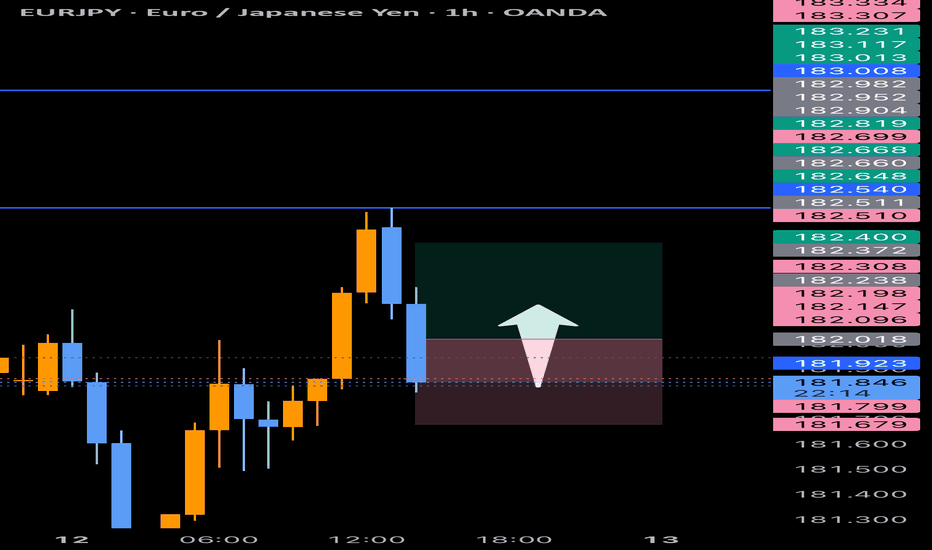

EURGBP | FRGNT DAILY FORECAST | Q1 | W6 | D12 | Y26📅 Q1 | W6 | D12 | Y26

📊 EURGBP | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

G O L D : (Buy Stop 5082+)Gold Buy Stop - (Xausd) looking to be buying this is due to its trend and price structure as usual we follow the trend and look at the structure ,combine that with our daily direction this helps us discover the sentiment of the market for the day

Potential New Price : 5118.269

Lit/Usdt BINANCE:LITUSDT.P

**LIT / USDT – 2H**

First thing — structure is **bearish. No debate.**

Lower highs + descending trendline pressing price down 📉

### 🔴 Key Levels I’m Watching

* **1.678 – 1.745** → Major supply / rejection zone

* **1.404** → Current weak support

* **1.358 – 1.324** → Strong demand zone below

Right now price is sitting around **1.41**, basically resting on support but with **downtrend pressure above**.

---

### What’s Likely?

⚠️ As long as price stays below that descending trendline, this is a **sell-the-rally market**.

Two main scenarios:

**1️⃣ Weak bounce → continuation down**

Small relief bounce toward 1.48–1.52, then continuation toward **1.358 / 1.324 liquidity**.

**2️⃣ Clean breakdown of 1.404**

If this level breaks with volume, expect quick move into that lower demand zone.

---

### When Would Bias Change?

Only if:

* Price reclaims **1.578**

* And especially if it breaks above **1.678**

Until then… structure says bears in control 🐻

---

DISCLAIMER : RISKY AVOID , NOT FINANCIAL ....

XPL/USDTBINANCE:XPLUSDT.P

**XPL / USDT (Perpetual – 1H (-- Binance --)**

🔴 **Range Resistance** at **0.0862 🚫**

🟢 **Range Support** at **0.0781 🛡️**

🟡 **Major Demand Below** near **0.0741 ⚠️**

📦 Price is clearly moving inside a **sideways range**, rejecting both highs and lows multiple times.

Momentum is weak — market waiting for expansion.

🎯 If price **holds 0.0781 and reclaims momentum**, upside move toward **0.0862** is possible.

⚠️ If **0.0781 breaks cleanly**, expect sweep toward **0.0741 demand zone** before any bounce.

