Global Financial Market and Its Structure1. What Is the Global Financial Market?

A financial market is any platform—physical or digital—where buyers and sellers come together to trade financial instruments such as stocks, bonds, currencies, commodities, and derivatives. When these platforms operate across borders and connect economies worldwide, they form the global financial market.

This global market works on two core principles:

A. Free Flow of Capital

Money can move from one country to another seeking higher returns, lower risk, or better opportunities.

B. Integration of Economies

Events in one market can quickly impact others. For example, a rate hike by the US Federal Reserve affects currencies, stock markets, bond yields, and commodity prices around the world.

2. Why Does the Global Financial Market Exist?

The global market exists to serve four essential purposes:

1. Capital Allocation

Countries and companies need money to build infrastructure, expand business, and fund innovation. Investors need profitable places to put their money. The global market connects them.

2. Liquidity

It provides a place to buy and sell assets easily, ensuring that investors can enter or exit trades without major delays.

3. Risk Management

Through derivatives, hedging tools, and diversified global portfolios, investors can protect themselves from currency risk, interest rate risk, and geopolitical risk.

4. Price Discovery

It helps decide fair value of assets—such as currency rates, gold prices, or stock valuations—based on demand and supply.

3. Structure of the Global Financial Market

The global financial market can be divided into five major segments:

Capital Markets

Money Markets

Foreign Exchange (Forex) Markets

Commodity Markets

Derivatives Markets

Together, they form the complete structure.

A. Capital Markets (Stocks and Bonds)

Capital markets are where businesses and governments raise long-term funds. They are divided into:

1. Equity Markets (Stock Markets)

Companies issue shares to raise money. Investors buy these shares to earn returns through price appreciation and dividends.

Examples:

New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange, Bombay Stock Exchange (BSE), National Stock Exchange (NSE).

Role in global finance:

Helps companies scale globally

Attracts foreign portfolio investors (FPI/FII)

Indicates economic health of a country

2. Debt Markets (Bond Markets)

Governments and corporations borrow money by issuing bonds. Investors earn interest in return.

Types of bonds:

Government bonds (US Treasuries, Indian G-Secs)

Corporate bonds

Municipal bonds

The bond market is actually bigger than the global equity market and heavily influences global interest rates and currency values.

B. Money Markets

Money markets deal with short-term borrowing and lending, typically less than one year. These markets support daily liquidity needs of financial institutions.

Instruments include:

Treasury bills

Commercial paper

Certificates of deposit

Interbank lending

Role:

Money markets ensure stability in the banking system. They act like the “blood circulation system” of global finance, maintaining smooth functioning of cash flows.

C. Foreign Exchange Market (Forex)

The forex market is the world’s largest financial market with over $7 trillion traded per day. It is a fully decentralized, 24-hour market connecting banks, institutions, governments, and traders.

Why Forex is Important:

Determines exchange rates

Supports global trade

Hedges currency risk

Enables cross-border investments

Currencies move due to:

Interest rate changes

Political events

Economic data (GDP, unemployment)

Speculation

Central bank interventions

Forex influences everything—from import/export prices to foreign travel, to inflation in a country.

D. Commodity Markets

Commodity markets allow trading of raw materials such as:

Energy: crude oil, natural gas

Metals: gold, silver, copper

Agriculture: wheat, coffee, sugar

These markets function in two formats:

1. Spot Markets

Immediate delivery of commodities.

2. Futures Markets

Contracts based on future delivery, widely used for hedging.

Commodity markets are heavily influenced by:

Geopolitics

Supply chain disruptions

OPEC policies

Weather conditions

Global demand cycles

Gold and oil are the two most influential commodities globally.

E. Derivatives Market

Derivatives are financial contracts whose value comes from underlying assets such as stocks, currencies, bonds, or commodities.

Common derivatives:

Futures

Options

Swaps

Forward contracts

Why derivatives matter:

Hedge risks (currency risk, interest rate risk)

Enable leverage

Increase liquidity

Allow complex trading strategies

Global derivative markets are massive, running into hundreds of trillions in notional value.

4. Key Participants in the Global Financial Market

The global market functions because of several major players:

1. Central Banks

Federal Reserve (USA), ECB, Bank of Japan, RBI etc.

They control interest rates, regulate liquidity, and manage currency stability.

2. Banks and Financial Institutions

Provide loans, trading services, market-making, and clearing operations.

3. Institutional Investors

Pension funds

Hedge funds

Mutual funds

Sovereign wealth funds

They move large volumes of capital globally.

