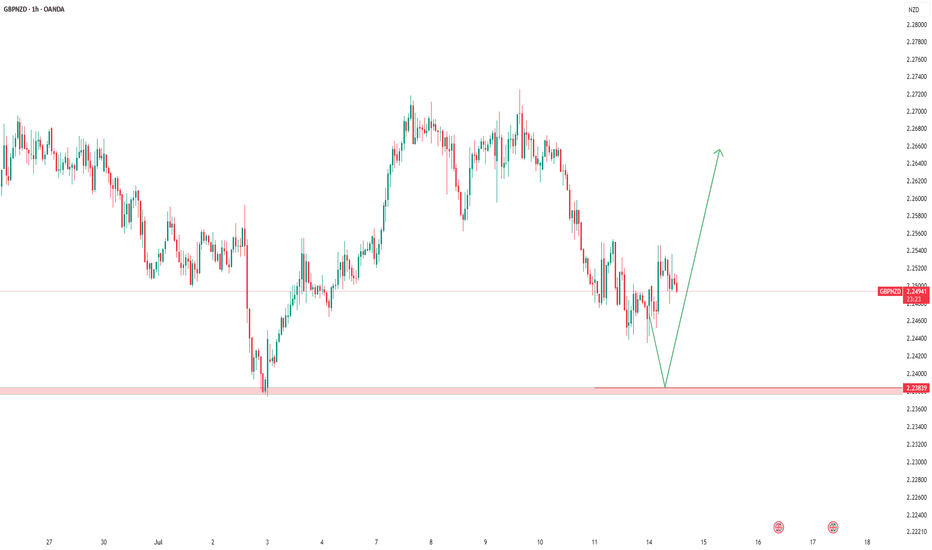

GBPNZD: Rebound from Support Hints at Fresh Upside MomentumGBPNZD has defended a major support zone after a sharp pullback, with buyers stepping in to regain control. The structure suggests the recent decline was corrective, and if momentum holds, the pair could climb back toward the mid-October highs. This setup blends technical strength with a macro backdrop still leaning in favor of GBP over NZD.

Current Bias

Bullish – price has rebounded from support, setting up for a recovery phase.

Key Fundamental Drivers

GBP: UK growth remains fragile but inflation pressures keep the BoE cautious on cutting rates too quickly.

NZD: Vulnerable to weak global growth, dairy price softness, and ongoing Chinese trade risks.

Relative Outlook: GBP holds a modest advantage due to stickier inflation compared with NZD’s growth-sensitive profile.

Macro Context

Interest Rates: The BoE is expected to remain cautious with cuts, while the RBNZ is mostly sidelined, limiting NZD’s rate appeal.

Economic Growth: UK growth is slow but steady; NZ’s growth is more exposed to external shocks, especially from China.

Commodity Flows: Dairy weakness caps NZD strength, while GBP is less commodity-dependent.

Geopolitical Themes: Trade tensions and tariffs weigh more heavily on NZD due to its export reliance.

Primary Risk to the Trend

A stronger-than-expected NZ CPI release or a dovish surprise from the BoE could undermine GBP and reverse bullish momentum.

Most Critical Upcoming News/Event

BoE policy updates and UK inflation readings.

RBNZ outlook and NZ CPI data.

Chinese economic releases affecting NZD.

Leader/Lagger Dynamics

GBPNZD is generally a lagger, reflecting moves in GBPUSD and NZDUSD. It tends to follow GBP momentum against the USD, while also being sensitive to risk sentiment through NZD.

Key Levels

Support Levels: 2.3051, 2.2885

Resistance Levels: 2.3328, 2.3519

Stop Loss (SL): 2.2885

Take Profit (TP): 2.3519

Summary: Bias and Watchpoints

GBPNZD is bullish after holding support, with targets set at 2.3328 and 2.3519 while SL protection sits at 2.2885. Fundamentally, sticky UK inflation and weaker NZ growth dynamics support GBP, though surprises in NZ CPI or dovish BoE tones could shift the balance. For now, the bias favors continuation higher, with GBP strength likely to dictate the pair’s direction.

Gbpnzdsignal

Will Layered Entries on GBP/NZD Pay Off This Week?💷🐑 GBP/NZD – Pound vs Kiwi Dollar Wealth Strategy Map (Swing/Day Trade)

📌 Market Setup

We’re diving into the GBP/NZD forex market, where the Pound squares off against the Kiwi Dollar. The plan is to ride the bullish momentum with a Hull Moving Average retest pullback at the demand zone.

🎯 Trade Plan

Entry Method (Layered Style): Multiple buy limit layers 📥 at

👉 2.29500 | 2.30000 | 2.30500 | 2.31000

(You can increase layers based on your own strategy)

Stop Loss (Risk Management): 2.28500 (recommended thief-style safety net 🛡️)

Target (Take Profit): 2.35500 🎯 — Expect strong resistance + overbought signals = time to escape with profits before the market “police” catch us! 🚨💰

⚠️ Note for Traders:

This is a flexible wealth map, not strict financial advice.

Ladies & Gentlemen (OGs) — your SL/TP is always your choice. Manage your risk like a pro and take money when the market gives it.

🔑 Key Points & Correlations

GBP/NZD tends to move in sync with risk sentiment.

Watch related pairs:

💷 FX:GBPUSD → For overall Pound strength.

🇳🇿 OANDA:NZDUSD → Kiwi momentum & correlation check.

💶 OANDA:EURNZD → Another Kiwi cross for confirmation.

💷 OANDA:GBPAUD → Similar risk-on/off dynamics with commodity currencies.

🧭 Strategy Mindset

This setup is based on layered entries (limit orders), using pullbacks into demand for precision. Combining risk management with patience = potential consistent returns.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GBPNZD #Forex #TradingStrategy #SwingTrade #DayTrade #ForexCommunity #WealthMap #HullMovingAverage #ForexEducation #GBP #NZD #FX

What causes a 5% growth in this graph?What appears on the chart is a change in the direction of upward fluctuations!

Now, why should these upward fluctuations or upward prospects appear on the chart, is a question that must be answered over time!

I hope that this time, like the previous analysis, we will reach the desired results with this indicator!

Good luck...

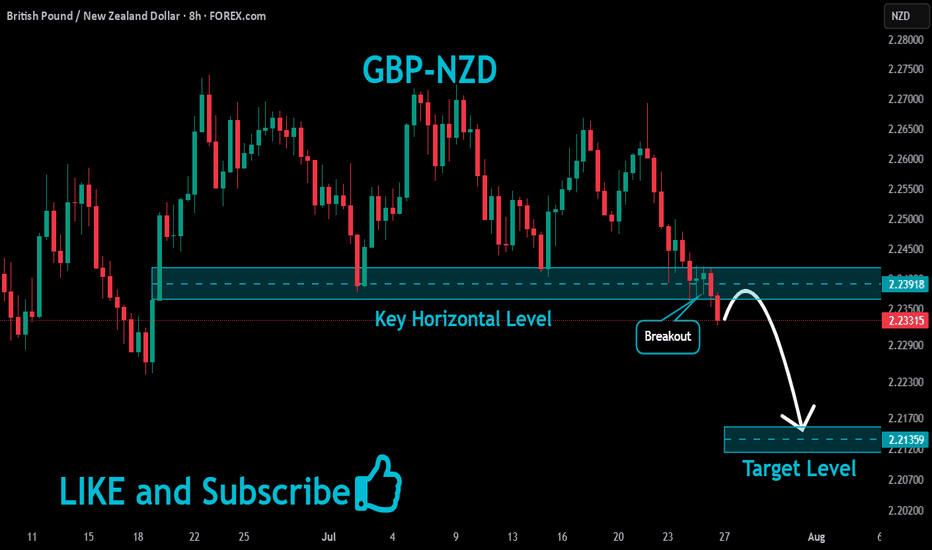

GBPNZD - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

Uptrend line breakout.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation after pullback until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

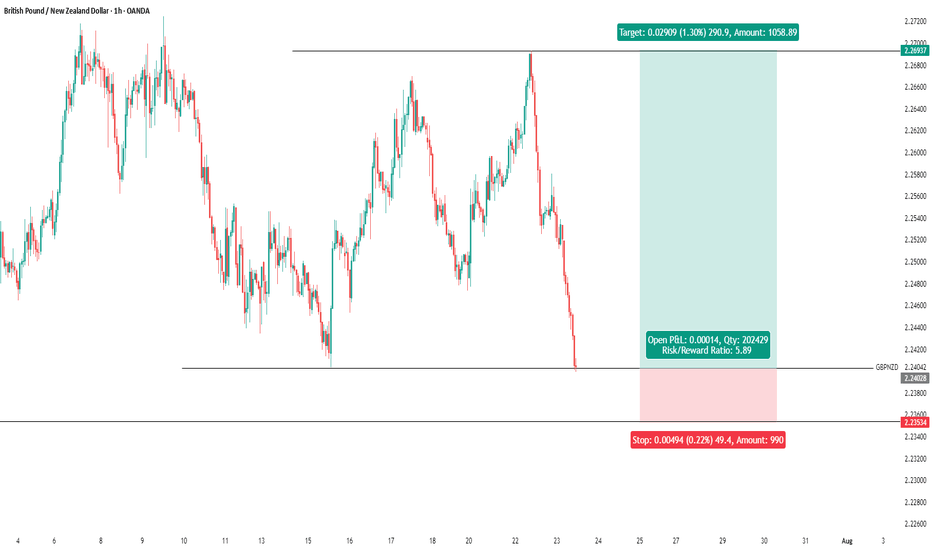

GBPNZD: 1100+ PIPs Move, Get Ready For Price To Bounce! Hey there everyone

We’re feeling optimistic about GBPNZD and expecting a bullish move that could take it to its previous yearly high. We’ve set three take profit targets, but feel free to adjust them based on your own analysis.

Good luck and trade safely! We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Give our ideas a like

- Share your thoughts in the comments

- Spread the word about our ideas

Cheers,

Team Setupsfx_

GBP/NZD Heist: Can You Swipe the Bullish Loot?GBP/NZD Sterling vs Kiwi Forex Bank Heist Plan (Swing/Day Trade) 🤑💰💸

🌟 Yo, Thief Traders! 🌟 Ready to pull off the ultimate GBP/NZD heist? Let’s swipe that Sterling vs Kiwi loot with the slickest Thief Trading Style! 🐱👤💪 Based on 🔥technical and fundamental analysis🔥, here’s the master plan to rob this Forex vault blind. Follow the chart, stay sharp, and let’s bag that cash! 💵🚀

Plan: Bullish 📈

🔔 Mission: We’re going LONG, thieves! The market’s ripe for a bullish raid. Get ready to stack those pips! 💰

🔓 ENTRY: SWIPE THE LOOT (LAYERED APPROACH)

The Thief doesn't just kick the door down! We use a precise, layered entry to maximize our haul and minimize risk. Place these BUY LIMIT ORDERS to stack the cash efficiently:

🧨 LAYER 1: 2.31500

🧨 LAYER 2: 2.31000

🧨 LAYER 3: 2.30800

🧨 LAYER 4: 2.30400

🧨 LAYER 5: 2.30000

🛠️ PRO TIP: You can increase your limit layers based on your own capital. More layers = bigger score!

Stop Loss 🛑

🚨 Thief SL: Set at 2.29000. Dear Ladies & Gentlemen (Thief OGs), adjust your SL based on your strategy, lot size, and risk tolerance. Stay sneaky, not sorry! 🕴️

Target 🎯

🏃♂️ Escape Plan: The police barricade’s up at 2.35500! Grab your stolen pips and bolt before the cops close in! 🚔💨

Market Intel 📊

💹 Why Bullish? GBP/NZD is primed for a breakout, driven by key technicals and fundamentals. Check the latest COT Report, Quantitative Analysis, Sentimental Outlook, and Intermarket Analysis for the full scoop! 🔗👀

⚠️ Trading Alert: News releases can shake the market like a getaway car chase! 📰

🚫 Avoid new trades during high-impact news.

🛡️ Use trailing stops to lock in profits and protect your loot!

Risk Management 📝

📌 Stay sharp, thieves! Markets move fast. Adjust your plan with real-time data and keep your risk tight. No reckless heists! 🧠

💡 Pro Tip: Monitor macro trends and sentiment to stay one step ahead of the market cops.

Boost the Heist! 🚀

💥 Hit that Boost Button to power up our robbery squad! 💪 Every boost helps us dominate the market and stack that cash. 🤑

🏆 Join the Thief Trading Style crew, make money daily, and live the heist life! 🤝❤️🎉

Stay tuned for the next Forex heist, you slick money makers! 🐱👤💸 Catch you at the next vault! 😎🚀

GBP/NZD Bullish Trap or Treasure? Watch Breakout!🔥 GBP/NZD “POUND vs KIWI” – Bank Money Robbery Plan 🎭 (Swing/Scalping)

📌 Trade Plan (Thief Strategy Style)

Bias: Bullish 🐂 (Pending Order Plan – watching resistance breakout)

Breakout Entry: ⚡ Above 2.30100 → Set alarm to catch breakout in TradingView alerts.

Layered Entries (Thief Style): Multiple buy limits after breakout confirmation

2.29000 | 2.29300 | 2.29600 | 2.30000 (you can adjust/increase layers as per your own plan).

Stop Loss (Thief SL): @ 2.28400 🛑 (adjust based on personal risk).

Target 🎯: 2.32300 → Police barricade resistance / overbought zone / liquidity trap.

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s) – TP is your own choice 🚪💰. Take the money when YOU want, at your own risk.

📊 GBP/NZD Market Sentiment Report (Updated: 07 Sept 2025)

Day’s Range: 2.2878 – 2.3017

52-Week Range: 2.0996 – 2.3365

Open: 2.2978 | Previous Close: 2.2980

😰 Fear & Greed Index (Market Sentiment)

Score: 53/100 (Neutral 😐)

Extreme Fear: 14% | Fear: 23% | Neutral: 15% | Greed: 46% | Extreme Greed: 2%

Indicators: Volatility, options activity & safe-haven demand suggest balanced sentiment.

🏦 Fundamental & Macro Score

Interest Rates:

🇬🇧 Bank of England: 4.0%

🇳🇿 Reserve Bank of NZ: 3.0%

1-Year Change: +7.86% 🟢 (GBP strength).

Key Drivers:

UK housing slowdown (mortgage approvals ↑ but construction contracted).

NZ building consents +5.4% in July → NZD resilience.

🎯 Retail & Institutional Sentiment

Retail Traders: Mixed positioning (both bullish & bearish flows).

Institutional Outlook: Cautious → GBP volatility + NZD’s China exposure.

🐂📉 Market Outlook (Medium-Term)

Overall Score: 55% Bullish 🟢

Support Factors: GBP rate advantage.

Risks: UK macro weakness + NZD strength in commodities.

💡 Why This Thief Plan?

✔ Breakout entry with layered buy limits = precision scaling 🎯

✔ Macro favors GBP over NZD (interest rate edge).

✔ Sentiment = neutral (room for breakout move).

✔ Liquidity pockets above → perfect robbery escape zone 🚔💨

🔎 Related FX Pairs to Watch

FX:GBPUSD | OANDA:GBPAUD | OANDA:GBPCAD | OANDA:EURNZD | OANDA:AUDNZD

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GBPNZD #Forex #SwingTrading #Scalping #PriceAction #ThiefStrategy #SmartMoney #BreakoutTrading #ForexCommunity #GBP #NZD

GBP/USD Rising Wedge Breakdown Potential

The GBP/USD 30-minute chart shows price moving within an ascending trendline but recently stalling near resistance around 1.3550–1.3560. The Ichimoku cloud suggests weakening bullish momentum, with price struggling to sustain above the support line.

Bearish Setup: A breakdown below the ascending trendline and cloud support around 1.3500 could trigger stronger downside pressure.

Targets: If selling momentum continues, price may test the 1.3420 and 1.3395 support levels.

Stop Loss: A safe invalidation zone lies above 1.3550–1.3560, where further upside would invalidate the bearish scenario.

🔎 Overall, GBP/USD looks vulnerable to a short-term pullback unless it reclaims strong bullish momentum above 1.3550.

GBPNZD Massive Bullish Breakout!

HI,Traders !

#GBPNZD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

gbpanzd buy signal Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

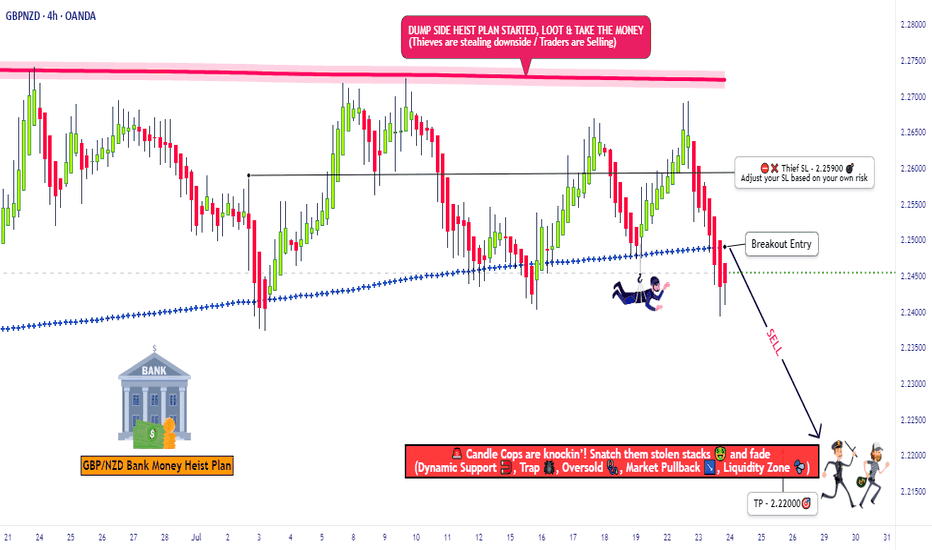

"GBP/NZD: Bearish Storm Brewing – Get Ready!🚨 GBP/NZD HEIST ALERT: "Pound vs Kiwi" Bearish Trap Setup! 🚨 (Scalping/Day Trade)

🌟 Attention, Market Robbers & Profit Pirates! 🌟

🔥 Thief Trading Strategy Activated – Time to short the GBP/NZD like a pro! This pair is setting up for a bearish heist, and we’re locking in entries before the drop. High-risk, high-reward? You bet.

🎯 TRADE PLAN (Bearish Ambush)

Entry Zone (Short) 📉:

Optimal: Sell limit orders on retests (15m/30m timeframe).

Thief’s Trick: Layer entries (DCA-style) near recent highs for max efficiency.

"Enter like a sniper, escape like a ghost." 👻

Stop Loss 🛑:

4H Swing High/Wick (Near 2.25900) – Adjust based on your risk & lot size.

"A smart thief always has an exit route." 🏃💨

Target 🎯: 2.22000 (or escape early if the trap snaps shut!)

💣 WHY THIS HEIST? (Bearish Triggers)

Technical Setup: Oversold bounce? Nah. Consolidation → Reversal trap.

Fundamentals: Weak GBP sentiment? Strong NZD data? Check the news!

Market Psychology: Bulls are getting trapped at resistance—time to fade them.

⚠️ THIEF’S WARNING

News = Volatility Bomb 💣 – Avoid new trades during high-impact events.

Trailing SLs = Your Best Friend – Lock profits & dodge reversals.

💎 BOOST THIS IDEA & JOIN THE HEIST!

🔥 Hit 👍 LIKE, 🚀 BOOST, and FOLLOW for more lucrative robberies!

💸 "Steal the market’s money—before it steals yours." 🏴☠️

🔔 Stay tuned—next heist coming soon! 🔔

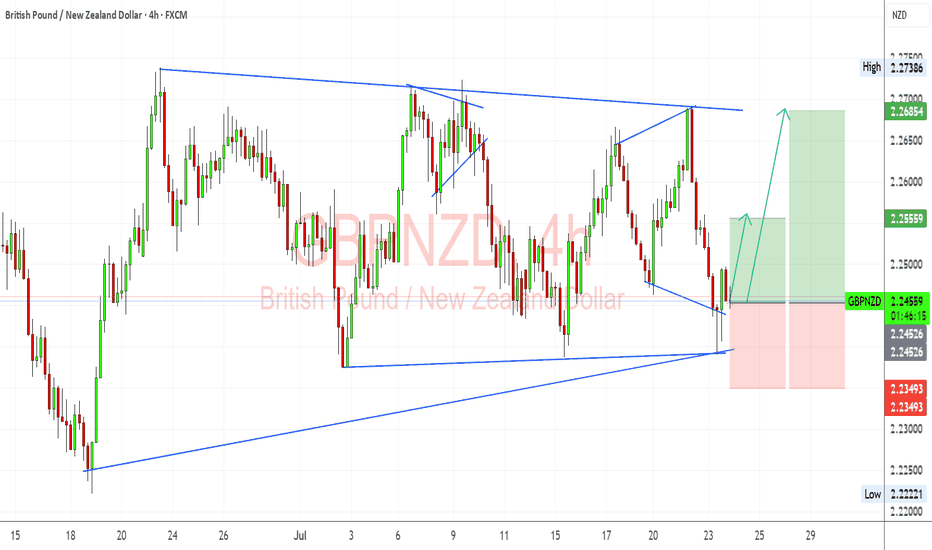

GBPNZD Analysis — 4H Chart ReviewI’m watching GBPNZD for a potential bullish continuation after a successful retest of the long-term ascending trendline. Price rejected near the lower boundary of the symmetrical triangle and showed bullish momentum right off that support. My structure suggests potential upside targets at 2.25559 (minor resistance) and 2.26854 (upper triangle boundary/major resistance zone).

🔍 Fundamental Context:

🇬🇧 GBP Fundamentals:

UK CPI came in softer than expected, and BoE rate cuts are slowly being priced in for late 2025.

However, BoE still sounds relatively hawkish compared to RBNZ due to inflation persistence in services.

Strong UK wage growth and sticky inflation give GBP some near-term yield support.

🇳🇿 NZD Fundamentals:

RBNZ remains on hold, but dovish tilt noted in recent communications.

NZD under pressure from falling dairy prices and weak global growth sentiment (especially China).

Risk-off flows and Fed hawkishness keep NZD vulnerable as a high-beta currency.

⚠️ Risks to the Setup:

A surprise hawkish turn from RBNZ or better-than-expected NZ data could boost NZD.

Renewed UK political instability or weak retail sales data may pressure GBP.

Broader market risk sentiment — NZD may strengthen if risk-on returns and US yields drop.

🗓️ Key News/Events to Monitor:

UK Retail Sales (July 25)

RBNZ Governor Orr Speech (if scheduled)

US PCE (for global risk impact)

Chinese macro data (indirect NZD driver)

🔁 Leader/Lagger Perspective:

GBPNZD often leads EURNZD during GBP-specific catalysts (BoE speeches, UK CPI).

It lags NZDUSD and NZDCAD when risk sentiment or commodity cycles dominate.

📌 Summary: Bias and Watchpoints

I'm bullish on GBPNZD in the short term, especially after a strong trendline retest and recovery off the 2.2450 zone. Fundamentals support GBP resilience over NZD due to relatively hawkish BoE stance and weaker New Zealand data. The main risk to this setup would be a dovish BoE surprise or strong NZ commodity-led rebound. I'll be watching UK Retail Sales and general risk sentiment closely. This pair can act as a leader during UK-specific news but becomes a lagger when risk flows dominate broader NZD direction.

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD – Waiting for Price to Reach the ZoneWe’re currently waiting for price to reach our key level.

Once it does, and we see a valid buy signal, we’ll enter a long position.

🔄 All scenarios remain active.

Those who follow my analyses regularly already know the flow —

so no need to repeat the full breakdown.

As always, we don’t predict – we react to price.

We’re not here to guess what the market will do,

we’re here to manage our risk and trade what we see.

GBP/NZD: The Great Liquidity Grab? (Long Trade Plan)"🏦💰 GBP/NZD BANK VAULT RAID: Bullish Heist in Progress! (Long Setup) 💰🏦

🚨 Overbought Trap? Or Trend Continuation? Here’s How to Loot Pips Safely! 🚨

🦸♂️ GREETINGS, MARKET MARAUDERS!

