GBPUSD Could Push Higher? | Rate-Cut Risk Pressures the Dollar!Hey Traders,

In today’s trading session, we are closely monitoring GBPUSD for a potential buying opportunity around the 1.33800 zone. GBPUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.33800 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, growing expectations of a potential interest rate cut by the Federal Reserve in the coming months continue to weigh on the US Dollar. A softer USD environment typically supports upside momentum in GBPUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

GBP

EURGBP - When Structure Breaks, Bias FollowsFor a while, EURGBP was respecting a rising blue broadening wedge, keeping the overall momentum bullish. That changed.

📉 Momentum has now shifted from bullish to bearish after price broke below the blue rising structure, signaling a clear loss of upside control.

Since then, price has been trading inside a falling red channel, confirming that sellers are in control for now.

🔍 What matters next:

As long as EURGBP remains below the broken structure and continues to trade within the falling channel.

Any pullback toward the upper bound of the red channel, and the previous structure low marked in red, will be considered a sell zone!

I’ll then be zooming into lower timeframes and looking for trend-following short setups.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPNZD to continue in the upward move?GBPNZD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 2.3400 will confirm the bullish momentum.

The measured move target is 2.3475.

We look to Buy at 2.3300 (stop at 2.3225)

Our profit targets will be 2.3450 and 2.3475

Resistance: 2.3400 / 2.3450 / 2.3475

Support: 2.3350 / 2.3300 / 2.3225

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBPUSD H4 | Bullish Reversal SetupThe price is reacting off our buy entry at 1.3420, which is an overlap support.

Our stop loss is set at 1.3371, which is a pullback support that aligns with the 127.2% Fibonacci extension.

Our take profit is set at 1.3485, which is a pullback resistance that lines up with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Approaching key resistance?GBP/JPY is rising towards the pivot, which has been identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement. This could reverse the trend and lead to a pullback to the 1st support, acting as a pullback support.

Pivot: 211.34

1st Support: 210.89

1st Resistance: 211.81

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bearish drop?GBP/USD is rising towards the resistance level, which is a pullback resistance and could reverse from this level to our take profit.

Entry: 1.3484

Why we like it:

There is a pullback resistance.

Stop loss: 1.3567

Why we like it:

There is a swing high resistance level.

Take profit: 1.3355

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPUSD Channel Down starting new Bearish Leg.The GBPUSD pair has been trading within a 6-month Channel Down and appears to have just started its new Bearish Leg as Tuesday's Lower High was priced exactly on its top.

As the same time, it almost hit the 0.786 Fibonacci retracement level, which is where the previous (September 17 2025) Lower High was formed, while also the 1D RSI is on the decline after marginally turning overbought (above 70.00).

As a result, we expect the pattern's new Bearish Leg to unfold and can be confirmed as soon as the price breaks below the 1D MA200 (orange trend-line). The previous two Bearish Legs declined by -4.70% and -5.24% respectively, and in both cases the 1D RSI hit the 30.00 oversold barrier.

A new -4.70% decline would target 1.2930, but since this time the 1W MA100 (red trend-line) is in the way, which is the market's long-term Support, we expect a more fair Target to be 1.3050 until we can confirm further downside.

If the 1D RSI hits 30.00 before the price reaches 1.3050, we will take profit regardless.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBPAUD (PENDING LONG)This is the buy trade to take out liquidity... Previous supply already served its purpose it should now get liquidated, I can see it going above 2.02880 but I cant see it going above 2.04742 yet so ill be looking to short this pair after this plays out... The safest stop loss is 1.99592 for this trade tbh.

Bullish bounce off overlap support?Cable (GBP/USD) is falling towards the pivot, which has been identified as an overlap support and oculd bounce to the 1st resistance.

Pivot: 1.3422

1st Support: 1.3347

1st Resistance: 1.3530

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

My view on GBPUSDMy view on GBPUSD 👇

I like the higher-timeframe structure, but right now price is reacting inside demand after a pullback, so I’m more cautious here.

What I’m watching:

We’ve had a CHoCH into demand, so this area could act as a base

I’d expect some consolidation or a small sweep before any strong move

If price holds above 1.3420–1.3400 and shows bullish confirmation, I’m open to longs toward 1.3550–1.3600

If demand fails, then we could see a deeper pullback before continuation

Overall: bullish bias, but I’d prefer confirmation from demand, not chasing the move.