4. Corporations

Raise funds, hedge forex exposures, and engage in cross-border trade.

5. Retail Traders/Investors

Participate in stocks, forex, crypto, and commodities.

6. Governments

Issue debt, regulate markets, and manage economic policies.

5. How Global Financial Markets Are Connected

An event in one part of the world can have global ripple effects.

Examples:

A US interest rate hike strengthens the dollar and weakens emerging market currencies.

Oil supply cuts by OPEC raise global inflation.

A banking crisis in Europe can shock global equity markets.

This interconnectedness increases efficiency but also increases vulnerabilities.

6. Technology and Global Markets

Technology has completely transformed global markets:

High-frequency trading

Algorithmic trading

Digital payment systems

Blockchain and cryptocurrencies

Online brokerage and investment apps

Today, markets operate round-the-clock, and information travels instantly.

7. Risks in the Global Financial Market

While global markets create opportunities, they also carry risks:

Liquidity risk

Interest rate risk

Currency volatility

Political instability

Systemic banking failures

Market bubbles and crashes

Proper regulation and risk management are essential to maintain stability.

Conclusion

The global financial market is a powerful and complex system that drives economic growth, trade, and investment across nations. It is structured into several interconnected segments—capital markets, money markets, forex markets, commodity markets, and derivatives markets. Each plays a unique role in ensuring smooth movement of money, efficient price discovery, risk management, and global economic coordination.

In an increasingly interconnected world, understanding the structure of global financial markets is essential for traders, investors, policymakers, and anyone seeking to make informed financial decisions.

Globalliquidityindex

Central Bank Policies for Beginners in the World Trade Market1. What Is a Central Bank?

A central bank is a government-backed financial institution that manages a nation’s money supply, inflation, currency value, interest rates, and financial stability.

Examples:

Federal Reserve (USA)

European Central Bank (ECB)

Reserve Bank of India (RBI)

Bank of Japan (BoJ)

Bank of England (BoE)

People’s Bank of China (PBoC)

Central banks are not profit-making bodies. Their job is to maintain economic health, ensure stable currency, and create a predictable environment for businesses and international trade.

2. Why Central Banks Matter in Global Trade

Global trade involves buying and selling goods/services across borders. Every trade transaction depends on:

currency exchange rates,

interest rates,

credit availability,

inflation levels,

and economic stability.

All of these variables are either controlled or influenced by central bank policies.

For example:

If the US Federal Reserve hikes interest rates → the US dollar strengthens → emerging markets face currency pressure → global commodities like gold and oil react immediately.

If the RBI cuts interest rates → exports may become more competitive → imports become relatively expensive → affecting India’s trade balance.

In short, central banks shape the macroeconomic environment in which international trade operates.

3. The Core Goals of Central Banks

Central bank policies revolve around achieving major economic goals:

a) Controlling Inflation

High inflation weakens purchasing power and disrupts trade.

Low inflation or deflation slows economic activity.

Central banks aim for a moderate inflation level (usually 2%).

b) Stabilizing the Currency

A stable currency creates smooth international trade.

Fluctuations can cause:

export/import price shocks,

higher hedging costs,

volatility in forex markets.

c) Managing Economic Growth

Central banks cool the economy when it's overheated and support it during recessions.

d) Ensuring Financial Stability

They monitor banks, credit markets, and liquidity to avoid crises.

4. Key Central Bank Tools (Beginner-Friendly Breakdown)

1) Policy Interest Rates

Interest rates are the most powerful tool.

Central banks raise or cut the repo rate, federal funds rate, or benchmark rate to control the economy.

When interest rates go UP:

Loans become expensive.

Businesses slow down expansion.

Consumer spending declines.

Currency strengthens.

Imports become cheaper.

Stock markets usually fall.

Bond yields rise.

When interest rates go DOWN:

Loans become cheaper.

Businesses borrow and expand.

Consumer spending grows.

Currency weakens.

Exports become more competitive.

Stock markets often rise.

Gold and commodities gain.

Interest rate decisions heavily affect global forex and equity markets, often leading to immediate volatility.

2) Open Market Operations (OMO)

These are buying or selling government bonds to regulate liquidity.

Buying bonds → injects money → increases liquidity

Selling bonds → removes money → reduces liquidity

OMOs are crucial during crises (like 2008 or COVID-19) to prevent market freezing.

3) Quantitative Easing (QE)

QE is an advanced form of OMO.

The central bank purchases large amounts of financial assets to pump liquidity into the economy.

Effects:

Lower long-term interest rates

Higher stock prices

Weaker currency

Increased global capital flow into emerging markets

Example:

The Federal Reserve used QE in 2008 and 2020, sending global markets into strong bullish phases.

4) Foreign Exchange (FX) Intervention

Central banks sometimes buy or sell their own currency to stabilize it.

Example:

RBI sells dollars to strengthen the rupee.

Bank of Japan buys yen to prevent excessive weakness.

Such interventions affect:

import prices

export competitiveness

forex trading

global capital flows

5) Reserve Requirements

This is the percentage of deposits that banks must keep without lending.

Higher reserve ratio → less lending → slower economy

Lower reserve ratio → more lending → faster economy

China’s PBoC frequently uses reserve requirement changes to manage its massive trade-driven economy.

5. How Central Bank Policies Impact the Global Trade Market

1) Currency Value and Exchange Rates

Exchange rates directly influence global trade profitability.

Example:

Weak local currency → exports rise, imports fall

Strong local currency → exports fall, imports rise

Central bank policies are the number one driver of currency strength.

Forex traders follow every speech, statement, and interest rate decision like a catalyst event.

2) Commodity Prices

Most global commodities—oil, gold, copper—are priced in USD.

When the Federal Reserve changes policy:

USD strengthens → commodities fall

USD weakens → commodities rise

Central banks indirectly influence:

international oil trade

gold reserves management

industrial metal pricing

shipping and freight rates

3) Stock Markets

Interest rate decisions immediately move global equities.

Rate hikes cause downgrades in growth forecasts, hurting stock markets.

Rate cuts encourage risk-on behavior, pushing equities higher.

Emerging markets like India, Brazil, and Indonesia react strongly to US Fed and ECB policies due to foreign institutional investment (FII) inflows/outflows.

4) Global Capital Flows

Capital moves across borders depending on interest rate differences.

If US rates are high, global money flows back to the US, weakening emerging markets.

If US rates fall, capital flows into Asia, boosting markets like India.

Central banks shape these flows through rate decisions and liquidity tools.

5) Trade Balances

A nation’s export–import performance changes with:

currency valuation

inflation levels

credit availability

interest rate environment

Example:

If RBI reduces rates → rupee weakens → Indian exports like textiles, IT services, and chemicals become more competitive.

This shapes global supply chains.

6. How Traders Use Central Bank Signals

Professional traders track every macro clue, such as:

FOMC minutes

RBI MPC meeting notes

Inflation reports

GDP forecasts

Central bank speeches

Market participants try to predict whether central banks will be:

Hawkish (favor rate hikes)

Dovish (favor rate cuts)

This sentiment often moves markets even before the actual decision is taken.

7. Central Bank Policy Cycles

Policies move in cycles depending on the economy:

Tightening Cycle (Hawkish)

Higher rates

Reduced liquidity

Strong currency

Lower inflation

Lower equity prices

Easing Cycle (Dovish)

Lower rates

More liquidity

Weaker currency

Higher inflation risk

Higher equity prices

World trade flows change direction with each cycle.

8. Central Banks During a Crisis

In crises, central banks:

inject massive liquidity

cut interest rates

support banks

stabilize currency

buy government and corporate bonds

This prevents:

trade collapse

credit freeze

currency crashes

COVID-19 is the best example: global central banks coordinated huge rate cuts and QE to revive world trade and markets.

Conclusion

Central bank policies act like the command center for global financial systems. Their decisions shape interest rates, inflation, currency strength, commodity prices, trading volumes, capital flows, and international trade dynamics. For beginners in the world trade market, understanding central bank behavior is essential because macro fundamentals drive long-term market trends.

If you follow central bank statements and policy cycles closely, you will gain a powerful edge in forex trading, commodity analysis, equity market positioning, and global economic forecasting.

Market Noise That Traps Retail Traders1. What Is News Trading?

News trading is a strategy where traders take positions based on the expected market reaction to economic events or announcements. These events can be:

Economic data (GDP, inflation, interest rates, unemployment)

Central bank decisions (RBI, Fed, ECB meetings)

Corporate earnings and guidance

Mergers, acquisitions, buybacks

Global geopolitical developments

Commodity reports (OPEC meetings, inventory data)

Government policies and regulations

News changes market expectations, and markets move on expectations — that’s the core idea behind news trading.

2. What Is “Noise” and Why Is It Dangerous?

Noise is any information that creates confusion without adding value.

Examples of noise:

Clickbait headlines (“Market to crash 20%?”)

Social media hype (Twitter/X rumors)

WhatsApp university “insider news”

Delayed news after the market has already reacted

TV channel opinions that change every minute

Over-analysis without data

Emotional panic or euphoria from retail traders

Noise causes wrong decisions, late entries, and over-trading.

Professional traders avoid it by sticking to verified, timely, and market-moving information.

3. Why Most Retail Traders Fail in News Trading

Retail traders often:

React after the move has already happened

Trade based on emotions, not data

Follow misleading social media posts

Don’t understand whether news is actually important

Lack a prepared plan before events

Cannot interpret the deviation between expected and actual data

Professional traders, on the other hand, plan days ahead and execute in seconds.

4. How to Trade News Without Noise – The Clean Process

The core idea is: Be prepared before the news, respond instantly to real numbers, avoid emotional reactions.

Here’s the step-by-step process:

Step 1: Know Which News Actually Matters

Not all news moves markets. Learn to classify news into:

High Impact News

RBI policy meetings

US Federal Reserve meetings

Inflation data (CPI, WPI)

GDP growth numbers

Employment data

Major earnings announcements

Geopolitical tensions (war, sanctions, oil shocks)

Medium Impact News

Industrial production

Services PMI, Manufacturing PMI

Consumer sentiment

Smaller corporate updates

Low Impact News

Minister speeches

General opinions

Minor announcements

Over-analyzed TV commentary

Rule: Focus only on news with real economic consequences.

Step 2: Prepare a News Calendar

Before the week starts, create a watchlist of events:

Date

Time

Expected numbers

Previous numbers

Expected market reaction

Tools to use:

Economic calendars

Earnings calendars

OPEC & inventory calendars

RBI/Fed meeting schedules

Preparation removes confusion and reduces noise.

Step 3: Understand “Expectations vs Reality”

Markets don’t react to news itself; they react to the difference between expected and actual results.

Example:

If inflation is expected at 5% but comes at 5.4%, markets fall.

If it comes at 4.7%, markets rise.

This deviation is called “surprise factor.”

Professional traders instantly measure this deviation and take positions.

Step 4: Use the 10-Second Rule During News

During major announcements:

Avoid trading in the first 10 seconds

Let the initial volatility settle

Watch the direction that forms after the first burst

This protects you from:

Whipsaws

False breakouts

High spreads

Stop-loss hunting

Clean news trading happens when you allow the dust to settle.

Step 5: Read Market Reaction, Not Headlines

Instead of reacting to headlines, look at:

Price action

Volume

Market structure

Order flow

Option chain (PCR, IV crush, delta shift)

Markets sometimes reverse the initial move when the news is already priced in.

Price is the real truth.

Step 6: Have a Pre-Defined Plan

Before the news releases, decide:

If number is better → buy or go long

If number is worse → sell or go short

If number meets expectations → avoid trading

This clarity eliminates emotional decisions.

Step 7: Avoid Social Media & TV Noise

Once news is released, social feeds explode with:

Panic

Rumors

Emotional reactions

Incorrect interpretations

Professionals ignore all this and stick to data and price.

5. Tools and Indicators to Reduce Noise in News Trading

These tools help you filter real movements from noise:

1. Volume Profile

Shows if the move has real institutional participation or just retail panic.

2. Market Structure

Identifies:

break of structure (BOS)

change of character (CHOCH)

real trend direction

3. Volatility Indicators

ATR (Average True Range)

Implied volatility (IV)

They help you avoid fake spikes.

4. Liquidity Zones

News often sweeps liquidity before moving in the real direction.

5. Option Chain Analysis

IV Crush

Rapid delta movement

Change in OI

PCR shift

This gives instant information on institutional positioning.

6. Best Markets for News Trading

Forex Market

Most sensitive to:

interest rate decisions

inflation

employment data

Stock Market

Most sensitive to:

earnings

M&A news

regulatory changes

Commodity Market

React to:

crude oil inventory

OPEC decisions

weather reports (for agri commodities)

Index Futures (Nifty, Bank Nifty)

React strongly to:

RBI policy

global cues

geopolitical risk

These markets give clean opportunities during news.

7. Common Mistakes to Avoid

Trading BEFORE the news – high risk

Entering too late AFTER the move – trap

Following hype and rumors

Not using stop-loss

Taking too large position sizes

Over-trading due to excitement

Ignoring the bigger trend

Avoiding these mistakes helps you trade news without getting caught in noise.

8. Risk Management for News Trading

News trading is profitable only with strict risk rules:

Keep position size small (1–2%)

Use stop-loss every time

Avoid averaging losers

Take profits quickly

Never hold weak trades through big events

News moves fast; your risk control must be even faster.

9. How Professionals Maintain Clarity

Top traders follow this checklist:

They prepare for news

They track expectations, not opinions

They avoid emotions

They follow price action

They execute as per plan

They ignore noisy sources

They use data, not predictions

This is why their entries are clean and exits are disciplined.

Conclusion

Trading news without noise is all about clarity, preparation, discipline, and data-based decisions.

Instead of reacting to hype, you follow a structured process:

Identify high-impact news

Study expectations

Wait for real numbers

Confirm with price action

Execute clean trades

Manage risk tightly

When done properly, news trading can give some of the best and fastest profits in the market. When done emotionally, it becomes the fastest way to lose money.

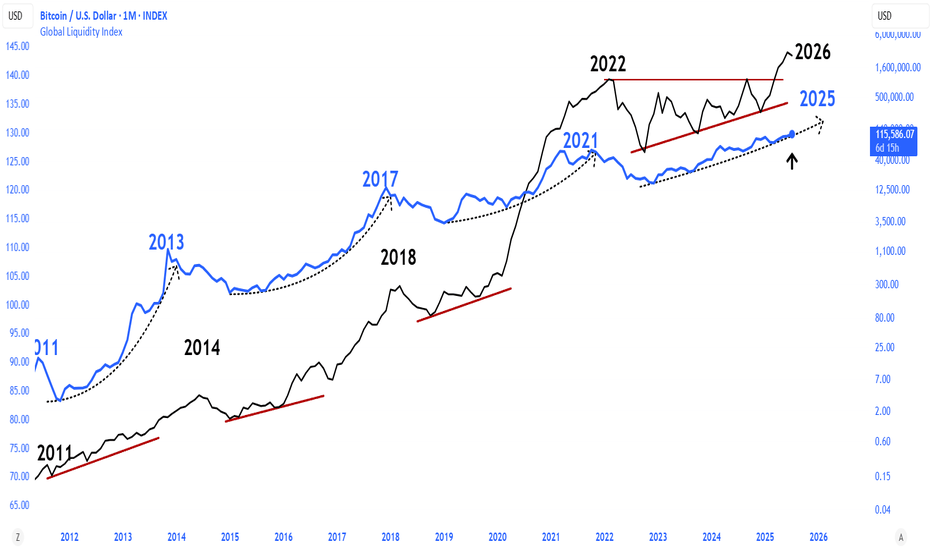

Pairing between BTC & Global Liquidity IndexSup everyone,

if you're active on twitter or have been looking around for crypto trade ideas you might have stumbled upon the Global Liquidity Index chart (at least I have).

I've stumbled upon it a few months back and have been testing it ever since, let me tell you what this chart is about:

The Global Liquidity Index basically measures how much money is flowing through global markets—think of it like the pulse of the financial system... traders and investors use it to get a sense of overall market conditions, liquidity availability, and risk appetite.

Now, here’s the cool thing: when you layer the Global Liquidity Index onto the Bitcoin chart, you notice something interesting— BITSTAMP:BTCUSD tends to react, but with a delay. Typically, there's about a 2-3 month lag. If global liquidity spikes or makes a sharp V-shaped recovery, Bitcoin usually mirrors this movement roughly 80 days later.

Why does this happen? Well, Bitcoin is a highly speculative asset, and institutions—especially banks—often wait to see solid liquidity signals before moving their capital into riskier assets like crypto. They prefer confirmation over speculation, which explains the delay.

So, in simple terms, by tracking global liquidity, you get a pretty useful heads-up about where Bitcoin might be headed a couple of months down the road.

The Global Liquidity Index is essentially a snapshot showing how much money central banks and financial institutions are injecting or pulling out of the global economy. Think of it like a big gauge tracking how "easy" or "tight" money conditions are worldwide.

It usually takes into account factors like:

Central Bank Policies: How much money central banks are printing or how they're changing interest rates.

Bank Reserves and Credit Availability: The amount banks can lend out, influencing how easily money flows through markets.

Government Spending and Stimulus: Fiscal policies injecting liquidity directly into the economy.

International Capital Flows: Money moving across borders, affecting global market liquidity.

When liquidity is abundant, there's more money sloshing around looking for places to invest. That typically pushes up asset prices—including speculative ones like Bitcoin—as investors seek higher returns. Conversely, when liquidity tightens (like when central banks raise interest rates or pull back stimulus), money becomes scarcer, risk appetite shrinks, and assets tend to dip.