⚡ **Quick Take:**

* Structure = **range-bound 🧊**

* No clear trend on 1H

* Best trade comes from **range high or range low reaction**

* Wait for breakout + volume for strong move 📊

**Disclaimer:** For educational purposes only 📚 — manage risk and confirm your setups ⚠️.

GBPCAD | FRGNT DAILY FORECAST | Q1 | W6 | D11 | Y26📅 Q1 | W6 | D11 | Y26

📊 GBPCAD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

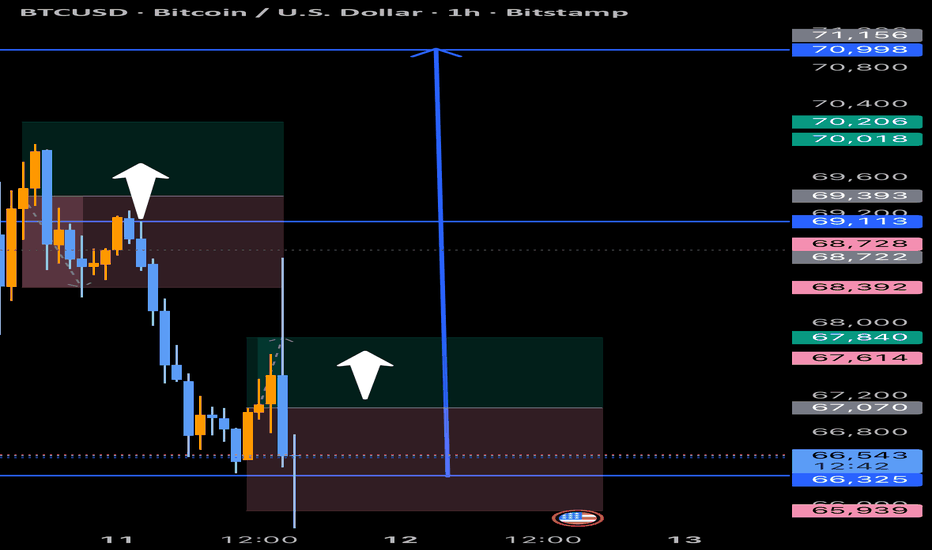

BTC : (70103.85 Daily High)Bitcoin will be crossing over to the potential level of (70103.85) this is due to the daily time frame as it needs to close above it’s previous high , and on the (1 Hour) it’s looking to give a nice bullish push up that will head upwards using (3 white soldiers), the structure is very clear to see and with price included we could even touch the (71468.81) area / price zone)

GBPUSD | FRGNT DAILY FORECAST | Q1 | W6 | D10 | Y26📅 Q1 | W6 | D10 | Y26

📊 GBPUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

EURGBP | FRGNT DAILY FORECAST | Q1 | W6 | D10 | Y26📅 Q1 | W6 | D10 | Y26

📊 EURGBP | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

Rally Into Resistance, Sell-the-Retrace Setup Toward 4,660

Here’s a clean breakdown of what this chart is saying 👇

Market Structure

Gold is still in a broader bearish structure.

We saw a strong impulsive sell-off, followed by a corrective bounce (classic dead-cat / pullback move).

The white curved paths you marked show lower highs forming, which keeps sellers in control.

🧱 Key Zones

Major Resistance Zone: ~5,105 – 5,213

This area previously acted as support → broke down → now acting as supply.

Entry / Minor Resistance: ~5,000 – 5,050

Price is currently reacting here. This is where sellers are expected to step in.

Near-Term Support: ~4,905

A minor reaction level, but not strong enough to flip trend.

Primary Target / Demand Zone: ~4,658

Strong historical demand + prior reaction low. Logical downside objective.

📉 Price Action Read

The bounce from ~4,700 looks corrective, not impulsive.

Momentum weakens as price approaches resistance → bearish continuation likely.

The projected spike above resistance followed by a sharp drop suggests liquidity grab before the sell-off.

🎯 Trade Bias (Based on the Chart)

Bias: Bearish

Ideal Play:

Sell rejection from 5,000 – 5,100

Confirmation via bearish candles / lower-timeframe rejection

Target: 4,660 demand zone

Invalidation: Clean acceptance above ~5,213

🧠 Big Picture Takeaway

This is a pullback into resistance within a downtrend, not a trend reversal. Unless gold reclaims and holds above the upper resistance zone, rallies are likely selling opportunities, not buys.

Acu/Usdt **ACU / USDT (Perpetual – 1H)**

🔴 **Key Resistance Zone** at **0.11331 – 0.11715 🚫**

🔴 Higher Resistance at **0.12264 ⛔**

🟢 **Immediate Support** around **0.10000 – 0.09666 🛡️**

📉 Market is coming from a **strong downtrend**, but price is now **accumulating near support**.

📦 Small consolidation range forming above **0.1000**, showing short-term stabilization.

🎯 If buyers step in and break above **0.11331**, next push could target **0.11715 → 0.12264**

⚠️ If **0.09666 breaks**, downside continuation likely toward lower demand.

⚡ **Quick Take:**

* Trend = **bearish overall 📉**

* Short-term = **base forming 🧊**

* Watch for **breakout above 0.1133** or breakdown below **0.0966**

* Patience until clear confirmation 🔎

**Disclaimer:** Educational purpose only 📚 — manage risk properly ⚠️.

BTCUSD Daily – Bearish Breakdown & Sell-the-Retests Setup

Here’s what the chart is saying, clean and to the point:

Market Structure

Clear distribution → breakdown sequence on the daily.

Price topped near the mid-90Ks, rolled over, and lost the 83–84K demand zone (former support marked in blue).

That loss flipped market structure firmly bearish.

Key Levels

Major breakdown level: ~83–84K (prior demand → resistance)

Supply / entry zone: ~72–74K (blue zone labeled “entry”)

Current support: ~67.4K (thin blue line)

Primary target: ~60–62K (grey demand zone)

Price Action Logic

The vertical sell-off into ~67K suggests impulsive bearish strength, not exhaustion.

The projected path shows a dead-cat bounce / consolidation into ~72–74K.

That zone aligns with:

Prior consolidation

Bearish retest logic

Likely supply from trapped longs

Trade Thesis (as illustrated)

Bias: Short

Entry idea: Sell a rejection in the 72–74K zone

Invalidation: Strong daily close back above ~75K

Target: 60–62K demand (first meaningful higher-timeframe support)

Big Picture

Unless BTC reclaims the 80K+ region quickly, this chart favors continuation lower, not a V-shaped recovery. The structure says rallies are for selling, not buying.

Gwei/UsdtBINANCE:GWEIUSDT.P

**GWEI / USDT (Perpetual – 2H)**

🔴 **Key Resistance Levels** at **0.030143 🚫**, then **0.032897 ⛔**, and higher at **0.036043 🧱**

🟢 **Immediate Support Zone** around **0.025221 – 0.023869 🛡️**

📉 Price is sitting at **demand after a steady downtrend**, showing signs of short-term exhaustion.

🎯 A **relief bounce** from this zone could target **0.0280 → 0.030143**

⚠️ If **0.023869 breaks**, downside may extend toward lower liquidity levels

⚡ **Quick Take:**

* Trend still **bearish 📉**

* Price reacting at support 🧊

* Bounce possible, but needs **strong volume confirmation 📊**

* Break of support = continuation risk ⚠️

**Disclaimer:** *For educational purposes only 📚 — not financial advice 💡. Always manage risk properly ⚠️.*

USDCAD — FRGNT DAILY FORECAST Q1 | D5 | W5 | Y26📅 Q1 | D5 | W5 | Y26

📊 USDCAD — FRGNT DAILY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:USDCAD

DXY TO THE MOON ! Q1 | D5 | W5 | Y26 FRGNT DAILY FORECAST📅 Q1 | D5 | W5 | Y26

📊 DXY — FRGNT DAILY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY