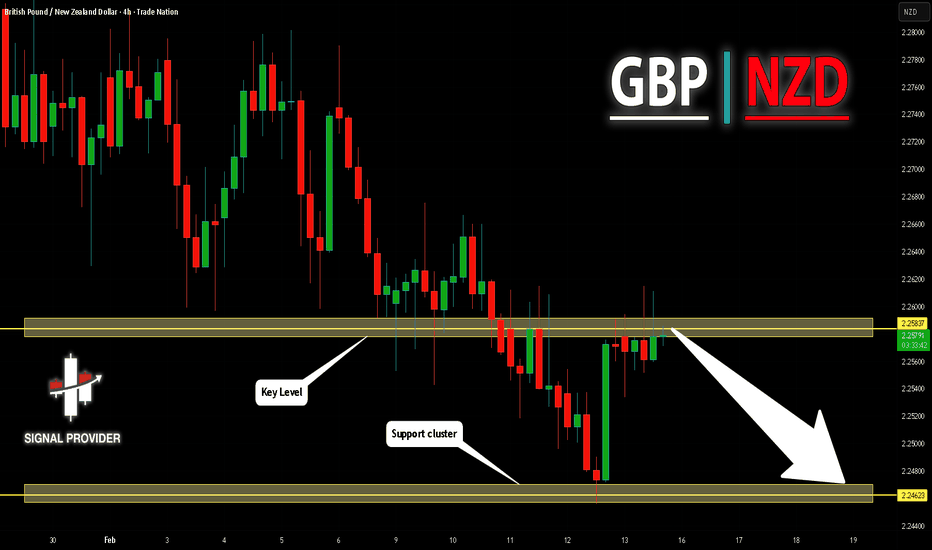

GBPNZD – Bearish Channel Retest Offering Short OpportunitiesHello Trading Fam! 👋

Price is in a clear downtrend within a descending channel, so bias is bearish.

Price has retraced back into a previous support-turned-resistance “structure” zone plus the top of the channel.

That confluence area is where you look for bearish signals (rejection candles, breaks of minor lows) to enter shorts, targeting the lower channel.

Don’t forget to like and share your thoughts in the comments! ❤️

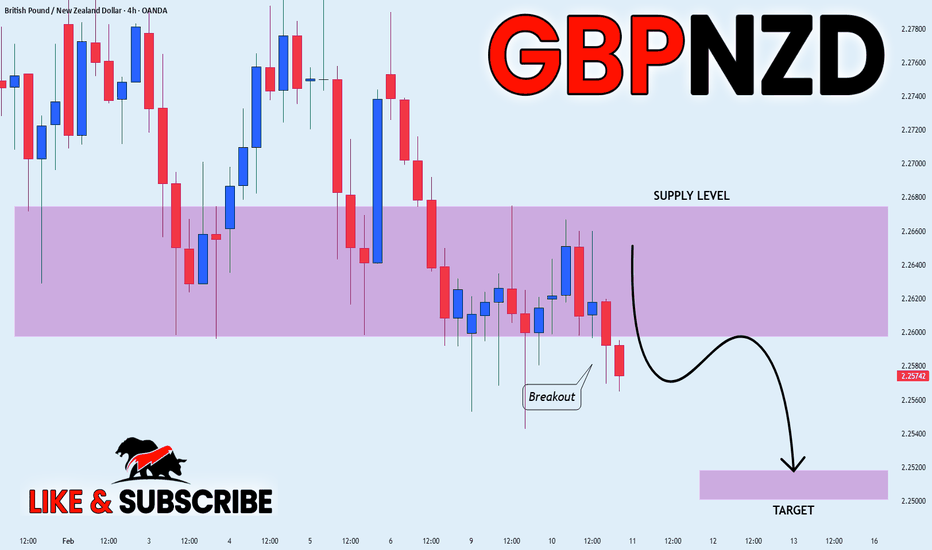

GBPNZD

GBPNZD Is Very Bearish! Sell!

Here is our detailed technical review for GBPNZD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 2.258.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 2.251 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD Will Go Down! Short!

Take a look at our analysis for GBPNZD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 2.258.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 2.246 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD: Bullish Reversal Is Now Inevitable. Big Move In Making! Dear Traders,

The GBPNZD pair is currently in a swing sell. The price has failed to reverse and continue breaking support zones. This presents a great opportunity to swing buy GBPNZD. The price is likely to fall around our buying zone and then reverse nicely towards our take profit. Please manage your risk accurately when trading GBPNZD. Wait for the price to reach our area and then for it to be rejected in a smaller timeframe.

Team Setupsfx_

GBPNZD | Final Rally 2.46+ Before CollapseGBPNZD | The Final Push Before the Crash 🌋 | Wave (5) Climax in Motion!

🔍 Quick Outlook

GBPNZD is unfolding its micro wave (5) of C , the final stretch of the b wave of the Supercycle .

Momentum is fading, Smart Money is positioning, and a major reversal is brewing. ⚡

After a minor correction near 2.25 – 2.21, a last push higher is expected toward 2.46 + , aligning with the 1.618 Fib extension and the buy-side liquidity zone .

Once liquidity is taken, price may enter a multi-year bearish Wave C , targeting 1.70 – 1.62. 📉

🌊 Wave Theory + Confluence

✅ Wave (5) of C active – terminal phase underway

🎯 1.618 Fib extension ≈ 2.46

🕐 Minor wave (4) correction almost done

💥 Expect liquidity sweep above 2.45 – 2.48 then reversal

💰 Smart Money + Structure

🏦 Institutions accumulating below 2.25 before final markup

🎣 Liquidity inducement above 2.45 = trap zone

🔻 BOS below 2.1580 → bearish confirmation

🧩 Rising-wedge structure shows exhaustion

🔄 Market Cycle Perspective

We’re in the Euphoria phase — once wave (5) completes, the Depression phase (Wave C) could unfold toward 1.62 support before a new macro up-cycle begins.

Summary

"GBPNZD is in its final euphoric rally! One last liquidity grab above 2.45 before the big markdown begins. Watch closely 👀"

⚡ If this breakdown helps your outlook — Boost 👍, Comment 💬 & Follow 🔔 for live GBPNZD updates and multi-wave setups!

— Team FIBCOS

Trade the liquidity, not the noise." 💡

GBPNZD: Bullish Continuation & Long Trade

GBPNZD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPNZD

Entry - 2.2589

Sl - 2.2572

Tp - 2.2619

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPNZD RE ENTERED - SHORTS CONTINUED INTO THE ABYSSWe can see that GBPNZD has been in a strong downtrend, and found support and has been range trading between 2.25908 and 2.28024 recently it has broken support at 2.25908.

Today we have seen the pair retrace back to the 0.50 fib level expecting hte downside to resume from here

I am expecting the next leg down to continue TP - 2.22961

GBPNZD Testing Deep Support as Reversal Pressure Starts to BuildGBPNZD has been in a steady, grinding decline, and the structure on the 4H chart shows a clean sequence of lower highs and lower lows. What stands out now is location: price is pressing into a well-defined support zone after a corrective channel breakdown. When a pair stretches this far in one direction while approaching higher-timeframe demand, I stop chasing and start asking whether the next move is exhaustion or continuation. The setup here is less about momentum and more about reaction at levels.

Current Bias

Short term: Bearish, but stretched — leaning toward corrective bounce risk.

Medium term: Still structurally bearish unless price reclaims the 2.28–2.30 resistance band.

Key Fundamental Drivers

GBP side: Bank of England remains cautious, with growth soft and structural drag themes still present in UK outlook discussions. Rate expectations are not aggressively rising, which limits strong GBP upside.

NZD side: NZD is sensitive to global risk sentiment and China-linked growth signals. When risk tone stabilizes, NZD tends to hold better than GBP.

Rate differential theme: Relative policy expectations between BoE and RBNZ are not widening sharply, which reduces strong trend fuel and supports more range or rotation behavior after extended moves.

Risk appetite: NZD benefits more than GBP in mild risk-on flows, reinforcing the recent downside in GBPNZD.

Macro Context

Interest rate expectations: Major central banks remain data dependent. Markets are reacting heavily to labor and inflation data rather than forward guidance alone. That keeps rate spread trades unstable.

Growth trends: UK growth signals remain uneven, while NZ is tied closely to external demand and commodity-linked flows.

Commodity flows: Stable to firm commodity tone tends to support NZD relative to GBP.

Geopolitical themes: Trade policy noise, sanctions chatter, and tariff discussions globally keep FX volatility elevated and favor selective risk currencies over slower-growth currencies like GBP at times.

Primary Risk to the Trend

The main risk to continued downside is risk sentiment flipping positive while USD and yields soften, which typically lifts NZD broadly — but if GBP catches a relative bid on UK data or BoE repricing, GBPNZD can snap back sharply from support. This pair is known for violent mean-reversion rallies after extended drops.

Most Critical Upcoming News/Event

Next high-impact UK data (inflation / growth / labor)

Any RBNZ policy signals or NZ inflation data

Major US labor or inflation releases that shift global rate expectations and risk sentiment (indirect but powerful driver for NZD crosses)

Leader/Lagger Dynamics

GBPNZD is typically a lagger pair.

It usually follows GBPUSD and NZDUSD direction rather than leading them.

Also reacts to AUDNZD and GBPAUD rotation flows.

If NZD strength shows first in NZDUSD and AUDNZD drops, GBPNZD often follows lower afterward.

If GBP starts outperforming across GBPUSD and GBPJPY, GBPNZD rebounds tend to follow.

Key Levels

Support Levels:

2.2600–2.2540 zone (current demand and recent low area)

Below that: 2.2300 area as deeper swing support if breakdown extends

Resistance Levels:

2.2815 area

2.2960 area

2.3400–2.3450 higher-timeframe supply zone

Stop Loss (SL):

Below 2.2500 for bounce setups from current support zone

Take Profit (TP):

First: 2.2815

Second: 2.2960

Extension: 2.3400 zone if broader reversal unfolds

Summary: Bias and Watchpoints

Right now GBPNZD is still bearish in structure, but it’s pressing directly into a major support zone after a prolonged slide, which raises the odds of at least a corrective bounce. Fundamentally, the pair has been driven by relatively softer GBP tone and steadier NZD risk sensitivity, but that spread is not expanding aggressively — which weakens trend continuation odds at extremes. The biggest risk to the downside trend is a shift in rate expectations or risk sentiment that boosts GBP relative to NZD and triggers a squeeze higher. I’m watching reactions around 2.26 support closely; failure there opens deeper downside, but a firm hold sets up a recovery toward 2.28 and possibly 2.30+. This is level-driven now, not chase-driven.

GBP/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/NZD is making a bullish rebound on the 4H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 2.259 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD Will Fly From SupportHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on EURNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPNZD Will Go Higher From Support! Buy!

Take a look at our analysis for GBPNZD.

Time Frame: 5h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 2.261.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 2.277 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

NZDUSD: false breakout setup🛠 Technical Analysis: On the H4 chart, NZDUSD remains in a broader bullish structure after the earlier “global bullish signal” from the base. The recent pullback formed a corrective descending channel, but the latest dip produced a clear false breakout below the lower boundary. Price has now reclaimed the key demand area around 0.5989–0.5991, turning it back into near-term support. The pair is holding above the rising SMA100 and SMA200, suggesting the short-term trend is still constructive despite the correction. A sustained hold above the reclaimed support increases the odds of a push back to the upper resistance zone near 0.6086. If price slips back below 0.5989 and fails to recover quickly, the bullish scenario weakens and the move could extend toward lower supports.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 0.59893

🎯 Take Profit: 0.60857

🔴 Stop Loss: 0.59255

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

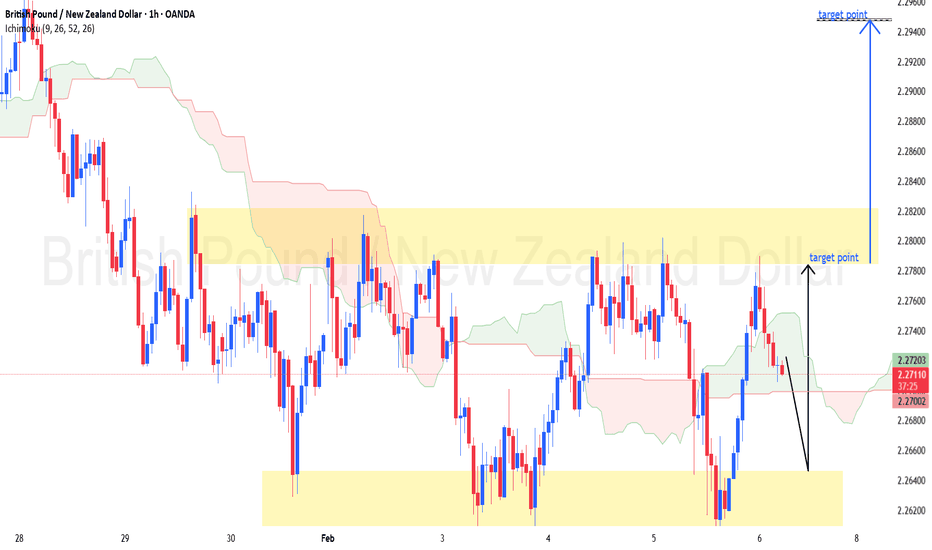

GBPNZD – 1H Chart Targets...GBPNZD – 1H Chart Targets 📊

Based on my chart (range market + demand reaction + Ichimoku in middle):

🔍 Market Bias

Short-term Bullish Pullback from demand

Overall structure still range / corrective

📈 Buy Setup

Buy Zone:

2.2620 – 2.2660 (lower demand zone)

Targets:

🎯 TP1: 2.2780

🎯 TP2: 2.2860

🎯 TP3 (Final): 2.2940 ✅ (upper resistance / marked target)

Stop Loss:

🛑 Below 2.2580

⚠️ Trade Notes

Expect reaction at 2.2780 (mid-range resistance)

Best to secure partial profits

Strong rejection from upper zone may give sell setup later

GBPUSD Next MoveGBPUSD is respecting a clean bullish market structure after the impulsive breakout above the mid-range resistance cluster and is now pulling back into a confluence demand zone aligned with previous structure, Fibonacci retracement, and liquidity sweep behavior, which signals a classic breakout and retest continuation pattern rather than reversal. Price holding above this support band shows buyers defending higher lows, keeping bullish momentum intact and positioning the pair for continuation toward the upper resistance region if the zone holds. Fundamentally, pound strength is being supported by relatively sticky UK inflation expectations and a Bank of England stance that remains cautious about aggressive rate cuts, while the US dollar side is facing pressure from softer growth signals and shifting Federal Reserve rate path expectations, reducing yield advantage and favoring risk-on currency flows. This combination of bullish price action structure, demand zone reaction, higher timeframe trend continuation, and shifting monetary policy expectations creates a strong probability environment for upside expansion, making pullbacks into support technically attractive within a trend-following strategy focused on momentum, liquidity, and smart money positioning.

GBPNZD: Short Trading Opportunity

GBPNZD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GBPNZD

Entry Level - 2.2735

Sl - 2.2766

Tp - 2.2688

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPNZD SWING BREAKOUT|SHORT|

✅GBPNZD strong bearish breakout below a key structure confirms ICT continuation. Price trades in discount after decisive displacement, with weak pullbacks suggesting smart money control and downside liquidity draw toward lower imbalance. Time Frame 12H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPNZD - Two Magnets, Two Clear JobsGBPNZD is trading between two zones that keep acting like magnets:

On the upside, the red structure has been attracting price again and again. Every time price reaches that area, sellers show up. As long as that structure holds, that’s where I’ll be looking for shorts.📉

On the downside , the blue demand zone keeps pulling price back in. That’s where buyers previously stepped in with strength. As price approaches that zone, I’ll be looking for longs.📈

For now, we wait!⏱️

Which magnet do you think price hits next? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPNZD Will Go Down From Resistance! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2.277.

The above observations make me that the market will inevitably achieve 2.270 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Sterling vs Kiwi: Navigating GBP/NZD Divergence in 2026The GBP/NZD pair currently faces significant downward pressure. Recent market forecasts suggest a strengthening New Zealand Dollar (NZD) against the British Pound (GBP). Investors increasingly anticipate a hawkish stance from the Reserve Bank of New Zealand (RBNZ). Meanwhile, the UK economy struggles with stagnant growth and cooling inflation. This divergence creates a compelling narrative for global currency traders.

Macroeconomics and Interest Rate Paths

Macroeconomic indicators drive the current fluctuations in this currency cross. The RBNZ remains focused on persistent domestic inflation. Consequently, markets expect interest rates in New Zealand to stay elevated. In contrast, the Bank of England (BoE) faces pressure to cut rates. High borrowing costs have significantly weakened UK consumer spending. This interest rate differential continues to pull the GBP/NZD exchange rate lower.

Geostrategy and Trade Alliances

Geostrategy plays a vital role in determining long-term currency value. New Zealand benefits from its strategic proximity to the recovering Asia-Pacific markets. Increased demand from China directly boosts the value of Kiwi commodity exports. Conversely, the United Kingdom navigates a complex post-Brexit trade landscape. Sterling remains highly sensitive to European political shifts and global trade tensions. These geopolitical factors dictate the flow of international capital.

Leadership and Central Bank Credibility

Management styles at central banks heavily influence market confidence. RBNZ Governor Adrian Orr maintains a transparent and assertive policy framework. His clear communication often reduces market uncertainty during volatile periods. Meanwhile, the BoE leadership emphasizes a cautious, data-dependent approach. This difference in management culture impacts how investors perceive currency risk. Professional traders prioritize currencies backed by decisive and predictable leadership.

Technology, Innovation, and Cybersecurity

Modern financial markets rely on high-tech infrastructure and robust cybersecurity. London remains a global leader in fintech innovation and patent filings. However, New Zealand is rapidly digitizing its agricultural and financial sectors. Both nations invest in advanced science to protect banking systems from cyber threats. Secure digital frameworks ensure market liquidity and prevent sudden price shocks. Technology remains the invisible backbone of the GBP/NZD exchange rate.

Industry Trends and Future Outlook

The "commodity-linked" nature of the NZD defines current industry trends. Rising global prices for dairy and meat products support the Kiwi dollar. Furthermore, the shift toward green energy increases the demand for specialized Kiwi tech exports. The UK must innovate within its service sector to regain competitive ground. Analysts expect the GBP/NZD pair to remain volatile through mid-2026. Successful traders will monitor RBNZ policy shifts and global trade data.

GBPNZD: Bulls Will Push

The recent price action on the GBPNZD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️