So, when you're watching the Global Liquidity Index, you're basically monitoring how central banks and institutions are influencing market sentiment and investment behaviors, which eventually impacts speculative assets like Bitcoin—but with that notable delay we talked about earlier.

Practically speaking, here's how you apply the Global Liquidity Index to Bitcoin:

You watch for major turning points—peaks, bottoms, or sharp reversals—in global liquidity. Once you spot one, mark your calendar about 2–3 months forward (around 80 days). That’s usually when Bitcoin mirrors that move.

So, for instance, if the Global Liquidity Index sharply rebounds upward (a V-shaped recovery), you'd expect BTC to follow with a rally roughly two to three months later. On the flip side, if liquidity peaks and starts declining, it's a heads-up that Bitcoin could face downward pressure within the next few months.

This gives you a practical edge—you're essentially previewing BTC’s possible moves.

All things said, if you look at BTC's chart right now and apply the Global Liquidity Index to it you can see how the second has broken its previous high a few months back, but BTC yet has to break its, you can arrive to the conclusions here....

With no reversal in sight (for now) in the Global Liquidity Index, there don't seem to be signs of "spoofing", no case in which the index starts declining and so makes traders who know about this delay start to sell earlier than the delay.

End of the story - things look promising for BTC and you should definitely keep the Global Liquidity Index in your list of indicators.

Global M2 MONEY SUPPLY VS GLOBAL LIQUIDITYWhich is the best to track ₿itcoin price action?

Lots of macro gurus have been arguing over the two.

For comparison, I have indexes for both metrics on a 12-Week Lead, tracking the 4 largest central banks:

The Federal Reserve (including TGA & RRP), People’s Bank of China, European Central Bank and Bank of Japan.

Let’s start by defining each.

Global M2 Money Supply covers physical cash in circulation and cash equivalents such as checking and savings deposits, as well as money market securities.

Global Liquidity covers a broader measure of liquid assets driven by central bank balance sheets, private sector financial activity (e.g., lending, corporate cash), and cross-border capital flows.

Historically, both move closely in lock-step and act as a great leading indicator for ₿itcoin, however we can see that Global Liquidity can have more drastic fluctuations.

We saw a large divergence in CRYPTOCAP:BTC PA with both metrics when the Blackrock iShares ₿itcoin ETF appeared on the DTCC list, a procedural step signaling progress toward potential approval.

When you look at the charts of all three, you can see there are points where either metric might follow CRYPTOCAP:BTC PA a bit closer, so in the end I would say it’s best to track both to find confluence in the signal.

Global Liquidity Index Overlaid on S&P 500 Tracking the Global Liquidity Index with the S&P 500 helps understand liquidity's impact on market performance and predict future moves. The GLI offers a unified view of central bank balance sheets, converted to USD, excluding currency-pegged banks, with reliable data since 2007.

Rising liquidity often leads to market growth, while declining liquidity could signal pullbacks or increased volatility.

Liquidity Spikes: Sudden rises in the GLI may boost the S&P 500.

Liquidity Dips: Falling liquidity may signal market decline due to higher volatility and trading difficulties.

Divergence between the GLI & S&P 500:

If stocks rise while liquidity falls, a correction might be coming. If liquidity rises while stocks fall, the market might catch up to the liquidity increase.

The GLI indicates that risk appetite is starting to decline. High liquidity encourages risk-taking; low liquidity leads to safer investments, increasing volatility and potential market declines.

Thanks for Liking and Sharing! 🥕🐇

Global Liquidity Index Against BTCHeres the global liquidity index mapped against BTC and its past cycle data for reference.

Im sure you can spot the positive correlation it has.... When global liquidity increases, risk on assets such as BTC increase due to an influx of new liquidity in money markets.

We have been consolidating for 2 years in the global liquidity index in an ascending triangle. I am expecting it to push up, break out, retest similar to the prior cycle fractal and continue higher, in turn pushing money markets including BTC into ATHs

The Global Liquidity Index is looking very interesting here.The GLI is looking very interesting at these levels. It's currently bouncing around within the Fibonacci retracement levels shown. Stocks and crypto usually perform better during times of increased liquidity for obvious reasons. Now that we are heading into a period where central banks around the world are propping up markets with freshly printed cash, we may see this index set a new high, which will be good for asset prices overall.

Good luck, and always use a stop loss!