GBP/JPY From Range Support To Test 18-Year HighsThe early part of the week brought a drawdown in the GBP/JPY rally, but that move has been contained as bulls showed up to hold the lows above range support, just above the 210.00 level.

The challenge at this point actually draws back to USD/JPY, which is testing above the 158.00 level at the moment. As that pair gets closer to 160.00, fears or perhaps even threats of intervention get more and more real. This complicates the backdrop in USD/JPY, especially for bullish breakout setups or scenarios.

So, interestingly the more attractive theme here in GBP/JPY is likely a combination of US Dollar weakness combined with continuation of bullish trend in GBP/USD, and a similar argument can be made for the long side of EUR/JPY, as well.

For next week in GBP/JPY, traders should be prepared for either scenario: A break of the Monday high at 212.16 opens the door for bullish trend continuation, at which point prior range resistance becomes ideal higher-low support. That plots from around 211.42 up to 212.59.

Or - if we do see the pair pullback and retain mean-reverting, range-bound tendency, the same zone from 210-210.31 remains of interest for range continuation scenarios in the pair. - js

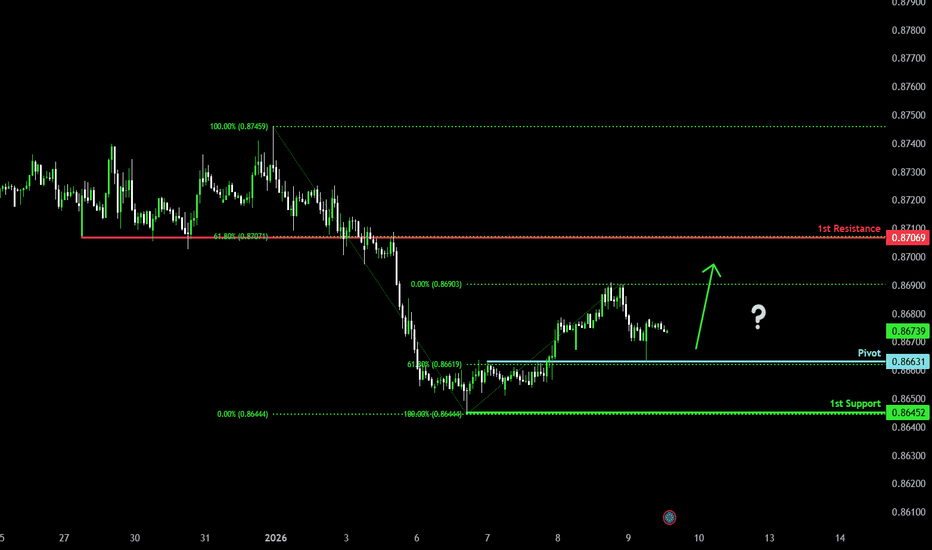

Bullish bounce off?EUR/GBP has bounced off the pivot, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.8663