To all the Profit Pirates & Risk-Takers! 🌍💸

Using our 🔥Thief Trading Tactics🔥 (a ruthless combo of price action + liquidity grabs + macro triggers), we’re executing a bullish heist on GBP/NZD ("Sterling vs Kiwi")—this is not advice, just a strategic raid blueprint for those who trade like outlaws.

📈 THE HEIST PLAN (LONG ENTRY FOCUS)

🎯 Profit Zone: 2.28700 (or escape earlier if momentum stalls)

💥 High-Stakes Play: Overbought but squeezing higher—trap for bears.

🕵️♂️ Trap Spot: Where sellers get liquidated.

🔑 ENTRY RULES:

"The Vault’s Open!" – Swipe bullish loot on pullbacks (15-30min TF).

Buy Limit Orders near swing lows for better risk/reward.

Aggressive? Enter at market—but tighter stops.

📌 SET ALERTS! Don’t miss the breakout retest.

🛑 STOP LOSS (Escape Route):

Thief SL at recent swing low (2H timeframe).

⚠️ Warning: "Ignore this SL? Enjoy donating to the market."

🎯 TARGETS:

Main Take-Profit: 2.28700 (or trail partials).

Scalpers: Ride long waves only. Trailing SL = VIP exit pass.

📡 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ COT Data (Are funds long GBP/short NZD?)

✅ Rate Spreads (GBP vs NZD yield shifts)

✅ Commodity Correlations (Dairy prices? Risk mood?)

✅ Sentiment Extreme (Retail over-shorting?)

🚨 NEWS RISK ALERT

Avoid new trades during RBNZ/BOE speeches (unless you like volatility casinos).

Trailing stops = your bulletproof vest.

💣 BOOST THIS HEIST!

👍 Smash Like to fuel our next raid!

🔁 Share to recruit more trading bandits!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#Forex #GBPNZD #TradingView #LiquidityGrab #TrendContinuation #ThiefTrading

💬 COMMENT: "Long already—or waiting for a deeper pullback?" 👇🔥

GBP/NZD Vault Breach?! Ready for a Clean Bullish Heist?🔓💷 GBP/NZD — The Sterling Vault Heist Plan 🐱💻💰💹

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To all the Money Makers, Market Magicians, and Chart Whisperers — it's time for another precision strike in the forex jungle! 🤑📊⚔️

🚨 Operation: GBP/NZD – Sterling vs Kiwi Bank Play 🚨

We're eyeing a bullish breakout based on solid thief-style technicals and stealthy fundamentals. The play: Long entry with high conviction — the vault is cracked open, now it's about how smooth the job gets executed! 🏦💸

🎯 Setup Breakdown:

🎯Entry Zone:

The loot is there for the taking! Ideal entries near recent 15min or 30min lows/swing points — look for a pullback entry to join the bullish breakout crew.

🟢 The market shows strength, momentum, and intention.

🛑Stop Loss (Thief Shield):

Placed tactically near the 2H swing low (around 2.23800).

⚖️ Adjust based on your lot sizing, trade volume, and risk appetite — the escape route is always planned.

💰Target Area (The Vault Door):

📌 Eyeing 2.28500 as the final vault exit — but feel free to grab your profits early if the heat rises. 🔥

Smart robbers know when to vanish.

🧠 Scalper's Note:

Ride only on the bullish side.

💼 Got big pockets? Enter now.

💡 Running light? Wait for the retest and team up with swing players for the score.

Use Trailing SL to guard your gold — protect what you steal!

📚 Market Intel:

This bullishness is no accident — backed by:

📰 Macros | 💹 COT Data | 📊 Sentiment | 🔎 Intermarket Analysis

The vault doesn’t open every day — this move is calculated.

⚠️Heads Up:

News volatility can trigger alarms 🚨

❌ Avoid fresh entries during major releases

✅ Use trailing SLs to manage live positions

Stay sharp. React fast. Think like a thief. 🧠

💥 If you vibe with the Thief Trading Style, smash that ❤️Boost Button❤️ and support the squad!

We move smart, strike clean, and profit consistently. This is Forex Heisting, redefined.

Stay tuned — the next master plan is loading... 🧨🔐💷📈

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade