GBPUSD: Intraday Buying Setup 04/02/2026The FX:GBPUSD pair dropped after the DXY reversed to bullish. Since the start of this week, the price has been declining. We’ve identified a potential buying zone where we believe the price will likely move. Once the price reaches our marked ‘point of interest’ the trade will activate and you can set a stop loss based on your analysis and risk management.

If you agree with our work, please comment below.

Team Setupsfx_

Gbpusdbuy

GBPUSD: Intraday Trading Idea Possible Sell Worth 250+ PipsDear Traders,

I hope you’re doing well. We’re seeing strong selling pressure at the current price range and believe the price could drop around 1.3500, a 250+ pip move. We’re waiting for a strong bearish candle to close to confirm the bearish drop.

If you like our work, please like and comment. Follow us for more.

Team Setupsfx_

#GBPUSD: Previous Entry Invalidated,Next We Wait For Price! Our previous GBPUSD entry was invalidated as the pound declined while the DXY turned bearish. However, our view remains bullish on GBPUSD and the price is likely to reverse from our new entry area. Once the price enters the discounted zone we can then wait for it to reach one of our target or take-profit levels. This week’s NFP data is likely to affect our trade and could invalidate our entry if it is positive for the DXY.

Best wishes and safe trading.

Team Setupsfx

GBPUSD: Highly Probable +1400 Pips Trading Setup! Dear Traders,

📌GBPUSD has shown strong bullish momentum, with price action indicating upward pushes. However, caution is advised as temporary pullbacks are possible before sustained rallies resume. The pair’s movement is influenced by the US Dollar Index (DXY), which is showing signs of potential weakness. This supports the bullish outlook for GBPUSD.

📌Currently, the pair is in a bullish trend with temporary corrective dips expected. There’s a safe entry area for buyers around the ‘blue marked’ arrow. Three profit targets are marked, each for partial or full profit-taking. Avoid early entries near the ‘red marked’ arrow area, as it carries higher risk. Instead, prefer entries after the price breaks above the trend line, confirms liquidity absorption, and retests the breakout zone.

📌Furthermore, the US Dollar Index (DXY) is likely to decline due to upcoming economic data and market sentiment, which will favour GBP strength. The UK economic outlook is positive, supporting Sterling’s resilience. However, US economic uncertainty, with slowing growth and potential interest rate adjustments, may further pressure the dollar.

📌Finally, wait for the price to revisit the ‘blue marked’ support for a safer entry opportunity. Enter long positions after the trend line breaks and retests confirmation. Aim for the three defined targets, scaling out positions progressively. Maintain disciplined risk management throughout.

If you enjoy our work, please like and comment on the post. Your support means the world to us and encourages us to share more educational trading setups. If you’d like us to analyse any other trading plans, please comment below, and we’ll analyse them as soon as possible. 📊❤️

⚠️Disclaimer⚠️

This is not financial advice and is only for educational purposes. Please do your own research and make decisions based on your own knowledge and chart analysis. Financial markets can lead to serious losses, so have a thorough trading plan and risk management strategy.

Thank you❤️

Team Setupsfx_

#GBPUSD: +910 PIPS Buying Setup! Swing Setup! GBPUSD broken through the bearish trend line liquidity now we think price is likely to continue uptrend with around 910+ pips swing buying setup. We also have important news coming up this week so be careful while trading also use accurate risk management while trading.

Good luck and trade safe!

Team Setupsfx_

#GBPUSD: Three Targets Swing Buy 720+ Pips Move **Trading Setup For GBPUSD 1 Daily Time Frame**

🔺After a while where the price was mostly down, it hit a low of 1.30 but then turned around. Since then, it has been climbing steadily, with little dips that have only made it go higher. Right now, it is at 1.3490, which we think is a good time to start a long position in GBPUSD.

🔺Trading at the current price is a smart move because the price is up, which helps keep our risk in check and makes the trade more likely to succeed. We can put a stop-loss order below the blue line we marked.

🔺To make some money, we have set three goals. First, we aim for 1.3657, which is a big wall that the price needs to get over. Once it does, we can look at the second goal, which is 1.42. We will keep doing the same thing until we reach our final goal of 1.42.

🔺We would love for you to like and comment on our analysis, as it helps us make more content. Thanks so much for your support!

Sincerely,

Team SetupsFX_🏆❤️

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FPMARKETS:GBPUSD GBP/USD is rebounding from the 1.3810–1.3820 support zone, which aligns with prior demand and the lower boundary of the recent consolidation structure. Price has reclaimed short-term momentum after holding above support, suggesting buyers are defending this area.

The broader structure shows a higher low formation, while price is now pushing back toward the 1.3870–1.3880 resistance zone, where previous supply capped upside moves. As long as price remains above the support zone, the near-term bias favors further upside continuation.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 1.3810 – 1.3820

Stop Loss: 1.3800

Take Profit 1: 1.3842

Take Profit 2: 1.3870 – 1.3880

Risk–Reward Ratio: Approx. 1 : 2.89

❌ Invalidation

A decisive break and sustained close below 1.3800 would invalidate the bullish setup and signal renewed downside risk.

🌐 Macro Background

GBP/USD remains supported near multi-year highs as the US Dollar stays under pressure following the Federal Reserve’s neutral rate hold and ongoing uncertainty surrounding future Fed leadership. While the Fed offered no clear dovish signal, markets continue to price in medium-term USD softness amid political and policy uncertainty.

In this environment, Sterling strength remains intact, allowing GBP/USD to stay bid as long as key technical support holds.

🔑 Key Technical Levels

Resistance Zone: 1.3870 – 1.3880

Support Zone: 1.3810 – 1.3820

Bullish Invalidation: Below 1.3800

📌 Trade Summary

GBP/USD is holding above a well-defined support zone and showing signs of continuation toward the upper resistance band. As long as price stays above 1.3810, dips are viewed as buy-the-pullback opportunities, targeting 1.3870–1.3880.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

GBPUSD:Intraday Trading Setup 250+ Pips MoveDear Traders,

GBPUSD showed us the change of character has occurred and now it also has retested the price zone, now it is likely to be heading towards 1.3700 area which in our view is likely to be a next target for GBPUSD. According to the fib placement we can see price reversing from 0.618 point. As stated in the chart that there is only one swing target and stop loss can be placed based on your risk management.

Good luck and thanks for the support throughout these years, also like and comment for more such analysis.

Regards,

Team Setupsfx_

GBPUSD : Buy Trade Recap January 27, 2026This idea is a recap of a GBPUSD buy that played out cleanly by respecting structure and patience rather than perfect timing.

Price held above our higher time frame support and continued to honor the bullish bias even as intraday price action tested trader conviction. Instead of reacting to every pullback the focus was on allowing price to do the work once the level was accepted.

This trade was not about catching the bottom. It was about positioning with a clear invalidation and letting the market move when it was ready. The entry aligned with the broader directional bias while risk remained predefined and controlled.

Key takeaway

You do not need constant confirmation once your level and plan are defined. Trusting the process and giving the trade space is often the difference between participation and over management.

As always this is for educational purposes not financial advice.

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FOREXCOM:GBPUSD GBP/USD is currently trading just below a key resistance zone at 1.3456–1.3464, where price has shown clear rejection after the recent upside attempt. The latest rally failed to produce a sustained breakout above the prior high, forming a high-zone rejection + pullback consolidation structure.

From a price-action perspective, bullish momentum is fading, and the market is starting to roll over beneath resistance. The projected path suggests a minor rebound into the resistance band, followed by a downside continuation toward the 1.3400–1.3390 support zone, rather than an immediate bullish breakout.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 1.3456 – 1.3464

Stop Loss: 1.3472

Take Profit 1: 1.3401

Take Profit 2: 1.3393

Risk–Reward Ratio: Approx. 1 : 3.61

📌 Invalidation

A sustained break and close above 1.3472 would invalidate the bearish setup and require a reassessment of the market structure.

🌐 Macro Background

Fundamentally, while recent UK employment data provided short-term support for Sterling, markets are now waiting for the UK December CPI, PPI, and Retail Price Index releases, creating scope for a “buy-the-rumor, sell-the-fact” pullback.

On the US side, ongoing uncertainty surrounding the US–Greenland issue, along with renewed tariff threats from President Trump toward European countries, continues to fuel risk aversion. This environment raises the probability of a near-term technical rebound in the US Dollar. Against this backdrop, GBP/USD remains vulnerable to profit-taking and corrective downside pressure near the upper resistance band.

🔑 Key Technical Levels

Resistance Zone: 1.3456 – 1.3464

Support Zone: 1.3390 – 1.3400

Bearish Invalidation: Above 1.3472

📌 Trade Summary

GBP/USD is showing signs of rejection beneath a key resistance zone, with fading upside momentum. As long as price remains capped below 1.3456–1.3464, the bias favours a sell-on-rallies approach, targeting a pullback toward the lower support band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute investment or trading advice. Financial markets involve risk, and traders should manage positions according to their own risk tolerance.

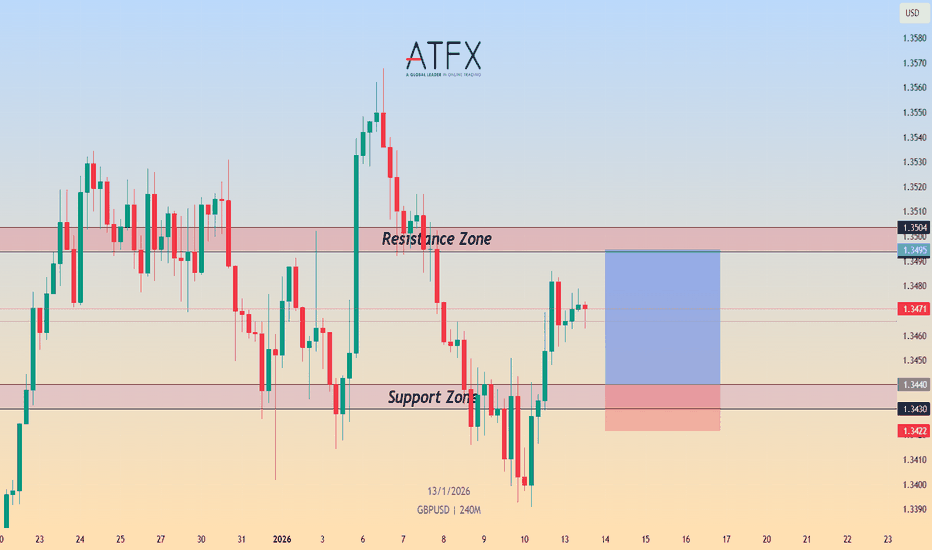

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FPMARKETS:GBPUSD GBP/USD is currently trading within a short-term recovery phase after rebounding from the 1.3430–1.3440 support zone. Price action shows a clear rejection of lower levels, with buyers stepping in aggressively following the recent pullback.

The pair is now stabilizing above the former demand area, suggesting that downside momentum has eased. As long as GBP/USD holds above the highlighted support zone, the technical structure favours a bullish continuation, with price likely to consolidate briefly before attempting a move higher toward the upper resistance band around 1.3495–1.3504.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 1.3430 – 1.3440

Stop Loss: 1.3422

Take Profit 1: 1.3495

Take Profit 2: 1.3505

Risk–Reward Ratio: Approx. 1 : 2.9

📌 Invalidation:

A sustained break and close below 1.3422 would invalidate the bullish setup and signal a deeper corrective move.

🌐 Macro Background

Sterling has found support amid renewed concerns over the independence of the U.S. Federal Reserve, which has weighed on the US Dollar and provided a near-term tailwind for GBP/USD. Political pressure on the Fed has increased uncertainty around future policy decisions, prompting USD softness across the board.

On the UK side, expectations for further Bank of England rate cuts remain, but markets appear to have largely priced in gradual easing. In the near term, attention is firmly on upcoming U.S. CPI inflation data, which could drive volatility. Until clearer direction emerges, GBP/USD remains supported on dips as long as USD sentiment stays fragile.

🔑 Key Technical Levels

Resistance Zone: 1.3495 – 1.3505

Support Zone: 1.3430 – 1.3440

Bullish Invalidation: Below 1.3422

📌 Trade Summary

GBP/USD has rebounded from a well-defined support zone and is holding above key demand. As long as price remains supported above 1.3430, the bias favours a buy-on-dips strategy, targeting a recovery toward the 1.3500 resistance area.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

GBP/USD Possible imminent Longs My bias on GU this week is aligned with the rest of the market — looking for short-term bullish continuation. Price is currently reacting from a 12hr demand zone, and I expect this area to hold given its prior validation.

There is also a deeper, more discounted demand zone sitting at the extreme of the recent bullish structure, which remains a secondary area of interest if price pushes lower.

Confluences for GU Buys:

• Overall structure remains bullish, despite a recent CHOCH to the downside

• Higher-time-frame bias is still bullish unless we see a clear BOS to the downside

• Clean 12hr and 1hr demand zones in close proximity

• Price is slowing down, increasing the probability of a stronger reaction

• DXY approaching supply, supporting potential upside in GU

P.S. Since we’ve seen a change of character, this bullish move may be corrective, potentially leading into a reaction from a higher supply zone. Trade with awareness and adapt to price.

GBP.USD longs from 1.33800My focus on GU this week is to look for buy opportunities in line with the bullish trend. Price has left behind a clean 8hr demand zone that caused a break of structure to the upside, and I’ll be waiting for a retracement into that area.

Once price taps into this demand zone, I’ll look for long setups to target further upside.

Confluences for Buys:

• Price approaching a clean 8hr demand zone

• POI sits within the ideal Fibonacci dealing range

• Break of structure to the upside confirms bullish bias

• Liquidity resting above that price may look to take

P.S. If price continues higher without retracing into my zone, I’ll wait for another bullish break of structure and then identify a new POI to trade from.

GBPUSD: Bullish Trend To Continue Dominating! Dear Traders,

Overview of GBPUSD📊📈

🔺The US dollar is expected to continue declining, which will likely push our GBPUSD price to an all-time high. As the new year begins, we believe this will be a key level for traders to monitor.

🔺🔺GBP has been bullish against other currencies. Next week’s price behaviour will be crucial in this trade.

Entry, Exit And Take Profit💥

🔺🔺Enter as shown in the chart, using strict risk management. Set your take profit to swing one at 1.44. For your stop loss, set it below 200 pips only if that aligns with your strategy.

Team SetupsFX_

GBPUSD: Bullish Push to 1.345?FX:GBPUSD is eyeing a bullish reversal on the 4-hour chart , with price rebounding from cumulative long liquidation near a golden cross on the 4H timeframe, converging with a potential entry zone that could trigger upside momentum if buyers defend against dips amid recent consolidation. This setup suggests a recovery opportunity after the pullback, targeting higher resistance levels with favorable risk-reward.

Entry between 1.3222–1.3266 for a long position (entry at these levels with proper risk and capital management is recommended). Target at 1.3450 . Set a stop loss at a daily close below 1.3177 , yielding a risk-reward ratio of approximately 1:2. Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's momentum post-golden cross.🌟

Fundamentally , GBPUSD is trading around 1.331 in mid-December 2025, with key events this week centered on the US Dollar amid the Federal Reserve's FOMC meeting on December 9-10, where a 25-basis-point rate cut is widely expected, potentially weakening the USD further if signals are dovish, though dissent among policymakers could introduce volatility. Supporting data includes Tuesday's NFIB Optimism Index (Nov) at 6:00 am ET and JOLTS Job Openings (Oct, delayed) at 10:00 am ET, which could influence USD strength if labor market resilience persists. Wednesday likely features November CPI data, a critical inflation gauge that may solidify or alter Fed cut expectations if readings show cooling prices. For the British Pound , no major high-impact releases this week, but anticipation builds for the Bank of England's MPC decision next week on December 18, where a quarter-point rate cut is priced in at ~85% probability amid fragile UK growth and inflation concerns, potentially pressuring GBP if confirmed dovish. Overall, softer US data and Fed easing could favor GBP upside this week. 💡

📝 Trade Setup

🎯 Entry (Long):

1.3222 – 1.3266

(Entry at these levels is valid with proper risk & capital management.)

🎯 Target:

1.3450

❌ Stop Loss:

Daily close below 1.3177

⚖️ Risk-to-Reward:

~ 1:2

Does GBPUSD hold the golden-cross support and push toward 1.3450 — or will FOMC volatility create a deeper pullback first? 👇

New GBP/USD Upside Move: Can Bulls Maintain Control?Asset: GBP/USD — “THE CABLE”

Type: Forex Market Trade Opportunity Guide (Swing / Day Trade)

Market Bias: Bullish Momentum Plan 📈✨

🔥 TRADE SETUP OVERVIEW

A strong bullish continuation plan has been validated following a TMA breakout above 1.33400, signaling renewed upside interest and a potential drive toward higher resistance levels.

🎯 ENTRY PLAN

Entry: Any price level after the confirmed breakout above 1.33400

The breakout structure supports momentum buyers and short-term trend followers.

🛡️ STOP LOSS (RISK GUIDELINE)

Suggested SL: 1.32600

⚠️ This is a flexible stop level.

Dear Ladies & Gentlemen (Thief OG’s), adjust your SL according to your personal risk appetite & strategy.

This plan is for market guidance — not a fixed rule.

🎯 TARGET — ESCAPE BEFORE POLICE ARRIVES 🚓🤣

Strong resistance + overbought region + potential liquidity trap zone

Main TP: 1.34400

Again: This is a guideline. Use your own TP decisions based on strategy & risk management.

📊 TECHNICAL OUTLOOK

TMA breakout confirms bullish shift 📈

Price moving above short-term dynamic zones supports continuation

Dollar softness & GBP strength align with trend direction

Structure favors clean trend leg toward upside liquidity pockets

🔗 RELATED PAIRS TO WATCH + CORRELATION NOTES

🇺🇸💵 1. USD/CHF (Inverse Correlation to GBP/USD)

Typically moves opposite GBP/USD

If USD/CHF is falling, it supports Cable bullish bias

Watch for USD weakness confirmation

🇺🇸💵 2. DXY – U.S. Dollar Index (Direct Driver)

A softening dollar boosts GBP/USD

If DXY breaks supports → bullish continuation for Cable

🇪🇺🇬🇧 3. EUR/GBP (Inverse to GBP Strength)

If EUR/GBP is falling → GBP gaining strength → supports GBP/USD bullish continuation

4. AUD/USD (Positive Correlation)

Both Cable & Aussie often climb together when USD weakens

If AUD/USD is showing bullish continuation → Cable gets confirmation

5. NZD/USD (Risk-On Correlation)

Similar risk sentiment behaviour

If NZD/USD is also breaking highs → bullish risk flow → strengthens GBP/USD bias

🧭 FINAL SUMMARY

The Cable is showing a clean bullish structure after the TMA breakout. Market sentiment, USD behavior, and correlated pairs are aligning in favor of a continuation move toward overhead resistance. Manage risk smartly, adjust levels responsibly, and follow your strategy.

GBPUSD Roadmap — Algorithmic Outlook. Liquidity Atlas — GBP/USD Narrative Mapping

The market doesn’t move randomly — it seeks imbalance, liquidity and inefficiencies like a hunter locked on its target.

In this chart, price engineered equal highs, built a liquidity shelf above structure, then rotated downward to sweep short-term liquidity. What looks like hesitation to some, is simply accumulation and redistribution — the footprint of algorithmic delivery.

We track intention, not candles.

🔍 Key Structural Logic

• Prior BISI marked the demand that institutional orders reacted to

• Clear EQH + BSL formed above, creating a destination for future draw

• Short-term liquidity (SSS) taken → price moved into discounted zone

• SSL sits below as a possible liquidity sweep area before continuation

• Model suggests displacement > retrace > expansion when efficiency returns

Markets leave stories behind — imbalance is just unfinished business.

What This Teaches:

📍 Liquidity ≠ noise. It is the market’s fuel.

📍 A premium zone may act as distribution, discount as accumulation.

📍 Smart trading begins when impatience ends.

📍 You don’t trade the chart — you read the narrative.

Retail reacts. Smart money prepares.

Your goal is to be the observer — not the follower.

Do you wait for liquidity to shift,

or do you enter where you wish price will go?

The answer separates traders from students of the market.

GBPUSD Trade Plan Pending POC Reclaim and BOS ConfirmationI'm watching the GBP/USD closely right now. The pair has been moving in a strong, sustained bullish trend, and we're currently seeing a healthy pullback develop. 🔄

🐂

My focus is on the Volume Profile Point of Control (POC) — if price reclaims and holds above this key level, it could signal a shift back in favour of the buyers. 📊

✨

Should we then get a bullish break of structure, that’s where I’ll be looking for a Buy opportunity to trade with the prevailing trend. 🎯

📈

Not financial advice — for educational purposes only.

---

GBP/USD Breakout Done , Long Setup Valid To Get 150 Pips !Here is my 4H Chart on GBP /USD , We Have A Fake Breakout and then the price Back Above my old Support and we have a very good Bullish Price Action on 1 And 2 And 4 Hours T.F Also the price playing very good around my Support and i entered a buy trade after 4H Closure And i`m waiting the price to retest the broken area to can get a confirmation to Add another entry , So i see it`s a good chance to Buy this pair if it go Down a little to retest the broken area and then we can Buy it and targeting 100 to 150 pips . and if we have a daily closure again Below my Support then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4 - Perfect 4H Closure .

5- The Price Respect The Support Again .

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FPMARKETS:GBPUSD GBP/USD has bounced from the Support Zone at 1.3061–1.3029, after a sharp four-day decline. Price is now consolidating just above support around 1.3060, with the next Resistance Zone seen near 1.3147–1.3174.

As long as 1.3030 holds, the structure favours a corrective rebound back into the previous consolidation band. A decisive break above 1.3120 would open the way toward 1.3170+. Conversely, a clean close below 1.3030 would invalidate the bullish setup and expose the 1.2980–1.3000 region.

🎯 Trade Setup

Idea: Buy near support for a rebound toward the resistance zone.

Entry: 1.3039 – 1.3061

Stop Loss: 1.3032

Take Profit 1: 1.3147

Take Profit 2: 1.3174

Risk–Reward Ratio: ≈ 1 : 2.6

Bias remains cautiously bullish while price holds above 1.3030.

🌐 Macro Background

Cable is trading with mild gains around 1.3060, snapping a four-day losing streak as markets turn cautious ahead of the delayed US September NFP release.

FXStreet’s Lallalit Srijandorn notes that markets now see a BoE December rate cut as likely, after UK CPI slowed to 3.6% YoY in October, reinforcing expectations of policy easing and limiting medium-term upside for GBP. At the same time, the coming UK budget on 26 November could further shape BoE expectations.

On the US side, the labour-market picture remains blurred by the 43-day government shutdown, which delayed key economic data. Economists expect around 50k new jobs in September and unemployment at 4.3%. A weaker-than-expected NFP print could weigh on the USD and support GBP/USD, while a strong report would reinforce the Fed’s cautious stance and potentially cap the pair’s recovery.

FOMC minutes showed “strongly differing views” on the December decision: while most officials still support cuts in principle, many are open to keeping rates steady for the rest of the year, leaving the policy path highly data-dependent.

Overall, GBP faces headwinds from BoE cut pricing, but short-term, a softer USD on weak NFP could allow a technical rebound toward 1.3150–1.3170.

🔑 Key Technical Levels

Resistance: 1.3147 – 1.3174

Support: 1.3039 – 1.3061

Psychological Levels: 1.3000, 1.3100

📌 Trade Summary

GBP/USD is attempting to base above 1.3039 support after an extended selloff. The setup favours buying dips toward support, targeting a corrective move into the 1.3147–1.3174 resistance band, especially if the US NFP report disappoints and pressures the USD. A daily close below 1.3030 would negate this view and argue for a deeper slide toward 1.2980.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

Uptrend Oscillation: Pullback Post-Open, 1.3300 BreakoutGenerally, it’s still in an upward oscillation.

Post-market opening, a minor retracement is expected before the uptrend resumes, with significant resistance near 1.3300—await a breakout

Buy 1.31500 - 1.31600

TP 1.31900 - 1.32400 - 1.32800

Accurate signals updated daily. They serve as a reliable guide for trading issues – feel free to refer to them. Hope they help!