1st Support: 0.8645

1st Resistance: 0.8706

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

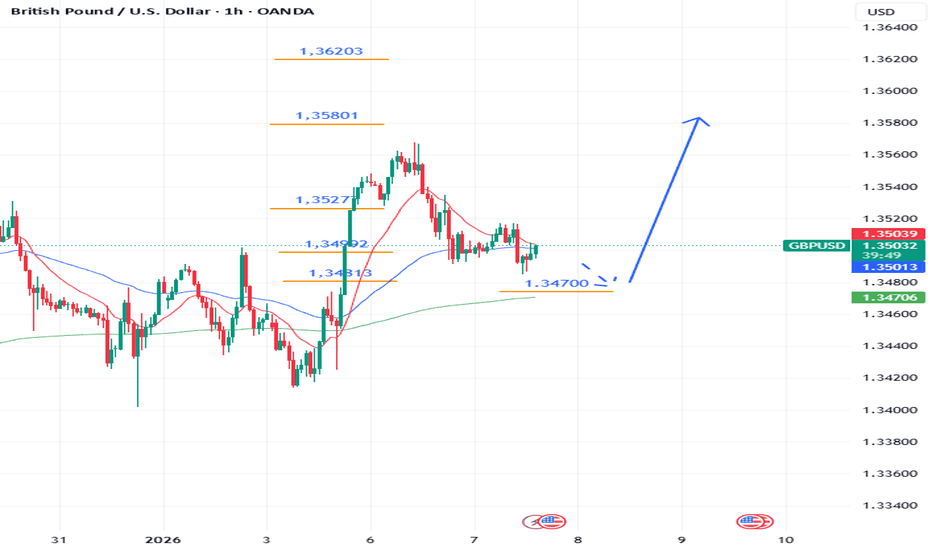

Coinranger| GBPUSD. Attempting to rise to 1.35801🔹The DXY has completed its full set of upward waves, though it went through suffering during the process. But there's still a chance of completing an extension upward wave for DXY at 98.333, but it's not a given that this will happen. The priority is down for now.

🔹The pound, unlike the euro, didn't hold back and immediately completed the main set of upward waves. Now, taking into account the DXY's yet-to-be-realized pullback potential, the pound could complete the missing extension to a minimum level of 1.35801. However, everything depends on the DXY's behavior. By levels:

1️⃣Below

1.34700 - more likely the +-150 pip range, where the pound could still fall if the DXY tries to complete its extension on h1. There's no point in considering price levels down further for now. 2️⃣Above:

1.35801 - the first extension of the h1 ascending wave set

1.36203 - the second extension of the h1 ascending wave set

Сonclusion: for now, I expect the fund to rise as the DXY declines.

GBPUSD is Nearing a Decent Support Area!Hey Traders, in today's trading session we are monitoring GBPUSD for a buying opportunity around 1.33600 zone, GBPUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.33600 support and resistance area.

Trade safe, Joe.

GBPJPY H1 | Bearish Drop OffBased on the H1 chart analysis, we can see that the price has reacted off the sell entry level at 211.37, which is an overlap support.

Our stop loss is set at 211.98, which is a swing high resistance.

Our take profit is set at 210.54, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited (

Bearish drop?GBP/JPY has reacted off the pivot and could drop to the 1st support whic has been identified as an overlap support.

Pivot: 211.43

1st Support: 210.78

1st Resistance: 211.88

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EURGBP — FRGNT DAILY CHART FORECAST Q1 | D7 | W1 | Y26

📅 Q1 | D7 | W1 | Y26

📊 EURGBP — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

GBPAUD (Pending SELL)GA is known to be volatile and move fast I can see this trade idea play out in the near future, If price does break above my zone it will most like go to 2.04300 next but for now its all sells until zones get invalidated... If price liquidates 1.99600 before hitting my pending short I would not look for the short at my current price anymore I would wait because that's the price I am currently targeting.

GBPUSD H1 | Bullish Bounce The price is falling towards our buy entry level at 1.3466, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our stop-loss is set at 1.3428, which is a pullback support level.

Our take-profit level is set at 1.3528, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off overlap support?GBP/USD is falling towards the support level, which is an overlap support level that is slightly below the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3421

Why we like it:

There is an overlap support level that is slightly below the 50% Fibonacci retracement.

Stop loss: 1.3351

Why we like it:

There is an overlap support level that lines up with the 38.2% Fibonacci retracement.

Take profit: 1.3531

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPUSD - Right Into Resistance… Again!GBPUSD is now trading at a very important intersection.

Price is pressing right into the upper red trendline, while also sitting inside the green resistance zone. This is not a random area... it’s a level that has already rejected price multiple times in the past.

From a bigger-picture perspective, the structure remains overall bearish, with price still respecting the descending channel. The recent push higher looks more like a corrective move rather than a true trend reversal.

As long as this trendline + resistance intersection holds, my focus stays clear:

I’ll be looking for trend-following shorts, preferably after lower-timeframe confirmation and signs of bearish control.

Only a strong and clean break above this zone would force a reassessment. Until then, sellers still have the edge.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPNZD H4 | Bearish Reversal SetupBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 2.34067, which is a pullback resistance that is slightly below the 161.8% Fibonacci extension.

Our stop loss is set at 2.3549, which is a swing high resistance.

Our take profit is set at 2.3213, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (