TheGrove | GBPUSD BUY | Idea Trading AnalysisGBPUSD is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity GBPUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Gbpusdsetup

GBPUSD 📊 FX:GBPUSD Technical Analysis (4H Timeframe)

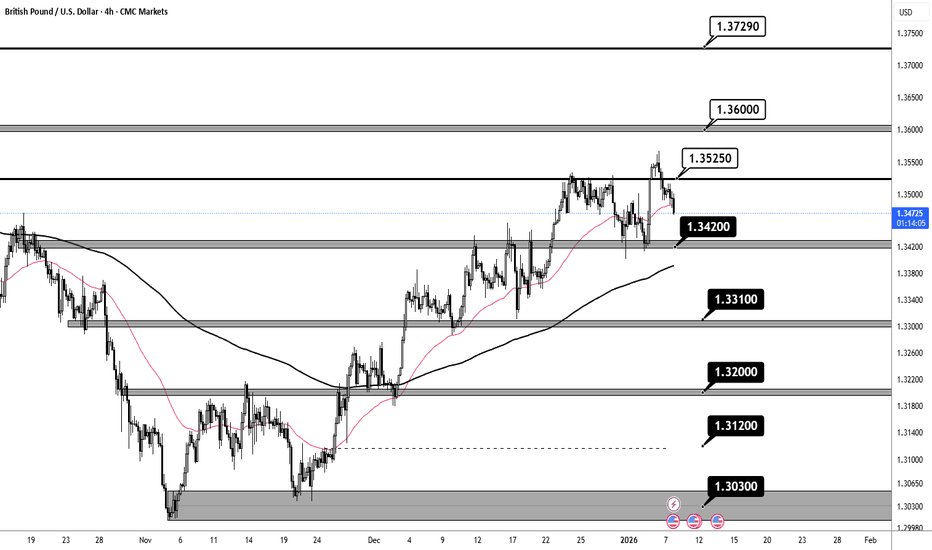

The overall trend is decisively bullish, characterized by a series of higher highs and higher lows. The price is currently trading well above the EMA 200 (black line), which maintains a positive slope, confirming long-term upward momentum 📈. While the EMA 50 (red line) is currently acting as immediate dynamic support, we see a slight exhaustion in the last few candles near the recent peak. The price is presently in a minor corrective phase (wave 5), testing the strength of the buyers near the 1.34753 USD level. As long as the price holds above the previous broken resistance turned support at 1.34200 USD, the bullish structure remains intact for a continuation toward the next measured move 🚀.

🔑 Key Levels to Watch:

Target Resistance 1: 1.35250 USD (Recent Swing High) 🎯

Target Resistance 2: 1.36000 USD (Major Grey Box) 🚩

Major Upside Target: 1.37290 USD (Next Structural Level) 🏆

Immediate Support: 1.34200 USD (Grey Box/Flip Zone) 💡

Intermediate Support: 1.33100 USD & 1.32000 USD (Dashed Lines) ⚡

Primary Demand Origin: 1.30300 USD (Main Grey Box) 🛡️

Q1 | W2 | Y26 GBPUSD — FRGNT WEEK AHEAD FORECAST📅 Q1 | W2 | Y26

📊 GBPUSD — FRGNT WEEK AHEAD FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈🔥

FX:GBPUSD

#GBPUSD: Three Targets Swing Buy 720+ Pips Move **Trading Setup For GBPUSD 1 Daily Time Frame**

🔺After a while where the price was mostly down, it hit a low of 1.30 but then turned around. Since then, it has been climbing steadily, with little dips that have only made it go higher. Right now, it is at 1.3490, which we think is a good time to start a long position in GBPUSD.

🔺Trading at the current price is a smart move because the price is up, which helps keep our risk in check and makes the trade more likely to succeed. We can put a stop-loss order below the blue line we marked.

🔺To make some money, we have set three goals. First, we aim for 1.3657, which is a big wall that the price needs to get over. Once it does, we can look at the second goal, which is 1.42. We will keep doing the same thing until we reach our final goal of 1.42.

🔺We would love for you to like and comment on our analysis, as it helps us make more content. Thanks so much for your support!

Sincerely,

Team SetupsFX_🏆❤️

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FOREXCOM:GBPUSD GBP/USD has rebounded sharply from the 1.3449–1.3454 support zone, but the recovery has stalled near the 1.3479–1.3484 resistance zone, which aligns with a descending trendline resistance from the late-December highs. This confluence has capped upside attempts so far.

On the 1-hour chart, price action shows hesitation candles near resistance, suggesting that bullish momentum is losing strength. The broader structure remains corrective within a descending trend, with price still trading below the key trendline.

As long as GBP/USD fails to sustain above 1.3484, the technical bias favours a pullback back toward support.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 1.3479 – 1.3484

Stop Loss: 1.3492

Take Profit 1: 1.3454

Take Profit 2: 1.3449

Estimated Risk-to-Reward: approx. 1 : 2.19

The bearish setup remains valid as long as price stays below 1.3484 on an hourly closing basis.

🌐 Macro Background (Simplified)

From a macro perspective, expectations of Federal Reserve rate cuts in 2026 continue to weigh on the US Dollar, which has helped GBP/USD stabilize above recent lows. However, short-term USD weakness may already be partially priced in.

At the same time, the Bank of England’s gradual easing path limits aggressive upside in Sterling. BoE officials have emphasized that each subsequent rate cut will be a “closer call,” keeping policy relatively cautious compared with market expectations for the Fed.

In short: macro forces support near-term stability, but technical resistance suggests limited upside and a corrective pullback risk.

🔑 Key Technical Levels

Resistance Zone: 1.3479 – 1.3484

Support Zone: 1.3454 – 1.3449

Bearish Invalidation: Hourly close above 1.3484

📌 Trade Summary

GBP/USD has recovered from support but is struggling to break above a key resistance zone reinforced by a descending trendline. With upside momentum fading near 1.3484, a short-term pullback toward 1.3454–1.3449 is favoured.

The bearish outlook remains valid unless price breaks and holds above 1.3484, which would signal a shift toward bullish continuation.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

GBPUSD - buy now it's going upGBPUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. GBPUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. Buy GBPUSD now it's going up

GBPUSD: Bullish Trend To Continue Dominating! Dear Traders,

Overview of GBPUSD📊📈

🔺The US dollar is expected to continue declining, which will likely push our GBPUSD price to an all-time high. As the new year begins, we believe this will be a key level for traders to monitor.

🔺🔺GBP has been bullish against other currencies. Next week’s price behaviour will be crucial in this trade.

Entry, Exit And Take Profit💥

🔺🔺Enter as shown in the chart, using strict risk management. Set your take profit to swing one at 1.44. For your stop loss, set it below 200 pips only if that aligns with your strategy.

Team SetupsFX_

GBPUSD - buy nowGBPUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. GBPUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. Buy GBPUSD now

GBP/USD - H4 Weekly Outlook- Channel Breakout📝 Description 🔍 Setup (Market Structure) OANDA:GBPUSD

GBP/USD is trading inside a rising channel on H4 and has recently shown a channel breakout attempt followed by a retest near the upper zone. Price is now consolidating under a key resistance area, making this a decision week.

🔴Higher highs & higher lows intact

🔴Breakout + retest structure visible

🔴Momentum slowing near resistance → wait for confirmation

📍 Key Levels :

🟢 Resistance Zone: 1.3420 – 1.3455

🔴 1st Support: 1.3215 – 1.3200

🔴 2nd Support: 1.3135 – 1.3100

#GBPUSD #ForexTrading #WeeklyOutlook #ChannelBreakout #PriceAction #SupportResistance #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always use proper risk management and stop-loss.

💬 Support the Analysis👍 Like if you’re watching GBP/USD this week

💬 Comment: Breakout or Rejection?

🔁 Share with traders following GBP pairs

GBPUSD - time to buy nowGBPUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. GBPUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. Time to Buy GBPUSD now

Is the Cable Entering a New Bullish Expansion Phase?🔥 GBP/USD "THE CABLE" BULLISH BREAKOUT SETUP | SWING/DAY TRADE 📈💷

📊 CURRENT MARKET DATA (Real-Time Verified)

Current Price: 1.3372 ✅

Today's Range: 1.3341 - 1.3401

52-Week Range: 1.2098 - 1.3789

Technical Rating: Strong Buy 🟢

🎯 TRADE SETUP OVERVIEW

Asset: GBP/USD (British Pound / US Dollar)

Nickname: "The Cable" 🌊

Trade Type: Swing Trade / Day Trade

Direction: BULLISH 📈

💡 TECHNICAL ANALYSIS & PLAN

Bullish Confirmation: ✅

Simple Moving Average Pullback Confirmed

Breakout Pattern Identified

Retest Completed Successfully

Currently Trading Near Support Zone

Strategy: SMA Pullback + Breakout + Retest Entry

🎲 "THIEF" LAYERING ENTRY STRATEGY

Entry Method: Multiple Limit Orders (Layering Style)

Suggested Entry Layers:

🟢 Layer 1: 1.33200

🟢 Layer 2: 1.33400

🟢 Layer 3: 1.33600

Note: You can add additional layers based on your own strategy and risk tolerance. This layering approach allows for averaging into the position as price pulls back.

🛡️ RISK MANAGEMENT

Thief Strategy Stop Loss: 1.33000 ⛔

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - Adjust your stop loss based on YOUR OWN strategy and risk management rules. This is not a recommendation, but rather one approach to consider. Your capital, your rules! 💪

🎯 TARGET & EXIT PLAN

Target Price: 1.34900 🎯

Exit Strategy Considerations:

Strong resistance zone ahead

Potential overbought conditions

Trap zones identified near target

⚠️ PROFIT-TAKING DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - This is NOT a recommendation to hold until this specific target. Take profits at YOUR own discretion based on YOUR risk appetite. Your money, your rules. Exit when YOU feel comfortable! 💰

🌍 RELATED PAIRS TO WATCH

Monitor these correlated USD pairs for confluence:

💵 USD Index ( TVC:DXY )

Why Watch: Direct inverse correlation with GBP/USD

Key Point: USD weakness = GBP/USD strength

Current Status: Showing bearish pressure per COT report

💶 FX:EURUSD

Current Price: ~1.1744

Correlation: Strong positive correlation with GBP/USD

Key Point: Both pairs move together against USD

Watch For: EUR/USD breakouts often lead GBP/USD

💴 OANDA:GBPJPY

Current Price: ~208.29

Correlation: Shows GBP strength independent of USD

Key Point: Confirms overall Pound momentum

Watch For: Yen weakness adds fuel to GBP strength

🦘 OANDA:AUDUSD

Current Price: ~0.6646

Correlation: Risk-on/risk-off indicator

Key Point: Risk appetite affects both pairs

Watch For: Commodity currency strength = risk-on environment

🍁 OANDA:GBPCAD

Correlation: Direct GBP strength measurement vs commodity currency

Key Point: Isolated GBP performance indicator

Watch For: Divergence signals unique GBP catalysts

📌 KEY CORRELATION INSIGHTS

🔴 When USD Weakens:

GBP/USD rises ↗️

EUR/USD rises ↗️

AUD/USD rises ↗️

DXY falls ↘️

🟢 When GBP Strengthens:

GBP/USD rises ↗️

GBP/JPY rises ↗️

EUR/GBP may fall ↘️

GBP/CAD rises ↗️

💡 Trading Tip: If you see ALL USD pairs rising together (EUR/USD, AUD/USD, GBP/USD), this confirms broad USD weakness. If only GBP/USD rises while EUR/USD stalls, this signals specific GBP strength.

⚡ FUNDAMENTAL CATALYSTS

🇺🇸 USD Factors:

Federal Reserve expected to cut rates (90% probability of 25bps cut)

Softer US economic data weighing on Dollar

"Hawkish cut" expected with cautious guidance

🇬🇧 GBP Factors:

Bank of England meeting scheduled December 18

Mixed UK economic data (inflation cooling, labor market softening)

88% probability of BoE rate cut priced in

📱 TRADE MANAGEMENT CHECKLIST

✅ Monitor DXY for USD strength/weakness

✅ Watch EUR/USD for confirmation

✅ Check GBP/JPY for isolated GBP strength

✅ Set alerts at entry layers

✅ Adjust position size to your risk tolerance

✅ Use proper stop loss discipline

✅ Take partial profits at psychological levels

✅ Trail stop loss as position moves in your favor

⚠️ FINAL RISK DISCLAIMER

This is an educational trade idea, NOT financial advice.

Trade at your own risk

Past performance ≠ future results

Only risk capital you can afford to lose

Adjust ALL levels to your own strategy

Markets can remain irrational longer than you can remain solvent

Always use proper risk management

🏆 TRADE WITH DISCIPLINE | PROFIT WITH PATIENCE

Good luck, Thief OG's! May the pips be ever in your favor! 🎯💰📈

Like 👍 | Follow 🔔 | Comment 💬

Cable Surge Potential: MA Breakout Signals Bullish Pathway📊 GBP/USD "THE CABLE" | Bullish Breakout Setup - Swing Trade Alert 🚀

🎯 TRADE PLAN: BULLISH MOMENTUM PLAY

📍 Entry Strategy:

✅ Pending BUY Order @ 1.32000 (Post Moving Average Breakout)

⏰ Wait for confirmed breakout + candle close above the MA

🛡️ Stop Loss:

❌ Conservative SL @ 1.30500 (-150 pips)

⚠️ RISK DISCLAIMER: This is MY stop loss based on my strategy. Adjust according to YOUR risk tolerance, position sizing & trading plan. Trade at your own risk.

🎯 Take Profit Target:

💰 Primary TP @ 1.33700 (+170 pips)

📊 Moving Average acting as resistance + overbought zone confluence

⚠️ PROFIT DISCLAIMER: Lock partials on the way up. Trail your stops. This is NOT financial advice - manage YOUR exits based on YOUR strategy.

🔍 TECHNICAL ANALYSIS:

📈 Trend: Bullish structure forming

🧱 Key Level: 1.32000 breakout zone = trigger

🚧 Resistance: MA + 1.33700 zone acting as "police barricade"

⚡ Setup: Classic MA breakout + momentum continuation

💱 CORRELATED PAIRS TO WATCH:

Positive Correlation (Move Together):

EUR/USD - Currently @ 1.1609 - Both pairs influenced by USD strength/weakness. If EUR/USD rallies, GBP/USD typically follows.

GBP/JPY - Currently @ 203.39 - Confirms GBP strength across multiple pairs

Inverse Correlation (Move Opposite):

USD/JPY - Currently @ 154.69 - USD strength indicator. If USD/JPY falls, it signals USD weakness = GBP/USD strength

DXY (Dollar Index) - Watch for DXY weakness to confirm GBP/USD upside

Key Correlation Insight:

🔗 If you see EUR/USD breaking resistance + DXY breaking support simultaneously = HIGH probability GBP/USD follows through to target

⚠️ RISK MANAGEMENT RULES:

✔️ Never risk more than 1-2% of account per trade

✔️ Set alerts, don't chase the market

✔️ Respect your stop loss - NO EXCEPTIONS

✔️ Take partials at key levels (1.3250, 1.3300)

✔️ Monitor correlations - if EUR/USD reverses, watch GBP/USD closely

👊 Good luck, OG Traders! Drop a 👍 if you're watching this setup!

Is the Cable Preparing for a Deeper Slide? GBP/USD Outlook🎯 GBP/USD "THE CABLE" - Cash Flow Heist Setup 🏴☠️💰

📊 Market Overview

The Cable is showing bearish momentum as we approach key resistance zones. This swing/day trade setup focuses on capturing downside movement with strategic risk management.

🔍 Trade Setup Details

Direction: 🐻 BEARISH

Entry Zone: FLEXIBLE - Multiple entry opportunities available at current price levels

Stop Loss: 🛡️ 1.35000 (Invalidation level - protect your capital!)

Target: 🎯 1.33300 (Strong support zone + oversold conditions)

📈 Technical Analysis

Key Observations:

Resistance Overhead: Price facing rejection at upper levels

Support Target: 1.33300 confluence zone with multiple factors:

Historical strong support

Oversold territory expected

Potential trap zone for late shorts

⚠️ Risk Management Note:

Fellow traders, these levels are MY analysis points. Your risk tolerance = Your rules. Adjust SL/TP based on YOUR account size and strategy. Lock profits along the way - don't get greedy! 💼

🌐 Related Pairs to Watch

Keep an eye on these correlated instruments:

EUR/USD - Euro strength/weakness impacts Cable

DXY (US Dollar Index) - Inverse correlation with GBP/USD

GBP/JPY - Confirms GBP momentum

EUR/GBP - Shows relative strength between pairs

💵 USD Pairs Correlation:

OANDA:AUDUSD - Risk sentiment gauge

OANDA:NZDUSD - Commodity currency correlation

FX:USDJPY - Safe haven flows indicator

Key Point: If DXY strengthens, expect additional downside pressure on Cable. Monitor EUR/USD for confirmation of USD strength vs. weakness in GBP specifically.

🎓 Strategy Notes

This is a "cash flow management" approach - meaning we're looking to capture liquidity moves and bank profits systematically. The setup combines:

✅ Technical levels

✅ Market structure

✅ Risk-reward optimization

✅ Exit strategy before reversal zones

Pro Tip: Consider scaling out at 1.33500 to secure partial profits before the final target!

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GBPUSD #TheCable #ForexTrading #SwingTrading #DayTrading #TechnicalAnalysis #ForexSignals #CashFlow #BearishSetup #PriceAction #SupportAndResistance #RiskManagement #ForexStrategy #DXY #CurrencyTrading #TradingIdeas #ForexCommunity #MarketAnalysis

#GBPUSD: +910 PIPS Buying Setup! Swing Setup! GBPUSD broken through the bearish trend line liquidity now we think price is likely to continue uptrend with around 910+ pips swing buying setup. We also have important news coming up this week so be careful while trading also use accurate risk management while trading.

Good luck and trade safe!

Team Setupsfx_

New GBP/USD Upside Move: Can Bulls Maintain Control?Asset: GBP/USD — “THE CABLE”

Type: Forex Market Trade Opportunity Guide (Swing / Day Trade)

Market Bias: Bullish Momentum Plan 📈✨

🔥 TRADE SETUP OVERVIEW

A strong bullish continuation plan has been validated following a TMA breakout above 1.33400, signaling renewed upside interest and a potential drive toward higher resistance levels.

🎯 ENTRY PLAN

Entry: Any price level after the confirmed breakout above 1.33400

The breakout structure supports momentum buyers and short-term trend followers.

🛡️ STOP LOSS (RISK GUIDELINE)

Suggested SL: 1.32600

⚠️ This is a flexible stop level.

Dear Ladies & Gentlemen (Thief OG’s), adjust your SL according to your personal risk appetite & strategy.

This plan is for market guidance — not a fixed rule.

🎯 TARGET — ESCAPE BEFORE POLICE ARRIVES 🚓🤣

Strong resistance + overbought region + potential liquidity trap zone

Main TP: 1.34400

Again: This is a guideline. Use your own TP decisions based on strategy & risk management.

📊 TECHNICAL OUTLOOK

TMA breakout confirms bullish shift 📈

Price moving above short-term dynamic zones supports continuation

Dollar softness & GBP strength align with trend direction

Structure favors clean trend leg toward upside liquidity pockets

🔗 RELATED PAIRS TO WATCH + CORRELATION NOTES

🇺🇸💵 1. USD/CHF (Inverse Correlation to GBP/USD)

Typically moves opposite GBP/USD

If USD/CHF is falling, it supports Cable bullish bias

Watch for USD weakness confirmation

🇺🇸💵 2. DXY – U.S. Dollar Index (Direct Driver)

A softening dollar boosts GBP/USD

If DXY breaks supports → bullish continuation for Cable

🇪🇺🇬🇧 3. EUR/GBP (Inverse to GBP Strength)

If EUR/GBP is falling → GBP gaining strength → supports GBP/USD bullish continuation

4. AUD/USD (Positive Correlation)

Both Cable & Aussie often climb together when USD weakens

If AUD/USD is showing bullish continuation → Cable gets confirmation

5. NZD/USD (Risk-On Correlation)

Similar risk sentiment behaviour

If NZD/USD is also breaking highs → bullish risk flow → strengthens GBP/USD bias

🧭 FINAL SUMMARY

The Cable is showing a clean bullish structure after the TMA breakout. Market sentiment, USD behavior, and correlated pairs are aligning in favor of a continuation move toward overhead resistance. Manage risk smartly, adjust levels responsibly, and follow your strategy.

GBPUSD FRGNT DAILY FORECAST - Q4 | W50 | D10 | Y25 |📅 Q4 | W50 | D10 | Y25 |

📊 GBPUSD FRGNT DAILY FORECAST

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:GBPUSD

GBPUSD SELL | Idea Trading AnalysisGBPUSD is moving on Resistance area .

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPUSD

I still did my best and this is the most likely count for me at the moment.

GBP/USD Price Outlook – Trade Setup📊 Technical Structure

FPMARKETS:GBPUSD GBP/USD continues to consolidate around the 1.3330 level after last week’s strong rebound, with price holding above the 1.3316–1.3326 support zone while repeatedly failing to break the 1.3358–1.3370 resistance zone. A descending trendline from prior highs continues to cap upside momentum, forming a compression pattern as the pair approaches the Federal Reserve decision.

The 4H structure suggests that price may retest the resistance zone once more before potentially rolling over. As long as GBP/USD stays below 1.3358–1.3370, bearish rejection scenarios remain likely. A decisive break above the trendline would shift momentum to the upside, while a break below 1.3316 opens the door toward deeper support.

🎯 Trade Setup

Idea: Sell from resistance, looking for rejection below the descending trendline.

Entry: 1.3358 – 1.3370

Stop Loss: 1.3372

Take Profit 1: 1.3326

Take Profit 2: 1.3316

Risk–Reward Ratio: ≈ 1 : 3.1

As long as price stays below the descending trendline and below 1.3370, the bearish setup remains valid. A 4H close above the resistance zone invalidates this scenario.

🌐 Macro Background

Markets are waiting for the Federal Reserve interest rate decision on Wednesday, and traders aren’t willing to push GBP/USD aggressively in either direction. The USD stays weak because investors expect the Fed to cut interest rates again, which lowers the dollar’s yield advantage and generally supports GBP/USD.

On the UK side, the end of budget uncertainty gives the British Pound some support. The UK government announced tax adjustments to stabilize public finances, helping calm investor concerns and giving GBP a firmer footing.

Overall, GBP/USD trades in a tight range because both sides—USD weakness from Fed expectations and GBP support from fiscal clarity—are balancing each other until the FOMC meeting provides new direction.

🔑 Key Technical Levels

Resistance Zone: 1.3358 – 1.3370

Support Zone: 1.3316 – 1.3326

Invalidation Level: 1.3372 (4H close above)

📌 Trade Summary

GBP/USD consolidates near 1.3330 as traders wait for the Fed. The technical picture favours selling the resistance zone at 1.3358–1.3372 due to trendline pressure and repeated rejection. However, macro factors remain mixed ahead of the FOMC decision. Downside targets sit at 1.3316 and 1.3316 unless price breaks above 1.3372 which would signal bullish continuation.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

GBPUSD: Rallies Are Getting Sold, & Dollar Still Has Upper HandEvery time GBPUSD tries to lift its head, it seems to run straight into supply. Zooming out, this chart feels like a classic distribution phase after a strong first-half rally. Fundamentally, that makes sense. Sterling has lost its earlier policy edge, while the dollar continues to benefit from relative growth resilience and sticky US yields. From here, GBPUSD looks more like a corrective bounce inside a bigger bearish structure than the start of a fresh uptrend.

Current Bias

Bearish.

GBPUSD is trading below key trend resistance, and recent upside attempts are being capped. Until price can reclaim and hold above the upper supply zones, rallies look vulnerable to renewed selling.

Key Fundamental Drivers

Bank of England vs Fed divergence fading

Earlier GBP strength was built on the idea that the BoE would be more restrictive for longer. That narrative has weakened. UK inflation has cooled, growth data is soft, and rate cuts are firmly on the table for 2026.

Meanwhile, the Fed is preparing to cut, but at a cautious pace. That keeps US rate differentials from swinging decisively against the dollar.

UK growth fragility

UK activity data continues to point to sluggish growth and a vulnerable consumer. This limits how aggressive the BoE can be, especially compared to a US economy that is slowing but not stalling.

USD demand and risk backdrop

In periods of uncertainty or policy repricing, USD demand remains strong. GBP does not benefit from safe-haven flows and tends to underperform when global risk sentiment wobbles.

Macro Context

Interest rate expectations

Markets are pricing gradual easing from both central banks, but the Fed is seen as more patient and reactive to data. That keeps US yields relatively supported versus the UK.

Economic growth trends

The US is slowing from above-trend levels; the UK is closer to stagnation. That relative growth story still favors USD over GBP.

Geopolitics and policy risk

Trade tensions, election risk, and global policy uncertainty tend to support USD over cyclical currencies like GBP.

Overall, the macro backdrop aligns with a bearish GBPUSD bias rather than a sustained recovery.

Primary Risk to the Trend

The main risk to the bearish view would be:

A sharp deterioration in US data that forces the Fed into faster or deeper rate cuts than currently expected, or

A surprise reacceleration in UK inflation or growth that pushes the BoE into a less-dovish stance.

Either scenario could weaken USD or boost GBP enough to invalidate the downside structure.

Most Critical Upcoming News/Event

US data: CPI, PCE, NFP and Fed speakers, particularly anything that materially shifts rate-cut expectations.

UK data: CPI, labor market reports, GDP updates, and BoE communication confirming or challenging the easing bias.

At the margin, USD-side events remain more influential for direction.

Leader/Lagger Dynamics

GBPUSD is a lagger.

It tends to follow moves in DXY and US yields, rather than lead them.

Cable often confirms broader USD strength or weakness after it shows up first in DXY or pairs like USDJPY.

GBP crosses (such as GBPJPY or EURGBP) can sometimes move first and give early clues for GBPUSD.

Key Levels

Support Levels:

1.3200–1.3180: Near-term support and prior reaction area.

1.3000–1.2950: Major downside magnet if bearish momentum accelerates.

Resistance Levels:

1.3350–1.3400: Key supply zone where recent rallies have stalled.

1.3700–1.3800: Major macro resistance and bearish invalidation area.

Stop Loss (SL):

Above 1.3800 on a daily closing basis, which would signal a structural shift back to GBP strength.

Take Profit (TP):

First target around 1.3200,

Extension toward 1.3000 if USD strength persists and risk sentiment weakens.

Summary: Bias and Watchpoints

GBPUSD remains bearish, both structurally and fundamentally. The BoE is drifting further into an easing cycle while the Fed remains cautious, keeping relative yield support tilted toward the dollar. As long as price stays capped below the 1.3350–1.3400 resistance zone, rallies look like selling opportunities rather than trend reversals.

Key levels to watch are support near 1.3200 and the larger downside target around 1.3000. A daily close above 1.38 would force a reassessment, but until then, Cable appears to be a lagging pair that reflects broader USD strength, not a driver of it.

GBPUSD Roadmap — Algorithmic Outlook. Liquidity Atlas — GBP/USD Narrative Mapping

The market doesn’t move randomly — it seeks imbalance, liquidity and inefficiencies like a hunter locked on its target.

In this chart, price engineered equal highs, built a liquidity shelf above structure, then rotated downward to sweep short-term liquidity. What looks like hesitation to some, is simply accumulation and redistribution — the footprint of algorithmic delivery.

We track intention, not candles.

🔍 Key Structural Logic

• Prior BISI marked the demand that institutional orders reacted to

• Clear EQH + BSL formed above, creating a destination for future draw

• Short-term liquidity (SSS) taken → price moved into discounted zone

• SSL sits below as a possible liquidity sweep area before continuation

• Model suggests displacement > retrace > expansion when efficiency returns

Markets leave stories behind — imbalance is just unfinished business.

What This Teaches:

📍 Liquidity ≠ noise. It is the market’s fuel.

📍 A premium zone may act as distribution, discount as accumulation.

📍 Smart trading begins when impatience ends.

📍 You don’t trade the chart — you read the narrative.

Retail reacts. Smart money prepares.

Your goal is to be the observer — not the follower.

Do you wait for liquidity to shift,

or do you enter where you wish price will go?

The answer separates traders from students of the market.

GBPUSD Trade Plan Pending POC Reclaim and BOS ConfirmationI'm watching the GBP/USD closely right now. The pair has been moving in a strong, sustained bullish trend, and we're currently seeing a healthy pullback develop. 🔄

🐂

My focus is on the Volume Profile Point of Control (POC) — if price reclaims and holds above this key level, it could signal a shift back in favour of the buyers. 📊

✨

Should we then get a bullish break of structure, that’s where I’ll be looking for a Buy opportunity to trade with the prevailing trend. 🎯

📈

Not financial advice — for educational purposes only.

---